TIDMGFRD

RNS Number : 1105O

Galliford Try Holdings PLC

05 October 2021

GALLIFORD TRY HOLDINGS PLC

PUBLICATION OF ANNUAL REPORT AND FINANCIAL STATEMENTS 2021 AND

NOTICE OF 2021 ANNUAL GENERAL MEETING

Galliford Try Holdings plc has today, in accordance with LR

9.6.1 R of the Listing Rules, submitted to the Financial Conduct

Authority's National Storage Mechanism copies of the following:

-- The Annual Report and Financial Statements 2021.

-- Notice of 2021 Annual General Meeting.

-- Form of Proxy for the 2021 Annual General Meeting.

The documents will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The Annual Report and Financial Statements and Notice of Annual

General Meeting are also available on the Galliford Try website at

www.gallifordtry.co.uk/investors/reports-presentations/.

A condensed set of the Group's financial statements and

information on important events that have occurred during the

financial year and their impact on the financial statements were

included in Galliford Try Holdings plc's Final Results Announcement

on 16 September 2021. That information, together with the

information set out below which is extracted from the Annual Report

and Financial Statements 2021 constitute the material required by

DTR 6.3.5 of the Disclosure Guidance and Transparency Rules which

is required to be communicated to the media in full unedited text

through a Regulatory Information Service. This announcement is not

a substitute for reading the full Annual Report and Financial

Statements 2021. Page and note references in the text below refer

to page numbers and note references in the Annual Report and

Financial Statements 2021. To view the results announcement, slides

of the results presentation and the results webcast please visit

www.gallifordtry.co.uk/investors/reports-presentations/.

Our principal risks

In previous years, we have monitored and reported our principal

risks using a framework comprised of 12 risk themes. There was a

high degree of interdependence between these risk themes because in

many cases, they represented causes rather than impacts. For

example, we had separate risk themes in relation to the opportunity

pipeline, project selection and work winning, but the ultimate risk

for the Group is that we fail to secure an appropriate pipeline of

projects to achieve our revenue and profitability targets. At a

Group level, the Board now monitors risk using the following four

principal risks, a detailed analysis of which is provided

below:

Work winning.

Project delivery.

Resources.

Compliance and cyber security.

This simplified approach facilitates a more targeted focus on

the most significant risks and the actions being taken to manage

them.

At an individual business unit level, our risk management

process still captures and monitors risks and mitigations using the

12 risk themes so that we can take targeted actions to address

issues that are specific to the regions and sectors in which they

operate.

Work winning

Risk description

We fail to secure an appropriate pipeline of projects to achieve

our revenue and profitability targets.

Our risk appetite

We aim to secure a forward order book that provides a high

degree of certainty of current year plus following year revenue,

while reflecting appropriate margin, cash and risk attributes.

Maintaining discipline in the projects that we bid for is a

fundamental element of our internal control framework. We will only

bid for projects where we are confident that we have the

experience, knowledge and supply chain to deliver effectively and

where the client relationships and commercial terms support a

collaborative approach to managing risk.

Potential causes of risk

> A significant and sustained reduction in Government

investment in building and infrastructure projects reduces the

opportunity pipeline.

> Delays to and/or reduced levels of private sector

investment due to macro-economic conditions.

> Failure to secure positions on key procurement

frameworks.

> Failure to meet the increasing sustainability expectations

of our clients.

> Poor quality bid submissions.

> Failure to maintain discipline in project selection.

Current risk environment

Public sector opportunities are now coming to market quicker as

funding has been secured. Likewise, the private sector market

remains resilient with opportunities in commercial sectors such as

Private Rented Sector (PRS) and student accommodation increasing

both for Construction and Investments. Medium to longer term, the

outlook for public sector markets remains positive. However, there

is a greater degree of uncertainty in the private sector as the

longer-term impacts of the pandemic on the way we live and work,

and the buildings that are required, are not yet clear.

Maintaining discipline in project selection remains absolutely

fundamental to delivering on our strategic objectives. Our risk

management in evaluating opportunities is robust and is supported

by a clear sector focus. The Procurement Playbook sets out

principles for a more collaborative approach to sharing of risks

between client and contractor. However, these principles will take

time to become embedded in client behaviours and we still observe

some clients attempting to pass more risk on. We remain vigilant to

this risk and maintain discipline in reviewing and challenging

onerous contract conditions.

We continue to be successful in winning work and securing

positions on key frameworks with good quality clients. However, the

market remains very competitive and we must compete not just on

price, but by demonstrating our ability to deliver against the

clients' priorities, especially in relation to carbon

reduction.

Market review p16

Emerging risks

> Clients start to move away from the traditional main

contractor/subcontractor model, instead opting for more

self-delivery and enterprise delivery models.

> We innovate or adopt new technologies too early, incurring

costs associated with being an early adopter, or too late, losing

market share.

> Client attitudes to sustainability shift at differing

rates, leaving some clients focused on construction cost and others

on whole-life cost and carbon performance.

> We fail to balance the need to be competitive with

delivering long-term sustainability in the assets we build and/or

we are not adequately rewarded for the long-term value we deliver

to clients.

> PRS becomes a less attractive market to invest in, reducing

the opportunities in this market.

> The political arena in the UK continues to be increasingly

unpredictable. Radical shifts in Government policy reduce the

certainty of opportunities in the public and regulated sectors.

Mitigations

> We manage the potential impact of an economic downturn by

building a high-quality order book with projects that meet our

strict risk profile.

> We concentrate on sectors where we have core strengths and

clients with long-term growth and profitability potential.

> We focus on securing positions on key procurement

frameworks (page 48) and repeat business with key clients through a

centralised, dedicated pre-construction team. This allows for

strategic planning, better collaboration and reduced risk of

project failure.

> We have robust review and approval controls for bids and

contracts supported by a risk-based heat map tool to ensure that

project selection is aligned to our risk appetite. Any potentially

onerous terms or other misalignment to our contract selection

criteria are flagged early on in the process and escalated for

Board review.

> We typically target lower-risk contract types as described

on page 6.

> We carry out peer reviews of bids where relevant to ensure

robust review and challenge of risks and assumptions and to promote

knowledge sharing across the business.

Key risk indicators

> Percentage of planned revenue secured.

> Percentage of pipeline in frameworks.

> Order book by client type.

> Percentage of repeat business with existing clients.

Project delivery

Risk description

We fail to deliver projects safely, on time, in agreement with

contractual terms, and to a high quality for our clients.

Risk appetite

We prioritise health and safety above everything else and

believe that nothing is so important that we cannot take the time

to do it safely.

We will not tolerate poor quality and strive to deliver high

quality buildings and infrastructure for our clients that provide

safe environments for the occupiers and users of the assets.

We aim to provide realistic and transparent forecasts of project

performance with potential risks to programme and margins

identified and addressed before they materialise.

Potential causes of risk

> Changing regulations.

> Non-compliance with health and safety regulations and/or

poor safety behaviours.

> Programme delays and cost escalation.

> Poor control of client and subcontractor variations and

claims processes.

> Contractual notices not given as per contract

requirements.

> Poor record-keeping and document management.

> Poor design quality and/or co-ordination.

> Failure to comply with quality control procedures.

> Extended periods of adverse weather conditions.

> Subcontractor poor performance and/or insolvency.

> Unrealistic estimates, including cost to complete,

inflation estimates, outcomes of disputes and final value included

in project forecasts.

Current risk environment

Safety performance has remained strong through the second half

of the financial year. The Covid-19 site operating procedures are

embedded and have driven a greater focus on planning. This was

further supported by the refresh of our Challenging Beliefs,

Affecting Behaviours behavioural safety programme in the first half

of 2021. We have had an increased focus on wellbeing across the

Group through initiatives such as Wellbeing Wednesdays and Feel

Good Fridays which have been well-received by our people. Our

thinking on safety now extends to consideration of the safety in

use of the buildings we construct and, in the case of our FM

business, the buildings we operate.

The disruption to programmes caused earlier in the Covid-19

pandemic has subsided and extensions of time agreed wherever

possible. Covid-19 site operating procedures are now very well

established, and productivity has returned to normal levels. Any

additional costs associated with Covid-19 health and safety

measures are built into all project forecasts but do not have a

material impact on margins. The latest round of project commercial

health checks, performed in March 2021 again observed that project

risks are well understood and where necessary, reflected in the

forecasts.

As a side effect of the increased scrutiny of fire safety on

legacy projects, 12-year defects claims are becoming more common.

Defending these claims incurs legal costs and can take up

management resource and therefore it remains important that quality

inspection records are well maintained within Fieldview and

Viewpoint as most claims relate to defects in design or

workmanship. Our Technical Services team is working on a wide range

of initiatives to drive continuous improvement in quality,

including investment in digital tools to support better design

integration and visualisation. The revised approach to auditing

compliance with our quality management systems and processes has

been implemented and ActivSHEQ (the platform that we use for safety

auditing and reporting) is being used to record and report the

results of quality management system audits. This will drive

greater consistency in auditing and more visibility of compliance

trends.

Emerging risks

> Insurers withdraw from the market for PI cover for

construction contractors and/or insurance cover becomes

prohibitively expensive.

> We fail to adapt our processes to meet the requirements of

our clients to have better and more reliable data about the assets

we design and build for them.

> The country fails to learn from Covid-19 and any potential

new global pandemic has a significant/similar impact on the

construction industry that it had with Covid-19.

> Building designs and construction methodologies fail to

adapt to the effects of climate change, leading to reduced

productivity, programme delays and cost overruns.

Mitigations

> Continued reinforcement of our behavioural safety programme

Challenging Beliefs, Affecting Behaviour, and the introduction of

Lead Indicators which target no harm.

> A values-driven approach to project delivery focusing on

close collaboration and client satisfaction to enable achievement

of end goals for both parties.

> Robust review and approval of contractual terms,

pre-contract to ensure we do not sign up to contracts with onerous

terms. This includes the employment of margin thresholds and

escalation to the Board of any contracts that do not meet our

criteria.

> Rigorous quality control in our business management system

policies and procedures and digitalisation to improve data, quality

and efficiency.

> Due diligence to select competent designers and

subcontractors to work with and use specialist consultants at key

review stages.

> Comprehensive commercial training.

> We have introduced standardised formats (value cost

analysis and cost and value reconciliation) for monitoring and

reporting project performance and forecasts.

> Monthly cross-disciplinary contract review meetings on all

projects enable a robust assessment of programme status, risks and

commercial forecasts and are investing in upgrading our existing

ERP systems.

> A programme of commercial 'health checks' to provide an

independent assessment of the project team's reported project

performance and forecast outturn.

> Operational controls including health and safety site risk

assessments, which are monitored through a regular audit

process.

> Introduction of Technical and Business Support Forums that

drive process improvements across health and safety,

digitalisation, carbon reduction, procurement, design management,

mechanical and electrical, and commercial activities.

> Escalation processes to respond promptly and appropriately

to incidents.

Key risk indicators

> RIDDOR and AFR scores.

> Forecast project margins.

Link to our strategic priorities

Progressive culture

Socially responsible delivery

Quality and innovation

Fair and sustainable financial returns

Resources

Risk description

We fail to secure the right people and other resources necessary

to deliver our projects and manage our business.

Risk appetite

We aim to recruit employees from a diverse talent pool who are

aligned to our values and behaviours.

We seek to work with financially resilient subcontractors,

suppliers and joint venture partners who share our values in

relation to safety, quality and sustainability.

Potential causes

> We are unable to attract, retain and/or develop the right

staff to meet our future needs, we mismatch our staffing levels to

peaks and troughs in activity or lack diversity.

> Lack of capacity in the supply chain due to high levels of

activity in the construction sector.

> Subcontractor and/or client insolvency.

> Failure to comply with fair payment practices.

> Lack of geographical coverage.

Current risk environment

The availability and pricing of products and materials in most

categories are being adversely affected by a significant and

sustained demand and supply imbalance. Multiple factors including

Covid-19 disruption to manufacturers, the Suez Canal backlog, new

customs procedures, and a shortage of drivers are all causing

supply-side issues. Meanwhile, the high levels of activity in the

housebuilding and infrastructure sectors in particular are leading

to unprecedented demand. We are mitigating this risk through early

engagement with the supply chain and incorporating inflation

clauses into contracts wherever possible. If tender lead-in times

are high, we re-price projects to account for any inflation.

Subcontractor insolvency risk has reduced as most of our Aligned

subcontractors continued to work throughout the pandemic without

furloughing staff. The more significant subcontractor risk is the

current skills shortages in certain trades, including bricklayers

and joiners. Such shortages could extend to other trades as

construction activity continues to increase.

The pandemic continues to have a huge impact on people,

particularly their mental health. We are supporting our teams

through several initiatives including Wellbeing Wednesdays, Feel

Good Fridays, the Be Well Podcast Library and targeted employee

surveys. A Company-wide employee survey is planned for later in

2021. Large infrastructure schemes and a mismatch between skilled

worker supply and demand are driving salaries up and increasing the

risk of employees leaving for higher reward packages. We continue

to develop our own people and provide them with opportunities for

progression. However, it remains a competitive market for talent

and we continue to improve the way we promote the business and

develop our employee offering.

We continue to manage cash effectively and the extra disciplines

that have been introduced in the past 12 months have further

improved the accuracy of our cash forecasting and helped improve

our cash performance. The introduction of domestic reverse charge

for VAT during the year created a one-off improvement to cash flow,

but we have passed this back to our supply chain by making further

improvements in the time we take to pay.

Emerging risks

> There is a generational shortage of skills as more

experienced staff retire who are not replaced in sufficient numbers

because the construction sector cannot compete with other sectors

in attracting talent.

> Innovations in the use of technology will require us to

attract a workforce with a very different set of skills.

> Depletion or increased scarcity of non-renewable materials

may lead to greater volatility in prices and more regular

disruption to supply.

Mitigations

> The Group has an established HR strategy based on best

practice principles and relevant legislation which, among other

things, includes the regular review of remuneration and benefits

packages to ensure we remain competitive.

> Our succession planning and talent management processes

enable continuity and identification of future leaders.

> We operate graduate and trainee programmes to develop our

own pipeline of talent.

> We develop long-term relationships with key suppliers and

subcontractors to ensure that we remain a priority customer when

resources and materials are in short supply.

> Our Advantage through Alignment programme facilitates

greater engagement with our key supply chain members and provides

them with greater visibility of our pipeline of projects.

> We are committed to paying 95% of supply chain invoices

within 60 days, and achieving the new standards of the Prompt

Payment Code.

> We monitor subcontractor financial strength using a credit

tracker on the Dun & Bradstreet portal.

> Each business unit reviews its cash forecast weekly and

monthly, and the Group prepares a detailed daily cash book forecast

for the following eight-week period to highlight any risk of

intra-month fluctuations. These forecasts are reviewed at business

unit, division and Group level.

Key risk indicators

> Material and trade shortages.

> Voluntary staff churn rate.

> Prompt Payment Code performance statistics.

> Average month end cash.

Link to our strategic priorities

Progressive culture

Socially responsible delivery

Quality and innovation

Fair and sustainable financial returns

Regulatory compliance

Risk description

We fail to comply with requirements of the various legal and

regulatory regimes in which we operate, resulting in a high-profile

breach and regulatory censure.

Our risk appetite

We have zero tolerance for non-compliance with regulations. We

expect all employees and subcontractors to be aware of all

regulations relevant to their role and to comply at all times. We

also expect our people to speak up if they observe or suspect

non-compliance.

Potential causes

> Failure to update our procedures to reflect changes to key

legislation and regulations.

> Failure to provide sufficient and effective training to all

staff.

> Failure to implement effective compliance monitoring

processes.

Current risk environment

During the year, we have successfully managed the transition to

new regulatory requirements in relation to off-payroll working

(IR35) and the introduction of the Domestic Reverse Charge VAT

procedure.

We continue to monitor the findings and recommendations from the

Grenfell inquiry and will be ready to adapt to any changes in

building regulations. Where necessary, we have already incorporated

the lessons learned from Grenfell into our processes, specifically

in relation to design co-ordination and accountabilities.

We are preparing for the expected review and update of the

Modern Slavery legislation in the next 12 months. A review of the

likely changes is under way with our focus on moving beyond basic

legal compliance to adopting and advocating for good practice

throughout our supply chain.

As part of the Group's continued compliance with anti-fraud and

bribery legislation, we issued e-learning focused on the Criminal

Finances Act 2017, and new Corporate Criminal Offences (CCO)

introduced in the Act.

Emerging risks

> Greater devolution or even full independence may lead to

very different regulatory regimes in Scotland and the rest of the

UK.

Mitigations

> Galliford Try has comprehensive policies and guidance at

every level including our Code of Conduct, mandatory regulatory and

cyber security e-learning for all employees, an anonymous and

independent whistleblowing helpline, regular legal updates and

briefings, six-monthly compliance declarations, and conflict of

interest registers and authorisations.

> The Ethics and Compliance Committee, chaired by the General

Counsel & Company Secretary, provides ongoing monitoring and

oversight of policy and compliance activity in relation to key

areas of legislation.

Key risk indicators

Number of external enforcement cases.

Viability Statement

As required by provision 31 of the UK Corporate Governance Code,

the Board has assessed the prospects and financial viability of the

Group, taking account of the Group's current position and the

potential impact of the principal risks to the Group's ability to

deliver its business plan. The assessment of prospects has been

made using a period of five years, which aligns to our strategic

plan period. The assessment of viability has been made using a

period of three years, which aligns with our budget period and

provides reasonable visibility of future revenue from the existing

order book. Since the sale of the housebuilding businesses and the

recapitalisation of the business in January 2020, the Group no

longer has any debt facilities and associated covenants, therefore

viability has been assessed in terms of the headroom against

available cash reserves.

Assessment of prospects

As outlined in our Strategic report, the long-term prospects of

the business are supported by a refreshed strategy which builds on

our existing strengths and the growth opportunities in our target

markets.

Our alignment to the Government's continued investment in the

UK's social and economic infrastructure is a fundamental driver of

demand for our services and plays to our strengths in the health,

education, defence, highways and environment markets. Our ability

to achieve sustainable growth within these markets is underpinned

by our position on the most significant procurement frameworks, our

commitment to supporting the decarbonisation of the built

environment and our investment in digital technologies to drive

continuous improvement in quality and productivity.

Our people remain the key to our success and our focus on

attracting and retaining a more diverse workforce as well as

increasing the proportion of apprentices and graduates help us

access the skills and expertise required to deliver on our

sustainable growth strategy.

Assessment of viability

The base case for the cash flow projections modelled in our

assessment of viability is the budget for the three years from 1

July 2021 which incorporates appropriate contingencies against

plausible day-to-day downside risks, primarily the Group's

principal risks as disclosed previously. The base case shows

average month end net cash growing in line with earnings and

assumes that the Group continues to operate without debt

facilities.

Against this base case, we have stress-tested the forecasts and

modelled the impact on cash flow and liquidity of a number of

downside scenarios related to our principal risks, including a

combined downside scenario that includes a number of these

sensitivities occurring together. The scenarios modelled and their

link to the underlying principal risks are described in the table

below.

Although we have included a further national lockdown scenario

in our stress testing, the business and our cash performance has

shown a high degree of resilience throughout the Covid-19 pandemic.

Our sites have largely remained open and the adherence to stringent

risk mitigation measures in our sites and offices, together with

good engagement with our clients and supply chain has minimised the

disruption to project delivery.

Scenario modelled Link to principal

risks

----------------------------------------------------------------------- -----------------------

Scenario 1 * Work winning

Reduction in construction volumes

Our cash performance is correlated with earnings growth and therefore

reliant on construction activity being in line with our assumptions.

We have modelled a reduction in construction volumes that would

equate to a 10% reduction in monthly cash receipts offset by a

proportionate reduction in payments, relative to our base case

forecast.

----------------------------------------------------------------------- -----------------------

Scenario 2 * Resources

Deterioration in working capital

We have modelled the impact of a deterioration in our working capital,

which could be caused by delays in receiving payments from clients

and/or earlier payments to our supply chain.

----------------------------------------------------------------------- -----------------------

Scenario 3 * Resources

Irrecoverable cost increases

There is a risk of a prolonged period of materials cost inflation

and therefore we have modelled the impact of failing to fully mitigate

these cost increases on our projects.

Scenario 4

Covid - national lockdown * Project delivery

While considered unlikely, there is the potential for new variants

combined with seasonal pressure on the NHS to result in further

national lockdowns during the winter of 2021/22. In this scenario,

we have modelled the impact on working capital of programme delays

and reduced operational efficiency.

----------------------------------------------------------------------- -----------------------

Scenario 5

'Perfect storm' * Work winning

We also tested the unlikely but plausible scenario where all of

scenarios 1-4 combine at the same time.

* Resources

* Project delivery

----------------------------------------------------------------------- -----------------------

As part of the viability assessment, the Board also considered

the mitigations and interventions available to manage the impact of

one or more of the downside scenarios occurring. The base case

already includes significant cash contingencies and the Board has

considered further mitigating actions that are available to it.

Based on the results of this analysis, the Board has concluded

that it has a reasonable expectation that the Group will be able to

continue in operation and meet its liabilities as they fall due

over the three-year period of its assessment.

Related party transactions

Transactions between the Group and its related parties are

disclosed as follows:

Group

Amounts owed

Sales to by

related parties related parties

--------------------- ------------------ ------------------

2021 2020 2021 2020

GBPm GBPm GBPm GBPm

--------------------- -------- -------- -------- --------

Trading transactions

Related parties 110.5 75.8 42.2 35.9

--------------------- -------- -------- -------- --------

Interest and

dividend income

from related

parties

------------------------- ------------------

2021 2020

GBPm GBPm

------------------------- -------- --------

Non-trading transactions

Related parties 4.4 4.5

------------------------- -------- --------

The related party transactions above reflect continuing

operations. Sales to related parties within discontinued operations

amount to GBPnil (2020: GBP50.3m) and interest and dividend income

received from related parties amount to GBPnil (2020:

GBP11.1m).

Sales to related parties are based on terms that would be

available to unrelated third parties. Amounts owed by related

parties consist predominantly of subordinated debt within the PPP

and Other Investments portfolio, that if held to maturity would be

due over the next 27 years (2020: 28 years). These receivables are

unsecured, with interest rates varying between a range of 9% and

12%. Payables are due within one year (2020: one year) and are

interest free.

Company

Transactions between the Company and its subsidiaries which are

related parties, which are eliminated on consolidation, are

disclosed as follows:

Interest and

dividend income

from related

parties

------------------------- ------------------

2021 2020

GBPm GBPm

------------------------- -------- --------

Non-trading transactions

Subsidiary undertakings 2.0 100.0

------------------------- -------- --------

The Company has provided performance guarantees in respect of

certain operational contracts entered into between joint ventures

and a Group undertaking.

Statement of directors' responsibilities

The directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law, the directors

have prepared the Group and Parent Company financial statements in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006. Under company law,

the directors must not approve the financial statements, unless

they are satisfied that they give a true and fair view of the state

of affairs of the Group and Parent Company and of the profit or

loss of the Group and Parent Company for that period.

In preparing the financial statements, the directors are

required to:

> select suitable accounting policies and then apply them

consistently;

> make judgments and accounting estimates that are reasonable

and prudent;

> state whether they have been prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006, subject to any material

departures disclosed and explained in the financial statements;

> state whether they have been prepared in accordance with

international financial reporting standards adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the European Union,

subject to any material departures disclosed and explained in the

financial statements;

> prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business;

> prepare a Directors' report, a Strategic report and

Directors' Remuneration report which comply with the requirements

of the Companies Act 2006.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group and

Parent Company's transactions and disclose with reasonable accuracy

at any time the financial position of the Group and Parent Company

and enable them to ensure that the financial statements and the

Directors' Remuneration report comply with the Companies Act 2006

and, as regards the Group financial statements, Article 4 of the

IAS Regulation. They are also responsible for safeguarding the

assets of the Group and the Parent Company and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The directors are responsible for ensuring the Annual Report and

the financial statements are made available on a website. Financial

statements are published on the Company's website in accordance

with legislation in the United Kingdom governing the preparation

and dissemination of financial statements, which may vary from

legislation in other jurisdictions. The maintenance and integrity

of the Company's website is the responsibility of the directors.

The directors' responsibility also extends to the ongoing integrity

of the financial statements contained therein.

The directors consider that the Annual Report and Accounts,

taken as a whole, is fair, balanced and understandable and provides

the information necessary for shareholders to assess the Group and

Parent Company's performance, position, business model and

strategy.

Each of the directors, whose names and functions are listed on

page 56, confirms that to the best of their knowledge:

> The Parent Company financial statements have been prepared

in accordance with the applicable set of accounting standards and

Article 4 of the IAS Regulation and give a true and fair view of

the assets, liabilities, financial position and profit and loss of

the Group and the Parent Company.

> The Annual Report and Accounts includes a fair review of

the development and performance of the business and the financial

position of the Group and Parent Company, together with a

description of the principal risks and uncertainties that it

faces.

In the case of each director in office at the date the

Directors' report is approved:

> so far as the director is aware, there is no relevant audit

information of which the Group and Group's auditors are unaware;

and

> they have taken all the steps that they ought to have taken

as a director in order to make themselves aware of any relevant

audit information and to establish that the Group and Group's

auditors are aware of that information.

For and on behalf of the Board

Bill Hocking

Chief Executive

16 September 2021

Forward-looking statements

Forward-looking statements have been made by the directors in

good faith using information up until the date on which they

approved this Annual Report. Forward-looking statements should be

regarded with caution due to uncertainties in economic trends and

business risks. The Group's businesses are generally not affected

by seasonality.

For further enquiries:

Galliford Try Holdings Kevin Corbett, Company

plc Secretary 01895 855001

Clara Melia, Investor Relations 020 3289 5520

Tulchan Communications James Macey White 0207 353 4200

Giles Kernick

Notes to Editors

Galliford Try Holdings plc is a leading UK construction group

listed on the London Stock Exchange. Operating as Galliford Try and

Morrison Construction, the group carries out building and

infrastructure projects with clients in the public, private and

regulated sectors across the UK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSDKPBQPBDDNKK

(END) Dow Jones Newswires

October 05, 2021 11:47 ET (15:47 GMT)

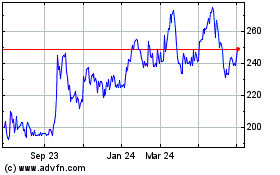

Galliford Try (LSE:GFRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

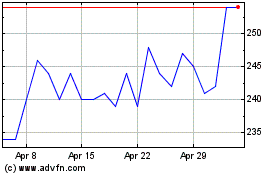

Galliford Try (LSE:GFRD)

Historical Stock Chart

From Apr 2023 to Apr 2024