Caspian Sunrise plc BNG Contract Area Early Licence Renewal (7739U)

27 October 2017 - 5:00PM

UK Regulatory

TIDMCASP

RNS Number : 7739U

Caspian Sunrise plc

27 October 2017

Caspian Sunrise PLC ("Caspian Sunrise" or the "Company")

BNG Contract Area Early Licence Renewal

Introduction

Caspian Sunrise PLC (AIM:CASP) ("Caspian Sunrise"), the Central

Asian oil and gas company, with a focus on Kazakhstan, is pleased

to update the market with news of the extension of its licence at

its flagship BNG Contract Area.

BNG licence renewal

Caspian Sunrise has a 99% interest in the BNG Contract Area,

which is located in the west of Kazakhstan, 40 kilometers southeast

of Tengiz, on the edge of the Mangistau Oblast.

As previously announced the licence at the BNG Contract Area is

due for renewal in June 2018, when it was expected the Company

would apply for a 29-year full production licence to cover the

whole BNG Contract Area.

The principal benefit from moving to a full production licence

will be the ability to sell the majority of oil produced based on

world prices rather than the domestic prices permitted under an

appraisal licence (currently typically $16-$20 per barrel).

A drawback is that a condition of such a licence upgrade may

have been the need to curtail some of the planned exploration and

development activities especially at our deeper prospects. This

stems predominantly from the need to have explored regions and

structures during the appraisal period of a licence to allow

unrestricted further development during the full production

phase.

Caspian Sunrise is therefore delighted to announce its early

agreement with the Kazakh regulatory authorities to extend the

whole of its licence at BNG on an appraisal basis for a further six

years effective from June 2018 with the opportunity from that date

to apply to convert individual structures to full production status

at the Company's timing.

The ability to elect the timing of when to apply for different

structures to move to full production status will allow the Company

to manage the move from appraisal to production on a structure by

structure basis rather than for the Contract Area as a whole.

This marks a very positive outcome as it should be possible for

instance for the Company to operate its highly successful and well

developed MJF structure on a full production licence basis while

continuing to explore other shallow and deep prospects.

For example the shallow MJF Structure already has 5 producing

wells with a sixth well nearing its total depth. In comparison, the

potential shallow New Structure has only one well drilled and to

date this has not shown it can produce at commercial rates but

given more time and work may do so.

Of greatest importance however is the benefit for the deeper

prospects to be explored more fully before moving to full

production status. For example the Deep Airshagyl Structure, with

A5 & A6 already drilled and A8 due for spudding in Q4 2017, and

where we have more information on likely structure boundaries, is

likely to be suitable for a move to full production status before

the deep Yelemes Structure on which only Deep Well 801 has been

drilled to date with Deep Well 802 is planned for H1 2018.

Another consequence of this better phasing will be that, if the

Company so choses, even its deep drilling could be funded by the

pre-sale of oil from the BNG Contract Area making any large scale

equity fund-raising entirely discretionary.

The first opportunity to apply for a structure to be licenced on

a full production basis remains June 2018.

In summary, the early agreement on the terms of the licence

allows the Company's management to better plan for the maximisation

of the returns from the BNG Contract Area and lessens the need to

seek external large scale equity funding for our planned deep

drilling programme.

Clive Carver, Executive Chairman of Caspian Sunrise,

commented:

The flexibility afforded to the Company by the early agreement

with the Kazakh authorities on the extension of the licence for the

BNG Contract Area should materially improve the returns to current

shareholders as the funding of our near term deep wells should now

be within the Company's control from the pre-sales of oil without

the need for dilutive equity issues.

Ends

Enquiries:

Caspian Sunrise PLC

Clive Carver

Executive Chairman +7 727 375 0202

WH Ireland, Nominated Adviser

& Broker

James Joyce

James Bavister +44 (0) 207 220 1666

Yellow Jersey PR

Tim Thompson +44 (0) 203 735 8825

Qualified Person

Mr. Nurlybek Ospanov, Caspian Sunrise PLC's Chief Geologist /

Technical Director who is a member of the Society of Petroleum

Engineers ("SPE"), has reviewed and approved the technical

disclosures in this announcement.

This announcement has been posted to:

www.caspiansunrise.com/investors

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDPGGUGUUPMPUQ

(END) Dow Jones Newswires

October 27, 2017 02:00 ET (06:00 GMT)

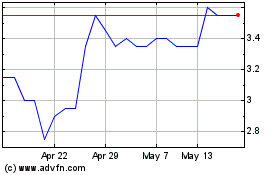

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Apr 2024 to May 2024

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From May 2023 to May 2024