Lloyds Banking Sells European Commercial Real Estate Loans for EUR280 Million

20 March 2014 - 6:54PM

Dow Jones News

By Ian Walker

LONDON--Lloyds Banking Group PLC (LLOY.LN) said Thursday it is

selling a portfolio of European commercial real estate loans to

MELF Sarl, an entity affiliated with Marathon Asset Management LP,

for 280 million euros ($389.46 million) as part of its strategy to

reduce its non-core run-off portfolio.

The 33%-government-owned bank added that the sale won't have a

material effect on the group, including on its capital position,

due to existing provisions taken against these assets. It will use

the money raised for general corporate purposes.

Lloyds expects the sale to complete in the second quarter of

this year.

Shares closed Wednesday at 79 pence, valuing the company at

GBP56.49 billion.

Write to Ian Walker at ian.walker@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

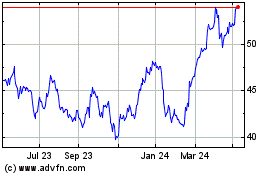

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2024 to May 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From May 2023 to May 2024