Premier Oil's Losses Widen After Write-Downs

26 February 2016 - 12:00AM

Dow Jones News

LONDON—Premier Oil PLC, one of the U.K.'s biggest independent

oil companies, on Thursday reported a wider full-year loss after it

wrote down the value of some of its oil and gas fields by just over

$1 billion before tax because of the sharp decline in oil

prices.

It was the second consecutive year that Premier took an

impairment on its assets, highlighting the continued pain felt

across the energy industry as the oil price rout shows no signs of

abating.

From the smallest explorers and service companies all the way up

to the supermajors such as Exxon Mobil Corp. and Royal Dutch Shell

PLC, earnings have plummeted and profits have slumped amid the

decline in oil prices, which have fallen some 70% since mid-2014 to

around $35 a barrel currently.

While the entire oil and gas sector is suffering, the smaller

independents that play a key role opening up new regions of the

world to oil and gas development, have been at the sharp end of the

slumping oil price. Unlike the major oil companies, explorers don't

have other parts of their businesses to fall back on when oil

prices are down, such as refining and marketing, and have had to

slash costs and capital expenditure and delay more expensive

projects.

Premier has already reduced operating costs in 2015 by a quarter

and plans more cuts this year including a significant reduction in

capex this year and next.

"I don't think the oil price will stay at $35 for very long, but

what we're not doing is building a business that only survives at

$75 a barrel. We're getting our business into shape to survive a

sub-$50 oil price in the long run," Premier Chief Executive Tony

Durrant said in an interview.

One project that Premier has delayed is its Sea Lion oil field

in the Falkland Islands. The company has begun advanced engineering

for the development, which will take about 18 months.

"We're looking for further cost savings on Sea Lion. We're not

going to sanction the project today or if we're concerned about the

long-term price," Mr. Durrant said.

Premier's 2015 impairment was principally related to its Solan

field in the U.K. North Sea. It took the company's posttax loss to

$1.1 billion for the year ended Dec. 31, 2015 compared with a

posttax loss of $210 million the year before.

Revenue fell 35% to $1.07 billion on lower achieved oil and gas

prices and a 9% drop in oil and gas output to 57,600 barrels of oil

equivalent a day last year.

Premier's shares fell as much as 9.1% before paring back losses

to 39.8 pence each, down 4.36% on the day.

The company said it plans to produce 65,000 to 70,000 barrels of

oil equivalent a day following a contribution from its proposed

$135 million acquisition of German utility E.ON SE's U.K. North Sea

assets, which are mainly gas fields, and output from Solan, which

is due to start producing soon.

Premier said about 30% of its 2016 oil production will be hedged

at $73.4 a barrel once the acquisition of E.ON's U.K. assets

completes. Premier's net debt rose to $2.24 billion, up from $2.12

billion in 2014.

Write to Selina Williams at selina.williams@wsj.com and Alex

MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

February 25, 2016 07:45 ET (12:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

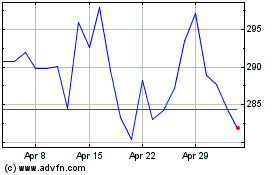

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

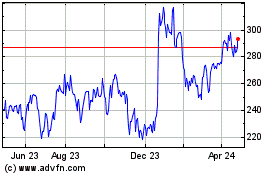

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Jul 2023 to Jul 2024