TIDMONC

RNS Number : 0912B

Oncimmune Holdings PLC

31 May 2023

This announcement contains inside information

for the purposes of the UK Market Abuse Regulation

31 May 2023

Oncimmune Holdings plc

("Oncimmune" or the "Company")

Interim Results

The ImmunoINSIGHTS pharma services business continues to deliver

value to 7 of the top 15 global pharma companies and build

relationships with new accounts despite the softening market

Post period sale of Oncimmune Limited and EarlyCDT Lung blood

test to Freenome for GBP13M, enabling a repayment of EUR 7.2M debt

to IPF; the company expects to have GBP6.7m in cash

Post period signing of long-term MSA with Freenome with

guaranteed commitment of at least EUR1.14M per annum

Oncimmune Holdings plc (AIM: ONC.L), the leading autoantibody

profiling company to the pharmaceutical and biotechnology industry,

today announces its unaudited interim results for the six months

ended 28 February 2023 ("H1 FY2023").

Financial highlights (including Post Period Events)

-- Recognised revenue for the period was GBP1.12M (15 Months to

31 August 2022 ("FY 2022"): GBP3.79M and 12 months to 31 May 2022

("May 2022") GBP3.86M). The current value of the contracted order

book at ImmunoINSIGHTS is EUR3.5M as at 1 March 2023. Delays in the

delivery of samples from major contracts signed in the period has

delayed recognised revenue into the second half of H2 FY2023.

-- Gross profit for the period was GBP0.48M (FY 2022: GBP1.83M and May 2022 GBP1.46M).

-- Administrative expenses were GBP2.86M (FY 2022: GBP8.70M and

May 2022 GBP7.05M) which included GBP0.78M of depreciation and

amortisation (FY 2022: GBP1.64M and May 2022 GBP1.43M) which is

non-cash . Furthermore, GBP1.08M of the period's administrative

expenses (which includes GBP0.56M of depreciation and amortisation)

relate to Oncimmune Limited and will be discontinued following the

sale to Freenome Holdings, Inc. ("Freenome") (the "Sale") which was

announced on 22 May 2023.

-- Research & Development expenses were GBP0.69M (FY 2022:

GBP1.85M and May 2022 GBP1.52M) of which GBP0.15M related to

Oncimmune Limited will be discontinued post the Sale .

-- Share-based payments were GBP0.44M (FY 2022: GBP1.69M and May

2022 GBP1.80M) which are non-cash.

-- Cash used in operating activities (pre-financing) for the

period was GBP2.32M (FY 2022: GBP6.69M and May 2022 GBP5.80M).

-- Loss after tax was GBP4.06M (FY 2022: GBP11.39M and May 2022

GBP9.51M). However, post the Sale, the Company is expected to

benefit from substantially lower operating costs with the removal

of Oncimmune Limited's administration and research &

development costs, which for the period were GBP1.23M.

-- Gross cash balance at the period end of GBP0.78M (FY 2022:

GBP1.43M and May 2022 GBP2.53M) and net debt at the period end of

GBP9.64M (FY 2022: GBP9.31M and May 2022 GBP8.16M). The gross cash

balance and the net debt amount do not include the proceeds from

the Sale.

-- Post period the Company sold Oncimmune Limited for a total of

GBP13M in cash. Immediately following the Sale and the repayment of

existing debt, the Company's expected cash balance will be GBP6.7M

(which includes the GBP1.3M held in escrow for 12 months in

accordance with the terms of the Sale).

* Financial comparators for the period are for 12 months to 31

May 2022 and 15 months to 31 August 2022, as a result of a change

in our financial year to 31 August. For H1 2022 numbers, please

follow

https://d2ysp6t8sg26jc.cloudfront.net/2022-02-28/9456C/b43993b57e7704175206f19e6ad0a0bb013d0401.html

Commercial and operational highlights (including post

period)

-- Since acquiring the ImmunoINSIGHTS business for an all-share

consideration in March 2019, we have contracted with the majority

of the top 10 global pharmaceutical companies and delivered high

quality projects which provide our clients with deep insights into

their clinical assets and programmes.

-- ImmunoINSIGHTS and Freenome have signed a long-term Master

Services Agreement ("MSA"), under which Freenome will leverage the

ImmunoINSIGHTS discovery services business to further accelerate

Freenome's pipeline for multiple cancers, with a guaranteed

commitment by Freenome to purchase services from Oncimmune Germany

GmbH worth at least EUR1.14M per year, with revenue recognised on a

quarterly basis. The MSA has an overall term of five years, with a

fixed initial term of two years and Freenome's option to extend for

a further three years on the same terms.

-- Upon the divestment of the EarlyCDT portfolio to Freenome,

there is now a singular focus on the ImmunoINSIGHTS business and

supporting our customers with their clinical trials.

-- In H1 FY2023, the focus has been on deepening the

relationship with existing accounts and expanding our reach across

asset teams through MSAs. These MSA's unlock benefits that include

improved speed of contracting on future projects and

extensions.

-- Whilst our deliverable is strong, the pharmaceutical services

market has been soft over the last 15 months, both because of a

lack of biotech investment, and macroeconomic uncertainty. We

believe these headwinds will turn a corner in the next 6

months.

-- In December 2023, the Company announced that a number of

contracts had been signed before the pharmaceutical sector year end

in December, including contracts with a combined value of

approximately $1.25 million with an existing global pharmaceutical

client. As at

1 March 2023 the current value of the contracted order book at

ImmunoINSIGHTS is EUR3.5M.

-- In January, a new multi-year MSA was signed with a new top 10

pharmaceutical group for the provision of ImmunoINSIGHTS clinical

laboratory services, expected to support multiple autoantibody

profiling projects focusing on autoimmune, cardiovascular and

prenatal diseases.

-- As we expand our reach and impact, it is not unusual to identify a novel application of the ImmunoINSIGHTS platform. Indeed, we were able to sign a new contract with a leading UK-based biotech company to collaborate on the discovery of autoantibody biomarkers for the detection of sepsis, in which all intellectual property rights ("IPR") developed during the collaboration shall be owned exclusively by Oncimmune, with an option for our customer to commercialise.

-- Beyond pharma contracts, we have remained active in

collaborating with academia. In the period, the Company signed a

new commercial contract with a leading US research institution to

analyse samples and generate autoantibody profiles in serum in

patients with confirmed Glioblastoma Multiforme.

-- More recently, the Company has signed another contract to use

the ImmunoINSIGHTS platform in Chronic Inflammatory Demyelinating

Polyneuropathy ("CIDP"), as well as two new autoimmune disease

contracts.

Dr Adam M Hill, CEO of Oncimmune said: "The sale of Oncimmune

Limited to Freenome not only allows for a singular focus on

building value in our ImmunoINSIGHTS platform, but also is a lead

indicator of renewed confidence in the UK lifescience sector after

a period of significant under investment. Whilst the Pharma

services market has softened during the last 12-15 months, there is

now an unprecedented wall of therapeutic assets queued to enter

clinical trials, which bodes well for ImmunoINSIGHTS into 2024 and

beyond. It remains my firm belief that this platform has the

potential to offer significant value to our customers, and is

primed to respond, at scale, in lockstep with the market as it

inevitably rebounds. Post the sale of the Oncimmune Limited, our

focus is the expansion of the ImmunoINSIGHTS services business with

an intention to achieve a cash flow break even position in the near

term."

For further information:

Oncimmune Holdings plc

Dr Adam M Hill, Chief Executive Officer

Matthew Hall, Chief Financial Officer

contact@oncimmune.co.uk

Singer Capital Markets (Nominated Adviser and Broker)

Phil Davies, Harry Gooden, George Tzimas, James Fischer

+44 (0)20 7496 3000

Zeus (Joint Broker)

Dominic King, Victoria Ayton, Dan Bate

+44 (0)20 3829 5000

+44 (0)20 3727 1000

About Oncimmune

Oncimmune is a leader in autoantibody profiling to the

pharmaceutical and biotechnology industry , primarily focused on

the growing fields of immuno-oncology, autoimmune disease and

infectious diseases. The ImmunoINSIGHTS service business leverages

Oncimmune's technology platform and methodologies across multiple

diseases, to offer life-science organizations actionable insights

for therapies across the development and product lifecycle. Our

core immune-profiling technology is underpinned by our library of

over eight thousand immunogenic proteins, one of the largest of its

kind. This helps identify trial participants and patients into

clinically relevant subgroups, enabling development of targeted and

more effective treatments.

Oncimmune's ImmunoINSIGHTS service business is based at the

Company's discovery research centre in Dortmund, Germany. The

business platform enables life science organizations to optimize

drug development and delivery, leading to more effectively targeted

and safer treatments for patients.

For more information, visit www.oncimmune.com

Chief Executive's and Chairman's Review

We are pleased to report the Group's unaudited half year results

for the six months ended 28 February 2023, including an update on

the commercial and operational progress since last period end.

Oncimmune is a leader in autoantibody profiling to the

pharmaceutical and biotechnology industry , primarily focused on

the growing fields of immuno-oncology, autoimmune disease, and

infectious diseases. The Group has a diversified and growing

revenue stream from its discovery and development service-based

platform, delivering actionable insights into therapies under

development to its pharmaceutical and biotech partners. Oncimmune's

ImmunoINSIGHTS pharma services laboratory facility is based in

Dortmund, Germany and its commercial team is based in Boston, USA,

and in Europe.

Oncimmune's ImmunoINSIGHTS platform enables life science

organisations to optimise drug development and delivery, leading to

more effective targeting, as well as safer, treatments for

patients. Underpinned by our proprietary library of over 8,000

immunogenic proteins, we help identify clinical trial participants

and patients in clinically relevant subgroups, enabling the

development of more effective treatments with lower risk of adverse

events.

Business update

The Group launched the ImmunoINSIGHTS service in February 2020

as Oncimmune's contract discovery and development service-based

platform. Since then, the ImmunoINSIGHTS platform has grown to

deliver contracts with 7 of the top 15 global pharmaceutical

companies and this is expected to grow again by the end of this

financial year.

We currently anticipate that by the end of FY2023 the majority

of revenues will have been earned from the top 15 global

pharmaceutical clients. This is a result of a concerted effort to

build a reputation for quality service delivery, ultimately leading

to MSAs with our most frequent customers, unlocking benefits that

include improved speed of contracting on future projects and

extensions, a deepening of customer engagement and preferred

supplier status for autoantibody profiling services. In all cases,

this has been an evolution from an ad hoc purchase order,

highlighting the importance of developing customer relationships,

and also the value of the ImmunoINSIGHTS offering to customers.

In December, the Company announced a number of contracts had

been signed before the pharmaceutical sector year end, including:

contracts with a combined value of approximately $1.25 million with

an existing global pharmaceutical client; a new multi-year MSA with

a new top 10 pharmaceutical group for the provision of

ImmunoINSIGHTS clinical laboratory services, expected to support

multiple autoantibody profiling projects focusing on autoimmune,

cardiovascular and prenatal diseases; and a new contract with a

leading UK-based biotech company to collaborate on the discovery of

autoantibody biomarkers for the detection of sepsis.

In this latter deal, all intellectual property rights ("IP")

developed during the collaboration shall be owned exclusively by

Oncimmune, and the biotech company shall have the option to extend

the collaboration to a verification study on commercial terms with

Oncimmune and to take-up an option to enter into a 20-year

agreement to licence from the Company the IP generated from the

collaboration in consideration for an upfront payment and an

ongoing royalty payment.

Furthermore, the Company has also signed a new commercial

contract with a leading US research institution to analyse samples

and generate autoantibody profiles in serum in patients with

confirmed Glioblastoma Multiforme.

More recently, the Company has signed another contract to use

the ImmunoINSIGHTS platform in Chronic Inflammatory Demyelinating

Polyneuropathy ("CIDP"), as well as two new autoimmune disease

contracts.

Although the timelines between initial discussions and

contracting have lengthened as we progress through FY2023, in large

part due to the global macroeconomic situation increasing the

financial constraints experienced by customers in this sector, the

pipeline for the ImmunoINSIGHTS service business remains healthy.

The current value of the contracted order book is EUR1.3M.

Divestment of non-core assets

As mentioned in previous announcements, the Directors had been

considering several options for the realisation of value from the

Group's non-core assets. We are therefore pleased to report that

the Group announced on 22 May 2023 the successfully divestment of

its wholly owned subsidiary, Oncimmune Limited, including the

EarlyCDT (R) Lung blood test. This disposal will enable the Company

to focus its entire resources on unlocking the potential of its

ImmunoINSIGHTS pharma services platform in support of therapeutic

clinical development programmes.

Oncimmune has sold all the issued shares in Oncimmune Limited

for GBP13 million in cash, of which GBP1.3 million in cash has been

held in escrow for 12 months in the event of any claims against

warranties and representations. In addition, Oncimmune's pharma

services business, Oncimmune Germany GmbH and Freenome have signed

a MSA, under which Freenome will commit to use the Company's

ImmunoINSIGHTS pharma services business for a minimum of two years,

with a guaranteed commitment worth at least EUR1.14M per year.

Furthermore, Freenome has entered an option to extend the

commitment under this ImmunoINSIGHTS agreement for a further three

years with the same commitment of at least EUR1.14M per year.

Scientific publications, reports and awards

In line with the Group's core objectives, we have continued to

push the boundaries of understanding with the ImmunoINSIGHTS

platform, publishing our results at world class conferences, and in

high impact factor scientific publications.

In March, Oncimmune's scientists presented collaborative work

undertaken with Dr Sonpavde's team, Dana Faber, at the Mosbacher

Kolloquium on Immune Engineering - from Molecules to Therapeutic

Approaches(1) . The work showcased the potential of the

ImmunoINSIGHTS platform in identifying markers for clinical outcome

of Immune Checkpoint Inhibitor treatment of patients with

metastatic Urothelial Carcinoma. The expanded work is currently the

subject of a manuscript that will be submitted for publication

shortly.

In collaboration with Faron Pharmaceuticals Oy, Oncimmune

scientists presented in April on the use of ImmunoINSIGHTS to

examine Exmarilimab's induction of B-cell activation and

autoantibody production (2) .

In May, in collaboration with Roche, we were able to present the

use of ImmunoINSIGHTS in profiling of the antibody response to

viral and bacterial antigens and its correlations with

time-to-hospital discharge on samples from patients from both the

Covacta and Mariposa study (3) . Extensions of this work are

anticipated to be further presented later on in 2023.

Finally, our work with Roche on the TAIL trial has been accepted

for an oral presentation at ASCO in June 2023 (4) . The

presentation demonstrates the use of ImmunoINSIGHTS in baseline

autoantibody profiling in NSCLC patients with pre-existing

autoimmune diseases or who had received prior anti-PD-1 therapy

before enrolment in the TAIL study.

Outlook

The ImmunoINSIGHTS business, acquired for an all-share

consideration in March 2019, is an exciting business which has

significant high margin revenue growth. It is expected that by the

end of this financial year, ImmunoINSIGHTS will have contracted

with the majority of the top 10 global pharmaceutical companies,

delivering high quality projects which provide our clients with

deep insights into their clinical assets and programmes.

The Board sees the potential to not only build upon the MSAs

established so far, but also to continue to add new customers to

the portfolio. In addition, the Board is increasingly excited about

the potential to further evolve Oncimmune's business model now all

resource is focused upon it. This will require a greater focus on

exploiting the substantial intellectual property developed since

2019.

In summary, we are successfully delivering against our strategic

objectives and have created a focused business which has a

specialised commercial offering. With focus, this platform has

significant near-term growth prospects; its operational cost base

is already covered by our MSA with Freenome. Against this backdrop,

the Board is confident of delivering increasing value to all

stakeholders.

On behalf of the Board, we would like to thank our shareholders

for their continued support throughout the first half of FY 2023,

and we look forward to updating the market on Oncimmune's further

progress periodically.

Alistair Macdonald Dr Adam M Hill

Chairman Chief Executive Officer

1. Sonpavde G, Freeman D, Adib E, Talal E, Thomas J, Nuzzo PV,

Ravi A, Tuff M, Mantia C, McGregor B, Berchuk J, Budde P, Abhari

BA, Rupieper E, Gajewski J, McDaid R, Schubert A-S, Kilian A,

Bräutigam M, Zucht H-D, Ravi P. Multiplexed autoantibody profiling

to identify markers for clinical outcome of Immune Checkpoint

Inhibitors in metastatic Urothelial Carcinoma patients. Mosbacher

Kolloquium - Immune Engineering - from Molecules to Therapeutic

Approaches, March 2023.

2. Elisa M. Vuorinen, Mari L. Björkman, Reetta Virtakoivu, Juho

Jalkanen, Sofia Aakko, Akira Takeda, Petra Budde, Hans-Dieter

Zucht, Manuel Brautigam, Behnaz Ahangarianabhari, Petri Bono, Maija

Hollmén. Exmarilimab induces B-cell activation and autoantibody

production;

https://www.abstractsonline.com/pp8/#!/10828/presentation/3192 .

Poster presented at AACR Annual Meeting 14-19 April, 2023

3. Shrivastava D, Budde P, Onabajo O, Bräutigam M, Zucht HD,

McBride J, Bauer R, Chandler GS, Kuebler P. Profiling of the

antibody response to viral and bacterial antigens and its

correlations with time-to-hospital discharge: Covacta and Mariposa

study. Poster abstract accepted for 106th annual meeting of The

American Association of Immunologists (AAI) 11.15 May, 2023

4. Budde P, Rodriguez Abreu D, Zucht HD, Shrivastava D, Kilian

AL, Hoglander E, Shoshkova S, Markovic M, Kaul M, Cardona JV,

Chandler GS, Mohindra R. Baseline autoantibody profiling in NSCLC

patients with pre-existing autoimmune diseases or who had received

prior anti-PD-1 therapy before enrolling in the TAIL study. Oral

presentation for ASCO 2-6 June, 2023.

Chief Financial Officer's review

The Company's recognised revenue for the six months to 28

February 2023 was GBP1.12M (FY 2022: GBP3.79M and May 2022

GBP3.86M) . The value of the contracted order book at

ImmunoINSIGHTS is EUR3.5M as at 1 March 2023. Delays in the

delivery of samples from major contracts signed in the period has

delayed recognised revenue into the second half of H2 FY2023.

Gross profit for the period was GBP0.48M (FY 2022: GBP1.83M and

May 2022 GBP1.46M) .

Administrative expenses were GBP2.86M (FY 2022: GBP8.70M and May

2022 GBP7.05M) which included GBP0.78M of depreciation and

amortisation (FY 2022: GBP1.64M and May 2022 GBP1.43M) which is

non-cash. Furthermore, GBP1.08M of the period's administrative

expenses (which includes GBP0.56M of depreciation and amortisation)

relate to Oncimmune Limited and will be discontinued post the

Sale.

Research & development expenses were GBP0.69M (FY 2022:

GBP1.85M and May 2022 GBP1.52M) of which GBP0.15M related to

Oncimmune Limited which will be discontinued post the Sale.

Share-based payments were GBP0.44M (FY 2022: GBP1.69M and May

2022 GBP1.80M) which are non-cash.

Cash used in operating activities (pre-financing) for the period

was GBP2.32M (FY 2022: GBP6.69M and May 2022 GBP5.80M).

Loss after tax was GBP4.06M (FY 2022: GBP11.39M and May 2022

GBP9.51M). However, post the Sale, the Company is expected to

benefit from substantially lower operating costs with the removal

of Oncimmune Limited's administration and research &

development costs, which for the period were GBP1.23M.

Gross cash balance at the period end of GBP0.78M (FY 2022:

GBP1.43M and May 2022 GBP2.53M) and net debt at the period end of

GBP9.64M (FY 2022: GBP9.31M and May 2022 GBP8.16M). The gross cash

balance and the net debt amount do not include the proceeds from

the Sale.

In May 2023, the Company sold the entire share capital in

Oncimmune Limited for GBP13M in cash, structured as consideration

for equity and debt repayment, of which GBP1.3M in cash is being

held in escrow for 12 months in the event of any claim by Freenome

against the customary warranties and indemnity given to Freenome in

the sale and purchase agreement .

Separate from the Sale, ImmunoINSIGHTS and Freenome have signed

a long-term MSA, under which Freenome will leverage the

ImmunoINSIGHTS discovery services business to further accelerate

Freenome's pipeline for multiple cancers, with a guaranteed

commitment by Freenome to purchase services from Oncimmune Germany

GmbH worth at least EUR1.14M per year, with revenue recognised and

paid on a quarterly basis. The MSA has an overall term of five

years, with a fixed initial term of two years and Freenome's option

to extend for a further three years on the same terms.

Oncimmune has an existing debt facility with IPF Management SA

("IPF Partners") (the "IPF Facility") with an outstanding principal

balance of EUR11.6M prior to this Sale. In connection with the

Sale, Oncimmune has agreed to repay EUR7.2M (being EUR5.6M of

principal and EUR1.6M of interest) of the outstanding IPF Facility.

Oncimmune has today entered into a new debt facility (the "New IPF

Facility") for the outstanding EUR6.0M in principal from the

previous IPF Facility under which the principal amount is repayable

over the next three years, with a principal repayments holiday for

the first 12 months, and with interest commencing from September

2023 on the same cash margin rate as in the previous IPF Facility.

Repayments under the New IPF Facility have been profiled such that

40% (or EUR2.4M) of the EUR6.0M facility will be repaid at the end

of the agreement in March 2026.

The New IPF Facility is secured by fixed and floating charges

over the assets of Oncimmune and the shares in Oncimmune Germany

GmbH and may be repaid at any time, subject to an early repayment

fee. The interest rate is 9% per annum over 3-month EURIBOR

(subject to a floor of 0%) and is payable quarterly.

Following payment of the EUR7.2M under the IPF Facility and

other costs associated with the Sale, the Company expects to have

approximately GBP6.7M in cash (which includes the GBP1.3M held in

escrow as described above).

Reference was made in the audited results for the 15-month

period ended 31 August 2022 to the Group's debt obligations giving

rise to a material uncertainty. The Board considers that the

repayment of debt under the IPF Facility, the repayment profile of

the new IPF Facility, together with the net proceeds from the Sale,

removes any material uncertainty as regards going concern.

Matthew Hall

Chief Financial Officer

Oncimmune Holdings plc

Consolidated income statement for the six months ended 28

February 2023

Unaudited Audited Unaudited

6 months 15 months 12 months

to to to

28 February 31 August 31 May

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

-------------------------------- ------ ------------- ----------- -----------

Revenue 1,124 3,788 3,859

Cost of sales (645) (1,962) (2,402)

Gross profit 479 1,826 1,457

Administrative expenses (2,858) (8,702) (7,052)

Research and development

expenses (690) (1,851) (1,517)

Share-based payment (440) (1,691) (1,800)

Total administrative

expenses (3,988) (12,244) (10,369)

Other income 36 413 326

Operating loss (3,473) (10,005) (8,586)

Finance income - 8 -

Finance costs (578) (1,562) (943)

-------------------------------- ------ ------------- ----------- -----------

Finance costs - net (578) (1,554) (943)

Loss before income

tax (4,051) (11,559) (9,529)

Income tax (expense)/credit (5) 173 17

Loss for the period/year (4,056) (11,386) (9,512)

Other comprehensive

income

Items that may be subsequently

reclassified to profit

and loss, net of tax

Currency translation

differences (54) (130) (384)

Loss after tax and

total comprehensive

income for the period/year

attributable to equity

holders (4,110) (11,516) (9,896)

Loss per share:

Basic and diluted (pence) 3 (5.8p) (16.5p) (13.7p)

Oncimmune Holdings plc

Consolidated statement of financial position as at 28 February

2023

Unaudited Audited Unaudited

28 February 31 August 31 May

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

---------------------------------- ------- --------------- ------------- ------------

Assets

Non-current assets

Goodwill 1,578 1,578 1,578

Intangible assets 2,048 3,017 3,237

Property, plant and equipment 741 788 918

Right-of-use assets 146 552 627

Deferred tax asset 647 613 927

5,160 6,548 7,287

------------------------------------------ --------------- ------------- ------------

Current assets

Inventories 391 430 413

Trade and other receivables 1,436 1,340 6,219

Contract assets 110 417 808

Cash and cash equivalents 780 1,425 2,530

2,717 3,612 9,970

------------------------------------------ --------------- ------------- ------------

Total assets 7,877 10,160 17,257

------------------------------------------- --------------- ------------- ------------

Equity: Capital and reserves

attributable to the equity

holders

Share capital 741 695 695

Share premium 42,687 40,634 40,635

Merger reserve 31,883 31,882 31,882

Other reserves - - 5,894

Own shares (1,926) (1,926) (1,926)

Foreign exchange translation

reserve 89 (42) (296)

Retained earnings (79,532) (75,422) (79,611)

Total equity (6,058) (4,179) (2,727)

------------------------------------------- --------------- ------------- ------------

Liabilities

Non-current liabilities

Borrowings 4,283 3,917 2,420

Other liabilities 2,000 2,000 2,000

Lease liability 111 295 352

Deferred tax 201 311 115

------------------------------------------- --------------- ------------- ------------

6,595 6,523 4,887

------------------------------------------ --------------- ------------- ------------

Current liabilities

Trade and other payables 927 1,176 1,963

Contract liabilities 381 180 5,180

Other statutory liabilities 2 34 40

Lease liability 226 321 443

Borrowings 5,804 6,105 7,471

7,340 7,816 15,097

------------------------------------------ --------------- ------------- ------------

Total liabilities 13,935 14,339 19,984

------------------------------------------- --------------- ------------- ------------

Total equity and liabilities 7,877 10,160 17,257

------------------------------------------- --------------- ------------- ------------

Oncimmune Holdings plc

Consolidated statement of cash flows for the six months ended 30

November 2021

Unaudited Audited Unaudited

6 months 15 months 12 months

to to to

28 February 31 August 31 May

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------------------ ------------- ----------- -----------

Cash flow from operating activities

Loss before income tax (4,105) (11,559) (9,529)

Adjusted by:

Depreciation and amortisation 780 1,643 1,429

Lease modification (157) - -

Interest receivable (28) (8) -

Interest expense 508 1,562 943

Share-based payment charge 440 1,691 1,800

Foreign exchange movements - - 3

(2,562) (6,671) (5,354)

Changes in working capital:

(Increase)/decrease in inventories 39 (287) (270)

Decrease/(increase) in trade and

other receivables 177 629 253

(Decrease)/increase in trade and

other payables 30 (363) (428)

Cash used in operating activities (2,316) (6,692) (5,799)

Interest paid (442) (597) (169)

Interest received 28 8 -

Income tax (paid)/received (5) 409 (243)

Deferred tax adjustment (110) - -

Net cash used in operating activities (2,845) (6,872) (6,211)

------------------------------------------ ------------- ----------- -----------

Cash flow from investing activities

Purchase of property, plant and

equipment (25) (306) (504)

Disposal/(purchase) of intangible

assets 667 (625) -

Payment of deferred consideration (110) - -

Net cash (used in)/generated from

investing activities 532 (931) (504)

------------------------------------------ ------------- ----------- -----------

Cash flow from financing activities

Net funds raised through share issues 2,099 141 142

Loan advances - 2,546 3,345

Loan repayments - (1,643) (2,347)

Principal elements of lease repayments (122) (392) (153)

Net cash (used in)/generated from

financing activities 1,977 652 987

------------------------------------------ ------------- ----------- -----------

Net (decrease)/increase in cash

and cash equivalents (336) (7,151) (5,728)

Movement in cash attributable to

foreign exchange (309) (55) (375)

------------------------------------------ ------------- ----------- -----------

Cash and cash equivalents at the

beginning of the period 1,425 8,631 8,631

------------------------------------------ ------------- ----------- -----------

Cash and cash equivalents at the

end of the period 780 1,425 2,528

------------------------------------------ ------------- ----------- -----------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General information

The principal activity of Oncimmune Holdings plc (the "Company")

and its subsidiaries (together, the "Group") is that of

autoantibodies profiling to the pharmaceutical and biotechnology

industry, specifically in the areas of immune-oncology, autoimmune

disease and infectious diseases, and the research and development

of autoantibody for the early detection of very wide range of solid

cancers, in partnership with Freenome. The Company is incorporated

and domiciled in the United Kingdom. The address of its registered

office is 1 Park Row, Leeds, United Kingdom, LS1 5AB . The

registered number is 09818395.

As permitted, this Interim Report has been prepared in

accordance with the AIM rules and not in accordance with IAS 34

"Interim Financial Reporting".

This Consolidated Interim Report and the financial information

for the six months ended 28 February 2023 does not constitute full

statutory accounts within the meaning of section 434 of the

Companies Act 2006 and are unaudited. This unaudited Interim Report

was approved by the Board of Directors on 19 May 2023.

The consolidated interim financial statements are presented in

Sterling and have been rounded to the nearest thousand

(GBP'000).

The consolidated financial statements are prepared under the

historical cost convention.

The Group's financial statements for the period ended 31 August

2022 have been filed with the Registrar of Companies. The Group's

auditor's report on these financial statements was unqualified and

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

Electronic communications

The Company is not proposing to distribute hard copies of this

Interim Report for the six months ended 28 February 2023 unless

specifically requested by individual shareholders.

The Board believes that by utilising electronic communication it

delivers savings to the Company in terms of administration,

printing and postage, and environmental benefits through reduced

consumption of paper and inks, as well as speeding up the provision

of information to shareholders.

News updates, Regulatory News and Financial statements can be

viewed and downloaded from the Company's website,

www.oncimmune.com. Copies can also be requested from; The Company

Secretary, Oncimmune Holdings plc, 1 Park Row, Leeds, United

Kingdom, LS1 5AB or by email: info@oncimmune.com

2. Events after the reporting period

Oncimmune has sold the entire share capital in Oncimmune Limited

and Oncimmune Europe GmbH for GBP13M in cash, structured as

consideration for equity and debt repayment, of which GBP1.3M in

cash is being held in escrow for 12 months in the event of any

claim by Freenome against the customary warranties and indemnity

given to Freenome in the sale and purchase agreement.

Oncimmune has an existing debt facility with IPF Management SA

("IPF Partners") (the "IPF Facility") with an outstanding principal

balance of EUR11.6M prior to this Sale. In connection with the

Sale, Oncimmune has agreed to repay EUR7.2M (being EUR5.6M of

principal and EUR1.6M of interest) of the outstanding IPF Facility.

Oncimmune has today entered into a new debt facility (the "New IPF

Facility") for the outstanding EUR6.0M in principal from the

previous IPF Facility under which the principal amount is repayable

over the next three years, with a principal repayments holiday for

the first 12 months, and with interest commencing from September

2023 on the same cash margin rate as in the previous IPF Facility.

Repayments under the New IPF Facility have been profiled such that

40% (or EUR2.4M) of the EUR6.0M facility will be repaid at the end

of the agreement in March 2026.

The New IPF Facility is secured by fixed and floating charges

over the assets of Oncimmune and the shares in Oncimmune Germany

GmbH and may be repaid at any time, subject to an early repayment

fee. The interest rate is 9% per annum over 3-month EURIBOR

(subject to a floor of 0%) and is payable quarterly.

Following payment of the EUR7.2M under the IPF Facility and

other costs associated with the Sale, the Company expects to have

approximately GBP6.7M in cash (which includes the GBP1.3M held in

escrow as described above). Reference was made in the audited

results for the 15-month period ended 31 August 2022 to the Group's

debt obligations giving rise to a material uncertainty. The Board

considers that the repayment of debt under the IPF Facility, the

repayment profile of the new IPF Facility, together with the net

proceeds from the Sale, removes any material uncertainty as regards

going concern.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFFIERIIVIV

(END) Dow Jones Newswires

May 31, 2023 02:00 ET (06:00 GMT)

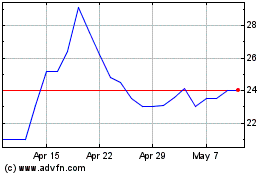

Oncimmune (LSE:ONC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oncimmune (LSE:ONC)

Historical Stock Chart

From Apr 2023 to Apr 2024