TIDMHAN TIDMHANA

RNS Number : 4304I

Hansa Trust PLC

09 December 2015

Hansa, investing to create

long--term growth

Half Year Report

Six Months Ended

30 September 2015

Welcome

I'm pleased to present our Half Year Report to the

shareholders.

You will note the pace of change of the portfolio has slowed

somewhat from recent periods, now the new investments are largely

in place. Alec Letchfield outlines his thoughts on the market and

key investments in his Portfolio Manager's Report.

The Company held a well-attended AGM in July following which

Jonathan Davie assumed the role of Chairman of the Audit Committee.

As in previous years, I have noted a couple of the points discussed

at the AGM for those of you who could not attend.

Finally, by the time you receive this Report, you will no doubt

have noted that the first interim dividend of 8.0p per share for

the year to 31 March 2016 was paid on 27 November 2015.

I trust you will find our thoughts on the current market and our

prospects (both short and longer-term) interesting.

Yours sincerely

Alex Hammond-Chambers

THIS DOCUMENT IS IMPORTANT and if you are a holder of Ordinary

shares it requires your immediate attention. If you are in doubt as

to the action you should take or the contents of this document, you

should seek advice from an independent financial advisor,

authorised if in the UK under the Financial Services and Markets

Act 2000, or other appropriately authorised financial advisor if

outside of the UK. If you have sold or transferred your Ordinary

shares in the Company, you should send this document and any

accompanying Form of Proxy, immediately to the purchaser or

transferee; or to the stockbroker, bank or other agent through whom

the sale or transfer was effected for onward transmission as soon

as practicable.

COMPANY REGISTRATION AND NUMBER: The Company is registered in

England & Wales under company number 126107.

Chairman's Report to the Shareholders

Alex Hammond--Chambers

Chairman

The details of our first half year returns are covered by Alec

Letchfield's Portfolio Manager's Report, allowing me to report on

the long-term (five year) returns, which are the Company's stated

goals. So the basic statistics covering the last five years

are:

5 Year Performance to 30 SepT 2015

Sept Sept

2010 2015

Net Asset Value 1,017.80p 1,083.50p +6.5%

--------- --------- ------

Net Asset Value (Total Divs

(total return) Paid: 64.5p) +12.8%

-------------------- ------

Benchmark +18.8%

--------- --------- ------

These returns lag behind our benchmark but they are made up of

two distinct returns within the portfolio - from our holding in

Ocean Wilsons Holdings Ltd ("OWH") and from the rest of the Hansa

Trust portfolio:

Net Asset Value ("NAV") per HT Share

Rest of Portfolio OWH Total NAV

Sept-10 579.4p 438.4p 1,017.8p

----------------- ------- ---------

Sept-15 787.3p 296.2p 1,083.5p

----------------- ------- ---------

Movement +207.9p -142.2p +65.7p

----------------- ------- ---------

+35.9% -32.4% +6.5%

----------------- ------- ---------

The table above shows that the 'Rest of Portfolio' (pre and post

the strategy changes) has fared really rather well.

Shareholders will be very aware of the much publicised political

and economic circumstances in Brazil, which have had a marked

effect on OWH's share price (-32.4% over the five years). The share

price of its Brazilian subsidiary, Wilson Sons, actually rose 10%

over the period in Brazilian Real, but the collapse of the value of

the Brazilian currency turned that increase into a decline of 51%

when expressed in Sterling. That the share price of Wilson Sons

should have risen in value against the huge headwind of the

declining stock market is testament to the progress the company has

made over the last five years, in developing its marine services

business and the high regard in which the company and its

management is held.

Share Prices

Sept 2010 Sept 2015

Ocean Wilsons

(GBP) 1,125.0p 760.0p -32.4%

--------- --------- ------

Wilson Sons (BRL) BRL 26.5 BRL 29.2 +10.1%

--------- --------- ------

Wilson Sons (GBP) 993.0p 487.2p -50.9%

--------- --------- ------

Brazil's BOVESPA

(BRL) 69,429.8 45,059.3 -35.1%

--------- --------- ------

Brazil's BOVESPA

(GBP) 26,007.9 7,517.5 -71.1%

--------- --------- ------

Brazilian Real/GBP BRL 2.670 BRL 5.994 -55.5%

--------- --------- ------

The decline in the value of our holding in Ocean Wilsons has

tended to mask the progress made in the rest of the portfolio.

Shareholders will be aware of the development of our investment

strategy which we undertook in the early part of 2014, which has

now been running for about a year and a half. Alec's report goes

into some detail on it, commenting on the four different investment

silos we have adopted as part of that strategy.

Long-term Share Price Returns

Of course the returns which matter most are those shareholders

experience through their shareholdings - in turn through the share

prices. The table below provides the data concerning the two

classes of shares and their share prices over the period.

5 Year Performance to 30th SepT 2015

Sept Sept

2010 2015

Ordinary Share Price 837.50p 813.80p -2.8%

------- ------- -----

Ordinary Share Price (Total Divs

(total return) Paid: 64.5p) +4.9%

---------------- -----

Discount: Ordinary

Share -17.7% -24.9%

------- ------- -----

"A" Ordinary Share

Price 820.00p 782.50p -4.6%

------- ------- -----

"A" Ordinary Share (Total Divs

Price (total return) Paid: 64.5p) +3.3%

---------------- -----

Discount: "A" Ordinary

Share -19.4% -27.8%

------- ------- -----

These share price return figures are heavily influenced by the

fact that the discount has widened because, we believe, of the

Brazilian factor with which our shares are associated. I comment on

the situation in Brazil below, but I reiterate the point made in

the last Annual Report that "it will take time for Brazil to turn

itself around and re--engage the attention of international

investors, it (a lower discount) will not be realised overnight".

We do believe that, with improvements in the Brazilian story, which

will in time come, the discounts on our shares will narrow.

Interestingly our five year record coincides with this period of

Brazilian difficulties to which I refer overleaf.

Brazil

The difficulties that the politics and economics of Brazil are

encountering are quite well broadcast, if only because of their

severity. The present difficulties, it can be argued, started

towards the end of 2011 and the beginning of 2012 when the price of

commodities around the world started to fall and the value of the

US Dollar started to rise. Brazil's BOVESPA peaked at circa

BRL73,000 towards the end of 2010 (BRL45,000 at the end of

September 2015); the Real was circa BRL1.70 per US Dollar (BRL3.96

at the end of September 2015) and many of the important commodities

peaked in the first half of 2011 - iron ore, for instance, Brazil's

biggest commodity export, peaked in February 2011 at circa $190 per

ton (circa $55 per ton at the end of September 2015). Gradually,

over the period, the external economics of Brazil deteriorated

(notwithstanding the significant decline in the value of the Real,

the benefits of which take time to take effect). Brazil now needs a

strong government to get the country's finances back in order and

on the path to a sustainable recovery.

Meanwhile Wilson Sons has continued to prosper and is well set

to enjoy the benefits of the large investment programme it

undertook during recent years.

DIVIDEND

Shareholders will now be familiar with our new dividend policy

which is to declare at the beginning of the Company's fiscal year

and subsequently pay two interim dividends - in the case of this

fiscal year each of 8p per share, making a total of 16p for the

year as a whole. On 20 October 2015, we formerly declared the first

interim dividend of 8p, payable on 27 November 2015.

The Annual General Meeting (16 July 2015)

Shareholders will be familiar with the practice that we have

adopted of highlighting one or two of the important questions

raised at each year's Annual General Meeting - with our responses

to them. There were two I would like to highlight in this

statement:

(MORE TO FOLLOW) Dow Jones Newswires

December 09, 2015 02:00 ET (07:00 GMT)

-- Following Alec Letchfield's presentation on the portfolio and

its prospects, he was asked about the criteria he used in selecting

funds for investment and whether the liquidity of the subsequent

holding was a material consideration. Over and above the objective

of making investments in funds that our shareholders could not

easily make for themselves (and in some cases not at all), he

responded that he looked for an alignment of interest between the

manager of the fund in question and the fund itself (usually being

an investment by the manager in the fund), good stock picking

processes and disciplines and an appropriate structure of the fund

in relation to its investment objective. He stated he did not have

any overriding rules about the liquidity of investments in funds,

but rather treated each investment on a case by case basis. One of

the advantages of managing a closed ended fund - such as that of an

investment trust - is that the liquidity of the portfolio's

holdings is not an important priority.

-- The second question addressed to the Board, concerned the

validity of continuing to hold the large investment in Wilson Sons,

through Ocean Wilsons, given the difficulties occurring in Brazil.

It was noted that Wilson Sons was a well-managed company with

excellent prospects (the primary criteria for making any equity

investment) which was the reason the investment in that business

had made us a lot of money in the past. It was also pointed out

that the Board wished to keep a strategic investment in Ocean

Wilsons so Hansa Trust would be consulted should there ever be the

prospect of the sale of the company. Further, it was also noted

there had been times in the past when there were difficulties in

Brazil and when it would have been tempting to sell the Ocean

Wilsons holding but that, by not selling in difficult times, Hansa

Trust had benefitted from huge gains in the share price in better

times. The Board felt Wilson Sons was well positioned to take

advantage of the government's requirement for local (Brazilian)

involvement in marine services.

Longer-Term Prospects

It seems the world economy (in which we have - selectively

chosen - some exposure) is in the doldrums. Nobody seems to know -

with any great degree of assurance - quite which way it is drifting

- into a period of stag-deflation (to coin a rather ugly phrase!),

recession, or even rather higher inflation. With the first two

comes a continuation of quantitative easing, ultra-low interest

rates and, quite possibly, continuing buoyant securities markets -

as investors chase the income that interest rates no longer afford.

Stock markets are driven by money and confidence and, as long as

the money is there and there is confidence that the patient (the

post 2008/9 global economy) is making an albeit slow recovery

towards better times, markets will continue to perform well - as

they have done since the nadir of the early months of 2009.

The pluses are that (rather perversely) the slow global economic

growth would appear to prolong ultra-low interest rates, corporate

balance sheets are strong, profits are buoyant (albeit with one or

two problem areas - mining and oil for instance) and margins are

high. As long as this continues, the prospects for dividends and

dividend growth (a very important prop for equity markets) remain

good and the demand for equities likewise.

But there are clouds on the horizon - global debt continues to

grow and grow, some emerging market economies and their

international indebtedness are causes for concern, politics is

throwing up some strange bedfellows (particularly because of the

division caused by - perceived or otherwise - growing financial

inequality), mass immigration problems, growing concern about

cybercrime and the uncertainty of the politics of Russia and the

economics of China. Then there are the black swans which appear out

of left field, which are bemusing and worrying (Volkswagen's diesel

engine emissions scandal being the latest such event). Anyone of

them can have an effect on confidence - one of the two drivers to

markets levels I mentioned above.

And thirdly there is - what appears to be unlikely at the moment

but which can appear quite suddenly and as unexpectedly - the

possibility of rather more than mild inflation. It can literally

erupt. It would mean much higher interest rates quite quickly and

almost certainly lead to a material reverse in the value of

financial markets. Fortunately, at this time, it seems to be a

lesser possibility.

Investing in such uncertain circumstances is not easy. But in

the end though, successful long-term equity investment is all about

backing good companies/funds run by able and honest people. Our

success in our investment in Wilson Sons is just such an example of

backing good management over a long time. The rest of the portfolio

stands up to the same scrutiny which makes your Board optimistic of

long-term success, without being certain of short--term

fluctuations.

Alex Hammond--Chambers

Chairman

27 November 2015

Half Year Management Report

The Directors present their Report and Condensed Financial

Statements for the six months to 30 September 2015.

THE BOARD'S OBJECTIVES

The Board's primary objective is to achieve growth of

shareholders' value over the medium to long--term.

THE BOARD

Your Board consists of the following persons, each of whom

brings certain individual and complementary skills and experience

to the Board's workings. Individual profiles for each member of the

Board can be found in the Company's Annual Report and on our

website.

Alex Hammond-Chambers (Chairman of the Board), Jonathan Davie

(Chairman of Audit Committee), Raymond Oxford, William Salomon and

Geoffrey Wood.

BUSINESS REVIEW FOR THE SIX MONTHS TO 30 SEPTEMBER 2015

The business review, which includes an indication of important

events which have occurred within the six months to 30 September

2015, are covered in the Chairman's Report to the Shareholders and

the Portfolio Manager's Report.

KEY RISKS FOR THE FINANCIAL YEAR TO 31 MARCH 2016

The key risks and uncertainties relating to the six months ended

30 September 2015 and for the year to 31 March 2016 are covered in

the Chairman's Report to the Shareholders, the Portfolio Manager's

Report and also within the notes to the Financial Statements.

GOING CONCERN BASIS OF ACCOUNTING FOR THE FINANCIAL YEAR TO 31

MARCH 2016

The Directors consider it appropriate to adopt the going concern

basis of accounting in preparing these Half-Year Financial

Statements. The Directors do not know of any material uncertainties

to the Company's ability to continue to adopt this approach over a

period of at least 12 months from the date of approval of these

Financial Statements.

RELATED PARTY TRANSACTIONS

During the period, Hansa Capital Partners LLP charged portfolio

management fees and company secretarial fees to the Company,

amounting to GBP1,031,000, excluding VAT (year to 31 March 2015:

GBP1,968,000). Amounts outstanding at 30 September 2015 were

GBP164,000 (31 March 2015: GBP173,500).

THE BOARD'S RESPONSIBILITIES

The Board is charged by the shareholders with the responsibility

for looking after the affairs of the Company. It involves the

'stewardship' of the Company's assets and liabilities and 'the

pursuit of growth of shareholder value'. These responsibilities

remain unchanged from those detailed in the last Annual Report.

The Directors confirm to the best of their knowledge that:

-- the condensed set of Financial Statements contained within

the Half-Year Financial Report has been prepared in accordance with

International Accounting Standard 34 'Interim Financial Reporting'

and on a going concern basis.

-- this Interim Management Report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the FCA's Disclosure

and Transparency Rules.

The above Interim Management Report including the Responsibility

Statement was approved by the Board on 27 November 2015 and was

signed on its behalf by:

Alex Hammond-Chambers

Chairman

27 November 2015

Portfolio Manager's Report -

Seeing the wood for the trees

One of the most challenging and vital aspects of fund management

is separating the truly important events from the background noise.

As a fund manager, so often one becomes caught up in the day-to-day

machinations of the market, scrutinising company profit

announcements, waiting with bated breath for the next piece of

macro data and so on. In reality this is almost always

counter-productive, leading to excessive dealing, incurring high

transaction charges and hindering one's ability to spot the really

important factors. We try not to do this at Hansa. Rather, it is

most often best to ignore the short-term noise, turn off the

Bloomberg terminal if necessary and resist the urge to trade the

markets.

What is necessary, however, is to identify major inflection

points, where it is right to re--assess one's positioning and

adjust portfolios accordingly. Typically, this would be the

recognition of a coming bear market, or a supercycle beginning or

indeed ending. Correctly identifying these is challenging but

worthwhile, since the resulting asset allocation calls are the main

drivers of investment performance and are far more influential than

the outcomes of individual stocks or funds.

With this approach in mind, we consider the events of the

summer. Stock markets have been through a torrid time. In equity

markets, the MSCI World fell 5.0% during the quarter and 10.0% over

the six month period. Within this, the US, Europe and UK fell by

3.3%, 5.2% and 6.6% respectively, over three months and by 8.6%,

10.2% and 9.2% over six months. Other asset classes have not

escaped the weakness over the quarter, with oil down 21.2%, copper

by 7.2% and local currency emerging market debt by 7.1%.

Naturally we ask ourselves whether this is just a summer lull,

exacerbated by a lack of liquidity and sovereign wealth fund

selling, or if the market is signalling that something more

important is afoot and a change in strategy is required?

(MORE TO FOLLOW) Dow Jones Newswires

December 09, 2015 02:00 ET (07:00 GMT)

On the face of it there appears to be good reason for concern

with two of the most important market drivers, China and US

interest rates, experiencing important changes.

China, which has been one of the main drivers of global growth

over the past decade, is wobbling. In truth, the Chinese economy

has been experiencing a lower growth rate for some while now,

coming down from over 10% to 7%, according to official numbers.

There is a sense, however, that having expanded too quickly and

invested too heavily, growth could go into freefall. The Chinese

government has recognised this and is attempting to manage a

transition from an export driven economy to a service and consumer

led one. However, such shifts rarely happen seamlessly and its

efforts may be both too little and too late. Recent decisions to

weaken the exchange rate and artificially prop-up the stock market

only serve to fuel the belief that the situation is out of

control.

The other concern is that of a change in direction in US

interest rates. A feature of markets in recent years has been the

persistent use of liquidity in the face of economic and stock

market weakness. Undoubtedly this policy has boosted global stock

markets, as money works its way through the system in pursuit of

higher returns and income, albeit its impact on growth and lending

seems to be diminishing. Naturally, with the US nearing a turning

point in its rate cycle, and with US rates forming the basis for

the global risk free rate, there is a fear that stock markets will

decline in the face of such a change.

Exacerbating this situation is the current market backdrop. Much

like a chemical reaction, where conditions need to be optimal to

see a really explosive effect, stock markets are at their most

vulnerable at particular points in the cycle. Typically at the

start of the cycle when valuations are low and fear is high,

markets can tolerate numerous shocks and disappointments. However,

as the cycle matures and valuations rise, the ability for markets

to shake off disappointments diminishes. In the current situation,

with the maturing cycle showing high, albeit not excessive,

valuations and with markets not having experienced a meaningful

pull-back for some while now, share prices are particularly

susceptible to negative news flow.

Whether these conditions herald the next bear market is likely

to depend on the economic outlook, since true bear markets

typically go hand-in-hand with recessions. Currently, a recession

in the developed world, which continues to dominate global stock

markets, does not appear likely. Growth is undoubtedly lacklustre

but nonetheless positive. The US and UK lead the way with their

cycles being more advanced and growth more robust, but even Europe

is seeing positive signs of a recovery in growth from depressed

levels.

The outlook for emerging markets is less clear. With Chinese

growth falling and many commodity-exporting emerging nations under

pressure in the face of weakening commodity prices, prospects for

their economies and stock markets remain challenging. To a large

degree this is captured in current valuations, which are now

significantly below most developed markets. Unfortunately these

situations have a habit of persisting for longer than one expects,

and typically prior excesses lead to prices over-shooting on the

downside.

The concern has been that this slow-down in emerging markets

causes a recession in developed markets. Back in 1998, when many

emerging markets experienced a sharp decline in their growth,

developed markets escaped relatively unscathed. With emerging

markets now much larger, however, and with global trade now far

more interconnected, the danger of weakness in emerging markets

rippling through to developed markets is greater. Our sense at this

point is that whilst any emerging market weakness will weigh on

developed market growth, it will not push them into recession.

Partly this reflects the fact that most developed markets are

commodity importers and are the beneficiaries of weak commodity

prices. Also, since many emerging markets are net exporters, they

are not key sources of demand for developed markets and hence their

impact is more muted.

Taking into account all these factors, we conclude that the

markets have probably experienced a summer lull, albeit a

particularly severe one. We acknowledge that the uncertainty in the

global economy, combined with the slowdown in China and the

anticipated rate rising cycle in the US, are likely to contribute

to ongoing bouts of volatility. However, we are not making

significant changes to our strategy, although we are looking to add

less correlated investments in order to help protect against market

draw--downs.

Portfolio Review and Activity

During this challenging period for markets, your Company's NAV

has returned -4.1% on a total return basis over the six month

period to the end of September, with the NAV falling from 1,138.6p

per share to 1,091.4p per share (again, on a total return basis

including the dividend of 8.0p per share paid in the period).

Excluding the Brazil-focused Ocean Wilsons Holdings the Company's

NAV has returned -3.6%. This compares to a return of 1.7% for the

benchmark, which is absolute in nature, and -11.0% for the MSCI All

Country World Index. Underlying contributors to this performance

are discussed in the silo review below.

Activity levels have been modest over the period, reflecting the

fact that most of the changes post the strategic review have now

been made. In the second quarter we sold JO Hambro Japan and

purchased the Lyxor Nikkei 400 ETF, a passive fund that tracks the

new Japanese index focusing on those companies with good

shareholder returns and corporate governance. We also purchased

Indus Japan Long Only, an active Japanese fund with a focus on

larger capitalisation stocks and added to our position in Goodhart

Hanjo Japan following a positive update with the manager.

We also purchased the Global Event Partners Fund managed by

BlackRock, reflecting our desire to start adding less correlated

investments, which will provide us with some protection from

falling markets as the stock market cycle matures.

Core/Regional funds

As would be expected, the Core/Regional silo saw a wide range of

returns over the past six months. Pleasingly our two hedge funds

produced robust returns with BlackRock European Hedge rising by

12.9% and CF Odey UK Absolute Return by 6.1%. The manager of the

BlackRock European Hedge fund, Alister Hibbert, has managed risk

well, reducing his overall exposure to markets and has also made

money by being short a number of names in the commodity sector. We

feel we have the great advantage of having access to some of the

world's best fund managers, which provides us insight into their

thoughts on markets. Our discussions with Alister Hibbert reinforce

our macro view, as he argues China is unlikely to derail the

domestic recovery in Europe, whilst acknowledging that we remain in

a low growth world.

Your Company's exposures to Asian and emerging markets have

unsurprisingly been under pressure, with Schroder ISF Asian Total

Return, Prince Street Institutional and NTAsian Discovery down by

12.5%, 14.8% and 23.4% respectively over the past half year. The

combined exposure to the latter two is relatively modest at just 2%

of portfolio assets, whilst the weighting in Schroder Asian, which

actively manages its risk levels, is higher at 2.3%.

Eclectic and Diversifying funds

The Eclectic and Diversifying silo also saw a spread of returns

over the past six months. DV4, our property investment, returned an

excellent 9.3% whereas our technology fund, GAM Star Technology and

JLP Credit Opportunity fell by 14.6% and 15.3%, respectively. JLP

is a fund which invests in stressed credit that typically comes

under pressure at the very end of a cycle, as recession nears and

defaults start to rise. This is not what we envisage in the

near--term and we suspect the recent underperformance partly

reflects the low liquidity in the sector owing to regulatory

restrictions on banks. As coupons are paid and bonds are redeemed

we would expect significant value to be realised.

UK Equities

Our largest holding, NCC Group (Mkt Cap GBP630m), was purchased

at IPO in 2004 and is fundamentally a services business, with the

world's largest team of highly skilled testers or "ethical hackers"

who find vulnerabilities in companies' cyber defences, offering an

almost unique way to play the cybersecurity theme in the UK. The

firm's Domain Services proposition is an internally funded start-up

which is still evolving towards a higher proportion of consultancy

type revenues, as it aims to create a safe corner of the internet.

The original Escrow division remains the cornerstone of the group

and is highly cash generative, storing software source code for

critical applications, to ensure business continuity should a

software vendor fail. The dividend has been increased at a compound

rate of 25% pa since the company floated in 2004.

While on the subject of cybersecurity, Experian (Mkt Cap

GBP10.6bn), now the only FTSE 100 holding left in the portfolio,

recently announced that its North American business experienced an

unauthorised acquisition of information from a server that

contained data, on behalf of one of its clients (T-Mobile, USA,

Inc), on approximately 15 million consumers in the US. While

regrettable, similar instances are unfortunately commonplace in

such businesses and importantly the breach did not involve payment

card numbers or banking information.

(MORE TO FOLLOW) Dow Jones Newswires

December 09, 2015 02:00 ET (07:00 GMT)

Hansteen Holdings (Mkt Cap GBP885m) invests primarily in

industrial properties in the UK and Europe, focusing on properties

with the potential for high yields and opportunities for value

improvement. The portfolio is diversified in terms of country and

tenant type and is weighted 50% in Germany, 28% in the UK and 22%

in Northern Europe. It is managed on a very hands-on basis via a

platform of 16 regional offices. Since inception, Hansteen has

delivered strong NAV returns alongside an attractive and growing

dividend. Owing to the increasingly strong occupier and investment

demand within the market, this is expected to continue.

UBM (Mkt Cap GBP2.3bn), a leading global marketing services and

communications company, whose primary focus is events, has

confirmed it is in discussions with a number of parties about a

potential sale of its PR Newswire business, which would turn UBM

into a fully-focused events business which could drive a re-rating

of its shares.

Ocean Wilsons Holdings

The second quarter results for Wilson Sons, which were released

in August, showed a strong rise in EBITDA of 37.8% from the

previous year. This was despite the continuing weak macroeconomic

picture in Brazil. During the year, the Wilson Sons' share price,

in Brazilian Real terms, has increased 4.2% from BRL28.3 to

BRL29.5, at a time when the BOVESPA has weakened by 11.9%. The

resilience of the company's logistics and maritime operations is

encouraging and demonstrates the benefits of the company's

diversity.

Revenues in Container Terminals continue to be pressured, down

18.1% from the previous year, but there are signs that agricultural

exports through the terminals are picking up, helped by the weak

Real. Meanwhile, Towage revenues improved 3.9%, owing to increases

in harbour manoeuvres and special operations during the quarter.

Growth in harbour manoeuvres was mainly driven by new port

operations in the state of Pará, while the expanding special

operations helped contribute to an increased EBITDA margin of 44.6%

in the segment.

The portfolio of Ocean Wilsons Investments, the subsidiary of

OWH, was valued at $248.5m at the end of June 2015, which was down

slightly from $251.7m at the end of December 2014. The decline was

primarily due to $7.0m of dividends paid in the period, principally

to fund the 2014 final dividend payment to shareholders of OWH. The

time-weighted, gross--of-fees, performance over this six month

period was 2.2%.

In the third quarter, the share price of OWH fell by 14.8% (in

Pound Sterling terms), meaning it is down 11.0% over the first six

months of our company's financial year, and down 7.0% with

dividends reinvested. The share price represents a discount to the

look-through NAV of 26.1%, based on the market value of the Wilson

Sons' shares together with the latest valuation of the investment

portfolio.

Company share performance and discount

During the six months to September 2015, the Ordinary and 'A'

non-voting Ordinary share prices fell by 46.2p and 45.0p

respectively - both approximately 5.4% of their values at 31 March

2015. Whilst this is partly a reflection of the wider market

malaise during this time (the MSCI All Countries World Index fell

11.9% during this period), it is mainly the impact of the falling

value of OWH on the portfolio which, as noted above, has suffered

due to the weakening Brazilian Real and fallen by 10.2% in Sterling

terms or c.33p per Hansa share.

During this period, the discount of both share classes has

remained fairly constant (Ordinary: 24.9%; 'A' non-voting Ordinary:

27.8%). We believe that a key reason for the ongoing discount is

the continuing market uncertainly over the Brazilian economy.

Summary

The current market setback represents one of the most

significant tests since we began the long road to recovery post the

Great Financial Crisis, matched only by the Euro crisis of 2011. As

discussed above, we do not believe this heralds the next recession

and bear market in the developed economies, but it is a situation

we will monitor closely. However, we do expect to see ongoing

volatility as the slowdown in China and other emerging markets

plays out.

We remain encouraged by the progress of your portfolio, which

whilst not delivering positive returns over the past few months,

has significantly outperformed global equity markets. The vast

majority of the strategic changes have now been made such that we

have a blend of both direct UK equities and complementary

world-class funds. Undoubtedly our investment in Wilson Sons, via

the holding in Ocean Wilsons Holdings, is weighing on sentiment but

we remain of the view this is an excellent company that will emerge

from the crisis in Brazil as a stronger and even more successful

entity. Furthermore, at just 15% of the Hansa Trust assets, and

with the Trust standing on a 26% discount to NAV, you could argue

you are getting this great company for free!

Alec Letchfield

Hansa Capital Partners LLP

October 2015

Portfolio Statement

as at 30 September 2015

Investments Fair value Percentage of

GBP000 Net Assets

UK Equity

---------- -------------

NCC Group PLC 14,385 5.5

---------- -------------

Hansteen Holdings PLC 8,608 3.3

---------- -------------

Galliford Try PLC 8,297 3.2

---------- -------------

UBM PLC 7,859 3.0

---------- -------------

Experian PLC 5,444 2.1

---------- -------------

Great Portland Estates PLC 5,127 2.0

---------- -------------

Cape PLC 4,112 1.6

---------- -------------

Brooks Macdonald Group PLC 3,418 1.3

---------- -------------

Goals Soccer Centres PLC 3,359 1.3

---------- -------------

Hargreaves Services PLC 2,368 0.9

---------- -------------

Hilton Food Group PLC 1,661 0.6

---------- -------------

Cairn Energy PLC 743 0.3

---------- -------------

Petroceltic International PLC 453 0.2

---------- -------------

Immupharma PLC 400 0.2

---------- -------------

Altitude Group PLC 330 0.1

---------- -------------

Seven other investments 448 0.2

---------- -------------

Total UK Equity 67,012 25.8

---------- -------------

Strategic

---------- -------------

Wilson Sons (through our holding in Ocean Wilsons

Holdings) * 39,222 15.1

---------- -------------

Total Strategic 39,222 15.1

---------- -------------

Core Regional Funds

---------- -------------

Findlay Park American Fund 11,700 4.5

---------- -------------

Adelphi European Select Equity Fund Class F 8,656 3.3

---------- -------------

Select Equity Offshore Ltd Class D 7,636 2.9

---------- -------------

Goodhart Partners Longitude Fund: Hanjo Fund 7,429 2.9

---------- -------------

Vulcan Value Equity Fund 7,308 2.8

---------- -------------

Indus Japan Long Only Fund 6,281 2.4

---------- -------------

CF Odey UK Absolute Return Fund Class I 5,976 2.3

---------- -------------

Schroder ISF Asian Total Return Fund Class

D 5,863 2.3

---------- -------------

BlackRock European Hedge Fund Class I 4,900 1.9

---------- -------------

Pershing Square Holdings 4,687 1.8

---------- -------------

(MORE TO FOLLOW) Dow Jones Newswires

December 09, 2015 02:00 ET (07:00 GMT)

Vanguard FTSE Developed Europe ex UK Equity

Index 3,659 1.4

---------- -------------

Lyxor UCITS ETF JPX - Nikkei 400 3,581 1.4

---------- -------------

Prince Street Institutional Offshore Ltd 3,314 1.3

---------- -------------

NTAsian Discovery Fund Classes A & B 2,013 0.8

---------- -------------

Total Core Regional Funds 83,003 32.0

---------- -------------

Eclectic & Diversifying Assets

---------- -------------

Ocean Wilsons Investments (through our holding

in Ocean Wilsons Holdings) * 31,859 12.3

---------- -------------

DV4 Ltd 11,837 4.5

---------- -------------

GAM Star Technology Fund 8,888 3.4

---------- -------------

Global Event Partners Ltd Class F 7,937 3.0

---------- -------------

JLP Credit Opportunity Cayman Fund 4,026 1.5

---------- -------------

Total Eclectic & Diversifying Assets 64,547 24.7

---------- -------------

Total Investments 286,829 97.6

---------- -------------

Net current assets/(liabilities) 6,251 2.4

---------- -------------

Net Assets 260,035 100.0

---------- -------------

*Hansa Trust owns 9,352,770 shares in Ocean Wilsons Holdings

Limited ("OWH"). In order to reflect better Hansa Trust's exposure

to different market silos, the two subsidiaries of OWH, Wilson Sons

and Ocean Wilsons (Investments) Ltd ("OWIL") are shown separately

above. The fair value of Hansa Trust's holding in OWH has been

apportioned across the two subsidiaries in the ratio of the latest

reported NAV of OWIL, that being the NAV of OWIL shown per the 30

June 2015 OWH accounts, to the market value of OWH's holding in

Wilson Sons, that being the bid share price of Wilson Sons

multiplied by the number of shares held by OWH at 30 September

2015.

Financial Statements

Condensed Group Income Statement

For the six months ended 30 September 2015

(Unaudited) (Unaudited) (Unaudited)

Six months ended Six months ended Year ended

30 September 2015 30 September 2014 31 March 2015

Revenue Capital Total Revenue Capital Revenue Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- -------- ------- ------- ------- ------- -------- --------

Losses on investments

held at fair value - (14,963) (14,963) - (1,020) (1,020) - (12,707) (12,707)

------- -------- -------- ------- ------- ------- ------- -------- --------

Exchange losses on

currency balances - (13) (13) - (32) (32) - (12) (12)

------- -------- -------- ------- ------- ------- ------- -------- --------

Investment income 5,143 - 5,143 5,405 - 5,405 6,302 - 6,302

------- -------- -------- ------- ------- ------- ------- -------- --------

5,143 (14,976) (9,833) 5,405 (1,052) 4,353 6,302 (12,719) (6,417)

------- -------- -------- ------- ------- ------- ------- -------- --------

Investment management

fees (981) - (981) (935) - (935) (1,868) - (1,868)

------- -------- -------- ------- ------- ------- ------- -------- --------

Other expenses (523) - (523) (527) - (527) (1,274) - (1,274)

------- -------- -------- ------- ------- ------- ------- -------- --------

(1,504) - (1,504) (1,462) - (1,462) (3,142) - (3,142)

------- -------- -------- ------- ------- ------- ------- -------- --------

Profit/(Losses) before

finance costs and

taxation 3,639 (14,976) (11,337) 3,943 (1,052) 2,891 3,160 (12,719) (9,559)

------- -------- -------- ------- ------- ------- ------- -------- --------

Finance costs - - - (5) - (5) (7) - (7)

------- -------- -------- ------- ------- ------- ------- -------- --------

Profit before taxation 3,639 (14,976) (11,337) 3,938 (1,052) 2,886 3,153 (12,719) (9,566)

------- -------- -------- ------- ------- ------- ------- -------- --------

Taxation - - - - - - - - -

------- -------- -------- ------- ------- ------- ------- -------- --------

Profit for the period 3,639 (14,976) (11,337) 3,938 (1,052) 2,886 3,153 (12,719) (9,566)

------- -------- -------- ------- ------- ------- ------- -------- --------

Return per Ordinary

and 'A' non-voting

Ordinary share 15.2p (62.4)p (47.2)p 16.4p (4.4)p 12.0p 13.1p (53.0)p (39.9)p

------- -------- -------- ------- ------- ------- ------- -------- --------

The Company does not have any income or expense that is not

included in the Profit/(Loss) for the period. Accordingly the

"Profit/(Loss) for the period" is also the "Total Comprehensive

Income for the period", as defined in IAS 1 (revised) and no

separate Statement of Comprehensive Income has been presented.

The total column of this statement represents the Group's Income

Statement, prepared in accordance with IFRS. The supplementary

revenue and capital return columns are both prepared under guidance

published by the Association of Investment Companies.

All revenue and capital items in the above statement derive from

continuing operations.

Condensed Statement of Changes in Equity

For the six months ended 30 September 2015

(Unaudited)

Capital

Share redemption Retained

capital reserve earnings Total

GBP000 GBP000 GBP000 GBP000

Net assets at 1 April 2015 1,200 300 271,792 273,292

-------- ----------- --------- --------

Losses for the period - - (11,337) (11,337)

-------- ----------- --------- --------

Dividends - - (1,920) (1,920)

-------- ----------- --------- --------

Net assets at 30 September 2015 1,200 300 258,535 260,035

-------- ----------- --------- --------

Condensed Statement of Changes in Equity

For the six months ended 30 September 2014

(Unaudited)

Capital

Share redemption Retained

capital reserve earnings Total

GBP000 GBP000 GBP000 GBP000

Net assets at 1 April 2014 1,200 300 285,913 287,413

-------- ----------- --------- -------

Gains for the period - - 2,886 2,886

-------- ----------- --------- -------

Dividends - - (2,640) (2,640)

-------- ----------- --------- -------

Net assets at 30 September 2014 1,200 300 286,159 287,659

-------- ----------- --------- -------

Condensed Statement of Changes in Equity

For the year ended 31 March 2015

(MORE TO FOLLOW) Dow Jones Newswires

December 09, 2015 02:00 ET (07:00 GMT)

(Audited)

Capital

Share redemption Retained

capital reserve earnings Total

GBP000 GBP000 GBP000 GBP000

Net assets at 1 April 2014 1,200 300 285,913 287,413

-------- ----------- --------- -------

Losses for the period - - (9,566) (9,566)

-------- ----------- --------- -------

Dividends - - (4,555) (4,555)

-------- ----------- --------- -------

Net assets at 31 March 2015 1,200 300 271,792 273,292

-------- ----------- --------- -------

Condensed Group Balance Sheet

as at 30 September 2015

(Unaudited) (Unaudited) (Audited)

30 September 30 September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

Non-current assets

-------------- -------------- ----------

Investments held at fair value through profit

or loss 253,784 280,969 255,264

-------------- -------------- ----------

253,784 280,969 255,264

-------------- -------------- ----------

Current assets

-------------- -------------- ----------

Trade and other receivables 377 9,302 9,358

-------------- -------------- ----------

Cash and cash equivalents 6,174 750 9,039

-------------- -------------- ----------

6,551 10,052 18,397

-------------- -------------- ----------

Current liabilities

-------------- -------------- ----------

Trade and other payables (300) (3,362) (369)

-------------- -------------- ----------

Net current assets 6,251 6,690 18,028

-------------- -------------- ----------

Net assets 260,035 287,659 273,292

-------------- -------------- ----------

Capital and reserves

-------------- -------------- ----------

Called up share capital 1,200 1,200 1,200

-------------- -------------- ----------

Capital redemption reserve 300 300 300

-------------- -------------- ----------

Retained earnings 258,535 286,159 271,792

-------------- -------------- ----------

Total equity shareholders' funds 260,035 287,659 273,292

-------------- -------------- ----------

Net asset value per Ordinary and 'A' non-voting

Ordinary share 1,083.4p 1,198.5p 1,138.6p

-------------- -------------- ----------

Condensed Cash Flow Statement

For the six months ended 30 September 2015

(Unaudited) (Unaudited) (Audited)

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

Cash flows from operating activities

------------- ------------- ---------

(Loss)/Gain before finance costs and taxation (11,337) 2,891 (9,559)

------------- ------------- ---------

Adjustments for:

------------- ------------- ---------

Realised gains on investments (2,427) (5,480) (10,803)

------------- ------------- ---------

Unrealised losses on investments 17,390 6,500 23,510

------------- ------------- ---------

Effect of foreign exchange rate changes 13 32 12

------------- ------------- ---------

(Increase)/decrease in trade and other receivables (191) (2,393) 3,487

------------- ------------- ---------

(Decrease)/increase in trade and

------------- ------------- ---------

other payables (69) (19) 88

------------- ------------- ---------

Taxes paid - - -

------------- ------------- ---------

Purchase of non - current investments (27,725) (67,566) (82,976)

------------- ------------- ---------

Sale of non - current investments 23,414 53,112 76,604

------------- ------------- ---------

Net cash (outflow)/inflow from operating activities (932) (12,923) 363

------------- ------------- ---------

Cash flows from financing activities

------------- ------------- ---------

Interest paid on bank loans - (5) (7)

------------- ------------- ---------

Dividends paid (1,920) (2,640) (4,555)

------------- ------------- ---------

Drawdown of loans - 3,100 -

------------- ------------- ---------

Net cash outflow/(inflow) from financing activities (1,920) 455 (4,562)

------------- ------------- ---------

Decrease in cash and cash equivalents (2,852) (12,468) (4,199)

------------- ------------- ---------

Cash and cash equivalents at beginning of period 9,039 13,250 13,250

------------- ------------- ---------

Effect of foreign exchange rate changes (13) (32) (12)

------------- ------------- ---------

Cash and cash equivalents at end of period 6,174 750 9,039

------------- ------------- ---------

Notes to the Condensed Financial Statements

1. ACCOUNTING POLICIES

The Financial Statements of the Group have been prepared under

the historical cost convention, except for the measurement at fair

value of investment, and in accordance with International Financial

Reporting Standards ("IFRS") as adopted by the European Union.

The Half Year Financial Statements have been prepared in

accordance with International Accounting Standard 34 "Interim

Financial Reporting" and are consistent with the basis of the

accounting policies set out in the Group and Company's Annual

Report and Accounts at 31 March 2015.

(MORE TO FOLLOW) Dow Jones Newswires

December 09, 2015 02:00 ET (07:00 GMT)

These Financial Statements are presented in Sterling, the

currency of the primary economic environment in which the Group

operates.

2 INCOME

(Unaudited) (Unaudited) (Audited)

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

Income from quoted investments

------------- ------------- ---------

UK dividends 1,083 1,553 2,428

------------- ------------- ---------

Overseas and other dividends 3,924 3,811 3,737

------------- ------------- ---------

Property income distributions 133 41 137

------------- ------------- ---------

5,140 5,405 6,302

------------- ------------- ---------

Other income

------------- ------------- ---------

Interest receivable on AAA rated money market

funds 3 - -

------------- ------------- ---------

Total income 5,143 5,405 6,302

------------- ------------- ---------

3 DIVIDENDS PAID

(Unaudited) (Unaudited) (Audited)

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2015 2014 2015

GBP000 GBP000 GBP000

Final dividend for 2015: 0.0p (2014: 11.0p) - 2,640 2,640

------------- ------------- ---------

Second interim dividend for 2015 (paid May 2015):

8.0p (2014: 0.0p) 1,920 - -

------------- ------------- ---------

First interim dividend for 2015 (paid November

2014): 8.0p - - 1,920

------------- ------------- ---------

Unclaimed dividends refunded - - (5)

------------- ------------- ---------

4,555

------------- ------------- ---------

Note: The first interim dividend for 2016, payable in November

2015 will be 8.0p per share (2015, paid November 2014: 8.0p).

4 RETURN PER SHARES

The returns stated below are based on 24,000,000 shares, being

the weighted average number of shares in issue during the

period.

Revenue Capital Total

Pence Pence Pence

Period GBP000 per share GBP000 per share GBP000 per share

---------- -------- ---------- -------- ----------

Six months ended 30 September

2015 (Unaudited) 3,639 15.2 (14,976) (62.4) (11,337) (47.2)

----- ---------- -------- ---------- -------- ----------

Six months ended 30 September

2014 (Unaudited) 3,938 16.4 (1,052) (4.4) 2,886 12.0

----- ---------- -------- ---------- -------- ----------

Year ended 31 March 2015 (Audited) 3,153 13.1 (12,719) (53.0) (9,566) (39.9)

----- ---------- -------- ---------- -------- ----------

5 FINANCIAL INFORMATION

The financial information contained in this Half Year Report is

not the Company's statutory accounts as defined in section 434-436

of the Companies Act 2006. The financial information for the six

months ended 30 September 2015, and 30 September 2014 are not for a

full financial year, have not been audited or reviewed by the

Auditors and have been prepared in accordance with accounting

policies consistent with those set out in the Annual Report and

Accounts for the year ended 31 March 2015.

The statutory accounts for the financial year ended 31 March

2015 have been delivered to the Registrar of Companies and received

an Audit Report which was unqualified, did not include a reference

to any matters to which the Auditors drew attention by way of

emphasis without qualifying the report and did not contain

statements under section 498 (2), (3) and (4) of the Companies Act

2006.

The Half Year financial information was approved by the Board of

Directors on 27 November 2015.

6 NET ASSET VALUE PER SHARE

The Net Asset Value per share is based on the net assets

attributable to equity shareholders of GBP260,035,000 (30 September

2014: GBP287,659,000; 31 March 2015: GBP273,292,000) and on

24,000,000 shares, being the number of shares in issue at the

period ends.

7 COMMITMENTS AND CONTINGENCIES

The Company has a commitment to DV4 Ltd, an unquoted property

investment company. As of 7 March 2015, the investment period for

DV4 ended. Under the commitment agreement, this allows DV4 to call

the remaining outstanding amount of the original commitment but

only for existing projects for a period of two years, or for the

payment of expenses and liabilities of DV4. As at 30 September

2015, the Company's undrawn commitment was GBP702,372 and the

interest free loan referred to in past reports had been fully

repaid (30 September 2014: undrawn commitment GBP1,296,227; loan

GBP1,162,880). The holding in DV4 is held at a current valuation of

GBP11,837,000 (2014: GBP9,120,000).

8 PRINCIPAL RISKS AND UNCERTAINTIES

The principal financial and related risks faced by the Company

fall into the following broad categories - External and Internal.

External risks to shareholders and their returns are those that can

severely influence the investment environment within which the

Company operates: including government policies, economic

recession, declining corporate profitability, rising inflation and

interest rates and excessive stock market speculation. Internal and

operational risks to shareholders and their returns are: portfolio

(stock and sector selection and concentration), balance sheet

(gearing), and/or administrative mismanagement. In respect of the

risks associated with administration, the loss of Approved

Investment Trust status under s.1158 CTA 2010 would have the

greatest impact.

A review of the half year and the outlook for the Company can be

found in the Chairman's Report to the Shareholders and in the

Portfolio Manager's Review.

Information on each of these areas is given in the Strategic

Report within the Annual Report and Accounts for the year ended 31

March 2015. In the view of the Board these principal risks and

uncertainties are applicable to the remaining six months of the

financial year as they were to the six months under review.

9 FAIR VALUE HIERARCHY

Fair Value Hierarchy

IFRS 13 'Fair Value Measurement' requires an entity to classify

fair value measurements, using a fair value hierarchy that reflects

the significance of the inputs used in making the measurements. The

fair value hierarchy has the following levels:

Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the assets or liability, either directly

(ie as prices) or indirectly (ie derived from prices); and

Level 3: inputs for the asset or liability not based on

observable market data (unobservable inputs).

The financial assets and liabilities measured at fair value in

the statement of financial position are grouped into the fair value

hierarchy, are detailed below:

30 September 2015 Level Level Level Total

1 2 3 GBP000

GBP000 GBP000 GBP000

Financial assets at fair value through

profit or loss

------- ------- ------- -------

Quoted equities 142,780 - - 142,780

------- ------- ------- -------

Unquoted equities - - 11,837 11,837

------- ------- ------- -------

Fund investments - 99,167 - 99,167

------- ------- ------- -------

Net fair value 142,780 99,167 11,837 253,784

(MORE TO FOLLOW) Dow Jones Newswires

December 09, 2015 02:00 ET (07:00 GMT)

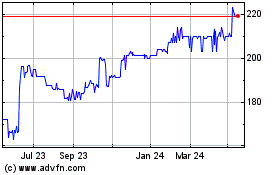

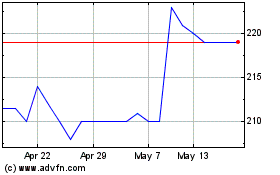

Hansa Investment (LSE:HAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hansa Investment (LSE:HAN)

Historical Stock Chart

From Jul 2023 to Jul 2024