Comptoir Group PLC Trading Update (1421H)

05 June 2017 - 7:15PM

UK Regulatory

TIDMCOM

RNS Number : 1421H

Comptoir Group PLC

05 June 2017

Comptoir Group PLC ("Comptoir" or the "Company")

Trading Update

The Company today announces a trading update ahead of its Annual

General Meeting on the 7(th) June 2017. The Company currently

operates 23 restaurants, 10 of which opened in the last 8 months,

and 2 franchise locations.

The Directors confirm that, overall, the past two months have

seen a continuation of the difficult trading it reported at the

time of its prelims in April 2017. While the business saw improved

sales figures over the Easter weekend and half term holidays,

unfortunately much of this benefit was subsequently lost in the

final two weeks of the month. In May 2017 the Company also

experienced an unexpected decline in like for like sales and profit

at certain mature restaurants, particularly in retail-led locations

and at its higher-spend restaurants, Levant and Kenza.

In addition, although the group as a whole is seeing a

progression in sales, a number of the restaurants opened in 2016

remain behind expectations in terms of their anticipated maturity

trading curve.

Like many of its peers in the sector, the Company is

experiencing upward pressure on costs, including incremental wage

costs and related taxes (apprenticeship levy), higher food and

drink costs (driven by depreciation in sterling versus the Euro)

and increases in rent and business rates. Together with the

softening in consumer spending, these factors have had a

significant impact on restaurant profitability and visibility over

short-term trading trends. The Company has taken steps to limit the

increase in central overheads

The Directors believe the Comptoir brand continues to have a

strong appeal to consumers and landlords and there remains

considerable potential for expansion in the UK. The Company still

expects to open 3 more restaurants before the end of 2017 -

Comptoir Reading, Comptoir Oxford and Shawa Oxford - together with

a first international franchise operation in the Netherlands with

HMS Host.

Lastly, the Directors confirm that they expect to raise GBP2.7m

(gross) from the sale and leaseback of the freehold of its central

processing unit (CPU) in North London. The net proceeds will be

used to fund the remaining new openings for 2017 and strengthen the

Group's working capital position. A further announcement on the

sale and leaseback will be made in due course.

This announcement contains inside information.

Enquiries:

Comptoir Group plc

Chaker Hanna Tel: 0207 486 1111

Cenkos Securities plc (NOMAD and Broker)

Bobbie Hilliam Tel: 020 7397 8900

Harry Pardoe

Alex Aylen

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTOKPDDCBKKNAK

(END) Dow Jones Newswires

June 05, 2017 05:15 ET (09:15 GMT)

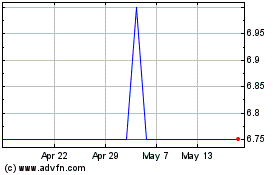

Comptoir (LSE:COM)

Historical Stock Chart

From Apr 2024 to May 2024

Comptoir (LSE:COM)

Historical Stock Chart

From May 2023 to May 2024