India Capital Growth Fund Limited Net Asset Value(s) (5153B)

07 June 2019 - 6:08PM

UK Regulatory

TIDMIGC

RNS Number : 5153B

India Capital Growth Fund Limited

07 June 2019

7 June 2019

India Capital Growth Fund Limited (the "Company" or "ICGF")

Net Asset Value statement at 31 May 2019

Net Asset Value

The Company announces its Net Asset Value per share as at 31 May

2019 was 102.24 pence.

In May the Net Asset Value (NAV) was up slightly (0.2%) in

Sterling terms, whilst the BSE Mid Cap TR Index was up 4.1%,

delivering under performance against the notional benchmark of

3.9%. In local currency terms, the NAV was down 2.4% for the

month.

Portfolio update

Positive contribution to the portfolio's performance came from

Federal Bank (up 15.7%), PI Industries (up 8.9%) and Sobha

Developers (up 13.4%). Negative contribution came from Manpasand

Beverages (down 52.9%), Motherson Sumi Systems (down 21.3%) and

Aurobindo Pharma (down 17.9%).

Market and economic update

Indian equity markets saw a broad based rally in May with the

BSE Sensex and BSE Midcap indices up 1.8% and 1.4% respectively

(both total return in Indian Rupees) on the back of the BJP

government increasing its seat share and winning an absolute

majority for a second successive term. Exceeding expectations, this

is the first time a party has returned to power with a majority

since 1971. Over the month foreign institutional investors and

domestic institutions were net buyers to the tune of (US$ 1.4bn)

and (US$754m). The Indian Rupee depreciated by 0.2% against US

Dollar and appreciated 2.6% against Pound Sterling.

India's real GDP growth moderated to 5.8% in 4QFY19 compared to

6.6% in 3QFY19 due to a contraction in agricultural activity and a

slowdown in manufacturing and construction, whilst growth in

services improved. On the demand side, even though private

consumption slowed to 7.2%, government consumption expenditure,

increased 13.1%. Investment growth (gross fixed capital formation)

fell sharply to 3.6%. For the year FY19 GDP growth slowed to 6.8%

from 7.2% in FY18. Nirmala Sitharaman, the newly appointed Finance

Minister will present her first Union Budget for FY19/20 on 5(th)

July.

India's benchmark 10 year bond yield slid to an 18-month low to

7.03% as falling oil prices (down 14.9% for the month) and tame

inflation suggest market expectations of more interest cut rates

driven by a policy shift from the RBI from neutral to

accommodative.

Portfolio analysis by sector as at 31 May 2019

Sector No. of Companies % of Portfolio

Financials 7 23.9%

Materials 8 20.9%

Consumer Discretionary 5 11.2%

Information Technology 3 10.2%

Consumer Staples 4 9.7%

Industrials 4 9.3%

Health Care 3 7.0%

Real Estate 2 3.0%

Communication Services 0 0.0%

Energy 0 0.0%

Utilities 0 0.0%

Total Equity Investment 36 95.2%

Net Cash 4.8%

Total Portfolio 36 100.0%

Top 20 holdings as at 31 May 2019

Holding Sector % of Portfolio

Federal Bank Financials 5.3%

Tech Mahindra Information Technology 4.8%

City Union Bank Financials 4.8%

PI Industries Materials 4.3%

Kajaria Ceramics Industrials 4.2%

NIIT Technologies Information Technology 4.1%

Jyothy Laboratories Consumer Staples 3.5%

Divi's Laboratories Health Care 3.4%

Ramkrishna Forgings Materials 3.3%

Berger Paints India Materials 3.2%

IDFC Bank Financials 3.1%

Jammu & Kashmir Bank Financials 3.0%

Indusind Bank Financials 3.0%

Sobha Developers Real Estate 2.8%

Aurobindo Pharma Health Care 2.8%

Emami Consumer Staples 2.8%

Welspun India Consumer Discretionary 2.7%

Yes Bank Financials 2.6%

The Ramco Cements Materials 2.6%

Radico Khaitan Consumer Staples 2.6%

Portfolio analysis by market capitalisation size as 31 May

2019

Market capitalisation size No. of Companies % of Portfolio

Small Cap (M/Cap < US$2bn) 21 45.3%

Mid Cap (US$2bn < M/Cap < US$7bn) 13 42.2%

Large Cap (M/Cap > US$7bn) 2 7.8%

Total Equity Investment 36 95.2%

Net Cash 4.8%

Total Portfolio 36 100.0%

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVUGUMUQUPBURM

(END) Dow Jones Newswires

June 07, 2019 04:08 ET (08:08 GMT)

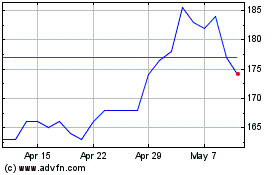

India Capital Growth (LSE:IGC)

Historical Stock Chart

From Apr 2024 to May 2024

India Capital Growth (LSE:IGC)

Historical Stock Chart

From May 2023 to May 2024