TIDMMAI

RNS Number : 1238K

Maintel Holdings PLC

19 September 2016

Maintel Holdings Plc

("Maintel", the "Company" or the "Group")

Interim results for the 6 months to 30 June 2016

Maintel Holdings Plc, the leading systems integrator and managed

services provider, is pleased to announce its interim results for

the 6 month period to 30 June 2016.

Highlights

-- Group revenue increased 54% to GBP38.1m (H1 2015: GBP24.8m),

including GBP15.4m contribution from Azzurri([1])

-- Increase in recurring revenue to 75% (H1 2015: 71%)

-- Group gross profit increased 38% to GBP13.1m (H1 2015: GBP9.5m)

-- Group adjusted EBITDA increased 23% to GBP4.4m (H1 2015:

GBP3.6m), including GBP1.7m contribution from Azzurri

-- Adjusted earnings per share([2]) at 26.6p (H1 2015: 27.4p)

-- Robust cash performance, with underlying cash conversion ([3]) of 88%

-- Net debt ([4]) of GBP27.1m, better than board expectations

-- Strong order backlog for H2, on track to meet full year profit expectations

-- Progressive dividend policy reiterated:

o Interim dividend per share at 13.4p (H1 2015: 12.8p)

o Full year 2016 dividend to grow 5% year on year, with 10%

growth for FY17

-- Acquisition of Azzurri remains on track to be earnings enhancing in this financial year

Operational Highlights

-- Transformational acquisition of Azzurri completed 4 May 2016

-- Pleasing performance post-acquisition with notable contract

wins and delivery of synergy plan on track

Key Financial Information

Unaudited results for 6 Increase/

months ended 30 June: 2016 2015 (decrease)

Group revenue GBP38.1m GBP24.8m 54%

Adjusted profit before tax([5]) GBP3.9m GBP3.3m 17%

Adjusted earnings per share([1]) 26.6p 27.4p (3%)

Interim dividend per share

proposed 13.4p 12.8p 5%

Commenting on the Group's results, Eddie Buxton, CEO, said:

"The highlight of the period was the acquisition of Azzurri

which was transformational for Maintel, adding significantly to our

offering both in terms of products and services, specifically in

the highly profitable growth areas of managed and cloud based

services, and also its highly complementary customer base.

Excluding Azzurri, trading in the underlying Maintel business

was slower than expected due to delays in the timing of four large

contracts. All of these contracts closed successfully at the end of

Q2 2016 and as such we enter the second half with a strong order

book as well as a full pipeline of opportunities. Our growth

prospects remain positive and we are confident of delivering a

profit performance for the year in line with market

expectations."

Notes

[1] Azzurri Communications Limited (Azzurri) is the principal

trading operation for Warden Holdco Limited, which was acquired on

4 May 2016 (note 5).

[2] Adjusted earnings per share is basic (loss)/earnings per

share of (8.2p) (H1 2015: 16.8p), adjusted for intangibles

amortisation, exceptional costs relating to the acquisition of

Azzurri (H1 2015: Proximity) and deferred tax charges on Datapoint

and Azzurri profits (note 3). The weighted average number of shares

in the period increased to 12.0m (H1 2015:10.7m) arising from the

equity raise in May 2016 to support the Azzurri acquisition.

[3] Cash conversion is adjusted EBITDA to operating cash flow

excluding acquisition costs.

[4] Interest bearing debt (excluding issue costs of debt) minus

cash.

[5] Adjusted profit before tax of GBP3.9m (H1 2015: GBP3.3m) is

basic profit before tax, adjusted for intangibles amortisation and

the Azzurri exceptional costs (H1 2015: Proximity).

For further information please contact:

Eddie Buxton, Chief Executive 020 7401 4601

Mark Townsend, Chief Financial

Officer 020 7401 4663

FinnCap

Jonny Franklin-Adams / Emily

Watts 020 7220 0500

Chairman's statement

I am pleased to be able to report a satisfactory set of results

for the period, with reported revenue having increased by 54%,

compared with H1 2015, to GBP38.1m and adjusted profit before tax

increasing by 17% to GBP3.9m (H1 2015: GBP3.3m), incorporating 2

months' contribution from the Azzurri business acquired in May

2016. Adjusted earnings per share (EPS) decreased by 3% to 26.6p

(H1 2015: 27.4p) as a result of the additional shares issued to

support the Azzurri acquisition.

The overall gross margin of the Group slightly declined to 34%

(H1 2015: 38%). This reduction is due to the inclusion of the lower

margin Azzurri business, with a small decrease in the underlying

business due to the lower contribution of higher margin

professional services to the mix, which we expect to recover in H2

assisted by the large backlog of orders.

Recurring contracted revenue made up 75% of H1 2016 revenues (H1

2015: 71%; FY 2015: 69%) including the contribution from Azzurri

which, as anticipated, brought a higher level of recurring revenue

to the Group (Azzurri standalone business is 79% recurring).

Revenues in the managed services and technology division

increased by 24% to GBP23.8m, with managed services related revenue

up 18% compared with H1 2015 and technology (equipment sales) up

34%, including the contribution from Azzurri. The historic Maintel

business showed an 8% decrease, due to four large multi-year

contracts only being signed at the end of Q2. This is expected to

have a positive impact on the division's growth in H2. The pipeline

here remains strong and in particular we are seeing an increase in

public sector opportunities.

The network services division showed an encouraging 173% growth

in revenue to GBP11.7m (H1 2015: GBP4.3m) driven by a significant

contribution from Azzurri, in particular in data revenues.

Excluding Azzurri, divisional gross margin increased by 2% to 28%.

Maintel's underlying revenues declined by 2%, after excluding a

one-off equipment sale in H1 2015, performing better than the

market trend.

The mobile division's revenue increased 90% to GBP2.7m (H1 2015:

1.4m). Maintel's historic mobile division saw a reduction in

revenue of 17% over the previous year, due partly to the changes in

roaming charges but mainly due to the reduction in small business

customer acquisition and retention. We have taken the decision to

reduce our presence in the small business space and refocus

activity in line with the other product propositions targeting the

mid-market sector.

As part of this review, the Group closed the Azzurri small

business mobile operation in East Kilbride and is in the process of

migrating these customers from the base. While the combined Group

will continue to benefit from real scale in mobile, our exposure is

expected to be under 9% of Group turnover moving forward.

In May 2016, the Group completed the transformational

acquisition of Azzurri for an enterprise value of GBP48.5m. In

order to fund this, the Group secured banking facilities of

GBP36.0m and issued GBP24m of new equity.

Azzurri brings additional scale, a wider product capability and

a large and complementary customer base to the Maintel Group. The

combined Group now has a comprehensive and compelling services

portfolio including managed, data and cloud based services. Our

offering will also allow customers to choose public or private

hosted cloud services and will accelerate the shift in business mix

to these high growth areas of the market. The early signs are

positive, with year on year growth of 83% in our hosted unified

communications offering and two further new contracts signed in Q2,

which have added an additional 4,500 hosted seats onto our

platform.

The integration of Azzurri is progressing very well, with the

Group on track to achieve synergies of GBP1.9m in the current year

and the GBP4.6m of annualised synergies from 2017 forecast at the

time of the acquisition. The combined business will be integrated

onto a common set of systems in early October 2016.

We ended the first half of the financial year with a healthy

backlog of signed projects and enter the second half with a strong

pipeline. Trading conditions remain good although there is evidence

of sales cycles for larger customers becoming longer.

The Group continues to deliver strong cash generation with 88%

of adjusted EBITDA converting to cash in the period and net debt

standing at GBP27.1m at period-end, slightly ahead of board

expectations. The Board proposes to pay an interim dividend of

13.4p, representing a 5% growth on the 2015 interim dividend,

equivalent to 50% of adjusted earnings per share.

I would like to welcome new colleagues from Azzurri to the Group

and thank all our staff for their hard work and commitment during

the first half of 2016. It is also a pleasure to welcome new

investors and thank them and our existing shareholders for their

support.

J D S Booth

Chairman

16 September 2016

Business review

Results for the year

The first half of 2016 has seen an increase in revenue of 54% to

GBP38.1m (H1 2015: GBP24.8m) and adjusted profit before tax (as

described below) of 17% to GBP3.9m (H1 2015: GBP3.3m).

The period benefited from two months' contribution from Azzurri

(see note 5), which was acquired in May 2016 and therefore made no

contribution to the comparative period last year.

Adjusted earnings per share (EPS) decreased by 3% to 26.6p (H1

2015: 27.4p) based on an increased weighted average number of

shares in the period of 11,992,977 (H1 2105: 10,739,299) following

an equity raise in May 2016 to support the Azzurri acquisition. The

acquisition of Azzurri remains on track to be earnings enhancing

this financial year.

On an unadjusted basis, the Company generated a loss before tax

of GBP0.7m (H1 2015: profit of GBP2.1m), equivalent to a loss per

share of 8.2p (H1 2015: earnings of 16.8p). This includes GBP2.8m

of exceptional costs associated with the Azzurri acquisition and

related restructuring activities (H1 2015: GBP0.1m in respect of

the Proximity acquisition) and intangibles amortisation of GBP1.8m

(H1 2015: GBP1.1m), the increase in the latter due to the acquired

Azzurri intangible.

6 months 6 months Year

to 30 to 30 to 31

June June December Increase/

2016 2015 2015

GBP000 GBP000 GBP000 (decrease)

Revenue 38,060 24,750 50,623 54%

--------- --------- ---------- ------------

(Loss)/profit before

tax (696) 2,094 4,151

Add back intangibles

amortisation 1,752 1,118 2,235

Exceptional items

mainly relating

to the acquisition

of Azzurri (H1

2015: Proximity) 2,806 98 884

Adjusted profit

before tax 3,862 3,310 7,270 17%

--------- --------- ---------- ------------

Adjusted EBITDA(a) 4,352 3,552 7,725 23%

--------- --------- ---------- ------------

Of which(b) : Maintel 2,634 3,552 7,725 (26%)

Azzurri 1,718 - -

Basic (loss)/earnings

per share (8.2p) 16.8p 38.0p

Diluted (8.2p) 16.6p 37.5p

--------- --------- ---------- ------------

Adjusted earnings

per share(c) 26.6p 27.4p 60.3p (3%)

Diluted 26.1p 27.0p 59.5p (3%)

--------- --------- ---------- ------------

(a) Excluding the exceptional costs (note 4)

(b) After management charges

(c) Adjusted profit after tax divided by weighted average number

of shares (note 3)

Azzurri

Maintel completed the acquisition of Azzurri on 4 May 2016 for

an aggregate cash consideration of GBP1 and with a commitment that

the Company procure the repayment of Azzurri's then existing senior

debt and other indebtedness immediately following completion. This

equated to an enterprise value for Azzurri of GBP48.5m.

Azzurri was a transformational acquisition for Maintel,

providing additional scale and product capability, with an

attractive customer base. The combined Group now has a

comprehensive and compelling services portfolio including managed,

data and cloud based services. The enlarged Group offering will

also allow customers to choose public or private hosted cloud

services and will accelerate the shift in business mix to these

high growth areas of the market.

Since acquisition the business has been performing well with

some notable new customer wins, particularly with ICON Communicate,

Azzurri's hosted unified communications proposition. Recent major

wins include a large insurance company with 3,000 seats, a large

charity with 1,600 seats and an expansion of the relationship with

a major housing association. There has been an 83% increase in

UCaaS seats on the ICON platform in the past twelve months.

We are continuing Azzurri's investment in the ICON platform;

Microsoft's Skype for Business product has been added to Mitel's

unified communications offering, and we will be launching an

Avaya-based service before the year end, providing support for

three of the recognised leading vendors in the Unified

Communications market. We have also invested in increasing both the

capacity and resilience of the platform, and gained certification

to enable us to offer fully PCI compliant services, allowing us to

offer a significant advantage for any organisation processing card

payments.

The integration of Azzurri is on track and progressing well; the

senior management team is in place, the sales team has been

integrated and reorganised; and the back office re-organisation,

including moving onto one set of systems across the Group, will

have been completed by the end of the year. The anticipated 2016

in-year and 2017 annualised synergies of GBP1.9m and GBP4.6m

respectively are in line with previously stated objectives.

As part of the integration planning, the board has undertaken a

strategic review of its mobile business, resulting in the decision

to reduce its exposure in the SME space. As a result Azzurri's East

Kilbride operation was closed in May 2016. Consequently, the

ongoing exposure to mobile is expected to account for under 9% of

Group turnover.

As a consequence of the acquisition, significant legal and

professional fees have been incurred, amounting to GBP2.5m. In

addition, as part of the integration process, there have been a

number of redundancies across the Group in H1. The cost of these

redundancies along with other synergy related costs amounted to

GBP0.3m. Both these costs have been disclosed as an exceptional

item in the income statement. Further exceptional costs associated

with the integration will be incurred in H2 but with cost savings

thereafter.

Review of operations

The following table shows the performance of the three operating

segments of the Group. The 2016 half year numbers include two

months' contribution from Azzurri.

6 months 6 months Year

to 30 to 30 to 31

June June December

Revenue analysis 2016 2015 2015 Increase/

GBP000 GBP000 GBP000 (decrease)

Maintel (excluding

Azzurri)

Managed services

related 11,238 12,005 23,900 (6%)

Technology(d) 6,408 7,175 15,714 (11%)

---------------------------- --------- --------- ---------- -----------

Managed services

and technology

division 17,646 19,180 39,614 (8%)

Network services

division 3,960 4,267 8,383 (7%)

Mobile division 1,187 1,430 2,815 (17%)

---------------------------- --------- --------- ---------- -----------

Total Maintel (excluding

Azzurri) 22,793 24,877 50,812 (8%)

---------------------------- --------- --------- ---------- -----------

Azzurri(e)

Managed services

related 2,908 - - -

Technology(d) 3,228 - - -

---------------------------- --------- --------- ---------- -----------

Managed services

and technology

division 6,136 - - -

Network services

division 7,698 - - -

Mobile division 1,523 - - -

---------------------------- --------- --------- ---------- -----------

Total Azzurri 15,357 - - -

---------------------------- --------- --------- ---------- -----------

Total Maintel Group

Managed services

related 14,146 12,005 23,900 18%

Technology(d) 9,636 7,175 15,714 34%

----------------------- ------- ------- ------- ------

Managed services

and technology

division 23,782 19,180 39,614 24%

Network services

division 11,658 4,267 8,383 173%

Mobile division 2,710 1,430 2,815 90%

Intercompany (90) (127) (189) (29%)

----------------------- ------- ------- ------- ------

Total Maintel Group 38,060 24,750 50,623 54%

----------------------- ------- ------- ------- ------

(d) Technology includes revenues from hardware, software,

professional services and other sales

(e) Azzurri was acquired on 4 May 2016, and therefore an

estimated two months' of its financial performance has been

considered post- acquisition

Excluding Azzurri, the Group experienced lower trading activity

than expected in H1, with four major sales contracts taking longer

to close than anticipated. All were closed at the end of Q2 and

have contributed to our strong H2 order book.

Three of the contracts are multi-year managed services contracts

with a total value of over GBP11.0m. While these contract wins have

had no impact on H1 revenues they will have a significant positive

impact on H2 results.

Recurring contracted revenue made up 75% of H1 2016 revenues (H1

2015: 71%) including the 2 months' contribution from Azzurri which,

as anticipated, brought a higher level of recurring revenue to the

Group (Azzurri standalone business is 79% recurring in the period

since acquisition).

Overall gross margin for the Group reduced to 34% (H1 2015: 38%)

driven by the lower margin contribution from Azzurri in this

period.

Detailed divisional performance is described further below.

Managed services and technology division

The managed services and technology division provides the

management, maintenance, service and support of both on premise and

off premise voice and data equipment across the UK and

internationally, on a contracted basis. It also supplies and

installs voice and data equipment together with providing

professional services, both to our direct clients and through our

partner relationships.

Revenues in this division increased by 24% to GBP23.8m, with

managed services related revenue up 18% compared with H1 2015 and

technology (equipment and professional services sales) up 34%, both

significantly boosted by the contribution from Azzurri. The

underlying Maintel business excluding Azzurri declined by 8%, with

managed services related revenue reducing by 6% and technology

revenue by 11%, due to the timing of new contracts completing, as

detailed above.

The division's sales pipeline remains strong in both private and

public sectors and we are starting to see significant growth in the

hosted/cloud opportunities as a proportion of the pipeline.

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015 Increase/

GBP000 GBP000 GBP000 (decrease)

Maintel (excluding

Azzurri)

Divisional revenue 17,646 19,180 39,614 (8%)

Division gross

profit 6,666 7,749 15,749 (14%)

Gross margin (%) 38% 40% 40%

-------------------- --------- --------- ---------- ------------

Azzurri

Divisional revenue 6,136 - - -

Division gross -

profit 1,878 - -

Gross margin (%) 31% - -

-------------------- --------- --------- ---------- ------------

Total Maintel Group

Divisional revenue 23,782 19,180 39,614 24%

Division gross

profit 8,544 7,749 15,749 10%

Gross margin (%) 36% 40% 40%

--------------------- ------- ------- ------- ----

Managed services

Excluding Azzurri, revenue declined by 6% due to the delay in

signing the previously highlighted large contracts which completed

during June. As a result the managed service base grew to GBP26m, a

6% increase over December 2015; this will have a significant

benefit to H2 results.

H1 2016 continued to see a reduction in the legacy maintenance

base as the Group focuses on winning larger managed service

contracts with newer technology and a wider suite of services to

support these contracts.

The pipeline for new managed services opportunities is growing;

however, the greater complexity of these opportunities has resulted

in a lengthening of sales cycles and the on-boarding process

compared to traditional maintenance contracts.

Technology

Excluding Azzurri, the first half of 2016 was soft for

technology sales which held back headline revenue growth year on

year in this area.

As with managed services, the backlog of sales moving into H2 is

healthy, with a GBP0.9m project to upgrade a data network for a

public sector client and a GBP1.8m contract for a large

construction group, being delivered in August/September.

The public sector framework is providing a significant source of

new opportunities particularly in healthcare and local government.

We are, however, starting to see some impact of cloud based

opportunities on equipment sales and we see this trend continuing,

and we are well placed with Azzurri's ICON platform to take

advantage of this.

Network services division

The network services division sells a portfolio of services

which includes telephone line rental, inbound and outbound

telephone calls, data connectivity, internet access and hosted IP

telephony solutions. These services complement those offered by the

managed service and technology division and the mobile

division.

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015 Increase/

GBP000 GBP000 GBP000 (decrease)

Maintel (excluding

Azzurri)(f)

Call traffic 1,242 1,288 2,589 (4%)

Line rental 1,441 1,655 3,185 (13%)

Data connectivity

services 1,265 1,309 2,566 (3%)

Other 12 15 43 (20%)

----------- --------- ---------- ------------

Total division 3,960 4,267 8,383 (7%)

Division gross

profit 1,095 1,121 2,284 (2%)

Gross margin (%) 28% 26% 27%

-------------------- ----------- --------- ---------- ------------

Azzurri

Call traffic 1,132 - - -

Line rental 2,029 - - -

Data connectivity

services 4,473 - - -

Other 64 - - -

------- ------ ------ -----

Total division 7,698 - - -

Division gross

profit 2,102 - - -

Gross margin (%) 27% - - -

--------------------- ------- ------ ------ -----

Total Maintel Group

Call traffic 2,374 1,288 2,589 84%

Line rental 3,470 1,655 3,185 110%

Data connectivity

services 5,738 1,309 2,566 338%

Other 76 15 43 407%

------- ------ ------ -----

Total division 11,658 4,267 8,383 173%

Division gross

profit 3,197 1,121 2,284 185%

Gross margin (%) 27% 26% 27%

--------------------- ------- ------ ------ -----

(f) VoIP of GBP214,000 (30 June 2015: GBP161,000; 31 December

2015: GBP370,000) and Inbound calls of GBP90,000 (30 June 2015:

GBP89,000; 31 December 2015: GBP182,000) have been reclassified

from Other to Data connectivity services and Call traffic

respectively.

Network services revenues increased by 173% year on year, driven

by the contribution from Azzurri.

Excluding Azzurri, Maintel revenues declined by 7%, but

excluding a one off GBP235,000 equipment sale associated with a WAN

optimisation project in H1 2015, underlying revenue only declined

by 2%. Divisional gross margin increased by 2% to 28% partly due to

the H1 2015 equipment sale being at low margin.

Call minutes revenue was 4% down on the prior year driven by a

major customer re-signing at lower volumes as they implement a

Skype for Business roll out, which also impacted legacy line rental

revenue. Call revenue has been more resilient than expected given

the combination of the market reduction in call volumes, regulatory

price reductions and bundled free minute packages.

Legacy line rental revenues decreased by 13%, impacted by a

combination of the above and our continued pro-active transitioning

of customers onto newer SIP based voice technology, which has seen

year on year growth of 33%.

As we continue to see this move away from legacy calls and lines

services to newer data and SIP technology, our underlying data

services revenue has grown by a healthy 18% year on year, excluding

the one off project installation in H1 2015 previously noted.

Moving forward, the acquisition of Azzurri strengthens our

position in this sector with ICON Connect, our Data Network

proposition.

Mobile division

Maintel Mobile derives its revenues primarily from commissions

received under its dealer agreements with Vodafone and O(2) ,

whilst Azzurri derives most of its revenues from dealer agreements

with O(2) .

6 months 6 months Year

to 30 to 30 to 31

June June December Increase/

2016 2015 2015

GBP000 GBP000 GBP000 (decrease)

Maintel (excluding

Azzurri)

Revenue 1,187 1,430 2,815 (17%)

Gross profit 581 694 1,196 (16%)

Gross margin (%) 49% 49% 42%

-------------------- --------- --------- ---------- ------------

Azzurri

Revenue 1,523 - - -

Gross profit 859 - - -

Gross margin (%) 56% - - -

-------------------- --------- --------- ---------- ------------

Total Maintel Group

Revenue 2,710 1,430 2,815 90%

Gross profit 1,440 694 1,196 107%

Gross margin (%) 53% 49% 42%

--------------------- ------ ------ ------ -----

At 30 At 30 At 31

June June December Increase/

2016 2015 2015 (decrease)

Maintel (excluding

Azzurri)

Number of customers 773 770 830 -%

Number of connections 11,643 12,662 12,011 (8%)

Azzurri

Number of customers 2,192 - - -

Number of connections 48,000 - - -

Total Maintel Group

Number of customers 2,965 770 830 285%

Number of connections 59,643 12,662 12,011 371%

Excluding Azzurri, the Mobile division saw a reduction in

revenue of 17% over the previous year due partly to the changes in

roaming charges but mainly due to the reduction in small business

customer acquisition and retention as the Group refocused its

investment into other areas of higher growth potential.

Gross margins of 49% were maintained at similar levels to H1

2015.

As highlighted earlier in the report, as part of integrating

Azzurri, the Group has undertaken a strategic review of its mobile

business, resulting in the decision to reduce its presence in the

small business space. This reduces the exposure of mobile for the

Group and re-focuses our sales activity in line with the other

product propositions in the target mid-market sector. As a result,

the ongoing exposure to mobile is expected to reduce to under 9% of

Group turnover.

As part of this review, the Group closed the Azzurri small

business mobile operation in East Kilbride and is in the process of

removing these customers from the Azzurri base.

The combined Group will continue to benefit from real scale in

mobile as well as Azzurri's greater experience and well-defined

mobile managed service wrap that is attractive to larger

customers.

Administrative expenses, excluding intangibles amortisation,

management recharges and non-trading adjustments

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015 Increase/

Administrative

expenses(g) GBP000 GBP000 GBP000 (decrease)

Maintel (excluding

Azzurri)

Maintel sales expenses 2,958 3,077 6,323 (4%)

Maintel other administrative

expenses 3,011 2,956 5,207 2%

--------- --------- ----------- -----------

Maintel excluding

Azzurri total administrative

expenses 5,969 6,033 11,530 (1%)

------------------------------- --------- --------- ----------- -----------

Azzurri

Azzurri sales expenses 1,614 - -

Azzurri other administrative

expenses 1,434 - -

--------- --------- ----------- -----------

Azzurri total administrative

expenses 3,048 - -

------------------------------- --------- --------- ----------- -----------

Total Maintel Group

Total sales expenses 4,572 3,077 6,323 49%

Total other administrative

expenses 4,445 2,956 5,207 50%

Total administrative

expenses 9,017 6,033 11,530 49%

(g) Excluding intangibles amortisation, management

recharges and exceptional expenses.

Total administrative expenses increased by 49% to GBP9.0m.

Excluding Azzurri, Maintel's costs are down 1% on last year at

GBP6.0m, with lower underlying sales costs and headcount

compensating for inflation increases. In addition, property costs

are lower year on year, as a result of the office moves in H2 2015

which included the consolidation of two offices (Brentford and

Webber Street) into our current Blackfriars HQ and the move to

cheaper Dublin premises.

Following the Azzurri acquisition, headcount as at 30 June 2016

for the Group now stands at 727 (30 June 2015: 282).

As we progress with our integration plan, total administration

costs will continue to be tightly controlled and we will deliver

further cost savings in H2 in line with the integration plan

produced at the time of the transaction.

The exceptional costs of GBP2.8m (H1 2015: GBP0.1m) shown in the

income statement primarily relate to the legal and professional

fees from the acquisition of Azzurri of GBP2.5m and redundancy

costs incurred resulting from the acquisition and integration of

GBP0.3m (H1 2015: Proximity of GBP0.1m).

The intangibles amortisation charge increased in the period due

to the 2 month charge resulting from the Azzurri acquisition.

Impairment and amortisation charges are discussed further

below.

Foreign exchange

The Group's reporting currency is sterling; however it trades in

other currencies, notably the euro, and has assets and liabilities

in those currencies. The euro rate moved from EUR1.36 = GBP1 at 31

December 2015 to EUR1.21 = GBP1 at 30 June 2016. The effect of this

and other movements in the period was a gain to the income

statement of GBP92,000 (H1 2015 charge: GBP100,000), which is

included in other administrative expenses.

The exchange difference arising on the retranslation at the

reporting date of the equity of the Group's Irish subsidiary, whose

functional currency is the euro, is recorded in the translation

reserve as a separate component of equity, being GBP37,000 in the

period (H1 2015: GBP54,000).

Interest

The increase in the net interest charge to GBP295,000 (H1 2015:

GBP139,000) resulted from the additional borrowings taken on to

finance the Azzurri acquisition, with net borrowings excluding

issue costs of debt increasing to GBP27.1m at 30 June 2016 (30 June

2015: GBP8.8m) from a year end 2015 balance of GBP3.2m.

Taxation

The effective tax charge for H1 2016 was GBP290,000 against the

loss of GBP696,000 (H1 2015 tax charge: GBP287,000), for the

reasons described below. Each of the Group companies is taxed at

20%, with the exception of Maintel International Limited, which is

taxed at 12.5% (H1 2015: 20.25%; 12.5%). Certain expenses that are

disallowable for tax raise the underlying effective rate above

this, and form the predominant reason why a tax charge was incurred

on the period's loss.

The tax charge in the period was adversely impacted due to

certain acquisition related costs deemed disallowable which

amounted to GBP497,000. This was offset by the tax charge

benefiting from some adjustments, including (a) relief claimed on

certain 2015 costs which were deemed disallowed in that period but

are now allowed following further investigation (GBP26,000), and

(b) the difference in the rate at which deferred tax on the

amortisation of the intangibles is released (GBP21,000).

The tax charge in the period includes a deferred tax charge

relating to the tax losses of the Datapoint companies, whereby they

do not currently pay corporation tax on their profits, but a tax

asset in respect of the historic losses is charged to the income

statement as the losses are used. This deferred tax charge in the

period was GBP237,000 (H1 2015: GBP179,000).

The tax charge in the period also includes a deferred tax charge

relating to the Azzurri profits, whereby they do not currently pay

corporation tax on their profits, but a tax asset in respect of the

historic capital allowances is charged to the income statement as

the capital allowances are used. This deferred tax charge in the

period was GBP311,000 in relation to the brought forward capital

allowances.

Dividends and adjusted earnings per share

An interim dividend for 2015 of 12.8p (GBP1.4m) was paid on 7

October 2015 and a final dividend for 2015 of 16.5p per share

(GBP1.8m) was paid on 5 April 2016, taking the total dividend

declared in 2015 to 29.3 pence per share.

As previously highlighted, it is the board's intention to

increase the dividend pence per share by 5% over 2015 total

dividend pence per share and then growing progressively year on

year by 10% for 2017.

As a result, the board proposes to pay an interim dividend of

13.4p in respect of 2016 on 12 October to shareholders on the

register at the close of business on 30 September, which equates to

a pay-out ratio as a percentage of adjusted earnings of 50%. The

corresponding ex-dividend date will be 29 September. In accordance

with accounting standards, this dividend is not accounted for in

the financial statements for the period under review, as it had not

been committed as at 30 June 2016.

Consolidated statement of financial position

Net assets increased by GBP20.4m to GBP27.0m from 31 December

2015 due to the inclusion of the acquired balance sheet of

Azzurri.

Intangible assets at GBP64.4m, have increased by GBP46.3m from

31 December 2015, driven by intangibles arising on the acquisition

of Azzurri (see note 5).

The value of property, plant and equipment has increased by

GBP3.0m to GBP3.6m from 31 December 2015. This includes a freehold

property valued at GBP1.6m and plant and equipment and leasehold

improvements of GBP1.3m resulting from the acquisition of Azzurri.

Post-acquisition, Azzurri incurred GBP0.2m of expenditure relating

to the ICON platform and expanding capacity in its data centre

infrastructure. Maintel incurred minimal capital expenditure in H1

2016 with its tangible asset value in line with the year end 2015

balance at GBP0.7m.

Trade and other receivables increased by GBP24.5m in the period

to GBP35.5m with GBP21.2m attributable to Azzurri. Excluding

Azzurri, Maintel trade and other receivables increased by GBP3.3m,

the main elements being (a) an increase in trade receivables driven

by two orders for equipment and licences amounting to GBP3.5m, both

of which were settled in August, offsetting the impact of a high

level of seasonal renewals at the end of 2015 and (b) higher

prepaid support costs covering several contracts signed in H1

2016.

Inventories are valued at GBP2.7m at 30 June, an increase of

GBP1.4m from 31 December 2015, with Azzurri contributing GBP1.5m.

Excluding Azzurri, Maintel inventories have reduced marginally by

GBP0.1m compared to year end 2015 to GBP1.2m, as a result of strong

control over the levels of managed service stock; there was little

movement in the stock held for resale.

Trade and other payables amounted to GBP49.6m, an increase of

GBP29.3m in the period. Excluding Azzurri, trade and other payables

were at GBP19.8m reflecting a GBP0.6m reduction when compared to

the year end 2015 value of GBP20.3m. The main drivers were the

weighting of customer contract renewals to H2 2015 so that a higher

level of deferred income is carried at December than at June,

together with a lower VAT liability caused by lower equipment sales

and the impact of acquisition costs. These were offset by an

increase in trade payables and accruals due to the impact of the

remaining acquisition costs settled in July, vendor costs

associated with a large equipment deal in June and accrued bank

interest.

Corporation tax liabilities have reduced by GBP0.1m due to lower

profits emanating from Maintel's trading activities in H1 2016. As

noted in the Taxation section above, no corporation tax provision

has been made for Azzurri's profit contribution since acquisition,

as there are sufficient brought forward capital allowances to

offset any corporation tax provision required.

The deferred tax liability has increased by GBP2.1m in the first

half to GBP2.9m resulting from (a) the creation of a deferred tax

liability of GBP4.3m associated with the Azzurri intangibles of

GBP23.2m and (b) the deferred tax adjustment related to the

Datapoint and Azzurri historical tax losses and capital allowances

respectively of GBP0.6m in aggregate offset by (a) a deferred tax

asset of GBP2.5m resulting from the acquisition of Azzurri (see

note 5), and (b) the unwinding of intangibles amortisation related

deferred tax liabilities from Azzurri and previous acquisitions of

GBP0.3m.

Intangible assets

The Group has two intangible asset categories: (i) an intangible

asset represented by customer contracts and relationships, brand

value, product platforms and software acquired from third party

companies, and (ii) goodwill relating to those acquisitions.

The intangible assets represented by purchased customer

contracts and relationships, brand value, product platforms and

software were carried at GBP29.7m at the period end (31 December

2015: GBP8.3m). The intangible assets are subject to an average

amortisation charge of 18% of cost per annum in respect of the

managed service and technology division, 13% per annum in respect

of the network services division and 16% per annum in respect of

the mobile customer relationships, with GBP1.8m being amortised in

H1 2016 (H1 2015: GBP1.1m), the increase being attributable to the

Azzurri intangibles acquired in May 2016.

Goodwill of GBP34.7m (31 December 2015: GBP9.9m) increased by

GBP24.8m as a result of the Azzurri acquisition. No impairment has

been charged to the consolidated statement of comprehensive income

in H1 2016 (H1 2015: GBPnil).

Cash flow

The Group had net debt (excluding issue costs of debt) of

GBP27.1m at 30 June 2016, compared with GBP3.2m at 31 December

2015, and an explanation of the GBP23.9m increase is set out

below.

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015

GBP000 GBP000 GBP000

Cash generated from/(consumed

by) operating activities

before acquisition costs 3,826 (113) 7,829

Taxation (231) (761) (1,048)

Capital expenditure less

proceeds of sale (250) (49) (554)

Finance cost (net) (295) (139) (264)

--------- --------- ----------

Free cashflow 3,050 (1,062) 5,963

Dividends (1,777) (1,243) (2,621)

Acquisition (net of cash (45,433) - -

acquired)

Acquisition costs paid (2,514) - -

Proceeds from borrowings 31,000 - -

Repayments of borrowings (6,000) (800) (4,000)

Issue of new ordinary shares 24,000 54 54

Share issue costs (781) - -

Issue costs of debt (348) - -

--------- --------- ----------

Increase/(decrease) in

cash and cash equivalents 1,197 (3,051) (604)

Cash and cash equivalents

at start of period 2,784 3,347 3,347

Exchange differences (37) 54 41

--------- --------- ----------

Cash and cash equivalents

at end of period 3,944 350 2,784

Bank borrowings (31,000) (9,200) (6,000)

--------- --------- ----------

Net debt excluding issue

costs of debt (27,056) (8,850) (3,216)

Adjusted EBITDA (note 4) 4,352 3,552 7,725

The Group generated GBP3.8m of cash from operating activities

excluding acquisition costs, with a GBP0.3m negative working

capital impact in the period, compared with GBP0.1m consumed in the

comparative period. This was underpinned by a high cash conversion

rate of 88% of adjusted EBITDA to operating cash flow excluding

acquisition costs.

The net effect of the equity raised and new borrowing facilities

associated with the acquisition of Azzurri together with repaying

existing borrowing facilities, acquisition related costs and

settlement of the 2015 final dividend consumed GBP1.9m in cash and

cash equivalents.

The increase in the net debt position compared with December

2015 is a result of the borrowings acquired in May 2016 to fund the

acquisition of Azzurri (see note 8).

Outlook

Notwithstanding the softer than anticipated trading in the

Maintel business excluding Azzurri, the first half was a very

positive period for Maintel as a Group. The highlight of the period

was the acquisition of Azzurri, which in the two months' since

completion performed well and in line with expectations, including

the signing of several substantial contracts which have contributed

to our order backlog for the second half. Our integration plan is

on track, with significant further cost savings to be made in the

second half. As stated at the time of the acquisition of Azzurri,

we expect the acquisition to be earnings enhancing this financial

year.

In the underlying Maintel business, the signing of the four

delayed contracts at the end of Q2 will have a positive impact on

growth in H2 and we enter the second half with a strong order book

and a full pipeline of opportunities.

With our service offering now broader and more attractive than

previously, we can expect a greater proportion of opportunities to

be successfully converted, albeit that with larger customers, multi

service contracts are more complex, resulting in longer sales

cycles.

We therefore remain confident for the second half of the

financial year, and of delivering a profit outcome for the full

year in line with the market expectations.

The Group continues to deliver good cash generation and the

focus is on maintaining a progressive dividend policy whilst

simultaneously reducing the debt levels, in line with the board's

target of 2x adjusted EBITDA by the end of the financial year.

On behalf of the board

E Buxton

Chief Executive

16 September 2016

Maintel Holdings Plc

Consolidated statement of comprehensive income

for the 6 months ended 30 June 2016 (unaudited)

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015

note GBP000 GBP000 GBP000

(unaudited) (unaudited) (audited)

Revenue 2 38,060 24,750 50,623

Cost of sales (24,961) (15,268) (31,571)

------------ ------------ -----------

Gross profit 13,099 9,482 19,052

Other operating income 75 - 12

Administrative expenses

---------------------------- ----- ------------ ------------ -----------

Intangibles amortisation (1,752) (1,118) (2,235)

Exceptional costs 7 (2,806) (98) (884)

Other administrative

expenses (9,017) (6,033) (11,530)

---------------------------- ----- ------------ ------------ -----------

(13,575) (7,249) (14,649)

Operating (loss)/profit (401) 2,233 4,415

Finance income 3 - 1

Financial expense (298) (139) (265)

(Loss)/profit before

taxation (696) 2,094 4,151

Taxation expense (290) (287) (69)

------------ ------------ -----------

(Loss)/profit for the

period and attributable

to owners of the parent (986) 1,807 4,082

Other comprehensive

(expense)/income for

the period

Exchange differences

on translation of foreign

operations (37) 54 41

------------ ------------ -----------

Total comprehensive

(loss)/income for the

period (1,023) 1,861 4,123

============ ============ ===========

(Loss)/earnings per

share

Basic 3 (8.2p) 16.8p 38.0p

Diluted 3 (8.2p) 16.6p 37.5p

============ ============ ===========

Maintel Holdings Plc

Consolidated statement of financial position

at 30 June 2016 (unaudited)

30 June 30 June 31 December

2016 2015 2015

Note GBP000 GBP000 GBP000

(unaudited) (unaudited) (audited)

Non current assets

Intangible assets 64,402 19,249 18,132

Property, plant and

equipment 3,631 262 673

68,033 19,511 18,805

------------ ------------ ------------

Current assets

Inventories 2,704 1,386 1,298

Trade and other receivables 35,539 12,578 11,040

Cash and cash equivalents 3,944 350 2,784

------------ ------------ ------------

42,187 14,314 15,122

------------ ------------ ------------

Total assets 110,220 33,825 33,927

Current liabilities

Trade and other payables 49,555 17,353 20,276

Current tax liabilities 116 396 257

Borrowings 8 - 2,000 2,000

Total current liabilities 49,671 19,749 22,533

Non current liabilities

Deferred tax liability 2,894 1,200 834

Borrowings 8 30,652 7,200 4,000

------------ ------------ ------------

Total net assets 27,003 5,676 6,560

============ ============ ============

Equity

Issued share capital 142 108 108

Share premium 24,354 1,169 1,169

Capital redemption reserve 31 31 31

Share based remuneration 24 - -

reserve

Translation reserve 51 101 88

Retained earnings 2,401 4,267 5,164

Total equity 27,003 5,676 6,560

============ ============ ============

Maintel Holdings Plc

Consolidated statement of changes in equity

for the 6 months ended 30 June 2016 (unaudited)

Share Capital Translation Share Retained

capital Share redemption reserve based earnings Total

premium reserve remuneration

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January

2015 107 1,116 31 47 - 3,703 5,004

Profit for

the period - - - - - 1,807 1,807

Other comprehensive

income:

foreign currency

translation

differences - - - 54 - - 54

--------------------- ---------- ---------- ------------ ------------- -------------- ----------- ---------

Total comprehensive

income for

the period - - - 54 - 1,807 1,861

Dividend - - - - - (1,243) (1,243)

Issue of

new ordinary

shares 1 53 - - - - 54

At 30 June

2015 108 1,169 31 101 - 4,267 5,676

Profit for

the period - - - - - 2,275 2,275

Other comprehensive

income:

foreign currency

translation

differences - - - (13) - - (13)

--------------------- ---------- ---------- ------------ ------------- -------------- ----------- ---------

Total comprehensive

income for

the period - - - (13) - 2,275 2,262

Dividend - - - - - (1,378) (1,378)

At 31 December

2015 108 1,169 31 88 - 5,164 6,560

Loss for

the period - - - - - (986) (986)

Other comprehensive

income:

foreign currency

translation

differences - - - (37) - - (37)

--------------------- ---------- ---------- ------------ ------------- -------------- ----------- ---------

Total comprehensive

loss for

the period - - - (37) - (986) (1,023)

Dividend - - - - - (1,777) (1,777)

Issue of

new ordinary

shares 34 23,966 - - - - 24,000

Share issue

costs - (781) - - - - (781)

Grant of

share options - - - - 24 - 24

At 30 June

2016 142 24,354 31 51 24 2,401 27,003

Maintel Holdings Plc

Consolidated statement of cash flows

for the 6 months ended 30 June 2016 (unaudited)

6 months 6 months Year

to 30 to 30 June to 31

June 2015 December

2016 2015

GBP000 GBP000 GBP000

(unaudited) (unaudited) (audited)

Operating activities

(Loss)/profit before taxation (696) 2,094 4,151

Adjustments for:

Intangibles amortisation 1,752 1,118 2,235

Share based payment charge 24 - -

(Loss)/profit on sale of fixed

asset - (2) 4

Depreciation charge 195 103 191

Interest received (3) - (1)

Interest payable 298 139 265

Operating cash flows before

changes in working capital 1,570 3,452 6,845

Decrease in inventories 22 50 138

(Increase)/decrease in trade

and other receivables (3,971) (159) 1,379

Increase/(decrease) in trade

and other payables 3,691 (3,456) (533)

------------ ------------ ----------

Cash generated from/(consumed

by) operating activities (see

sub analysis below) 1,312 (113) 7,829

Cash generated from/(consumed

by) operating activities excluding

acquisition costs 3,826 (113) 7,829

Exceptional cost - acquisition

costs (2,514) - -

------------ ------------ ----------

Cash generated from/(consumed

by) operating activities 1,312 (113) 7,829

------------------------------------- ------------ ------------ ----------

Tax paid (231) (761) (1,048)

------------ ------------ ----------

Net cash flows from operating

activities 1,081 (874) 6,781

------------ ------------ ----------

Investing activities

Purchase of plant and equipment (250) (51) (554)

Proceeds from disposal of - 2 -

plant and equipment

------------------------------------- ------------ ------------ ----------

Purchase price in respect (47,028) - -

of business combination

Net cash acquired with subsidiary

undertaking 1,595

(45,433) - -

Interest received 3 - 1

Net cash flows from investing

activities (45,680) (49) (553)

------------ ------------ ----------

Financing activities

Proceeds from borrowings 31,000 - -

Repayment of borrowings (6,000) (800) (4000)

Interest payable (298) (139) (265)

Issue of new ordinary shares 24,000 54 54

Share issue costs (781) - -

Issue costs of debt (348) - -

Equity dividends paid (1,777) (1,243) (2,621)

Net cash flows from financing

activities 45,796 (2,128) (6,832)

------------ ------------ ----------

Net increase/(decrease) in

cash and cash equivalents 1,197 (3,051) (604)

Cash and cash equivalents

at start of period 2,784 3,347 3,347

Exchange differences (37) 54 41

------------ ------------ ----------

Cash and cash equivalents

at end of period 3,944 350 2,784

============ ============ ==========

Maintel Holdings Plc

Notes to the interim financial information

1. Basis of preparation

The financial information in these interim results is that of

the holding company and all of its subsidiaries (the Group). It has

been prepared in accordance with the recognition and measurement

requirements of International Financial Reporting Standards as

adopted for use in the EU (IFRSs) but does not include all of the

disclosures that would be required under IFRSs. Except for the

revised revenue recognition policy adopted in the Mobile segment,

the accounting policies applied by the Group in this financial

information are the same as those applied by the Group in its

financial statements for the year ended 31 December 2015 and are

those which will form the basis of the 2016 financial

statements.

From 1 January 2016, the Group has reviewed its Mobile revenue

recognition policy, and concluded to change its policy relating to

the recognition of advance commissions received from network

operators. There is no material difference in the financial

statements as a result of adopting the new revenue recognition

policy.

A number of amendments to and interpretations of existing

standards have become effective for periods beginning on 1 January

2016, but no new standards; none of these is expected to materially

affect the Group.

The Group's results are not materially affected by seasonal

variations.

The comparative financial information presented herein for the

year ended 31 December 2015 does not constitute full statutory

accounts for that period. The Group's annual report and accounts

for the year ended 31 December 2015 have been delivered to the

Registrar of Companies. The Group's independent auditor's report on

those statutory accounts was unqualified, did not draw attention to

any matters by way of emphasis, and did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006.

The financial information for the half-years ended 30 June 2016

and 30 June 2015 is unaudited but has been subject to a review in

accordance with International Standard on Review Engagements (UK

and Ireland) 2410, "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity".

In preparing the interim financial statements the directors have

considered the Group's financial projections, borrowing facilities

and other relevant financial matters, and the board is satisfied

that there is a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. For this reason the directors continue to adopt the going

concern basis in preparing the financial statements.

2. Segmental information

For management reporting purposes and operationally, the Group

consists of three business segments: (i) telecommunications managed

service and technology sales, (ii) telecommunications network

services, and (iii) mobile services. Each segment applies its

respective resources across inter-related revenue streams which are

reviewed by management collectively under these headings. The

businesses of each segment and a further analysis of revenue are

described under their respective headings in the business

review.

The chief operating decision maker has been identified as the

board, which assesses the performance of the operating segments

based on revenue and gross profit.

Six months to 30 June 2016 (unaudited)

Managed Central/

service Network inter-

and technology services Mobile company Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 23,782 11,658 2,710 (90) 38,060

================ =========== ========= ========= ========

Gross profit 8,544 3,197 1,440 (82) 13,099

---------------- ----------- --------- ---------

Other operating income 75

Total administrative

expenses (9,017)

Intangibles amortisation (1,752)

Exceptional costs (2,806)

--------

Operating loss (401)

Interest (net) (295)

--------

Loss before taxation (696)

Taxation expense (290)

Loss after taxation (986)

========

Further analysis of revenue streams is shown in the business

review.

Intercompany trading consists of telecommunications services,

and recharges of sales, engineering and rent costs, GBP46,000 (H1

2015: GBP86,000) attributable to the managed service and technology

segment, GBP41,000 (H1 2015: GBP38,000) to the network services

segment and GBP3,000 (H1 2015: GBP3,000) to the mobile segment.

Managed

service Central/

and Network inter-

technology services Mobile company Total

GBP000 GBP000 GBP000 GBP000 GBP000

Other

Intangibles amortisation 111 - - 1,641 1,752

Exceptional costs 319 - - 2,487 2,806

============ =========== ======== ========= =======

Six months to 30 June 2015 (unaudited)

Managed

service Central/

and Network inter-

technology services Mobile company Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 19,180 4,267 1,430 (127) 24,750

============ =========== ========= ========= =========

Gross profit 7,749 1,121 694 (82) 9,482

------------ ----------- --------- ---------

Total administrative

expenses (6,033)

Intangibles amortisation (1,118)

Exceptional costs (98)

---------

Operating profit 2,233

Interest (net) (139)

---------

Profit before taxation 2,094

Taxation expense (287)

Profit after taxation 1,807

=========

Managed

service Central/

and Network inter-

technology services Mobile company Total

GBP000 GBP000 GBP000 GBP000 GBP000

Other

Intangibles amortisation 126 - - 992 1,118

Exceptional costs 98 - - - 98

============ =========== ======== ========= =======

Year ended 31 December 2015 (audited)

Managed

service Central/

and Network inter-

technology services Mobile company Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 39,614 8,383 2,815 (189) 50,623

============ =========== ========= ========= =========

Gross profit 15,749 2,284 1,196 (177) 19,052

------------ ----------- --------- ---------

Other operating

income 12

Total administrative

expenses (11,530)

Intangibles amortisation (2,235)

Exceptional costs (884)

---------

Operating profit 4,415

Interest (net) (264)

---------

Profit before taxation 4,151

Taxation (69)

Profit after taxation 4,082

=========

Managed

service Central/

and Network inter-

technology services Mobile company Total

GBP000 GBP000 GBP000 GBP000 GBP000

Other

Intangibles amortisation 251 - - 1,984 2,235

Exceptional costs 884 - - - 884

============ =========== ======== ========= =======

Revenue is wholly attributable to the principal activities of

the Group and other than sales of GBP4,282,000 to EU countries and

GBP966,000 to the rest of the world, arises within the United

Kingdom.

Intercompany trading consists of telecommunications services,

and recharges of sales, engineering and rent costs, GBP90,000

attributable to the managed service and technology segment,

GBP93,000 to the network services segment and GBP6,000 to the

mobile segment.

3. Earnings per share

Earnings per share is calculated by dividing the (loss)/profit

after tax for the period by the weighted average number of shares

in issue for the period, these figures being as follows:

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015

GBP000 GBP000 GBP000

(unaudited) (unaudited) (audited)

Earnings used in basic and

diluted EPS, being (loss)/profit

after tax (986) 1,807 4,082

Adjustments: Amortisation

of intangibles 1,752 1,118 2,235

Exceptional costs (note 7) 2,806 98 884

Tax relating to above adjustments (934) (264) (666)

Deferred tax charge on Datapoint

profits 239 179 451

Deferred tax charge on Azzurri 311 - -

profits

Increase in deferred tax

asset - - (500)

Adjusted earnings used in

adjusted EPS 3,188 2,938 6,486

------------ ------------ ----------------

The adjustments above have been made in order to provide a

clearer picture of the trading performance of the Group.

Datapoint has brought forward tax losses, so that it will pay no

tax in respect of its 2016 profits. On acquisition and subsequently

in 2015, however, a deferred tax asset was recognised in respect of

its tax losses, and a deferred tax charge has been recognised in

the income statement in respect of the period's profits. As this

does not reflect the reality and benefit to the Group of the

non-taxable profits, the deferred tax charge is adjusted above.

Azzurri has brought forward tax capital allowances, so that it

will pay no tax in respect of its 2016 profits. On acquisition, a

deferred tax asset was acquired in respect of its capital

allowances, and a deferred tax charge has been recognised in the

income statement in respect of the period's profits. As this does

not reflect the reality and benefit to the Group of the non-taxable

profits, the deferred tax charge is adjusted above.

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015

Number Number Number

(000s) (000s) (000s)

Weighted average number of

ordinary shares of 1p each 11,993 10,739 10,754

Potentially dilutive shares 200 140 145

---------- ---------- -----------

12,193 10,879 10,899

========== ========== ===========

(Loss)/profit per share

Basic (8.2p) 16.8p 38.0p

Basic and diluted (8.2p) 16.6p 37.5p

Adjusted - basic after the

adjustments in the table

above 26.6p 27.4p 60.3p

Adjusted - basic and diluted

after the adjustments in

the table above 26.1p 27.0p 59.5p

======== ======== ======

In calculating diluted earnings per share, the weighted average

number of ordinary shares in issue is adjusted to assume conversion

of all dilutive potential ordinary shares. The Group has one

category of potentially dilutive ordinary share, being those share

options granted to employees where the exercise price is less than

the average price of the Company's ordinary shares during the

period.

4. Earnings before interest, tax, depreciation and amortisation (EBITDA)

The following table shows the calculation of EBITDA and adjusted

EBITDA:

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015

GBP000 GBP000 GBP000

(unaudited) (unaudited) (audited)

(Loss)/Profit before tax (696) 2,094 4,151

Net interest payable 295 139 264

Depreciation of property,

plant and equipment 195 103 191

Amortisation of customer

relationship intangibles 1,752 1,118 2,235

------------ ------------ ----------

EBITDA 1,546 3,454 6,841

Exceptional costs 2,806 98 884

Adjusted EBITDA 4,352 3,552 7,725

============ ============ ==========

5. Business combinations

On 4 May 2016 the Company acquired the entire share capital of

Azzurri at the following provisional fair value amounts:

GBP000

Purchase consideration

Cash 47,028

________

Assets and liabilities acquired

Tangible fixed assets 2,903

Inventories 1,428

Trade and other receivables 20,528

Cash 1,595

Trade and other payables (25,588)

________

866

Intangible assets

Customer relationships 16,030

Software 2,369

Brand 3,480

Product platform 1,299

Deferred tax asset 2,459

Deferred tax liability on Intangible assets (4,319)

________

Net assets and liabilities acquired 22,184

________

Goodwill 24,844

________

Cash flows arising from the acquisition GBP000

were as follows:

Purchase consideration settled in cash (47,028)

Direct acquisition costs (note 7) (2,514)

Cash balances acquired 1,595

________

(47,947)

________

Azzurri was acquired to complement and extend the Group's

existing offerings of telecommunications and data services and

enable further cross-selling to and from other Group operations, as

further described in the business review. The goodwill is

attributable to the workforce of the acquired business,

cross-selling opportunities and cost synergies that are expected to

be achieved from sharing the expertise and resource of Maintel with

that of Azzurri and vice versa.

The acquisition of Azzurri Communications Limited was effected

by the acquisition of its parent company, Warden Holdco Limited for

a purchase consideration of GBP47.0m. Warden Holdco Limited and

Warden Midco Limited are the holding company and intermediate

holding company of Azzurri Communications Limited and its

subsidiaries.

The business was acquired for a cash consideration of GBP1,

together with procurement of its senior debt facilities, loan

notes, and acquisition related fees of GBP20.5m, GBP24.0m, and

GBP2.5m respectively. These acquired liabilities were settled

immediately following acquisition, and therefore formed part of the

aggregate purchase consideration of GBP47.0m.

The purchase consideration quoted in the admission document for

the Azzurri acquisition was GBP48.5m, but this was reduced to

GBP47.0m through price adjustment mechanisms.

The customer relationships, software, brand and product

platforms are estimated to have a useful life of one to eight years

based on the directors' experience of comparable intangibles and

are therefore amortised over those periods and are subject to an

annual impairment review.

A deferred tax liability of GBP4.3m has been recognised above

which is being credited to the income statement pro rata to the

amortisation of the intangibles. The Azzurri related amortisation

charge in 2016 is GBP0.5m.

The trade and other receivables are stated net of

impairment.

Since its acquisition, Azzurri has contributed the following to

the results of the Group before management charges of GBP0.2m:

GBP000

Revenue 15,357

________

Profit before tax 1,116

________

Azzurri's revenue for the period 1 January 2016 to 30 June 2016

was GBP43.6m and before management charges, its loss before tax,

including exceptional and pre acquisition debt costs was

GBP2.5m.

The Group incurred GBP2.5m of third party costs related to this

acquisition. These costs are included in administrative expenses in

the consolidated statement of comprehensive income.

6. Dividends

6 months 6 months Year

to 30 to 30 to 31

June June December

2016 2015 2015

GBP000 GBP000 GBP000

(unaudited) (unaudited) (audited)

Dividends paid

Final 2014, paid 1 May 2015

- 11.6p per share - 1,243 1,243

Interim 2015, paid 7 October

2015 - 12.8p per share - - 1,378

Final 2015, paid 5 April 1,777 - -

2016 - 16.5p per share

1,777 1,243 2,621

============ ============ ==========

The directors propose the payment of an interim dividend for

2016 of 13.4p (2015: 12.8p) per ordinary share, payable on 12

October 2016 to shareholders on the register at 30 September 2016.

The cost of the proposed dividend, based on the number of shares in

issue as at 15 September 2016, is GBP1.9m (2015: GBP1.4m).

7. Exceptional costs

On 4 May 2016 the Company acquired the entire issued share

capital of Warden Holdco Limited whose principal trading entity is

Azzurri Communications Limited. Legal and professional costs of

GBP2.5m were incurred by Maintel in 2016 in relation to the

acquisition, together with redundancy costs of GBP0.3m as a result

of synergies achieved pre and post-acquisition. H1 2015 redundancy

costs of GBP0.1m related to the acquisition of Proximity. These

costs have been treated as exceptional in the income statement as

they are not normal operating expenses.

8. Borrowings

30 June 30 June 31 December

2016 2015 2015

GBP000 GBP000 GBP000

(unaudited) (unaudited) (audited)

Current bank loan - secured - 2,000 2,000

Non-current bank loan - secured 30,652 7,200 4,000

30,652 9,200 6,000

============ ============ ============

On 8 April 2016 the Group entered into new facilities with the

Royal Bank of Scotland plc to support the acquisition of Azzurri.

These consist of a revolving credit facility totalling GBP36.0m in

committed funds on a reducing basis for a five year term (with an

option to borrow up to a further GBP20.0m in uncommitted accordion

facilities) and replaced the Company's existing term and revolving

credit facilities with Lloyds Bank plc which were fully repaid and

terminated.

Under the terms of the facility agreement the committed funds

reduce to GBP31.0m on the three year anniversary, and to GBP26.0m

on the four year anniversary from the date of signing.

Non-current bank loan above is stated net of unamortised issue

costs of debt of GBP0.3m.

Independent review report to Maintel Holdings Plc

Introduction

We have been engaged by the company to review the financial

information in the interim results for the six months ended 30 June

2016 which comprises the consolidated statement of comprehensive

income, the consolidated statement of financial position, the

consolidated statement of changes in equity, the consolidated

statement of cash flows, and explanatory notes.

We have read the other information contained in the interim

results and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The interim results, including the financial information

contained therein, are the responsibility of and have been approved

by the directors. The directors are responsible for preparing the

interim results in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

Our responsibility

Our responsibility is to express to the company a conclusion on

the financial information in the interim results based on our

review.

Our report has been prepared in accordance with the terms of our

engagement to assist the company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the financial information in the interim

results for the six months ended 30 June 2016 is not prepared, in

all material respects, in accordance with the rules of the London

Stock Exchange for companies trading securities on AIM.

BDO LLP

Chartered Accountants and Registered Auditors

London

16 September 2016

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127)

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EQLFFQKFEBBV

(END) Dow Jones Newswires

September 19, 2016 02:00 ET (06:00 GMT)

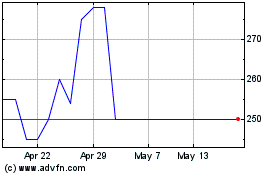

Maintel (LSE:MAI)

Historical Stock Chart

From Jun 2024 to Jul 2024

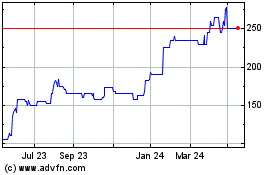

Maintel (LSE:MAI)

Historical Stock Chart

From Jul 2023 to Jul 2024