TIDMDRV

RNS Number : 4740C

Driver Group plc

13 June 2023

DRIVER GROUP PLC

Interim Report

For the six months ended 31 March 2023

Key Points - for the six months ended 31 March 2023

6 months 6 months

Ended Ended

31 March 2023 31 March

GBP000 2022 GBP000 Change

Unaudited Unaudited GBP000

--------------------------- -------------- ------------ -------

Revenue 24,219 24,429 (210)

Gross Profit 6,340 5,882 458

Gross Profit % 26% 24% 2%

--------------------------- -------------- ------------ -------

Profit before tax 508 130 378

Add: Share-based payment

charge 202 272 (70)

Underlying* profit before

tax 710 402 308

--------------------------- -------------- ------------ -------

Underlying* profit before

tax % 3% 2% 1%

Underlying* earnings per

share 1.0p 0.2p 0.8p

Net cash** 5,277 3,678 1,599

-- Underlying* profit before tax at GBP0.7m (2022: GBP0.4m)

resulting in an underlying* profit before tax margin of 3% (2022:

2%).

-- Profit before tax at GBP0.5m (2022: GBP0.1m).

-- Net cash** increase year on year of GBP1.6m to GBP5.3m (2022:

GBP3.7m).

-- Revenue slightly down to GBP24.2m (2022: GBP24.4m) which is

attributable to the restructured Middle East and Asia Pacific

regions.

-- Gross profit margin at 26% (2022: 24%), a GBP0.5m increase to

GBP6.3m (2022: GBP5.9m).

-- Middle East returned to operational profit pre

provisioning.

-- Fee earner headcount decreased to 238 (2022: 294)

predominantly attributable to Middle East and Asia Pacific

regions.

-- Overall utilisation rates*** improved to 75.6% (2022:

69.6%).

-- Europe & Americas (EuAm) reported underlying* profit

before tax for the period of GBP2.9m (2022: GBP2.4m) with

utilisation rates*** at 76.1% (2022: 72.7%).

-- Middle East (ME) reported underlying* loss before tax for the

period of GBP0.1m (2022: loss GBP0.3m) with utilisation rates*** at

72.3% (2022: 60.9%).

-- Asia Pacific (APAC) reported underlying* loss before tax for

the period of GBP0.1m (2022: loss GBP0.5m) with utilisation

rates*** at 66.1% (2022: 71.3%).

Mark Wheeler, Chief Executive Officer of Driver Group, said:

'It is a pleasure to see the benefits of last year's

restructuring starting to come through in the first half. With all

regions currently benefiting from a steady flow of enquiries, the

Group is ideally placed to capitalise on global opportunities where

and when they arise.

While we continue to have only short-term visibility in terms of

fee forecasting, given the nature of our service offering, the

Board expects a profitable year with strategic changes to form a

solid foundation for future growth.'

Shaun Smith, Non-Executive Chair, said:

'I was delighted to join the Board of Driver Group in March this

year as Chair and have been impressed by the enthusiasm and

commitment of everyone that I have met since joining and have been

encouraged by the performance in the first half. I very much look

forward to working with Mark and his team across the business, both

in the UK and internationally, as we continue to focus on improving

the performance of the Group and delivering enhanced shareholder

value.'

Results presentation

Driver Group's leadership team will be hosting a presentation

for analysts at 09:30 BST on 13 June 2023. Analysts have already

been invited to participate in a Q&A during the presentation,

but any eligible person not having received details should contact

the Company's PR advisers, Acuitas Communications, at

driver@acuitascomms.com or on 020 3745 0293.

The Group will also host a presentation for investors on 15

June, at 10:00 BST. Questions can be submitted before and during

the online event.

To register for the webinar, please visit this link:

https://www.equitydevelopment.co.uk/news-and-events/driver-group-results-presentation-15june2023

A recording of the presentation will be available shortly

afterwards here:

https://www.equitydevelopment.co.uk/research/tag/driver-group

Enquiries:

Driver Group plc 020 7377 0005

Mark Wheeler (CEO)

Charlotte Parsons (CFO)

Singer Capital Markets (Nomad

& Broker) 020 7496 3000

Sandy Fraser

Jen Boorer

Alex Emslie

Acuitas Communications 020 3745 0293 / 07799 767676

Simon Nayyar simon.nayyar@acuitascomms.com

Arthur Dingemans arthur.dingemans@acuitascomms.com

INTRODUCTION

Driver Group is focussed on delivering a return to profitability

in the current financial year after the challenges encountered

during the FY22 financial year. The Group saw positive progress in

Quarter 1 and that momentum continued and strengthened in Quarter

2.

We are pleased to report an increase in the Group's underlying*

profit before tax to GBP0.7m from GBP0.4m in the comparative

period, in line with the Group's Trading update of 27 April 2023 on

revenue which, following the Middle East restructuring, has

remained stable. We believe this has been a creditable performance,

laying strong foundations for continued improvements to deliver the

Group's future profitability.

In common with many of our industry peers and professional

services firms more widely, the Group has inevitably been exposed

to the effects of the recent global economic headwinds, and the

impact that the war in Ukraine has had on some of our clients and

their own counterparties, in relation to both work in hand and the

deferral of some existing projects in the pipeline.

The EuAm region has continued to perform well and is now

established as our central business hub, continuing our focus on

global office collaboration, maximising utilisation, improving

efficiencies, and delivering cost effectiveness; expert services

play a large part in this, and we continue our efforts to increase

our number of experts worldwide.

The Middle East region has returned to an operational profit, as

a result of the implementation of the realignment of strategy and

servicing in the region announced in November 2022 while also

significantly reducing the trading risk in the region. We continue

to closely monitor performance in the region.

We have seen an improvement in trading performance in APAC, a

result of actions taken following the strategic review, and t he

Group remains well positioned to expand its work with South Korean

clients after a very successful office launch in Seoul in March

this year.

The overheads review and cost saving measures, previously

announced, are ongoing with some savings already realised and with

significant further savings anticipated to take effect from Quarter

4 of FY23 and beyond.

PEOPLE

Driver is a people business and the recruitment and retention of

the best people in our sector is a key priority. The Board is

pleased to see that the revised Executive board is effectively

supporting the CEO and CFO to deliver the Group's strategy which

continues to have a positive impact upon the business.

The restructuring of the Middle East and APAC led to a

short-term reduction in the number of senior testifying experts in

the business, and it is pleasing that the business has already

backfilled these positions in other regions, allowing revenue

retention for Diales expert work, which is expected to transition

to continued growth in these services.

TRADING PERFORMANCE

Group revenue for the six months to 31 March 2023 remained

stable at GBP24.2m, compared to the same period in 2022 (GBP24.4m).

Overall, the Group reported an increase in underlying profit before

tax of GBP0.7m (2022: GBP0.4m).

Revenues in the EuAm region increased to GBP19.1m (2022:

GBP17.4m) with revenues in the Middle East down to GBP3.7m (2022:

GBP5.4m) and revenues in APAC down to GBP1.4m (2022: GBP1.7m). This

is in line with our strategy of EuAm being our central business

hub.

The EuAm region delivered an underlying profit of GBP2.9m (2022:

GBP2.4m) while the Middle East region recorded an operational

profit of GBP0.1m (2022: loss GBP0.2m), underlying loss of GBP0.1m

(2022: underlying loss GBP0.3m), and the APAC region recorded an

underlying loss of GBP0.1m (2022: underlying loss GBP0.5m).

Underlying*basic earnings per share were 1.0p (2022: 0.2p), and

the basic earnings per share was 0.6p (2022: loss 0.3p).

The Group's net cash balance in the period continued to improve

totalling GBP5.3m on 31 March 2023 (2022: GBP3.7m).

DIVID

The final dividend announced at the time of the results for the

year to 30 September 2022 (0.75p per share) in February was paid in

April 2023. Reflecting our confidence in the medium-term prospects

for the Group and with the strong balance sheet position the Board

recommends the payment of an interim dividend of 0.75p per share

for 2023 (2022: 0.75p per share). The interim dividend will be paid

on 27 October 2023 to shareholders who are on the register of

members at the close of business on 22 September 2023, with an

ex-dividend date of 21 September 2023 .

OUTLOOK

Driver Group's business in Europe and the Americas continues to

trade very profitably. Performance has strengthened with the

implementation of our cost-saving strategies, a limited number of

which are already taking effect, and the balance will flow through

to the bottom line in the next trading year. Post-restructure, the

Middle East are expected to contribute a profit for the current

financial year with APAC being well placed to improve further

during FY24 as a consequence of work coming out of Korea.

While the second half of the year for Driver has been shown

historically to be strong. April was slower than expected owing to

the timing of the Easter weekend and a succession of public

holidays, which affected utilisation. The Board is currently

considering its policy on forward guidance, which will reflect the

short-term revenue visibility.

* Underlying figures are stated before the share-based payment

costs and exceptional costs

Consolidated Income Statement

Interim report for the six months ended 31 March 2023

6 months ended 6 months Year ended

31 March 2023 ended 30 September

GBP000 31 March 2022

Unaudited 2022 GBP000

GBP000 Audited

Unaudited

REVENUE 24,219 24,429 46,897

Cost of sales (17,729) (18,413) (37,095)

Impairment movement (150) (134) (188)

---------------------------------------------- -------------- ---------- -------------

GROSS PROFIT 6,340 5,882 9,614

Administrative expenses (5,851) (5,767) (12,107)

Other operating income 41 75 167

---------------------------------------------- -------------- ---------- -------------

Underlying* operating profit 732 462 (861)

Exceptional costs - - (1,000)

Share-based payment charge and

associated costs (202) (272) (465)

---------------------------------------------- -------------- ---------- -------------

OPERATING PROFIT/(LOSS) 530 190 (2,326)

Finance income 32 - -

Finance costs (54) (60) (100)

---------------------------------------------- -------------- ---------- -------------

PROFIT/(LOSS) BEFORE TAXATION 508 130 (2,426)

Tax expense (note 2) (207) (309) (460)

---------------------------------------------- -------------- ---------- -------------

PROFIT/(LOSS) FOR THE PERIOD 301 (179) (2,886)

Profit/(loss) attributable to non-controlling

interests - - (2)

Profit/(loss) attributable to equity

shareholders of the parent 301 (179) (2,884)

---------------------------------------------- -------------- ---------- -------------

301 (179) (2,886)

---------------------------------------------- -------------- ---------- -------------

Basic earnings/(loss) per share

attributable to equity shareholders

of the parent (pence) 0.6p (0.3)p (5.5)p

Diluted earnings/(loss) per share

attributable to equity shareholders

of the parent (pence) 0.6p (0.3)p (5.3)p

---------------------------------------------- -------------- ---------- -------------

*Underlying figures are stated before the share-based payment

costs (this is not a GAAP measure)

Consolidated Statement of Comprehensive Income

Interim report for the six months ended 31 March 2023

6 months 6 months Year ended

ended ended 30 September

31 March 31 March 2022

2023 2022 GBP000

GBP000 GBP000 Audited

Unaudited Unaudited

---------------------------------------------- ---------- ---------- -------------

PROFIT/(LOSS) FOR THE PERIOD 301 (179) (2,886)

---------------------------------------------- ---------- ---------- -------------

Other comprehensive income/(loss):

Items that could subsequently be reclassified

to the Income Statement:

Exchange differences on translating

foreign operations 473 (187) (970)

---------------------------------------------- ---------- ---------- -------------

Other comprehensive income/(loss)

for the year net of tax 473 (187) (970)

---------------------------------------------- ---------- ---------- -------------

TOTAL COMPREHENSIVE INCOME/(LOSS)

FOR THE PERIOD 774 (366) (3,856)

---------------------------------------------- ---------- ---------- -------------

Total comprehensive income/(loss)

attributable to:

Owners of the parent 774 (366) (3,854)

Non-controlling interest - - (2)

---------------------------------------------- ---------- ---------- -------------

774 (366) (3,856)

---------------------------------------------- ---------- ---------- -------------

Consolidated Statement of Financial Position

Interim report for the six months ended 31 March 2023

6 months ended 6 months Year ended

31 March 2023 ended 30 September

GBP000 31 March 2022

Unaudited 2022 GBP000

GBP000 Audited

Unaudited

------------------------------- -------------- ---------- -------------

NON-CURRENT ASSETS

Goodwill 2,969 2,969 2,969

Property, plant and equipment 344 567 384

Right of use assets 400 2,130 1,375

Intangible asset 756 759 798

Deferred tax assets 202 186 192

------------------------------- -------------- ---------- -------------

4,671 6,611 5,718

------------------------------- -------------- ---------- -------------

CURRENT ASSETS

Trade and other receivables 16,065 20,640 20,281

Current tax receivable 166 360 470

Cash and cash equivalents 5,277 3,678 4,931

------------------------------- -------------- ---------- -------------

21,508 24,678 25,682

------------------------------- -------------- ---------- -------------

TOTAL ASSETS 26,179 31,289 31,400

------------------------------- -------------- ---------- -------------

CURRENT LIABILITIES

Borrowings - - -

Trade and other payables (9,087) (8,409) (11,296)

Derivative financial liability - (384) (1,938)

Lease creditor (317) (938) (754)

Current tax payable - (188) (251)

------------------------------- -------------- ---------- -------------

(9,404) (9,919) (14,239)

------------------------------- -------------- ---------- -------------

NON-CURRENT LIABILITIES

Lease creditor (110) (1,066) (634)

Deferred tax liability (167) (149) (169)

------------------------------- -------------- ---------- -------------

(277) (1,215) (803)

------------------------------- -------------- ---------- -------------

TOTAL LIABILITIES (9,681) (11,134) (15,042)

------------------------------- -------------- ---------- -------------

NET ASSETS 16,498 20,155 16,358

------------------------------- -------------- ---------- -------------

SHAREHOLDERS' EQUITY

------------------------------- -------------- ---------- -------------

Share capital 216 216 216

Share premium 11,496 11,496 11,496

Merger reserve 1,055 1,055 1,055

Currency reserve (908) (598) (1,381)

Capital redemption reserve 18 18 18

Treasury shares (1,525) (1,025) (1,525)

Retained earnings 6,145 8,990 6,478

Own shares (3) (3) (3)

TOTAL SHAREHOLDERS' EQUITY 16,494 20,149 16,354

------------------------------- -------------- ---------- -------------

NON-CONTROLLING INTEREST 4 6 4

------------------------------- -------------- ---------- -------------

TOTAL EQUITY 16,498 20,155 16,358

------------------------------- -------------- ---------- -------------

Consolidated Cash flow Statement

Interim report for the six months ended 31 March 2023

6 months ended 6 months Year ended

31 March 2023 ended 30 September

GBP000 31 March 2022

Unaudited 2022 GBP000

GBP000 Audited

Unaudited

------------------------------------------ -------------- ---------- -------------

CASH FLOWS FROM OPERATING ACTIVITIES

Profit/(loss) for the period 301 (179) (2,886)

------------------------------------------ -------------- ---------- -------------

Adjustments for:

Depreciation 84 127 239

Amortisation of right to use assets 375 501 917

Amortisation of intangible asset 42 - 40

Exchange adjustments 105 15 (361)

Finance income (32) - -

Finance expense 54 60 100

Tax expense 207 309 460

Equity settled share-based payment

charge 151 272 229

------------------------------------------ -------------- ---------- -------------

OPERATING CASH FLOW BEFORE CHANGES

IN WORKING CAPITAL AND PROVISIONS 1,287 1,105 (1,262)

Decrease/(increase) in trade and

other receivables 4,283 (1,611) (1,330)

(Decrease)/increase in trade and

other payables (3,562) (235) 4,000

------------------------------------------ -------------- ---------- -------------

CASH GENERATED/(USED) IN OPERATIONS 2,008 (741) 1,408

Tax paid (139) (390) (539)

------------------------------------------ -------------- ---------- -------------

NET CASH INFLOW/(OUTFLOW) FROM

OPERATING ACTIVITIES 1,869 (1,131) 868

------------------------------------------ -------------- ---------- -------------

CASH FLOWS FROM INVESTING ACTIVITIES

------------------------------------------ -------------- ---------- -------------

Interest received 32 - -

Acquisition of property, plant

and equipment (44) (319) (398)

Proceeds from the disposal of property,

plant and equipment - - 150

Acquisition of intangible asset - (244) (321)

------------------------------------------ -------------- ---------- -------------

NET CASH OUTFLOW FROM INVESTING

ACTIVITIES (12) (563) (569)

------------------------------------------ -------------- ---------- -------------

CASH FLOWS FROM FINANCING ACTIVITIES

------------------------------------------ -------------- ---------- -------------

Interest paid (54) (60) (100)

Repayment of borrowings - (1,000) (1,000)

Proceeds of borrowings - 1,000 1,000

Repayment of lease liabilities (961) (635) (821)

Purchase of Treasury shares - - (500)

Dividends paid to the equity shareholders

of the parent (391) (392) (783)

------------------------------------------ -------------- ---------- -------------

NET CASH OUTFLOW FROM FINANCING

ACTIVITIES (1,406) (1,087) (2,204)

------------------------------------------ -------------- ---------- -------------

Net increase/(decrease) in cash

and cash equivalents 451 (2,781) (1,904)

Effect of foreign exchange on cash

and cash equivalents (105) (15) 361

Cash and cash equivalents at start

of period 4.931 6,474 6,474

------------------------------------------ -------------- ---------- -------------

CASH AND CASH EQUIVALENTS AT

OF PERIOD 5,277 3,678 4,931

------------------------------------------ -------------- ---------- -------------

Consolidated Statement of Changes of Equity

Interim Report for the six months ended 31 March 2023

For the six months ended 31 March 2023 (Unaudited):

Non-

Share Share Treasury Merger Other Retained Own controlling Total

capital premium shares reserve reserves(2) earnings shares Total(1) interest Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

CLOSING

BALANCE

AT 30

SEPTEMBER

2022 216 11,496 (1,525) 1,055 (1,363) 6,478 (3) 16,354 4 16,358

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Profit for the

period - - - - - 301 - 301 - 301

Other

comprehensive

loss for the

period - - - - 473 - - 473 - 473

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Total

comprehensive

loss for the

period - - - - 473 301 - 774 - 774

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Contributions

by

and

distributions

to owners

Dividend - - - - - (785) - (785) - (785)

Share-based

payment

charge - - - - - 151 - 151 - 151

Purchase of - - - - - - - - - -

Treasury

shares

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Total

contributions

by and

distributions

to owners - - - - - (634) - (634) - (634)

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

CLOSING

BALANCE

AT 31 MARCH

2022 216 11,496 (1,525) 1,055 (890) 6,145 (3) 16,494 4 16,498

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

For the six months ended 31 March 2022 (Unaudited):

Non-

Share Share Treasury Merger Other Retained Own controlling Total

capital premium shares reserve reserves(2) earnings shares Total(1) interest Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

CLOSING

BALANCE

AT 30

SEPTEMBER

2021 216 11,496 (1,025) 1,055 (393) 9,916 (3) 21,262 6 21,268

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Loss for the

period - - - - - (179) - (179) - (179)

Other

comprehensive

loss for the

period - - - - (187) - - (187) - (187)

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Total

comprehensive

loss for the

period - - - - (187) (179) - (366) - (366)

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Contributions

by

and

distributions

to owners

Dividend - - - - - (783) - (783) - (783)

Share-based

payment

charge - - - - - 36 - 36 - 36

Purchase of - - - - - - - - - -

Treasury

shares

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Total

contributions

by and

distributions

to owners - - - - - (747) - (747) - (747)

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

CLOSING

BALANCE

AT 31 MARCH

2022 216 11,496 (1,025) 1,055 (580) 8,990 (3) 20,149 6 20,155

-------------- -------- -------- -------- -------- ----------- -------- ------- -------- ----------- -------

Consolidated Statement of Changes of Equity (continued)

Interim Report for the six months ended 31 March 2023

For the year ended 30 September 2022 (Audited):

Non-

Share Share Treasury Merger Other Retained Own controlling Total

capital premium shares reserve reserves(2) earnings shares Total(1) interest Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- ------- ------- -------- ------- ----------- -------- ------- -------- ----------- -------

OPENING BALANCE

AT 1 OCTOBER

2021 216 11,496 (1,025) 1,055 (393) 9,916 (3) 21,262 6 21,268

----------------- ------- ------- -------- ------- ----------- -------- ------- -------- ----------- ---------

Loss for the year - - - - - (2,884) - (2,884) (2) (2,886)

Other

comprehensive

income for the

year - - - - (970) - - (970) - (970)

----------------- ------- ------- -------- ------- ----------- -------- ------- -------- ----------- ---------

Total

comprehensive

income for the

year - - - - (970) (2,884) - (3,854) (2) (3,856)

----------------- ------- ------- -------- ------- ----------- -------- ------- -------- ----------- ---------

Dividends - - - - - (783) - (793) - (783)

Share-based

payment

charge and

associated

costs - - - - - 229 - 229 - 229

Purchase of

Treasury

shares - - (500) - - - - (500) - (500)

----------------- ------- ------- -------- ------- ----------- -------- ------- -------- ----------- ---------

CLOSING BALANCE

AT 30 SEPTEMBER

2022 216 11,496 (1,525) 1,055 (1,363) 6,478 (3) 16,354 4 16,358

----------------- ------- ------- -------- ------- ----------- -------- ------- -------- ----------- ---------

(1) Total equity attributable to the equity holders of the Parent

(2) 'Other reserves' combines the currency reserve and capital

redemption reserve. The movement in the current and prior year

relates to the translation of foreign currency equity balances and

foreign currency non-monetary items.

1 BASIS OF PREPARATION

The consolidated interim financial information has been prepared

using accounting policies which are consistent with those applied

at the prior year end 30 September 2022 and that are expected to be

adopted in the Group's full financial statements for the year

ending 30 September 2023. The financial information in this interim

report is in compliance with the recognition and measurement

principles of international accounting standards but does not

include all disclosures that would be required under IFRSs and are

not IAS 34 compliant. The accounting policies have been applied

consistently throughout the Group for the purposes of preparation

of this financial information. The financial information for the

half years ended 31 March 2023 and 31 March 2022 does not

constitute statutory accounts within the meaning of Section 434(3)

of the Companies Act 2006 and is unaudited but has been reviewed by

our auditors.

The comparative financial information for the year ended 30

September 2022 included within this report does not constitute the

full statutory accounts for that period. The statutory Annual

Report and Financial Statements for 2022 have been filed with the

Registrar of Companies. The Independent Auditor's Report on that

Annual Report and Financial Statements for 2022 was unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006.

The Financial Statements have been prepared on a going concern

basis. In reaching their assessment, the Directors have considered

a period extending at least twelve months from the date of approval

of this financial report.

The Directors have prepared cash flow forecasts covering a

period of more than 12 months from the date of releasing these

financial statements. This assessment has included consideration of

the forecast performance of the business for the foreseeable future

and the cash and financing facilities available to the Group. At 31

March 2023 the Group had cash reserves of GBP5.3m. The strong

trading performance and cash collections in the period resulted in

a cash increase of GBP0.4m from that reported at 30 September

2022.

The Directors have also prepared a stress case scenario that

demonstrates the Group's ability to continue as a going concern

even with a significant drop in revenues and limited mitigating

cost reduction to re-align with the revenue drop.

Based on the cash flow forecasts prepared including appropriate

stress testing, the Directors are confident that any funding needs

required by the business will be sufficiently covered by the

existing cash reserves. As such these Financial Statements have

been prepared on a going concern basis.

2 TAXATION

The tax charge for the half-year ended 31 March 2023 is based on

the estimated tax rates in the jurisdictions in which the Group

operates, for the year ending 30 September 2023.

3 DIVID

In view of the medium-term prospects for the Group along with

the strong balance sheet position, the Board recommends the payment

of an interim dividend of 0.75p per share for 2023 (2022: 0.75p per

share).

During the period, the Group paid an interim dividend for 2022

of 0.75p per share (2022: 0.75p per share) and approved a final

dividend for 2022 of 0.75p per share which was paid in April

2023.

4 POST BALANCE SHEET EVENT

There have been no significant events requiring disclosure since

31 March 2023.

5 SUMMARY SEGMENTAL ANALYSIS

REPORTABLE SEGMENTS

For management purposes, the Group is organised into three

operating divisions: Europe & Americas (EuAm), Middle East (ME)

and Asia Pacific (APAC). These divisions are the basis on which the

Group is structured and managed, based on its geographic structure.

The following key service provisions are provided across all three

operating divisions: quantity surveying, planning / programming,

quantum and planning experts, dispute avoidance / resolution,

litigation support, contract administration and commercial advice /

management. Segment information about these reportable segments is

presented below.

Europe Middle Asia

Six months ended 31 March & Americas East Pacific Eliminations Unallocated Consolidated

2023 (Unaudited) GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Total external revenue 19,128 3,724 1,367 - - 24,219

Total inter-segment revenue 760 237 318 (1,315) - -

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Total revenue 19,888 3,961 1,685 (1,315) - 24,219

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Segmental profit/(loss) (2) 2,939 (92) (144) - - 2,703

Unallocated corporate expenses

(1)(2) - - - - (1,971) (1,971)

Share-based payment charge - - - - (202) (202)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Operating profit/(loss) 2,939 (92) (144) - (2,173) 530

Finance income - - - - 32 32

Finance expense - - - - (54) (54)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) before taxation 2,939 (92) (144) - (2,195) 508

Taxation - - - - (207) (207)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) for the period 2,939 (92) (144) - (2,402) 301

------------------------------- ----------- ------- -------- ------------ ----------- ------------

(1) Unallocated costs represent Directors' remuneration,

administration staff, corporate head office costs and expenses

associated with AIM.

(2) Unallocated corporate expenses are stated before the central

recharge. Historically a recharge was recognised monthly. The prior

year comparative figure below of GBP1.1m is net of a cross charge

amount totalling GBP0.6m.

Europe Middle Asia

Six months ended 31 March & Americas East Pacific Eliminations Unallocated Consolidated

2022 (Unaudited) GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Total external revenue 17,370 5,405 1,654 - - 24,429

Total inter-segment revenue 746 450 290 (1,486) - -

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Total revenue 18,116 5,855 1,944 (1,486) - 24,429

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Segmental profit/(loss) 2,377 (332) (485) - - 1,560

Unallocated corporate expenses

(1) - - - - (1,098) (1,098)

Share-based payment charge - - - - (272) (272)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Operating profit/(loss) 2,377 (332) (485) - (1,370) 190

Finance income - - - - - -

Finance expense - - - - (60) (60)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) before taxation 2,377 (332) (485) - (1,430) 130

Taxation - - - - (309) (309)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) for the period 2,377 (332) (485) - (1,739) (179)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

(1) Unallocated costs represent Directors' remuneration,

administration staff, corporate head office costs and expenses

associated with AIM.

Europe Middle Asia

Year ended 30 September & Americas East Pacific Eliminations Unallocated Consolidated

2022 (A udited ) GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Total external revenue 35,089 8,063 3,745 - - 46,897

Total inter-segment revenue 1,093 754 551 (2,398) - -

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Total revenue 36,182 8,817 4,296 (2,398) - 46,897

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Segmental profit/(loss) 3,923 (1,814) (544) - - 1,565

Unallocated corporate expenses

(1) - - - - (2,426) (2,426)

Share-based payments charge

and associated costs - - - - (465) (465)

Exceptional costs - - - - (1,000) (1,000)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Operating profit/(loss) 3,923 (1,814) (544) - (3,891) (2,326)

Finance income - - - - - -

Finance expense - - - - (100) (100)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) before taxation 3,923 (1,814) (544) - (3,991) (2,426)

Taxation - - - - (460) (460)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

Profit/(loss) for the period 3,923 (1,814) (544) - (4,451) (2,886)

------------------------------- ----------- ------- -------- ------------ ----------- ------------

(1) Unallocated costs represent Directors' remuneration,

administration staff, corporate head office costs and expenses

associated with AIM.

6 EARNINGS PER SHARE

6 months 6 months

ended ended Year ended

31 March 31 March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

----------------------------------------------- ----------- ----------- -------------

Profit/(loss) for the financial period

attributable to equity shareholders 301 (179) (2,884)

Exceptional costs - - 1,000

Share-based payments cost and associated

costs 202 272 465

----------------------------------------------- ----------- ----------- -------------

Underlying* profit/(loss) for the financial

period 503 93 (1,419)

----------------------------------------------- ----------- ----------- -------------

Weighted average number of shares:

- Ordinary shares in issue 53,962,868 53,962,868 53,962,868

- Shares held by EBT (3,677) (3,677) (3,677)

- Treasury shares (1,642,543) (1,687,208) (1,405,839)

----------------------------------------------- ----------- ----------- -------------

Basic weighted average number of shares 52,316,648 52,271,983 52,553,352

Effect of employee share options 1,618,097 2,684,905 2,309,028

----------------------------------------------- ----------- ----------- -------------

Diluted weighted average number of shares 53,934,745 54,956,888 54,862,380

----------------------------------------------- ----------- ----------- -------------

Basic earnings/(loss) per share attributable

to equity shareholders of the Parent (pence) 0.6p (0.3)p (5.5)p

Diluted earnings/(loss) per share attributable

to equity shareholders of the Parent (pence) 0.6p (0.3)p (5.3)p

Underlying* basic earnings/(loss) per

share 1.0p 0.2p (2.7)p

----------------------------------------------- ----------- ----------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UURURORUNAUR

(END) Dow Jones Newswires

June 13, 2023 02:00 ET (06:00 GMT)

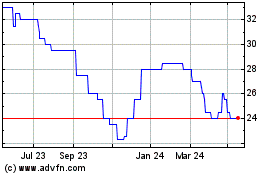

Driver (LSE:DRV)

Historical Stock Chart

From Dec 2024 to Dec 2024

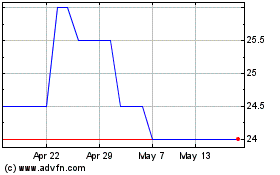

Driver (LSE:DRV)

Historical Stock Chart

From Dec 2023 to Dec 2024