TIDMGAW

RNS Number : 6633Z

Games Workshop Group PLC

14 January 2020

PRESS ANNOUNCEMENT

GAMES WORKSHOP GROUP PLC

14 January 2020

HALF-YEARLY REPORT

Games Workshop Group PLC ('Games Workshop' or the 'Group')

announces its half-yearly results for the six months to 1 December

2019.

Highlights:

Six months to Six months

to

1 December 2019 2 December

2018

-------------------------------- ---------------- -------------

Revenue GBP148.4m GBP125.2m

Revenue at constant currency* GBP145.6m GBP125.2m

Operating profit pre-royalties

receivable GBP48.5m GBP35.3m

Royalties receivable GBP10.7m GBP5.5m

Operating profit GBP59.2m GBP40.8m

Operating profit at constant GBP57.1m GBP40.8m

currency*

Profit before taxation GBP58.6m GBP40.8m

Cash generated from operations GBP60.4m GBP36.0m

Basic earnings per share 145.9p 101.3p

Dividend per share declared in

the period 100p 65p

Kevin Rountree, CEO of Games Workshop, said:

"Our business and the Warhammer Hobby continue to be in great

shape.

We are pleased to once again report record sales and profit

levels in the period. The global team have worked their socks off

to deliver these great results. My thanks go out to them all.

Sales for the month of December are in line with our

expectations.

We are also announcing that the Board has today declared a

dividend of 45 pence per share, in line with the Company's policy

of distributing truly surplus cash."

...Ends...

For further information, please

contact:

Games Workshop Group PLC 0115 900 4003

Kevin Rountree, CEO

Rachel Tongue, Group Finance

Director

Investor relations website investor.games-workshop.com

General website www.games-workshop.com

*Constant currency revenue and operating profit are calculated

by comparing results in the underlying currencies for 2018 and

2019, both converted at the average exchange rates for the six

months ended 2 December 2018.

FIRST HALF HIGHLIGHTS

Six months to Six months

to

1 December 2019 2 December

2018

------------------------------------------- ---------------- -------------

Revenue GBP148.4m GBP125.2m

Revenue at constant currency* GBP145.6m GBP125.2m

Operating profit pre-royalties receivable GBP48.5m GBP35.3m

Royalties receivable GBP10.7m GBP5.5m

Operating profit GBP59.2m GBP40.8m

Operating profit at constant currency* GBP57.1m GBP40.8m

Profit before taxation GBP58.6m GBP40.8m

Cash generated from operations GBP60.4m GBP36.0m

Basic earnings per share 145.9p 101.3p

Dividend per share declared in the period 100p 65p

Revenue by segment

Six months to Six months Six months Six months

to to to

1 December 2019 2 December 1 December 2 December

2018 2019 2018

Constant currency Constant currency Actual rates Actual rates

-------------- ------------------ ------------------ ------------- -------------

Trade GBP76.1m GBP61.4m GBP78.1m GBP61.4m

Retail GBP45.3m GBP42.6m GBP45.8m GBP42.6m

Online GBP24.2m GBP21.2m GBP24.5m GBP21.2m

-------------- ------------------ ------------------ ------------- -------------

Total revenue GBP145.6m GBP125.2m GBP148.4m GBP125.2m

-------------- ------------------ ------------------ ------------- -------------

INTERIM MANAGEMENT REPORT

Our business and the Warhammer Hobby continue to be in great

shape.

We are pleased to once again report record sales and profit

levels in the period. The global team have worked their socks off

to deliver these great results. My thanks go out to them all. A

special thanks goes out to our design to manufacturing team, who

have once again delivered on our promise to make the best

miniatures in the world. Our new Citadel Colours paint launch in

the period was a step change in our paint offer. Product innovation

continues to be a key area of focus.

Sales for the month of December are in line with our

expectations.

We are also announcing that the Board has today declared a

dividend of 45 pence per share, in line with the Company's policy

of distributing surplus cash. This will be paid on 2 March 2020 for

shareholders on the register at 24 January 2020, with an

ex-dividend date of 23 January 2020. The last date for elections

for the dividend re-investment plan is 10 February 2020.

Core business

Sales and profit growth continue across our trade, retail and

our online channels. Our constant focus on managing our balance

sheet has ensured our net cash generation has remained healthy

allowing us to invest appropriately, to date GBP5.7 million in

capital projects in the first half. We have also declared GBP32.6

million in dividends during the period.

We have made some good progress with our key priorities. Each of

these is designed to ensure we deliver our exciting operational

plan and continue to engage and inspire our loyal customers.

Our global team - our performance, as ever, was driven by a

considerable team effort across all aspects of our global,

vertically integrated business. It is paramount, then, to our

ongoing success that we continue to invest in our people. To that

end, we have strengthened our central 'People' team adding

additional resources to recruitment, personal development,

wellbeing and pay and other rewards.

Communities and customer engagement - we have continued to build

new communities, opening 12 stores in the period and c.200 trade

accounts. Our digital engagement continues to increase in reach and

scope. Users accessing Warhammer-community.com over the six month

period are up 48% compared to the same period last year and

sessions per user have also increased, meaning our fans are

visiting more often and are more engaged with the content.

IT systems - we have made some good progress on implementing our

European ERP system and upgrading our warehousing capacity and

systems in both Memphis and Nottingham. All projects are broadly on

track and in line with spending limits.

Sustainability - it's early days for us on this important topic.

We have kicked off several projects in the period to look at ways

we can do what is right for our stakeholders and the broader

public. This is a priority for us. We are committed to delivering

better progress.

Non core business

Media and entertainment

Our development work on a TV series, based on the Eisenhorn

series of novels, continues to make good progress. No production

contracts have been signed yet nor have we booked any guaranteed

royalties. Our small, dedicated team of experts continues to work

with our external partners learning how this industry works to

ensure, if it does go into production, our first TV show is not

only true to our IP but is a commercial success too.

Licensing income

Royalties receivable in the period increased by GBP5.2 million

to GBP10.7 million. This includes GBP6.2 million of guaranteed

royalty income on the signing of new licence contracts (2018:

GBP1.6 million). These headline numbers look great. As always this

income continues to be uncertain and, as we recognise guaranteed

royalty income in full on signing the contract, it is even harder

to predict when income will be recognised. As the first half has

seen more new contracts signed than prior years, we will therefore

not make any promises or forecasts on the level of future income.

We are always looking for long term partners that can deliver great

quality products in platform, console and digital gaming markets

without doing any harm to our IP or the core business.

Sales

Reported sales grew by 19% to GBP148.4 million for the period.

On a constant currency basis, sales were up by 16% from GBP125.2

million to GBP145.6 million; split by channel this comprised: Trade

GBP76.1 million (2018: GBP61.4 million), Retail GBP45.3 million

(2018: GBP42.6 million) and Online GBP24.2 million (2018: GBP21.2

million).

Trade

Trade achieved growth of 27% with growth in all key countries.

In the period, our net number of trade outlets increased by c.200

accounts which helped drive forward sales in this channel. It's

worth noting that a large number of independent retailers now also

sell our products online, meaning our customers have more choice

than ever about where to buy Warhammer.

Retail

This channel showed growth in all countries. We opened,

including relocations, 19 stores. After closing 7 stores, our net

total number of stores at the end of the period is 529. As always

it is a challenging environment. The key priority in the period

reported has been to continue to offer our store managers the

appropriate product and sales support to help them recruit new

customers, engage our existing customers and re-engage lapsed

customers. Ensuring we always recruit great store managers, and

offer our customers an exceptional in-store experience, remain a

priority for us.

Online

Online sales grew by 15% compared to last year. We continue to

improve the online store shopping experience and functionality of

the store. Personalised content and ease of navigation remain areas

of focus. As noted above, our customers have a lot of options when

it comes to shopping for Warhammer online, and are able to buy our

products both through our own web stores, reported in Online and

through those of independent retailers, reported in Trade.

Operating profit and profit before taxation

Operating profit before royalty income increased by GBP13.2

million to GBP48.5 million. On a constant currency basis, operating

profit before royalty income increased by GBP11.6 million to

GBP46.9 million. Following the adoption of IFRS 16 'Leases' in June

2019, a liability has been recognised in respect of future lease

payments as well as a corresponding asset representing the right to

use the underlying asset during the lease term. The interest

expense incurred on the lease liabilities and the depreciation

charged on the right-of-use asset is recognised separately in the

income statement. During the period, as a result of the transition

of IFRS 16, additional interest of GBP0.6 million and additional

depreciation of GBP4.6 million have been recognised, partially

offset by a reduction in rental payments in other operating

expenses of GBP4.6 million.

Operating expenses increased by GBP6.0 million due to investment

in sales facing activities relating to new retail store costs and

continued investment in marketing and other central costs. As in

the prior year, we have again rewarded all of our staff with a

payment in December of GBP500 each due under the profit share

scheme.

On a constant currency basis, royalty income increased by GBP4.7

million to GBP10.2 million.

Total operating profit increased by GBP18.4 million to GBP59.2

million. The net impact in the six months to 1 December 2019 of

exchange rate fluctuations was a gain of GBP2.1 million. It is not

the Group's policy to hedge against foreign exchange rate

exposure.

Profit before taxation increased by GBP17.8 million to GBP58.6

million after recognising the impact of adopting IFRS 16.

Capital employed

12 month average capital employed** increased by GBP7.5 million

to GBP74.7 million. The book value of tangible and intangible

assets increased by GBP24.0 million. The impact of IFRS 16 being

adopted during the period has resulted in an increase in tangible

assets of GBP16.3 million, with the underlying increase of GBP7.7

million being mainly due to investments in a second production

facility, warehouse expansion and the ongoing investment in the

implementation of a new ERP system. Trade and other receivables

increased by GBP1.9 million as a result of growth in trade revenue

and inventory increased by GBP2.7 million due to the timing of

product launches and to meet product demand. Liabilities increased

by GBP21.1 million, of which GBP16.4 million relates to lease

liabilities recognised on the adoption of IFRS 16. The net impact

of the adoption of IFRS 16 was a decrease in average capital

employed of GBP0.1 million.

Return on capital employed

We continue to deliver great returns. During the period our

return on capital employed increased from 96% at November 2018 to

111% at November 2019. This was driven by the increase in operating

profit before royalties receivable, offset by an increase in

investment in capacity and in working capital.

Cash generation

During the period, the Group's core operating activities

generated GBP37.7 million of cash after tax payments (2018: GBP23.9

million). The Group also received cash of GBP5.1 million in respect

of royalties in the period (2018: GBP4.0 million). In the period,

the Group had purchases of tangible and intangible assets and

product development costs of GBP13.7 million (2018: GBP10.9

million), lease liability payments of GBP4.8 million (2018:

GBPnil), dividends of GBP21.1 million (2018: GBP21.0 million) and

net interest and foreign exchange losses of GBP0.4 million (2018:

gains of GBP0.1 million). In addition UK corporation tax payments

were GBP16.2 million (2018: GBP7.9 million) as HMRC changed the

quarterly payment timings during the period. There were net funds

at the end of the period of GBP33.0 million (2018: GBP25.3

million).

Dividends

In the period we declared and paid dividends of 30 pence per

share and 35 pence per share (2018: 30 pence and 35 pence)

amounting to GBP21.1 million (2018: GBP21.0 million). A dividend of

35 pence per share was declared on 19 November 2019 amounting to

GBP11.4 million. In addition, a dividend has been declared today of

45 pence per share amounting to GBP14.7 million.

Risks and uncertainties

The board has overall responsibility for ensuring risk is

appropriately managed across the Group. The top seven risks to the

Group are reviewed at each board meeting. The risks are rated as to

their business impact and their likelihood of occurring. In

addition, the Group has a disaster recovery plan to ensure ongoing

operations are maintained in all circumstances. The principal risks

identified in 2019/20 are discussed below. These risks are not

intended to be an extensive analysis of all risks that may arise

but more importantly are the ones that could cause business

interruption in the year ahead.

-- Recruitment - to always have a world class team to support

our business. The risk is that we compromise and recruit only for

skills and not on the personal qualities that we need new members

of our global team to demonstrate to ensure we deliver our

long-term goals. The Games Workshop recruitment process aims to

ensure we recruit for attitude as well as skills, to help mitigate

this risk. This end to end process starts with writing a new job

specification highlighting the personal qualities needed in the job

as well as the skills, through to a robust induction process which

will help them be successful in their job. Our new recruitment and

onboarding systems also help in ensuring the recruitment process is

efficient and effective for both the new recruit and the recruiting

manager.

-- Supply chain - to deliver a seamless supply of products to

our customers. The risk is that there are unnecessary delays or

expense. Constant review by the executive directors and the rest of

the board of our production and warehousing capacity ensures that

issues are dealt with in an appropriate timescale. This is

particularly relevant given the recent growth in sales.

-- Range management - we are reviewing our range to ensure that

we are exploring all opportunities. The risk is that we don't fully

capitalise on all the opportunities that are available to us or

that we have too much stock. To ensure we have the right product in

the right place at the right time, we have been investing in our

merchandising and logistics team throughout the period.

-- ERP change - we are changing our core ERP system in the UK

which is a complicated project with the risk of widespread business

disruption if it is not implemented well. It is being implemented

and managed by a strong internal project team and specialist ERP

software consultants.

-- Innovation - to surprise and delight our customers with ever

better new miniatures and related products. The risk is that we

become complacent. Our design studios are responsible for creating

great new miniatures, games and complementary products. The sales

of new products are reviewed and assessed by the executive team and

the design studios to ensure that we continue to deliver on our

promise to make the best miniatures in the world.

-- IP exploitation - to optimise our Warhammer brands fully, in

addition to being innovative in our core business. The risks are

that we do harm to the core business or that we don't take this

opportunity seriously. With the appointment of our new

non-executive director, Kate Marsh, the board will manage the risk

going forward supporting the senior team on these new

opportunities.

-- Distractions - this is anything else that gets in the way of us delivering our goals.

Games Workshop relies upon the continued availability and

integrity of its IT systems. Our business critical systems are

monitored and disaster recovery plans are in place and reviewed to

ensure they remain up to date. The security of our systems is

reviewed with software updates applied and equipment updated as

required.

We do not consider that we have material solvency or liquidity

risks.

In our opinion the greatest risk is the same one that we repeat

each year, namely, management. So long as we have the right people

in the right jobs we will be fine. Problems will arise if the board

allows egos and private agendas to rule. We will do our utmost to

ensure that this does not happen.

Brexit impact statement

Following the UK Government invoking Article 50 of the Treaty of

Lisbon, notifying the European Council of its intention to withdraw

from the EU, Games Workshop has reviewed the impact that this may

have on the Group. The key risks for Games Workshop relate to the

movement of goods from the UK to the EU across all sales channels

as well as the recruitment and retention of EU nationals working in

the UK. These risks have been assessed and plans have been put in

place to help mitigate the possible impact of these changes

depending on the nature of the UK's withdrawal from the EU.

Going concern

After making appropriate enquiries, the directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for at least twelve months from

the date of approval of the condensed consolidated interim

financial information. For this reason they have adopted the going

concern basis in preparing this condensed consolidated interim

financial information.

Statement of directors' responsibilities

The directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with IAS 34,

'Interim Financial Reporting', as adopted by the European Union,

and that the interim management report herein includes a fair

review of the information required by DTR 4.2.7 and DTR 4.2.8,

namely: an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of (i) the principal risks

and uncertainties for the remaining six months of the financial

year; (ii) material related party transactions in the first six

months and (iii) any material changes in the related party

transactions described in the last annual report.

There have been no changes to the board since the annual report

for the year to 2 June 2019. A list of all current directors is

maintained on the investor relations website at

investor.games-workshop.com.

By order of the board

K D Rountree

CEO

R F Tongue

Group Finance Director

14 January 2020

*Constant currency revenue and operating profit are calculated

by comparing results in the underlying currencies for 2018 and

2019, both converted at the average exchange rates for the six

months ended 2 December 2018.

**We use average capital employed to take account of the

significant fluctuation in working capital which occurs as the

business builds both inventories and trade receivables in the

pre-Christmas trading period. Return is defined as operating profit

before royalty income, and the average capital employed is adjusted

by deducting assets and adding back liabilities in respect of cash,

borrowings, taxation, royalty income and dividends.

CONSOLIDATED INCOME STATEMENT

Six months Six months

to to

Notes 1 December 2 December Year to

2019 2018 2 June 2019

GBP000 GBP000 GBP000

------------------------------- -------- ------------- ------------ -------------

Revenue 3 148,350 125,225 256,574

Cost of sales (45,316) (41,392) (83,306)

------------------------------- -------- ------------- ------------ -------------

Gross profit 103,034 83,833 173,268

Operating expenses 3 (54,545) (48,552) (103,434)

Other operating income -

royalties receivable 10,670 5,490 11,365

------------------------------- -------- ------------- ------------ -------------

Operating profit 3 59,159 40,771 81,199

Finance income 63 38 102

Finance costs (638) - (5)

------------------------------- -------- ------------- ------------ -------------

Profit before taxation 5 58,584 40,809 81,296

Income tax expense 6 (11,131) (7,999) (15,475)

------------------------------- -------- ------------- ------------ -------------

Profit attributable to owners

of the parent 47,453 32,810 65,821

------------------------------- -------- ------------- ------------ -------------

Basic earnings per ordinary

share 7 145.9p 101.3p 202.9p

Diluted earnings per ordinary

share 7 144.6p 100.7p 200.8p

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME AND EXPENSE

Six months Six months

to to

1 December 2 December Year to

2019 2018 2 June 2019

GBP000 GBP000 GBP000

--------------------------------------------- ------------- ------------ -------------

Profit attributable to owners of

the parent 47,453 32,810 65,821

Other comprehensive income

Items that may be subsequently reclassified

to profit or loss

Exchange differences on translation

of foreign operations (1,701) 771 708

--------------------------------------------- ------------- ------------ -------------

Other comprehensive (expense)/income

for the period (1,701) 771 708

--------------------------------------------- ------------- ------------ -------------

Total comprehensive income attributable

to owners of the parent 45,752 33,581 66,529

--------------------------------------------- ------------- ------------ -------------

The following notes form an integral part of this condensed

consolidated interim financial information.

CONSOLIDATED BALANCE SHEET

1 December 2 December

2019 2018 2 June 2019

Notes GBP000 GBP000 GBP000

---------------------------------- -------- ----------- ----------- ------------

Non-current assets

Goodwill 1,433 1,433 1,433

Other intangible assets 9 18,052 14,850 16,004

Property, plant and equipment 10 39,066 33,029 35,303

Right-of-use assets 11 29,022 - -

Trade and other receivables 4,516 1,866 3,085

Deferred tax assets 8,680 6,713 8,582

---------------------------------- -------- ----------- ----------- ------------

100,769 57,891 64,407

---------------------------------- -------- ----------- ----------- ------------

Current assets

Inventories 21,708 22,393 24,192

Trade and other receivables 28,749 21,821 18,796

Current tax assets 676 319 814

Cash and cash equivalents 32,967 25,335 29,371

---------------------------------- -------- ----------- ----------- ------------

84,100 69,868 73,173

---------------------------------- -------- ----------- ----------- ------------

Total assets 184,869 127,759 137,580

---------------------------------- -------- ----------- ----------- ------------

Current liabilities

Lease liabilities (8,086) - -

Trade and other payables (18,799) (15,950) (19,199)

Dividends payable 4 (11,436) - -

Current tax liabilities (2,364) (8,522) (9,135)

Provisions for other liabilities

and charges 12 (526) (510) (919)

---------------------------------- -------- ----------- ----------- ------------

(41,211) (24,982) (29,253)

---------------------------------- -------- ----------- ----------- ------------

Net current assets 42,889 44,886 43,920

---------------------------------- -------- ----------- ----------- ------------

Non-current liabilities

Lease liabilities (20,354) - -

Other non-current liabilities (943) (682) (1,010)

Provisions for other liabilities

and charges 12 (1,454) (519) (844)

---------------------------------- -------- ----------- ----------- ------------

(22,751) (1,201) (1,854)

---------------------------------- -------- ----------- ----------- ------------

Net assets 120,907 101,576 106,473

---------------------------------- -------- ----------- ----------- ------------

Capital and reserves

Called up share capital 1,634 1,624 1,625

Share premium account 13,030 12,251 12,281

Other reserves 2,984 4,748 4,685

Retained earnings 103,259 82,953 87,882

---------------------------------- -------- ----------- ----------- ------------

Total equity 120,907 101,576 106,473

---------------------------------- -------- ----------- ----------- ------------

The following notes form an integral part of this condensed

consolidated interim financial information.

CONSOLIDATED STATEMENT OF CHANGES IN TOTAL EQUITY

Called

up Share

share premium Other Retained Total

capital account reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------- --------- --------- ---------- ---------- ---------

At 2 June 2019 and 3 June 2019 1,625 12,281 4,685 87,882 106,473

Profit for the six months to 1

December 2019 - - - 47,453 47,453

Exchange differences on translation

of foreign operations - - (1,701) - (1,701)

---------------------------------------- --------- --------- ---------- ---------- ---------

Total comprehensive income for

the period - - (1,701) 47,453 45,752

Transactions with owners:

Share-based payments - - - 197 197

Shares issued under employee sharesave

scheme 9 749 - - 758

Deferred tax charge relating to

share options - - - (359) (359)

Current tax credit relating to

exercised share options - - - 649 649

Dividends declared to Company

shareholders - - - (32,563) (32,563)

---------------------------------------- --------- --------- ---------- ---------- ---------

Total transactions with owners 9 749 - (32,076) (31,318)

---------------------------------------- --------- --------- ---------- ---------- ---------

At 1 December 2019 1,634 13,030 2,984 103,259 120,907

---------------------------------------- --------- --------- ---------- ---------- ---------

Called

up Share

share premium Other Retained Total

capital account reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------- --------- --------- ---------- ---------- ---------

At 3 June 2018 and 4 June 2018 1,617 11,571 3,977 70,957 88,122

Profit for the six months to 2

December 2018 - - - 32,810 32,810

Exchange differences on translation

of foreign operations - - 771 - 771

---------------------------------------- --------- --------- ---------- ---------- ---------

Total comprehensive income for

the period - - 771 32,810 33,581

Transactions with owners:

Share-based payments - - - 140 140

Shares issued under employee sharesave

scheme 7 680 - - 687

Deferred tax charge relating to

share options - - - (281) (281)

Current tax credit relating to

exercised share options - - - 355 355

Dividends declared to Company

shareholders - - - (21,028) (21,028)

---------------------------------------- --------- --------- ---------- ---------- ---------

Total transactions with owners 7 680 - (20,814) (20,127)

---------------------------------------- --------- --------- ---------- ---------- ---------

At 2 December 2018 1,624 12,251 4,748 82,953 101,576

---------------------------------------- --------- --------- ---------- ---------- ---------

Called

up Share

share premium Other Retained Total

capital account reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------- --------- --------- ---------- ---------- ---------

At 3 June 2018 and 4 June 2018 1,617 11,571 3,977 70,957 88,122

Profit for the 52 weeks to 2 June

2019 - - - 65,821 65,821

Exchange differences on translation

of foreign operations - - 708 - 708

---------------------------------------- --------- --------- ---------- ---------- ---------

Total comprehensive income for

the period - - 708 65,821 66,529

Transactions with owners:

Share-based payments - - - 339 339

Shares issued under employee sharesave

scheme 8 710 - - 718

Deferred tax credit relating to

share options - - - 224 224

Current tax credit relating to

exercised share options - - - 818 818

Dividends declared to Company

shareholders - - - (50,277) (50,277)

---------------------------------------- --------- --------- ---------- ---------- ---------

Total transactions with owners 8 710 - (48,896) (48,178)

---------------------------------------- --------- --------- ---------- ---------- ---------

At 2 June 2019 1,625 12,281 4,685 87,882 106,473

---------------------------------------- --------- --------- ---------- ---------- ---------

The following notes form an integral part of this condensed

consolidated interim financial information.

CONSOLIDATED CASH FLOW STATEMENT

Six months Six months

to to

Notes 1 December 2 December Year to

2019 2018 2 June 2019

GBP000 GBP000 GBP000

---------------------------------------- -------- ------------ ------------ -------------

Cash flows from operating activities

Cash generated from operations 8 60,428 35,968 88,776

UK corporation tax paid (16,249) (7,885) (14,217)

Overseas tax paid (1,410) (159) (2,079)

---------------------------------------- -------- ------------ ------------ -------------

Net cash generated from operating

activities 42,769 27,924 72,480

---------------------------------------- -------- ------------ ------------ -------------

Cash flows from investing activities

Purchases of property, plant and

equipment (8,494) (6,560) (13,651)

Proceeds on disposal of property,

plant and equipment 23 - 10

Purchases of other intangible

assets (1,474) (812) (1,875)

Expenditure on product development (3,726) (3,536) (6,962)

Interest received 63 38 102

---------------------------------------- -------- ------------ ------------ -------------

Net cash used in investing activities (13,608) (10,870) (22,376)

---------------------------------------- -------- ------------ ------------ -------------

Cash flows from financing activities

Proceeds from issue of ordinary

share capital 758 687 718

Repayment of principal under finance (4,841) - -

leases

Interest paid (10) - (5)

Dividends paid to Company shareholders (21,127) (21,028) (50,277)

---------------------------------------- -------- ------------ ------------ -------------

Net cash used in financing activities (25,220) (20,341) (49,564)

---------------------------------------- -------- ------------ ------------ -------------

Net increase/(decrease) in cash

and cash equivalents 3,941 (3,287) 540

Opening cash and cash equivalents 29,371 28,545 28,545

Effects of foreign exchange rates

on cash and cash equivalents (345) 77 286

---------------------------------------- -------- ------------ ------------ -------------

Closing cash and cash equivalents 32,967 25,335 29,371

---------------------------------------- -------- ------------ ------------ -------------

The following notes form an integral part of this condensed

consolidated interim financial information.

NOTES TO THE FINANCIAL INFORMATION

1. Basis of preparation

The Company is a limited liability company, incorporated and

domiciled in the United Kingdom. The address of its registered

office is Willow Road, Lenton, Nottingham, NG7 2WS.

The Company has its listing on the London Stock Exchange.

This condensed consolidated interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. Statutory accounts for the year ended 2

June 2019 were approved by the board of directors on 29 July 2019

and have been delivered to the Registrar of Companies. The report

of the auditors on those accounts was unqualified, did not contain

an emphasis of matter paragraph and did not contain any statement

under either section 498 (2) or section 498 (3) of the Companies

Act 2006.

This condensed consolidated interim financial information has

not been audited or reviewed pursuant to the Auditing Practices

Board guidance on 'Review of Interim Financial Information' and

does not include all of the information required for full annual

financial statements.

This condensed consolidated interim financial information for

the six months ended 1 December 2019 has been prepared in

accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority and with IAS 34, 'Interim Financial

Reporting' as adopted by the European Union. The condensed

consolidated interim financial information should be read in

conjunction with the annual financial statements for the year ended

2 June 2019 which have been prepared in accordance with IFRSs as

adopted by the European Union.

After making appropriate enquiries, the directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future. For

this reason they have adopted the going concern basis in preparing

this condensed consolidated interim financial information.

This condensed consolidated interim financial information was

approved for issue on 14 January 2020.

This condensed consolidated interim financial information is

available to shareholders and members of the public on the

Company's website at investor.games-workshop.com.

The preparation of interim financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, revenues and expenses. Actual

results may differ from these estimates.

In preparing this condensed consolidated interim financial

information, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 2 June 2019,

with the addition of the additional judgements and estimations

needed in the application of IFRS 16, including determination of

the lease term, calculation of the discount rate, and the

separation of lease and non-lease components.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 2 June 2019, as

described in those financial statements, except for the adoption of

new standards effective from 3 June 2019. The Group applies for the

first time IFRS 16 'Leases', effective from 3 June 2019. The nature

and the impact of the changes are disclosed in note 2.

The Group does not consider that any other standards, amendments

or interpretations issued by the IASB, but not yet applicable, will

have a significant effect on the financial statements.

2. Change in accounting policy

IFRS 16 'Leases' supersedes IAS 17 'Leases' and related

interpretations, and applies to financial periods commencing on or

after 1 January 2019. This new standard sets out the principles for

the recognition, measurement, presentation and disclosure of leases

and requires lessees to account for all leases under a single

on-balance sheet model similar to the accounting for finance leases

under IAS 17. The standard includes two recognition exemptions for

lessees: leases of 'low value' assets; and short-term leases (i.e.

leases with a term less than 12 months). At the lease commencement

date, a liability will be recognised in respect of the future lease

payments and a corresponding asset representing the right to use

the underlying asset during the lease term. The interest expense

incurred on the lease liability and the depreciation charged on the

right to use asset will be recognised separately in the income

statement. Right-of-use assets are measured at an amount equal to

the lease liability, adjusted by the amount of any prepaid or

accrued lease payments.

Where a lease includes the option for the Group to extend the

lease term, the Group applies judgement as to whether it is

reasonably certain that the opportunity to extend will be taken.

Certain events will result in the lease liability being re-measured

(e.g. a change in the lease term, a change in future lease payments

resulting from a change in an index or rate used to determine those

payments). The re-measurement will be first adjusted against the

right-of-use asset and any excess charged to profit or loss.

The Group has applied the modified retrospective approach for

its transition to this new standard from 3 June 2019, meaning that

prior reporting periods have not been restated. In adopting this

approach the Group intends to use the following practical

expedients as offered by the standard:

- Application of a single discount rate to a portfolio of leases

with reasonably similar characteristics;

- The use of hindsight in determining the lease term if the

contract contains options to extend or terminate the lease;

- Exclusion of initial direct costs from the measurement of the

right of use asset at the date of initial application;

- Reliance has been placed on the assessment made under IAS 37

to identify onerous leases, rather than performing an impairment

test on right-of-use assets on transition; and

- No recognition of leases whose term ends within twelve months

of the date of initial application.

The Group has elected to apply the standard to contracts that

were previously identified as leases applying IAS 17 and IFRIC 4.

The Group will not apply the standard to contracts that were not

previously identified as containing a lease. The Group has elected

to apply the transition exemption for leases where the underlying

asset is of low value, i.e. when the underlying asset has a value

of GBP5,000 or less when new. We will not be separating lease

components from non-lease components for any asset class other than

buildings.

The Group has calculated and applied the incremental borrowing

rate ('IBR') to its future cash flows to determine the lease

liability. The incremental borrowing rate has been defined by the

standard as 'the rate of interest that a lessee would have to pay

to borrow over a similar term, and with similar security, the funds

necessary to obtain an asset of a similar value to the right-of-use

asset in a similar environment'. The Group has no external

borrowing, therefore a credit risk spread approach has been used to

calculate the IBR, which combines the risk-free security rate and a

corporate security rate in each economic environment in which the

Group has a lease, linked to the life of the underlying lease

agreement. The weighted average incremental borrowing rate applied

by the Group on transition was 2.07%.

Once a right-of-use asset has been capitalised, it is

subsequently depreciated over the length of the lease term, or, for

the assets capitalised at transition, the remaining lease term from

the date of transition. The provisions of IAS 36 concerning

impairment testing also apply to capitalised right-of-use

assets.

The impact of the transition to IFRS 16 on 3 June 2019 on the

results on the consolidated balance sheet was as follows:

Impact of

change in

2 June 2019 accounting 3 June

GBP000 standards 2019

GBP000 GBP000

------------------------------------------------ ----------------------- --------------------

Non-current assets 64,407 33,598 98,005

- Right-of-use assets - 33,598 33,598

Current assets 73,173 (905) 72,268

- Trade and other receivables 18,796 (905) 17,891

Current liabilities (29,253) (8,705) (37,958)

- Lease liabilities - (8,786) (8,786)

- Provisions for other liabilities

and charges (919) 81 (838)

Non-current liabilities (1,854) (23,988) (25,842)

- Lease liabilities - (24,079) (24,079)

- Provisions for other liabilities

and charges (844) 91 (753)

Net assets 106,473 - 106,473

------------------------------------- --------- ----------------------- --------------------

There were no assets previously held under finance leases prior

to transition.

The introduction of IFRS 16 has had the following effects on the

consolidated financial statements following transition:

- An increase in the carrying value of fixed assets and an

increase in financial liabilities on the balance sheet on

recognition of the new right-of-use assets and their corresponding

lease liabilities. Financial obligations from operating leases were

previously reported off balance sheet. Rental prepayments sitting

in trade and other receivables at 2 June 2019 relating to assets

now capitalised were removed as these have been built into the

future cash flows used in the calculation of the asset value.

- Right-of-use assets have been depreciated since the date of

transition, and these depreciation charges, along with the interest

expense on the lease liability have been recognised in the income

statement, in operating expenses and finance charges respectively.

Rental charges, other than those related to short-term or low value

leases, are no longer recognised in the Income statement. In the

six months to 1 December 2019, this has led to an increase in

interest expenses of GBP0.6 million, an increase in depreciation of

GBP4.6 million, and a decrease in other operating expenses of

GBP4.6 million.

3. Segment information

As Games Workshop is a vertically integrated business,

management assesses the performance of sales channels and

manufacturing and distribution channels separately. At 1 December

2019, the Group is organised as follows:

- Sales channels. These channels sell product to external

customers, through the Group's network of retail stores,

independent retailers and online via the global web stores. The

sales channels have been aggregated into segments where they sell

products of a similar nature, have similar production processes,

similar customers, similar distribution methods, and if they are

affected by similar economic factors. The segments are as

follows:

- Trade. This sales channel sells globally to independent

retailers, agents and distributors. It also includes the Group's

magazine newsstand business and the distributor sales from the

Group's publishing business (Black Library).

- Retail. This includes sales through the Group's retail stores,

the Group's visitor centre in Nottingham and global

exhibitions.

- Online. This includes sales through the Group's global web

stores and digital product sales through external affiliates.

- Product and supply. This includes the design and manufacture

of products and incorporates the production facility in the UK and

the Group logistics and merchandising costs. This also includes

adjustments for the profit in stock arising from inter-segment

sales and charges for inventory provisions.

- Central costs. These include the Company overheads, head

office site costs and marketing costs.

- Service centre costs. Provides support services (IT,

accounting, payroll, personnel, procurement, legal, health and

safety, customer services and credit control) to activities across

the Group and undertakes strategic projects.

- Royalties. This is royalty income earned from third party

licensees after deducting associated licensing costs.

- Media and entertainment. Costs associated with developing our

IP as digital content for animation and television.

The chief operating decision-maker assesses the performance of

each segment based on operating profit, excluding share option

charges recognised under IFRS 2, 'Share-based payment', charges in

respect of the Group's profit share scheme and the discretionary

payment to employees in the year ended 2 June 2019. This has been

reconciled to the Group's total profit before taxation below.

The segment information reported to the executive directors for

the periods included in this financial information is as

follows:

Six months Six months Year ended

to to 2 June 2019

1 December 2 December GBP000

2019 2018

GBP000 GBP000

------------------------ ------------------- ----------------------- ------------------------

Trade 78,096 61,445 121,445

Retail 45,804 42,547 87,803

Online 24,450 21,233 47,326

Total external revenue 148,350 125,225 256,574

------------------------ ------------------- ----------------------- ------------------------

For information, we analyse external revenue further below:

Six months Six months Year ended

to to 2 June 2019

1 December 2 December GBP000

2019 2018

GBP000 GBP000

--------------------------------- ------------ ------------------------- --------------------------

Trade

UK and Continental Europe 33,869 25,816 51,324

North America 33,921 27,171 53,509

Australia and New Zealand 3,273 2,838 5,061

Asia 3,619 2,657 5,332

Rest of world 2,283 1,761 3,796

Black Library 1,131 1,202 2,423

Total Trade 78,096 61,445 121,445

--------------------------------- ------------ ------------------------- --------------------------

Retail

UK 13,751 13,652 27,831

Continental Europe 10,964 10,404 21,380

North America 14,876 12,935 27,428

Australia and New Zealand 4,496 4,182 8,316

Asia 1,717 1,374 2,848

Total Retail 45,804 42,547 87,803

--------------------------------- ------------ ------------------------- --------------------------

Online 24,450 21,233 47,326

Total external revenue 148,350 125,225 256,574

--------------------------------- ------------ ------------------------- --------------------------

Operating expenses by segment are regularly reviewed by the

executive directors and are provided below:

Six months Six months Year ended

to to 2 June 2019

1 December 2 December GBP000

2019 2018

GBP000 GBP000

------------------------------------------- ------------ ----------------------- ------------------------

Trade* 5,050 6,525 13,475

Retail* 29,075 23,946 49,524

Online* 2,368 2,731 5,668

Product and supply 1,786 1,666 3,789

Central costs 6,332 5,140 9,653

Service centre costs 7,999 6,946 14,700

Royalties 519 346 775

Media and entertainment 118 - -

------------------------------------------- ------------ ----------------------- ------------------------

Total segment operating expenses 53,247 47,300 97,584

Share-based payment charge 196 140 339

Profit share scheme charge 1,102 1,112 2,226

Discretionary payment to employees - - 3,285

Total group operating expenses 54,545 48,552 103,434

------------------------------------------- ------------ ----------------------- ------------------------

*Retail operating expenses in the six months to 2 December 2018

are net of inter group marketing service income of GBP2,671,000

(year ended 2 June 2019: GBP5,515,000) which was recognised within

the Trade (GBP2,133,000) and Online (GBP538,000) segments (year

ended 2 June 2019: Trade: GBP4,307,000, Online: GBP1,208,000).

These inter group charges were effective for a five year term

following the structural reorganisation in 2014 and are no longer

applicable.

Total segment operating profit is as follows and is reconciled

to profit before taxation below:

Six months Six months Year ended

to to 2 June 2019

1 December 2 December GBP000

2019 2018

GBP000 GBP000

----------------------------------------- ------------ ----------------------- ------------------------

Trade* 31,507 22,474 43,688

Retail* 1,767 4,821 10,386

Online* 15,697 13,060 29,247

Product and supply 16,487 9,594 18,517

Central costs (7,035) (5,946) (10,684)

Service centre costs (7,999) (6,946) (14,695)

Royalties 10,151 4,966 10,590

Media and entertainment (118) - -

----------------------------------------- ------------ ----------------------- ------------------------

Total segment operating profit 60,457 42,023 87,049

Share-based payment charge (196) (140) (339)

Profit share scheme charge (1,102) (1,112) (2,226)

Discretionary payment to employees - - (3,285)

----------------------------------------- ------------ ----------------------- ------------------------

Total group operating profit 59,159 40,771 81,199

Finance income 63 38 102

Finance costs (638) - (5)

----------------------------------------- ------------ ----------------------- ------------------------

Profit before taxation 58,584 40,809 81,296

----------------------------------------- ------------ ----------------------- ------------------------

4. Dividends

Dividends of GBP9,751,000 (30 pence per share) and GBP11,376,000

(35 pence per share) were declared and paid in the six months to 1

December 2019. A further dividend of GBP11,436,000 (35 pence per

share) was declared during the period and was paid prior to the

approval of the consolidated interim financial information and a

dividend of GBP14.7 million (45 pence per share) was declared

today.

Dividends of GBP9,705,000 (30 pence per share) and GBP11,323,000

(35 pence per share) were declared and paid in the six months to 2

December 2018. Further dividends of GBP9,749,000 (30 pence per

share), GBP8,124,000 (25 pence per share), and GBP11,376,000 (35

pence per share) were declared and paid during the second half of

the year.

5. Profit before taxation

The following costs have been incurred in the reported periods

in respect of ongoing redundancies, inventory provisions,

impairments and loss-making retail stores:

Six months Six months Year ended

to to 2 June 2019

1 December 2 December GBP000

2019 2018

GBP000 GBP000

---------------------------------------- --------------- ----------------------- ------------------------

Redundancy costs and compensation

for loss of office 73 264 934

Impairment/(reversal of impairment)

of property, plant and equipment 119 (18) 8

Net charge/(credit) to property provisions

including closed or

loss-making retail stores - 108 (150)

Net inventory provision creation 2,917 3,422 5,770

----------------------------------------------- -------- ----------------------- ------------------------

6. Tax

The taxation charge for the six months to 1 December 2019 is

based on an estimate of the full year effective rate of 19.0%

(2018: 19.6%). While we continue to expect a rate above that for a

business with activities based solely in the UK due to higher

overseas tax rates, it will be offset by increased elimination of

inter group profit at those same rates.

7. Earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to owners of the parent by the weighted average number

of ordinary shares in issue throughout the relevant period.

Six months Six months Year ended

to to 2 June 2019

1 December 2 December GBP000

2019 2018

GBP000 GBP000

------------------------------------- ------------ ----------------------- ------------------------

Profit attributable to owners

of the parent (GBP000) 47,453 32,810 65,821

------------------------------------- ------------ ----------------------- ------------------------

Weighted average number of ordinary

shares in issue (thousands) 32,530 32,376 32,438

------------------------------------- ------------ ----------------------- ------------------------

Basic earnings per share (pence

per share) 145.9 101.3 202.9

------------------------------------- ------------ ----------------------- ------------------------

Diluted earnings per share

The calculation of diluted earnings per share has been based on

the profit attributable to owners of the parent and the weighted

average number of shares in issue throughout the relevant period,

adjusted for the dilution effect of share options outstanding at

the period end.

Six months Six months Year ended

to to 2 June 2019

1 December 2 December GBP000

2019 2018

GBP000 GBP000

------------------------------------------ ------------ ----------------------- ------------------------

Profit attributable to owners of

the parent (GBP000) 47,453 32,810 65,821

------------------------------------------ ------------ ----------------------- ------------------------

Weighted average number of ordinary

shares in issue (thousands) 32,530 32,376 32,438

Adjustment for share options (thousands) 280 199 347

------------------------------------------ ------------ ----------------------- ------------------------

Weighted average number of ordinary

shares for diluted earnings per

share (thousands) 32,810 32,575 32,785

------------------------------------------ ------------ ----------------------- ------------------------

Diluted earnings per share (pence

per share) 144.6 100.7 200.8

------------------------------------------ ------------ ----------------------- ------------------------

8. Reconciliation of profit to net cash from operating activities

Six months Six months Year ended

to to 2 June 2019

1 December 2 December GBP000

2019 2018

GBP000 GBP000

--------------------------------------- --------------- ----------------------- ------------------------

Operating profit 59,159 40,771 81,199

Depreciation of property, plant and

equipment 4,460 3,754 8,941

Impairment/(reversal of impairment)

of property, plant and equipment 119 (18) 8

(Profit)/loss on disposal of property,

plant and equipment (17) 9 144

Loss on disposal of intangible assets - - 188

Amortisation of capitalised development

costs 2,533 2,965 5,341

Amortisation of other intangibles 614 754 1,608

Depreciation of right-of-use assets 4,611 - -

Loss on disposal of right-of-use (11) - -

assets

Share-based payments 197 140 339

Changes in working capital:

-Decrease/(increase) in inventories 2,130 (2,195) (3,357)

-Increase in trade and other receivables (11,900) (5,911) (4,021)

-Decrease in trade and other payables (1,715) (4,085) (2,149)

-Increase/(decrease) in provisions 248 (216) 535

--------------------------------------------- --------- ----------------------- ------------------------

Net cash from operating activities 60,428 35,968 88,776

--------------------------------------------- --------- ----------------------- ------------------------

9. Other intangible assets

1 December 2 December 2 June 2019

2019 2018 GBP000

GBP000 GBP000

--------------------------------- ----------- ---------------------- -----------------------

Net book value at beginning of

period 16,004 14,195 14,195

Additions 5,200 4,348 8,894

Exchange differences (5) 1 3

Disposals - - (188)

Amortisation charge (3,147) (3,719) (6,949)

Reclassification from property,

plant and equipment - 25 49

Net book value at end of period 18,052 14,850 16,004

--------------------------------- ----------- ---------------------- -----------------------

10. Property, plant and equipment

1 December 2 December 2 June 2019

2019 2018 GBP000

GBP000 GBP000

-------------------------------------- ----------- ---------------------- -----------------------

Net book value at beginning of

period 35,303 30,072 30,072

Additions 8,494 6,608 14,238

Exchange differences (146) 119 145

Disposals (6) (9) (154)

Depreciation charge (4,460) (3,754) (8,941)

(Impairment)/reversal of impairment

charge (119) 18 (8)

Reclassification to other intangible

assets - (25) (49)

Net book value at end of period 39,066 33,029 35,303

-------------------------------------- ----------- ---------------------- -----------------------

11. Right-of-use assets

1 December 2 December 2 June 2019

2019 2018 GBP000

GBP000 GBP000

-------------------------------- ----------- ---------------------- -----------------------

Net book value at beginning of - - -

period

Additions 34,472 - -

Exchange differences (718) - -

Disposals (121) - -

Depreciation charge (4,611) - -

Net book value at end of period 29,022 - -

-------------------------------- ----------- ---------------------- -----------------------

Included within additions for the period is GBP33.6 million of

right-of-use assets recognised on transition to IFRS 16 on 3 June

2019. See note 2 for further information.

12. Provisions for other liabilities and charges

Analysis of total provisions:

1 December 2019 2 December 2 June 2019

GBP000 2018 GBP000

GBP000

--------------------------------------- ------------------------ ---------------------- -----------------------

Current 526 510 919

Non-current 1,454 519 844

--------------------------------------------- ------------------ ---------------------- -----------------------

Total provisions for other

liabilities and charges 1,980 1,029 1,763

--------------------------------------------- ------------------ ---------------------- -----------------------

Employee benefits Property Total

GBP000 GBP000 GBP000

--------------------------------- ---------- ------------------ ---------------------- -----------------------

At 3 June 2018 768 460 1,228

Charged to the income statement 78 108 186

Exchange differences 9 8 17

Utilised (68) (334) (402)

--------------------------------------------- ------------------ ---------------------- -----------------------

At 2 December 2018 787 242 1,029

--------------------------------------------- ------------------ ---------------------- -----------------------

At 3 June 2018 768 460 1,228

Charged to the income statement 727 123 850

Exchange differences 3 2 5

Utilised (44) (276) (320)

--------------------------------------------- ------------------ ---------------------- -----------------------

At 2 June 2019 1,454 309 1,763

Charged/(credited) to the

income statement 431 (118) 313

Exchange differences (31) (1) (32)

Utilised (40) (24) (64)

At 1 December 2019 1,814 166 1,980

--------------------------------------------- ------------------ ---------------------- -----------------------

13. Seasonality

The Group's monthly sales profile demonstrates an element of

seasonality around the Christmas period which impacts sales in the

month of December.

14. Commitments

Capital expenditure contracted for at the balance sheet date but

not yet incurred is GBP4,592,000 (2018: GBP2,969,000).

15. Related party transactions

There were no material related-party transactions during the

period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BIGDBGGBDGGX

(END) Dow Jones Newswires

January 14, 2020 02:00 ET (07:00 GMT)

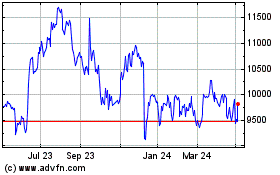

Games Workshop (LSE:GAW)

Historical Stock Chart

From Mar 2024 to May 2024

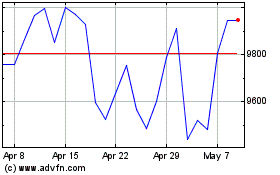

Games Workshop (LSE:GAW)

Historical Stock Chart

From May 2023 to May 2024