TIDMCASP

RNS Number : 7600R

Caspian Sunrise plc

31 October 2023

Caspian Sunrise PLC ("Caspian Sunrise" or the "Group")

Operational update

Introduction

The Board of Caspian Sunrise is pleased to provide the following

operational update on the Group's activities.

Impact of sanctions

Shareholders are reminded that neither the UK nor the EU has

imposed sanctions on oil produced in Kazakhstan and transported via

the Russian pipeline network. Nevertheless, the sanctions on Russia

continue to have a significant impact on the Group's current

position.

The disruption from the need to source drilling consumables from

China continues to have an adverse impact on day to day operations.

However, on a more positive note, the discount for oil produced in

Kazakhstan and sold internationally via the Russian pipeline

network has narrowed from the initial $35 per barrel to nearer $10

per barrel.

The two month lag in receiving payment for oil sold

internationally and the associated costs and taxes attributable to

international sales mean, even with Brent at $90 per barrel, we

remain better off selling to the traditional domestic market and

the newer domestic mini-refinery market.

With domestic prices at approximately $32 per barrel and

domestic mini-refinery prices at approximately $34 per barrel we

estimate that the headline Brent price would need to be

approximately $100 per barrel to make a switch to international

sales worthwhile.

BNG Overview

The plan at the two shallow structures on the BNG Contract area

is to use a horizontal drilling approach on the older MJF wells to

target oil in the Jurassic and on the older wells at the South

Yelemes structure to target oil in the shallower Dolomite.

With the deeper structures the plan is to complete the current

mandated drilling programme by drilling Well 803 and completing

Well A7, before looking to bring as many as possible of the deep

wells already drilled into production. After Well 803, it is

unlikely any further deep wells will be drilled at the BNG Contract

area.

BNG Production

Since our last update in the interim results released towards

the end of September 2023, no additional wells have yet returned to

production. Accordingly, production levels remain at approximately

2,000 bopd.

In particular there has been no contribution from the previously

strongly performing MJF wells 142 and 141.

BNG Shallow structures

MJF

At Well 142 the side track is almost complete and ready for

testing, which if successful would lead to the well contributing to

increased production levels from mid-November.

Well 155 is due to be spudded before the end of November and

drilled to a depth of approximately 3,000 meters with drilling

expected to be completed by the end of Q1 2024.

Well 141 is the next shallow well to be worked over with a

horizontal side track with work expected to commence in December

2023.

South Yelemes

Wells 54, 805, 806 & 807 are to be worked over using a G20

rig starting in Q1 2024 at depths of approximately 2,000 meters

targeting the previously unexplored Dolomite.

Deep structures

Yelemes Deep

At Well 802 the problem has been our inability to remove a stuck

pipe to allow the well to be properly tested. Work at Well 802 has

now stopped to allow the rig to be used to drill Well 803 the last

of the deep wells in our BNG work programme, which is due to be

spudded in mid-November and drilled to a planned depth of 3,950

meters. Drilling is expected to complete by March 2024.

We are in early stage discussions with specialist international

drilling companies to have them bring Well 802 into production on a

success basis in return for a revenue split on that well.

Airshagyl

At Deep Well A5 the plan remains to drill a new side track using

one of the rigs recently in use at Block 8, with work starting in

November.

Drilling at Deep Well A7, was paused at a depth of 2,000 meters.

The plan is to use the G70 rig previously used to drill Deep Well

A8 to finish drilling Well A7 to a maximum depth of 4,750

meters.

Other deep wells

At both deep Well A6 and Deep Well 801 we will consider the

various options in light of the outcomes at the other Deep Wells

referred to above.

Production expectations

Our hope and belief is that the work planned for the shallow

structures will significantly improve production levels before the

year end. We also believe the work planned at the deep structures

provides the best chance for a transformative deep well

success.

Block 8

Shareholders are reminded that the option to acquire Block 8 has

been exercised with the timing of completion now largely dependent

on the usual regulatory approvals.

Drilling at the two deep wells undertaken by CTS, the Group's

wholly owned drilling subsidiary, has been completed with both now

preparing for testing. Success with these wells, once the Block 8

acquisition has completed, could also significantly add to

production levels.

Oil trading

We are pleased to report that the encouraging start to our oil

trading activities continues. While we remain cautious, limiting

trading for the time being to oil produced on our own assets, we

believe this new income stream will become increasingly important

to the Group in the coming years.

Caspian Explorer

Preparations continue to make the Caspian Explorer ready for the

summer 2024 ENI contract.

Additionally, we are in discussions with a number of potential

partners concerning further contracts in 2024 and beyond.

3A Best

There has been no change in the position at 3A Best where the

licence has expired, other than KMG, the Kazakh state national oil

& gas company, has acquired the adjacent and highly successful

Dunga field.

Other projects

We are evaluating a number of other on shore and offshore

opportunities both to acquire existing contract areas and to drill

on contract areas belonging to others in return for earning an

equity position. We are also evaluating opportunities in the

minerals sector.

Dividend update

In June 2023 we suspended dividend payments following the

failure to receive the $22.5 million payment due for the sale of

50% of the Caspian Explorer and the adverse impact of sanctions

both on the ability to sell to international markets and the extra

costs involved in sourcing consumables from China. At the time we

undertook to review the position towards the end of the year.

While the discount for oil produced in Kazakhstan and delivered

via the Russian pipeline network has narrowed, the continuing

adverse impact of Russian sanctions plus the number of

opportunities to increase longer term shareholder value by

corporate actions leads the Board to consider the resumption of

dividend payments in the near future to be unlikely.

Auditors

We are please to welcome PKF Littlejohn LLP as the Group's new

auditors starting with the audit for the year ending 31 December

2023.

Corporate presentation

We draw shareholders attention to an updated corporate

presentation, which may be found on the Caspian Sunrise website

using the following link

https://www.caspiansunrise.com/investors/circulars-documents/

Comment

Clive Carver, Chairman said

"We are getting to the point of discovering the outcome of

sustained drilling campaigns at both the BNG and Block 8 Contract

Areas.

Success in the shallow structures would significantly increase

day to day production volumes. Success in any of the deep

structures would significantly impact the Group's longer term

value.

We therefore look forward to updating shareholders with

developments in the coming weeks and months."

Contacts:

Caspian Sunrise PLC

Clive Carver, Chairman +7 727 375 0202

WH Ireland, Nominated Adviser & Broker

James Joyce +44 (0) 207 220 1666

James Bavister

Andrew de Andrade

Qualified person

Mr. Assylbek Umbetov, a member of the Association of Petroleum

Engineers, has reviewed and approved the technical disclosures in

this announcement.

This announcement has been posted to:

www.caspiansunrise.com/investors

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDWPGMAUUPWGQU

(END) Dow Jones Newswires

October 31, 2023 03:00 ET (07:00 GMT)

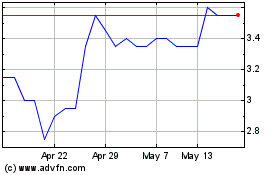

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Dec 2024 to Dec 2024

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Dec 2023 to Dec 2024