TIDMORCP

RNS Number : 4431N

Oracle Power PLC

25 September 2023

25 September 2023

Oracle Power PLC

("Oracle", the "Company" or the "Group")

Unaudited Interim Results for the six months to 30 June 2023

Oracle Power PLC (AIM: ORCP), the international natural

resources project developer, announces its unaudited interim

results for the six months ended 30 June 2023, which is also

available on its website at: www.oraclepower.co.uk.

Chairman's Statement for the six months to 30 June 2023

Summary of Interim Results

Oracle has made significant progress in relation to its

multi-project portfolio consisting of one gold project progressing

work in Western Australia via a joint venture, the multiple project

Thar coal block in Pakistan (the "Thar Project"), which includes a

large solar project, and a very exciting green hydrogen project in

the south of Pakistan (the "Green Hydrogen Project"). For the Green

Hydrogen Project, the Company has set up a joint venture company,

Oracle Energy Limited ("Oracle Energy"), with Kaheel Energy FZE

("Kaheel Energy"), which is wholly owned by His Highness Sheikh

Ahmed Bin Dalmook Al Maktoum.

As is to be expected for a project development company with

pre-revenue projects at development stages, the Company's financial

results for the six months to 30 June 2023 show the Group to have

made a loss after taxation of GBP613,773 (6 months ended 30 June

2022: GBP356,295). The increase in overheads during the period of

GBP257,478 is principally due to foreign exchange losses and an

adjustment to how the Company accounts for associate company

investments.

At 30 June 2023, the Group had cash and cash equivalents of

GBP326,946 (30 June 2022: GBP762,300) and total assets less current

liabilities of GBP 6,117,075 (30 June 2022: GBP6,890,347).

Operational Update

Australia

The Company currently holds one prospective gold asset, the

Northern Zone Project, which is located in a globally significant

gold region of Western Australia. The Northern Zone Project is

located 25km east of the major gold mining centre of Kalgoorlie,

the home of the 'Super Pit' mine which is the second largest gold

mine in Australia. At the end of 2022, we decided to spend no

further funds exploring the Jundee East mine and the carrying value

of this asset was impaired in that period.

In the Chief Executive Officer's statement contained within this

report, Ms Memon has prepared a separate operational update which

further details the Company's progress in Australia.

Pakistan

The Pakistan authorities continue to work with the Chinese

Government through the China-Pakistan Economic Corridor ("CPEC").

This will assist with the obtaining of finance to develop Thar

Block VI. We keep in close touch with the Government of Pakistan at

both federal and provincial levels to ensure the continued support

for the Thar Project.

Post period end, we received the letter of intent ("LOI") from

Directorate of Alternative Energy of the Government of Sindh

relating to the establishment of a 1,200MW hybrid solar/wind, green

hydrogen/power project in Pakistan, enabling development of the

Green Hydrogen Project to commence.

In the Chief Executive Officer's statement contained within this

report, Ms Memon has prepared a separate operational update which

further details the Company's progress in Pakistan.

Conclusion

The Board extends its appreciation to the Energy Department, the

Government of Sindh, as well as the Ministry of Energy (Power

Division), Government of Pakistan, for their continued support. The

Board also continues to be most grateful for the patience and

support of the Company's shareholders.

Mark W. Steed

Chairman of the Board - Oracle Power PLC

Date: 25 September 2023

Chief Executive Officer's statement for the six months ended 30

June 2023

In the first half of 2023, we have made significant progress in

relation to the development of all our projects in Pakistan and

Western Australia.

Review of operations

Pakistan

Thar Block VI

As part of our continuing development of Thar Block VI, in May

2023 we signed a strategically significant off-take and development

MOU with the Government of Sindh, K electric; the largest private

electricity distributor in Pakistan, and PowerChina International.

The 1.32 MW coal to power plant will be developed within CPEC,

where it is on the priority list. The MOU allows for the

development of the power plant either on the Block VI site or at

Port Qasim for ease of transmission.

As part of our strategy to build our green energy portfolio, we

also initiated a project to develop a proposed 1GW solar facility

on our mine site at Block VI and signed a development MOU with

PowerChina International. We also obtained provisional permission

from the Government of Sindh for this development and have since

commenced the necessary work to fulfil their requirements. This

project places us at the forefront of companies in the region that

are committed to developing responsible and sustainable energy

solutions. Furthermore, the solar project at Thar will also offset

carbon emissions from existing and future coal power plants, by

providing green energy to local industry and communities. Oracle

also continued to work on its CTG/L initiative during this period

and, given the growing natural gas crisis in Pakistan, the

government has become more engaged with us regarding the

commencement of feasibility work.

Green Hydrogen Project

In the first half of 2023, Oracle has continued swiftly to

develop its green hydrogen project in partnership with Kaheel

Energy. Significantly in March 2023, a development and financing

MOU was signed with the State Grid Corporation of China, the

world's third largest company by revenue. During this period, State

Grid has commissioned and funded a Hybrid Power and Transmission

study.

We also signed two very important off-take MOUs as we continued

to de-risk this investment. The first one with Emirates Global

Aluminium was signed in February 2023, to meet the de-carbonisation

needs of its aluminium smelters. In June 2023, we continued to

strengthen our off-take prospects by signing another important

off-take MOU for all our future green ammonia and green hydrogen

production along with carbon credits, with PetroChina Middle East

Company.

In February 2023, Oracle established a senior position in the

green hydrogen development universe by becoming an associate

partner of Dii, Desert Energy Alliance, a partnership network for

the development and commercialisation of green hydrogen. In March

2023, Oracle also successfully completed the award and registration

of the land lease.

In June 2023, the Company was also pleased to announce a

collaboration for project development assistance and knowledge

sharing, with Global Green Growth Institute, headquartered in Seoul

under the Chairmanship of Ban ki-Moon.

Post period end, in September 2023, the Company was pleased to

announce the completion of the technical and commercial Feasibility

Study relating to the Green Hydrogen Project. The study, undertaken

by leading international construction engineering company,

thyssenkrupp Uhde, supports the development of a 400MW capacity

green hydrogen production facility. The results of the study were

noted to be very encouraging and on a par with industry

expectations as observed in other green hydrogen projects announced

worldwide, providing significant confidence in the development

route towards commercialisation. The Company are now moving into a

highly active period as it works towards completing power and grid

interconnectivity feasibility studies in collaboration with State

Grid Corporation of China, followed by geotechnical and

environmental studies, leading into the FEED stage, and formulation

of the investment and lender consortium.

Australia

In Western Australia, Oracle entered into a farm-in agreement

for the Northern Zone Project with Riversgold Limited

("Riversgold") (ASX:RGL), an ASX-listed gold exploration company in

May 2023. As a result of this deal, the Company and its

shareholders will be able to participate in the potential upside of

any exploration success from the Riversgold committed workplan. An

extensive diamond drilling programme was completed in August 2023

which substantiated previous exploration work, with very wide zones

of intense alteration in all four diamond drill holes demonstrating

high gold prospectivity. The Company is currently awaiting assay

results and will report these to the market in due course.

The Riversgold transaction highlights Oracle's strategy of

forming partnerships to create value for shareholders and the

Company is optimistic about the development of the partnership

moving forwards.

With regard to Jundee East, the results of our exploration

programme did not warrant any further work and the value of the

asset was impaired in 2022.

Outlook

During the first half of 2022, we actively pivoted towards a

more environmentally responsible project development strategy, by

selecting green energy development to be a part of our portfolio.

This has continued into 2023 and the Company is also reviewing

other global green energy opportunities with His Highness Sheikh

Ahmed Dalmook Al Maktoum.

We remain determined to generate value from the investments that

we have made. We have launched another significant renewable power

project to create further development opportunities on our coal

block in Thar. At the same time, with an eye on critical energy

needs and market demand, we have also forged a strategically

valuable off-take partnership for coal to power and are now working

towards securing financing support for our coal to power project

under the CPEC umbrella.

The last six months have taken us further forward in terms of

progressing our strategic vision and project developments and we

are committed to continuing this progress going forward.

Naheed Memon

Chief Executive Officer - Oracle Power PLC

Date: 25 September 2023

CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHS TO 30 JUNE 2023

(Unaudited) (Unaudited) (Audited)

6 Months 6 Months Year ended

to to

30 June 2023 30 June 2022 31 Dec 2022

CONTINUING OPERATIONS GBP GBP GBP

Revenue - - -

Administrative expenses (621,197) (356,538) (1,311,012)

OPERATING LOSS (621,197) (356,538) (1,311,012)

Finance costs - - -

Finance income 7,424 243 14,592

Amounts written off and p/l on disposals - - 6,762

LOSS BEFORE INCOME TAX (613,773) (356,295) (1,289,658)

Income tax - - -

LOSS FOR THE PERIOD (613,773) (356,295) (1,289,658)

------------- ------------- ------------

Earnings per share expressed in pence

per share:

Basic (0.02) (0.01) (0.04)

Diluted (0.02) (0.01) (0.04)

STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS TO 30 JUNE 2023

(Unaudited) (Unaudited) (Audited)

6 Months 6 Months Year ended

to to

30 June 2023 30 June 2022 31 Dec 2022

GBP GBP GBP

LOSS FOR THE YEAR (613,773) (356,295) (1,289,658)

ITEMS THAT WILL OR MAY BE RECLASSIFIED

TO PROFIT OR LOSS:

Exchange gains arising on translation

on foreign operations (331,076) (35,456) (178,459)

OTHER COMPREHENSIVE LOSS FOR THE PERIOD,

NET OF INCOME TAX (331,076) (35,456) (178,459)

------------- ------------- ------------

TOTAL COMPREHENSIVE LOSS FOR THE PERIOD (944,849) (391,751) (1,468,117)

------------- ------------- ------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE SIX MONTHS TO 30 JUNE 2023

(Unaudited) (Unaudited) (Audited)

6 Months 6 Months Year ended

to to

30 June 2023 30 June 2022 31 Dec 2022

GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible assets 4,688,947 5,640,968 5,023,296

Property, plant and equipment 2,615 4,948 3,885

Investments in equity accounted associates 667,337 120,284 668,782

Loans and other financial assets 619,773 435,871 580,079

5,978,672 6,202,071 6,276,042

------------- ------------- ------------

CURRENT ASSETS

Trade and other receivables 39,427 73,530 45,069

Cash and cash equivalents 326,946 762,300 150,905

366,373 835,830 195,974

------------- ------------- ------------

TOTAL ASSETS 6,345,045 7,037,901 6,472,016

------------- ------------- ------------

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 3,695,415 2,896,479 3,078,297

Share premium 18,807,922 18,358,858 18,632,040

Translation reserve (1,326,201) (852,122) (995,125)

Share scheme reserve 67,896 66,733 58,179

Retained earnings (15,127,899) (13,579,600) (14,504,409)

TOTAL EQUITY 6,117,133 6,890,348 6,268,982

------------- ------------- ------------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 227,912 147,553 203.034

Borrowings - - -

TOTAL LIABILITIES 227,912 147,553 203,034

------------- ------------- ------------

TOTAL EQUITY AND LIABILITIES 6,345,045 7,037,901 6,472,016

------------- ------------- ------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Called up Retained earnings Share Translation Share Scheme Reserve Total Equity

share premium Reserve

capital

GBP GBP GBP GBP GBP GBP

Balance at 31

December 2021 2,650,325 (13,223,305) 17,853,012 (816,666) 66,733 6,530,099

Loss for the period - (356,295) - - - (356,295)

Other comprehensive

income - - - (35,456) - (35,456)

Issue of Share

Capital 246,154 - 505,846 - - 752,000

---------- ------------------ ----------- ------------ --------------------- -------------

Balance at 30 June

2022 2,896,479 (13,579,600) 18,358,858 (852,122) 66,733 6,890,348

---------- ------------------ ----------- ------------ --------------------- -------------

Loss for the period - (933,363) - - - (933,363)

Other comprehensive

income - - - (143,003) - (143,003)

Share warrants

expired - 8,554 (8,554) -

Issue of Share

Capital 181,818 - 273,182 - - 455,000

---------- ------------------ ----------- ------------ --------------------- -------------

Balance at 31

December 2022 3,078,297 (14,504,409) 18,632,040 (995,125) 58,179 6,268,982

---------- ------------------ ----------- ------------ --------------------- -------------

Loss for the period - (613,773) - - - (613,773)

Other comprehensive

income - - - (331,076) - (331,076)

Share warrants

granted - (9,717) 9,717 -

Issue of Share

Capital 617,118 - 175,882 - - 793,000

---------- ------------------ ----------- ------------ --------------------- -------------

Balance at 30 June

2023 3,695,415 (15,127,899) 18,807,922 (1,326,201) 67,896 6,117,133

---------- ------------------ ----------- ------------ --------------------- -------------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 30 JUNE 2023

(Unaudited) (Unaudited) (Audited)

6 Months 6 Months to Year ended

to

30 June 2023 30 June 2022 31 Dec 2022

GBP GBP GBP

Cash flows from operating activities

CF note

Cash used in operations 1 (388,338) (458,199) (707,714)

Net cash used in operating

activities (388,338) (458,199) (707,714)

------------- ------------- ------------

Cash flows from investing activities

Purchase of intangible fixed

assets (39,199) (262,283) (378,963)

Purchase of investments in

associates - (120,284) (668,782)

Issue of loans (193,747) (20,683) (184,929)

Interest received 7,424 243 14,592

Net cash used in investing

activities (225,522) (403,007) (1,218,082)

------------- ------------- ------------

Cash flows from financing activities

Proceeds of share issue 793,000 752,000 1,207,000

Net cash from financing activities 793,000 752,000 1,207,000

------------- ------------- ------------

Increase / (decrease) in cash

and cash equivalents 179,140 (109,206) (718,796)

------------- ------------- ------------

Cash and cash equivalents at CF note

beginning of period 2 150,905 872,000 872,000

Effect of exchange rate changes (3,099) (494) (2,299)

Cash and cash equivalents at CF note

end of period 2 326,946 762,300 150,905

------------- ------------- ------------

NOTES TO THE CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 30 JUNE 2022

1. RECONCILIATION OF LOSS BEFORE TAX TO CASH USED IN

OPERATIONS

(Unaudited) (Unaudited) (Audited)

6 Months to 6 Months Year ended

to

30 June 2023 30 June 31 Dec 2022

2022

GBP GBP GBP

Loss before tax (613,773) (356,295) (1,289,658)

Depreciation 103 103 205

Impairment loss on intangible assets 17,224 - 579,728

Impairment loss on loans to associates 145,230 - 25,785

Loss/(Gain) on foreign exchange movement 41,782 (55,575) 10,300

Finance income (7,424) (243) (14,592)

Share of loss from associate undertaking 1,444 - -

Gain on disposal of subsidiary undertaking - - (6,762)

(415,414) (412,010) (694,994)

Increase in trade and other receivables (18,340) (23,422) (38,025)

Increase / (decrease) in trade and

other payables 45,416 (22,767) 25,305

Cash used in operations (388,338) (458,199) (707,714)

------------- ----------- ------------

2. CASH AND CASH EQUIVALENTS

The amounts disclosed on the cash flow statement in respect of

cash and cash equivalents are in respect of the statement of

financial position amounts:

(Unaudited) (Unaudited) (Audited)

6 Months 6 Months Year ended

to to

30 June 30 June 31 Dec 2022

2023 2022

GBP GBP GBP

Cash and cash equivalents 326,946 762,300 150,905

NOTES TO THE FINANCIAL STATEMENTS - UNAUDITED RESULTS

FOR THE SIX MONTHS ENDED 30 JUNE 2023

1. Basis of preparation

These interim financial statements for the six-month period

ended 30 June 2023 have been prepared using the historical cost

convention, on a going concern basis and in accordance with

applicable UK adopted International Financial Reporting Standards

and IFRIC interpretations and with those parts of the Companies Act

2006 applicable to reporting groups under IFRS. They have also been

prepared on a basis consistent with the accounting policies

expected to be applied for the year ending 31 December 2023, and

which are also consistent with the accounting policies applied for

the year ended 31 December 2022 except for the adoption of any new

standards and interpretations.

These interim results for the six months ended 30 June 2023 are

unaudited and do not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006. The financial statements for

the year ended 31 December 2022 have been delivered to the

Registrar of Companies and filed at Companies House and the

auditors' report on those financial statements was unqualified but

contained an emphasis of matter in respect of a material

uncertainty relating to going concern. The auditors' report did not

contain a statement made under Section 498(2) or Section 498(3) of

the Companies Act 2006.

2. Loss per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares of 3,311,808,627 (30 June 2022:

2,795,197,507 and 31 December 2022: 2,902,488,933) outstanding

during the period. There is no difference between the basic and

diluted loss per share.

3. Called up share capital

(Unaudited) (Unaudited) (Audited)

6 Months to 6 Months to Year ended

30 June 2023 30 June 2022 31 Dec 2022

Allotted, called up

and fully paid

Ordinary shares of 0.1p

each 3,735,415,387 2,896,479,558 3,078,297,740

The number of shares in issue was as follows:

Number of shares

Balance at 31 December 2021 2,650,325,712

Issued during the period 246,153,846

-----------------

Balance at 30 June 2022 2,896,479,558

Issued during the period 181,818,182

-----------------

Balance at 31 December 2022 3,078,297,740

Issued during the period 657,117,647

-----------------

Balance at 30 June 2023 3,735,415,387

-----------------

For further information please contact:

Oracle Power PLC +44 (0) 203 580

Naheed Memon 4314

Strand Hanson Limited (Nominated Adviser

and Joint Broker) +44 (0) 20 7409

Rory Murphy, Matthew Chandler, Rob Patrick 3494

Global Investment Strategy UK Limited

(Joint Broker) +44 (0) 20 7048

Samantha Esqulant 9432

St Brides Partners Limited (Financial

PR) +44 (0) 20 7236

Susie Geliher, Isabel de Salis 1177

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFVLAVISFIV

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

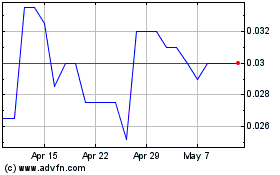

Oracle Power (LSE:ORCP)

Historical Stock Chart

From Apr 2024 to May 2024

Oracle Power (LSE:ORCP)

Historical Stock Chart

From May 2023 to May 2024