TIDMAREC

RNS Number : 6853M

Arecor Therapeutics PLC

23 September 2021

Arecor Therapeutics plc

("Arecor", the "Company" or the "Group")

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Positive results from Phase I clinical trial for AT278

ultra-concentrated ultra-rapid acting insulin candidate for

diabetes

Three new partnership agreements

Successful GBP20 million AIM IPO

Cambridge, UK, 23 September 2021: Arecor Therapeutics plc (AIM:

AREC), a globally focused biopharmaceutical company advancing

today's therapies to enable healthier lives, today announces its

interim results for the six months ended 30 June 2021.

Sarah Howell, Chief Executive Officer of Arecor, said: "We have

made tremendous progress across the business during the first six

months of the year with our successful IPO on AIM and very

successful Phase I clinical results for AT278 being key highlights.

Earlier this week, we announced positive results from the Phase I

clinical trial for our ultra-concentrated ultra-rapid acting

insulin, AT278, the second product in our diabetes franchise. This

follows the positive results of the Phase I clinical trial for

AT247, our ultra-rapid acting insulin, and positions Arecor with a

combination of rapid concentrated and ultra-rapid insulins to

advance diabetes treatment. In addition, our new partnership

agreements with Lilly and Par, and most recently with Intas

Pharmaceuticals, further demonstrate the strength and breadth of

our Arestat(TM) platform. With the GBP20 million raised, we are now

well-placed to advance our proprietary pipeline with further

clinical trials for our lead products planned in the coming year,

including the expected completion of the US Phase I clinical trial

for AT247."

Operational Highlights (including post-period events):

-- Positive results from Phase I clinical trial for AT278, an

ultra-concentrated ultra-rapid acting insulin, demonstrating

significantly early accelerated PK/PD profile compared to market

leading comparator, NovoRapid(R)

-- Positive Phase I clinical data of AT247 presented at ATTD,

the leading international diabetes conference

-- Received FDA clearance of IND application for AT247, an

ultra-rapid acting insulin, paving the way for the US clinical

trial

-- Signed three new partnership agreements with Eli Lilly and

Company ('Lilly'), Par Sterile Products ('Par') and Intas

Pharmaceuticals ('Intas')

-- Awarded GBP2.8 million Innovate UK grant to support Phase II development of AT247

-- Grant of US patent as part of a global patent portfolio

underpinning the Arestat(TM) platform

Financial Highlights:

-- Successful IPO on AIM, raising GBP20 million

-- Revenue of GBP0.5 million (H1 2020: GBP0.8 million, including

GBP0.3 million milestone payment)

-- Investment in R&D of GBP1.9 million (H1 2020: GBP1.6 million)

-- Loss after tax for the period of GBP3.1 million (H1 2020: GBP1.0 million)

-- Cash and cash equivalents of GBP22.1 million at 30 June 2021 (30 June 2020: GBP2.5 million)

-- Debt free at 30 June 2021, following the conversion of GBP4.4

million loan notes into new ordinary shares, immediately prior to

the IPO

Analyst conference call today

Dr Sarah Howell, Chief Executive Officer, and Susan Lowther,

Chief Financial Officer, will host a meeting and webcast for

analysts and investors at 11.00 am UK time today. A copy of the

interim results presentation will be released later this morning on

the Company website at www.arecor.com. Please contact Consilium

Strategic Communications for details on arecor@consilium-comms.com

/ +44 203709 5700.

For more information, please contact:

Arecor Therapeutics plc www.arecor.com

Dr Sarah Howell, Chief Executive Officer Tel: +44 (0) 1223 426060

Email: info@arecor.com

Susan Lowther, Chief Financial Officer Tel: +44 (0) 1223 426060

Email: info@arecor.com

Mo Noonan, Communications Tel: +44 (0) 7876 444977

Email: mo.noonan@arecor.com

Panmure Gordon (UK) Limited (NOMAD and

Broker)

Freddy Crossley, Emma Earl (Corporate

Finance)

Rupert Dearden (Corporate Broking) Tel: +44 (0) 20 7886 2500

Consilium Strategic Communications

Chris Gardner, David Daley, Angela Gray Tel: +44 (0) 20 3709 5700

Email: arecor@consilium-comms.com

Notes to Editors

About Arecor

Arecor Therapeutics plc is a globally focused biopharmaceutical

company transforming patient care by bringing innovative medicines

to market through the enhancement of existing therapeutic products.

By applying our innovative proprietary formulation technology

platform, Arestat(TM), we are developing an internal portfolio of

proprietary products in diabetes and other indications, as well as

working with leading pharmaceutical and biotechnology companies to

deliver enhanced formulations of their therapeutic products. The

Arestat(TM) platform is supported by an extensive patent

portfolio.

For further details please see our website, www.arecor.com

This announcement contains inside information for the purposes

of the retained UK version of the EU Market Abuse Regulation (EU)

596/2014 ("UK MAR").

Corporate Overview

Arecor has continued to make strong progress in the first six

months of the financial year including its Admission to AIM on 3rd

June 2021 and associated successful placing which raised GBP20

million from new and existing shareholders.

During the period and in the lead up to these results, our

proprietary portfolio has made great advancements, with AT247, our

ultra-rapid insulin, presented at key conferences, receipt of a

substantial grant toward its Phase II development, and importantly,

U.S. Food and Drug Administration (FDA) clearance of the IND for a

Phase I clinical trial in the US. In addition, the positive results

of our first Phase I clinical trial for AT278, our

ultra-concentrated ultra-rapid insulin, further build on and

validate our diabetes franchise. These results are clinically

significant and signal AT278's potential to disrupt the market for

insulin treatment in people with diabetes. With no concentrated

(>200 U/mL) rapid acting insulin products currently on the

market, not only does AT278 have the potential to be the first such

product available to patients, it would be a critical enabler in

the development of next generation miniaturised insulin delivery

systems. There remains an urgent need for new insulin products that

can deliver improved patient outcomes. Progress in our portfolio

shows the potential of our enhanced therapeutics to deliver

significant clinical benefits to patients.

We have also continued to strengthen our portfolio of products

partnered with major pharmaceutical companies, demonstrating how

our formulation technology can bring enhanced products to market

for partners that simplify care and improve medicine

management.

Operational highlights (including post period end)

In March, we were awarded a GBP2.8 million grant from Innovate

UK to support the Phase II development of AT247, Arecor's

ultra-rapid acting insulin for the treatment of diabetes which has

been developed using our ground-breaking Arestat(TM) platform.

In June, we presented data at the leading international diabetes

conference ATTD (Advanced Technologies & Treatments for

Diabetes) following the successful results of our Phase I study of

AT247 ultra-rapid acting insulin, in which AT247 demonstrated

faster insulin absorption with an accelerated Pharmacokinetic (PK)

and Pharmacodynamic (PD) profile compared to NovoRapid(R) and

Fiasp(R).

In September, we received clearance from the FDA of our

Investigational New Drug (IND) application for AT247 allowing a

clinical trial to commence in the US. The IND supports a Phase I

clinical trial in approximately 24 participants with type I

diabetes, to further explore the clinical benefits of AT247. In a

recently published European Phase I clinical study, AT247 exhibited

an earlier insulin appearance, exposure, and offset, with

corresponding enhanced early glucose-lowering effect compared with

NovoRapid(R) and Fiasp(R). This new US clinical trial is expected

to complete in 2022.

In September, we announced positive results from a Phase I

clinical trial of our second product in the diabetes franchise,

AT278, an ultra-concentrated ultra-rapid acting insulin, which

demonstrated superiority over current market leading comparator,

NovoRapid(R). In the double-blind, randomised, two-way cross over

Phase I clinical study in 38 participants with Type I diabetes, the

pharmacokinetics (PK), pharmacodynamics (PD) and safety of a single

subcutaneous (SC) dose of 0.3 U/Kg AT278 (500 U/mL) were compared

with those of a single SC dose of 0.3 U/Kg NovoRapid(R) (100 U/mL),

a currently available gold standard rapid acting insulin treatment,

in a euglycemic clamp setting. The trial met the primary endpoint

of non-inferiority with respect to glucose lowering action as

compared with NovoRapid(R) (100 U/mL rapid acting insulin). In

addition to meeting this primary endpoint, AT278 also demonstrated

a significantly accelerated early PK/PD profile compared to

NovoRapid(R). No safety signals were detected. AT278 has the

potential to enable more effective management of blood glucose

levels to the increasing number of people with diabetes with high

daily insulin requirements (>200 units/day) whilst maintaining

the convenience and compliance benefits of being able to deliver

their required insulin doses in a lower injection volume via a

single injection. A truly rapid acting concentrated insulin is a

critical enabler in the development of the next generation

miniaturised insulin delivery devices.

Partnership agreements

During the period, and in the lead up to the financial results,

we added three new agreements to our partner portfolio of global

pharmaceutical companies including agreements with Lilly and Par in

the period and an agreement with Intas in September. In each of

these collaborations we apply our Arestat(TM) technology, which

enhances the properties of therapeutic proteins, peptides and

vaccines, to deliver superior reformulations of our partners'

proprietary products.

Our partners fully fund the development work and have the option

to acquire rights to the new proprietary formulation and associated

Intellectual Property under a technology licensing model, with

associated milestone and royalty payments.

In May, we signed an agreement to develop a differentiated,

thermostable formulation of one of Lilly's global, proprietary

products intended for self-administration. The thermostable

formulation would allow greater convenience of use of the product

by patients, whilst maintaining its integrity.

In June, we signed an agreement to develop a differentiated,

stable, single dose, Ready-to-Use ("RTU") formulation of one of

Par's products for intravenous administration. The new product

formulation supports safe medication practices and operational

efficiency by eliminating the need for reconstitution.

In September, we signed an agreement with Intas to develop a new

formulation to improve its usability for the patient compared to

current marketed products and in particular facilitate home use

outside of a healthcare environment. Upon successful completion of

development, Accord Healthcare, an affiliate of Intas, will promote

this product across all major markets.

Intellectual Property portfolio

In May, we were granted a patent by the United States Patent and

Trademark Office of U.S., Utility Patent No. 10,925,965 B2, that

contributes to the Group' global patent portfolio underpinning our

Arestat(TM) platform. This US patent claims proprietary formulation

technology aimed at enabling stabilised multi-dose protein products

that are desirable in the market but are often challenging to

achieve.

The US is an important international market for

biopharmaceuticals and one where Arecor has established commercial

and development partnerships.

Finance

Revenue recognised in the period of GBP0.5 million was derived

from formulation development projects and was in line with

expectations. In the prior period, revenue recognised of GBP0.8

million included a GBP0.3 million milestone from an existing

license agreement.

Other operating income of GBP51,000 (H1 2020: GBP0.3 million)

reflected start-up activities relating to a GBP2.8 million grant,

which was awarded by Innovate UK in March 2021. Other operating

income of GBP0.3 million in the prior period, was derived from two

Innovate grant projects which ended during 2020.

Investment in R&D increased to GBP1.9 million (H1 2020:

GBP1.6 million) and included Phase I clinical trial costs for

AT278, an ultra-concentrated ultra-rapid acting insulin. Other

administrative expenses increased to GBP1.4 million (H1 2020:

GBP0.7 million) which reflected the placing costs of GBP0.5 million

incurred in the period.

The total loss after tax for the period was GBP3.1 million (H1

2020: GBP1.0 million).

Following the admission to AIM on 3(rd) June, the Group closed

the first half of the financial year with a strong cash balance of

GBP22.1 million, compared to GBP2.5 million at 30 June 2020.

Summary and Outlook

"We have made tremendous progress across the business during the

first six months of the year with key highlights including our

successful IPO on AIM and, earlier this week, positive results from

the Phase I clinical trial for our ultra-concentrated ultra-rapid

acting insulin, AT278, the second product in our diabetes

franchise. This follows the positive results of the Phase I

clinical trial for AT247, our ultra-rapid insulin for diabetes, and

positions Arecor with a combination of rapid concentrated and

ultra-rapid insulins to advance diabetes treatment. In addition, we

have secured three new technology partnership collaborations with

Lilly, Par and Intas, further demonstrating the strength and

breadth of our Arestat(TM) technology platform. With the GBP20

million raised, we are now well-placed to rapidly advance our

proprietary pipeline with further clinical trials for our lead

products planned in the coming year, including the expected

completion of a US Phase I clinical trial for AT247."

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Consolidated Statement of Comprehensive Income

Notes Period ended Period Year ended

30 June 2021 ended 30 31 December

June 2020 2020

Unaudited Unaudited Audited

GBP GBP GBP

Revenue 3 460,021 817,043 1,697,593

Other operating income 51,341 342,608 452,456

Research and development (1,892,459) (1,620,575) (3,936,557)

Sales, General and Administrative 4 (1,440,899) (721,449) (1,323,692)

Share based compensation 5 (134,340) (158,911) (317,822)

Operating loss (2,956,336) (1,341,284) (3,428,022)

Finance income 4,556 3,548 2,976

Finance expense 6 (500,278) (6,249) (87,289)

Loss before tax (3,452,058) (1,343,985) (3,512,335)

Taxation 346,511 297,156 759,968

Loss for the period (3,105,547) (1,046,829) (2,752,367)

Basic and diluted loss per

share (GBP) 7 (0.17) (0.06) (0.17)

There were no other items of comprehensive income during the

periods under review.

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Consolidated Statement of Financial Position

Notes 30 June 2021 30 June 2020 31 December

2020

Unaudited Unaudited Audited

GBP GBP GBP

Assets

Non-current assets

Intangible Assets 34,030 42,363 38,196

Property, Plant and Equipment 361,000 371,089 375,346

Other receivables 48,000 48,000 48,000

443,030 461,452 461,542

Current assets

Trade and other receivables 612,003 227,812 165,536

Current tax receivable 346,511 295,445 758,257

Cash and cash equivalents 22,149,496 2,476,731 2,898,460

------------ ------------ ------------

23,108,010 2,999,988 3,822,253

Current liabilities

Trade and other payables (1,996,533) (864,432) (1,303,118)

Lease liabilities (124,813) (62,622) (105,215)

(2,121,346) (927,054) (1,408,333)

Non-current liabilities

Lease liabilities (168,314) (213,992) (191,903)

Borrowings 9 - - (1,698,229)

Derivative financial instruments - - (211,543)

------------ ------------ ------------

(168,314) (213,992) (2,101,675)

Net Assets 21,261,380 2,320,394 773,787

============ ============ ============

Equity

Share capital 10 276,835 27,135 27,155

Share premium 10 23,348,020 11,593,688 11,593,688

Other reserves 11,454,787 - -

Share-based compensation reserve 297,359 885,920 1,044,831

Retained earnings (14,115,621) (10,186,349) (11,891,887)

------------ ------------ ------------

Shareholder's funds 21,261,380 2,320,394 773,787

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Consolidated Statement of Changes in Equity

Share-based

Share Share Other compensation Retained Total

capital premium reserves reserve earnings equity

GBP GBP GBP GBP GBP GBP

For the period ended

30 June 2021

Balance at 1 January

2021 27,155 11,593,688 - 1,044,831 (11,891,887) 773,787

Loss for the period -- - - - (3,105,547) (3,105,547)

- - - -

--------------------------- ---------- ------------- ----------- -------------- ------------- ------------

Total comprehensive

loss for the period - - - - (3,105,547) (3,105,547)

Contributions by and

distributions to owners:

Shares issued by Arecor

Limited 625 - - - - 625

Share-based compensation:

reversal of Arecor

Limited charge - - - (881,813) 881,813 -

Capitalisation of

shares 138,901 (138,901) - - - -

Incorporation of Arecor

Therapeutics Limited - (11,454,787) 11,454,787 - - -

Share-based compensation: - - - 134,340 - 134,340

Arecor Therapeutics

plc charge

Shares issued by Arecor

Therapeutics plc 110,154 24,784,798 - - - 24,894,952

Share issue expense - (1,436,778) - - - (1,436,778)

Total contributions

by and distributions

to owners 249,680 11,754,332 11,454,787 (747,473) 881,813 23,593,139

---------- -------------

Balance at 30 June

2021 (Unaudited) 276,835 23,348,020 11,454,787 297,359 (14,115,621) 21,261,380

--------------------------- -------------- ------------- ------------

For the period ended

30 June 2020

Balance at 1 January

2020 26,732 11,593,688 - 727,009 (9,139,520) 3,207,909

Loss for the period - - - - (1,046,829) (1,046,829)

- - - - -

--------------------------- ---------- ------------- ----------- -------------- ------------- ------------

Total comprehensive

loss for the period - - - - (1,046,829) (1,046,829)

Contributions by and

distributions to owners:

Issue of shares 403 - - - - 403

Share-based compensation - - - 158,911 - 158,911

--------------------------- ---------- ------------- ----------- -------------- ------------- ------------

Total contributions

by and distributions

to owners 403 - - 158,911 - 159,314

Balance at 30 June

2020 (Unaudited) 27,135 11,593,688 - 885,920 (10,186,349) 2,320,394

--------------------------- -------------- ------------- ------------

For the year ended

31 December 2020

Balance at 1 January

2020 26,732 11,593,688 - 727,009 (9,139,520) 3,207,909

Loss for the year - - - - (2,752,367) (2,752,367)

- - - - - -

Total comprehensive

loss for the year - - - - (2,752,367) (2,752,367)

Contributions by and

distributions to owners:

Issue of shares 423 - - - - 423

Share-based compensation - - - 317,822 - 317,822

--------------------------- ---------- ------------- ----------- -------------- ------------- ------------

Total contributions

by and distributions

to owners 423 - - 317,822 - 318,245

--------------------------- ---------- ------------- ----------- -------------- ------------- ------------

Balance at 31 December

2020 (Audited) 27,155 11,593,688 - 1,044,831 (11,891,887) 773,787

=========================== ========== ============= =========== ============== ============= ============

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Consolidated Statement of Cash Flows

Period ended 30 June 2021 Period ended 30 June 2020 Year ended 31 December 2020

Unaudited Unaudited Audited

GBP GBP GBP

Cash flow from operating

activities

Loss before tax (3,452,058) (1,343,985) (3,512,335)

Finance income (4,556) (3,548) (2,976)

Finance costs 500,278 6,249 87,289

Share-based compensation 134,340 158,911 317,822

Depreciation 78,054 108,645 160,292

Amortisation 4,167 4,167 8,334

Foreign exchange movements (2,711) 43,371 42,944

-------------------------- -------------------------- ----------------------------

(2,742,486) (1,026,190) (2,898,630)

Changes in working capital

(Increase)/ decrease in trade

and other receivables (446,467) 321,446 383,722

Increase/(decrease) in trade and

other payables 693,415 (75,133) 363,553

Tax received 758,257 294,713 294,713

-------------------------- -------------------------- ----------------------------

1,005,205 541,026 1,041,988

Net cash used in operating

activities (1,737,281) (485,164) (1,856,642)

Cash flow from investing

activities

Purchase of property, plant &

equipment (14,510) (44,307) (52,295)

Interest received 258 3,548 2,976

Net cash used in investing

activities (14,252) (40,759) (49,319)

Cash flow from financing

activities

Issue of ordinary shares 20,000,626 403 423

Share issue costs (1,436,778) - -

Shareholder loans 2,500,000 - 1,905,474

Transaction costs on loan

received - - (65,006)

Capital payments on lease

liabilities (53,190) (21,813) (49,225)

Interest paid on lease

liabilities (10,800) (6,249) (17,985)

-

-------------------------- -------------------------- ----------------------------

Net cash generated by / (used

in) financing activities 20,999,858 (27,659) 1,773,681

Net increase / (decrease) in

cash and cash equivalents 19,248,325 (553,582) (132,280)

Cash and cash equivalents at

beginning of period or

financial year 2,898,460 3,073,684 3,073,684

Exchange rate movement 2,711 (43,371) (42,944)

-------------------------- -------------------------- ----------------------------

Cash and cash equivalents at end

of period or financial year 22,149,496 2,476,732 2,898,460

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Notes to the financial information

COMPANY INFORMATION

Arecor Therapeutics plc ("Arecor" or "the Company") is a public

limited company incorporated and registered in England and Wales on

13 April 2021 at Chesterford Research Park, Little Chesterford,

Saffron Walden, CB10 1XL with registered number 13331147.

The business of the Company and its principal activity is to act

as a holding company. The Group's activities and operations are

carried on by Arecor Limited, the Company's wholly owned

subsidiary.

On 24 May 2021 Arecor Limited undertook a bonus issue of shares

and share options on the basis of five shares for every one share

or share option held.

On 24 May 2021 all shareholders and convertible loan note

holders in Arecor Limited and the Company entered into a Share and

CLN Exchange Agreement, pursuant to which the Company acquired the

entire issued share capital and convertible loan notes in Arecor

Limited.

On 24 May 2021 the Company was re-registered under section 92 of

the Companies Act as a public limited company.

On 2 June 2021, pursuant to a Shareholders' resolution passed on

26 May 2021 and class consents:

a) the A ordinary shares, A1 ordinary shares and B ordinary

shares were converted into ordinary shares;

b) the ordinary shares were converted into C ordinary shares; and

c) the Company renamed the C ordinary shares into ordinary shares

On 3 June 2021 the Company's shares were admitted to trading on

AIM, a market operated by The London Stock Exchange.

1. BASIS OF PREPARATION

The financial statements for the period ended 30 June 2021

incorporate the results of Arecor Therapeutics plc and Arecor

Limited. The Group's consolidated interim financial information for

the period to 30 June 2021 are unaudited. They were approved by the

board of directors on 20th September 2021.

International Financial Reporting Standards as adopted for use

in the European Union ("IFRS") is subject to amendment and

interpretation by the International Accounting Standards Board

("IASB") and the IFRS Interpretations Committee and there is an

on-going process of review and endorsement by the European

Commission. The financial information has been prepared on the

basis of IFRS that the Directors expect to be applicable at 31

December 2021.

The consolidated statements have been prepared and are presented

as a continuation of the financial statements of Arecor Limited,

adjusted to reflect the share capital of the new parent. The

results presented for the comparative periods relate to Arecor

Limited.

The financial information contained in these interim financial

statements does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. These interim financial

statements do not include all of the information and disclosures

required in the annual financial statements. The financial

information for the six months ended 30 June 2021 and 30 June 2020

is unaudited.

Financial statements for year ended 31 December 2020 have been

filed with the Registrar of Companies for Arecor Limited (Company

registration number 06256698). The audit report for this period,

previously filed, was unmodified.

Since the registration of Arecor Therapeutics plc in April 2021,

audited financial statements have yet to be filed with the

Registrar of Companies.

All intra-Group transactions, balances, income and expenses have

been eliminated in full on consolidation.

The financial information is presented in Sterling, which is the

functional currency of the Group and has been rounded to the

nearest GBP.

2. PRINCIPAL ACCOUNTING POLICIES

The interim financial statements have been prepared in

accordance with the accounting policies set out in the audited

financial statements for the period ended 31 December 2020 and

IFRS.

a) Going Concern

The Directors are pleased to present the financial information

on a going concern basis. Having carefully considered the cash

position of GBP22.1 million at the 30 June 2021 reporting date and

the cashflow forecast for the 12 months from the date of approval

of the interim results, the Directors are confident that the Group

has sufficient cash to make the necessary investments to grow in

line with its strategic vision and to meet the liabilities of the

business as they fall due.

The current COVID-19 pandemic has the potential to materially

impact the ability of the Group to execute its strategy and to

negatively impact the Group's cashflow forecast. At the date of

approval of the interim results, the Company's operations have not

been significantly impacted by the crisis.

The Directors are confident that at this time of economic

uncertainty, the Group has a stable cash position and all necessary

actions have been taken to protect the business from the impact of

the COVID-19 pandemic.

b) Revenue

Revenue is measured based on the consideration that the Company

expects to be entitled to in exchange for transferring promised

goods and services. There are two main revenue types: the first

arises from the performance of formulation development studies and

the second from granting of licences.

Formulation development

Revenue from the performance of formulation development projects

is recognised as the performance obligation defined in a contract

is performed over time. The progress of the work is dictated by

project phases, hence time passed best indicates the stage of

completion of a service performed over time, over the life of each

element of the contract. The Company's performance does not create

an asset with an alternative use to the Company and the Company has

an enforceable right to payment for performance completed to

date.

Transaction prices are determined based on prices agreed in the

contracts, each of which is negotiated individually with the

customer. This includes the allocation of the whole contract price

between each distinct performance obligation within each

contract.

The types of contracts entered into by the Company do not

include any obligations for returns or refunds nor are warranties

offered relating to the work performed.

None of the practical expedients in IFRS 15 have been

applied.

In general, revenue is billed in advance of performance of work

for each phase of a contract, meaning most arrangements give rise

to contract liabilities as each invoice is raised, and these

liabilities are fully released before the next billing point.

Licence agreements

Revenue from licence agreements where it has been assessed as

giving the right to use the underlying intellectual property, is

recognised at the granting of the licence.

Where agreements combine the grant of a licence and the

provision of services the consideration is allocated between the

two elements based on the identifiable elements of the separate

performance obligations, being the licence grant and the distinct

obligations included in the agreement.

Where licences include variable consideration, typically in the

form of milestone payments, revenue is recognised when a milestone

is achieved.

Non-government grants

Where the Company receives non-government grants, they are

treated as revenue as they have comparable performance obligations

and conditions to other revenue contracts. These grants typically

relate to research projects rather than licences.

c) Government grants

The Company receives UK government grants for research work.

Grants are agreed for named projects, offering reimbursement of

specified costs incurred on these projects. The grants are paid

after each grant reporting period when the claim is submitted, and

there are no clauses requiring the Company to repay any amounts as

the funding is cost-based rather than outcome-based. The

administering body has the right to request information on any

items within each grant claim and to request an independent

auditor's report. There are no clawback provisions relating to the

grants as they are not paid until after the relevant expenditure

has been incurred and agreed, and this is the only condition.

Revenue-based grants have been credited to the statement of

comprehensive income in the period to which they relate.

d) Research and development costs

Research expenditure is expensed as it is incurred. Development

costs relating to internally developed products are capitalised

from the date at which all of the following criteria are met for a

product:

-- The technical feasibility of completing the project (so that

an intangible asset thereby generated will be available for use or

sale) can be demonstrated;

-- An intention to complete the project can be demonstrated;

-- An ability to use or sell an intangible asset generated by

the project can be demonstrated;

-- It is possible to demonstrate how an intangible asset

generated by the project will generate probable future economic

benefits for the Company;

-- It is possible to demonstrate the availability of adequate

technical, financial & other relevant resources to complete the

development and to use or sell an intangible asset generated by the

project;

-- An ability to measure reliably the expenditure attributable

to the project can be demonstrated.

Until all of the above criteria are met, such costs are

classified as research expenditure and expensed accordingly. As

drug products cannot be commercialised until they have completed

Phase III clinical trials and received regulatory approval, the

Company considers that the above criteria have not been met for any

current products and therefore all costs will continue to be

expensed until such time as they are met.

Included within research expenditure are all costs relating to

the development and protection of the Company's intellectual

property. These are expensed through the Statement of Comprehensive

Income.

e) Share based compensation

The Company operates an All-Employee Share Option Plan (AESOP)

and grants EMI share options to all eligible employees. The

Company's Long Term Incentive Plan (LTIP) is principally used to

grant options to senior management. A grant of options under the

AESOP and the LTIP was made on 3 June 2021.

On 2 June, certain employees entered into an EMI option exchange

agreement where they agreed to release an option over shares in

Arecor Limited ('Old Option') for a replacement option over shares

in the Company ('Rollover Option'). The Rollover Options are

treated as having been granted on the date on which the Old Option

was granted and are exercisable subject to the same conditions as

applied to the Old Option.

f) Impairment of non-financial assets

At each balance sheet date, the Directors review the carrying

amounts of the Company's tangible and intangible assets to

determine whether there is any indication that those assets have

suffered an impairment loss. If any indication of impairment

exists, the recoverable amount of the asset is estimated in order

to determine the extent of the impairment loss, if any.

g) Leases

The Company has taken the IFRS 1 exemption in relation to the

adoption of IFRS 16, thereby measuring the lease liability at the

present value of the remaining lease payments, discounted using the

lessee's incremental borrowing rate at the date of transition to

IFRS. The right of use asset is measured at the transition date at

an amount equal to the lease liability, adjusted by the amount of

any prepaid or accrued lease payments relating to that lease

recognised in the statement of financial position immediately

before the date of transition to IFRS.

The Company assesses whether a contract is or contains a lease,

at inception of the contract. The Company recognises a right of use

asset and a corresponding lease liability with respect to all lease

arrangements in which it is the lessee.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted by using the rate implicit in the lease. If this rate

cannot be readily determined, the lessee uses its incremental

borrowing rate.

Right of use assets are recognised in a separate category of

property, plant and equipment and are depreciated over the shorter

period of lease term and useful life of the underlying asset,

starting at the commencement date of the lease.

3. REVENUE AND OPERATING SEGMENT

Year ended

Period ended Period ended 31 December

30 June 2021 30 June 2020 2020

UK - - -

Europe 46,539 369,158 735,675

Rest of World 413,482 447,885 961,918

Total revenue 460,021 817,043 1,697,593

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The Board of Directors has been identified as the chief operating

decision maker, who is responsible for allocating resources,

assessing the performance of the operating segment and making

strategic decision.

For the period ending 30 June 2021, five customers (period to 30

June 2020, three customers) each contributed more than 10% of the

Company's revenue, with the largest three customers contributing

30%, 19% and 18% respectively (period to June 2020, 42%, 33%,

11%).

Year ended

Period ended Period ended 31 December

30 June 2021 30 June 2020 2020

Formulation development projects 375,648 389,631 666,089

Licence agreements - 339,443 920,015

Non-Government grants 84,373 87,969 111,489

Total revenue 460,021 817,043 1,697,593

Revenue from formulation development projects is recognised as

the performance obligations set out in agreements are satisfied

over time.

Revenue from licence agreements which include a right to use the

underlying intellectual property is recognised at the granting of a

licence. Where agreements combine the grant of a licence and the

provision of services the recognition is allocated between the two

elements based on the identifiable elements of performance

obligations set out in each agreement. Milestones defined in

license agreements are recognised when a milestone is achieved.

4. SALES, GENERAL AND ADMINISTRATIVE COSTS

Operating expenditure which is not considered as Research and

Development is treated as Sales, General and Administrative costs.

This includes Finance, HR, Administrative and Business Development

teams, building facilities and costs relating to the Board of

Directors.

In the period Sales, General and Administrative included GBP0.5

million non-recurring costs associated with the Admission of Arecor

Therapeutics plc to AIM.

Expenditure from continuing operations for the period of GBP1.0

million was broadly in line with the prior period (H1 2020: GBP0.9

million).

5. SHARE BASED COMPENSATION

On 2 June, certain employees entered into an EMI option exchange

agreement where they agreed to release an option over shares in

Arecor Limited ('Old Option') for a replacement option over shares

in the Company ('Rollover Option'). The Rollover Options are

treated as having been granted on the date on which the Old Option

was granted, with the earliest grant date being 12 December 2018

and the latest grant date being 3 November 2020.

The Rollover Options are subject to graded vesting: one third

vest on the first anniversary of the date of grant and two thirds

vest in equal instalments over the following 24 months. The

Rollover Options are subject to the same conditions which applied

to the Old Option. The exercise price is GBP0.01 per share.

The Company operates an All-Employee Share Option Plan (AESOP)

and grants EMI share options to eligible employees. A grant of

options under the AESOP was made on 3(rd) June at an exercise price

of GBP2.26 per share. The options are subject to graded vesting

with one third vesting on the first, second and third anniversary

of the date of grant.

The Company's Long Term Incentive Plan (LTIP) is principally

used to grant options to Executive directors and senior management.

A grant of options under the LTIP was made on 3rd June at an

exercise price of GBP0.01 per share. The LTIP options will vest

after three years subject to meeting a performance criteria of

total shareholder return in relation to the techMARK mediscience

index over the same period. Ordinary shares acquired on exercise of

the LTIP options are subject to a holding period of a minimum of

one year from the date of vesting.

The movement in share options in the period was as follows:

Number of Options

Opening Balance at 1 January 2020 144,100

Options vested and exercised (42,299)

Options lapsed (1,319)

Options granted 21,250

Balance at 31(st) December 2020 121,732

Options vested and exercised (62,493)

Options lapsed (5,250)

Bonus issue (five to one basis) 269,945

EMI Options granted 404,750

LTIP options granted 700,000

Balance at 30 June 2021 1,428,684

Charges to the Statement of Comprehensive Income GBP

Period to June 2021 134,340

Period to June 2020 37,822

Year to December 2020 79,723

The Rollover Options have been treated as a modification of the

original options, adjusted for the bonus issue of five share

options for every one share option held and the corresponding

dilution of the fair value of each option. The vesting period of

the Rollover Options is unchanged.

6. FINANCE EXPENSES

Included in Finance expense is a charge of GBP0.5 million

relating to the conversion of the convertible loan note instruments

into ordinary shares at a subscription price which was at a

discount of 10% to the placing price at Admission.

7. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the loss

attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during

the period.

Given the Company's reported loss for the periods and financial

year, share options were not taken into account when determining

the weighted average number of ordinary shares in issue during the

year as they would be anti-dilutive, and therefore the basic and

diluted loss per share are the same.

On 3 June, 8,849,558 ordinary shares were issued by the Company

pursuant to the placing and admission to AIM.

These share issues have been included in the earnings per share

calculation of the prior period and year ended 31 December 2020, to

provide a comparable calculation.

Basic and diluted loss per share

Period ended Period ended Year ended

30 June 2021 30 June 31 December 2020

2020

Loss for the period (GBP) (3,105,547) (1,046,829) (2,752,367)

Weighted average number of ordinary shares (number) 18,237,593 16,202,890 16,247,322

Loss per share from continuing operations (GBP per share) (0.17) (0.06) (0.17)

============== ============= ==================

8. RELATED PARTY TRANSACTIONS

In the period and pre-Admission to AIM the Company paid

consultancy fees of GBP42,217 (2020: GBP23,882) to one

non-executive director and one former non-executive director who

are also shareholders.

9. BORROWINGS AND DERIVATIVES

At 30 June At 30 June At 31 December

2021 2020 2020

GBP GBP GBP

Non-current

Convertible loan notes - - 1,698,229

============ ============ ===============

- - 1,698,229

============ ===================================== ===============

Total borrowings - - 1,698,229

============ ============ ===============

At 30 June At 30 June At 31 December

2021 2020 2020

GBP GBP GBP

Non-current

Embedded derivative - - 211,543

============ ============ ===============

- - 211,543

============ ================================== ===============

Convertible loan note instruments

On 28 October 2020, Arecor Limited executed a convertible loan

note instrument which constituted GBP1,905,474 unsecured

convertible loan notes. On 31 March 2021, Arecor Limited executed a

supplemental loan note instrument for GBP2,500,000 unsecured

convertible loan notes.

The terms of these instruments included interest payable at the

rate of eight per cent. per annum. The loan notes plus accrued,

unpaid interest could be:

a) converted into shares on the admission to a recognised

investment exchange including AIM;

b) converted into shares upon raising equity capital of at least GBP8,000,000; or

c) redeemed on the first business day after the fifth anniversary of the date of issue.

Following the adoption by the Company of the convertible loan

notes and completion of the Share and CLN Exchange on 24 May 2021,

the convertible loan notes in Arecor Limited were released. The

convertible loan stock of GBP4,405,474 in the Company was converted

into ordinary shares, immediately prior to Admission, at a 10%

discount to the placing price. This has been treated as a finance

expense in the Consolidated Statement of Comprehensive Income.

Interest accrued was disregarded on conversion in accordance

with the terms of the instruments.

10. EQUITY

Share Capital

At 30 June At 30 June At 31 December

2021 2020 2020

Number Number Number

Allotted, called up and fully

paid

Ordinary shares of GBP0.01 27,683,532 134,676 135,245

A Ordinary shares of GBP0.01 1,397,715 1,397,715

A1 Ordinary shares of GBP0.01 24,600 24,600

B Ordinary shares of GBP0.01 243,386 244,776

C Ordinary shares of GBP0.01 913,182 913,182

----------- ----------- ---------------

Total share capital 27,683,532 2,713,559 2,715,518

=========== =========== ===============

At 30 June At 30 June At 31 December

2021 2020 2020

GBP GBP GBP

Allotted, called up and fully

paid

Ordinary shares of GBP0.01 276,835 1,347 1,352

A Ordinary shares of GBP0.01 13,977 13,977

A1 Ordinary shares of GBP0.01 246 246

B Ordinary shares of GBP0.01 2,434 2,448

C Ordinary shares of GBP0.01 9,132 9,132

----------- ----------- ---------------

Total share capital 276,835 27,136 27,155

=========== =========== ===============

On 2 June 2021, pursuant to a Shareholders' resolution passed on

26 May 2021 and class consents:

a) the A ordinary shares, A1 ordinary shares and B ordinary

shares were converted into ordinary shares;

b) the ordinary shares were converted into C ordinary shares; and

c) the Company renamed the C ordinary shares as ordinary shares

This resulted in 16,668,066 existing ordinary shares.

On 2 June 2021, 2,165,908 ordinary shares were issued pursuant

to the share and convertible loan note conversion.

On 3 June 2021 8,849,558 ordinary shares were issued by the

Company pursuant to the placing and admission to AIM, raising GBP20

million before expenses.

Share Premium

Proceeds received in addition to the nominal value of the shares

issued during the period have been included in share premium less

registration and other regulatory fees and net of related tax

benefits. Costs of new shares issued to share premium in the period

amounted to GBP24,754,332. Registration and other regulatory fees

incurred as a result of these transactions amounted to

GBP1,436,778.

11. EVENTS AFTER THE BALANCE SHEET DATE

There have been no events since the 30 June 2021 reporting date

that have had a material impact on the financial results

announced.

12. COPIES OF INTERIM REPORT

Copies of the interim report are available to the public free of

charge from the Company at Chesterford Research Park, Little

Chesterford, Saffron Walden, CB10 1 XL during normal business hours

for 14 days from today.

Copies are also available on the Company's website at

www.arecor.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAENAAFKFEAA

(END) Dow Jones Newswires

September 23, 2021 02:00 ET (06:00 GMT)

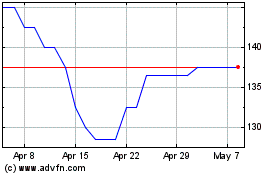

Arecor Therapeutics (LSE:AREC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arecor Therapeutics (LSE:AREC)

Historical Stock Chart

From Apr 2023 to Apr 2024