TIDMGSF

RNS Number : 1317G

Gore Street Energy Storage Fund PLC

17 July 2023

17 July 2023

Gore Street Energy Storage Fund plc

(the "Company" or "GSF")

Full Year Results

Internationally diversified portfolio supports strong growth in

NAV, EBITDA and best-in-class revenue generation

Gore Street Energy Storage Fund plc, the internationally

diversified energy storage fund, is pleased to announce its Audited

Full Year results for the year ended 31 March 2023.

Performance highlights for the year ended 31 March 2023:

-- NAV increased 47.8% to GBP556.3m (FY 2022: GBP376.5m).

-- NAV per share increased 5.9% to 115.6 pence (FY 2022: 109.1 pence).

-- Total NAV return of 12.3% and 48% since 31 March 2022 and

IPO, respectively (FY22: 13.1% and 34.2%).

-- GBP39.3m in revenue was generated during the reporting period

(FY 2022 GBP29.3m), averaging GBP135,000 per MW/yr. Over the 2022

calendar year, the Company achieved a consistently high average

revenue of GBP157,000 per MW/yr.

-- EBITDA of the operational portfolio increased 19% to GBP27.8

million (FY 2022: GBP23.3 million), with 63.5% secured outside

Great Britain.

-- Dividends paid during the 12-month period of 7 pence per

share, with an operational dividend cover of 0.90x. This was

achieved with c.25% of the Company's portfolio operational at the

period end.

-- Dividends declared for the period of 7.5 pence per share.

-- Weighted average discount rate increased to 10.1% (FY 2022: 8.3%).

-- Portfolio revenue curves increased during the period, largely

driven by the Company's geographically diverse portfolio.

Deployment and fundraising

-- The Company raised GBP150m in an oversubscribed issuance in April 2022.

-- As of 31 March 2023, the Company had drawn down GBPnil from its Debt Facility.

-- The Company remains fully funded to meet all contractual

obligations and EPC payments over the next 18 months, utilising

equity and its existing debt facility.

-- Operational assets producing income increased to a total

capacity of 291.6MW (FY 22: 231.7MW).

-- Portfolio expansion continued with sizeable new projects

acquired in attractive new markets, offering unique diversification

and differentiation:

-- 144.65 MW across 8 assets in Texas, US

-- 200 MW construction asset in GB

-- 200 MW construction-ready asset in California, US

-- The Company's geographical split is now: 42% in GB, 27% in

Ireland, 12% in Texas, 17% in California and 2% in Germany.

Post Period-end Highlights:

-- The energisation of the Stony asset, with a capacity of 79.9

MW, has been scheduled with National Grid ESO for July-end

2023.

-- Post reporting period, the Company increased its existing

Debt facility from GBP15m to GBP50m, with an accordion option of up

to 30% of Gross Asset Value ("GAV").

CEO of Gore Street Capital, the investment manager to the

Company, Alex O'Cinneide, commented:

"I am pleased to announce that the Company has maintained its

upward trajectory, achieving significant milestones by adding

landmark assets to our portfolio. Additionally, we have generated

industry-leading revenues from four uncorrelated markets, further

bolstering our success.

As we have consistently communicated, the discussion around

system duration in GB has now shifted towards recognising

international diversification as the key determinant of sustained

profitability. The Company's ability to thrive amidst challenging

market dynamics in GB showcases the strength of the Company's

unique approach.

Looking ahead to 2023 and 2024, we look forward to bringing over

half a GW of operational capacity online across five diverse

markets. We are confident this strategic expansion will have a

positive impact on dividend cover, leading to increased shareholder

value whilst supporting continued incremental growth in NAV. We

look forward to updating the market regularly on the progress of

this expanding international operational capacity.

We remain committed to driving efficiency and have witnessed a

consistent growth in revenue and EBITDA year on year. This trend is

expected to be further supported as we bring online increased

operational capacity in rapidly evolving markets that offer

significantly higher revenue potential and promising

forward-looking revenue forecasts.

In line with our focus on driving efficiencies, we have made

strategic decisions to prioritise larger assets for energisation.

This approach leverages economies of scale and ongoing efforts to

increase the capacity of some of the smaller sites within our

construction portfolio. More details on this can be found within

the Annual Report.

We are optimistic about the next year as we strategically expand

our capacity in multiple jurisdictions. This approach ensures

sustainable returns across a well-diversified portfolio, mitigating

risks associated with a single market. We look forward to updating

our valued shareholders on our progress throughout the upcoming

reporting period."

Results presentation today

There will be a presentation for sell-side analysts at 9.00 a.m.

today, 17 July 2023. Please contact Buchanan for details on

gorestreet@buchanancomms.co.uk

Annual Report:

The Company's annual report and accounts for the year ended 31

March 2023 are also being published in hard copy format and an

electronic copy will shortly be available to download from the

Company's webpages https://www.gsenergystoragefund.com/. Please

click on the following link to view the document:

http://www.rns-pdf.londonstockexchange.com/rns/1317G_1-2023-7-14.pdf

The Company will be submitting its Annual Report and Accounts to

the National Storage Mechanism, which will shortly be available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

For further information:

Gore Street Capital Limited

Alex O'Cinneide / Paula Travesso Tel: +44 (0) 20 3826 0290

Shore Capital (Joint Corporate Broker)

Anita Ghanekar / Rose Ramsden / Iain Sexton (Corporate Advisory) Tel: +44 (0) 20 7408 4090

Fiona Conroy (Corporate Broking)

J.P. Morgan Cazenove (Joint Corporate Broker)

William Simmonds / Jérémie Birnbaum (Corporate Finance) Tel: +44

(0) 20 3493 8000

Buchanan (Media Enquiries)

Charles Ryland / Henry Wilson / George Beale Tel: +44 (0) 20

7466 5000

Email: gorestreet@buchanan.uk.com

Notes to Editors

About Gore Street Energy Storage Fund plc

Gore Street is London's first listed and internationally

diversified energy storage fund dedicated to the low carbon

transition. It seeks to provide Shareholders with sustainable

returns from their investment in a diversified portfolio of

utility-scale energy storage projects. In addition to growth

through increasing operational capacity and a considerable

pipeline, the Company aims to deliver consistent and robust

dividend yield as income distributions to its Shareholders.

https://www.gsenergystoragefund.com

Gore Street Energy Storage Fund plc Annual report for the year

ended 31 March 2023

Key Metrics

For the year ending 31 March 2023

NAV PER SHARE

115.6p

(2022: 109.1p)

OPERATIONAL EBITDA

GBP27.8m

(2022: GBP23.3m)

DIVID YIELD

6.9%

(2022: 6.2%)

NAV TOTAL RETURN

for the year ended 31 March 2023

12.3%

(2022: 13.1%)

OPERATIONAL CAPACITY

291.6MW

(2022: 231.7MW)

TOTAL CAPACITY

1.17GW

(2022: 628.5MW)

Key Metrics

As at 31 March As at 31 March

2023 2022 % Change

---------------------------------------------- -------------- -------------- --------

Net Asset Value (NAV) GBP556.3m GBP376.5m 47.8%

---------------------------------------------- -------------- -------------- --------

Number of issued Ordinary shares 481.4m 345.0m 39.5%

---------------------------------------------- -------------- -------------- --------

NAV per share 115.6p 109.1p 5.9%

---------------------------------------------- -------------- -------------- --------

NAV Total Return for the year* 12.3% 13.1%

---------------------------------------------- -------------- -------------- --------

NAV Total Return since IPO* 48.0% 34.2%

---------------------------------------------- -------------- -------------- --------

NAV Total Return for the year including

dividend reinvestment* 12.6% 13.4%

---------------------------------------------- -------------- -------------- --------

NAV Total Return since IPO including dividend

reinvestment* 52.4% 36.8%

---------------------------------------------- -------------- -------------- --------

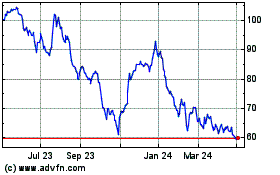

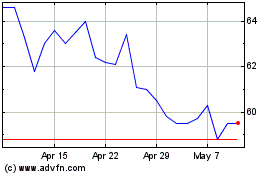

Share price based on closing price at

indicated date 100.8p 113.0p -10.8%

---------------------------------------------- -------------- -------------- --------

Market capitalisation based on closing

price at indicated date GBP485.3m GBP389.9m 24.5%

---------------------------------------------- -------------- -------------- --------

Share Price Total return for the year* -4.6% 11.1%

---------------------------------------------- -------------- -------------- --------

Share price total return since IPO* 31.8% 37.0%

---------------------------------------------- -------------- -------------- --------

(Discount)/Premium to NAV* -12.8% 3.6%

---------------------------------------------- -------------- -------------- --------

Portfolio's total capacity 1.17 GW 628.5 MW 86.2%

---------------------------------------------- -------------- -------------- --------

Portfolio's operational capacity 291.6 MW 231.7 MW 25.9%

---------------------------------------------- -------------- -------------- --------

Total Comprehensive Income for the Company GBP63.4m GBP42.5m 49.1%

---------------------------------------------- -------------- -------------- --------

Operational EBITDA GBP27.8m GBP23.3m 19.0%

---------------------------------------------- -------------- -------------- --------

Total Fund EBITDA GBP16.8m GBP15.2m 10.8%

---------------------------------------------- -------------- -------------- --------

Dividends per Ordinary Share paid during

the year 7p 7p**

---------------------------------------------- -------------- -------------- --------

Operational Dividend cover* 0.90x 1.29x**

---------------------------------------------- -------------- -------------- --------

Dividend Yield* 6.9% 6.2%

---------------------------------------------- -------------- -------------- --------

Ongoing Charges Figure* 1.37% 1.45%

---------------------------------------------- -------------- -------------- --------

* Some of the financial measures above are classified as

Alternative Performance Measures, as defined by the European

Securities and Markets Authority and are indicated with an asterisk

(*). Definitions of these performance measures, and other terms

used in this report, are given on page 103 together with supporting

calculations where appropriate.

** Dividends of 5p per Ordinary Share were paid in the year

ended March 2022, as a result of two dividends payments being made

in the quarter ended March 2021, with the December 2020 quarter

dividend paid at the end of March 2021. Due to this timing of

payments, only 5p was paid for the prior year. To ensure

comparability and to reflect a more meaningful and accurate

dividend cover for the comparable period, dividends paid of 7p is

reflected, being the 5p paid between 1 April 2021 and March 2022

plus the December 2020 quarter dividend paid at the end of March

2021, which due to timing of payment was not reflected as paid in

the year ended 31 March 2022.

Chair's Statement

I am pleased to present the Company's Annual Results for the

year ending 31 March 2023

Overview and Performance

This has been a successful period of growth and diversification,

with the Company entering two new grids and holding a uniquely

diversified portfolio of 1.17 GW across five uncorrelated markets.

These assets achieved strong growth and an attractive dividend

yield for our investors, with a NAV total return of 12.3% and 7.5p

in dividends declared for the period. The dividend for the year,

based on the 31 March closing share price of 100.8p, was equivalent

to a 6.9% yield. Over the five years since our IPO, the Company has

delivered a NAV total return of 48%, including 29p of dividends

paid to Shareholders. With 291.6 MW of operational capacity in the

portfolio thus far, the last financial year laid the foundations

for a sustained period of growth and opportunity for our portfolio.

Over 500 MW of capacity is scheduled to come online by the end of

2024 across the Company's portfolio, including in California, where

the 200 MW Big Rock asset will establish us in a new market, the

CAISO grid. During the reporting period, the Company generated an

average revenue of GBP135,000 per MW/ yr, resulting in total

revenue of GBP39.3 million. Post-reporting period, the Company

successfully expanded the existing GBP 15 million revolving debt

facility with Santander to GBP 50 million together with an

accordion option.

In 2018, we identified the vulnerability of relying on a single

market and the volatility it introduced to our revenues and overall

profitability. We made our first international acquisition in 2019

on the all-Irish Grid, where we now have a fleet of assets

totalling 310 MW, of which 130 MW is operational.

During the reporting period, the contributions from our Irish

assets have been significant, generating the largest proportion of

revenue for the Company. Our Irish assets boast a duration of

sub-30 minutes (and therefore the lowest capital expenditure within

our portfolio and significantly below the market average), which is

optimally sized to capitalise on the available contracts on this

grid. Moreover, these assets have consistently over delivered and

now surpass the level of revenue we see in the GB market.

Expanding our operations into new geographies required extensive

efforts to navigate the regulatory landscapes, establish networks,

and understand the contracts available with each grid operator.

While pursuing a GB-only strategy could have expedited deployment

and led to a larger operational asset base today, 2023 has shown us

that this would not have been the correct approach. By pursuing an

internationally diversified strategy, the Company hasn't been

wholly exposed to a grid with currently declining revenues, as

opposed to the diversified fleet of assets we currently possess,

which continues to deliver industry-leading returns for our

investors.

The Company remains well-capitalised to meet all contractual

obligations over the next 12 months without further debt. The

Company maintains a gearing level of less than 5% of NAV. This

aspect is significant, differentiating the Company and insulating

it from increased debt servicing costs.

Over the next period, we aim to introduce a conservative level

of debt. Accounting for the construction funding requirements for

the 522 MW of capacity targeting energisation by end of December

2024 and milestone payments for assets targeting energisation after

this period, net debt is expected to stay below GBP150m or 21% of

GAV over the 18 months from the date of publication. Considering

the prevailing cost of debt and the recent interest rate hikes, I

believe this is the appropriate approach.

During the period, the Company continued to execute on its

growth strategy, both in terms of capacity and geographical

diversification. This first led to the successful acquisition of

three operational assets and four pre-construction assets in the

ERCOT market of Texas in April 2022, with a combined capacity of

69.65 MW, which was later followed in January 2023 with the

acquisition of the 75 MW Dog Fish asset in the State. The Company

continued this momentum in February 2023 by entering a fifth grid

market with the completion of the acquisition of Big Rock, a 200

MW/400 MWh asset located in California.

The Company made one of its largest investments to date with the

200 MW Middleton project, which will be built in the north of

England. Together these project additions have taken the Company's

portfolio to a capacity of 1.17 GW spread across five distinct

energy systems, with access to more uncorrelated revenue streams

than ever before.

Macroeconomic Environment

There have been considerable macroeconomic shifts in the

reporting period - ranging from rising short-term inflation and

interest rates to increasing construction costs - due, in part, to

the unprecedented financial market conditions that have developed

over the financial year. Our Investment Manager has demonstrated

sound risk management and resilience within this context, adopting

effective measures to mitigate their impact on the portfolio.

Through its dedicated construction team, we have secured

competitively priced engineering, procurement, and construction

(EPC) contracts, leveraging pre-established relationships and

economies of scale, given the size of the Company's construction

portfolio. The Company has also benefitted from minimal debt

exposure, insulating it from increased debt servicing costs, while

our unique diversification has proven valuable in creating natural

hedges against FX volatility and pricing movements experienced in

the GB market.

Despite these conditions, the fundamental growth drivers for

energy storage remain strong, driven by the worldwide transition to

low-carbon energy generation and further reinforced by the global

concern over energy security. We remain confident in the Company's

ability to deliver sustainable dividends and attractive capital

growth for our investors over the long term.

Dividends

The Board has approved a fourth interim dividend of 1.5 pence

per share, bringing the total dividend announced for the period

ending 31 March 2023, to 7.5 pence per share, in line with the

Company's progressive Dividend Policy. The dividend paid for the

year based on the 31 March 2023 closing share price of 100.8p was

equivalent to a 6.9% yield.

NAV Performance

NAV has continued to progress in line with the Company's target

returns increasing from 109.1p per share in March 2022 to 115.6p

per share as of 31 March 2023, reflecting a NAV Total Return of

12.3% for the reporting period. With a significant portion of the

portfolio under construction (c. 75% on a MW basis), we maintain a

positive outlook on our ability to continue to deliver long-term

value to our shareholders as we deploy operational capacity over

the next period and beyond.

As we progress with the build-out of our construction portfolio,

we expect further positive impacts on revenue generation, dividend

coverage, and enhanced shareholder value as projects are de-risked

and revalued from stages of construction to becoming

operational.

Discount Management

In the interest of discount management, at the Board's

discretion, the Company is able to repurchase its shares at a price

lower than Net Asset Value (NAV). However, as the Company's funds

are fully committed to the build-out of the portfolio assets, and

the healthy returns available, we do not believe this to be the

optimal course of action. The Board will diligently monitor the

performance of the share price and retains the ability to employ

appropriate discount control mechanisms if deemed necessary.

Strategy and Operational Performance

Our strategy in FY 2022/23 continued to be led by participation

in various ancillary services, which remain the most profitable

source of income available to energy storage assets. The portfolio

engaged in some wholesale trading opportunities when appropriate

but achieved 93% of total revenue from ancillary services,

emphasising the significance of these services in the revenue stack

and highlighting the effectiveness of our system duration in the GB

market.

The GB portfolio performed well in the first half of the

reporting period, driven by our success in FFR services and the

introduction of Dynamic Services. High revenues from DS3 ancillary

services in Ireland, resulting from increased renewable generation

in winter months, helped offset the impact of declining prices

witnessed in GB during the second half of the financial year. This

seasonal volatility underscores the value of our portfolio

operating across multiple grids and geographies, reducing our

exposure to revenue fluctuations in any single market.

Similar patterns of seasonal performance were seen in Germany,

where our newly acquired asset was called on to help tackle the

sustained volatility experienced over the summer months as gas

prices peaked. August provided the highest monthly revenue from the

ancillary services market, with prices remaining stable throughout

winter.

The summer also proved beneficial for the Company's operational

assets in Texas, where several extreme weather events, including a

heat wave in July 2022, caused ancillary services prices to spike

above $2,000 (GBP1,590)/MW/hr as demand increased. A similar impact

was seen in December 2022, resulting from a winter storm, which

drove prices even higher.

This volatility in summer and winter, separated by subdued

pricing in the transitional seasons of spring and autumn, can be

seen broadly across the portfolio and illustrates the value of

having assets located across multiple grids to capitalise on

extreme swings in supply and demand.

Sustainability

Over the past 12 months, we have continued to build on our

commitments around how we record and report the Company's impact.

The Company's first ESG & Sustainability report, published in

August 2022 for the previous reporting period, delivered voluntary

disclosures for our GB and Ireland assets covering emissions,

social metrics and efforts to understand the human rights exposure

of our supply chain. We have ramped up these efforts during the

reporting period and expanded our reporting to cover Germany, Texas

and California, where we added assets in early 2022.

An SFDR Article 8 periodic report covering Principle Adverse

Impacts (PAIs) is disclosed in this report. This will be followed

in August 2023 by the Company's second ESG & Sustainability

Report, which will include reporting under the Sustainable Finance

Disclosure Regulation (SFDR) and the Task Force for Climate-related

Financial Disclosures (TCFD) disclosures.

Debt

Post-reporting period, the Company successfully expanded the

existing GBP15 million GBP revolving debt facility with Santander

to GBP50 million. The facility includes an accordion option to

increase beyond GBP50m to up to 30% of Gross Asset Value. Pricing

for the GBP50m facility remains unchanged at 300 basis points over

SONIA. Throughout the calendar year, we will remain focused on

optimising the Company's capital structure and are actively

exploring debt options in both GBP and USD.

The recent acquisition of the Big Rock project in California

presents an opportunity for project level financing by leveraging

its unique revenue profile under the Resource Adequacy mechanism.

This programme has similarities to GB's Capacity Market in that it

aims to ensure safe and reliable operation of the grid through

security of supply but can offer up to 40% of revenue under a

long-term contract. This level of secured revenue allows us to

consider asset-level debt financing in a new way, further

supporting the Company's decision to diversify its portfolio.

Board Composition and Succession Planning

In the 2022 half-year report, I updated shareholders on our

progress with the recruitment of a new Director. We are delighted

to welcome Lisa Scenna to the Board, effective 1 May 2023. Lisa's

skills and experience are detailed on page 49 and she will be

standing for election at the AGM with the rest of the Board.

The remuneration and nomination committee also recommended that

the Board seek to appoint a new Director in 2024/25 and every two

or three years thereafter, such that Directors' retirement dates

are staggered as part of orderly succession planning.

AGM and Continuation Vote

This year marks an important milestone for the Company, as it

passed its five-year anniversary. When the Company's shares started

trading on 25 May 2018, it was the first listed company offering

access to energy storage.

Five years later, the Company has built an internationally

diversified portfolio of 1.17 GW and delivered a NAV total return

of 48% including 29p of dividends paid to Shareholders.

The Company's continued progress with geographic, grid and

revenue diversification is detailed in this report, as are the

Company's plans for future growth as its pre-construction assets

become operational, accessing and stacking additional revenue

sources, driving returns and adding to dividend cover.

In accordance with the Company's articles of association, the

Board is required to put forward a proposal for the continuation of

the Company to shareholders at five-yearly intervals. The Board

believes the Company is delivering what it set out to do at IPO,

that its long-term investment objectives remain appropriate and

that the Investment Manager is well placed to continue to deliver

those objectives. The Board encourages shareholders to vote in

favour of the continuation resolution at the AGM.

The AGM will be held at the offices of Stephenson Harwood, 1

Finsbury Circus, London EC2M 7SH on Thursday 21 September 2023 at

9.30 am. Further details are included in the Notice of AGM on page

90 of the annual report. I look forward to welcoming shareholders

attending in person. If you are not able to attend in person, or

prefer to vote by proxy, but have questions for the Board, please

contact the Company Secretary at cosec@gorestreetcap.com .

Outlook

We begin the next reporting period cautiously optimistic,

recognising the opportunities that our diversified strategy

presents. The current pricing landscape in GB necessitates an

international approach granting access to a wide range of revenue

streams across uncorrelated markets, 2023 and beyond will

illustrate this as we bring more international capacity online.

The appropriate assumptions employed by the Company, coupled

with the continued growth of our fund and diligent work by the

Investment Manager, provide reassurance amidst the recent pricing

volatility experienced within the energy storage industry and

prepares us for future market developments.

The regulatory landscape continues to shift in GB as we head

towards the uncertainty of a General Election, which is already

delaying decisions by regulators and obscuring the broader future

direction of the market. New revenue opportunities in Germany and

the US, such as through the Resource Adequacy programme in

California or the yet--to--be--implemented ECRS service in Texas,

help to provide a focus for activity in the coming months while

maintaining our high levels of availability across the fleet.

We find ourselves at a pivotal juncture for the Company's

growing presence across five geographically diverse grids, which I

am delighted to say is contributing to the Company's continued

growth in the face of declining revenue in the GB market.

Patrick Cox

Chair

Investment Manager's Report

Dr Alex O'Cinneide

CEO of Gore Street Capital, the Investment Manager

"I'm delighted to report that the Company continued to deliver

for shareholders through a dedicated focus on building a robust and

diversified portfolio during a historic year for the energy sector.

The Company's asset value continues its trajectory of strong and

sustained growth, exceeding target returns and continues to meet

the dividend target laid out to shareholders. The Company has

achieved a NAV Total Return of 48% since IPO."

The Company's NAV increased by 47.8% from the end of the last

fiscal year (31 March 2022). The key drivers of the increase from

GBP376.5m (1st April 2022) to GBP556.3m (31 March 2023) were: (i) a

fundraise of GBP147.3m in net proceeds in April 2022, (ii)

acquisitions of operational and construction projects in Great

Britain (GB), Texas and California, totalling 544.7 MW. The

acquisitions included the 200 MW Big Rock acquisition in

California, the 200 MW Middleton acquisition in GB, the 75 MW

Dogfish asset, and a 69.65 MW portfolio of assets in Texas, and

(iii) changes in key forecasts across the portfolio.

Table 1

Changes in

Movement in NAV NAV per share

since March 2022 in pence

--------------------------------------------------------- --------------

NAV March 2022 109.1

--------------------------------------------------------- --------------

Offering Proceeds 0.3

--------------------------------------------------------- --------------

Offering + Fund + Subsidiary Holding Companies Operating

Expense -3.6

--------------------------------------------------------- --------------

Dividends -6.4

--------------------------------------------------------- --------------

Cash Generation 6.5

--------------------------------------------------------- --------------

Revenue Curves 4.7

--------------------------------------------------------- --------------

Inflation 2.7

--------------------------------------------------------- --------------

Discount Rates -2.2

--------------------------------------------------------- --------------

CM Contracts Awarded 2.9

--------------------------------------------------------- --------------

Asset Depreciation and Other DCF Changes -4.7

--------------------------------------------------------- --------------

New Investments to FV 6.3

--------------------------------------------------------- --------------

NAV March 2023 115.6

--------------------------------------------------------- --------------

The Investment Manager's Report provides readers with an

explanation of the backdrop in each of the markets the Company

operates in. It details the revenues generated, how the assets

performed, and the specific drivers of the portfolio's NAV. It also

includes a Q&A with the Investment Manager's CIO and CFO, Sumi

Arima, where he talks about the Company's strategy and his thoughts

on the markets in which the Company operates. The Investment

Manager's CEO, Dr Alex O' Cinneide, then gives his views on the

Company's performance, and outlook of the future.

A glossary of industry terms can be found on page 106 of the

annual report.

Portfolio

1.17 GW

Total portfolio (GW)

1.54 GWh

Total portfolio (GWh)+

291.6 MW

Operational

881.6 MW

Pre-construction and construction phase projects

Portfolio in GB & Northern Ireland (GBP)

Asset name Capacity Ownership

-------------- ------------------------ ---------

1 Boulby 6.0 MW | 6.0 MWh 99.9%

---------- ------------------------ ---------

2 Cenin 4.0 MW | 4.8 MWh 49.0%

---------- ------------------------ ---------

3 POTL 9.0 MW | 4.5 MWh 100.0%

---------- ------------------------ ---------

4 Lower Road 10.0 MW | 5.0 MWh 100.0%

---------- ------------------------ ---------

5 Mullavilly 50.0 MW | 21.3 MWh 51.0%

---------- ------------------------ ---------

6 Drumkee 50.0 MW | 21.3 MWh 51.0%

---------- ------------------------ ---------

7 Hulley 20.0 MW | 20.0 MWh 100.0%

---------- ------------------------ ---------

8 Lascar 20.0 MW | 20.0 MWh 100.0%

---------- ------------------------ ---------

9 Larport 19.5 MW | 19.5 MWh 100.0%

---------- ------------------------ ---------

10 Ancala 11.2 MW | 11.2 MWh 100.0%

---------- ------------------------ ---------

11 Breach 10.0 MW | 10.0 MWh 100.0%

---------- ------------------------ ---------

12 Stony Energisation | July 2023 100.0%

---------- ------------------------ ---------

13 Ferrymuir Energisation | Sep 2023 100.0%

---------- ------------------------ ---------

14 Enderby Energisation | June 2024 100.0%

---------- ------------------------ ---------

15 Middleton Energisation | Dec 2026 100.0%

---------- ------------------------ ---------

Republic of Ireland & Germany (EUR)

Asset name Capacity Ownership

--------------------------- ------------------------ ---------

16 Cremzow 22.0 MW | 29.0 MWh 90.0%

---- --------------------- ------------------------ ---------

17 Porterstown 30.0 MW | 30.0 MWh 51.0%

---- --------------------- ------------------------ ---------

17.1 Porterstown Expansion Energisation | June 2024 51.0%

---- --------------------- ------------------------ ---------

18 Kilmannock Energisation | H2 2025 51.0%

---- --------------------- ------------------------ ---------

18.1 Kilmannock Expansion Energisation | H2 2026 51.0%

---- --------------------- ------------------------ ---------

North America (USD)

Asset name Capacity Ownership

----------------- ------------------------ ---------

19 Snyder 9.95 MW | 19.9 MWh 100.0%

------------- ------------------------ ---------

20 Westover 9.95 MW | 19.9 MWh 100.0%

------------- ------------------------ ---------

21 Sweetwater 9.95 MW | 19.9 MWh 100.0%

------------- ------------------------ ---------

22 Big Rock Energisation | Dec 2024 100.0%

------------- ------------------------ ---------

23 Dogfish Energisation | Dec 2024 100.0%

------------- ------------------------ ---------

24 Wichita Falls Energisation | June 2025 100.0%

------------- ------------------------ ---------

25 Mesquite Energisation | June 2025 100.0%

------------- ------------------------ ---------

26 Mineral Wells Energisation | June 2025 100.0%

------------- ------------------------ ---------

27 Cedar Hill Energisation | June 2025 100.0%

------------- ------------------------ ---------

-- Operational Assets

-- Assets under construction / pre-construction

* MWh included for operational sites

+ Based on expected system duration and may be subject to change

Market Overview

Summary

The world is experiencing unparalleled transition to a cleaner,

more secure energy system through the widespread adoption of

renewable energy sources. Generation from wind turbines, solar

panels and other distributed renewable energy resources is rapidly

decarbonising global power grids with inherently intermittent

output, leading to higher volatility on energy grids. The ability

to effectively capture, store and discharge energy when it is most

needed has become a critical tool in successfully integrating clean

power generation, improving the efficiency of energy systems and

reducing the world's reliance on polluting fossil fuels.

New urgency has emerged within the low carbon energy transition

following Russia's ongoing invasion of Ukraine, which has exposed

several markets' overreliance on fossil fuels. Shortages of oil and

gas, combined with increased episodes of extreme weather, have

caused energy prices to spike as demand outstripped supply.

Energy storage owners are well placed to provide grid operators

with the flexibility they need to reduce these imbalances between

energy demand and supply by supporting them to reduce system

volatility. This improves energy security to maintain the

electricity grid system at the correct frequency and keep the

lights on while ensuring the global move towards decarbonisation

can continue at pace. The faster these flexible renewable energy

solutions can be deployed, the faster society can move to a more

sustainable world.

As a global owner of large-scale energy storage assets working

in five grids (Great Britain, Ireland, Germany, ERCOT in Texas and

CAISO in California), the Company is delivering these benefits in

multiple jurisdictions. This internationally diversified approach

means the Company's operational assets - online in four

uncorrelated markets to date - can utilise the dynamic and flexible

capabilities of energy storage technology to stack revenue streams

across contracted and merchant opportunities.

The majority (72%) of the Company's 291.6 MW operational

portfolio benefit from Capacity Market (CM) contracts, which allow

merchant revenues to be stacked around secure income. The remaining

capacity (28%) operates on a purely merchant basis, adding further

diversity to our revenues. This allows the entirety of the

portfolio to counteract any quarterly downturns or volatility

experienced in specific markets throughout the year and maintain

healthy returns for the Company and its shareholders.

Further details are below in high-level summaries of each market

the Company is active in:

Great Britain (GB) market

Table 2

TSO National Grid

--------------------------------- -------------------------------

GB Portfolio (operational) 109.7 MW/101 MWh

--------------------------------- -------------------------------

Share of the market(2) 4.4%

--------------------------------- -------------------------------

Annual revenue GBP15.2m

--------------------------------- -------------------------------

Revenue per MW GBP138,400/MW (GBP15.80/MW/hr)

--------------------------------- -------------------------------

Revenue per MWh GBP150,400/MWh (GBP17.17/MW/hr)

--------------------------------- -------------------------------

EBITDA GB grid % of Total EBITDA 36%

--------------------------------- -------------------------------

Ancillary services continued to represent the majority of

revenues for all energy storage assets in fiscal year (FY) 2022/23,

which saw National Grid ESO unveil a full suite of new frequency

response services. Dynamic Regulation (DR) was launched in April

2022, after a testing phase in Q4 2021, followed by Dynamic

Moderation (DM) in May 2022. They were introduced with the aim of

retiring services such as Firm Frequency Response (FFR), in which

energy storage had widely participated in previous years. FFR was

intended to be phased out within FY 2022/23 but has continued

largely due to uncertainty and the extension of the trial period

for new services (DM and DR). With a view to duration across the

period, the majority of uncontracted revenue came from FFR or

Dynamic Containment (DC) which both can be provided by sub one- and

one-hour systems. Whilst DR was the most profitable in the period,

it was capped at 100 MW, creating a small opportunity for systems

over 1.5 hours.

National Grid ESO began to procure higher volumes of the

previously introduced DC over the summer in 2022 and increased the

price cap for the DC product alongside the gradual introduction of

DR. Removal of the initial GBP17/MW/h price cap, combined with DR

and procurement volumes required by National Grid ESO exceeding the

supply-side capacity of energy storage in GB, allowed participants

to push DC clearing prices upwards to the benefit of the entire

market.

H2 of the reporting period was marked by a fall in D-suite (DC,

DM, DR) prices caused by market saturation, particularly towards

the end of the period when additional capacity in the GB market

came online.

As FFR and D-suite services are mutually exclusive for a given

period, this downward price trend - which continued into March 2023

- made FFR one of the most lucrative services for energy storage in

the Autumn and Winter of 2022/23 as market participants priced in

the opportunity cost of D-suite and wholesale trading into their

FFR bids, which National Grid accepted.

The opportunity cost for FFR bid prices is calculated to

encompass the estimated monthly revenue from the alternative

revenue stack. As a result, D-suite revenues are more sensitive to

the daily market grid and market dynamics such as National Grid ESO

buy curves, demand, electricity prices, and renewable penetration.

D-suite clearing prices remain uncertain and, therefore, more

volatile.

Procurement volumes of FFR were reduced towards the end of FY

2022/23 as part of the electricity transmission system operator's

phase-out of FFR, driving increased competition as the market

sought guaranteed monthly revenue rather than risk exposure to

daily volatility in D-suite procurement auctions. The low perceived

opportunity in DC and decreasing procurement volumes dragged FFR

prices down.

DR volume caps, meanwhile, were raised from 100 MW to 200 MW as

of March 2023 to accommodate more consistent use of this service by

National Grid. DR has a lower frequency deviation trigger,

requiring more battery cycling than DC and assets below two-hours

duration to de-rate their capacity to participate in the market.

The additional strain led to fewer participants entering DR in the

initial period, creating lucrative opportunities for participants

qualified to enter this market. While DR has not been immune to the

downturn in revenues seen with DC, as more energy storage has

qualified for delivery, it continues to clear on average higher

than DC, reflecting the additional opportunity cost.

DM volumes have remained capped at 100 MW, as National Grid ESO

does not systematically acquire DM volumes.

Irish market

Table 3

SONI (Northern Ireland), EirGrid (Republic

TSO of Ireland)

------------------------------------ ------------------------------------------

Irish portfolio (operational) 130 MW / 72.6 MWh

------------------------------------ ------------------------------------------

Share of the market(3) 50% (NI), 6% (RoI)

------------------------------------ ------------------------------------------

Annual revenue GBP17.0m

------------------------------------ ------------------------------------------

Revenue per MW GBP130,800/MW (GBP14.93/MW/hr)

------------------------------------ ------------------------------------------

Revenue per MWh GBP234,200/MWh (GBP26.73/MWh/hr)

------------------------------------ ------------------------------------------

EBITDA Irish grid % of Total EBITDA 50%

------------------------------------ ------------------------------------------

Non-synchronous generation in the Irish market, led by wind

power, has been a key resource in efforts to achieve a 100%

renewable energy system and has created a market for ancillary

services through the DS3 (Delivering a Secure Sustainable

Electricity System) programme. Energy storage investment has been

encouraged via procurement through uncapped (annually procured) and

capped (up to six-year contracts auctioned in 2019) schemes.

Uncapped contracts unit price is based on System Non-

Synchronous Penetration (SNSP), which refers to the real-time

measure of intermittent renewable generation on the system and net

interconnector flows within the single electricity market. Revenue

is calculated based on annual fixed tariffs multiplied by various

scalars including availability and SNSP, the principal factor

driving volatility in DS3 revenues. This is predominantly set by

wind penetration levels, which represent the largest deployed

renewable generation resource in both Irish grids. There is a

direct correlation between SNSP levels and DS3 uncapped revenue,

which fluctuates with seasonal variation to provide higher

financial returns during the peak winter months. In contrast,

summer revenues have not reached the same levels as these months

typically experience fewer windy days and are not pushed higher by

the amount of solar generation in the market.

In contrast, capped contracts are fixed at the contracted price.

SNSP scalars, which provide a multiplier for the uncapped tariff

(common across the Irish DS3 uncapped market), experience seasonal

variations.

Energy storage assets can also participate in the Capacity

Market (CM), which functions similarly to the GB equivalent.

Eirgrid and SONI have begun testing trading capabilities and the

process of dispatching assets in the Balancing Mechanism (BM).

1

https://www.cleanenergywire.org/factsheets/what-german-households-pay-electricity#::text=The%20increase%20was%20mostly%20caused,

160%20percent%20compared%20with%202021.

2

https://energeia-binary-external-prod.imgix.net/4hCe-bWGRjCXayeF55Yi6NFpKM8.pdf?dl=Annual+Market+Update+2021.pdf

3 Source: Energy Storage Ireland: As of March 2023 there was 470

MW in Republic of Ireland, 200 MW in Northern Ireland.

German market

Table 4

50Hertz, Amperion, Tennet, Transnet

TSO BW

------------------------------------- -----------------------------------

German portfolio (operational) 22 MW / 29 MWh

------------------------------------- -----------------------------------

Share of the market (MaStR)(4) (50

Hertz)(5) 2.16% (Germany), 4.2% (50 Hertz)

------------------------------------- -----------------------------------

Annual revenue GBP3.3m

------------------------------------- -----------------------------------

Revenue per MW GBP149,800/MW (GBP17.10/MW/h)

------------------------------------- -----------------------------------

Revenue per MWh GBP113,600/MWh (GBP12.97/MWh/h)

------------------------------------- -----------------------------------

EBITDA German grid % of Total EBITDA 9%

------------------------------------- -----------------------------------

Germany comprises four transmission system operators (TSO) in a

single grid, each controlling an area of the country. The Company

currently interacts with the TSO 50Hertz by providing Frequency

(Primary) Control Reserve (FCR). This cross-border service operates

across eleven transmission system operators in eight European

countries, with 50Hertz and other German TSO able to pass on excess

flexibility to the wider European grid. FCR in Germany has

typically been delivered through gas as the biggest provider of

generation, meaning power prices generally mirror seasonal

variation in the wholesale gas market. This usually results in

lower prices during summer and higher in winter when demand for gas

and electricity is higher.

As illustrated in figure 4 of the annual report, power prices

increased sharply towards the end of 2021 to accommodate rising

demand across the EU as countries recovered from the economic

impact of the Covid-19 pandemic.

Electricity prices continued to increase in line with gas in

April 2022 following the Russian invasion of Ukraine, which

impacted energy supplies and gas storage in continental Europe, as

shown in figures 4 and 5 of the annual report. The resulting

shortage in supply across Europe during the reporting period drove

gas prices and the marginal cost of power production from gas-fired

power plants up in the summer. Over 2022 Germany paid more than

double for its natural gas imports compared to the previous year,

according to the Federal Office for Economic Affairs and Export

Control, BAFA1, which, in turn, caused FCR prices to surge.

The trend of increasing prices reached a record high of

EUR469/MWh in August 2022 when extreme summer temperatures impacted

hydropower generation due to low water levels. It even contributed

to low nuclear capacity in France due to low reservoir levels

reducing water available for cooling reactors(3).

As the EU entered the Autumn period, wholesale prices started to

decrease due to milder weather, which led to lower demand, and

higher gas storage availability after the EU implemented a

regulation requiring all storage facilities on the continent to be

filled to 80%, on average, before the winter of 2022/2023. This was

achieved in late August using LNG imports from the US(4) and caused

FCR prices to fall faster than seen in previous years.

1

https://www.reuters.com/business/energy/germanys-gas-bill-surged-109-last-year-despite-slashed-buying-2023-03-01/

3

https://gmk.center/en/news/electricity-prices-in-the-eu-fell-significantly-in-october-2022/

4 https://www.consilium.europa.eu/en/infographics/gas-storage-capacity/

4 Source: Mastr database, as of March 2023 there is around 1,019

MW of total capacity in Germany. 50 Hertz 521MW

(https://www.marktstammdatenregister.de/

MaStR/Einheit/Einheiten/OeffentlicheEinheitenuebersicht)

The factors of: Covid-19 recovery, worldwide gas volatility

caused by war in Europe, and extreme temperatures experienced

across the mainland created an abnormal seasonal variation during

the period, where FCR was higher in the summer and lower in the

winter. Prices stayed higher than the previous year, however, with

the average natural gas import price in December - equivalent to

EUR9.38/kWh - remaining 74% above a year earlier, following a

period of divestment from Russian supplies.

Additional revenue for short-duration flexibility is now

available through automatic Frequency Restoration Reserve (aFRR),

also known as Secondary Control Reserve, following a reduction in

delivery duration from four hours to 15 minutes. This service is

designed to support FCR should it fail to deliver the flexibility

needed to maintain the grid by maintaining a reserve in the power

grid that helps to keep the grid frequency stable. This provides

revenue for availability in case of activation and for actively

balancing energy when called on.

This reporting period also provided opportunities in wholesale

trading across the FCR market, with liquidity available from the

demand for balancing from renewable generators seeking to settle

their supply imbalances before facing high system charges.

ERCOT market (Texas, US)

Table 5

TSO ERCOT

------------------------------------ -----------------------------

ERCOT portfolio (operational) 29.85 MW / 59.7 MWh

------------------------------------ -----------------------------

Share of the market (ERCOT)(5) 1.4%

------------------------------------ -----------------------------

Annual revenue GBP3.8m

------------------------------------ -----------------------------

Revenue per MW GBP127,800/MW (GBP14.59/MW/h)

------------------------------------ -----------------------------

Revenue per MWh GBP63,900/MWh (GBP7.30/MWh/h)

------------------------------------ -----------------------------

EBITDA ERCOT grid % of Total EBITDA 5%

------------------------------------ -----------------------------

US President Joe Biden signed the Inflation Reduction Act into

law on 16 August 2022. The legislation provides $369bn over ten

years to tackle climate change and invest in the renewable energy

sector to reduce carbon emissions by 40% by 2030, compared with

2005 levels.

Two-thirds of this funding will be used to extend or introduce

support for emission-free electricity generation and storage

technologies.

Standalone utility-energy storage projects with a minimum name

plate capacity of 5 kWh can now access investment tax credits

(ITCs) worth at least 30% of capital expenditure for the first time

provided construction is underway by the end of 2024. Projects

beginning construction in 2025 through to 2032 will be able to

receive ITC support however specific facilities will be done on a

technology neutral basis. Per the 2022 unemployment data published

by the Bureau of Labour and Statistics (BLS), the Company's assets:

Dogfish, Wichita Falls, and Mineral Wells (combined 95MW) all

qualify for 40% ITC, provided that unemployment rates in these

regions remain equal to or higher than the national average.

This is expected to help grow the US battery storage market from

around 10 GW in 2022 to over 85 GW by 2035, with 29 GW (ERCOT) and

25 GW (CAISO) more in construction or planned(5) .

5 Source: S&P Global: Market Intelligence, as of March 2023

there is 2.2 GW of operational capacity;

https://www.spglobal.com/marketintelligence/en/news-insights/research/battery-stampede-spurs-sunny-storage-economics-in-ercot

;

https://www.50hertz.com/en/Transparency/GridData/Installedcapacity

Ancillary services are the main revenue driver in ERCOT, except

when extreme weather events create opportunities in wholesale

markets as real-time prices spike due to swings in supply and

demand. These weather events also impact ancillary services and can

produce price spikes and supply scarcity, driving demand for

Responsive Reserve Service (RRS).

The Company expanded the number of services offered after the

reporting period to include existing (e.g. Regulation Up/Down) and

new (e.g. ECRS - Contingency Reserve Service) revenue streams. The

wholesale market opportunity was and continues to be bearish,

mainly due to falling natural gas prices. This trend is expected to

reverse throughout 2023 and into 2024 in line with commodity prices

and demand increases.

CAISO market (California, US)

Table 6

TSO CAISO

------------------------------ ------------------------------------------

CAISO portfolio (construction) 200 MW / 400 MWh

------------------------------ ------------------------------------------

Advanced pre-construction phase (pre-NTP):

Current Status Batteries procured and in warehouse

------------------------------ ------------------------------------------

Target energisation Dec-end 2024

------------------------------ ------------------------------------------

The outlook for ancillary services in California's CAISO market

is well supported by three main fundamentals: grid flexibility,

high penetration of non-dispatchable renewable generation and

decommissioning of existing conventional generation. Deployment of

battery storage is integral to increasing penetration of renewable

energy as existing conventional energy resources are unable to meet

sub-second response requirements. This need for flexible capacity

has seen a rapid deployment of battery energy storage systems

motivated by the retirement of fossil fuel generation. CAISO

experiences a similar frequency of extreme weather events as ERCOT

despite its location on the opposite coastline - these events

create short-term spikes in wholesale and ancillary markets.

In addition to ERCOT, the Inflation Reduction Act applies in

CAISO and will give access to an ITC worth at least 30% of capital

expenditure, which can be extended to some Tax Credit Adders for

projects in low-moderate income communities, tribal lands, or

repurposed fossil fuel power plants to between 2% and 20% extra per

individual possible adder.

Revenue opportunities under the Resource Adequacy (RA)

mechanism, which acts as a tool for CAISO and the Local Regulatory

Authorities to ensure enough generation capacity is secured ahead

of time to deliver security of supply, are also drivers. RA can be

compared to the Capacity Market in GB in that it offers secure

revenue on which the prevailing ancillary/wholesale merchant

strategy can be stacked. They differ, however, in that RA contracts

are expected to represent up to 40% of the revenue of a battery

energy storage system, a materially higher proportion than GBs CM

contracts account for.

Revenue Generation and Portfolio Performance

The Company exercised a diverse strategy throughout the

reporting period, participating in a mixture of ancillary and

trading opportunities across the markets in which it is active.

Revenue was generated from a growing suite of services launched in

2022 (e.g. the expanded D-suite in GB), while the Company also

implemented steps to prepare for additional streams in 2023 (e.g.

wholesale trading in Germany) and post-period (e.g. ECRS in

ERCOT).

Great Britain (GB) market

Ancillary services played a key role in GB revenue generation,

accounting for 85.7% of annual revenue, or GBP13m. The strategy for

bidding into varying ancillary services was evaluated in advance as

FFR is bid into one month before delivery to secure

calendar-month-long agreements. D-suite services, meanwhile, are

bid into on a day-ahead basis and provided an alternative

strategy.

While all the assets were entered into FFR for all EFA blocks at

various points throughout the financial year, a higher bid strategy

was adopted for those more suited to delivering for the DC market.

This meant they were available to pick up FFR contracts if prices

reach a higher bid level but, in most months, meant they could

ensure an even split between FFR committed capacity and DC

committed capacity was achieved. This diversified services strategy

acted as a hedge against the volatile conditions experienced

earlier in the year.

Revenue in Q1 2022 was the highest of all reported quarters

since April 2021 and was 40% above the previous year's Q1 revenue.

This was largely due to the uplift in DC prices across this period,

with DC representing 51% of all revenues achieved (Capacity Market

included). The continued uplift in D-suite revenues also led to Q2

2022 being 18% ahead of the previous year, with D-suite

representing 73% of all revenues.

Lower prices were bid into FFR in H2 of the reporting period due

to fewer alternative opportunities in the D-suite market caused by

market saturation. H2's performance was 35.5% below the previous

year, in stark contrast to the excellent market conditions in

H1.

Whilst FFR prices cleared higher than DC and DM, on average,

decreased procurement volumes ahead of retiring the service

(contributing to increased competition) led to fewer batteries in

the portfolio receiving contracts. FFR represented only 31% of

revenue in H2, although the portfolio saw an increase in trading,

which accounted for 11% of revenues during the same period.

FY 2022/23 included the second half of the 2021/22 Capacity

Market delivery year and the first half of the 2022/23 delivery

year. Capacity Market revenue in H2 was 31% above H1, driven in

large part by the GBP75/kW clearing price of the 2022/23 T-1

Auction; the Port of Tilbury (POTL) asset secured a contract at

7.061 MW de-rated capacity. Capacity Market revenues represented

8.9% of the GB portfolio revenues during the financial year.

Irish market

Northern Ireland

Ancillary services, monetised through DS3 uncapped contracts,

generated 98% of revenues for the Northern Irish fleet, totalling

GBP15.5m across the financial year - an uplift of 27% of total

revenue compared with the previous financial year. DS3 uncapped

tariffs for each of the five contracted ancillary services are

subject to yearly variations by the Regulatory Authority in Ireland

and could inevitably lead to lower revenues being secured. Despite

a 10% reduction in DS3 tariffs in January 2022, the NI portfolio

still generated 24% more revenue from DS3 this financial year,

driven mainly by increased SNSP levels in the December-end

quarter.

Monthly DS3 uncapped revenues peaked in FY 2022/23 at

GBP29.24/MW/h, just short of the all-time high of c. GBP33.87/MW/h

in February 2022.

The remaining 2% of the revenue stack comprised two revenue

streams: Capacity Market and wholesale trading. The contracted

Capacity Market revenue generated around GBP36,000 per month in

total from both assets, starting from October 2022 and continuing

post-period until the contracts end in September 2023. The NI

portfolio also secured yearly Capacity Market contracts until

September 2027.

Trading remains in its infancy in the grid with limited

accessibility to the wholesale market. To date, bids from the NI

assets have been accepted to dispatch volume generating c.

GBP118,000.

Republic of Ireland

Porterstown Phase I operates under a six-year DS3 capped

contract (starting September 2021) with a fixed tariff rate of

EUR6.79/MW/h The asset was declared available to provide services

on 24 January 2023 and has since generated EUR326,000 throughout

the remainder of the March-end quarter. Prior to the DS3 capped

contract, the asset generated additional revenue from liquidated

damages caused by delays experienced by the engineering,

procurement, and construction (EPC) contractor in delivering the

project.

The NI & ROI portfolio generated an overall average weighted

price of GBP14.90/MW/h, with the bulk of the revenue generated from

DS3 uncapped revenue.

German market

The Company acquired the Cremzow project at the end of the

previous fiscal year with a view to targeting ancillary services in

a new market that presented similar conditions to GB. The asset

enabled the Company to capitalise on uncharacteristic price rises

in gas, power and ancillary markets during the summer of 2022.

Delivery of ancillary services resulted in revenues totalling

EUR3.7m through provision of FCR for 98.0% of the year, with

monthly revenue accrued directly from FCR peaking at EUR32.22/MW/h

in August to achieve a total of EUR488,000 - the highest monthly

revenue in FY 2022/23, marginally ahead of October 2022.

FCR prices remained stable during the winter months, once again

moving against expected seasonal variation where previously prices

would increase towards the end of the calendar year. The stability

at lower levels pushed the Company towards expansion into new

revenue streams, mainly the wholesale market.

The Company expanded its capabilities in Germany to include

wholesale trading through work with a new optimiser and, in March

2023, generated revenue of EUR73,400 solely from wholesale trading

following delays transitioning to a new FCR provider and pending

approval from 50 Hertz. Post-period, the Company's revenues will be

a blend of both streams with the expected addition of aFRR

following submittal of tests for post-period evaluation to join the

service.

Texas (ERCOT market)

Due to the significant renewable energy development in this

region and unique characteristics surrounding interconnections,

there is exposure to wholesale price volatility due to the inherent

intermittency of renewable generation. This isolation of the ERCOT

grid means there is an increasing need for flexibility. The

Company's activity this period, however, was focused on performing

RRS, which is also affected by swings in renewable supplies.

Several extreme weather events during FY 2022/23, such as a heat

wave in July 2022, caused RRS prices to spike above $2,000/ MW/h

for a short period. This occurrence was not isolated, with a

similar scenario in December 2022 resulting from a winter storm and

cold snap driving prices up to $3,000/MW/h. These short-term events

resulted in monthly revenue of $57.26/MW/h in July and $36.12/MW/h

in December.

Such events related to weather conditions are more likely to

occur during winter and summer, leaving spring and autumn as

transition seasons, typically referred to as shoulder months. In

ERCOT, steady wind and thermal generation led to lower prices in

RRS during the March-end quarter; consequently, the Company's

revenue dipped to $4.51/MW/h. The seasonal price volatility

captured by the ERCOT assets during extreme weather events versus

shoulder months are an expected market condition of operating in

ERCOT and offset the fall in revenue experienced during transition

periods of the year.

Overall portfolio performance

Overall, the portfolio generated GBP39.3m in revenues (2022

Fiscal Year GBP29.3m), with weighted annualised revenue of c.

GBP135,000/ MW (GBP15.40/MW/hr). This was achieved through

geographical diversification and the Company's unique ability to

generate revenues even when some markets were hindered by seasonal

variation or saturation.

Table 7

GBP(000s) FY 2022/23 % within grid % of portfolio

--------------------------------------- --------------------- ------------- --------------

GB - 109.7 MW / 101 MWh

--------------------------------------- --------------------- ------------- --------------

Ancillary services GBP13,012 85.7%

--------------------------------------- --------------------- ------------- --------------

Capacity Market GBP1,354 8.9%

--------------------------------------- --------------------- ------------- --------------

Wholesale Trading GBP822 5.4%

--------------------------------------- --------------------- ------------- --------------

GB total(6) GBP15,188 100.0% 38.6%

--------------------------------------- --------------------- ------------- --------------

Ireland - 130 MW / 72.6 MWh

--------------------------------------- --------------------- ------------- --------------

DS3 Capped/Uncapped GBP16,666 98.0%

--------------------------------------- --------------------- ------------- --------------

Capacity Market GBP216 1.3%

--------------------------------------- --------------------- ------------- --------------

Wholesale Trading GBP118 0.7%

--------------------------------------- --------------------- ------------- --------------

Ireland total GBP17,000 100.0% 43.3%

--------------------------------------- --------------------- ------------- --------------

Germany - 22 MW / 29 MWh

--------------------------------------- --------------------- ------------- --------------

Ancillary services GBP3,231 98.0%

--------------------------------------- --------------------- ------------- --------------

Wholesale Trading GBP65 2.0%

--------------------------------------- --------------------- ------------- --------------

Germany total(7) GBP3,296 100.0% 8.4%

--------------------------------------- --------------------- ------------- --------------

ERCOT - 29.9 MW / 59.7 MWh

--------------------------------------- --------------------- ------------- --------------

Ancillary services GBP3,711 97.3%

--------------------------------------- --------------------- ------------- --------------

Wholesale Trading GBP104 2.7%

--------------------------------------- --------------------- ------------- --------------

ERCOT total GBP3,815 100.0% 9.7%

--------------------------------------- --------------------- ------------- --------------

Portfolio total - 291.6 MW / 262.3 MWh GBP39,299 100.0% 100.0%

--------------------------------------- --------------------- ------------- --------------

Market Revenue GBP(000s) GBP(000s)/MW/yr GBP/MW/hr GBP(000s)/MWh/yr GBP/MWh/hr

----------------- ----------------- --------------- --------- ---------------- ----------

GB GBP15,188 GBP138 GBP15.80 GBP150 GBP17.17

----------------- ----------------- --------------- --------- ---------------- ----------

Irish GBP17,000 GBP131 GBP14.93 GBP234 GBP26.73

----------------- ----------------- --------------- --------- ---------------- ----------

Germany GBP3,296 GBP150 GBP17.10 GBP114 GBP12.97

----------------- ----------------- --------------- --------- ---------------- ----------

ERCOT GBP3,815 GBP128 GBP14.59 GBP64 GBP7.30

----------------- ----------------- --------------- --------- ---------------- ----------

Weighted averages GBP135 GBP15.39 GBP150 GBP17.10

----------------- ----------------- --------------- --------- ---------------- ----------

Total Revenue

(GBP000s) Jun-end Sep-end Dec-end Mar-end

------------- --------- -------- --------- --------

GB GBP4,844 GBP4,675 GBP3,657 GBP2,012

------------- --------- -------- --------- --------

NI GBP3,264 GBP1,963 GBP4,969 GBP5,313

------------- --------- -------- --------- --------

ROI GBP395 GBP403 GBP406 GBP287

------------- --------- -------- --------- --------

Germany GBP807 GBP1,076 GBP918 GBP494

------------- --------- -------- --------- --------

ERCOT GBP1,238 GBP1,529 GBP813 GBP235

------------- --------- -------- --------- --------

TOTAL GBP10,548 GBP9,646 GBP10,763 GBP8,341

------------- --------- -------- --------- --------

6 The Company holds a 49 % ownership interest in Cenin (4.0 MW)

and retains 49% of the generated revenue.

7 The Company holds a 90% ownership interest in Cremzow (22 MW)

and retains 90% of the generated revenue, while Enertrag maintains

a minority stake in the asset.

The charts on page 20 of the annual report highlight the

seasonal variation in each market and how the Company's diverse

portfolio results in exposure to lucrative opportunities when one

market is experiencing a downturn. As detailed above, saturation in

the GB ancillary market drove clearing prices down at the same time

as a pickup in the Irish market. While the overall result was lower

year-on-year fleet revenue in the March-end quarter, the impact

would have been more significant if the portfolio had been solely

exposed to the price decline in GB.

Operational

The operational assets (weighted by asset capacity in MW)

achieved over 95% availability during the year. This excellent

performance was supported by the increased availability of the GB

portfolio and a successful operational takeover of the Porterstown

asset in Ireland.

Great Britain: The overall availability for the GB fleet was

positive, highlighting successful interventions by the Commercial

Manager and management of O&M contracts over the year. The

latter half of the year showed a c. 5% increase in weighted average

availability to 94% (from 89% in H1 2022), driven predominantly by

improvements at Boulby, Port of Tilbury and Larport. The only asset

with material reductions in availability in the latter half of the

year was Ancala due to various project issues requiring repairs

that are now resolved and where downtime is subject to liquidated

damages under availability guarantees.

Ireland: Portfolio performance in Ireland (and Northern Ireland)

remains a highlight, with weighted availability (by MW capacity) of

99% over the reporting period between the three Irish projects. The

Company saw its first asset in the Republic of Ireland,

Porterstown, enter operations in January 2023. To date, there have

been no availability reductions with the asset. The Northern Irish

assets-Drumkee and Mullavilly-continue to meet performance

expectations and achieved 97% and 99% availability over the year,

respectively. Availability was impacted by quickly resolved

inverter failures. The O&M provider is providing additional

training with the supplier to further improve repair times in

future.

DS3 services provide most of the revenue for all three

operational Irish projects. In the reporting period, all DS3

events-instances where grid frequency drops below 49.8Hz and asset

response is assessed by the system operator- recorded on the Irish

network were successfully delivered and each project was monetised

successfully. The Commercial Manager's improvements to the

technical response of the assets addressed issues seen during the

previous financial year, highlighting the benefit of the Commercial

Manager's experienced technical team managing the assets.

Germany: The Cremzow project is generally performing well. In

July 2022, an inverter issue with the 2 MW proportion of the

project impacted availability but was resolved in a timely manner.

Availability impacts were infrequent and isolated over the year,

limiting the impact through timely successful maintenance

activities and active engagement by the Commercial Manager. The

asset recorded 96% availability over the reporting period and there

are no ongoing concerns, with availability expected to remain

high.

US - Texas: The three operational assets-Snyder, Sweetwater and

Westover-performed well during the period. Technical performance

was good across the 9.95 MW projects, and their total availability

averaged over 95%. The most notable availability impact was a

commercial restriction at Westover due to miscommunication between

the optimiser and the Texas system operator ERCOT, resulting in

lower availability in October 2022 (no ongoing concern). System

inverter issues were observed with limited availability impacts on

each occurrence, and the Investment Manager opted to make

preventative improvements to all inverters, which drove

availability reductions in H2 2022 but are expected to improve

availability over the longer term.

Table 8

H1 22/23

Region Availability

------------------ -------------

GB 88.8%

IRE 97.7%

GER 94.7%

ERCOT 96.7%

Weighted average: 93.6%

------------------ -------------

H2 22/23

Region Availability

------------------ -------------

GB 94.2%

------------------ -------------

IRE 99.0%

------------------ -------------

GER 96.7%

------------------ -------------

ERCOT 93.8%

------------------ -------------

Weighted average: 96.5%

------------------ -------------

FY-22/23 Availability

Region (% YTD)

------------------ ---------------------

GB 91.5%

------------------ ---------------------

IRE 98.6%

------------------ ---------------------

GER 95.7%

------------------ ---------------------

ERCOT 95.2%

------------------ ---------------------

Weighted average: 95.4%

------------------ ---------------------

Asset management developments

It was an exciting year for energy storage, particularly for

operations of the Company's portfolio. The Investment Manager

successfully onboarded assets on two new transmission networks: in

Germany and Texas. The over 95% availability on each of these grids

demonstrated the team's ability to quickly build and manage

relationships with new contractors despite the expansion into new

territories.

The Investment Manager's in-house technical team grew

substantially over the period and drove important initiatives for

the Company's operational assets and pipeline. The first retrofit

of an electrolyte vapour detection system-used to prevent the

operation of batteries in scenarios which may lead to thermal

runaway-was completed for the Cremzow project in Germany. Security

enhancements have been made to reduce the risk of thefts, enhance

safety performance (through monitoring and visibility) and gave the