EP Global Opps Tst Portfolio Holdings as at 31 January 2018

16 February 2018 - 6:00PM

UK Regulatory

TIDMEPG

EP GLOBAL OPPORTUNITIES TRUST PLC

PORTFOLIO HOLDINGS AS AT 31 JANUARY 2018

Rank Company Sector Country % of

Net Assets

1 Novartis Health Care Switzerland 3.6

2 Panasonic Consumer Goods Japan 3.6

3 Commerzbank Financials Germany 3.1

4 AstraZeneca Health Care United Kingdom 3.0

5 Bank Mandiri Financials Indonesia 3.0

6 HSBC Financials United Kingdom 2.9

7 Galaxy Entertainment Consumer Services Hong Kong 2.8

8 BP Oil & Gas United Kingdom 2.8

9 Ubisoft Entertainment Consumer Goods France 2.8

10 Sumitomo Mitsui Financial Financials Japan 2.8

11 Sumitomo Mitsui Trust Financials Japan 2.7

12 Bangkok Bank * Financials Thailand 2.7

13 Tesco Consumer Services United Kingdom 2.7

14 Synchrony Financial Financials United States 2.6

15 Mitsubishi Industrials Japan 2.6

16 ENI Oil & Gas Italy 2.6

17 Baidu Technology China 2.5

18 Credicorp Financials Peru 2.5

19 Royal Dutch Shell A Oil & Gas Netherlands 2.5

20 BNP Paribas Financials France 2.5

21 Shanghai Fosun Health Care China 2.4

Pharmaceutical H

22 PostNL Industrials Netherlands 2.4

23 Goodbaby International Consumer Goods China 2.4

24 Edinburgh Partners Emerging

Opportunities Fund Financials Other 2.4

25 Roche ** Health Care Switzerland 2.3

26 Sanofi Health Care France 2.2

27 DNB Financials Norway 2.2

28 Nomura Financials Japan 2.2

29 Japan Tobacco Consumer Goods Japan 2.2

30 East Japan Railway Consumer Services Japan 2.1

31 Apache Oil & Gas United States 2.1

32 Bayer Health Care Germany 2.1

33 Total Oil & Gas France 2.0

34 Alps Electric Industrials Japan 1.9

35 Swire Pacific A Industrials Hong Kong 1.9

36 CK Hutchison Industrials Hong Kong 1.9

37 Celgene Health Care United States 1.9

38 Telefonica Telecommunications Spain 1.7

39 Whirlpool Consumer Goods United States 1.6

40 Nokia Technology Finland 1.6

41 Edinburgh Partners Financials - United Kingdom 1.2

unlisted

Total equity investments 99.0

Cash and other net assets 1.0

Net assets 100.0

* The investment is in non-voting depositary

receipts

** The investment is in non-voting shares

GEOGRAPHICAL DISTRIBUTION

31 January 2018 % of Net Assets

Europe 33.6

Japan 20.1

Asia Pacific 19.6

United Kingdom 12.6

United States 8.2

Latin America 2.5

Other 2.4

Cash and other net assets 1.0

100.0

SECTOR DISTRIBUTION

31 January 2018 % of Net

Assets

Financials 32.8

Health Care 17.5

Consumer Goods 12.6

Oil & Gas 12.0

Industrials 10.7

Consumer Services 7.6

Technology 4.1

Telecommunications 1.7

Cash and other net 1.0

assets

100.0

As at 31 January 2018, the net assets of the Company were GBP147,148,000.

16 February 2018

Legal Entity Identifier: 2138005T5CT5ITZ7ZX58

ENQUIRIES:

Kenneth Greig

Edinburgh Partners AIFM Limited

Tel: 0131 270 3800

The Company's registered office address is:

27-31 Melville Street

Edinburgh

EH3 7JF

END

(END) Dow Jones Newswires

February 16, 2018 02:00 ET (07:00 GMT)

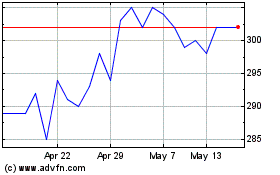

Global Opportunities (LSE:GOT)

Historical Stock Chart

From Apr 2024 to May 2024

Global Opportunities (LSE:GOT)

Historical Stock Chart

From May 2023 to May 2024