RNS No 2086e

HODDER HEADLINE PLC

23rd September 1997

INTERIM RESULTS

Hodder Headline announces more than doubled pre-tax profits and

earnings per share in its interim results for the six months to

30th June 1997.

The key points are:

* Pre-tax profits up 154% to #1.3 million (1996, #0.5

million)

* Sales #38.0 million (1996, #40.3 million)

* Operating profits up 67% to #1.6 million (1996, #0.9

million)

* Earnings per share up 127% to 2.5 pence (1996, 1.1 pence)

* Net borrowing reduced by 21% to #7.3 million (1996, #9.2

million)

* Gearing reduced to 22% (1996, 30%)

* Interim dividend raised by 10% to 2.2 pence net per share

(1996, 2.0 pence net per

share)

* Trading in July and August 1997 shows continued progress

Tim Hely Hutchinson, Group Chief Executive, commented on the

results and prospects:

"I am delighted that Hodder Headline continued to perform

strongly in the first half of the year.

The second half has also started well and publishing sales to

the end of August were 5% ahead of sales in the same eight

month period of 1996 on a like-for-like basis. We look forward

to a successful full year in 1997.

The retail book market in the UK has stabilised and shows some

promise of renewed growth, however the Australian market has

been weak this year. Overall, improved results are being

achieved in market conditions that remain challenging.

Our central strategy of investment in premium long-term

copyrights, for both consumer and educational titles, is

proving very effective in enabling us to improve profitability

despite this background, and has established the foundation for

a bright future.

Margin improvement continues to be a significant factor in the

Group's 1997 performance. For the future, we are continuing to

strive for quality sales growth, margin enhancement and the

highest standards of excellence in every area of the business."

Attached is a copy of the Group's 1997 Interim Report.

For further information, please contact:

Tim Hely Hutchinson, 0171 404 5959 on 23rd September

Group Chief Executive Otherwise, 0171 873 6000

Mark Opzoomer As above

Deputy Chief Executive

Richard Adam As above

Group Finance Director

John Sunnucks 0171 404 5959

Brunswick Public Relations

23rd September 1997

Chairman's Interim Statement

We are pleased to report continuing progress in the first half

of 1997. Pre-tax profits and earnings per share were more than

doubled compared to the same period in 1996, and net debt at

the period end was reduced compared to 30th June 1996.

The retail book market in the UK has stabilised and is showing

some promise of renewed growth. However, the Group's second

largest market, Australia, has been weak this year. Overall,

improved results are being achieved in market conditions that

remain challenging.

Our central strategy of investment in premium long-term

copyrights, for both consumer and educational titles, is

proving very effective in enabling us to improve profitability

despite this background and has established the foundation for

a bright future.

Results and Dividends

Pre-tax profits for the six months ended 30th June rose to

#1.3m (1996, #0.5m).

Total sales in the first half of 1997 were #38.0m (1996,

#40.3m). As we stated in our 1996 Annual Report, this year's

reported sales figures will be affected by our having

discontinued low margin agency and door-to-door business

overseas. The continuing strength of sterling also limited

reported sales growth in the period, although it has not had

any material impact on earnings.

Our policy of concentrating on higher margin business at home

and overseas is succeeding. Gross margins increased from 46%

to 49%. Other operating income grew by 55% to #1.6m due to the

contribution of the New Zealand-originated Anne Geddes

publishing joint venture. Net interest charges were lower at

#0.3m (1996, #0.4m) because of lower borrowing levels

throughout the period.

Taxation has been provided for at 33% (1996, 30%) as we fully

utilised the tax losses available for reinstatement by Hodder &

Stoughton during 1996. The estimated 1997 rate includes

recognition of the reduction in UK corporation tax rates from

33% to 31% announced in July.

Earnings per share for the period rose to 2.5 pence (1996, 1.1

pence). The Board has decided to increase the interim dividend

to 2.2 pence net per share (1996, 2.0 pence net per share).

This will be paid on 12th November 1997 to shareholders on the

register at 17th October 1997.

Balance Sheet

The Group's balance sheet continues to strengthen compared to

the same period in 1996 and key ratios in the business have

been improved. Net debt at 30th June was reduced by 21% to

#7.3m (1996, #9.2m). Shareholders' funds grew to #33.1m (1996,

#30.7m). Gearing was reduced to 22% (1996, 30%). Stock as a

percentage of annual sales reduced to 21.5% (1996, 22.5%) as

stock levels decreased to #19.5m (1996, #20.4m).

At the same time we have continued to invest substantially in

our forward publishing programme, and this is reflected in an

increase in the authors' royalty advances component of debtors.

Current Trading and Prospects

Publishing sales to the end of August were 5% ahead of sales in

the same eight month period of 1996 on a like-for-like basis.

Margin improvement continues to be a significant factor in the

Group's 1997 performance.

UK Consumer Publishing highlights for the second half include

bestselling crime writer Elizabeth George's first novel for

Hodder & Stoughton, Deception on His Mind, bestselling thriller

writer James Patterson's first novel for Headline, Cat and

Mouse, Dean Koontz's new novel, Fear Nothing, legendary cricket

umpire Dickie Bird's autobiography and the fourth instalment in

Stephen King's Dark Tower series, Wizard and Glass. These are

in addition to strong children's, religious and audiobook

lists. We are publishing slightly fewer new consumer titles in

the UK, particularly within Headline, but we are on average

selling more copies of each title. This policy is underpinning

the continued margin improvement.

Hodder & Stoughton Educational has just published its

innovative thirteen-volume Teach Yourself Revision Guides

series with plans to extend the series in 1998. Arnold will

publish its ground-breaking new edition of Topley & Wilson's

Microbiology and Microbial Infections in six-volume book form

and as a CD Rom in November.

Overseas, we continue to build our locally-originated

publishing programmes, including the highly successful Anne

Geddes range of photographic gift books.

Bookpoint has successfully introduced its next day service for

UK retailers and its financial performance also continues to

improve.

The Group's progress so far this year is encouraging and we

look forward to a successful full year in 1997. For the

future, we are continuing to strive for good quality sales

growth, margin enhancement and the highest standards of

excellence in every area of the business.

Management and Staff

Lord Donoughmore retired as Chairman at the Annual General

Meeting in May. All of us have very much appreciated his great

qualities as Chairman, which have contributed so much to the

Company's successful development. We extend our best wishes

for his retirement. I would also like to take this opportunity

to thank all the Group's staff for their dedication to building

today's Hodder Headline, a business where many individual

contributions are adding up to a strong performance.

Christopher Weston

23rd September 1997

Unaudited Consolidated Profit and Loss Account

For the six months ended 30th June

Year

ended

31st

December

Note 1997 1996 1996

#000 #000 #000

--------------------------------- --- ------ ------ ------

Turnover - continuing operations 2 38,011 40,250 92,830

Cost of sales (19,339) (21,731) (50,568)

--------------------------------- --- ------ ------ ------

Gross profit 18,672 18,519 42,262

Distribution costs (4,426) (4,396) (9,582)

Administrative expenses (14,308) (14,229)(27,854)

Other operating income 1,619 1,042 2,598

--------------------------------- --- ------ ------ ------

Operating profit - before 1,557 936 7,424

interests in associated

undertakings

Income from interests in 19 9 53

associated undertakings

--------------------------------- --- ------ ------ ------

Operating profit - continuing 2 1,576 945 7,477

operations

Interest receivable and similar 58 151 207

income

Profit on ordinary activities 1,317 519 6,605

before taxation

Tax on profit on ordinary 3 (435) (156) (1,948)

activities

--------------------------------- --- ------ ------ ------

Profit on ordinary activities 882 363 4,657

after taxation

Equity minority interests (14) 9 15

--------------------------------- --- ------ ------ ------

Profit for the financial period 868 372 4,672

Dividends 4 (776) (705) (2,292)

--------------------------------- --- ------ ------ ------

Retained profit / (loss) for the

financial period transferred to 92 (333) 2,380

reserves

--------------------------------- --- ------ ------ ------

Earnings per share 5 2.5p 1.1p 13.3p

--------------------------------- --- ------ ------ ------

Unaudited Consolidated Balance Sheet

At 30th June

At

31st

December

Note 1997 1996 1996

#000 #000 #000

----------- --------------------- ----- ------ ------ ------

Fixed assets

Intangible assets 514 527 536

Tangible assets 3,670 4,443 3,900

Investments 192 149 178

--------------------------------- --- ------ ------ ------

4,376 5,119 4,614

--------------------------------- --- ------ ------ ------

Current assets

Stocks 19,488 20,423 18,144

Debtors 41,552 37,130 43,171

Cash at bank and in hand 2,059 646 1,341

--------------------------------- --- ------ ------ ------

63,099 58,199 62,656

Creditors: amounts falling due

(24,469)(29,934)(32,029)

within one year

--------------------------------- --- ------ ------ ------

Net current assets 38,630 28,265 30,627

--------------------------------- --- ------ ------ ------

Total assets less current 43,006 33,384 35,241

liabilities

Creditors: amounts falling due (8,945) (1,340) (921)

after more than one year

Provisions for liabilities and (999) (1,352) (1,271)

charges

--------------------------------- --- ------ ------ ------

Net assets 2 33,062 30,692 33,049

--------------------------------- --- ------ ------ ------

Capital and reserves

Called up share capital 3,527 3,525 3,527

Share premium account 17,253 17,234 17,248

Merger reserve 3,171 3,171 3,171

Profit and loss account 9,068 6,723 9,075

--------------------------------- --- ------ ------ ------

Equity shareholders' funds 6 33,019 30,653 33,021

Equity minority interests 43 39 28

--------------------------------- --- ------ ------ ------

Shareholders' funds 33,062 30,692 33,049

--------------------------------- --- ------ ------ ------

Unaudited Consolidated Cash Flow Statement

For the six months ended 30th June

Year

ended

31st

December

Note 1997 1996 1996

#000 #000 #000

----------------------------------- --- ------ ------ ------

Net cash (outflow) / inflow from

operating activities

Net cash (outflow) / inflow from (704) 1,713 9,202

continuing operating activities

Cash outflow in respect of prior

year acquisition and (380) (348) (757)

reorganisation provisions

----------------------------------- --- ------ ------ ------

7 (1,084) 1,365 8,445

----------------------------------- --- ------ ------ ------

Returns on investment and servicing

of finance

Interest paid (268) (572) (1,077)

Interest received 62 149 207

Net cash outflow from returns on

investment and servicing of finance (206) (423) (870)

Taxation

UK corporation tax paid (105) (146) (519)

Overseas tax paid (41) (11) (129)

Tax paid (146) (157) (648)

----------------------------------- --- ------ ------ ------

Capital expenditure and financial

investment

Purchase of tangible fixed assets (451) (432) (769)

Purchase of intangible fixed assets - - (30)

Proceeds from sale of tangible 30 48 94

fixed assets

----------------------------------- --- ------ ------ ------

Net cash outflow from capital

expenditure and financial (421) (384) (705)

investment

----------------------------------- --- ------ ------ ------

Net cash outflow from the

acquisition of subsidiary - (220) (206)

undertakings

----------------------------------- --- ------ ------ ------

Equity dividends paid (1,587) (1,586) (2,291)

----------------------------------- --- ------ ------ ------

Net cash (outflow) / inflow before (3,444) (1,405) 3,725

financing

----------------------------------- --- ------ ------ ------

Financing

Issue of ordinary share capital 5 7 23

Proceeds from new borrowings 8,125 - -

Repayment of loans (142) (3,458) (3,858)

Capital element of finance lease (245) (258) (461)

payments

Receipts from new finance leases - - 25

----------------------------------- --- ------ ------ ------

Net cash inflow / (outflow) from 7,743 (3,709) (4,271)

financing

----------------------------------- --- ------ ------ ------

Increase / (decrease) in cash 4,299 (5,1140) (546)

----------------------------------- --- ------ ------ ------

Unaudited Reconciliation of Net Cash Flow to Movement in Net

Debt

For the six months ended 30th June

Year

ended

31st

December

Note 1997 1996 1996

#000 #000 #000

---------------------------------- --- ------ ------ ------

Increase / (decrease) in cash in 4,299 (5,114) (546)

the period

Cash (inflow) / outflow from

(increase) / decrease in debt and (7,738) 3,716 4,294

leasing finance

---------------------------------- --- ------ ------ ------

Change in debt resulting from cash (3,439) (1,398) 3,748

flows

Other finance lease movements (38) - 11

Currency translation differences 49 (249) (4)

---------------------------------- --- ------ ------ ------

Movement in net debt in the period (3,428 (1,647) 3,755

Net debt at start of period (3,837) (7,592) (7,592)

---------------------------------- --- ------ ------ ------

Net debt at end of period 8 (7,265) (9,239) (3,837)

---------------------------------- --- ------ ------ ------

Notes to the Interim Financial Statements

1 Basis of Preparation

The Interim Financial Statements have been prepared on the

basis of the accounting policies set out in Hodder

Headline PLC's financial statements for the year ended

31st December 1996. The Interim Financial Statements are

unaudited but have been reviewed by the Auditors and their

report to the Company is set out on the inside back cover

of this Interim Report.

The Interim Financial Statements do not comprise statutory

accounts within the meaning of Section 240 of the

companies Act 1985.

The comparative figures for the year ended 31st December

1996 are taken from the statutory accounts filed with the

Registrar of Companies. The Auditors' report on the

statutory accounts was unqualified and did not contain a

statement under Section 237 of the Companies Act 1985.

2 Segmental Analysis

For the six months ended 30th June

Year

ended

31st

December

1997 1996 1996

#000 #000 #000

----------------------------------- ------ ----- -------

Turnover - continuing operations

UK Consumer Publishing 22,206 21,605 48,959

UK Educational, Academic & 7,600 7,105 18,930

Professional Publishing

Overseas Operations 7,212 10,253 22,320

UK Distribution 993 1,287 2,621

----------------------------------- ------ ----- -------

38,011 40,250 92,830

----------------------------------- ------ ----- -------

Profits

UK Consumer Publishing 1,902 1,558 3,946

UK Educational, Academic & 168 371 2,452

Professional Publishing

Overseas Operations (72) (378) 1,625

UK Distribution (422) (606) (546)

----------------------------------- ------ ----- -------

Operating profit - continuing 1,576 945 7,477

operations

Net interest payable (259) (426) (872)

----------------------------------- ------ ----- -------

Profit before taxation 1,317 519 6,605

----------------------------------- ------ ----- -------

Net assets

UK Consumer Publishing 28,264 26,051 24,124

UK Educational, Academic & 4,973 4,600 4,762

Professional Publishing

Overseas Operations 5,779 7,631 6,646

UK Distribution 1,311 1,649 1,354

----------------------------------- ------ ----- -------

Net operating assets 40,327 39,931 36,886

Net borrowings (7,265)(9,239) (3,837)

----------------------------------- ------ ----- -------

33,062 30,692 33,049

----------------------------------- ------ ----- -------

3 Taxation

The taxation charge for the period is based on the

estimated effective rate of 33% for the year ending 31st

December 1997.

4 Dividends

An interim dividend of 2.2 pence net per share will be

paid on 12th November 1997 to shareholders on the register

at the close of business on 17th October 1997. The

ordinary shares will be marked ex dividend on 13th October

1997.

5 Earnings per Share

Earnings per share have been calculated using the weighted

average number of shares in issue during the period, which

for the six months to 30th June 1997 was 35,265,566

and for the six months to 30th June 1996 was 35,247,069.

6 Reconciliation of Movement in Equity Shareholders' Funds

For the six months ended 30th June

Year

ended

31st

December

1997 1996 1996

#000 #000 #000

Profit attributable to members of 868 372 4,672

the Company

Dividends (776) (705) (2,292)

92 (333) 2,380

Capital Subscribed 5 7 23

Exchange rate differences (99) 144 (217)

Net movement in equity (2) (182) 2,186

shareholders' funds

Opening equity shareholders' funds 33,021 30,835 30,835

Closing equity shareholders' funds 33,019 30,653 33,021

7 Reconciliation of Operating Profit to Net Cash Flow from

Operating Activities

For the six months ended 30th June

Year

ended

31st

December

1997 1996 1996

#000 #000 #000

Operating profit - before interests 1,557 936 7,424

in associated undertakings

Adjustments to operating profit:

Depreciation and amortisation 688 686 1,393

charges

Loss on sale of tangible fixed 7 1 32

assets

(Increase) / decrease in working

capital:

Proceeds from sale of property 182 3,458 3,458

held for sale

Stocks (1,432) (1,737) 117

Debtors 1,341 (543) (6,771)

Creditors (3,155) (1,088) 3,455

Increase in reorganisation 108 - 94

provisions

Net cash (outflow) / inflow from (704) 1,713 9,202

continuing operations

Cash outflow in respect of prior

year acquisition and reorganisation (380) (348) (757)

provisions

Net cash (outflow) / inflow from (1,084) 1,365 8,445

operating activities

8 Analysis of Changes in Net Debt during the Period

For the six months ended 30th June

At Net Other Effect At At

1st cash changes of 30th 30th

January flow foreign June June

1997 exchange 1997 1996

rates

#000 #000 #000 #000 #000 #000

Cash at bank and 1,341 681 - 37 2,059 646

in hand

Bank overdrafts (3,620) 3,618 - 2 - (7,665)

(2,279) 4,299 - 39 2,059 (7,019)

Borrowings due (142) 142 - - - (542)

within one year

Borrowings due - (8,125) - - (8,125) -

after one year

Finance Leases (1,416) 245 (38) 10 (1,199)(1,678)

(1,558) (7,738) (38) 10 (9,324)(2,220)

Net debt (3,837) (3,439) (38) 49 (7,265)(9,239)

9 Company Information

Copies of this statement are being sent to all

shareholders and are also available from the Company's

Registered Office : 338 Euston Road, London, NW1 3BH; telephone

0171 873 6000, fax 0171 873 6024.

10 Financial Calendar

Dates Events

13th October 1997 1997 Interim Dividend Ex Dividend

Date

17th October 1997 1997 Interim Dividend Record Date

12th November 1997 1997 Interim Dividend Payment

March 1998 1997 Preliminary Results Announcement

April 1998 1997 Annual Report & Accounts

May 1998 Annual General Meeting

May 1998 1997 Final Dividend Payment

Review Report by the Auditors to Hodder Headline PLC

We have reviewed the interim financial information for the six

months ended 30th June 1997 set out on pages 3 to 9 which is

the responsibility of, and has been approved by, the Directors.

Our responsibility is to report on the results of our review.

Our review was not performed for any purpose connected with any

specific transaction and should not be relied upon for any such

purpose.

Our review was carried out having regard to the Bulletin

"Review of Interim Financial Information" issued by the

Auditing Practices Board. This review consisted principally of

applying analytical procedures to the underlying financial

data, assessing whether accounting policies have been

consistently applied, and making enquiries of Group management

responsible for financial and accounting matters. The review

excluded any audit procedures such as tests of controls and

verification of assets and liabilities, and was therefore

substantially less in scope than an audit performed in

accordance with Auditing Standards. Accordingly we do not

express an audit opinion on the interim financial information.

On the basis of our review:

* in our opinion the interim financial information has been

prepared using accounting policies consistent with those

adopted by Hodder Headline PLC in its financial statements for

the year ended 31st December 1996 and

* we are not aware of any material modifications that should

be made to the interim financial information as presented.

Deloitte & Touche

Chartered Accountants and Registered Auditors

Hill House

1 Little New Street

London

EC4A 3TR

END

IR ALLETAAIFFAD

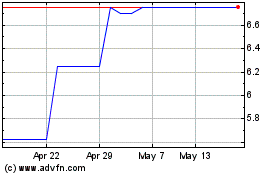

Hardide (LSE:HDD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hardide (LSE:HDD)

Historical Stock Chart

From Jul 2023 to Jul 2024