TIDMDNE

RNS Number : 0725U

Dunedin Enterprise Inv Trust PLC

24 March 2023

24 March 2023

For release 24 March 2023

Dunedin Enterprise Investment Trust PLC ("the Company")

Year ended 31 December 2022

Dunedin Enterprise Investment Trust PLC, the private equity

investment trust, announces its results for the year ended 31

December 2022.

Financial Highlights :

-- Share price total return of 18.5% in the year to 31 December 2022

-- Net asset value total return of 21.7% in the year to 31 December 2022

-- Realisations of GBP36.9m in the year

-- GBP41m returned via tender offer in November 2022

-- Interim dividend paid of 34.0p per share

-- Final dividend of 25.0p per share proposed for the year ended 31 December 2022

-- Total of GBP145.1m has been returned to shareholders since

the decision to wind-up the Trust in 2016

Comparative Total Return Performance

FTSE

Small Cap

(ex Inv

Net Asset Cos)

Year to 31 December 2022 value Share price Index

-------------------------- ---------- ------------ -----------

One year 21.7% 18.5% -17.3%

Three years 60.4% 58.1% 10.3%

Five years 95.2% 113.9% 11.9%

Ten years 148.4% 209.4% 130.3%

For further information please contact:

Graeme Murray

Dunedin LLP

07813 138367

Chairman's Statement

Duncan Budge, Chairman

I am pleased to report further progress in terms of performance

and the return of cash to shareholders.

The total return in the year to 31 December 202 2 was 21.7 % and

18.5 % in terms of net asset value per share and share price

respectively.

Your Company's net asset value per share increased from 558.8 p

to 627.1 p in the year. This is stated after allowing for dividends

per share paid in the year of 48.5p, totalling GBP6.4m .

The share price of 509 p at 31 December 202 2 represented a

discount of 1 8.8 % to the net asset value of 627.1 p per share.

The share price currently stands at 562.5p.

In November 202 2 a tender offer returned GBP 41 m to

shareholders. In total GBP 47.4 m was returned to shareholders this

year. Since shareholders approved the decision to implement a

managed wind-down of the Trust in May 2016 a total of GBP 145.1 m

has been returned to shareholders.

Your Company's net asset value decreased over the year from

GBP73.4m to GBP34.5m.

Portfolio

During the year a total of GBP36.9m was realised from the

investment portfolio.

The investment in RED, the provider of SAP contract and

permanent staff, was realised generating proceeds of GBP24.1m and a

return of 2.2x original cost. The transaction included an earn-out

arrangement which is dependent upon RED achieving profit targets in

the year to 31 March 2023. The earn-out has been valued at GBP4.0m

at 31 December 2022.

The realisation of Incremental, the market-leading IT services

platform, was completed in March 2022, generating proceeds of

GBP9.1m and a return of 2.4x original cost.

In January 2022 the remaining investment in CitySprint, the same

day courier, was realised, generating GBP1.5m.

In November 2022 Realza returned GBP2.9m following the sale of

Dolz, a manufacturer of water pumps for the automotive

industry.

Unrealised valuation increases of GBP 5 .3m were offset by

decreases of GBP 6.0 m. Valuation uplifts were achieved at Premier

Hytemp and FRA , offset by a reduction in the valuation of GPS .

Further details are provided in the Manager's Review.

Cash, Commitments & Liquidity

The original investment periods of all funds to which the

Company has made a commitment have now ended. In future the Company

is only required to meet drawdowns for follow-on investments,

management fees and expenses during the remainder of the life of

the funds.

At 31 December 202 2 the Company held cash and near cash

equivalents amounting to GBP 12 .4m. There are outstanding

commitments to limited partnership funds of GBP9. 6 m at 31

December 202 2 , consisting of GBP8.9m to Dunedin managed funds and

GBP0.7m to Realza.

Tender offer

A tender offer was approved by shareholders in November 20 22

for 58.1 % of the issued share capital at a 1. 0 % discount to the

net asset value at 30 September 202 2 . Under the tender offer GBP

41 m was returned to shareholders.

Dividends

An interim dividend of 34 .0p was paid in November 202 2 . It is

proposed that a final dividend of 25.0p per share be paid on 19 May

202 3.

Outlook

The Board acknowledges the importance of monitoring the

Company's costs as the wind-down progresses and will continue to

keep under review the options available to the Company. However, in

view of the Company's remaining investments and after discussions

with the Manager and the Company's advisers, the Board does not

currently anticipate putting formal proposals to Shareholders for a

members' voluntary liquidation of the Company in the short term

while the wind-down continues.

Furthermore, the Board considers maintaining the Company's

listed status to be important during this stage of the wind-down,

as many Shareholders would be unable to hold the Shares, or be

greatly inconvenienced by holding them, if they could not be traded

on the London Stock Exchange.

As the wind-down progresses, the Board will continue to assess

whether the Company's current arrangements remain in the interests

of Shareholders as a whole and will, of course, continue to keep

Shareholders informed as to the future of the Company.

Duncan Budge

Chairman

24 March 2023

Manager's Review

The total net assets return for the year, after taking account

of dividends and capital returned to shareholders, was 21.7 %.

The Company's net asset value decreased from GBP7 3.4 m to GBP

34.5 m over the year. As detailed below this movement is stated

following dividend payments totalling GBP 6.4 m and capital of GBP

41.5 m returned to shareholders via a tender offer in November 202

2 .

GBPm

--------------------------------------------------- ------

Net asset value at 1 January 2022 73.4

Unrealised value increases 5.3

Unrealised value decreases (6.0)

Realised gain over opening valuation 5.2

Net income and capital movements 4.5

--------------------------------------------------- ------

Net asset value prior to shareholder distributions 82.4

Dividends paid to shareholders (6.4)

Tender offer (41.5)

--------------------------------------------------- ------

Net asset value at 31 December 2022 34.5

--------------------------------------------------- ------

Portfolio Composition

The investment portfolio can be analysed as shown in the table

below.

Valuation Valuation

at at

1 January Additions Disposals Realised Unrealised 31 December

2022 in year in year movement movement 2022(1)

GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm

--------------------- ---------- --------- --------- --------- ---------- ------------

Dunedin managed 43.6 0.4 (34.0) 5.3 (1.2) 14.1

Third-party managed 5.2 0.1 (2.9) (0.1) 0.5 2.8

--------------------- ---------- --------- --------- --------- ---------- ------------

Investment portfolio 48.8 0.5 (36.9) 5.2 (0.7) 16.9

AAA rated money

market funds 11.8 28.4 (28.6) - - 11.6

--------------------- ---------- --------- --------- --------- ---------- ------------

60.6 28.9 (65.5) 5.2 (0.7) 28.5

--------------------- ---------- --------- --------- --------- ---------- ------------

(1) in addition the Company held net current assets of GBP 6.0

m

Realisations

In the year to 31 December 202 2 a total of GBP3 6.9 m was

realised from the investment portfolio.

In October 2022 the investment in RED, the provider of SAP

contract and permanent staff was realised in a secondary management

buy-out to AEA SBPE. The investment in RED was valued at GBP20.7m

at 31 December 2021. Proceeds from the sale amounted to GBP24.1m,

consisting of capital of GBP20.1m and income of GBP4.0m. The

investment in RED has generated cash proceeds of GBP25.5m,

representing a return of 2.2x original cost. Additionally, there

are future potential proceeds from an earn-out arrangement which

are dependent upon RED achieving profit targets in the year to 31

March 2023. The potential earn-out proceeds are valued at GBP4.0m

at 31 December 2022.

In March 2022 Incremental, the market-leading IT services

platform which designs, implements and supports clients with

ERP/CRM systems and cloud infrastructure, was realised by a trade

sale to Telefonica. Proceeds from the realisation amounted to

GBP9.1m, consisting of capital of GBP8.4m and income of GBP0.7m.

The investment in Incremental was valued at GBP6.0m at 31 December

2021 and has generated a return of 2.4x original cost.

In January 2022 the remaining investment in CitySprint, the same

day courier, was realised delivering proceeds of GBP1.5m. Total

proceeds from the original investment totalled GBP21.3m and

generated a 2.1x return on cost of GBP9.8m.

In November 2022 the remaining European fund, Realza, returned

GBP2.9m following the sale of Dolz, a manufacturer of water pumps

for the automotive industry.

Investment activity

A further GBP0. 5 m was drawn down by Dunedin and third-party

managed funds to meet management fees and ongoing expenses.

Unrealised valuation uplifts

In the year to 31 December 202 2 there were valuation uplifts

generated from the following investments: Premier (GBP 1.2 m) and

FRA (GBP 0.7 m) .

Premier Hytemp, the provider of highly engineered components to

the oil and gas industry, has experienced a recovery in

profitability following an increase in margins both in the UK and

Singapore. As the market outlook improves the company is tendering

for some significant contracts. The investment continues to be

valued on a discounted net assets basis.

Trading at FRA, the forensic accounting, data analytics and

e-discovery business, was impacted by COVID but has recovered

during 2022, albeit not as yet to the levels seen pre-COVID. The

uplift in valuation reflects the improved trading position.

In addition, there was a release of the provision for carried

interest in Dunedin Buyout Fund III LP amounting to GBP 2.8 m. The

majority of this movement was a result of carried interest released

on the sale of Incremental .

Unrealised valuation reductions

In the year to 31 December 202 2 there w as a valuation

reduction at GPS of GBP5.9m .

A partial sale of GPS, a market leader in payment processing

technology, was achieved in December 2021 generating a cash return

of 2.2x original cost. In the year the revenue of GPS has continued

to increase by 18%. However, since December 2021 the valuation

multiples applied to fintech companies have suffered a significant

downturn. This has resulted in no value being attributed to the

remaining investment.

Cash and commitments

The Company had outstanding commitments to limited partnership

funds of GBP9. 6 m, consisting of GBP8.9m to Dunedin managed funds

and GBP0.7m to Realza, the one remaining European fund.

The original investment periods of all funds to which the

Company has made a commitment have now ended. In future the Company

is only required to meet drawdowns for follow-on investments,

management fees and expenses during the remainder of the life of

the funds.

Valuations and Gearing

The average earnings multiple applied in the valuation of the

Dunedin managed portfolio was 8.3 x EBITDA (202 1 : 9. 7 x). These

multiples continue to be applied to maintainable profits.

Within the Dunedin managed portfolio, the weighted average

gearing of the companies was 4.1 x EBITDA (202 1 : 3.3 x).

Analysing the portfolio gearing in more detail, the percentage

of investment value represented by different gearing levels was as

follows:

Less than 1 x EBITDA - %

Between 1 and 2 x EBITDA 32 %

Between 2 and 3 x EBITDA - %

More than 3 x EBITDA 68 %

Fund Analysis

The chart below analyses the investment portfolio by investment

fund vehicle.

Dunedin Buyout Fund II 57 %

Dunedin Buyout Fund III 27 %

Realza 16%

Portfolio Analysis

Detailed below is an analysis of the head office of the

investment portfolio companies by geographic location as at 31

December 2022.

UK 85 %

Rest of Europe 15 %

Sector Analysis

Consumer products & services 14 %

Industrials 27 %

Support services 59 %

Valuation Method

Earnings - provision 10 %

Earnings - uplift 38 %

Assets basis 52 %

Dunedin LLP

24 March 2023

Total return of investments

at 31 December 2022

Original

cost of Realised Directors Total

investment to date*(1) Valuation(*2) return

Company name GBP'000 GBP'000 GBP'000 GBP'000

--------------- ----------------- ------------ -------------- --------

Weldex 9,505 119 6,612 6,731

--------------- ----------------- ------------ -------------- --------

FRA 6,035 5,504 4,132 9,636

--------------- ----------------- ------------ -------------- --------

Premier Hytemp 10,136 178 2,917 3,095

--------------- ----------------- ------------ -------------- --------

Realza 11,545 14,551 2,773 17,324

--------------- ----------------- ------------ -------------- --------

EV 8,321 - 1,921 1,921

--------------- ----------------- ------------ -------------- --------

GPS 8,220 18,203 - 18,203

--------------- ----------------- ------------ -------------- --------

Hawksford 6,910 7,087 - 7,087

--------------- ----------------- ------------ -------------- --------

60,672 45,642 18,355 63,997

--------------- ----------------- ------------ -------------- --------

*(1) - dividends and capital

*(2) - excludes carried interest provision of GBP1.5m

Income Statement

2022 2021

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment income 4,951 - 4,951 4,800 - 4,800

Gains on investments - 4,514 4,514 - 23,408 23,408

---------------------------- ------- ------- ------- ------- ------- -------

Total income 4,951 4,514 9,465 4,800 23,408 28,208

Expenses

Investment management fee (35) (105) (140) (29) (88) (117)

Other expenses (380) (13) (393) (384) (23) (407)

---------------------------- ------- ------- ------- ------- ------- -------

Profit before finance costs

and tax 4,536 4,396 8,932 4,387 23,297 27,684

Finance costs - - - (10) (32) (42)

---------------------------- ------- ------- ------- ------- ------- -------

Profit before tax 4,536 4,396 8,932 4,377 23,265 27,642

Taxation (37) 37 - 272 70 342

---------------------------- ------- ------- ------- ------- ------- -------

Profit for the year 4,499 4,433 8,932 4,649 23,335 27,984

---------------------------- ------- ------- ------- ------- ------- -------

Basic return per ordinary

share

(basic & diluted) 36.46p 35.92p 72.38p 26.56p 133.33p 159.89p

The total column of this statement represents the Income

Statement of the Group, prepared in accordance with UK-adopted

International Accounting Standards. The supplementary revenue and

capital columns are both prepared under guidance published by the

Association of Investment Companies. All items in the above

statement derive from continuing operations.

All income is attributable to the equity shareholders of Dunedin

Enterprise Investment Trust PLC.

Statement of Changes in Equity

for the year ended 31 December 2022

Year ended 31 December 2022

Capital Capital Capital Special Total

Share redemption Reserve reserve Distributable Revenue retained Total

capital reserve Realised - Reserve account earnings equity

GBP'000 GBP'000 * unrealised GBP'000 GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

-------------- ---------- ---------- ------------ -------------- ---------- ----------

At 31

December

2021 3,284 1,241 19,721 (8,378) 51,001 6,544 68,888 73,413

Profit for

the year - - 14,276 (9,842) - 4,499 8,933 8,933

Purchase and

cancellation

of shares (1,908) 1,908 (50) - (41,407) - (41,457) (41,457)

Dividends

paid - - - - - (6,371) (6,371) (6,371)

-------------- ---------- ------------ ---------- ------------ -------------- ---------- ---------- ----------

At 31

December

2022 1,376 3,149 33,947 (18,220) 9,594 4,672 29,993 34,518

-------------- ---------- ------------ ---------- ------------ -------------- ---------- ---------- ----------

* included in the profit for the year is GBP4.0m relating to the

deferred consideration on the sale of RED which will not qualify as

distributable profit until receipt

Year ended 31 December 2021

Capital Capital Capital Special Total

Share redemption Reserve reserve Distributable Revenue retained Total

capital reserve realised - Reserve account earnings equity

GBP'000 GBP'000 GBP'000 unrealised GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

-------------- ---------- ---------- ------------ -------------- ---------- ----------

At 31

December

2020 4,525 49,850 30,600 (16,357) 1,151 5,153 20,547 74,922

Profit for

the year - - 15,356 7,979 - 4,649 27,984 27,984

Cancellation

of capital

redemption

reserve - (49,850) - - 49,850 - 49,850 -

Purchase and

cancellation

of shares (1,241) 1,241 (26,235) - - - (26,235) (26,235)

Dividends

paid - - - - - (3,258) (3,258) (3,258)

-------------- ---------- ------------ ---------- ------------ -------------- ---------- ---------- ----------

At 31

December

2021 3,284 1,241 19,721 (8,378) 51,001 6,544 68,888 73,413

-------------- ---------- ------------ ---------- ------------ -------------- ---------- ---------- ----------

Balance Sheet

As at 31 December 2022

31 December 31 December

2022 2021

GBP'000 GBP'000

------------------------------------------- ------------ ------------

Non-current assets

Investments held at fair value 28,487 60,588

Current assets

Other receivables 5,375 297

Cash and cash equivalents 778 12,616

------------------------------------------- ------------ ------------

6,153 12,913

Current liabilities

Other liabilities (122) (88)

Net assets 34,518 73,413

------------------------------------------- ------------ ------------

Capital and reserves

Share capital 1,376 3,284

Capital redemption reserve 3,149 1,241

Capital reserve - realised 33,947 19,721

Capital reserve - unrealised (18,220) (8,378)

Special distributable reserve 9,594 51,001

Revenue reserve 4,672 6,544

------------------------------------------- ------------ ------------

Total equity 34,518 73,413

------------------------------------------- ------------ ------------

Net asset value per ordinary share (basic

and diluted) 627.1p 558.8p

Cash Flow Statement

for the year ended 31 December 2022

31 December 31 December

2022 2021

GBP'000 GBP'000

--------------------------------------------- ------------ ------------

Cash flows from operating activities

Profit before tax

Adjustments for: 8,932 27,642

(Gains) on investments (4,514) (23,408)

Interest paid - 42

(Increase) / decrease in debtors (1,058) 760

Increase / (decrease) in creditors 34 (2,183)

Net cash inflow from operating activities 3,394 2,853

Cash flows from investing activities

Purchase of investments (430) (1,550)

Drawdown from subsidiary (75) (79)

Purchase of 'AAA' rated money market funds (28,422) (6,213)

Sale of investments 30,007 38,547

Distribution from subsidiary 2,900 -

Sale of 'AAA' rated money market funds 28,615 8,100

--------------------------------------------- ------------ ------------

Net cash inflows from investing activities 32,595 38,805

Tax

Tax recovered - 342

Cash flows from financing activities

Tender offer (41,456) (26,235)

Dividends paid (6,371) (3,258)

Interest paid - (42)

--------------------------------------------- ------------ ------------

Net cash outflows from financing activities (47,827) (29,535)

Net (decrease)/increase in cash and cash

equivalents (11,838) 12,465

Cash and cash equivalents at 1 January 12,616 151

Cash and cash equivalents at 31 December 778 12,616

--------------------------------------------- ------------ ------------

Statement of Directors' Responsibilities in respect of the

Annual Report and the Financial Statements

The Directors are responsible for preparing the Annual Report

and financial statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law they have

elected to prepare the financial statements in accordance with

UK-adopted international accounting standards and applicable law

.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and of its profit or

loss for that period. In preparing these financial statements, the

Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgments and estimates that are reasonable and prudent;

-- state whether they have been prepared in accordance with UK-adopted international accounting standards;

-- assess the Company's ability to continue as a going concern, disclosing, as applicable, matters related to going

concern; and

-- use the going concern basis of accounting unless they either intend to liquidate the Company or to cease

operations, or have no realistic alternative but to do so. As explained in note 2, the Directors do not believe

that it is appropriate to prepare these financial statements on a going concern basis.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

its financial statements comply with the Companies Act 2006. They

are responsible for such internal control as they determine is

necessary to enable the preparation of financial statements that

are free from material misstatement, whether due to fraud or error,

and have general responsibility for taking such steps as are

reasonably open to them to safeguard the assets of the Company and

to prevent and detect fraud and other irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a Strategic Report, Directors' Report,

Directors' Remuneration Report and Corporate Governance Statement

that complies with that law and those regulations.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

Responsibility statement of the Directors in respect of the

annual financial report

We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the applicable set of accounting standards, give a true and

fair view of the assets, liabilities, financial position and profit or loss of the Company; and

-- the Strategic Report and Directors' Report includes a fair review of the development and performance of the

business and the position of the Company, together with a description of the principal risks and uncertainties

that it faces.

We consider the annual report and financial statements taken as

a whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the Company's

position and performance, business model and strategy.

Duncan Budge

Chairman

24 March 2023

Notes to the Accounts

1. Preliminary Results

The financial information contained in this report does not

constitute the Company's statutory accounts for the years ended 31

December 2022 or 2021. The financial information for 2021 is

derived from the statutory accounts for 2021 which have been

delivered to the Registrar of Companies. The auditor has reported

on those accounts. Their report was (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498(2) or (3) of

the Companies Act 2006. The audit of the statutory accounts for the

year ended 31 December 2022 is not yet complete. These accounts

will be finalised on the basis of the financial information

presented by the Directors in this preliminary announcement and

will be delivered to the Registrar of Companies following the

Company's annual general meeting.

2. Going Concern

The financial information for 2021 and 2022 has not been

prepared on a going concern basis, since the Company's current

objective is to conduct an orderly realisation of the investment

portfolio and return cash to shareholders. Following the Director's

assessment, no adjustments were deemed necessary to the investment

valuations or other assets and liabilities included in the

financial information as a consequence of the change in the basis

of preparation.

3. Dividends

Year to 31 Year to 31

December December

2022 2021

GBP'000 GBP'000

Dividends paid in the year 6,371 3,258

---------- ----------

A final dividend of 25.0p per share for the year ended 31

December 2022 is proposed and if approved, will be paid on 19 May

2023 to shareholders on the register at close of business on 21

April 2023. The ex-dividend date is 20 April 2023.

4. Earnings per share

Year to Year to

31 December 31 December

2022 2021

Revenue return per ordinary share

(p) 36.46 26.56

Capital return per ordinary share

(p) 35.92 133.33

Earnings per ordinary share (p) 72.38 159.89

Weighted average number of shares 12,342,190 17,501,856

The earnings per share figures are based on the weighted average

numbers of shares set out above. Earnings per share is based on the

revenue profit in the period as shown in the consolidated income

statement.

References to page numbers and notes in the disclosures below

are to page numbers and notes to the annual report and accounts of

the Company for the year ended 31 December 2022.

5. Principal Risks and Uncertainties (Strategic Report page 19)

The principal risks and uncertainties identified by the Board

which might affect the Company's business model and future

performance, and the steps taken with a view to their mitigation,

are as follows:

Investment and liquidity risk: the Company's investments are in

small and medium-sized unquoted companies, which by their nature

entail a higher level of risk and lower liquidity than investments

in large quoted companies. Mitigation: the Manager aims to limit

the risk attaching to the portfolio as a whole by closely

monitoring individual holdings, including the appointment of

investor directors to the board of portfolio companies. The Board

reviews the portfolio, including the schedule of projected exits,

with the Manager on a regular basis with a view to ensuring that

the orderly realisation process is progressing.

No change in overall risk in year

Portfolio concentration risk: following the adoption of the

Company's revised investment policy in May 2016 the portfolio will

become more concentrated as investments are realised and cash is

returned to shareholders. This will increase the proportionate

impact of changes in the value of individual investments on the

value of the Company as a whole. The Directors' valuation of the

Company's investments represents their best assessment of the fair

value of the investments as at the valuation date and the amounts

eventually realised from such investments may be more or less than

the Directors' valuation. Mitigation: the Directors and Manager

keep the changing composition of the portfolio under review and

focus closely on those holdings which represent the largest

proportion of total value.

Increase in overall risk in year

Financial risk: most of the Company's investments involve a

medium to long term commitment and many are relatively illiquid.

Mitigation: the Directors consider it appropriate to finance the

Company's activities through borrowing on a short-term basis.

Accordingly, the Board seeks to ensure that the availability of

cash reserves and bank borrowings match the forecast cash flows of

the Company both on a base and stress case basis given the level of

undraw commitments to limited partnership funds.

No change in overall risk in year

Economic risk: events such as economic recession or general

fluctuations in stock markets and interest rates may affect the

valuation of portfolio companies and their ability to access

adequate financial resources, as well as affecting the Company's

own share price and discount to net asset value. An economic risk

is the conflict in Ukraine. Mitigation: the Company invests in a

diversified portfolio of investments spanning various sectors and

maintains access to sufficient cash reserves to be able to provide

additional funding to portfolio companies should this become

necessary. The Manager and board of each portfolio company is

keeping under review the impact of the conflict in Ukraine and

developing contingency plans/mitigating actions where

appropriate.

No change in overall risk in year

Credit risk: the Company holds a number of financial instruments

and cash deposits and is dependent on counterparties discharging

their commitment. Mitigation: the Directors review the

creditworthiness of the counterparties to these investments and

cash deposits and seek to ensure there is no undue concentration of

credit risk with any one party.

No change in overall risk in year

Currency risk: the Company is exposed to currency risk as a

result of investing in companies who transact in foreign currencies

and funds denominated in euros. The sterling value of these

investments can be influenced by movements in foreign currency

exchange rates. Mitigation: Currency risk is monitored by the

Manager on an ongoing basis and on a quarterly basis by the

Board.

No change in overall risk in year

Internal control risk: the Company's assets could be at risk in

the absence of an appropriate internal control regime. Mitigation:

the Board regularly reviews the system of internal controls, both

financial and non-financial, operated by the Company and the

Manager. These include controls designed to ensure that the

Company's assets are safeguarded and that proper accounting records

are maintained.

No change in overall risk in year

6. Related Party Transactions (Notes to the Accounts page 57, note 22)

The Company has investments in Dunedin Buyout Fund II LP,

Dunedin Buyout Fund III LP and Dunedin Fund of Funds LP. Each of

these limited partnerships are managed by Dunedin. The Company has

paid a management fee of GBP0.4m (2021: GBP0.6m) in respect of

these limited partnerships. The total investment management fee

payable by the Company to the Manager is therefore GBP0.6m (2021:

GBP0.7m).

Since the Company began investing in Dunedin Buyout Funds ("the

Funds") executives of the Manager have been entitled to participate

in a carried interest scheme via the Funds. Performance conditions

are applied whereby any gains achieved through the carried interest

scheme associated with the Funds are conditional upon a certain

minimum return having been generated for the limited partner

investors. Additionally, within Dunedin Buyout Fund II LP and

Dunedin Buyout Fund III LP the economic interest of the Manager is

aligned with that of the limited partner investors by co-investing

in this fund.

As at 31 December 2022 there is a provision made within

Investments for carried interest of GBP1.4m (2021: GBP4.3m)

relating to Dunedin Buyout Fund III LP. Current executives of the

Manager are entitled to 42% of the carried interest in Dunedin

Buyout Fund III LP.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSUOABROAUOUAR

(END) Dow Jones Newswires

March 24, 2023 03:00 ET (07:00 GMT)

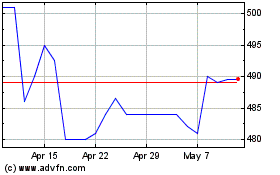

Dunedin Enterprise Inves... (LSE:DNE)

Historical Stock Chart

From Apr 2024 to May 2024

Dunedin Enterprise Inves... (LSE:DNE)

Historical Stock Chart

From May 2023 to May 2024