EP Global Opportunities Trust Plc - Portfolio Holdings as at 30 November 2017

15 December 2017 - 11:00PM

PR Newswire (US)

EP GLOBAL OPPORTUNITIES TRUST PLC

PORTFOLIO HOLDINGS AS AT 30 NOVEMBER 2017

| Rank |

Company |

Sector |

Country |

% of

Net Assets |

|

|

|

|

|

| 1 |

Royal Dutch Shell

A |

Oil & Gas |

Netherlands |

4.3 |

| 2 |

Panasonic |

Consumer Goods |

Japan |

3.8 |

| 3 |

Novartis |

Health Care |

Switzerland |

3.6 |

| 4 |

AstraZeneca |

Health Care |

United

Kingdom |

3.0 |

| 5 |

Bank Mandiri |

Financials |

Indonesia |

2.9 |

| 6 |

Commerzbank |

Financials |

Germany |

2.9 |

| 7 |

HSBC |

Financials |

United

Kingdom |

2.8 |

| 8 |

BP |

Oil & Gas |

United

Kingdom |

2.8 |

| 9 |

Sumitomo Mitsui

Financial |

Financials |

Japan |

2.7 |

| 10 |

Ubisoft

Entertainment |

Consumer Goods |

France |

2.7 |

| 11 |

Bangkok Bank * |

Financials |

Thailand |

2.6 |

| 12 |

Baidu |

Technology |

China |

2.6 |

| 13 |

Sumitomo Mitsui

Trust |

Financials |

Japan |

2.6 |

| 14 |

Roche ** |

Health Care |

Switzerland |

2.6 |

| 15 |

Tesco |

Consumer Services |

United

Kingdom |

2.5 |

| 16 |

Synchrony

Financial |

Financials |

United

States |

2.5 |

| 17 |

Galaxy

Entertainment |

Consumer Services |

Hong

Kong |

2.5 |

| 18 |

Mitsubishi |

Industrials |

Japan |

2.5 |

| 19 |

Credicorp |

Financials |

Peru |

2.5 |

| 20 |

Sanofi |

Health Care |

France |

2.4 |

| 21 |

BNP Paribas |

Financials |

France |

2.4 |

| 22 |

Edinburgh Partners

Emerging Opportunities Fund |

Financials |

Other |

2.4 |

| 23 |

Japan Tobacco |

Consumer Goods |

Japan |

2.3 |

| 24 |

PostNL |

Industrials |

Netherlands |

2.3 |

| 25 |

East Japan

Railway |

Consumer Services |

Japan |

2.2 |

| 26 |

Goodbaby

International |

Consumer Goods |

China |

2.2 |

| 27 |

Shanghai Fosun

Pharmaceutical H |

Health Care |

China |

2.2 |

| 28 |

Bayer |

Basic Materials |

Germany |

2.2 |

| 29 |

Nomura |

Financials |

Japan |

2.1 |

| 30 |

DNB |

Financials |

Norway |

2.1 |

| 31 |

Apache |

Oil & Gas |

United

States |

2.1 |

| 32 |

Total |

Oil & Gas |

France |

2.1 |

| 33 |

Celgene |

Health Care |

United

States |

2.0 |

| 34 |

Swire Pacific A |

Industrials |

Hong

Kong |

2.0 |

| 35 |

CK Hutchison |

Industrials |

Hong

Kong |

1.9 |

| 36 |

Telefonica |

Telecommunications |

Spain |

1.8 |

| 37 |

Nokia |

Technology |

Finland |

1.7 |

| 38 |

Alps Electric |

Industrials |

Japan |

1.7 |

| 39 |

Whirlpool |

Consumer Goods |

United

States |

1.6 |

| 40 |

Gemalto |

Technology |

Netherlands |

1.0 |

| 41 |

Edinburgh

Partners |

Financials –

unlisted |

United

Kingdom |

0.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

investments |

|

|

97.8 |

|

Cash and other net

assets |

|

|

2.2 |

|

|

|

|

|

|

Net assets |

|

|

100.0 |

|

|

|

|

|

|

* The

investment is in non-voting depositary receipts |

|

|

|

** The

investment is in non-voting shares |

|

|

|

|

|

|

|

|

|

|

|

|

GEOGRAPHICAL DISTRIBUTION

| 30 November 2017 |

% of Net

Assets |

|

|

| Europe |

34.1 |

| Japan |

19.9 |

| Asia Pacific |

18.9 |

| United Kingdom |

11.8 |

| United States |

8.2 |

| Latin America |

2.5 |

| Other |

2.4 |

| Cash and other net

assets |

2.2 |

|

100.0 |

SECTOR DISTRIBUTION

| 30 November 2017 |

% of Net

Assets |

| Financials |

31.2 |

| Health Care |

15.8 |

| Consumer Goods |

12.6 |

| Oil & Gas |

11.3 |

| Industrials |

10.4 |

| Consumer Services |

7.2 |

| Technology |

5.3 |

| Basic Materials |

2.2 |

| Telecommunications |

1.8 |

| Cash and other net assets |

2.2 |

|

100.0 |

As at 30 November 2017, the net

assets of the Company were £144,747,000.

15 December 2017

Legal Entity Identifier: 2138005T5CT5ITZ7ZX58

Enquiries:

Kenneth Greig

Edinburgh Partners AIFM Limited

Tel: 0131 270 3800

The Company’s registered office address is:

27-31 Melville Street

Edinburgh

EH3 7JF

Copyright r 15 PR Newswire

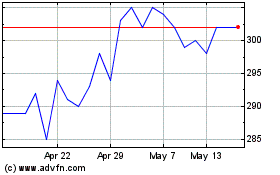

Global Opportunities (LSE:GOT)

Historical Stock Chart

From Apr 2024 to May 2024

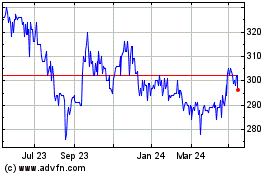

Global Opportunities (LSE:GOT)

Historical Stock Chart

From May 2023 to May 2024