TIDMAMTE

RNS Number : 7308T

AMTE Power PLC

16 November 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA OR

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE THE IMPORTANT NOTICES

AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF REGULATION (EU) NO 596/2014 WHICH

FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018, AS AMED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

For immediate release

16 November 2023

AMTE Power Plc

Proposed subscription, placing and convertible loan facility

AMTE Power Plc (AIM: AMTE) ("AMTE Power" or the "Company" and,

together with its subsidiary undertakings, the "Group"), a leading

developer and manufacturer of lithium-ion and sodium-ion battery

cells for specialist markets, is pleased to announce that it has

today entered into:

-- a conditional subscription agreement, as first anticipated on

25 July 2023, to raise GBP2.5 million (the "Subscription") at 1.7

pence per ordinary share of 0.5 pence each from Pinnacle

International Venture Capital Ltd, a newly incorporated entity

managed by Pinnacle International Capital Corp. (together with its

affiliates, " Pinnacle " ) (the "Subscription Agreement");

-- a conditional placing agreement to raise a further GBP400,000

at 0.5 pence per Ordinary Share (the "Placing"); and

-- a GBP200,000 convertible loan facility with Pinnacle (the "Convertible Loan Facility").

Any amounts advanced to AMTE Power under the Convertible Loan

Facility shall reduce the amount available to the Company under the

Subscription Agreement by a corresponding amount.

The Placing and the Convertible Loan Facility are intended to

provide the Group with sufficient working capital until completion

of the Subscription Agreement.

Pinnacle

Pinnacle International Capital Corp. is a global private equity

firm specializing in real estate developments and buyout

investments. Pinnacle is committed to achieving long-term

sustainable growth in its investments, with a well-established team

possessing vast investment expertise and a proven track record of

identifying and capitalizing on investment opportunities. The

prospective investment from Pinnacle is aligned with the UK's

regional investment zones and job creation initiatives. The

investment will be made through Pinnacle International Ventures

Limited, a newly incorporated entity managed by Pinnacle.

The Subscription Agreement

Pinnacle has agreed, under the Subscription Agreement, to

conditionally subscribe for 147,058,824 new Ordinary Shares (the

"Subscription Shares") (to be reduced by the issue of any

Conversion Shares issued under the Convertible Loan Facility) at

1.7 pence each and has been granted warrants, as anticipated on 8

September 2023, exercisable over a further 880,184,436 Ordinary

Shares at 0.5 pence each, such that its interest in the enlarged

share capital of the Company, following the Placing, the issue of

any Conversion Shares and the exercise of all outstanding warrants

and options, as of today's date, (the "Fully Diluted Share

Capital") will amount to 80 per cent.

The Subscription Agreement is conditional, inter alia, upon:

-- Pinnacle being satisfied with the conclusion of its continuing due diligence enquiries;

-- the UK Panel on Takeovers and Mergers (the "Panel") agreeing

to waive the obligation under Rule 9 of the City Code on Takeovers

and Mergers to make a mandatory offer for the entire issued share

capital of the Company which would otherwise apply to Pinnacle upon

completion of the Subscription and conversion of the convertible

loan facility, subject to the approval of independent shareholders

of the Company (the "Rule 9 Waiver");

-- Pinnacle obtaining any consent under the National Security

and Investments Act 2021 in respect of the Subscription, if

required; and

-- the resolutions to be proposed at the general meeting to

approve the Subscription (which shall include the Rule 9 Waiver)

(the "Subscription General Meeting") being passed.

The Subscription Agreement also provides that:

-- Pinnacle would be entitled whilst it has an interest of: (i)

no less than 50 per cent. of the Fully Diluted Share Capital to

appoint 60 per cent. of the board of directors (the "Board") of the

Company; and (ii) between 25 per cent and 50 per cent of the Fully

Diluted Share Capital to appoint 40 per cent. of the Board, in each

case alongside two executive directors and two non-executive

directors independent of Pinnacle and its associates;

-- In the event that Pinnacle does not fully take up its rights

to appoint directors of the Board, those directors that it does

appoint will have the voting rights of those directors not

appointed at that time;

-- Pinnacle would be entitled, whilst it has an interest of no

less than 25 per cent of the Fully Diluted Share Capital, to

approve certain decisions of the Board, including in relation

to:

o the acquisition of interests in other companies;

o alterations to the Company's share capital and the rights

pertaining thereto;

o the issue or redemption of equity or debt capital;

o the adoption of the annual budget and approval of major items

not detailed therein; and

o the appointment of any new directors of the Board.

-- Pinnacle would be entitled to be provided, subject to

customary confidentiality undertakings, with certain internal

management information whilst it has an interest of not less than

25 per cent of the Fully Diluted Share Capital;

-- Pinnacle has accepted certain basic covenants typical of an

agreement with a controlling shareholder whilst it has an interest

of no less than 30 per cent of the Fully Diluted Share Capital and

for so long as the Ordinary Shares are admitted to trading on

AIM;

-- It will be the intention of the Company to cancel the

admission of the Ordinary Shares to trading on AIM and to seek

admission of the Company's then issued and to be issued share

capital to the standard listing segment (or any successor thereof)

of the Official List and to trading on the London Stock Exchange's

Main Market for listed securities, once AMTE Power so qualifies;

and

-- In the event that the Company is no longer admitted to

trading on AIM, it will use its best endeavours to issue Pinnacle

with a class of golden or special share, the rights attaching to

which provide Pinnacle with consent, information and board

appointment rights as summarised herein for so long as Pinnacle

holds not less than 5 per cent. of the Ordinary Shares.

The proceeds of the Subscription, net of expenses, are expected

to provide the Company with working capital until the second

quarter of 2024, at which point it is the intention of Pinnacle

either to provide additional equity or debt funds, or facilitate

the access to such funds.

A circular convening the Subscription General Meeting will be

circulated to the Company's shareholders ("Shareholders") as soon

as practicable.

The Placing

The GBP400,000 Placing (before expenses) announced today

comprises 80,000,000 new Ordinary Shares (the "Placing Shares")

being issued at 0.5 pence per Ordinary Share

The Placing Agreement is subject, among other things, to:

-- the necessary resolutions required to implement the Placing

(the "Placing Resolutions") being duly approved at a general

meeting (the "Placing General Meeting") to be convened on 4

December 2023;

-- the Panel granting the Rule 9 Waiver and the circular to

shareholders convening the Subscription General Meeting being

posted;

-- admission to trading on AIM of the Placing Shares ("Admission") becoming effective; and

-- upon the Placing Agreement between the Company and the Joint

Bookrunners (as defined below) not being terminated in accordance

with its terms.

The Placing Agreement is not conditional upon completion of the

Subscription Agreement.

There can be no certainty that even if the Subscription

Agreement is approved by shareholders, that it will complete, in

which case it would be likely that AMTE Power would not be able to

meet its financial obligations as they fall due and there would be

no alternative other than for the Group to enter into

administration or some other form of insolvency procedure under

which the prospects for recovery of value, if any, by Shareholders

would be uncertain.

Application will be made to the London Stock Exchange for

Admission. It is anticipated that Admission will take place on or

before 8.00 a.m. on 5 December 2023.

Following Admission, the Company will have 246,259,777 Ordinary

Shares in issue. The Placing Shares will represent 32.5 per cent.

of the issued share capital as enlarged by the Placing, but, for

the avoidance of doubt, not the Subscription, and will be issued

fully paid and will rank pari passu in all respects with the

Company's existing Ordinary Shares, including the right to receive

all dividends and other distributions declared, made or paid after

the date of issue.

The Convertible Loan Facility

Pinnacle has agreed to provide the Group with a GBP200,000 zero

coupon convertible loan facility. Any loan drawn down under the

facility is convertible into new ordinary shares (the "Conversion

Shares") at 0.5 pence per share and any amount not converted is

repayable after two years. The Company has agreed to make payments

only in accordance with an agreed cash flow forecast or as

otherwise agreed by Pinnacle

The Facility Agreement is subject, among other things, to:

-- the Panel granting the Rule 9 Waiver and the circular to

shareholders convening the Subscription General Meeting being

posted;

-- the necessary shareholder resolutions required for the

Placing being approved by the Company's shareholders at the Placing

General Meeting ; and

-- the Subscription Agreement not being terminated.

The conversion rights under the Convertible Loan Facility are

themselves conditional upon the resolutions to be proposed at the

Subscription General Meeting to approve the Rule 9 Waiver being

passed.

Any amounts advanced to AMTE Power under the Convertible Loan

Facility shall reduce the amount available to the Company under the

Subscription Agreement by a corresponding amount.

The aggregate proceeds of the Placing and the Facility, net of

expenses, are intended to provide the Group with working capital

until mid December 2023, by when it is anticipated that the

Subscription Agreement will have been completed.

WH Ireland Limited ("WHI") is acting as nominated adviser, joint

bookrunner and joint broker in connection with the Placing. SI

Capital Limited ("SI Capital" and together with WHI, the "Joint

Bookrunners") is acting as joint bookrunner and joint broker in

connection with the Placing.

The circular convening the Placing General Meeting is expected

to be posted to Shareholders today. Once published, a copy will

also be made available on the Company's website at

www.amtepower.com .

Importance of the vote

If the resolutions are not approved by Shareholders at the

Placing General Meeting, the Placing would not proceed as currently

envisaged and, as such, the anticipated net proceeds of the Placing

would not become available to AMTE Power. Accordingly, in light of

the Group's reducing cash position, it would be likely that AMTE

Power would not be able to meet its financial obligations as they

fall due, ahead of completion of the Subscription Agreement, and

there would be no alternative other than for the Group to enter

into administration or some other form of insolvency procedure

under which the prospects for recovery of value, if any, by

Shareholders would be uncertain.

Alan Hollis, Chief Executive Officer at AMTE Power, said:

"We are delighted to receive the continued support from both our

existing and new shareholders. It is also a very positive

indication of intent from Pinnacle who are supporting AMTE Power

with a CLN to help complete the recapitalisation plan. I look

forward to making more positive progress as we move towards the

successful completion of the Pinnacle investment".

The person responsible for arranging the release of this

announcement on behalf of the Company is Anita Breslin, Chief

Financial Officer of the Company.

Enquiries

AMTE Power plc +44 (0)1847 867 200

Alan Hollis (Chief Executive Officer)

Anita Breslin (Chief Financial Officer)

WH Ireland (NOMAD and Joint Broker) +44 (0)207 220 1666

Chris Fielding / James Bavister (Corporate

Finance)

Fraser Marshall (Corporate Broking)

SI Capital Limited (Joint Broker) +44 (0)148 341 3500

Nick Emerson (Corporate Finance)

Nick Briers (Corporate Broking)

Camarco (Financial PR)

+44 (0)203 757 4992

Ginny Pulbrook / Rosie Driscoll / 4981

About AMTE Power

AMTE Power was founded in 2013 and is a leading UK developer and

manufacturer of lithium-ion and sodium-ion battery cells for

specialist markets. In March 2021, the Company was admitted to

trading on the AIM market of the London Stock Exchange. The Company

is focused on launching a series of next generation battery cells

based on new chemistries and cell structures that are designed to

solve key problems in power delivery, energy performance, and

safety. These new products are targeted at a range of specialist

markets including the electric vehicle industry and energy storage

sector.

AMTE Power's purpose-built cell manufacturing facility in

Thurso, Scotland has the second largest cell manufacturing capacity

in the UK and the Company also has a product development team based

in Oxford. AMTE's proposed gigafactory in Dundee, Scotland is

expected to be capable of producing over 8 million battery cells

per annum enabling the Company to rapidly scale up cell

production.

For further information visit the Company's website:

www.amtepower.com

Important notices

This announcement is for information purposes only and does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in any jurisdiction and should not be relied upon in

connection with any decision to subscribe for or acquire ordinary

shares in the capital of the Company. In particular, this

announcement does not constitute or form part of any offer to issue

or sell, or the solicitation of an offer to acquire, purchase or

subscribe for, any securities in the United States.

This announcement has been issued by, and is the sole

responsibility of, the Company. No person has been authorised to

give any information or to make any representations other than

those contained in this announcement and, if given or made, such

information or representations must not be relied on as having been

authorised by the Company.

No statement in this announcement is intended to be a profit

forecast or profit estimate and no statement in this announcement

should be interpreted to mean that earnings per share of the

Company for the current or future financial years would necessarily

match or exceed the historical published earnings per share of the

Company.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will",

"would" or "should" or, in each case, their negative or other

variations or comparable terminology. These forward-looking

statements include matters that are not historical facts. They

appear in a number of places throughout this announcement and

include statements regarding the directors of the current Company's

intentions, beliefs or expectations concerning, among other things,

the Company's results of operations, financial condition,

liquidity, prospects, growth, strategies, and the Company's

markets. By their nature, forward-looking statements involve risk

and uncertainty because they relate to future events and

circumstances. Actual results and developments could differ

materially from those expressed or implied by the forward-looking

statements. Forward-looking statements may and often do differ

materially from actual results. Any forward-looking statements in

this announcement are based on certain factors and assumptions,

including the directors of the Company's current view with respect

to future events and are subject to risks relating to future events

and other risks, uncertainties and assumptions relating to the

Company's operations, results of operations, growth strategy and

liquidity. Whilst the directors of the Company consider these

assumptions to be reasonable based upon information currently

available, they may prove to be incorrect. Save as required by

applicable law, the AIM Rules for Companies or the Disclosure

Guidance and Transparency Rules of the Financial Conduct Authority

(the "FCA"), the Company undertakes no obligation to release

publicly the results of any revisions to any forward-looking

statements in this announcement that may occur due to any change in

the directors of the Company's expectations or to reflect events or

circumstances after the date of this announcement.

WH Ireland Limited is authorised and regulated by the FCA in the

United Kingdom and is acting exclusively for the Company and no one

else in connection with the Placing, and WHI will not be

responsible to anyone (including any persons subscribing for

Placing Shares ("Placees")) other than the Company for providing

the protections afforded to its clients or for providing advice in

relation to the Placing or any other matters referred to in this

Announcement.

SI Capital Limited is authorised and regulated by the FCA in the

United Kingdom and is acting exclusively for the Company and no one

else in connection with the Placing, and SI Capital will not be

responsible to anyone (including any Placees) other than the

Company for providing the protections afforded to its clients or

for providing advice in relation to the Placing or any other

matters referred to in this Announcement.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by the Joint Bookrunners or by any of their

respective affiliates, agents, directors, officers, consultants,

partners or employees as to, or in relation to, the accuracy or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefor is

expressly disclaimed.

The price of shares and any income expected from them may go

down as well as up and investors may not get back the full amount

invested upon disposal of the shares. Past performance is no guide

to future performance, and persons needing advice should consult an

independent financial adviser.

Neither the content of the Company's website nor any website

accessible by hyperlinks to the Company's website is incorporated

in, or forms part of, this announcement.

Certain figures contained in this announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this announcement may not conform exactly

with the total figure given.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than the AIM

market of the London Stock Exchange.

All references to time in this announcement are to London time,

unless otherwise stated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKABBNBDDCDD

(END) Dow Jones Newswires

November 16, 2023 08:31 ET (13:31 GMT)

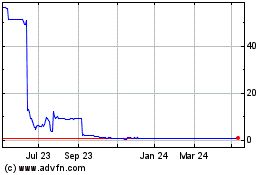

Amte Power (LSE:AMTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amte Power (LSE:AMTE)

Historical Stock Chart

From Apr 2023 to Apr 2024