Randall & Quilter Inv Hldgs Ltd R&Q completes Loss Portfolio Transfer (3571I)

19 June 2017 - 4:00PM

UK Regulatory

TIDMRQIH

RNS Number : 3571I

Randall & Quilter Inv Hldgs Ltd

19 June 2017

Randall & Quilter Investment Holdings Ltd.

R&Q completes Loss Portfolio Transfer with Fortune 500

Insurance Group

19 June 2017

Randall & Quilter Investment Holdings Ltd. ("R&Q") is

pleased to announce it has written a Loss Portfolio Transfer

reinsurance contract to assume a Bonds portfolio issued by a

Fortune 500 Insurance Group. The estimated undiscounted liabilities

assumed are c. $46.5m. R&Q worked in conjunction with Guy

Carpenter to successfully complete this transaction.

Ken Randall, Chairman and Chief Executive Officer of R&Q,

commented:

"We are delighted to complete this LPT of surety business, a

special focus of Accredited Surety & Casualty, our A- rated US

admitted carrier. This transaction demonstrates our ongoing

commitment to expand our legacy liability solutions to

counterparties within the North American market."

Ends

Enquiries to:

Randall & Quilter Investment www.rqih.com

Holdings Ltd.

Tom Booth Tel: +1 441 247

8330

Numis Securities Limited

Stuart Skinner (Nominated Tel: 020 7260

Adviser) 1000

Charles Farquhar (Broker) Tel: 020 7260

1000

Shore Capital Stockbrokers Limited

Dru Danford / Stephane Auton Tel: 020 7408

4090

FTI Consulting

Edward Berry/Tom Blackwell Tel: 020 3727

1046

Notes to Editors:

About R&Q

Randall & Quilter pursues a buy and build strategy and has

created a comprehensive range of investment activities and services

in the global non-life insurance market.

R&Q is focused on the following three areas:

-- Insurance Investments

-- Insurance Services

-- Underwriting Management

The Group:

-- provides a range of services to both the live and legacy

(re)insurance markets to support growing businesses and address

complex and challenging run-off issues;

-- employs over 400 insurance professionals based in the UK, US,

Bermuda, and Europe with wide service capability in both the 'live'

and 'run-off' markets;

-- owns and manages a portfolio of insurance companies, both

active and in run-off, in the UK, US and Europe with net assets of

GBP161m as at 31 December 2016;

-- owns an admitted P&C Insurer, A- rated by AM Best, with

licenses throughout the US; owns a Bermuda Class 3A insurance

company;

-- launched Syndicate 1991, which commenced underwriting from

January 1, 2013 and has an agreed capacity of GBP127m for 2017,

manages one RITC ('run-off') syndicate, 3330, and owns and operates

an MGA platform;

-- acquires and manages a portfolio of insurance receivables,

with a carrying cost of GBP5.6m as at 31 December 2016

The Group was founded by Ken Randall and Alan Quilter in

1991.

Legal Entity Identifier (LEI): 2138006K1U38QCGLFC94

Website: www.rqih.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCZMGMVZVDGNZM

(END) Dow Jones Newswires

June 19, 2017 02:00 ET (06:00 GMT)

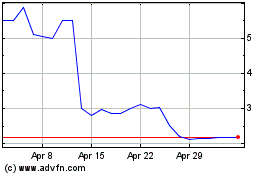

R&q Insurance (LSE:RQIH)

Historical Stock Chart

From Apr 2024 to May 2024

R&q Insurance (LSE:RQIH)

Historical Stock Chart

From May 2023 to May 2024