TIDMKITW

RNS Number : 5187G

Kitwave Group PLC

27 July 2021

27 July 2021

Kitwave Group plc

("Kitwave", the "Group" or the "Company")

Interim Results for the six months ended 30 April 2021

Kitwave Group plc (AIM: KITW), the independent, delivered

wholesale business, is pleased to announce its financial results

for the six months ended 30 April 2021. The results cover a

financial period prior to the flotation of the Company on 24 May

2021.

During the six months being reported the Group traded in line

with the Board's expectations. The results were impacted by

COVID-19 lockdown restrictions and, in particular, closures within

the leisure and hospitality sector. Since April 2021, trading has

returned close to pre-pandemic levels and the Directors are pleased

to confirm the Group is currently trading in line with market

expectations.

Financial summary

-- Revenues of GBP147.1 million (12 months ended 30 April 2020: GBP399.0 million).

-- Operating profit of GBP0.8 million (12 months ended 30 April 2020: GBP7.6 million).

-- GBP9.8 million cash generated from operations (12 months

ended 30 April 2020: GBP29.1 million).

The Board has declared an interim dividend of 2.25 pence per

share to be paid on 27 August 2021 to shareholders on the register

at the close of business on 6 August 2021. The ex-dividend date

will be 5 August 2021.

Post-period end

-- Significantly over-subscribed Placing and Admission to AIM on

24 May 2021, raising gross proceeds of GBP64.0 million for the

Company and GBP17.6 million for the Selling Shareholders.

-- Gross proceeds for the Company will be used to support the

Group's successful buy-and-build strategy, enhance the profile of

the Group and its brands, improve Kitwave's position with key

suppliers, strengthen the Group's balance sheet, and provide the

Group with greater ability to incentivise and retain key employees

going forward.

-- On Admission, Stephen ("Steve") Smith, Independent

Non-executive Chairman, and Gerard Murray, Independent

Non-executive Director, were appointed to the Board.

-- Trading during June and July 2021 has been strong as a result

of a period of warmer weather and consumer interest in the UEFA

European Championship driving sales, as well as the leisure and

hospitality sectors reopening further as nationwide COVID-19

lockdown restrictions have eased.

Operational highlights

-- The Group opened a new 70,000 sq. ft distribution centre in

Luton. The centre was delivered on time and on budget and

specifically commissioned to cater for Frozen & Chilled product

operations. The ability to store in excess of 5,000 pallets in

highly efficient cold store conditions will ensure that the Group

is well placed to meet future growth expectations and peak summer

demands of Kitwave's independent customers.

Paul Young, Chief Executive Officer of Kitwave, commented:

"I am pleased to report the Group's financial results for the

six months ended 30 April 2021, marking the first set of results to

be reported since Kitwave's successful Admission to trading on AIM

in May 2021.

"All of the Group's divisions have experienced some level of

impact from the stop-start nature of COVID-19 restrictions during

the period. Supply to pubs, restaurants and vending machine

operators was severely disrupted as these businesses were either

closed or operating under constraints. In contrast, our Frozen

& Chilled division was extremely resilient and operated close

to pre-COVID-19 levels throughout the period.

"Since mid-May 2021, COVID-19 lockdown restrictions have been

eased and trade has accelerated. Thanks to a period of warmer

weather and consumer interest in the Euros, we are already

experiencing sales volumes that are moving toward pre-pandemic

levels; this was the case even before the highly anticipated 19

July 2021 'Freedom Day'. As such, we remain confident that the

Group is on track to achieve its full year expectations. This

belief is further supported by the timing of the return to normal,

as it allows the Group to take full advantage of the second half of

our financial year, when trading is traditionally stronger due to

the seasonality of the Frozen & Chilled division.

"The Board anticipates a buoyant market to return once COVID-19

lockdown restrictions are removed fully and has confidence that the

Group will continue to be one of the leading independent delivered

wholesale providers in the UK. The UK grocery and foodservice

wholesale market remains highly fragmented and the Directors

believe this presents Kitwave with numerous additional growth

opportunities."

- Ends -

For further information please contact:

Kitwave Group plc Tel: +44 (0) 191 259 2277

Paul Young, Chief Executive Officer

David Brind, Chief Financial Officer

www.kitwave.co.uk

Canaccord Genuity Limited Tel: +44 (0) 20 7523 8150

(Nominated Adviser and Sole Broker)

Bobbie Hilliam

Alex Aylen

Richard Andrews

Georgina McCooke

Yellow Jersey PR Tel: +44 (0) 20 3004 9512

(Financial media and PR) kitwave@yellowjerseypr.com

Sarah Hollins

Henry Wilkinson

Matthew McHale

Company Overview

Founded in 1987, following the acquisition of a single-site

confectionery wholesale business based in North Shields, United

Kingdom, Kitwave is an independent, delivered wholesale business,

specialising in selling and delivering impulse products, frozen and

chilled foods, alcohol, groceries and tobacco to approximately

38,000, mainly independent, customers.

With a network of 26 depots, Kitwave is able to support delivery

throughout the UK to a diverse customer base, which includes

independent convenience retailers, leisure outlets, vending machine

operators, foodservice providers and other wholesalers, as well as

leading national retailers.

The Group's growth to date has been achieved both organically

and through a strategy of acquiring smaller, predominantly

family-owned, complementary businesses in the fragmented UK grocery

and foodservice wholesale market.

Kitwave Group plc (AIM: KITW) was admitted to trading on AIM of

the London Stock Exchange on 24 May 2021.

For further information, please visit www.kitwave.co.uk .

Chief Executive Officer's statement

Introduction

I am pleased to report the Group's financial results for the six

months ended 30 April 2021. Trading throughout the period was

heavily affected by the pandemic and these results reflect those

challenges.

Admission to AIM

On 24 May 2021, the Company announced a significantly

over-subscribed Placing and its Admission to AIM, raising gross

proceeds of GBP64.0 million for the Company and GBP17.6 million for

the Selling Shareholders. The Placing attracted strong support from

high quality institutional investors and, based on the Placing

Price, the Company's market capitalisation was approximately

GBP105.0 million at Admission. The Company intends to use the gross

proceeds of the Placing to reduce the Group's existing debt and to

pay the Group's expenses in connection with the Placing.

The Board believes that the Group's Admission will support its

successful buy-and-build strategy, enhance the profile of the Group

and its brands, improve Kitwave's position with key suppliers,

strengthen the Group's balance sheet, and provide the Group with

greater ability to incentivise and retain key employees going

forward.

Financial summary

In the six months to 30 April 2021, the Group achieved revenues

of GBP147.1 million, ( 12 months ended 30 April 2020 : GBP399.0

million), resulting in an operating profit of GBP0.8 million ( 12

months ended 30 April 2020 : GBP7.6 million). The key factor that

affected the performance in this period were the challenges that

the Group faced because of the COVID-19 restrictions.

6 months to 12 months to 18 months to

30 April 2021 30 April 2020 31 October

2020

Revenue (GBPm) 147.1 399.0 592.0

Gross margin % 17.9% 17.8% 18.1%

Operating profit (GBPm) 0.8 7.6 12.0

Capital expenditure of GBP1.8 million during the period

consisted mainly of the fit out and installation of the freezer

units in the new Luton site. This was funded from cash received

from Luton Borough Council as part of the Compulsory Purchase Order

on the previous Luton warehouse.

Cash generation remained strong in the period with GBP9.8

million generated from operating activities. After all debt

service, cash and cash equivalents increased by GBP6.8 million.

If the outcome of the Group's Admission of the Company to AIM

had been applied to the Group's balance sheet as at 30 April 2021

the pro forma balance sheet would have had equity reserves of

GBP58.5 million and net debt of GBP26.2 million.

Divisional summary

Set out below is the financial performance of the business by

division against the comparable six-month period to 30 April

2020:

6 months *6 months

GBPm to 30 April to 30 April

2021 2020

Group Revenue 147.1 189.5

Ambient 64.5 78.7

Frozen & Chilled 71.7 72.2

Foodservice 10.9 38.6

Head Office - -

Group Adjusted Operating Profit / (Loss)** (0.2) 3.0

Ambient 0.4 1.0

Frozen & Chilled 1.9 2.0

Foodservice (2.3) 0.2

Head Office (0.2) (0.2)

* Six months to 30 April 2020 divisional results are set out

above to provide a more relevant comparison.

** Group Operating Profit / (Loss) adjusted for restructuring,

acquisition and compensation for post combination costs and

income.

The Group's Ambient, Frozen & Chilled and Foodservices

divisions have all experienced some level of impact from the

stop-start nature of COVID-19 lockdown restrictions, as customers

found it more difficult to service consumers. Kitwave focuses on

independent retailers and foodservice providers; many of which were

closed from November 2020 to March 2021. Those that remained open

were undoubtedly affected more severely than larger retailers, as

consumers were told to stay at home.

In our experience, since Kitwave was founded in 1987, these

independents have always proven both determined and resilient,

adapting their businesses where necessary. We anticipate that a

large majority will steer themselves through these difficult times

too, and the long-term goodwill that we have fostered with our

customers has and will continue to stand us in good stead, enabling

us to quickly return to revenue growth as we move out of the

COVID-19 period.

Ambient division

The Ambient business performed in line with expectations during

the year but, as expected, was down on the comparable period as

COVID-19 impacted revenue normally generated through the sale of

impulse products to vending machines.

Frozen & Chilled division

The Frozen & Chilled division has now successfully

integrated the acquisition of Central Supplies, acquired in 2019,

and the division is trading well. The division maintains its strong

presence in the market and more opportunities, both through

acquisitions and customer base, are being presented because of its

strong nationwide infrastructure and capabilities. The results for

the six months to 30 April 2021, whilst affected by COVID-19 and

the restrictions on footfall in the main leisure sites across the

country, were very resilient and comparable with the prior

period.

Foodservice division

COVID-19 had the biggest effect on the Foodservice division,

particularly during the usually very busy Christmas period. The

prior year comparable numbers include trading from December 2019; a

pre-COVID trading period. To mitigate this lost revenue, the

trading divisions administration and distribution expenses were

reduced by 41% to GBP5.2 million after accounting for the benefit

of Coronavirus Job Retention Scheme (CJRS) furlough grants

presented as other income.

Operational review

In February 2021, the new Luton warehouse, specifically designed

and commissioned for dealing with Frozen & Chilled products

operations, was opened. The ability to store in excess of 5,000

pallets in highly efficient cold store conditions will ensure that

the Group is well placed to meet future growth expectations and

peak summer demands of our independent customers.

Strategy

Kitwave's strategy remains focused on the acquisition of smaller

regional players across the fragmented UK grocery and foodservice

wholesale market, while simultaneously driving organic growth. This

strategy has proven highly successful to date, with 10 wholesale

distributors having been acquired and integrated into the Group

since 2011.

The Board is firmly of the opinion that the Group's Admission to

AIM post-period will support this strategy, as well as enhancing

the brands within its portfolio in order to remain one of the

leading independent delivered wholesale providers in the UK.

We feel that, with in excess of 100 years of combined industry

knowledge and expertise, Kitwave has a highly experienced Board and

management team to deliver upon this strategy and generate

shareholder value.

Dividend

The Board intends to implement a progressive dividend policy and

to divide the interim and final dividends approximately on a one

third and two third split respectively. As a result, the Board has

declared an interim dividend of 2.25 pence per share to be paid on

27 August 2021 to shareholders on the register at the close of

business on 6 August 2021. The ex-dividend date will be 5 August

2021.

Summary and outlook

As long as we have known, independent retailers have adapted

their business to best serve consumers and we have seen this during

the pandemic with businesses adapting to government restrictions.

Bars and pubs, for example, have made the most of previously

under-used outdoor space, such as gardens and car parks, to provide

additional seating for customers, while restaurants have

successfully implemented takeaway services in place of 'eating in'.

As a result of these initiatives and the continued easing of the

lockdowns, we firmly believe that the wholesale market will return

strongly as we exit the lockdown phases.

Following the end of the period, thanks to warmer weather,

further easing of restrictions and consumer interest in the UEFA

European Championship, we have already seen stronger trading in

June and July 2021. As a result of the proactive and considerate

measures implemented by the management team, we are confident that

the Group will come out of the lockdown phases strongly and that

trading will continue to return to pre-COVID-19 levels.

We would like to express our thanks to all employees who have

worked tirelessly through this challenging period, without whom we

would not be in the position we are today.

The future looks bright for Kitwave, not only thanks to the

easing of COVID-19-related restrictions, but through organic and

M&A growth opportunities available to the Group due to a highly

fragmented UK grocery and foodservice wholesale market.

We look forward to updating stakeholders on this progress in due

course.

Paul Young

Chief Executive Officer

27 July 2021

Consolidated Statement of Profit and Loss and Other

Comprehensive Income

Note Unaudited Unaudited Audited

6 months 12 months 18 months

ended 30 ended 30 ended 31

April 2021 April 2020 October

2020

GBP000 GBP000 GBP000

Revenue 4 147,112 399,003 592,016

Cost of sales (120,841) (327,836) (484,842)

Gross profit 26,271 71,167 107,174

Other operating income 5 4,423 621 3,020

Distribution expenses (12,712) (29,308) (44,014)

Administrative expenses (17,192) (34,858) (54,156)

Operating profit 790 7,622 12,024

Analysed as:

Adjusted EBITDA 3,834 17,480 27,634

Depreciation (3,940) (6,918) (11,013)

Amortisation of intangible

assets (75) (96) (144)

Restructuring income/(costs) 6 2,192 (859) (1,467)

Acquisition expenses 6 - (570) (628)

Compensation for post combination

services 6 (1,221) (1,415) (2,358)

Operating profit 790 7,622 12,024

Finance expenses (4,269) (6,230) (10,719)

Analysed as:

Interest payable on bank loans

and bank facilities (769) (2,002) (2,805)

Interest and finance charges

payable on loan notes and

debenture loans (2,889) (4,876) (7,788)

Finance charges on financial

leases (611) (995) (1,579)

Fair value movement on financial

liabilities - 1,643 1,453

Finance expenses (4,269) (6,230) (10,719)

(Loss)/profit before tax (3,479) 1,392 1,305

Tax on (loss)/profit 34 (1,119) (1,805)

(Loss)/profit for the financial

period (3,445) 273 (500)

Other comprehensive income - - -

Total comprehensive (loss)/income

for the period (3,445) 273 (500)

Basic earnings per share attributable

to B1 shares 7 (61.51) 4.88 (8.94)

Diluted earnings per share

attributable to B1 shares 7 (61.51) 4.88 (8.94)

Non-GAAP measures

-------------------------------------- ---- ----------- ----------- ----------

Basic underlying earnings per

share attributable to B1 shares 7 (71.40) 26.25 42.72

Diluted underlying earnings

per share attributable to B1

shares 7 (71.40) 26.25 42.72

Consolidated Balance Sheet

Unaudited Unaudited Audited

30 April 30 April 31 October

2021 2020 2020

GBP000 GBP000 GBP000

Non-current assets

Goodwill 31,249 31,267 31,249

Intangible assets 336 461 412

Property plant and equipment 9,854 9,629 9,310

Right-of-use assets 22,987 22,202 20,600

Investments 20 20 20

Investment Property 175 175 175

64,621 63,754 61,766

Current assets

Inventories 32,961 27,270 23,198

Trade and other receivables 47,945 48,273 44,558

Cash and cash equivalents 7,117 - 342

88,023 75,543 68,098

Total assets 152,644 139,297 129,864

Current liabilities

Bank overdrafts - 703 -

Interest bearing loans and

borrowings 16,661 19,686 17,681

Lease liabilities 4,448 5,445 5,202

Trade and other payables 59,255 49,535 40,307

Tax payable 1,472 1,258 1,984

81,836 76,627 65,174

Non-current liabilities

Interest bearing loans and

borrowings 49,507 38,179 43,079

Lease liabilities 19,335 16,848 16,200

Other financial liabilities 5,410 6,863 5,410

Deferred tax liabilities 54 60 54

74,306 61,950 64,743

Total liabilities 156,142 138,577 129,917

Net (liabilities)/assets (3,498) 720 (53)

Equity attributable to equity

holders of the

parent

Called up share capital 50 1 1

Share premium account 2,944 12,993 12,993

Consolidation reserve (33,098) (33,098) (33,098)

Retained earnings 26,606 20,824 20,051

(Accumulated deficit)/Equity (3,498) 720 (53)

Consolidated Statement of Changes in Equity

12 months ended 30 April Called Share Profit

2020 up premium Consolidation and loss Total

share account reserve account equity

capital

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 May 2019

(audited) 1 12,993 (33,098) 20,551 447

Total comprehensive income

for the

period

Profit - - - 273 273

Total comprehensive income

for

the period - - - 273 273

Total contribution by

and distribution - - - - -

to owners

Balance at 30 April 2020

(unaudited) 1 12,993 (33,098) 20,824 720

6 months ended 31 October

2020

Balance at 1 May 2020

(unaudited) 1 12,993 (33,098) 20,824 720

Total comprehensive loss

for the

period

Loss - - - (773) (773)

Total comprehensive loss

for

the period - - - (773) (773)

Total contribution by

and distribution - - - - -

to owners

Balance at 31 October

2020 (audited) 1 12,993 (33,098) 20,051 (53)

6 months ended 30 April Called Share Profit

2021 up premium Consolidation and loss Total

share account reserve account equity

capital

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 November

2020 (audited) 1 12,993 (33,098) 20,051 (53)

Total comprehensive loss

for the

period

Loss - - - (3,445) (3,445)

Total comprehensive loss

for

the period - - - (3,445) (3,445)

Transactions with owners

recorded directly in

equity

Bonus issue of shares 49 (49) - - -

Reduction in capital

- share premium - (10,000) - 10,000 -

Total contribution by

and distribution

to owners 49 (10,049) - 10,000 -

Balance at 30 April 2021

(unaudited) 50 2,944 (33,098) 26,606 (3,498)

Consolidated Cash Flow Statement

Unaudited Unaudited Audited

6 months 12 months 18 months

ended 30 ended 30 ended 31

April 2021 April 2020 October 2020

GBP000 GBP000 GBP000

Cash flow statement

Cash flow from operating activities

(Loss)/profit for the period (3,445) 273 (500)

Adjustments for:

Depreciation and impairment 4,016 7,014 11,157

Finance expenses 4,269 6,230 10,719

Profit on sale of property,

plant and equipment (25) (23) (5)

Gain on remeasurement of lease

liabilities (98) - -

Compensation for post contribution

services 1,221 1,415 2,358

Taxation (34) 1,119 1,805

5,904 16,028 25,534

(Increase)/decrease in trade

and other receivables (1,667) 11,349 19,425

(Increase)/decrease in inventories (9,763) 8,555 11,456

Increase/(decrease) in trade

and other payables 15,791 (4,146) (17,867)

10,265 31,786 38,548

Tax paid (469) (2,693) (2,693)

Net cash inflow from operating

activities 9,796 29,093 35,855

Cash flows from investing

activities

Acquisition of property, plant

and equipment (1.772) (2,664) (3,125)

Proceeds from sale of property,

plant and equipment 43 236 358

Acquisition of subsidiary

undertakings (including

overdrafts and cash acquired) - (13,535) (13,535)

Net cash outflow from investing

activities (1,729) (15,963) (16,302)

Cash flows from financing

activities

Proceeds from new loan 5,500 5,000 5,000

Net movement in invoice discounting

facility (429) (8,363) (6,941)

Interest paid (2,513) (3,719) (5,969)

Net movement in bank trade

loans 57 (880) (2,270)

Repayment of bank term loans (1,390) (1,768) (3,063)

Payment of lease liabilities (2,517) (5,308) (7,173)

Net cash outflow from financing

activities (1,292) (15,038) (20,416)

Net increase/(decrease) in

cash and cash equivalents 6,775 (1,908) (863)

Opening cash and cash equivalents 342 1,205 1,205

Cash and cash equivalents

at the end of the period 7,117 (703) 342

Notes

1 General information

Kitwave Group plc ("Company") is a public limited company

incorporated, domiciled and registered in England in the UK under

the Companies Act 2006. The Company's ordinary shares are traded on

the Alternative Investment Market ("AIM").

The registered number is 9892174 and the registered address is

Unit S3, Narvik Way, Tyne Tunnel Trading Estate, North Shields,

Tyne and Wear, NE29 7XJ. The Company's principal activity is to act

as a holding company for its subsidiaries (together "the Group"),

which together make up the Group's consolidated financial

information.

2 Basis of preparation

The condensed interim financial information presented in this

statement is for the six-month period ended 30 April 2021 and the

comparative figures for the 12-month period ended 30 April 2020,

both unaudited, and the audited 18-month period ended 31 October

2020.

The condensed financial information does not constitute

statutory accounts as defined in Section 435 of the Companies Act

2006. The statutory accounts for the 18-month period ended 31

October 2020 have been delivered to the Registrar of Companies and

the report of the auditor was (i) unqualified, (ii) did not include

a reference to any matters to which the auditor drew attention by

way of emphasis without qualifying their report, and (iii) did not

contain a statement under Section 498 (2) or (3) of the Companies

Act 2006.

The condensed financial information has been prepared in

accordance with IAS 34 Interim Financial Reporting and should be

read in conjunction with the Group's last annual consolidated

financial statements as included in the Company's Admission

Document, dated 7 May 2021.

The condensed financial information does not include all the

information required for the full annual financial statements,

however, selected explanatory notes are included to explain events

and transactions that are significant to an understanding of the

changes in the Group's financial position and performance since the

last annual consolidated financial statements.

3 Accounting policies

3.1 Critical accounting estimates and judgements

The preparation of financial information requires the Directors

to make judgements, estimates and assumptions concerning the future

performance and activities of the Group. These estimates and

assumptions are based on the historical experience and acquired

knowledge of the Directors, the result of which forms the basis of

the judgements made about the carrying value of assets and

liabilities that are not clear from external sources. Actual

results may differ from these estimates and those that may have a

material impact on the financial information are as follows:

Fair valuation of the put option liability

The fair value of the put option liability has been assessed by

the Group. The valuation is based on estimates of the forecast

Group Enterprise Value, net of debt, as at March 2023. The

estimates also take into account the historical accuracy of

forecasting and the sensitivity of the valuation to changes in

forecasts.

Impairment of trade receivables

IFRS 9, Financial Instruments, requires that provisioning for

financial assets needs to be made on a forward-looking expected

credit loss model. This requires management to consider historic,

current and forward-looking information to determine the level of

provisioning required.

Management has assessed the ageing of the trade receivables,

their knowledge of the Groups customer base, and other economic

factors as indicators of potential impairment.

3.2 Measurement convention

The financial statements are prepared on the historical cost

basis except that the following assets and liabilities are stated

at their fair value; financial instruments are classified at fair

value through profit or loss and unlisted investments.

3.3 Going concern

The condensed financial information has been prepared on a going

concern basis which the Directors consider to be appropriate for

the following reasons:

As part of the food supply industry, the Group continued to

trade throughout the COVID-19 pandemic and the financial position

and performance of the Group has remained robust through this

challenging period. The impact of COVID-19 on the Group's customers

has been most notable in the Foodservice division and for Vending

customers in the Ambient division. Revenue amongst this customer

base has been adversely impacted following Government-led closures

of customers' operations in the 'out of home' sector covering

cafes, restaurants, bars and hotels. Conversely, revenue in the

Group's other divisions and market segments has been robust. The

Group has continued to make use of the Coronavirus Job Retention

Scheme in affected divisions. The Group is cash generative and

generated GBP9,799,000 of cash from operating activities in the six

months ended 30 April 2021, illustrating the strong underlying

operating model of the Group.

On 24 May 2021, the Company was admitted to the AIM with

GBP64,000,000 of funds raised. These funds were used to pay down

interest bearing loans and borrowings of GBP51,217,000 with the

balance used to reduce the Groups draw on its working capital

facilities.

The Directors have produced and analysed a detailed cash flow

forecast for a period of 12 months from the date of approval of

this financial information and have taken into account known and

forecast developments in trading.

This forecast shows that the Group is expected to have

sufficient levels of financial resources available both to fund

operations and to pursue its stated growth strategy, even after

reasonable sensitivities of these forecasts.

As a result of this detailed analysis, the Directors consider

that the Group has access to sufficient resources to meet its

existing liabilities as they fall due and to ensure it is able to

meet its future liabilities for at least 12 months from the date of

the approval of this condensed financial information.

4 Segmental information

The following analysis by segment is presented in accordance

with IFRS 8 on the basis of those segments whose operating results

are regularly reviewed by the Board (the Chief Operating Decision

Maker as defined by IFRS 8) to assess performance and make

strategic decisions about allocation of resources.

The Group has the following operating and reporting

segments:

-- Ambient: Provides delivered wholesale of ambient food, drink and tobacco products;

-- Frozen & Chilled: Provides delivered wholesale of frozen and chilled food products;

-- Foodservice: Provides delivered wholesale of alcohol, frozen

and chilled food to trade customers;

-- Corporate: Contains the central functions that are not devolved to the business units.

These segments offer different products and services to

different customer types, attracting different margins. They each

have separate management teams.

The segments share a commonality in service, being delivered

wholesale of food and drink products. The Group therefore benefits

from a range of expertise, cross selling opportunities and

operational synergies in order to run each segment as competitively

as possible.

Each segment is measured on its adjusted EBITDA and internal

management reports are reviewed monthly by the Board. This

performance measure is deemed the most relevant by the Board to

evaluate the results of the segments relative to entities operating

in the same industry.

Prior to admission to AIM the Group and its segments reported

their monthly management accounts under FRS102. The below

information is therefore reported in FRS102 format with the

adjustments to convert to IFRS reporting also set out.

Ambient Frozen & Foodservice Corporate Total

Chilled

GBP000 GBP000 GBP000 GBP000 GBP000

6 months to 30 April

2021

Revenue 64,495 71,729 10,888 - 147,112

Inter-segment revenue 5,622 - 94 - 5,716

Segment revenue 70,117 71,729 10,982 - 152,828

Adjusted EBITDA (pre

IFRS 16) 754 2,458 (1,748) (167) 1,297

IFRS 16 adjustment 2,537

Adjusted EBITDA 3,834

Depreciation (3,940)

Amortisation (75)

Restructuring income 2,192

Compensation for post

combination services (1,221)

Interest expense (4,269)

Loss before tax (3,479)

Segment assets (under

UK GAAP) 32,877 50,525 18,112 24,159 125,673

Segment liabilities

(under UK GAAP) (23,437) (43,703) (10,121) (56,831) (134,092)

IFRS adjustments

Goodwill amortisation 10,327 10,327

Negative goodwill 122 122

Capitalised transaction

costs (760) (461) (1,221)

IFRS 16 (190) (502) (188) (880)

Compensation for post

combination services (3,427) (3,427)

IFRS net assets/(liabilities) 9,250 2,133 7,342 (22,223) (3,498)

Capital expenditure 283 1,448 33 - 1,765

* In the 6 months to 30 April 2021 there was no difference

between Adjusted EBITDA under IFRS and UK GAAP except for the

application of IFRS 16.

Ambient Frozen & Foodservice Corporate Total

Chilled

GBP000 GBP000 GBP000 GBP000 GBP000

12 months to 30 April

2020

Revenue 175,437 138,418 85,148 - 399,003

Inter-segment revenue 13,459 - 455 - 13,914

Segment revenue 188,896 138,418 85,603 - 412,917

Adjusted EBITDA (pre

IFRS 16) 3,626 7,303 2,725 (449) 13,205

IFRS 16 adjustment 4,275

Adjusted EBITDA 17,480

Depreciation (6,918)

Amortisation (96)

Restructuring costs (859)

Acquisition expense (570)

Compensation for post

combination services (1,415)

Interest income 1,643

Interest expense (7,873)

Profit before tax 1,392

Segment assets (under

UK GAAP) 32,178 40,986 19,003 20,478 112,645

Segment liabilities

(under UK GAAP) (20,523) (32,693) (13,998) (49,990) (117,204)

IFRS adjustments

Goodwill amortisation 8,095 8,095

Negative goodwill 122 122

Capitalised transaction

costs (724) (438) (1,162)

IFRS 16 (110) (156) (95) (361)

Compensation for post

combination services (1,415) (1,415)

IFRS net assets/ (liabilities) 11,545 5,998 4,472 (21,295) 720

Capital expenditure 1,015 1,148 311 - 2,474

* In the 12 months to 30 April 2020 there was no difference

between Adjusted EBITDA under IFRS and UK GAAP except for the

application of IFRS 16.

Ambient Frozen & Foodservice Corporate Total

Chilled

GBP000 GBP000 GBP000 GBP000 GBP000

18 months to 31 October

2020

Revenue 249,080 230,546 112,390 - 592,016

Inter-segment revenue 20,107 636 595 - 21,338

Segment revenue 269,187 231,182 112,985 - 613,354

Adjusted EBITDA (pre

IFRS 16) 5,280 13,547 2,700 (797) 20,730

IFRS 16 adjustment 6,904

Adjusted EBITDA 27,634

Depreciation (11,013)

Amortisation (144)

Restructuring costs (1,467)

Acquisition expense (628)

Compensation for post

combination services (2,358)

Interest income 1,453

Interest expense (12,172)

Profit before tax 1,305

Segment assets (under

UK GAAP) 35,066 32,620 20,894 19,502 108,082

Segment liabilities

(under UK GAAP) (23,477) (25,675) (12,488) (51,891) (113,531)

IFRS adjustments

Goodwill amortisation 9,306 9,306

Negative goodwill 122 122

Capitalised transaction

costs (760) (461) (1,221)

IFRS 16 (167) (270) (167) (604)

Compensation for post

combination services (2,207) (2,207)

IFRS net assets / (liabilities) 11,422 3,708 7,778 (22,961) (53)

Capital expenditure 1,395 2,256 1,165 - 4,816

* In the 18 months to 31 October 2020 there was no difference

between Adjusted EBITDA under IFRS and UK GAAP except for the

application of IFRS 16.

Geographical information: 6 months to 12 months 18 months

Group revenue 30 April to to

2021 30 April 31 October

2020 2020

GBP000 GBP000 GBP000

United Kingdom 143,838 389,914 579,436

Overseas 3,274 9,089 12,580

147,112 399,003 592,016

No one customer accounts for more than 10% of Group revenue.

5 Other operating income

6 months to 12 months 18 months

30 April to to

2021 30 April 31 October

2020 2020

GBP000 GBP000 GBP000

Net gain on disposal of fixed

assets 25 23 5

Net (loss)/ gain on foreign exchange (2) 5 5

Net gain on remeasurement of

lease liabilities and right-of-use

assets 98 - -

Property restructure 2,260 - -

Grant income 2,042 593 3,010

4,423 621 3,020

Grant income represents funding claimed through the Coronavirus

Job Retention Scheme.

The property restructure income arises as the result of a

Compulsory Purchase Order ("CPO") enacted by Luton Borough Council

relating to the Cargo 10 distribution facility. The result of the

CPO is that Eden Farm Limited and Squirrels (UK) Limited have

relocated to a new purpose-built warehouse on a neighbouring site

to Cargo 10 in Luton. Income to the Group during the period under

the terms of the CPO was GBP2,850,000 and was offset by costs

incurred, which include legal and professional fees and relocation

expenses, of GBP590,000.

6 Exceptional items

The Board considers the following items as exceptional items in

determining the adjusted EBITDA and forming the basis of the

Alternative Performance Measure ("APM") of basic underlying

earnings per share (Note 7). Exceptional items are defined as

income or expenses that arise from events or transactions that are

clearly distinct from the normal activities of the Group and

therefore are not expected to recur frequently.

The Board believes that this APM provides the readers with

important additional information regarding the earnings per share

performance of the Group. The following items comprise the

exceptional charges/(credits) during the periods.

6 months to 12 months 18 months

30 April to to

Exceptional cost/(income) comprises: 2021 30 April 31 October

2020 2020

GBP000 GBP000 GBP000

Transaction fees - 859 834

Restructuring - - 63

COVID-19 related restructuring

costs 68 - 570

Property restructure (2,260) - -

Acquisition expenses - 570 628

Compensation for post combination

services 1,221 1,415 2,358

(971) 2,844 4,453

COVID-19 related restructuring costs include a modest workforce

reduction as the subsidiaries have restructured to match customer

demand following Government-led trading restrictions. This cost was

largely incurred in the 18 months ended 31 October 2020 and the

additional costs incurred in the 6 months ended 30 April 2021 were

a result of extensions to Government-led trading restrictions.

Property restructure income is as set out in Note 5.

Compensation for post-combination services relates to the value

of the put option liability in connection the acquisition of the

remaining share capital of Central Supplies (Brierley Hill) Ltd

which is subject to an agreement to acquire it within two years of

the acquisition. As at 30 April 2021, this expense is materially

accrued in line with the 2-year vesting period.

7 Earnings per share

Basic earnings per share

Basic earnings per share for the six-month period ended 30 April

2021, 12-month period ended 30 April 2020 and the 18-month period

ended 31 October 2020 is calculated by dividing profit attributable

to ordinary shareholders by the weighted average number of ordinary

shares outstanding during each period as calculated below.

Diluted earnings per share

Diluted earnings per share for the six-month period ended 30

April 2021, 12-month period ended 30 April 2020 and the 18-month

period ended 31 October 2020 is calculated by dividing profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares, adjusted for the effects of all dilutive

potential ordinary shares (which comprise a put option) outstanding

during each period as calculated below.

Profit attributable to ordinary 6 months to 12 months 18 months

shareholders 30 April to to

2021 30 April 31 October

2020 2020

GBP000 GBP000 GBP000

(Loss)/profit attributable to

all shareholders (3,445) 273 (500)

GBP GBP GBP

Basic earnings per B1 share (61.51) 4.88 (8.94)

Diluted earnings per B1 share (61.51) 4.88 (8.94)

Weighted average number of ordinary 6 months to 12 months 18 months

shares 30 April to to

2021 30 April 31 October

2020 2020

Number Number Number

Issued ordinary shares at the

start of the period (see below) 101,100 100,710 101,100

Effect of shares subject to written

put (24,000) (24,000) (24,000)

Effect of shares without dividend

rights (21,100) (20,710) (21,100)

Weighted average number of ordinary

shares (basic) during

the period 56,000 56,000 56,000

Weighted average number of ordinary

shares (diluted) during the period 56,000 56,000 56,000

The ordinary A shares are those subject to the put option

liability.

The following Alternative Performance Measure ("APM") for

earnings per share is not defined or specified under the

requirements of International Financial Reporting Standards. The

Board believes that this APM provides the readers with important

additional information regarding the earnings per share performance

of the Group:

Basic underlying earnings per share

Profit attributable to the equity holders of the Group prior to

exceptional items and the fair value movement of the put option

liability measured through the Consolidated Statement of Profit or

Loss, divided by the weighted average number of ordinary shares

during the financial period.

6 months to 12 months 18 months

30 April to to

2021 30 April 31 October

2020 2020

GBP000 GBP000 GBP000

(Loss)/profit attributable to

all shareholders (3,445) 273 (500)

Exceptional items net of tax

(Note 6) (554) 2,840 4,346

Fair value adjustments on the

put option liability - (1,643) (1,453)

Underlying (loss)/profit attributable

to B1 shareholders (3,999) 1,470 2,393

GBP GBP GBP

Basic underlying (loss)/earnings

per B1 share (71.40) 26.25 42.72

Ordinary A shares have an associated redemption option held by

Pricoa Capital Group. The option is only exercisable from 1 March

2023 or in the instance of one or more of certain events occurring,

as set out in the Investor Agreement. These events include:

repayment of all of the Mezzanine notes, voluntary or involuntary

winding up of the company, sale of the business or change of

control. The option has been accounted for as a compound financial

instrument. This option was extinguished at the time of the Initial

Public Offering via the secondary placing (Note 8).

8 Post balance sheet events

Initial Public Offering and Listing

The Company placed 42,666,677 of new ordinary shares at 150

pence per share and existing shareholders placed 11,753,327 via a

secondary placing at 150 pence per share. The Company received net

proceeds of GBP60,700,000.

The Company's ordinary shares were admitted to trading on AIM on

24 May 2021, under the ticker "KITW", and the ISIN

GB00BNYKB709.

The table below sets out a pro-forma balance sheet to re-state

the 30 April 2021 financial position considering the effects of the

listing for illustrative purposes.

Unaudited Bonus Release Cash receipt Repayment Unaudited

30 April issue of amortised on issue of interest pro-forma

2021 of ordinary deal costs of placing bearing 30 April

shares and written shares loans and 2021

put option borrowings

and deal

costs

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Non-current assets

Goodwill 31,249 31,249

Intangible assets 336 336

Property plant and

equipment 9,854 9,854

Right-of-use assets 22,987 22,987

Investments 20 20

Investment property 175 175

64,621 - - - - 64,621

Current assets

Inventories 32,961 32,961

Trade and other receivables 47,945 47,945

Cash and cash equivalents 7,117 64,000 (59,113) 12,004

88,023 - - 64,000 (59,113) 92,910

Total assets 152,644 - - 64,000 (59,113) 157,531

Current liabilities

Interest bearing loans

and borrowings 16,661 (2,222) 14,439

Lease liabilities 4,448 4,448

Trade and other payables 59,255 59,255

Tax payable 1,472 1,472

81,836 - - - (2,222) 79,614

Non-current liabilities

Interest bearing loans

and borrowings 49,507 3,884 (53,391) -

Lease liabilities 19,335 19,335

Other financial liabilities 5,410 (5,410) -

Deferred tax liabilities 54 54

74,306 - (1,526) - (53,392) 19,389

Total liabilities 156,142 - (1,526) (55,614) 99,003

Net (liabilities)/assets (3,498) - 1,526 64,000 (3,500) 58,528

Equity attributable

to equity holders of

the parent

Called up share capital 50 223 427 700

Share premium account 2,944 (223) 63,573 66,294

Consolidation reserve (33,098) (33,098)

Retained earnings 26,606 1,526 (3,500) 24,632

(Accumulated deficit)/Equity (3,498) - 1,526 64,000 (3,500) 58,528

9 Ultimate controlling party

As at 30 April 2021, the ultimate controlling party of the Group

was PV Young. Following the completion of the IPO in May 2021,

there is no ultimate controlling party of the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKABKOBKDNOB

(END) Dow Jones Newswires

July 27, 2021 02:00 ET (06:00 GMT)

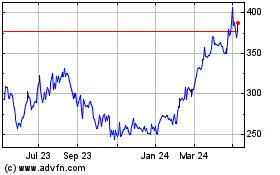

Kitwave (LSE:KITW)

Historical Stock Chart

From Mar 2024 to Apr 2024

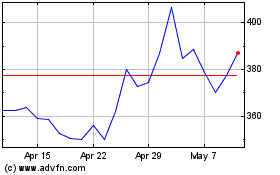

Kitwave (LSE:KITW)

Historical Stock Chart

From Apr 2023 to Apr 2024