TIDMALTN

AltynGold plc

("Altyn" or the "Company")

Results for the year ended 31 December 2021

AltynGold Plc (LSE:ALTN) an exploration and development company,

is pleased to announce its results for the year ended 31 December

2021.

Highlights

Financial highlights

-- Turnover increased in the year to US$50m (2020: US$30m) an

increase of 67%.

-- 27,747oz of gold sold (2020: 16,535oz), an increase of

68%.

-- Average gold price achieved (including silver), US$1,803oz,

(2020: US$1,816oz).

-- The Company made a profit before tax of US$18.3m (2020:

US$3.3m).

-- Adjusted EBITDA (Earnings before interest, tax, depreciation

and amortisation) of US$26.4m (2020: US$13.5m).

-- The Group repaid borrowings of US$7.9m (2020: US$3.4m).

-- Capital expenditure in the year amounted to US$8.1m (2020:

US$8.6m).

Operational highlights

-- Ore processed 571,000t (2020 506,000t).

-- Gold poured 28,450oz, (2020: 17,028oz) a 67% increase

year-on-year.

-- Mined gold grade 1.97g/t, (2020: 1.57g/t).

-- Operating cash cost US$649/oz, (2020: US$800/oz).

-- Gold recovery rate 83.05% (2020: 80.44%).

Underground development & exploration

-- Transport decline No.1 was developed and is now at 117masl on

ore bodies 3-8, transport decline 2 is now at 134masl, opening up

significant reserves at ore body 11.

-- Development of the shaft and tunnelling amounted to 6,209

linear metres.

-- Blast hole drilling at Sekisovskoye amounted to 119,340

linear metres.

-- Extensive maintenance and improvement works were carried out

to maintain production safely and efficiently.

-- Exploration work at Teren-Sai continued with the drilling of

22,580m linear metres of exploratory drilling.

Further Information:

For further information please contact:

AltynGold Plc

Rajinder Basra

+44 (0) 203 432 3198

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014.

Information on the Company

AltynGold Plc (LSE:ALTN) is an exploration and development

company, which is listed on the main market segment of the London

Stock Exchange.

To read more about AltynGold Plc please visit our website

www.altyngold.uk

CHAIRMAN'S STATEMENT

Given the backdrop of the COVID-19 pandemic, 2021 was pencilled

in by many Companies to potentially be a difficult trading year.

Indeed for some sectors this has been the case, in relation to

AltynGold, due to the careful management of its resources and

deployment of its fundraising into new equipment and infrastructure

improvements, the Company has been able to generate a significant

uplift in its revenue and profits. The primary driver to the

increase in revenues in the current year has been the increase in

production and grades achieved.

The Company is particularly pleased with the principal key

performance indicators in the majority of cases exceeding the

budgets that were set for the year. The Company generated an EBITDA

in excess of US$26m (2020: US$13.5m) on a turnover of US$50m (2020:

US$30m).

During the year the Company reviewed the staffing structure

which led to a number of changes at head office in terms of grade

and departmental structures. At Board level, after a review, two

new Non-Executive directors were appointed to complement the skills

and expertise of the existing Board. This resulted in the

employment of the Company's first female Director Maryam Buribayeva

who, together with Vladimir Shkolnik, will monitor and assess the

Company's environmental obligations. The Board sees its climate

change and environmental obligations has increasing importance in

the future and will monitor this closely, especially in light of

the new environmental laws introduced by the Kazakhstan government

in July 2021.

The Company is changing and evolving and moving towards its

medium term plan for the extraction of 850ktpa. The budget for 2023

is set at 650ktpa, with the move to 850ktpa being planned

thereafter. With a stable cost base and a gold price consensus of

US$1,700 in the medium term the business model is evolving. Further

plant upgrades are scheduled for 2023 that will move the capacity

up to 1mtpa for Sekisovskoye in the longer term.

In terms of funding, there is sufficient cash generation to fund

the expanded operations at Sekisovskoye and service the debt for

existing operations.

In relation to Teren-Sai, from the exploration work and test

production results, we believe the asset will add significantly to

the profitability of the Company. The development of Teren-Sai will

require additional funding initially. This can be met by the

Company's own resources, however it will require further external

funding to bring it fully on stream. With the Company gearing set

to go down with the repayment of the bond listed on AIX and the

scheduled repayment of the bank borrowings, the Company are looking

at a number of possibilities to raise further funds.

The Company is set to move forward having established a strong

platform for growth, from a review and strengthening of its

management and human resources, keeping tight controls over its

operational structure and ensuring that the right level of

financing is in place. The growth and prosperity of the Company are

always balanced by the Company's obligations to all stakeholders

and wider environmental issues which are growing in importance.

Kanat Assaubayev

Chairman

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

The Company achieved its principal goals in relation to its

current operations at Sekisovskoye being that of processing ore of

571ktpa (budget 570kpta), and producing gold of 34,258oz (target

33,634oz). The step up in ore extraction and the subsequent

processing of the ore has led to a marked change in the

profitability of the Company. The Company profits have climbed to

US$18.3m (2020: US$3.3m) and EBITDA has moved to US$26.4m from last

year's level of US$13.5m.

In relation to Teren-Sai the exploration program has proved

fruitful, and the extension of the licence and move to a commercial

discovery in Area no2 is being processed. Initially the areas will

be stripped, as the initial step to make it ready for ore

extraction. Further plans will be put in place once the licence is

acquired for Area No. 2. In relation to the other areas of

interest, further exploration drilling is to be continued.

During the year a comprehensive review was undertaken to assess

the human resources requirements of the Company. The review ranged

from the assessment of the Board, head office function and the

production workforce. This resulted in changes to the Board, with

the employment of the Company's first female Director. In relation

to head office, staff were employed to deal with the financial and

regulatory requirements of the Company. Fewer staff were required,

but the pay grades did increase to attract the calibre of staff

required. The increase at the production site was a result of the

greater volume of processing.

The Company drew down the balance of its facilities with Bank

Center Credit at the start of the year, and took on a short term

working capital loan at the start of the year repayable in

September 2022. The EBITDA is generating funds to repay the loans

during the year, finance its capital commitments and repay the AIX

bond in December 2022. In the current period factors that will have

a positive effect on the Company's profitability in the forthcoming

year are the devaluation of the Kazakh Tenge against the US Dollar

and the increase in the gold price, currently trading at a higher

rate than the average achieved in 2021 of US$1,803oz.

Economic outlook

In relation to COVID-19 the restrictions have largely eased and

there was little impact on the productivity of the Company. A

mention should also be made of the unrest which occurred at the

start of 2022 in Kazakhstan, which was largely contained to Almaty.

The Company was largely insulated from the effects of any lockdowns

and restrictions imposed. The Company is aware of its wider social

duties and obligations and is a responsible employer in this

regard, maintaining good relationships with its workforce.

With regard to the possible impact on the Company's operations

that may arise out of the conflict that has arisen in Ukraine and

sanctions imposed in Russia. On a macro scale Kazakhstan as a

country has close ties with Russia, and thus the devaluation of the

Russian Rouble has had an effect on devaluing the Kazakh Tenge

against the US Dollar, and there has been an upward push on the

price of an ounce of gold, which is currently trading in the range

of US$1,950oz. At a Company level, the trading with Russia has been

reviewed and alternative sources put in place for the small value

of consumables purchased from Russia. There is no reliance on

Russian companies in terms of the supply of capital equipment,

parts or financing. All sales will continue under the current off

take agreement with all sales made in Kazakhstan in US Dollars.

Mine development

The input of significant capital equipment additions in 2020 and

H1 2021 has enabled the Company to progress mining operations in

all areas of mining operations. A significant acquisition in this

regard was the purchase of the self-propelled tunnelling

equipment.

The principal development milestones achieved in the period

were:

-- Tunnelling and shaft sinking of 6,209 linear metres.

-- Blast hole drilling of 119,340 linear metres.

-- Exploration drilling was carried out and amounted to 18,943

linear metres.

-- Backfilling of voids was carried out in the period amounting

to a volume of 64,404m.

During this period the Company has been concentrating on

developing ore bodies 3-8 at horizons 117masl-178masl and ore body

11 at horizons 134masl-174masl.

The transport decline No.2 was extended by 343 linear metres

allowing the access of 640,000 tons of ore. Similarly transport

decline No. 1 was extended by 391 linear metres opening up

accessible reserves of 163,000 tons.

In order to continue to mine efficiently and safely the

following capital/maintenance was carried out:

-- A forced air facility was commissioned and built at elevation

355masl, this necessitated the installation of 17km of overhead 6Kv

lines. The Korfmann ventilation equipment will allow safe and

stable operations for a period up to 2029 in accordance with the

mine operational plans.

-- Various works were carried out to enable the efficient and

safe working of the stoping, this included introducing a new system

of stoping and obtaining an Ulba-150 charging unit to improve the

quality of ore crushing.

-- The mine operational procedures are constantly being updated

to conform to current safe working practices, during the period an

electronic accounting and explosive digitised log was

introduced.

The key production figures are shown below:

Mining results ore extraction

2021 2020

Ore mined T 571,035 506,050

Gold grade g/t 1.94 1.57

Silver grade g/t 1.81 1.08

Contained gold oz 35,580 25,555

Contained silver oz 33,296 17,525

Mining results processing

2021 2020

Crushing T 534,426 421,040

Milling T 541,576 420,256

Gold grade g/t 1.97 1.58

Silver grade g/t 1.63 1.13

Gold recovery % 83.05 80.44

Silver recovery % 73.54 72.81

Contained gold oz 34,258 21,355

Contained silver oz 28,408 15,253

Gold Poured oz 28,450 17,028

Silver poured oz 20,891 11,180

Projected capital expenditure

Total 2022 2023

US$m US$m US$m

Prospect drilling 2.3 1.4 0.9

Underground development 7.2 5.3 1.9

Infrastructure 5.2 0.4 4.8

Ore handling facilities 14.0 -- 14.0

Process plant incremental expansion 9.0 2.4 6.6

Teren-Sai exploration program 0.4 0.4 --

Total 38.1 9.9 28.2

Exploration -- Teren-Sai

During the year the Company conducted exploration drilling and

core drilling at three areas within the exploration site. In total

22,500m of pneumatic drilling and 7,500m of core drilling was

planned, the actual results were 22,580m and 7,560m

respectively.

The Company finalised its core drilling in Area no.2 in January

and February drilling 1,520m of core samples, and conducted further

core drilling in Area no. 5 amounting to 1,140m. Area No.5 core

samples are being analysed with a view to also moving this to the

commercial discovery phase, however due to time constraints in

finalising and analysing the drilling results during winter and the

need to complete all necessary paperwork to extend the licences

which have expired in May 2022, the Company has concentrated on

finalising the development of Area No2, and will progress the

development of Area no.5 in the future.

The principal focus of the work program in the current year was

to look at the prospective site at No. 6 where extensive

exploration drilling was carried out amounting to 22,580m, this was

followed up by 3,700m of core drilling towards the end of the year.

Sampled grades obtained from the core samples extracted ranged from

1.4g/t to 2.4g/t.

The exploration licence at Teren-Sai expired in May 2022, under

the contract the Company has the right to renew the licence. The

Company has submitted an application to extend the licence in order

to conduct further site works in Teren Sai and to further define

the areas of interest to the Company. In relation to Area No.2 the

Company is considering moving to the production phase after further

testing, and to the remaining sites of interest an extension to the

exploration licence. As noted in the prior year, the results from

the test production for Area No. 2 indicated an average grade of

1.8g/t, with the initial production being obtained from open pit

workings.

The move to a production licence will require additional capital

expenditure in order to build a new processing plant, a tailings

dam and other infrastructure requirements in order to process the

ore efficiently. The test production that was processed at

Sekisovskoye has shown that the ore can be processed using the same

technology as that currently being employed at Sekisovskoye. It is

the intention of the Company to make initial preparations for site

development, however moving to the full production phase will

require further fund raising to achieve its full potential. The

Company is in the process of looking at lines of funding to move

the project forward.

Capital requirements

The capex requirements for the next two years are detailed in

the table below. The budgeted plans foresee the Company expanding

ore extraction and production to a capacity of 1mtpa for

Sekisovskoye in 2023, at which point there will also be further

investment in the mining equipment needed to process the increase

in ore output.

In relation to the development of its prospective resource at

Teren-Sai, the current capex budget allows for the continuation of

exploration at the site. Further development of the site at

Teren-Sai is dependent on raising further funding, in addition to

that which will be provided from cash flow from existing

operations.

Longer term plan

The Company has a had a successful year, with the capex

investment increasing ore extraction from the Sekisovskoye site

which increased to 570ktpa. The aim remains to move this up to

1mtpa, and budgets have been drawn up and funds allocated to expand

the existing capacity of the processing plant to 1mtpa within two

years. The longer term aim is to increase the ore extraction

towards the 2mtpa within a time frame of 6 years.

The capex required as outlined above amounts to US$38m, and will

be largely met from funds raised from operations. In addition to

this an amount of US$75m will be required to bring the Teren-Sai

project on stream, as it will require new processing facilities and

infrastructure to be developed at the Teren-Sai site. In the

initial period the site will be stripped and made ready for open

pit production in order to move to production efficiently once the

necessary funding is in place. The brokers who are providing

sponsored research and opening up opportunities for investor

funding will play a key role in moving the projects forward.

The Board are constantly looking to diversify and invest in new

and complementary operations in Kazakhstan and internationally,

however the primary driver at present is to bring the Kazakhstan

gold sites, as outlined above, to their full potential.

FINANCIAL PERFORMANCE

Key performance indicators (KPIs)

Annual gold sales (oz)

27,747

2021 27,747

2020 16,535

2019 10,500

Annual gold poured (oz)

28,450

2021 28,450

2020 17,027

2019 10,537

Revenue (US$m)

US$50

2021 50.0

2020 30.0

2019 14.9

Operating cash cost of production (US$/oz)

US$649

2021 649

2020 800

2019 854

EBITDA (US$m)

US$26.4

2021 26.4

2020 13.5

2019 3.3

Net assets (US$m)

US$55.2

2021 55.2

2020 35.3

2019 33.3

The significant investment into plant upgrades and new capital

and infrastructure development during the year has resulted in the

Company meeting its targeted production levels and in a number of

areas exceeding them. The upgrades and new equipment allowed for

more targeted mining of the ore bodies resulting in higher grades

and recoveries being achieved in the year.

The ore mined was 571,000t against the budget of 570,000t, the

resulting ore processed of 534,000t was a significant improvement

on the prior year of 506,000t. The current run rate is indicating a

higher level of ore to be mined in the year to 31 December 2022.

This is a key deliverable for the Company and the management are

pleased with the performance in the year and are keen on driving

this forward to higher levels.

Gold processed has increased by 60% from the prior year to

34,258oz (2020: 21,355oz), the Company had budgeted 33.635oz. A

significant increase, the increase in output was accompanied by a

higher level of recovery of 83.05% increasing from 80.44% in the

prior year and the budgeted recovery rate of 82.13%. The upgrades

of the plant and capital investment have paid a key role in

increasing the levels being achieved.

During 2021, the Company sold 27,747oz of gold (2020: 16,535oz).

The average price achieved per oz was similar to that of last year

at US$1,803 (2020:US$1,816). The increase in profitability in the

Company has been achieved through a volume increase in production,

since the year end the average price of gold has increased and is

currently trading in the region of US$1,950 to US$2,000. It is

difficult to predict how the price of gold will move in the future

but the current sentiment is positive.

There were again no changes to the sales off-take agreement

currently in place with the Kazakh national refinery, which

continues to take all of the Company's output. As in the prior

year, sales are translated at the spot US$ market rate at the point

the gold is sold.

The total cash cost of production, which includes administrative

costs but excludes depreciation and provisions, amounted to

US$834/oz, (2020: S$970oz). The operating cash cost excluding

administrative costs amounted to US$649/oz (2020: US$800/oz). The

Kazakh Tenge in recent years has been weakening against the US

Dollar in 2020 it averaged 413Kzt to one US Dollar weakening to an

average of 426Kzt in 2021, it is currently in the region of 440Kzt.

As the Company's revenues are earned in US Dollars and a

significant cost base is in Kazakh Tenge, it will have the benefit

of reducing the cost base of the Company.

The administrative costs have increased in the year by US$2.3m

as a result of four principal factors. First, during the year the

Company as part of its wider responsibilities to the community the

Company agreed to assist in the building of a wing of a new

school/university building with an overall cost of US$550,000.

Second, there was an increase in wages and salaries by US$860,000

principally as a result of the increase in the number of staff as

well as the recruitment of experienced and skilled employees at a

higher salary rate. The third factor relates to various

professional fees of US$480,000 relating to sponsored research in

order to increase the Company profile and attract new investors and

the development of further funding opportunities. The final factor

was travel cost returning to a normal level as the Company emerged

from restrictions imposed by COVID, translating into an increase of

US$540,000.

The Company has reported a net profit of US$18.3m before tax

(2020: US3.38m) with a gross profit of US$27.8m (2020: US$12.4m).

As noted above the principal drivers to the better results was the

increased production, grades and recoverability achieved from the

investment of the capex.

The adjusted EBITDA increased to US$26.4m, (2020: US$13.5m)

details of the calculation are shown in note 13 of the financial

statements.

In relation to cash at the year end this was US$3.6m (2020:

US$7.2m). Cash generation as indicated by EBITDA was much higher in

the current year. The utilisation of funds by the Company was a

result of a net repayment of loans and capital expenditure in the

year and a substantial prepayment in relation to production

facilitation for the forthcoming period. These have resulted in a

drop in the cash balance at the year end, the balance is expected

to increase as the prepayment is unwound and as a result of higher

revenues from the increase in gold prices.

The bonds as listed on AIX of US$10m are due for repayment in

December 2022. During the year net borrowings were repaid of

US$1.6m. The interest incurred on the debt in 2021 amounted to

US$2.5m (2020: US$4.1m) the reduction was due to repayment of the

bonds to Amrita Investments Limited and African Resources Limited,

the balance of loans being repaid in H1 2021.

The Company managed to perform to its plan as set out and

increase revenues and profitability, dealing with any issues as

posed by the government restrictions involving COVID-19 and at the

same time looking after the welfare of the staff. The net assets of

the Company increased by US$19.9m.

CONSOLIDATED INCOME STATEMENT

for the year ended 31 December 2021

2021 2020

Note $000 $000

Revenue 3 50,290 30,032

Cost of sales (22,496) (17,610)

Gross profit 27,794 12,422

Administrative expenses (5,138) (2,826)

Share based payment -- (2,400)

Impairments (734) (34)

Operating profit 21,922 7,162

Foreign exchange (366) (1,508)

Finance expense (3,289) (2,324)

Total finance cost (3,655) (3,832)

Profit before tax 18,267 3,330

Taxation receipt/(expense) 56 (392)

Profit for the year attributable to the equity

holders of the parent 18,323 2,938

Profit per ordinary share

Basic 67.04c 11.27c

Diluted 67.04c 10.97c

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 December 2021

2021 2020

Note $000 $000

Profit for the year 18,323 2,938

Items that may be reclassified subsequently to the

income statement

Currency translation differences arising on translations of

foreign operations (1,491) (3,846)

Currency translation differences on translation of foreign

operations relating to tax 3,038 (1,011)

1,547 (4,857)

Total comprehensive profit/(loss) for the year 19,870 (1,919)

Total comprehensive profit/(loss) attributable to:

Equity holders of the parent 19,870 (1,919)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 December 2021

2021 2020

(Registration number: 05048549) Note $000 $000

Assets

Non-current assets

Intangible assets 5 13,346 12,849

Property, plant and equipment 6 35,350 32,092

Deferred tax assets 8,189 5,311

Trade and other receivables 3,925 6,700

Restricted cash 70 13

60,880 56,965

Current assets

Inventories 9,121 5,468

Trade and other receivables 21,530 7,182

Cash and cash equivalents 3,593 7,154

34,244 19,804

Total assets 95,124 76,769

Equity and liabilities

Current liabilities

Trade and other payables (5,684) (6,705)

Provisions (232) (151)

Loans and borrowings (15,087) (5,833)

(21,003) (12,689)

Non-current liabilities

Vat payable (242) (230)

Other payables (1,000) (492)

Provisions (5,453) (4,763)

Loans and borrowings (12,221) (23,260)

(18,916) (28,745)

Total liabilities (39,919) (41,434)

Equity

Share capital (4,267) (4,267)

Share premium (152,839) (152,839)

Merger reserve 282 282

Other reserves -- (333)

Foreign currency translation reserve 51,412 52,959

Accumulated losses 50,207 68,863

Equity attributable to owners of the company (55,205) (35,335)

Total equity and liabilities (95,124) (76,769)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 December 2021

Share

Currency based

Share Share Merger translation payment Other Accumulated Total

capital premium reserve reserve reserve reserves losses equity

$000 $000 $000 $000 $000 $000 $000 $000

At 1 January

2020 4,055 151,476 (282) (48,102) -- 333 (74,201) 33,279

Profit for the

year -- -- -- -- -- -- 2,938 2,938

Other

comprehensive

loss -- -- -- (4,857) -- -- -- (4,857)

Total

comprehensive

loss -- -- -- (4,857) -- -- 2,938 (1,919)

New share

capital

subscribed 13 62 -- -- -- -- -- 75

Share based

payment

charge -- -- -- -- 2,400 -- -- 2,400

Share options

exercised 199 1,301 -- -- (2,400) -- 2,400 1,500

At 31 December

2020 4,267 152,839 (282) (52,959) -- 333 (68,863) 35,335

At 1 January

2021 4,267 152,839 (282) (52,959) -- 333 (68,863) 35,335

Profit for the

year -- -- -- -- -- -- 18,323 18,323

Other

comprehensive

income -- -- -- 1,547 -- -- -- 1,547

Total

comprehensive

income -- -- -- 1,547 -- -- 18,323 19,870

Transfer to

reserves -- -- -- -- -- (333) 333 --

At 31 December

2021 4,267 152,839 (282) (51,412) -- -- (50,207) 55,205

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 31 December 2021

2020 2019

Note $000 $000

Cash flows from operating activities

Net cash flow from operating activities 6,797 4,245

Cash flows from investing activities

Acquisitions of property plant and equipment (5,502) (8,559)

Acquisition of intangible assets (830) (1,271)

Proceeds from test production -- 165

Net cash flows from investing activities (6,332) (9,665)

Cash flows from financing activities

Interest paid (2,411) (3,740)

Loans received 6,356 16,903

Loans repaid (7,985) (3,431)

Proceeds of share issue -- 1,500

Commission paid -- (588)

Net cash flows from financing activities (4,040) 10,644

Net (decrease)/increase in cash and cash equivalents (3,575) 5,224

Cash and cash equivalents at 1 January 7,154 1,934

Effect of exchange rate fluctuations on cash held 14 (4)

Cash and cash equivalents at 31 December 3,593 7,154

NOTES TO THE FINANCIAL STATEMENTS

for the year ended 31 December 2021

1 General information

AltynGold Plc (the "Company") is a Company incorporated in

England and Wales under the Companies Act 2006. The financial

information set out above for the years ended 31 December 2021 and

31 December 2020 does not constitute statutory accounts as defined

in Section 434 of the Companies Act 2006, but is derived from those

accounts. Whilst the financial information included in this

announcement has been compiled in accordance with international

financial reporting standards adopted pursuant to Regulation (EC)

in conformity with the requirements of the Companies Act 2006, this

announcement itself does not contain sufficient financial

information to comply with IFRS. A copy of the statutory accounts

for 2020 has been delivered to the Registrar of Companies and those

for 2021 will be layed before the shareholders at the Annual

General Meeting. The full audited financial statements for the

years end 31 December 2021 and 31 December 2020 do comply with

IFRS.

2 Going concern

The Group had a successful year increasing revenues by 67% from

the prior year to US$50m, resulting in an increase of adjusted

EBITDA to an amount in excess of US$26m. The Group did enter into

some further short term financing at the start of the year from the

Bank Center Credit in order to smooth the working capital of the

Group. The majority of this is repayable by September 2022. This

provided positive funding to the Group in the year, the adjusted

EBITDA is expected to continue at increasing levels in the future

as production grows, coupled with a strong gold price and the

devaluation of the Kazakh Tenge.

At the year-end the Group had cash resources of US$3.6m (2020:

US$7.2m) available. The decrease in funds from the prior year is

principally due to prepayments made to secure the services of

subcontractors in relation to future mine development and ore

extraction, as well as the repayment of loans in the year.

The Board have reviewed the Group's forecast cash flows for the

period to September 2023, which include the capital and interest

repayments to be made in relation to the Group's borrowings. The

principal loan that is due for repayment is the bond raised on the

Kazakhstan Stock exchange of US$10m which is repayable in December

2022. Capital and operating costs are based on approved budgets and

latest forecasts in the case of 2022 and current development plans

in the case of 2023. There are significant judgements inherent in

the cash forecast model, the significant assumptions are the

anticipated level of production to be achieved and the gold price.

In the case of planned production profiles these are based on a

planned increase from current levels being achieved and in the

latter the consensus view of the anticipated gold price in the

short/medium term.

Based on the Group's cash flow forecasts, the Directors believe

that the combination of its current cash balances, net cash flows

from operations, and increased production based on projections of

future growth, are sufficient for the Company to achieve its

current plans and cash requirements including the repayment of

loans which are due for repayment in the period.

The Group's adapted well to the impact of COVID-19, and there

was little impact on the operations of the Group from COVID-19, the

Ukraine conflict or the civil unrest that occurred in Kazakhstan in

the early part of the year. However the Board have considered

possible stress case scenarios that they consider may be likely to

impact on the Group's operations, financial position and forecasts.

Factors considered are operational disruptions that may lower the

production at the mine and possible impact on the price of gold if

this was to fall. From the analysis undertaken the Board have

concluded that the Group will be able to continue to trade by the

careful management of its existing resources. The stress tests

included the following scenarios amongst others, a fall in the gold

price to US$1,561oz, a drop in budgeted production by 20% or a

combination of both factors together. In each case the Group would

not experience a cash shortfall in either scenario. If required the

Group would manage its resources, reducing investment and managing

its payables in order to maintain liquidity.

The Board therefore considers it is appropriate to adopt the

going concern basis of accounting in preparing these financial

statements.

3 Revenue

The analysis of the Group's revenue for the year from continuing

operations is as follows:

2021 2020

$000 $000

Sale of gold and silver 50,031 29,790

Other sales 259 242

50,290 30,032

Included in revenues from sale of gold and silver are revenues

of US$50,031,000 (2020: US$29,790,000) which arose from sales of

precious metals to one customer based in Kazakhstan. Other sales

amounted to US$259,000 (2020: US$242,000) and related to lease and

rental income.

4 Profit per ordinary share

The calculation of basic and diluted earnings per share from

continuing operations is based upon the retained profit from

continuing operations for the financial year of US$18.3m (2020:

US$2.9m).

The weighted average number of ordinary shares for calculating

the basic earnings per share in 2021 and 2020 is shown below.

The diluted earnings per share in 2020 arose as the convertible

loan notes had conversion rights, which would have resulted in an

additional 702,650 shares being issued, the convertible loan notes

were all redeemed in the year. There are currently no share options

in issue that would result in diluted earnings per share.

2021 2020

No. No.

Basic 27,332,933 26,070,079

Diluted 27,332,933 26,772,729

5 Intangible assets

Teren-Sai Exploration and

geological data evaluation costs Total

Group US$000 US$000 US$000

Cost or valuation

At 1 January 2020 9,931 7,488 17,419

Additions -- 1,271 1,271

Amortisation capitalised -- 608 608

Currency translation (905) (717) (1,622)

At 31 December 2020 9,026 8,650 17,676

At 1 January 2021 9,026 8,650 17,676

Additions -- 830 830

Amortisation capitalised -- 585 585

Currency translation (225) (240) (465)

At 31 December 2021 8,801 9,825 18,626

Amortisation

At 1 January 2020 4,476 -- 4,476

Amortisation charge 608 -- 608

Currency translation (422) -- (422)

Revenue relating to test

production -- 165 165

At 31 December 2020 4,662 165 4,827

At 1 January 2021 4,662 165 4,827

Amortisation charge 585 -- 585

Currency translation (125) (7) (132)

At 31 December 2021 5,122 158 5,280

Carrying amount

At 31 December 2021 3,679 9,667 13,346

At 31 December 2020 4,364 8,485 12,849

At 1 January 2020 5,455 7,488 12,943

The intangible assets relate to the historic geological

information pertaining to the Teren-Sai ore fields. The ore fields

are located in close proximity to the current mining operations of

Sekisovskoye. The Company obtained a contract for exploration and

evaluation on the site in May 2016 from the Kazakh authorities, the

licence expired in May 2022. The Company has the right to extend

the licence and has submitted the necessary paperwork to extend the

exploration phase in the areas of interest within the Teren-Sai ore

field with a view to moving area No. 2 to the production phase.

The value of the geological data purchased is in the opinion of

the Directors the value that would have been incurred if the

drilling had been undertaken by a third party (or internally). The

Company has continued to develop the site with a CPR completed in

2019 on one of the fifteen target zones area 2, which includes 3

potential targets, and further exploration works in the other

areas. Full details are given in the mineral resources statement

included as part of the Annual Report.

The directors consider that no impairment is required taking

into account the CPR results, exploration and planned production in

the future. The write off of the geological data over the period of

the licence to the end of the (optional) extended licence period

May 2027 is appropriate. After that period the costs amortised are

capitalised in line with the Company's accounting policy within the

subsidiary TOO GMK Altyn MM LLP, there are no impairment

indicators.

6 Property, plant and equipment

Equipment, Plant,

Freehold fixtures machinery

Mining Land and and and Assets under

properties buildings fittings buildings construction Total

Group US$000 US$000 US$000 US$000 US$000 US$000

Cost or

valuation

At 1 January

2020 13,949 24,786 9,945 7,501 1,067 57,248

Additions 1,622 166 2,838 2,717 1,246 8,589

Disposals -- -- (70) (180) -- (250)

Transfers (764) 1,383 (26) 18 (471) 140

Transfer from

inventories -- -- -- -- 241 241

Currency

translation (1,543) (2,285) (907) (734) (110) (5,579)

At 31

December

2020 13,264 24,050 11,780 9,322 1,973 60,389

At 1 January

2021 13,264 24,050 11,780 9,322 1,973 60,389

Additions 3,356 197 2,147 653 2,187 8,540

Disposals -- -- (655) (4) -- (659)

Transfers -- 1,441 -- -- (1,441) --

Transfer from

inventories -- -- -- -- 170 170

Currency

translation (611) (654) (203) (261) (67) (1,796)

At 31

December

2021 16,009 25,034 13,069 9,710 2,822 66,644

Depreciation

At 1 January

2020 2,441 10,563 9,204 4,724 -- 26,932

Charge for

year 520 1,885 773 772 -- 3,950

Eliminated on

disposal -- -- (70) (180) -- (250)

Currency

translation (232) (997) (805) (441) -- (2,475)

Transfers 140 (80) 80 -- -- 140

At 31

December

2020 2,869 11,371 9,182 4,875 -- 28,297

At 1 January

2021 2,869 11,371 9,182 4,875 -- 28,297

Charge for

the year 699 2,188 817 782 -- 4,486

Eliminated on

disposal -- (2) (655) (4) -- (661)

Currency

translation (218) (238) (239) (133) -- (828)

Transfers -- -- -- -- -- --

At 31

December

2021 3,350 13,319 9,105 5,520 -- 31,294

Carrying

amount

At 31

December

2021 12,659 11,715 3,964 4,190 2,822 35,350

At 31

December

2020 10,395 12,679 2,598 4,447 1,973 32,092

At 1 January

2020 11,508 14,223 741 2,777 1,067 30,316

Included within the additions to mining properties is an amount

of US$430,000 relating to an increase in the abandonment and

restoration provision, see note 21.

Capitalised cost of mining property are amortised over the life

of the licence from commencement of production on a unit of

production basis. This basis uses the ratio of production in the

period compared to the mineral reserves at the end of the period.

Mineral reserves estimates are based on a number of underlying

assumptions, which are inherently uncertain. Mineral reserves

estimates take into consideration estimates by independent

geological consultants. However, the amount of mineral that will

ultimately be recovered cannot be known until the end of the life

of the mine.

Any changes in reserve estimates are, for amortisation purposes,

treated on a prospective basis. The recovery of the capitalised

cost of the Company's property, plant and equipment is dependent on

the development of the underground mine.

The Directors are required to consider whether the non-current

assets comprising, mineral properties, plant and equipment have

suffered any impairment. The recoverable amount is determined based

on value in use calculations. The use of this method requires the

estimation of future cash flows and the choice of a discount rate

in order to calculate the present value of the cash flows. The

directors considered entity specific factors such as available

finance, cost of production, grades achievable, and sales price.

The directors have concluded that no adjustment is required for

impairment.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20220624005432/en/

CONTACT:

AltynGold Plc

SOURCE: AltynGold Plc

Copyright Business Wire 2022

(END) Dow Jones Newswires

June 27, 2022 02:00 ET (06:00 GMT)

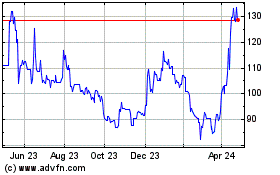

Altyngold (LSE:ALTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

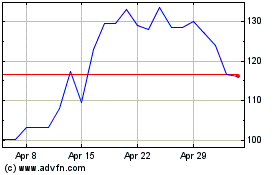

Altyngold (LSE:ALTN)

Historical Stock Chart

From Apr 2023 to Apr 2024