TIDMAML

RNS Number : 9500R

Aston Martin Lagonda Glob.Hldgs PLC

01 November 2023

1 November 2023

Aston Martin Lagonda Global Holdings plc

Results for the nine months to 30 September 2023

-- Q3 2023 performance in line with guidance and shows continued momentum

-- YTD revenue up 21%, driven by ASP growth and strong demand

-- DB12 deliveries commenced with order book extending into Q2 2024

-- Q3 Gross margin reaches 37% driven by strong mix dynamics

-- FY 2023 guidance maintained other than marginally updated volume outlook

GBPm YTD 2023 YTD 2022 % change Q3 2023 Q3 2022 % change

--------- --------- -------- --------

Total wholesale

volumes(1) 4,398 4,060 8% 1,444 1,384 4%

Revenue 1,039.5 857.2 21% 362.1 315.5 15%

Gross Profit 370.8 286.2 30% 134.5 98.1 37%

Adjusted EBITDA(2) 131.1 79.8 64% 50.5 21.2 138%

Adjusted operating

loss(2) (135.1) (128.2) (5%) (48.4) (55.5) 13%

Operating loss (145.3) (148.4) 2% (52.1) (58.5) 11%

Loss before tax (259.8) (511.3) 49% (117.6) (225.9) 48%

Net debt(2) 749.9 833.4 10% 749.9 833.4 10%

-------------------- --------- --------- --------- -------- -------- ---------

(1) Number of vehicles including Specials; (2) For definition of

alternative performance measures please see Appendix

YTD 2023 Financial highlights

-- Continued strong demand across existing and new product

lines; the recently launched DB12 is driving reappraisal of Aston

Martin amongst new audiences, with 55% of its initial customers new

to the Aston Martin brand and with order book now extending to Q2

2024

-- DBX orders also extending into 2024, as it continues to

establish itself as the benchmark in the ultra-luxury SUV segment

with over 25% market share in key markets. The DBX707 now

represents c.70% of SUV sales in 2023 supporting the positive gross

margin evolution

-- Wholesale volumes increased by 8% year-on-year to 4,398 (YTD

2022: 4,060) driven by strong demand across the portfolio. Q3 2023

volumes reflect the ongoing transition to our next generation

sports cars, which started with the initial deliveries of the DB12.

The DB12 production ramp up was temporarily affected as supplier

readiness and integration of the new EE platform that supports the

fully redeveloped infotainment system was delayed. These issues are

now resolved but did impact Q3 volume and our FY production

capacity

-- Revenue increased by 21% year-on-year to GBP1,040m primarily driven by:

- higher volumes of both Core and Special s with 67 Aston Martin

Valkyrie deliveries YTD in 2023 (YTD 2022: 44) including the first

deliveries of our sold-out Aston Martin Valkyrie Spider

-- Total ASP of GBP219k YTD in 2023, up 12% from GBP195k YTD in

2022

-- Total ASP of GBP234k in Q3 2023, up 11% from GBP211k in Q3

2022

- strong underlying pricing dynamics in the Core portfolio in

addition to favourable mix from DBS 770 Ultimate, offset by adverse

geographic mix and the planned ramp-down of certain models in

advance of the launch of our next generation of sports cars

-- Core ASP of GBP184k YTD in 2023, up 6% from GBP173k YTD in

2022

-- Core ASP of GBP183k in Q3 2023, down 3% from GBP189k in Q3

2022

-- Gross profit increased by 30% year-on-year to GBP371m (YTD

2022: GBP286m), and gross margin increased to 36% (YTD 2022: 33%).

The increase in gross profit was primarily driven by growth in

wholesale volumes and higher ASPs across the Core product

portfolio, favourable mix dynamics from the DBS 770 Ultimate, and

strong momentum from Specials, partially offset by higher

manufacturing and logistics costs, and FX

-- Adjusted EBITDA increased by 64% year-on-year to GBP131m (YTD

2022: GBP80m), primarily driven by the strong growth in gross

profit, partially offset by higher operating expenses including

reinvestments into brand and marketing activities, as well as

inflationary impacts on general costs. Adjusted EBITDA margin

increased to 13% (YTD 2022: 9%)

-- Operating loss of GBP145m included a GBP58m year-on-year

increase in depreciation and amortisation, as a result of higher

Aston Martin Valkyrie programme deliveries and the continuing

accelerated amortisation of capitalised development costs ahead of

next generation of sports cars starting in 2023

-- Loss before tax of GBP260m (YTD 2022: loss of GBP511m)

included a positive year-on-year impact from the revaluation of US

dollar-denominated debt

-- Free cash outflow of GBP297m (YTD 2022: GBP336m outflow) included:

- Increased capital investment year-on-year, in-line with FY

2023 guidance, primarily related to new model development,

including the next-generation of sports cars as well as development

of the Company's electrification programme

- Working capital outflow of GBP69m driven by increase in

inventory to support launch of next generation sports car models,

which is expected to partially unwind in Q4 2023

- Net cash interest payments of GBP53m

-- Total liquidity of over GBP600m (December 2022: GBP590m)

including cash of GBP544m and an additional c.GBP60m of revolving

credit facility available. YTD 2023 cash includes GBP216m of

proceeds from August's share offering and GBP95m proceeds from the

new shares issued to Geely International (Hong Kong) Limited in

May

-- Net debt of GBP750m (December 2022: GBP766m), including a

positive GBP17m non-cash FX revaluation of US dollar-denominated

debt as the GBP strengthened against the US dollar

Balance Sheet

-- We remain focused on reducing our leverage and retiring debt

and will continue to do so in consideration of a wide range of

factors. In line with the announcement in July, our objective is to

repay the second lien in full. During November, we will be

redeeming 50% of the outstanding second lien notes and beyond that,

we intend to undertake a fulsome refinancing exercise during the

first half of 2024

Q3 2023 Operational Highlights

-- The Company has continued the year-long global celebration of

Aston Martin's 110th anniversary with a series of unique events and

culminating in the launch of Valour, a spectacular, ultra-exclusive

V12-engined, manual transmission special edition

-- On 1 August, the Company successfully completed a share

offering raising gross proceeds of GBP216m to accelerate net

leverage reduction and support longer term growth

-- The Company proudly presented the DB12 Volante on 14 August

ahead of its global debut during Monterey Car Week in California.

Companion to the DB12 Coupe, this open-top model combines

spectacular Super Tourer performance and handling with the

irresistible sensory thrills of roof-down driving

-- On 19 September the new strategic supply arrangement with

Lucid Group, Inc. ("Lucid") was approved by Shareholders, providing

Aston Martin with access to Lucid's technologies, including

electric powertrains and battery systems

-- On 27 September the Company announced an update on the

development of Valhalla, its first series production mid-engine

supercar, with the first running prototype taking to the road later

this year, and set to enter production in 2024

-- The ongoing Formula 1(R) season being enjoyed by the Aston

Martin Aramco Cognizant Formula One(R) Team continues to drive

brand visibility and heightened product consideration, with a 7%

increase in website traffic versus non-race weekends in 2023 and

13% uplift in configurator traffic. Market research indicates that

60% of luxury car buyers strongly agree they are more likely to buy

an Aston Martin because of its association with F1(R)

-- On 4 October, the Company announced that Aston Martin is set

to enter the 2025 24 Hours of Le Mans Hypercar class with a racing

prototype version of the ultimate Hypercar, the Aston Martin

Valkyrie

- Through the invaluable support and backing of Aston Martin's

championship-winning endurance racing partner Heart of Racing, at

least one Aston Martin Valkyrie race car will be entered by Aston

Martin into the top Hypercar class of each of the FIA World

Endurance Championship and the IMSA WeatherTech SportsCar

Championships from 2025

- The prototype Aston Martin Valkyrie will participate in three

of sports car racing's most prestigious events; Le Mans, the Rolex

24 at Daytona and the 12 Hours of Sebring

-- On 9 October, a consortium working on the Company's

high-performance electrification strategy was awarded GBP9 million

of government funding through the Advanced Propulsion Centre UK,

further supplementing the research and development of Aston

Martin's innovative modular battery electric vehicle (BEV)

platform, which will be propelled by world-leading electric vehicle

technologies from Lucid

Lawrence Stroll, Executive Chairman commented:

"Our 110(th) anniversary year continues to be a fantastic one

for the Company, and we are delighted with the strategic and

financial progress we have made during the first nine months of

2023. Our volumes, pricing, gross margins and EBITDA are showing

strong improvement and we are delivering an accelerated industrial

turnaround.

"The launch of the DB12, which has seen extraordinary demand, is

driving a reappraisal of Aston Martin amongst new audiences, with

55% of initial DB12 customers new to the brand and when we launch

our second next generation sports car in Q1 next year, we expect a

similarly resounding response. Commencing deliveries of our next

generation of sports cars is a major milestone marking the

beginning of a completely new line up of front engine sports cars

that will reposition Aston Martin as an ultra-luxury

high-performance brand, enhance our growth and bring higher levels

of profitability.

"We are thrilled to be returning to Le Mans, the scene of many

historic triumphs for Aston Martin, aiming to write new history

with a racing prototype inspired by the Valkyrie. Aston Martin's

return to the pinnacle of endurance racing, in addition to our

partnership with the Aston Martin Aramco Cognizant Formula One(R)

team, will allow us to amplify our brand and build a deeper

connection with our customers and community.

"We look to the future with enormous excitement. Over the coming

quarters we will showcase our breath-taking line-up of new products

and we remain on track to substantially achieve our 2024/25

financial targets in 2024."

Amedeo Felisa, Chief Executive Officer commented:

"Our year-to-date performance has seen us continue to make

progress on our strategic direction with strong revenue and margin

growth. During Q3 we commenced deliveries of the game-changing

DB12, the first of our next-generation sports cars which has been

met with industry wide acclaim and exceptional demand since its

launch. Given the slight delays in the initial production ramp up

we have marginally updated our volume expectations for the year. As

we continue to transition the portfolio, we also delivered further

sales of the sold-out DBS 770 which we expect to conclude during

Q4.

"On Specials, we continued to deliver Valkyries during Q3

including the first of the Spider model and, over the remainder of

the year we will commence deliveries of the sold out 110-year

anniversary special, Valour, as well as the ultra-luxury DBR22.

"The expansion and transformation of our portfolio across both

Core and Specials will continue to bring significant improvements

in profitability, with all new models targeting a 40%+ gross

margin. Our Q3 financial performance was in line with our

expectations, and other than updating our volume outlook, we remain

on track to deliver on our full year guidance."

Outlook

For FY2023 our guidance, other than volumes, remain unchanged

since our FY 2022 results announcement on 1 March:

-- Given the initial delays experienced with the DB12 ramp up

during Q3, we have marginally updated our FY volume outlook as the

impact limits production capacity for the full year. Demand is very

strong, with DB12 orders into Q2 2024 and production is now running

at the rates required to meet our volume expectations for the

year

-- As we move into Q4, we expect to deliver improved ASPs and

gross margin evolution towards achieving our 40%+ target, supported

by the delivery of new products across the Core and Specials

ranges:

- In addition to the final deliveries of the sold-out DBS 770

Ultimate, we will continue deliveries of the first of our next

generation of sports cars - the DB12 Super Tourer

- Within Specials, in Q4 we plan to commence deliveries of the

ultra-luxury DBR22 and, in conjunction with our historic 110(th)

anniversary, the ultra-exclusive Valour. We also anticipate

continued deliveries of the sold-out Aston Martin Valkyrie

Spider

-- Within the fourth quarter of 2023, we continue to expect to

see a significant increase in adjusted EBITDA, primarily due to the

timing and related contribution of these new product launches

-- Overall, we expect to deliver significant growth in

profitability compared to 2022, driven by an increase in volumes as

well as higher gross margin in both Core and Special vehicles,

albeit with a marginally updated volume outlook. We now target

positive free cash flow in Q4 including the initial $33m (GBP26m)

cash payment to Lucid in relation to the strategic supply

arrangement announced on 26 June 2023, which is expected to be paid

in the fourth quarter of 2023

-- We expect to increase investment in brand and new product

launch activities during the year. This will also allow us to

continue to elevate our ultra-luxury performance brand positioning

and to support the acceleration of our longer-term growth

-- Although the operating environment remains volatile,

including ongoing inflationary pressures and pockets of supply

chain disruptions, our teams continue to work in partnership with

our suppliers to mitigate and minimise any impact on our

performance in 2023

We remain well on track to achieve our financial targets of

c.GBP2bn revenue and c.GBP500m adjusted EBITDA by 2024/25. The

Company expects to substantially achieve these financial targets in

2024. There is also no change to our expectations of achieving the

new medium-term guidance for 2027/28, announced earlier in the

year.

2023 guidance (unchanged other than volumes) :

-- Wholesales : year-on-year growth to c.6,700 units (revised from c.7,000 units)

-- Adjusted EBITDA margin : year-on-year expansion, up to c.20% adjusted EBITDA margin

-- Capex and R&D : c.GBP370m

-- Depreciation and amortisation : c.GBP350m-GBP370m

-- Interest costs : c.GBP120m (cash), assuming current exchange rates prevail for 2023

The financial information contained herein is unaudited.

All metrics and commentary in this announcement exclude

adjusting items unless stated otherwise and certain financial data

within this announcement have been rounded.

Enquiries

Investors and Analysts

Robert Berg Director of Investor Relations +44 (0) 7833

080458

robert.berg@astonmartin.com

Ella South Investor Relations Analyst

+44 (0) 7776 545420 ella.south@astonmartin.com

Media

Kevin Watters Director of Communications +44 (0)7764 386683

kevin.watters@astonmartin.com

Paul Garbett Head of Corporate & Brand Communications +44

(0)7501 380799

paul.garbett@astonmartin.com

Teneo

Harry Cameron + 44 (0)20 7353 4200

-- There will be a call for investors and analysts today at 08:30am GMT

-- The conference call can be accessed live via the corporate website https://www.astonmartinlagonda.com/investors/calendar

-- A replay facility will be available on the website later in the day

No representations or warranties, express or implied, are made

as to, and no reliance should be placed on, the accuracy, fairness

or completeness of the information presented or contained in this

release. This release contains certain forward-looking statements,

which are based on current assumptions and estimates by the

management of Aston Martin Lagonda Global Holdings plc ("Aston

Martin Lagonda"). Past performance cannot be relied upon as a guide

to future performance and should not be taken as a representation

that trends or activities underlying past performance will continue

in the future. Such statements are subject to numerous risks and

uncertainties that could cause actual results to differ materially

from any expected future results in forward-looking statements.

These risks may include, for example, changes in the global

economic situation, and changes affecting individual markets and

exchange rates.

Aston Martin Lagonda provides no guarantee that future

development and future results achieved will correspond to the

forward-looking statements included here and accepts no liability

if they should fail to do so. Aston Martin Lagonda undertakes no

obligation to update these forward-looking statements and will not

publicly release any revisions that may be made to these

forward-looking statements, which may result from events or

circumstances arising after the date of this release.

This release is for informational purposes only and does not

constitute or form part of any invitation or inducement to engage

in investment activity, nor does it constitute an offer or

invitation to buy any securities, in any jurisdiction including the

United States, or a recommendation in respect of buying, holding or

selling any securities.

Sales & Revenue analysis

Due to strong demand across the portfolio total wholesales of

4,398 increased by 8% year-on-year in the first nine months of 2023

(YTD 2022: 4,060). As expected, Sport/GT volumes year-to-date in

2023 continue to be lower than the comparative period due to the

ongoing transition to our next generation of sports car models. In

the third quarter of 2023, total wholesales included 30 Specials

(Q3 2022: 18), including the first deliveries of the sold out

Valkyrie Spider. DBX volumes increased by 23% year-on-year, driven

by the DBX707, the world's most powerful luxury SUV. The DBX707 is

now clearly established as a benchmark in the ultra-luxury SUV

segment with strong volume growth in the majority of our key

markets.

Geographically, the Americas was the strongest and the largest

region year-to-date, representing 32% of wholesales, driven by

strong demand for the DBX. EMEA excl. UK represented 29% of

wholesales year-to-date, with volumes increasing 44% year-on-year

driven by DBX and DBS 770 Ultimate, and includes the first

deliveries of our new DB12. Year-on-year wholesale volumes in APAC

were impacted by lower sales in China, which decreased by 57% YTD

in 2023 versus the comparative period in 2022, which more than

offset growth in wholesale volumes including the DBX707 and DBS 770

Ultimate outside of China. China continues to be a market where we

see significant opportunity for long-term growth. In our home

market, the UK, we grew wholesales 12% year-on-year driven by DBX

deliveries.

Revenues of GBP1,040m increased by 21% year-on-year, primarily

driven by strong pricing and mix dynamics and higher Aston Martin

Valkyrie deliveries. Revenues in the third quarter of 2023 of

GBP362m increased by 15% year-on-year, driven by higher wholesale

average selling price (ASP), growth in Core wholesale volumes and

the delivery of Specials.

Strong year-on-year pricing dynamics in the first nine months of

2023 were supported by price increases, reflecting the strong

pricing power of the Aston Martin brand, in addition to favourable

mix from DBX707, V12 Vantage, and DBS 770 Ultimate, and the

delivery of Specials. Year-to-date total wholesale ASP of GBP219k

(YTD 2022: GBP195k) included 68 Specials in the period, compared

with 50 in the comparative period, with Q3 2023 total ASP a record

level for Aston Martin of GBP234k (Q3 2022: GBP211k). Year-to-date

Core ASP was GBP184k (YTD 2022: GBP173k), due to strong underlying

pricing dynamics across the Core portfolio. Q3 Core ASP was GBP183k

(Q3 2022: GBP189k) which saw these strong pricing dynamics offset

by unfavourable FX dynamics, geographic mix impact and the planned

ramp-down of production of certain models in advance of the launch

of our next generation of sports cars.

Income statement

Gross profit of GBP371m increased by GBP85m, or 30%,

year-on-year, driven by growth in wholesale volumes and ASPs across

the Core product portfolio, and strong momentum from Specials,

partially offset by higher manufacturing, logistics and other

costs. This translated to a gross margin of 36%, a year-on-year

expansion of approximately 230 basis points, primarily driven by

strong pricing dynamics and mix which was particularly strong in Q3

2023 with gross margin reaching 37%. The company continues to

target a 40%+ contribution margin from future products.

Adjusted EBITDA of GBP131m increased by GBP51m, or 64%

year-on-year. This translated to an adjusted EBITDA margin of 13%,

an increase of approximately 330 basis points compared to the prior

year period. The year-on-year increase in adjusted EBITDA was

primarily due to strong growth in gross profit, partially offset by

higher operating expenses including reinvestments into brand and

marketing activities including events such as the Goodwood Festival

of Speed and Pebble Beach, product launch investments such as the

DB12 Volante and Valour, as well as investment in IT

infrastructure, and general inflationary impacts on manufacturing

costs.

Adjusting operating items of GBP10m (YTD 2022: GBP20m)

predominantly related to ERP implementation costs.

Net financing costs of GBP115m were down from GBP363m in the

comparative period, comprising a positive non-cash FX revaluation

impact of GBP17m, with the prior year significantly higher due to

the revaluation of the US dollar-denominated debt as the GBP

weakened against the US dollar, with an impact of GBP(245)m YTD

2022 versus GBP17m YTD 2023.

The GBP28m adjusting financing items was due to the revaluation

of share warrants. The loss before tax was GBP260m (YTD 2023:

GBP511m), an improvement of GBP251m year-on-year, and the loss for

the period was GBP260m (YTD 2023: GBP518m).

Cash flow and net debt

Cash flow from operating activities was an inflow of GBP31m (YTD

2022: GBP 57m outflow ), an improvement of c.GBP88m YTD . The

year-on-year change in cash flow from operating activities was

driven by higher EBITDA and improved working capital. Cash flow

from operating activities in YTD 2023 included a GBP69m outflow

related to movements in working capital (compared with a GBP 106m

outflow in YTD 2022 ). The largest driver was a GBP53m increase in

inventories primarily driven by the ramp up of our next generation

of sports cars at the end of the quarter, as well as initiatives to

improve production and supply chain resilience ahead of upcoming

vehicle launches .

Demand for Specials remained strong in the first nine months of

2023 , with continued deposit intake for Valour, DBR22 and

Valhalla. This was offset by higher deliveries of Aston Martin

Valkyrie programme vehicles which resulted in a net GBP1m unwind of

customer deposits (YTD 2022: GBP 9m inflow ).

Capital expenditure of GBP276m was up GBP63m over the

comparative period, with future investment focused on the next

generation of sports cars, as well as development of the Company's

electrification programme.

Free cash flow was an outflow of GBP297m; (YTD 2022: outflow of

GBP 336m ), primarily due to the changes in working capital-related

cashflows described above and the year-on-year increase in capital

expenditure. Cash at 30 September 2023 was GBP544m (31 December

2022: GBP583m) whilst net debt of GBP750m was broadly unchanged

from GBP766m at 31 December 2022.

APPICES

Wholesale number of vehicles

YTD 2023 YTD 2022 % change Q3 2023 Q3 2022 % change

--------- --------- -------- --------

Total 4,398 4,060 8% 1,444 1,384 4%

Core (excluding

Specials) 4,330 4,010 8% 1,414 1,366 4%

By region:

UK 774 694 12% 329 206 60%

Americas 1,417 1,152 23% 355 432 (18%)

EMEA ex. UK (3) 1,267 880 44% 433 266 63%

APAC [3] 940 1,334 (30%) 327 480 (32%)

By model:

Sport/GT 2,090 2,184 (4%) 721 623 16%

SUV 2,240 1,826 23% 693 743 (7%)

Specials 68 50 36% 30 18 67%

----------------- --------- --------- --------- -------- -------- ---------

Note: Sport/GT includes Vantage, DB11, DB12, and DBS

Summary Income Statement

GBPm YTD 2023 YTD 2022 Q3 2023 Q3 2022

--------- --------

Revenue 1,039.5 857.2 362.1 315.5

Cost of sales (668.7) (571.0) (227.6) (217.4)

--------- --------- -------- --------

Gross profit 370.8 286.2 134.5 98.1

Gross margin % 35.7% 33.4% 37.1% 31.1%

Operating expenses [4] (505.9) (414.4) (182.9) (153.6)

of which depreciation & amortisation 266.2 208.0 98.9 76 .7

--------- --------- -------- --------

Adjusted operating loss [5] (135.1) (128.2) (48.4) (55.5)

Adjusting operating items (10.2) (20.2) (3.7) (3.0)

--------- --------- -------- --------

Operating loss (145.3) (148.4) (52.1) (58.5)

Net financing expense (114.5) (362.9) (65.5) (167.4)

of which adjusting financing

(expense) income (28.3) 19.0 9.6 (5.4)

--------- --------- -------- --------

Loss before tax (259.8) (511.3) (117.6) (225.9)

Taxation (0.2) (6.7) (0.4) (2.3)

--------- --------- -------- --------

Loss for the period (260.0) (518.0) (118.0) (228.2)

Adjusted EBITDA (5) 131.1 79.8 50.5 21.2

Adjusted EBITDA margin 12.6% 9.3% 13.9% 6.7%

Adjusted loss before tax (5) (221.3) (510.1) (123.5) (217.5)

----------------------------------------------- --------- --------- -------- --------

Summary Cash Flow

GBPm YTD 2023 YTD 2022 Q3 2023 Q3 2022

--------- --------

Cash generated from/(used in) operating

activities 3 1.4 (56.9) 13.9 (23.8)

Cash used in investing activities

(excl. interest received) (275.0) (213.4) (94.8) (75.2)

Net cash interest (paid)/received (53.2) (65.3) 2.4 (2.8)

---------

Free cash outflow (296.8) ( 335.6) ( 78.5) ( 101.8)

Cash inflow from financing activities

(excl. interest) 262.8 666.7 218.1 707.7

(Decrease)/Increase in net cash (34.0) 331.1 139.6 605.9

--------- --------

Effect of exchange rates on cash

and cash equivalents (5.5) 21.8 4.1 9.7

----------------------------------------- --------- --------- -------- ---------

Cash balance 543.8 771.8 543.8 771.8

----------------------------------------- --------- --------- -------- ---------

Net Debt Overview

GBPm 30-Sep-23 31-Dec-22 30-Sep-22

---------- ----------

Loan notes (1,102.2) (1,104.0) (1,339.5)

Inventory financing (38.8) (38.2) (39.5)

Bank loans and overdrafts (57.9) (107.1) (126.9)

Lease liabilities (IFRS 16) (95.3) (99.8) (101.3)

Gross debt (1,294.2) (1,349.1) (1,607.2)

---------- ----------

Cash balance 543.8 583.3 771.8

Cash not available for short-term

use 0.5 0.3 2.0

----------------------------------- ---------- ---------- ----------

Net debt (749.9) (765.5) (833.4)

----------------------------------- ---------- ---------- ----------

Summary Balance Sheet

GBPm 30-Sep-23 31-Dec-22 30-Sep-22

---------- ----------

Non-current assets 1,965.3 1,978.9 1,978.2

Current assets 1,159.0 1,125.4 1,416.0

Total assets 3,124.3 3,104.3 3,394.2

Current liabilities 1,003.3 1,041.9 1,082.8

Non-current liabilities 1,272.7 1,289.9 1,526.4

Total liabilities 2,276.0 2,331.8 2,609.2

Total equity 848.3 772.5 785.0

---------- ----------

Alternative performance measures

In the reporting of financial information, the Directors have

adopted various Alternative Performance Measures ("APMs"). APMs

should be considered in addition to IFRS measurements. The

Directors believe that these APMs assist in providing useful

information on the underlying performance of the Group, enhance the

comparability of information between reporting periods, and are

used internally by the Directors to measure the Group's

performance.

-- Adjusted EBT is the loss before tax and adjusting items as

shown on the Consolidated Income Statement

-- Adjusted EBIT is loss from operating activities before adjusting items

-- Adjusted EBITDA removes depreciation, loss/(profit) on sale

of fixed assets and amortisation from adjusted EBIT

-- Adjusted EBITDA margin is adjusted EBITDA (as defined above) divided by revenue

-- Net Debt is current and non-current borrowings in addition to

inventory financing arrangements, lease liabilities, less cash and

cash equivalents, and cash held not available for short-term

use

-- Free cashflow is represented by cash (outflow)/inflow from

operating activities less the net cash used in investing activities

(excluding interest received) plus interest paid in the year less

interest received.

[3] Q3 2022 and YTD 2022 numbers restated

[4] Excludes adjusting items

[5] Alternative Performance Measures are defined in the

Appendix

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTEAAEFDAEDFAA

(END) Dow Jones Newswires

November 01, 2023 03:00 ET (07:00 GMT)

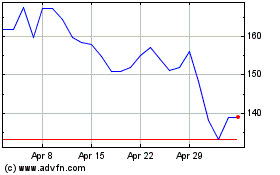

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Apr 2024 to May 2024

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From May 2023 to May 2024