TIDMLWI

RNS Number : 7519R

Lowland Investment Co PLC

13 December 2016

LOWLAND INVESTMENT COMPANY PLC

Annual Report for the year ended 30 September 2016

This announcement contains regulated information

-- Net Asset Value Total Return 12.2%(1)

-- Benchmark Total Return 16.8%

-- Growth in Dividend 9.8%

-- Dividend for the year 45.0p

Year ended Year ended

30 September 30 September

Key Data 2016 2015

------------------------------------ -------------- --------------

NAV per share at year end 1,432p 1,318p

Share Price at year end 1,337p 1,287p

Market Capitalisation GBP361m GBP346m

Dividend per share 45.0p 41.0p

Ongoing Charge

- including the performance fee 0.63% 0.85%

- excluding the performance fee 0.63% 0.60%

Dividend Yield (2) 3.4% 3.2%

Gearing at year end 6.2% 16.8%

Discount at year end(3) (6.6)% (2.4)%

(1) Net asset value per share total return (including dividends

reinvested)

(2) Based on the dividends paid in respect of the previous

twelve months

(3) Calculated using year end audited NAVs including current

year revenue

Sources: Morningstar for the AIC, Henderson, Datastream

MANAGEMENT REPORT

Commenting on the results Chairman, Peter Troughton, said:

Performance

The net asset value ('NAV') total return for the year was

+12.2%, while the FTSE All-Share Index delivered a total return of

+16.8%. It was year of handsome absolute returns, but our

performance was clearly disappointing relative to the index. The

main cause of this underperformance is Lowland's exposure to medium

and smaller companies in the index. They underperformed large

companies as they benefited less from Sterling depreciation.

Total return for the financial year %

------------------------------------- -----

FTSE 100 18.4

FTSE 250 10.2

Numis Smaller Companies 8.6

Whilst 2016 was not the best year for medium and smaller

companies, it is our exposure to these that has been an important

driver of the Company's longer-term outperformance of the

benchmark.

5 years 10 years 25 years

Total return to September 2016 % % %

-------------------------------- -------- --------- ---------

NAV 105.6 115.8 1367.9

Share Price 104.9 109.5 1319.9

FTSE All-Share Index 68.9 75.6 605.2

Dividends

The revenue earnings per share for the year are 47.7p, against

46.4p last year. This understates the underlying growth in

dividends from the portfolio, because last year we received a

materially higher level of special dividends. If we ignore these

special dividends, the earnings grew 4.6% which compares favourably

with dividend growth from the benchmark of 3.6% over the period.

This has allowed us to pay an increased dividend to shareholders.

Subject to shareholders approving the final dividend, the total

dividend for the year will be 45p, which as an increase of 9.8%

over last year's 41p. We will also be transferring GBP735,000 to

the revenue reserve. Over the past five years dividends have grown

at a compound rate of 10%. Over the last ten years, Lowland's

dividend growth has substantially outperformed the FTSE All-Share

Index dividend growth.

Review

We had thought interest rates might rise at the start of the

year. In fact they fell from 0.5% to 0.25% in the aftermath of the

UK's referendum on the European Union ('EU') in June. The Manager

believed that the outcome of the referendum would usher in a period

of uncertainty while Britain's new relationship with the EU is

established, so we reduced the gearing from 16% to 6%. This was a

decision to reduce portfolio risk, to protect shareholders' capital

and to have more firepower ready to invest when new opportunities

arise.

As it happens, we acted too soon. The market has performed well

in the immediate aftermath of the Brexit vote. The economy has

beaten expectations. But the prospect of leaving the EU has focused

attention on the UK's large current account deficit. The pound's

depreciation will assist the necessary correction, but this will

inevitably require a period of lower growth in domestic

consumption. The valuation of companies totally exposed to the UK

has fallen, despite the overall rally in the market. Once the level

of disruption to the economy can be gauged, there may be recovery

situations in the UK which will be worth investing in.

Gearing

As a Board we have in the past refrained from fixing our

borrowings with long-term debt, though it has been a recurring

subject of Board discussions during recent years. We have been

right to prefer the flexibility of short-term bank borrowing: this

has been to the advantage of shareholders while rates have stayed

low. However, rates on long-term debt have now fallen to attractive

levels; and the combined prospect of higher inflation in the UK and

a shift towards fiscal expansion in the US suggests that rates are

now turning. We have therefore issued a 20 year long loan note with

a coupon of 3.15% for GBP30m.

Share Issuance

We will issue shares if it helps produce an orderly market in

the stock and it enhances the NAV. During the year 126,138 shares

were issued at a premium of 3.9%. There were no share buybacks.

Ongoing Charge

The ongoing charge to the Company for the year ended 30

September 2016 as calculated in accordance with the Association of

Investment Companies (the 'AIC') methodology is 0.63% (2015: 0.60%

excluding the performance fee and 0.85% including the performance

fee). There was no performance fee payable this year.

The Board

I am very pleased that Gaynor Coley has agreed to join the

Board. She is a qualified Chartered Accountant and chairs the

Institute of Chartered Accountants in England and Wales Corporate

Responsibility Advisory Group. Gaynor was most recently the

Director of Public Programmes for The Royal Botanic Gardens at Kew.

Following a successful career in industry both as an internal

auditor at Bank of Nova Scotia and also as Finance Director at

Horizon Farms and Plymouth University, Gaynor joined The Eden

Project in its early days in 1997, taking it to the UK Visitor

Attraction of the Year for three successive years. She therefore

brings broad, relevant and unusual experience to the Board. She

will succeed Robbie Robertson as Chairman of the Audit Committee

following the AGM in 2017.

As announced with the half-year results, I will be standing down

at the Annual General Meeting having served on the Board for 26

years. During this period the dividend has grown from 7.75p in 1990

to 45p this year, an increase of 5.8 times; while the NAV per share

has risen from 165p to 1,432p an increase of 8.7 times. I have

every confidence that my successor, Robbie Robertson, who has

chaired the Audit Committee admirably, will enjoy the same

stimulating and supportive relationship with the Manager, which it

has been my privilege to have had all these years.

Portfolio Management

James Henderson has been the manager since 1990. He has for the

last three years been working with Laura Foll on the portfolio. The

Board is delighted that with effect from 1 November 2016 Laura has

been formally appointed as Joint Fund Manager. James and Laura will

continue to share investment decisions. The investment approach

will not be changed but it will be refreshed by Laura's added

responsibility for the performance.

Annual General Meeting ('AGM')

The AGM of the Company will be held at the offices of Henderson

on Tuesday 24 January 2017 at 12.30 pm. Full details of the

business to be conducted at the meeting are set out in the Notice

of Meeting which has been sent to shareholders with the Annual

Report. As usual our Fund Managers will be making a

presentation.

Outlook

Next year, inflation may rise as the lower level of Sterling

pushes up the cost of imported goods. If higher inflation becomes

established and fiscal policy is loosened, then short-term interest

rates will need to rise. After thirty years of falling interest

rates, and nearly ten years of 'emergency' rates, stock markets may

react badly to a higher rate environment. We certainly expect a

period of volatility for all stock markets, exacerbated in the UK

by the inevitable drip of Brexit negotiation stories.

The Fund Managers will continue to judge each investment

prospect on its own specific merits rather than taking a

macroeconomic view. The successful companies will be those that

have unique strengths in the quality of their products or the

excellence of the service they give. Companies with a competitive

advantage will ultimately prosper regardless of the economic

backdrop. These will be the companies that are able to grow their

dividends in coming years and perform during a period of marked

economic uncertainty.

Peter Troughton CBE

Chairman

13 December 2016

Principal Risks and Uncertainties and Viability Statement

The Board, with the assistance of the Manager, has carried out a

robust assessment of the principal risks facing the Company

including those that would threaten its business model, future

performance, solvency or liquidity. In carrying out this

assessment, the Board has considered the

market uncertainty arising from the result of the UK referendum

to leave the European Union. The Board has drawn up a matrix of

risks facing the Company and has put in place a schedule of

investment limits and restrictions, appropriate to the Company's

investment objective and policy, in order to mitigate these risks

as far as practicable. The principal risks which have been

identified, and the steps taken by the Board to mitigate these as

far as possible, and whether the Board considers the impact of such

risks has changed over the past year, are as follows:

Risk Controls and Mitigation

---------------------------------------- --------------------------------------------

Investment Activity and Strategy

Risk The Board manages these risks by

An inappropriate investment strategy ensuring a diversification of investments

or poor execution, for example, and a regular review of the extent

in terms of asset allocation or of borrowings. Henderson operates

level of gearing, may result in in accordance with investment limits

underperformance against the Company's and restrictions and policy determined

benchmark index and the companies by the Board, which includes limits

in its peer group, and also in on the extent to which borrowings

the Company's shares may be employed.

trading on a wider discount to

the net asset value per share. The Board reviews the investment

limits and restrictions on a regular

basis and Henderson confirms adherence

to them every month. Henderson provides

the Board with management information,

including performance data and reports

and shareholder analyses.

The Directors monitor the implementation

and results of the investment process

with the Fund Managers at each Board

meeting and monitor risk factors

in respect of the portfolio. Investment

strategy is reviewed at each meeting.

---------------------------------------- --------------------------------------------

Portfolio and Market Price Risk

Market risk arises from uncertainty The Fund Managers seek to maintain

about the future prices of the a diversified portfolio to mitigate

Company's investments. Although against this risk. The Board regularly

the Company invests almost entirely reviews the portfolio, activities

in securities that are listed and performance. An analysis of

on recognised markets, share prices the Company's portfolio is shown

may move rapidly. The companies in the Annual Report.

in which investments are made

may operate unsuccessfully, or

fail entirely.

---------------------------------------- --------------------------------------------

Financial Risk

The financial risks faced by the The Company minimises the risk of

Company include market price risk, a counterparty failing to deliver

interest rate risk, liquidity securities or cash by dealing through

risk, currency risk and credit organisations that have undergone

and counterparty risk. rigorous due diligence by Henderson.

The Company holds its liquid funds

almost entirely in interest bearing

bank accounts in the UK or on short-term

deposit. This, together with a

diversified portfolio which comprises

mainly investments in large and

medium-sized companies mitigates

the Company's exposure to

liquidity risk. Currency risk is

mitigated by the low exposure to

overseas stocks.

Risk Controls and Mitigation

---------------------------------------- ----------------------------------------------------

Gearing Risk

The Company has the ability under The Company minimises the risk by

existing covenants to gear up the regular monitoring of the levels

to 29.99% of the equity shareholder's of the Company's borrowings in accordance

funds other than in exceptional with the agreed limits. The Company

circumstances. In the event of confirms adherence to the covenants

a significant or prolonged fall of the loan facilities on a monthly

in equity markets gearing would basis.

exacerbate the effect of the falling

market on the Company's NAV per

share and, consequently its share

price.

---------------------------------------- ----------------------------------------------------

Operational Risk

Disruption to, or the failure Details of how the Board monitors

of, Henderson's accounting, dealing the services provided by Henderson

or payment systems or the Custodian's and its other suppliers, and the

records could prevent the accurate key elements designed to provide

reporting or monitoring of the effective internal control, are

Company's financial position. explained further in the Internal

Henderson contracts some of the Controls section of the Annual Report.

operational functions (principally

those relating to trade processing,

investment administration and

accounting), to BNP Paribas Securities

Services.

---------------------------------------- ----------------------------------------------------

Accounting, Legal and Regulatory

Risk The Board relies on its Company

In order to qualify as an investment Secretary and its professional advisers

trust, the Company must comply to ensure compliance with the Companies

with Section 1158 of the Corporation Act 2006 and UKLA Rules.

Tax Act 2010. A breach of

Section 1158 could result in the The Board receives internal control

Company losing investment trust reports produced by Henderson on

status and, as a consequence, a quarterly basis, which confirm

capital gains realised within regulatory compliance.

the

Company's portfolio would be subject

to Corporation Tax. Compliance

with the requirements of Section

1158 are monitored

by Henderson and the results are

reported at each Board meeting.

The Company must comply with the

provisions of the Companies

Act 2006 and, since its shares

are listed on the London Stock

Exchange, the UKLA's Listing and

Disclosure Guidance and

Transparency Rules and the Prospectus

Rules ('UKLA Rules'). A breach

of the Companies Act 2006 could

result in the Company and/or

the Directors being fined or the

subject of criminal proceedings.

A breach of the UKLA Rules could

result in the suspension of the

Company's shares; which in turn

would breach Section 1158.

The Board considers these risks to have remained unchanged

throughout the year under review.

Viability Statement

The Company is a long-term investor; the Board believe it is

appropriate to assess the Company's viability over a five year

period in recognition of our long-term horizon and what we believe

to be investors' horizons, taking account of the Company's current

position and the potential impact of the principal risks and

uncertainties as documented above.

The assessment has considered the impact of the likelihood of

the principal risks and uncertainties facing the Company, in

particular investment strategy and performance against benchmark,

whether from asset allocation or the level of gearing, and market

risk, in severe but plausible scenarios, and the effectiveness of

any mitigating controls in place.

The Board has taken into account the liquidity of the portfolio

and the gearing in place when considering the viability of the

Company over the next five years and its ability to meet

liabilities as they fall due. This included consideration of the

duration of the Company's loan facilities and how a breach of the

loan facility covenants could impact on the Company's liquidity,

net asset value and share price.

The Board does not expect there to be any significant change in

the current principal risks and adequacy of the mitigating controls

in place.

Also the Directors do not envisage any change in strategy or

objectives or any events that would prevent the Company from

continuing to operate over that period as the Company's assets are

liquid, its commitments are limited and the Company intends to

continue to operate as an investment trust. Only a substantial

financial crisis affecting the global economy could have an impact

on this assessment.

Where there is current uncertainty in the markets following the

UK referendum results to leave the European Union, the Board does

not believe that this will have a long-term impact on the viability

of the Company and its ability to continue in operation.

Based on this assessment, the Directors have a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the next five year

period.

Statement under Disclosure Guidance and Transparency Rule

4.1.12

Each of the Directors confirms that, to the best of his/her

knowledge:

-- the Company's financial statements, which have been prepared

in accordance with UK Accounting Standards and applicable law give

a true and fair view of the assets, liabilities, financial position

and profit of the Company; and

-- the Strategic Report, Report of the Directors and financial

statements include a fair review of the development and performance

of the business and the position of the Company, together with a

description of the principal risks and uncertainties that it

faces.

For and on behalf of the Board

Peter Troughton CBE

Chairman

13 December 2016

Fund Managers' Report

Investment Background

The Central Banks in the major economies, have created a real

dilemma for investors. Their policy has driven down the return on

'risk free assets'. For the policy to work capital needs to flow to

riskier assets attracted by their relative return and therefore

stimulate activity. However, to use the long gilt yield as a

valuation metric would be using an artificially manipulated gauge.

The yield on long-dated government bonds probably does not give any

insight into the likely levels of future inflation. Therefore

companies should not reduce the return hurdles they apply before

making long-term investments in the real economy. Too often this

year promoters of deals have claimed that an acquisition is good

because it will boost a company's earnings as the cost of money is

so low. This is dangerous ground. An acquisition by a company needs

to make operational sense and the financial disciplines around what

is a desirable deal, such as the required return on capital, should

not be altered. The longer interest rates stay at very low levels

the more investment discipline will become lax. Valuations on UK

equities moved into more expensive territory during the year. We

have reduced gearing as a result of this increased risk.

Performance Attribution

The largest positive contributor to performance this year was

Hill & Smith, a galvaniser and manufacturer of crash barriers.

It has been a long-held position for the Company, initially

purchased for GBP1.01 per share in 2004. In recent years it has

been an excellent performer, benefitting from a good management

team. They have successfully expanded their presence in the US and

maintained a strong balance sheet. In particular they have been a

beneficiary of the 'Road Investment Strategy' in the UK which spans

to the early 2020s, increasing demand for their crash barriers and

road signs. For the overall balance of the portfolio we have sold

part of the holding with the intention of reinvesting in good value

growing smaller companies.

At the sector level the Company benefited during the year from

its relatively low weighting in the banking sector. We continue to

be sceptical of the ability of domestic retail banks such as Lloyds

to grow earnings. Due to their high cost base and desire to protect

margins they are steadily losing market share to challenger banks

in key areas such as mortgages. Over time this downward pressure on

earnings will constrain their ability to pay high dividends and

therefore we currently hold no position. Within financials our

preference continues to be for insurers (such as Hiscox) which

generate strong returns across the underwriting cycle and provide

diversification for our high weight in the industrials sector.

The largest individual detractor from performance was industrial

chain manufacturer Renold, which has seen earnings come under

pressure as a result of difficult end markets in agriculture and

energy. What we find encouraging (and why we have added to the

shares on weakness) is that management have made real progress in

taking costs out of the business. This meant that despite the tough

environment margins grew year on year. We remain confident that in

a more buoyant sales environment they can achieve their target of

mid-teens margins which would leave the shares looking attractive

at this level.

We sold British American Tobacco too early. Our investment

process is valuation driven and we were concerned by the high

valuation.

Investment Activity

A substantial part of the investment process has historically

been recovery investing, where we feel the market has become overly

negative on a particular company or sector. In the Annual Report

last year we wrote about commodity companies. This year our

recovery plan included Standard Chartered and Rolls-Royce. Both

were existing positions that we added to following the appointment

of new management teams that are rigorously addressing legacy

problems. In the case of Standard Chartered, Bill Winters, the

Chief Executive Officer addressed questions over their balance

sheet via a rights issue and a dividend cut, and is now focused on

returning the business to revenue growth across emerging markets.

After recent meetings with management, we are confident they can

return the business to a strong growth path that will also lead to

substantial dividend payments. In the case of Rolls-Royce it has

been profitability rather than sales that have been problematic.

The technology and skills in the company already make it one of the

world leaders in large aerospace engines, but it has historically

been overly complex. The new Chief Executive Officer, Warren East,

has instilled a focus on cost and transparency.

In the smaller companies area we have added a new position,

Numis, a corporate broker and equity research firm. Numis' focus on

the UK, specifically small and medium sized companies means it is

winning share off larger competitors for both corporate brokerships

as well as fund raisings such as IPOs. This leaves it well placed

to deliver substantial earnings growth while already paying an

attractive dividend yield to shareholders.

For a number of years we have been selectively investing in

early-stage companies. These remain a small portion of the overall

Company (4% net assets), but provide an attractive level of

diversification and have so far added value. A new addition this

year was Atlantis Resources. Atlantis is aiming to commercialise

tidal power, with its first project in offshore Scotland. Tidal

power has advantages versus existing renewable energy because it is

both predictable and, as the turbines are below the water, not

unsightly. Given its early stage of commercial development it is

also currently subject to favourable environmental subsidies.

The largest sales during the year were the holdings in miners

Anglo American and Glencore. We aim to be mildly contrarian in

style and we had added to these positions when they were trading at

substantial discounts to book value in late 2015. While we have a

long time horizon in these cases the share prices moved further and

faster than we anticipated and we felt that market expectations

were beginning to look stretched. The investment style means that

we have a tendency to buy shares early on share price falls and

sell shares early when sentiment towards stocks changes. In

hindsight we sold our positions in miners too early, and we will

continue to review our position. For the time being we feel market

expectations are not reflecting the risks that remain.

Additional sales during the year were primarily where we saw

companies approaching fair value. Examples of this include tape

manufacturer Scapa, semiconductor manufacturer Infineon and

packaging producer DS Smith. In many cases we have held these

positions for a number of years and have seen them transition from

low rated recovery positions towards growth companies. Scapa, for

example, was originally purchased in 2001 for 66p per share. At the

time it was an industrial tape manufacturer that had legacy

asbestos and pension issues. It is now a well-managed health care

tape company making excellent margins. We are reducing the holding

at around GBP3 per share. Scapa illustrates well the importance in

smaller and medium sized company investing, of both being patient

and investing, behind excellent management teams.

The Board

Peter Troughton is retiring from the Board after 26 years. I

know it is considered best practice for directors to serve shorter

terms. Peter's contribution, however, demonstrates that there is

benefit in continuity. That Peter had already served during two

periods of real market weakness was of great benefit to the Manager

in helping position the portfolio for the recovery after the 2008

crash. We are grateful to him.

Portfolio Management

From 1 November 2016 we have been managing the portfolio as

joint managers. We do not intend the investment approach to alter

but it will allow us to follow more deeply UK companies. We both

know what we are looking for in the individual companies and are

mindful of the blend of the overall portfolio.

Outlook

Next year it is likely inflation will rise and output growth

will slow. There may be long term benefits from Brexit for the UK

economy. For companies the near term brings planning uncertainty

and higher costs of imported goods at a time of slowing economic

growth. Either company margins will come under pressure or

inflation will rise faster than expected. The benefits to exporters

of currency depreciation are not as large as in the past. The

companies held in the portfolio are further up the value chain than

they were twenty years ago. They sell on service and product

superiority rather than just price. This allows them to achieve

higher margins but it also means that the depreciation of Sterling

is less important. Inflation will become a medium-term problem if

wages rise to compensate for inflation and the reduced purchasing

power of Sterling outside the UK.

We will be on the lookout for companies whose valuation does not

reflect their ability to grow. Some of these will be recovery

situations where a business has faced up to its problems and

reinvented itself by focusing on its core strengths. Others will be

younger companies that are moving forwards into larger markets for

the first time. The success or failure of these companies will not

be determined by the economic background but rather by the quality

of their product and by the management's ability to capitalise on

it. There will be disappointments but the diversity of the list

does offer some protection. We are not investing on the basis of an

investment theme, but rather in individual businesses that have

some unique strengths. These businesses can be found in many

different areas. The successful portfolio blends different end

market exposures with choosing the successful operators in these

areas. This can be done by paying attention to what the companies

are saying and reporting.

James Henderson and Laura Foll

Fund Managers

13 December 2016

Twenty Largest Holdings

Approximate Valuation

Rank % of Market 2016

2016 (2015) Company portfolio Capitalisation GBP'000

-------------- ---------------------------------------- ------------ ----------------- ------------

Royal Dutch Shell

The company explores produces

and refines oil; it produces

fuels, chemical and lubricants

as well as operating filling

stations worldwide. They have

attacked their cost base and

have very high class assets which

1(3) positions them well for the future. 4.9 GBP170bn 20,137

-------------- ---------------------------------------- ------------ ----------------- ------------

HSBC

The global bank provides international

banking and financial services.

The diversity of the countries

it operates in as well as its

exposure to faster growing economies

2(6) make it well placed. 3.0 GBP120bn 12,471

-------------- ---------------------------------------- ------------ ----------------- ------------

Hiscox

The international insurance company

manages underwriting syndicates

and underwrites a range of personal

and commercial insurance. They

are very disciplined and have

over the long term have achieved

3 (2) a high return on capital. 3.0 GBP3bn 12,414

-------------- ---------------------------------------- ------------ ----------------- ------------

Senior

The company manufactures specialist

engineering products for the

automotive and aerospace sectors.

The share price has recently

been weak but the civil aerospace

business is set to return to

high single digit growth for

the foreseeable future with good

4(1) margins. 2.8 GBP800m 11,455

-------------- ---------------------------------------- ------------ ----------------- ------------

Phoenix

The company is a UK based specialist

closed life and pension fund

consolidator. The dividend and

asset value are growing and the

5(5) equity yields over 6%. 2.6 GBP2bn 10,537

-------------- ---------------------------------------- ------------ ----------------- ------------

Standard Chartered

The international banking group

operates principally in Asia,

Africa and the Middle East. The

new management team has focused

the bank back to areas of relative

6* strength in its growing markets. 2.4 GBP20bn 9,920

-------------- ---------------------------------------- ------------ ----------------- ------------

Scapa(1)

The company manufactures and

supplies technical tape and adhesive

film to various markets worldwide

including the medical, automotive,

construction and sports industries.

It has been a very successful

small company investment growing

its sales and margins over many

7(8) years 2.2 GBP400m 9,020

-------------- ---------------------------------------- ------------ ----------------- ------------

Prudential

The company provides an assortment

of insurance and investment products

around the world. The business

in the Far East has grown impressively

8* in recent years. 2.1 GBP35bn 8,882

-------------- ---------------------------------------- ------------ ----------------- ------------

GKN

The manufacturer produces automotive

components and aerospace parts.

The operating margins have improved

during a testing period for end

markets and further progress

9(13) is expected. 2.0 GBP5bn 8,136

-------------- ---------------------------------------- ------------ ----------------- ------------

Rio Tinto

The miner has interests in aluminium,

coal, copper, gold, iron ore,

uranium, zinc and diamonds. It

operates good quality assets

from a relatively low cost base

10(14) which puts it in a strong position. 1.9 GBP52bn 7,723

-------------- ---------------------------------------- ------------ -----------------

Hill & Smith

The manufacturer produces products

for the infrastructure, galvanizing,

building and construction industries.

The products include traffic

barriers, fencing, lighting columns,

storage tanks and variable message

signs. It has been a successful

small company investment over

11 (7) many years. 1.9 GBP800m 7,671

-------------- ---------------------------------------- ------------ ----------------- ------------

Irish Continental(2)

The group markets holiday packages

and provides passenger transport,

roll-on and roll-off freight

transport and container services

between Ireland, the United Kingdom

and continental Europe. It is

a very cash generative well-run

12(10) company. 1.8 GBP600m 7,526

-------------- ---------------------------------------- ------------ ----------------- ------------

Headlam

The company distributes floor

titles and carpeting. The price

of their products is being increased

their national coverage positions

13* them well to continue growing. 1.7 GBP400m 7,039

-------------- ---------------------------------------- ------------ ----------------- ------------

Croda

The company produces a diverse

range of products to go into

personal care, pharmaceuticals,

plastics, nutrition, fire prevention

and engineering. The value added

nature of their work means strong

14(20) margins are achieved. 1.6 GBP4bn 6,728

-------------- ---------------------------------------- ------------ ----------------- ------------

Relx

The company publishes information

for the scientific, medical,

legal and business sectors serving

customers worldwide. It is consistent

15* high quality growth business. 1.6 GBP30bn 6,583

-------------- ---------------------------------------- ------------ ----------------- ------------

Johnson Service(1)

A textile rental company that

provides linens for use across

workwear, hotels and restaurants.

In recent years the management

team have successfully de-geared

the balance sheet and grown operating

16(16) margins. 1.6 GBP400m 6,533

-------------- ---------------------------------------- ------------ ----------------- ------------

BP

A producer and refiner of oil.

Following the fall in the oil

price they have successfully

focussed on cost reduction in

order to bring down their breakeven

17(9) cost per barrel of oil produced. 1.6 GBP86bn 6,525

-------------- ---------------------------------------- ------------ ----------------- ------------

GlaxoSmithKline

Among the world's largest healthcare

companies that operates across

pharmaceuticals, vaccines and

consumer health. Following several

years of earnings pressure from

drugs going off patent they have

now returned to earnings growth

driven by success in areas such

18* as HIV. 1.5 GBP74bn 6,161

-------------- ---------------------------------------- ------------ ----------------- ------------

Rolls-Royce

The company designs and manufactures

engines as well as providing

aftermarket

services for use across aerospace

and industry. They have successfully

won market share across many

of the large new civil aerospace

programmes and under a new management

team have a renewed focus on

19* removing duplicate costs. 1.5 GBP12bn 5,940

-------------- ---------------------------------------- ------------ ----------------- ------------

Novae

The company is a Lloyd's underwriter,

writing insurance in areas such

as aviation and property. In

recent years they have hired

specialist underwriters across

a range of areas and have successfully

grown their premiums while remaining

20* disciplined. 1.4 GBP500m 5,911

-------------- ---------------------------------------- ------------ ----------------- ------------

43.1 177,312

-------------- ---------------------------------------- ------------ ----------------- ------------

At 30 September 2016 these investments totalled GBP177,312,000

or 43.1% of the portfolio.

* Not in the top 20 largest investments last year

1 AIM stocks

2 Overseas listed stocks (Canada, France, Germany, Ireland and

USA)

Audited Income Statement

Year ended 30 September Year ended 30 September

2016 2015

Revenue Capital Revenue Capital

return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- --------- --------- --------- ---------

Gains/(losses) on investments

held at fair value through

profit or loss - 29,331 29,331 - (8,387) (8,387)

Income from investments

(note 2) 15,944 - 15,944 15,542 - 15,542

Other interest receivable

and similar income (note

4) 108 - 108 105 - 105

--------- --------- --------- --------- --------- ---------

Gross revenue and capital

gains/(losses) 16,052 29,331 45,383 15,647 (8,387) 7,260

Management fee (1,806) - (1,806) (1,819) - (1,819)

Performance fee - - - - (908) (908)

Other expenses (472) - (472) (484) - (484)

--------- --------- --------- --------- --------- ---------

Net return/(loss) on ordinary

activities before finance

costs and taxation 13,774 29,331 43,105 13,344 (9,295) 4,049

Finance costs (764) - (764) (806) - (806)

--------- --------- --------- --------- --------- ---------

Net return/(loss) on ordinary

activities before taxation 13,010 29,331 42,341 12,538 (9,295) 3,243

Taxation on net return

on ordinary activities (117) - (117) (48) - (48)

--------- --------- --------- --------- --------- ---------

Net return/(loss) on ordinary

activities after taxation 12,893 29,331 42,224 12,490 (9,295) 3,195

===== ===== ===== ===== ===== =====

Return/(loss) per ordinary

share

- basic and diluted (note

5) 47.7p 108.7p 156.4p 46.4p (34.6)p 11.8p

===== ===== ===== ===== ===== =====

The total columns of this statement represent the Profit and

Loss Account of the Company. The revenue return and capital return

columns are supplementary to this and are prepared under guidance

published by the Association of Investment Companies. All revenue

and capital items in the above statement derive from continuing

operations. The Company had no recognised gains or losses other

than those disclosed in the Income Statement.

Audited Statement of Changes in Equity

Called Share Capital Other

up share premium redemption capital Revenue

Year ended capital account reserve reserves reserve Total

30 September 2016 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ---------- ----------- ------------ ------------ ----------- ------------

At 1 October 2015 6,723 59,923 1,007 275,268 11,642 354,563

Net return on ordinary activities

after taxation - - - 29,331 12,893 42,224

Ordinary shares issued 32 1,696 - - - 1,728

Third interim dividend (10.0p)

for the year ended 30 September

2015 paid 30 October 2015 - - - - (2,689) (2,689)

Final dividend (11.0p) for

the year ended

30 September 2015 paid 29

January 2016 - - - - (2,972) (2,972)

First interim dividend (11.0p)

for the year ended 30 September

2015 paid 29 April 2016 - - - - (2,972) (2,972)

Second interim dividend (11.0p)

for the year ended 30 September

2016 paid 29 July 2016 - - - - (2,972) (2,972)

--------- ---------- ---------- ----------- ---------- -----------

At 30 September 2016 6,755 61,619 1,007 304,599 12,930 386,910

===== ===== ===== ====== ===== ======

Called Share Capital Other

up share premium redemption capital Revenue

Year ended capital account reserve reserves reserve Total

30 September 2015 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ---------- ----------- ------------ ------------ ----------- ------------

At 1 October 2014 6,723 59,923 1,007 284,563 9,640 361,856

Net (loss)/return on ordinary

activities after taxation - - - (9,295) 12,490 3,195

Third interim dividend (9.0p)

for the year ended 30 September

2014 paid 31 October 2014 - - - - (2,421) (2,421)

Final dividend (10.0p) for

the year ended

30 September 2014 paid 30

January 2015 - - - - (2,689) (2,689)

First interim dividend (10.0p)

for the year ended 30 September

2015 paid 30 April 2015 - - - - (2,689) (2,689)

Second interim dividend (10.0p)

for the year ended 30 September

2015 paid 31 July 2015 - - - - (2,689) (2,689)

--------- ---------- ---------- ----------- ---------- -----------

At 30 September 2015 6,723 59,923 1,007 275,268 11,642 354,563

===== ===== ===== ====== ===== ======

Audited Statement of Financial Position

As at 30 As at 30

September September

2016 2015

GBP'000 GBP'000

----------------------------------------------- ------------ ------------

Investments held at fair value through profit

or loss

Listed at market value in the United Kingdom 326,129 328,949

Listed at market value on AIM 58,403 56,011

Listed at market value overseas 24,384 26,993

Unlisted 2,101 2,179

----------- -----------

411,017 414,132

----------- -----------

Current assets

Debtors 2,129 3,589

Cash at bank 2,178 669

----------- -----------

4,307 4,258

----------- -----------

Creditors: amounts falling due within one

year (28,414) (63,827)

----------- -----------

Net current liabilities (24,107) (59,569)

----------- -----------

Total assets less current liabilities 386,910 354,563

----------- -----------

Net assets 386,910 354,563

======= =======

Capital and reserves

Called up share capital 6,755 6,723

Share premium account 61,619 59,923

Capital redemption reserve 1,007 1,007

Other capital reserves 304,599 275,268

Revenue reserve 12,930 11,642

----------- -----------

Total shareholders' funds 386,910 354,563

======= =======

Net asset value per ordinary share - basic

and diluted (note 8) 1,432.0p 1,318.4p

======= =======

Audited Statement of Cash Flows

Year ended Year ended

30 September 30 September

2016 2015*

GBP'000 GBP'000

------------------------------------------- -------------- --------------

Cash flows from operating activities

Net return on ordinary activities before

taxation 42,341 3,243

Add back: finance costs 764 806

(Less)/add: (gains)/losses on investments

held at fair value through profit or

loss (29,331) 8,387

Withholding tax on dividends deducted

at source (136) (44)

(Increase)/decrease in debtors (374) 99

Decrease in creditors (827) (160)

----------- -----------

Net cash inflow from operating activities 12,437 12,331

Cash flows from investing activities

Purchase of investments (67,620) (68,100)

Sale of investments 102,719 53,569

----------- -----------

Net cash inflow/(outflow) from investing

activities 35,099 (14,531)

Cash flows from financing activities

Equity dividends paid (net of refund

of unclaimed distributions and reclaimed

distributions) (11,605) (10,488)

Proceeds from issue of ordinary shares 1,728 -

Net loans (repaid)/drawndown (35,418) 12,408

Interest paid (832) (809)

----------- -----------

Net cash (outflow)/inflow from financing

activities (46,127) 1,111

Net increase/(decrease) in cash and cash

equivalents 1,409 (1,089)

Cash and cash equivalents at start of

year 669 1,756

Effect of foreign exchange rates 100 2

----------- -----------

Cash and cash equivalents at end of year 2,178 669

======= =======

Comprising:

Cash at bank 2,178 669

----------- -----------

2,178 669

======= =======

* Restated see note 1a)

Notes to the Financial Statements:

1. Accounting policies

a) Basis of preparation

The company is a registered investment company as defined in

section 833 of the Companies Act 2006 and is incorporated in

the United Kingdom. It operates in the United Kingdom and is

registered at 201 Bishopsgate, London EC2M 3AE.

The Financial Statements have been prepared in accordance with

the Companies Act 2006, FRS 102 - The Financial Reporting Standard

applicable in the UK and Republic of Ireland (which is effective

for periods commencing on or after 1 January 2015) and with the

Statement of Recommended Practice: Financial Statements of Investment

Trust Companies and Venture Capital Trusts ("the SORP") issued

in November 2014. The date of transition to FRS 102 was

1 October 2014.

The Company has early adopted the amendments to FRS 102 in respect

of fair value hierarchy disclosures as published in March 2016.

The principal accounting policies applied in the presentation

of these Financial Statements are set out below. These policies

have been consistently applied to all the years presented. Following

the application of the revised reporting standards there have

been no significant changes to the accounting policies compared

to those set out in the Company's Annual Report for the year

ended 30 September 2015.

There has been no impact on the Company's Income Statement, Statement

of Financial Position (previously called the Balance Sheet) or

Statement of Changes in Equity (previously called the Reconciliation

of Movements in Shareholders' Funds) for periods previously reported.

The Cash Flow Statement previously reported has been restated

to comply with the new disclosure requirements of the revised

reporting standard.

The Financial Statements have been prepared under the historical

cost basis except for the measurement of fair value of investments.

In applying FRS 102, financial instruments have been accounted

for in accordance with Section 11 and 12 of the standard. All

of the Company's operations are of a continuing nature.

b) Going concern

The assets of the Company consist of securities that are readily

realisable and, accordingly, the Directors believe that the Company

has adequate resources to continue in operational existence for

at least twelve months from the date of approval of the financial

statements. Having assessed these factors, the principal risks

and other matters discussed in connections with the viability

statement, the Directors considered it appropriate to adopt the

going concern basis of accounting in preparing the financial

statements.

Gains/(losses) on investments held at fair 2016 2015

2. value through profit or loss GBP'000 GBP'000

---- ------------------------------------------------ ------------ ------------

Gains on the sale of investments based on

historical cost 23,452 16,617

Less: revaluation gains recognised in previous

years (14,374) (12,912)

----------- -----------

Gains on investments sold in the year based

on carrying value at previous Statement of

Financial Position date 9,078 3,705

Revaluation gains/(losses) on investments

held at 30 September 20,153 (12,094)

Exchange gains 100 2

---------- ---------

29,331 (8,387)

===== =====

2016 2015

3 Income from investments GBP'000 GBP'000

--- ---------------------------- ---------- ----------

UK dividends:

Listed investments 12,767 11,814

Unlisted 48 53

Property income dividends 228 210

--------- ---------

13,043 12,077

--------- ---------

Non UK dividends:

Overseas dividend income 2,901 3,465

--------- ---------

2,901 3,465

--------- ---------

15,944 15,542

===== =====

2016 2015

4. Other interest receivable and similar income GBP'000 GBP'000

------ ------------------------------------------------ ---------- ----------

Stock lending commission 44 61

Income from underwriting 64 44

--------- ---------

108 105

===== =====

At 30 September 2016 the total value of securities on loan by

the Company for stock lending purposes was GBP2,830,000 (2015:

GBP5,024,000). The maximum aggregate value of securities on loan at

any time during the year ended 30 September 2016 was GBP25,560,000

(2015: GBP20,742,000). The Company's agent holds collateral

comprising FTSE 100 stocks, Gilts and a French government bond with

a collateral value of GBP2,979,000 (2015: GBP5,821,000) amounting

to a minimum of 105% (2015: minimum 116%) of the market value of

any securities on loan. Stock lending commission has been shown net

of brokerage fees of GBP37,000 (2015: GBP66,000).

5. Return per ordinary share - basic and diluted

The return per ordinary share is based on the net return attributable

to the ordinary shares of GBP42,224,000 (2015: GBP3,195,000) and

on 26,992,028 ordinary shares (2015: 26,892,427) being the weighted

average number of ordinary shares in issue during the year. The

return per ordinary share can be further analysed between revenue

and capital, as below.

2016 2015

GBP'000 GBP'000

---- ----------------------------------------------- ------------ ------------

Net revenue return 12,893 12,490

Net capital return/(loss) 29,331 (9,295)

--------- ---------

Net total return 42,224 3,195

===== =====

Weighted average number of ordinary shares in

issue during the year 26,992,028 26,892,427

Revenue return per ordinary share 47.7p 46.4p

Capital return/(loss) per ordinary share 108.7p (34.6)p

----------- -----------

Total return per ordinary share 156.4p 11.8p

====== ======

The Company does not have any dilutive securities; therefore the

basic and diluted returns per share are the same.

6. Dividends paid and payable on the ordinary shares

2016 2015

Dividends on ordinary shares Record date Payment date GBP'000 GBP'000

---------------------------------- --------------- ---------------- --------------------- ----------

Third interim dividend (9.0p)

for the year ended 30 September 10 October 31 October

2014 2014 2014 - 2,421

Final dividend (10.0p) for the

year ended 9 January 30 January

30 September 2014 2015 2015 - 2,689

First interim dividend (10.0p)

for the year ended 30 September

2015 7 April 2015 30 April 2015 - 2,689

Second interim dividend (10.0p)

for the year ended 30 September

2015 3 July 2015 31 July 2015 - 2,689

Third interim dividend (10.0p)

for the year ended 30 September 9 October 30 October

2015 2015 2015 2,689 -

Final dividend (11.0p) for the

year ended 8 January 29 January

30 September 2015 2016 2016 2,972 -

First interim dividend (11.0p)

for the year ended 30 September

2016 8 April 2016 29 April 2016 2,972 -

Second interim dividend (11.0p)

for the year ended 30 September

2016 1 July 2016 29 July 2016 2,972 -

---------- ---------

11,605 10,488

===== =====

The third interim dividend and the final dividend for the year ended

30 September 2016 have not been included as a liability in these financial

statements. The total dividends payable in respect of the financial

year, which form the basis of the retention test under Section 1158

of the Corporation Tax Act 2010, are set out below.

2016

GBP'000

------------------------------------------------------------- ------------------------------------------------------

Revenue available for distribution by way of dividend for

the year 12,893

First interim dividend (11.0p) for the year ended 30

September

2016 (2,972)

Second interim dividend (11.0p) for the year ended 30

September

2016 (2,972)

Third interim dividend (11.0p) for the year ended 30

September

2016 (2,972)

Final dividend (12.0p) for the year ended 30 September

2016 (based on 27,018,565 ordinary shares in issue at 13

December 2016) (3,242)

----------

Revenue surplus 735

=====

For section 1158 purposes the Company's undistributed revenue represents

4.6% of the income from investments.

7 Called up share capital

Number of Nominal value

shares entitled Total number of shares

to dividend of shares GBP'000

-------------------- --------------------------- ------------------------ ----------------------------------

At 30 September

2015 26,892,427 26,892,427 6,723

Shares issued in

the

year 126,138 126,138 32

----------- ----------- -----------

At 30 September

2016 27,018,565 27,018,565 6,755

During the year, the Company issued 126,138 ordinary shares for total

proceeds of GBP1,728,000 (2015: GBPnil).

8. Net asset value per ordinary share

The net asset value per ordinary share of 1,432.0p (2015: 1,318.4p)

is based on the net assets attributable to the ordinary shares

of GBP386,910,000 (2015: GBP354,563,000) and on 27,018,565 (2015:

26,892,427) shares in issue on 30 September 2016.

The movements during the year of the assets attributable to the

ordinary shares were as follows:

2016 2015

GBP'000 GBP'000

------------------------------------------------ ------------- -------------

Total net assets at 1 October 354,563 361,856

Total net return on ordinary activities after

taxation 42,224 3,195

Share issue proceeds 1,728 -

Net dividends paid in the year:

Ordinary shares (11,605) (10,488)

------------ ------------

Net assets attributable to the ordinary shares

at 30 September 386,910 354,563

====== ======

9. 2015 Financial Information

The figures and financial information for the year ended 30 September

2015 are compiled from an extract of the published financial statements

for that year and do not constitute statutory accounts. Those financial

statements have been delivered to the Registrar of Companies and

included the report of the Auditors which was unqualified, did

not include a reference to any matter to which the auditors drew

attention without qualifying the report, and did not contain any

statements under sections 498(2) or 498(3) of the Companies Act

2006.

10. Dividend

The final dividend, if approved by the shareholders at the Annual

General Meeting, of 12.0p per ordinary share will be paid on 31

January 2017 to shareholders on the register of members at the

close of business on 6 January 2017. This will take the total dividends

for the year to 45.0p (2015: 41.0p). The Company's shares will

be traded ex-dividend on 5 January 2017.

11. Annual Report

The Annual Report will be posted to shareholders in December 2016

and will be available on the Company's website (www.lowlandinvestment.com)

or in hard copy format from the Company's Registered Office, 201

Bishopsgate, London, EC2M 3AE.

12. Annual General Meeting

The Annual General Meeting will be held on Wednesday, 24 January

2017 at 12.30 pm at 201 Bishopsgate, London, EC2M 3AE. The Notice

of Meeting will be sent to shareholders with the Annual Report.

For further information please contact:

James H Henderson Laura Foll

Fund Manager Fund Manager

Lowland Investment Company plc Lowland Investment Company plc

Telephone: 020 7818 4370 Telephone: 020 7818 6364

Sarah Gibbons-Cook James de Sausmarez

Investor Relations and PR Manager Head of Investment Trusts

Henderson Global Investors Limited Henderson Investment Funds Limited

Telephone: 020 7818 3198 Telephone: 020 7818 3349

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

_______________________

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EASADFDAKFFF

(END) Dow Jones Newswires

December 13, 2016 10:38 ET (15:38 GMT)

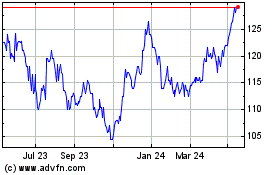

Lowland Investment (LSE:LWI)

Historical Stock Chart

From Jun 2024 to Jul 2024

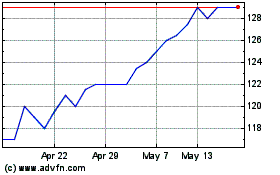

Lowland Investment (LSE:LWI)

Historical Stock Chart

From Jul 2023 to Jul 2024