Mortgage Advice Bureau(Holdings)PLC Pre-close Trading Update (9489L)

25 July 2017 - 4:00PM

UK Regulatory

TIDMMAB1

RNS Number : 9489L

Mortgage Advice Bureau(Holdings)PLC

25 July 2017

25 July 2017

Mortgage Advice Bureau (Holdings) plc ("MAB" or the "Group")

Pre-close Trading Update

This announcement contains inside information.

Mortgage Advice Bureau (Holdings) plc (AIM: MAB1), one of the

UK's leading consumer intermediary brands and specialist Appointed

Representative Networks, today issues a pre-close trading update

for the six months ended 30 June 2017, ahead of publishing its

interim results announcement on Tuesday, 26 September 2017(1) .

Revenue for the six months ended 30 June 2017 increased by 15%

to GBP49 million driven by a 14% increase in the average number of

Advisers to 974 over the period(2) . The total number of Advisers

had increased to 1,008 at 30 June 2017, an increase of 58 or 6%

since last year end (950 at 31 December 2016). As previously

reported on 24 May 2017, organic recruitment has been in line with

the Board's expectations and we expect new business recruitment to

be weighted to the second half of the year. At 30 June 2017, the

Group had a strong balance sheet with a cash position of GBP19

million, including GBP11 million of unrestricted cash balances.

In H1 2016 average revenue per Adviser increased by 9% compared

to H1 2015 due to the spike in Buy-To-Let applications resulting

from the impending stamp duty changes in April 2016. Against this

backdrop we have seen modest growth in productivity in the six

months ended 30 June 2017 and we expect this to continue. Current

trading is in line with the Board's expectations and the Board

looks forward to delivering further growth in the remainder of this

financial year.

(1) The interim dividend in respect of the six months ended 30

June 2017 will be paid on 27 October 2017 and the record date is 6

October 2017.

(2) The average number of Advisers in the twelve months ended 30

June 2017 was 950 (2016: 811).

Peter Brodnicki, CEO of Mortgage Advice Bureau (Holdings) plc,

said:

"Activity overall in the housing market has remained steady and

was not unduly affected by the election in early June. There are

some signs of softening home mover activity. However, for most of

those moving home currently, it is not a discretionary decision,

with lifestyle factors causing them to need to move. The

remortgaging market both for residential and buy-to-let remains

steady.

"We continue to enjoy a strong financial position and are

focussed on our market share growth. Our technology developments

are progressing well and will help drive our future market share

growth and further strengthen MAB's overall market position in 2018

and beyond."

Enquiries:

Mortgage Advice Bureau (Holdings) plc +44 (0)1332 525007

Peter Brodnicki, Chief Executive Officer

David Preece, Chief Operating Officer

Lucy Tilley, Finance Director

Nominated Adviser and Joint Broker:

Zeus Capital +44 (0)20 3829 5000

Martin Green

Nicholas How

Pippa Underwood

Joint Broker:

Canaccord Genuity +44 (0)20 7523 8350

Andrew Buchanan

Richard Andrews

Media Enquiries:

investorrelations@mab.org.uk

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSELFWLFWSEDW

(END) Dow Jones Newswires

July 25, 2017 02:00 ET (06:00 GMT)

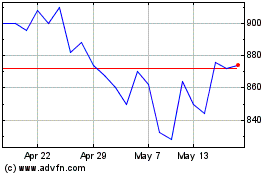

Mortgage Advice Bureau (... (LSE:MAB1)

Historical Stock Chart

From Apr 2024 to May 2024

Mortgage Advice Bureau (... (LSE:MAB1)

Historical Stock Chart

From May 2023 to May 2024