TIDMRECI TIDMTTM TIDMTTM

RNS Number : 5983B

Real Estate Credit Investments Ltd

21 September 2018

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, TO ANY "US PERSONS" (WITHIN THE

MEANING GIVEN TO IT IN REGULATION S UNDER THE US SECURITIES ACT OF

1933, AS AMED) OR INTO THE UNITED STATES, AUSTRALIA, CANADA, SOUTH

AFRICA OR JAPAN, OR ANY OTHER JURISDICTION, OR TO ANY PERSON, WHERE

DOING SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

21 September 2018

Real Estate Credit Investments Limited

Close of Issue of New Ordinary Shares

Further to the announcement by the Company on 20 September 2018,

the Board of Real Estate Credit Investments Limited ("RECI" or

"Company") is pleased to announce that the Company has raised gross

proceeds of GBP23.2 million through the issue of the maximum

available 13,938,298 new ordinary shares ("New Ordinary Shares") at

167 pence per New Ordinary Share (the "Issue"). The Issue was

oversubscribed, having received strong support from new and

existing investors.

The net proceeds of the Issue are intended primarily to be

invested in debt secured by commercial or residential properties in

the United Kingdom and Western Europe, which might take the form

of: (i) secured senior real estate loans; and (ii) securitised

tranches of secured real estate related debt securities such as

commercial mortgage-backed securities.

Liberum Capital Limited ("Liberum") was appointed as sole

bookrunner in relation to the Issue.

Following the success of the Issue, it is the Company's

intention to proceed to launch a new Placing Programme, in order to

take advantage of the continuing opportunities available to RECI

within the UK and Western European real estate markets

(particularly those in France and Germany).

All New Ordinary Shares issued under the Issue will, when issued

and fully paid, confer the right to receive all dividends or other

distributions made, paid or declared, if any, by reference to a

record date after the date of their issue.

Applications will be made to the UK Listing Authority and to the

London Stock Exchange for admission of the New Ordinary Shares to

be issued pursuant to the Issue to the premium segment of the UK

Listing Authority's Official List and to trading on the Premium

Segment of the London Stock Exchange's Main Market ("Admission").

Admission of the New Ordinary Shares is expected to occur at 8.00am

on 26 September 2018.

On Admission, the Company will have 153,321,282 Ordinary Shares

in issue (with no shares held in treasury). Each Ordinary Share

carries the right to one vote and, therefore, the total number of

voting rights in the Company will be 153,321,282 on Admission. This

figure may be used by Shareholders and other investors as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Bob Cowdell, Chairman of RECI, commented:

"The Board is grateful for the investor support of the

oversubscribed Issue, which has exhausted the Company's recently

renewed authority to issue new ordinary shares. Accordingly, we

believe that a new Placing Programme will provide the opportunity

for our shareholders and new investors to participate in the

Company's continuing growth and enable RECI to participate in the

attractive pipeline of opportunities identified by our Investment

Manager."

This announcement has been prepared by, and is the sole

responsibility of, Real Estate Credit Investments Limited. This

announcement has been released by Lisa Garnham of State Street

(Guernsey) Limited, Secretary of the Company.

Cheyne Capital Management (UK) LLP +44 (0)20 7968 7482

Investor Relations

Nicole Von Westenholz

Liberum Capital Limited (Sole Bookrunner) +44 (0)20 3100 2222

Shane Le Prevost

Richard Crawley

Richard Bootle

Laura Hamilton

Enquiries

Important notice

Terms not defined in this announcement shall have the meaning

given to them in the announcement of the Company published in

relation to the opening of the Issue dated 20 September 2018.

Neither this announcement nor any part of it shall form the

basis of or be relied on in connection with or act as an inducement

to enter into any contact or commitment whatsoever.

This announcement is only addressed to or directed at persons in

the United Kingdom who: (i) have professional experience in matters

relating to investments and fall within the definition of

"investment professionals" in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

"Order"); or (ii) high net worth companies, unincorporated

associations and partnerships and trustees of high value trusts as

described in Article 49(2) of the Order; or (iii) are other persons

to whom it may otherwise lawfully be communicated (all such persons

referred to in (i), (ii) and (iii) together being "Relevant

Persons"). Any investment or investment activity to which this

announcement relates is available only to and will only be engaged

in with the persons referred to in (i), (ii) and (iii).

Neither this announcement nor any part or copy of it may be

taken or transmitted into the United States, Australia, Canada,

South Africa or Japan, or distributed, in whole or in part,

directly or indirectly, to any US Persons or in or into the United

States, Australia, Canada, South Africa, Japan or any other

jurisdiction where, or to any other person to whom, to do so would

constitute a violation of applicable law. Any failure to comply

with this restriction may constitute a violation of applicable law.

This announcement does not constitute or form a part of any offer

to sell or issue, or a solicitation of any offer to purchase or

otherwise acquire, securities by any US Persons or in the United

States or in any other jurisdiction. Persons into whose possession

this announcement comes should observe all relevant

restrictions.

The Company has not been and will not be registered under the US

Investment Company Act and as such investors are not and will not

be entitled to the benefits of the US Investment Company Act. The

Ordinary Shares have not been and will not be registered under the

US Securities Act or with any securities regulatory authority of

any state or other jurisdiction of the United States, and may not

be offered, sold, resold, pledged, taken up, exercised, renounced,

delivered, distributed or transferred, directly or indirectly, into

or within the United States or to, or for the account or benefit

of, US Persons, except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the US

Securities Act and in compliance with any applicable securities

laws of any state or other jurisdiction of the United States and in

a manner which would not result in the Company being required to

register as an "investment company" under the US Investment Company

Act. In connection with the Placing Programme, subject to certain

exceptions, offers and sales of Ordinary Shares will be made only

outside the United States in "offshore transactions" to non-US

Persons pursuant to Regulation S under the US Securities Act. There

has been and will be no public offering of the Ordinary Shares in

the United States.

Neither the US Securities and Exchange Commission, nor any

securities regulatory authority of any state or other jurisdiction

of the United States, has approved or disapproved of the securities

of the Company or passed upon or endorsed the merits of any

offering of such securities.

Prospective investors should take note that any securities may

not be acquired by (i) investors using assets of (A) an "employee

benefit plan" as defined in Section 3(3) of US Employee Retirement

Income Security Act of 1974, as amended ("ERISA") that is subject

to Title I of ERISA; (B) a "plan" as defined in Section 4975 of the

US Tax Code, including an individual retirement account or other

arrangement that is subject to Section 4975 of the US Tax Code; or

(C) an entity which is deemed to hold the assets of any of the

foregoing types of plans, accounts or arrangements that is subject

to Title I of ERISA or Section 4975 of the US Tax Code or (ii) a

governmental, church, non-US or other employee benefit plan that is

subject to any federal, state, local or non-US law that is

substantially similar to the provisions of Title I of ERISA or

Section 4975 of the US Tax Code.

Liberum is authorised and regulated in the United Kingdom by the

Financial Conduct Authority. Liberum is acting for the Company and

no one else in connection with the Placing Programme and will not

be responsible to anyone other than the Company for providing the

protections afforded to clients of Liberum or for affording advice

in relation to any transaction or arrangement referred to in this

announcement. This announcement does not constitute any form of

financial opinion or recommendation on the part of Liberum or any

of its affiliates and is not intended to be an offer, or the

solicitation of any offer, to buy or sell any securities.

Forward-looking statements

This announcement may contain forward-looking statements

regarding the financial condition, results of operations, cash

flows, dividends, financing plans, business strategies, operating

efficiencies, budgets, capital and other expenditures, competitive

positions, growth opportunities, plans and objectives of management

and other matters relating to the Company. Statements in this

announcement that are not statements of historical facts are hereby

identified as forward-looking statements. In some instances,

forward-looking statements can be identified by the use of forward-

looking terminology, including terms such as "projects",

"forecasts", "anticipates", "expects", "believes", "intends",

"may", "will" or "should" or, in each case, their negative or other

variations or comparable terminology.

By their nature, forward-looking statements involve risk and

uncertainty as they relate to future events and circumstances.

Forward-looking statements are not guarantees of future

performance, and the actual results, performance or achievements of

the Company, and development of the markets and the industries in

which it operates or is likely to operate, may differ materially

from those-described in, or suggested by, any forward-looking

statements contained in this announcement. In addition, even if

actual results, performance, achievements or developments are

consistent with any forward-looking statements contained in this

announcement in a given period, those results, performance,

achievements or developments may not be indicative of results,

performance, achievements or developments in subsequent periods. A

number of factors could cause results, performance, achievements

and developments to differ materially from those expressed or

implied by any forward- looking statements including, without

limitation, general economic and business conditions, industry

trends, competition, changes in regulation and currency

fluctuations.

Any forward-looking statements in this announcement reflect the

Company's current view with respect to future events, speak only as

of their date and are subject to change without notice. Save as

required by applicable law or regulation, the Company and the other

parties named in this announcement expressly disclaim any

obligation or undertaking to update, review or revise any

forward-looking statement contained in this announcement whether as

a result of new information, future developments or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEPGUUGBUPRGCG

(END) Dow Jones Newswires

September 21, 2018 10:13 ET (14:13 GMT)

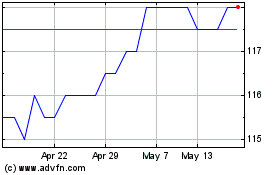

Real Estate Credit Inves... (LSE:RECI)

Historical Stock Chart

From Mar 2024 to May 2024

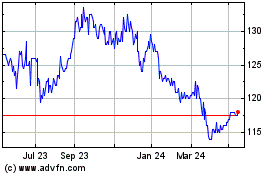

Real Estate Credit Inves... (LSE:RECI)

Historical Stock Chart

From May 2023 to May 2024