Profit for the

year - - - - - 3,010 3,010 718 3,728

Other

comprehensive

income - - - (126) (1,518) - (1,644) (739) (2,383)

Total

comprehensive

income for the

year - - - (126) (1,518) 3,010 1,366 (21) 1,345

Equity-settled

share-based

payment (note

25) - - - - - 82 82 - 82

Options exercised

(note 22) 58 118 - - - - 176 - 176

Equity dividends

paid - - - - - - - (1,014) (1,014)

At 31 March 2014 2,896 4,776 17,164 (577) (672) 29,925 53,512 3,649 57,161

Merger reserve

The merger reserve comprises premium on shares issued in

relation to business combinations.

Capital redemption reserve

The capital redemption reserve comprises amounts transferred

from retained earnings in relation to the redemption of preference

shares. For ease of presentation, the amount of GBP1.34 million

relating to the capital redemption reserve has been included within

the column of share premium and capital redemption reserve in the

balances at both the beginning and end of each year, with no

movements.

Hedging reserve

The hedging reserve comprises the effective portion of the

cumulative net change in the fair value of cash flow hedging

instruments related to hedged transactions that have not yet

occurred.

Translation reserve

The translation reserve comprises all foreign currency

differences arising from the translation of the financial

statements of foreign operations.

Shareholders' equity

Shareholders' equity represents total equity attributable to

owners of the Parent Company.

Consolidated balance sheet

as at 31 March 2014

As at As at

31 March 31 March

2014 2013

Notes GBP000 GBP000

---------------------------------------------------- ----- -------- --------

Non-current assets

Property, plant and equipment 11 32,049 29,993

Intangible assets 12 31,950 32,795

Deferred tax assets 13 3,665 4,250

---------------------------------------------------- ----- -------- --------

Total non--current assets 67,664 67,038

---------------------------------------------------- ----- -------- --------

Current assets

Inventory 14 48,460 50,114

Trade and other receivables 15 19,690 23,285

Cash and cash equivalents 16 8,111 2,301

---------------------------------------------------- ----- -------- --------

Total current assets 76,261 75,700

---------------------------------------------------- ----- -------- --------

Total assets 143,925 142,738

---------------------------------------------------- ----- -------- --------

Equity

Share capital 22 2,896 2,838

Share premium 3,436 3,318

Reserves 17,255 18,899

Retained earnings 29,925 26,833

---------------------------------------------------- ----- -------- --------

Equity attributable to owners of the Parent Company 53,512 51,888

---------------------------------------------------- ----- -------- --------

Non-controlling interests 3,649 4,684

---------------------------------------------------- ----- -------- --------

Total equity 57,161 56,572

---------------------------------------------------- ----- -------- --------

Non-current liabilities

Loans and borrowings 17 28,145 29,479

Deferred income 18 1,592 1,329

Provisions 19 860 862

Other financial liabilities 20 4,202 1,803

---------------------------------------------------- ----- -------- --------

Total non-current liabilities 34,799 33,473

---------------------------------------------------- ----- -------- --------

Current liabilities

Bank overdraft 16 2,529 336

Loans and borrowings 17 9,695 12,847

Deferred income 18 1,202 550

Provisions 19 165 107

Income tax payable 2,052 904

Trade and other payables 21 25,818 28,995

Other financial liabilities 20 10,504 8,954

---------------------------------------------------- ----- -------- --------

Total current liabilities 51,965 52,693

---------------------------------------------------- ----- -------- --------

Total liabilities 86,764 86,166

---------------------------------------------------- ----- -------- --------

Total equity and liabilities 143,925 142,738

---------------------------------------------------- ----- -------- --------

These financial statements were approved by the Board of

Directors on 19 June 2014 and were signed on its behalf by:

Paul Fineman Director

Anthony Lawrinson Director

Company number 1401155

Consolidated cash flow statement

year ended 31 March 2014

2014 2013

Notes GBP000 GBP000

----------------------------------------------------------------------------- ------ -------- --------

Cash flows from operating activities

Profit for the year 3,728 4,076

Adjustments for:

Depreciation 11 5,032 3,807

Amortisation of intangible assets 12 576 494

Finance expenses 8,10 3,616 3,466

Income tax charge 9 1,459 1,601

Loss/profit on sales of property, plant and equipment and intangible assets 5 4 (252)

Equity-settled share-based payment 25 82 22

----------------------------------------------------------------------------- ------ -------- --------

Operating profit after adjustments for non-cash items 14,497 13,214

Change in trade and other receivables 1,520 (1,965)

Change in inventory (722) (7,171)

Change in trade and other payables (48) 4,356

Change in provisions and deferred income (84) (901)

----------------------------------------------------------------------------- ------ -------- --------

Cash generated from operations 15,163 7,533

Tax paid (60) (937)

Interest and similar charges paid (3,221) (3,285)

----------------------------------------------------------------------------- ------ -------- --------

Net cash inflow from operating activities 11,882 3,311

----------------------------------------------------------------------------- ------ -------- --------

Cash flow from investing activities

Proceeds from sale of property, plant and equipment 140 421

Acquisition of intangible assets (206) (242)

Acquisition of property, plant and equipment (a) (5,085) (1,884)

Receipt of government grants 1,049 -

----------------------------------------------------------------------------- ------ -------- --------

Net cash outflow from investing activities (4,102) (1,705)

----------------------------------------------------------------------------- ------ -------- --------

Cash flows from financing activities

Proceeds from issue of share capital 176 266

Repayment of secured borrowings (5,646) (4,060)

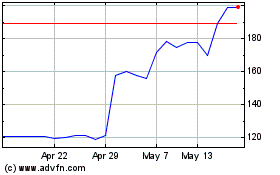

Ig Design (LSE:IGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ig Design (LSE:IGR)

Historical Stock Chart

From Jul 2023 to Jul 2024