TIDMRQIH

RNS Number : 1890Y

R&Q Insurance Holdings Ltd

05 September 2022

R&Q Insurance Holdings Ltd

Results for the half year ended 30 June 2022

Strong progress against strategic objectives demonstrated by

112% growth in recurring Fee Income to a record $53.1 million

5 September 2022

R&Q Insurance Holdings Ltd (AIM: RQIH) ('R&Q' or the

'Group'), the leading non-life global specialty insurance company

focusing on the Program Management and Legacy Insurance businesses,

today announces its results for the half year ended 30 June

2022.

Strategic and Governance Update

-- Raised $130 million via a placing, including a $34 million

Firm Issuance in June followed by a Conditional Issuance and Open

Offer for the remaining $96 million in July (the 'Fundraise'),

demonstrating strong shareholder support for our strategy

-- Significant progress made in executing against all 5 pillars

of our 5-year strategy to become a recurring fee-based,

capital-lighter business with increased returns on equity and

growing shareholder dividends

-- Appointment of Robert Legget as the Senior Independent

Director on 26 August as part of our ongoing plans to enhance our

Board composition. The Board plans to introduce an Independent

Non-Executive Chair as soon as possible with the appointment of

further Independent Non-Executive Directors in due course

H1 2022 Financial Highlights

Program Management

-- Gross Written Premium of $807.3 million (H1 2021: $444.8 million, an 82% increase)

-- Fee Income (incl. Tradesman stake) of $44.3 million (H1 2021:

$25.1 million, a 76% increase); Fee Income (excl. Tradesman stake)

increased 105%

-- Pre-Tax Operating Profit of $23.3 million (H1 2021: $9.9 million, a 136% increase)

-- Pre-Tax Operating Profit Margin of 54.0% (H1 2021: 39.9%, a 14.1 percentage point increase)

Legacy Insurance

-- Completed two transactions with Gross Reserves Acquired of

$5.3 million (transactions are seasonally active in Q4)

-- Reserves Under Management of $386.6 million

-- Fee Income of $8.8 million

-- Pre-Tax Operating Loss of $26.7 million as the business

transitions to an annual recurring, fee-based revenue model

Group

-- Total Fee Income of $53.1 million (H1 2021: $25.1 million, a 112% increase)

-- Pre-Tax Operating Loss of $24.3 million; results impacted by

Legacy Insurance revenue model transition

-- An interim dividend for H1 2022 will not be declared;

dividend strategy is to pay out 25 -- 50% of Pre-Tax Operating

Profit

-- Unrealised net investment losses of $88 million; unrealised

investment gains/losses always excluded from Pre-Tax Operating

Profit as they are non-economic and unlikely to be realised due to

the high credit quality fixed income portfolio and the Group's

asset-liability management strategy

Operational Highlights

-- Continued focus on cost control with Fixed Operating Expenses

increasing only 3% year-over-year at constant foreign exchange

rates and down 3% when accounting for foreign exchange

movements

-- Operational improvement programme underway with c. $10

million of the total $20 -- 25 million investment deployed since

2021, with the remainder to be incurred in H2 2022 and 2023

-- This investment in automation and technology processes is

expected to generate approximately $10 million of recurring annual

cost efficiencies by 2024

Outlook

-- Program Management expected to achieve $1.75 billion of Gross Written Premium in 2022

o Five programs launched post 30 June 2022 expected to generate

c. $250 million of annualised Gross Written Premium

o Further pipeline of 13 programs in advanced due diligence

totalling an additional c. $225 million of expected annualised

Gross Written Premium

o Fee Income equal to c. 5% of ceded Gross Written Premium

-- Legacy Insurance transaction execution continues to have heavy weighting towards Q4

o Strong pipeline of over $1 billion in gross reserves

o Over $1 billion of capacity in Gibson Re

o Fee Income equal to 4.25% of Reserves Under Management

-- R&Q reiterates guidance of achieving in excess of $90

million Pre-Tax Operating Profit in 2024

Summary Financial Performance (see Notes for definitions)

($m, except where noted) H1 2022 H1 2021 % Change

Program Management

Gross Written Premium 807.3 444.8 82%

Fee Income (1) 44.3 25.1 76%

Pre-Tax Operating Profit 23.3 9.9 136%

Pre-Tax Operating Profit Margin 54.0% 39.9% 14.1 pp

Legacy Insurance

Gross Reserves Acquired (2) 5.3 112.5 (95%)

Reserves Under Management 386.6 0.0 N/A

Fee Income 8.8 0.0 N/A

Pre-Tax Operating (Loss) (26.7) (14.8) 80%

Corporate / Other

Net Unallocated Expenses (6.7) (6.8) (1%)

Interest Expense (14.2) (11.8) 20%

Group

Fee Income 53.1 25.1 112%

Pre-Tax Operating (Loss) (24.3) (23.5) 3%

IFRS (Loss) After Tax (122.4) (36.8) 233%

Operating (Loss) Earnings per

Share (3) (8.5)c (8.5)c 0%

Dividend Per Share -- 2.0p N/A

(1) Includes minority stake in Tradesman Program Managers

(2) Gross of cessions to Gibson Re

(3) On a fully diluted basis

William Spiegel, Executive Chairman of R&Q, commented:

"I am pleased to report another six months of progress against

our 5-year strategy. These results showcase excellent underlying

momentum in executing our 5-pillar strategy as we continue our

transformation into a fee-based, capital-lighter business. This

transformation is evidenced by the significant growth in recurring

Fee Income, which has more than doubled from last year and now

represents over 60% of our Gross Operating Income, a proxy for

revenue. We also re-iterate our confidence in achieving in excess

of $90 million of Pre-Tax Operating Profit in 2024. As a result of

our strategy, R&Q will deliver more predictable earnings, with

increased returns on equity and growing sustainable shareholder

dividends over time.

Program Management continues to grow strongly with Gross Written

Premium up 82%, and a Pre-tax Operating Profit of $23.3 million. We

are now seeing the benefits of increasing scale, as demonstrated by

a margin of 54.0% (H1 2021: 39.9%), with our operating leverage

expected to drive this higher to c. 70% at scale. The pipeline in

Program Management also remains robust, with the business on track

to deliver its targeted $1.75 billion in Gross Written Premium for

FY 2022. In addition, we continue to explore minority stakes in

Managing General Agents where we provide Program Management

services, and have executed on our second investment after the

period close.

It is exciting to see Legacy Insurance generating recurring fees

for the first time under its new reinsurance relationship with

Gibson Re. In H1 2021, Fee Income of nearly $9 million based on

Reserves Under Management of $387 million as of 30 June 2022. As we

have previously outlined, this model will enable Legacy Insurance

to significantly increase its return on equity while materially

reducing earnings volatility and capital requirements. While it

will take time for the new structure to mature and scale, and our

operating performance reflects its transition, we remain on track

with our objectives and have a strong pipeline of deal activity in

place as we head into Q4 - historically the most active period for

legacy transactions.

The outlook for both Program Management and Legacy Insurance

remains highly favourable, with both well insulated against many of

the broader macroeconomic challenges impacting the wider insurance

industry such as rising interest rates, increasing inflation,

hardening (re)insurance pricing and the Ukraine/Russia conflict. In

addition, our recent Fundraise has further strengthened our capital

position, enhanced parent liquidity, and decreased financial

leverage, putting us on a strong financial footing to execute on

our business objectives. Our investment portfolio is well

positioned and comprises high-quality fixed income securities with

a duration that is shorter than our stable, casualty-oriented

liabilities. A rising rate environment is unlikely to require us to

realise any mark-to-market unrealised losses on our portfolio but

rather creates attractive reinvestment opportunities at

significantly higher yields.

In addition to the positive progress we are seeing in our two

businesses, we are also underway with implementing extensive

improvements in how we operate as a Group, aimed at making us more

efficient and technology-enabled, while enhancing our governance,

culture and risk management. As part of this effort, we are

investing a total of $20 -- 25 million, with c. $10 million already

incurred to date, in process automation and technology. We expect

this programme to generate c. $10 million of annual efficiencies by

2024, implying a payback on the upfront investment in approximately

three years.

It would be remiss if I did not comment on the requisition

notice from a minority shareholder and the proposed resolutions to

bring back the former executive chairman. While our sentiments on

this situation are documented in the Circular distributed on 24

August 2022, I wanted to personally thank the Board, our employees

and the shareholders who have provided support to both me and the

strategy that we have laid out and been executing on. Despite this

and a number of other exceptional corporate events in 2022 that

have caused some short-term and unexpected disruption to the

business, our focus for the remainder of the year and beyond is

firmly on the continued delivery of our plan.

In conclusion, the first half of the year has firmly

demonstrated our ability to deliver on our 5-year, 5-pillar

strategy of implementing a capital-lighter business model

underpinned by recurring Fee Income. We know there is more work to

do, but I am encouraged by how much we have already accomplished

and the pace at which we are evolving into a less balance sheet

intensive business with more predictable earnings. This is only

made possible because of our talented and committed employees, and

I would like to thank them for their ongoing efforts in helping us

to achieve our goals."

Investor presentation

Our shareholders presentation and accompanying video is

available on our website at:

http://www.rqih.com/investors/shareholder-information/investor-presentations

Enquiries to:

R&Q Insurance Holdings Ltd. Tel: 020 7780 5850

William Spiegel

Alan Quilter

Tom Solomon

Fenchurch Advisory Partners LLP (Financial Adviser)

Tel: 020 7382 2222

Kunal Gandhi

Brendan Perkins

Richard Locke

Tihomir Kerkenezov

Numis Securities Limited (Nominated Advisor & Joint

Broker) Tel: 020 7260 1000

Giles Rolls

Charles Farquhar

Barclays Bank PLC (Joint Broker) Tel: 020 7632 2322

Andrew Tusa

Anusuya Nayar Gupta

FTI Consulting Tel: 020 3727 1051

Tom Blackwell

Notes to financials

Pre-Tax Operating Profit is a measure of how the Group's core

businesses performed adjusted for Unearned Program Fee Income,

intangibles created in Legacy Insurance acquisitions, net realised

and unrealised investment gains on fixed income assets, exceptional

foreign exchange net gains upon consolidation and non-core,

non-recurring costs.

Operating EPS represents Pre-Tax Operating Profit adjusted for

the marginal tax rate, divided by the average number of diluted

shares outstanding in the period.

Tangible Net Asset Value represents Net Asset Value adjusted for

Unearned Program Fee Income, intangibles created in Legacy

Insurance acquisitions, net unrealised investment gains on fixed

income assets and foreign currency translation reserves.

Gross Operating Income represents Pre-Tax Operating Profit

before Fixed Operating Expenses and Interest Expense.

Fee Income represents Program Fee Income, Fee Income on Reserves

Under Management and our share of earnings from minority stakes in

MGAs.

Program Fee Income represents the full fee income from insurance

policies already bound including Unearned Program Fee Income,

regardless of the length of the underlying policy period. We

believe Program Fee Income is a more appropriate measure of the

revenue of the business during periods of high growth, due to a

larger than normal gap between written and earned premium.

Unearned Program Fee Income represents the portion of Program

Fee Income that has not yet been earned on an IFRS basis.

Underwriting Income represents net premium earned less net

claims costs, acquisition expenses, claims management costs and

premium taxes / levies.

Investment Income represents income on the investment portfolio

excluding net realised and unrealised investment gains on fixed

income assets.

Fixed Operating Expenses include employment, legal,

accommodation, information technology, Lloyd's syndicate, and other

fixed expenses of ongoing operations, excluding non-core and

exceptional items.

Pre-Tax Operating Profit Margin is our profit margin on Gross

Operating Income.

Gross Reserves Acquired represent Legacy Insurance reserves

acquired gross of reinsurance to Gibson Re.

Reserves Under Management represent reserves ceded to Gibson Re

for which R&Q earns an annual recurring fee of 4.25%.

Chief Financial Officer Review

We are pleased to report our financial results for the half year

ended 30 June 2022.

Group

Our Key Performance Indicators (KPIs) transparently measure the

underlying economics of the business and adjust IFRS results to

include fully written Program Fee Income and exclude non-cash

intangibles created from acquisitions in Legacy Insurance, net

realised and unrealised investment gains or losses on fixed income

investments, foreign currency translation reserves, non-core

expenses and exceptional items. This provides management and

shareholders with a clearer view of the trends in underlying

performance of the business.

Our results for the period reflect the transformation of Legacy

Insurance into an annual recurring fee-based business and hence are

not comparable to the prior year period where we earned upfront,

Day-One accounting gains. We expect the benefits of this

transformation to be reflected in the financial results as we

continue to deploy the capital of Gibson Re to reinsure 80% of

future transactions, and Legacy Insurance generates an appropriate

amount of Fee Income to absorb its Fixed Operating Expenses. As a

result, our Pre-Tax Operating Loss was $24.3 million during the

current period. Tangible Net Asset Value was $368.4 million, a 2%

increase compared to year-end 2021, primarily as a result of our

Firm Issuance of $34 million in June 2022 (the remaining Fundraise

of $96 million closed in July 2022).

One of our primary objectives is to grow Fee Income. Our Fee

Income was $53.1 million, a 112% increase compared to H1 2021, and

when annualised, was $106.2 million, and would represent a

compounded annual growth rate of 102% over 3 years. Fee Income

represented 61% of Gross Operating Income over the trailing twelve

months, an increase of 49 percentage points compared to the

business mix in 2019.

We continue to be very focused on cost control, with Group Fixed

Operating Expenses increasing by only 3% at constant foreign

exchange rates and decreasing by 3% when accounting for foreign

exchange movements during the period. We have incurred

approximately $10 million out of our total $20 -- 25 million budget

for the automation programme. This investment is expected to

deliver approximately $10 million of annual cost efficiencies by

2024 from process automation and technology upgrades that will

create scalability and operating leverage.

Our IFRS Loss After Tax was $122.4 million during H1 2022

primarily due to $88 million of unrealised net investment losses,

which we do not expect will be realised due to the high credit

quality, short duration of our investment portfolio.

Program Management

Our Program Management business continued to grow rapidly in H1

2022. We had 75 active programs, an increase of 15 programs

compared to 30 June 2021, and Gross Written Premium was $807.3

million, an 82% increase compared to H1 2021. Our Pre-Tax Operating

Profit was $23.3 million, a 136% increase compared to H1 2021.

These results are demonstrating the benefits of scale as we earned

a 54.0% profit margin, an increase of 14.1 percentage points

compared to H1 2021.

The primary driver of Pre-Tax Operating Profit is our Fee

Income, which represents Program Fee Income from written premium

ceded to reinsurers and our 40% minority stake in Tradesman Program

Managers. Fee Income was $44.3 million, a 76% increase compared to

H1 2021, which included $5.2 million from our minority stake in

Tradesman Program Managers. Excluding our stake in Tradesman, Fee

Income increased 105% compared to H1 2021. Underwriting Income

represents our c. 7% retention of Program Management insurance

risk. Our Underwriting Loss was $2.1 million, primarily due to

adverse development in UK motor and the higher cost of reinsurance

purchased to minimise earnings volatility. While our UK motor

exposure is very modest across our diversified book of business,

rate increases are coming through the underlying programs, which

should mitigate Underwriting Losses in the future. Our Investment

Income was $1.0 million, a 19% increase compared to H1 2021

primarily driven by underlying growth in the business. Finally,

Fixed Operating Expenses increased 34% compared to H1 2021 due to

the expansion of our staff, but grew more slowly than Gross

Operating Income, demonstrating the benefits of scale and operating

leverage.

Legacy Insurance

Our Legacy Insurance business concluded two transactions in the

period with Gross Reserves Acquired of $5.3 million (H1 2021:

$112.5 million). Transactions tend to be seasonally active in the

fourth quarter, with H1 2021 an exception due to the timing of

closing certain deals that had been negotiated at year-end 2020. At

30 June 2022, we had Reserves Under Management, which represent the

reserves ceded to Gibson Re, of $386.6 million compared to none in

the prior period. Our Pre-Tax Operating Loss was $26.7 million due

to the transformation to an annual recurring fee business, which is

expected to become profitable as Gibson Re, which assumes 80% of

legacy transactions in exchange for 4.25% of annual fees on

Reserves Under Management, is fully deployed by 2024.

With the formation of Gibson Re in Q4 2021, the primary driver

of our Pre-Tax Operating Profit is our Fee Income, which was $8.8

million, compared to none in H1 2021. Our Underwriting Income

represents tangible Day-One gains in respect of the risk retained

on transactions originated during the period as well as reserve

movements of risk retained on transactions closed in prior years.

Note that Day-One gains will not be allowed under future accounting

starting in 2023, which will require higher reserves at transaction

close. Our Underwriting Loss was $3.4 million due to a modest

amount of reserve strengthening. Underwriting Income is not

comparable to the prior period due to reinsuring 80% of

transactions to Gibson Re. Our Investment Income was $6.7 million,

a 27% decrease compared to H1 2021 due to mark-to-market unrealised

investment losses on equity and loan funds. Finally, our Fixed

Operating Expenses decreased 12% compared to H1 2021, primarily due

to expense control and foreign exchange movement.

Corporate and other

Our Corporate and Other segment includes unallocated operating

expenses and finance costs. Unallocated net operating expenses were

$6.7 million, relatively flat compared to H1 2021. Interest expense

was $14.2 million, a 20% increase compared to H1 2021 due to a

higher amount of bank debt, which is expected to decrease upon

receipt of the remaining $96 million Fundraise that closed in

July.

Cash and investments

Our Cash and Investments at 30 June 2022 was $1.6 billion. We

produced a book yield, which excludes net realised and unrealised

gains on fixed income investments, of 1.2%, a decrease of 20 bps

compared to H1 2021 due to the impact of mark-to-market losses on

equities and loan funds. Excluding these losses, our book yield was

1.5%.

We maintain a high-quality and conservative, liquid investment

portfolio so that we can produce consistent cash flows to meet our

liability obligations, while also earning a reasonable

risk-adjusted return. 97% of our portfolio was invested in cash,

money market funds, and fixed income investments. Of our fixed

income investments, 98% were rated investment grade. After cash,

which comprised 21% of our portfolio, our largest allocations were

to corporate bonds (39%), government and municipal securities

(20%), asset-backed securities (16%) and equities and funds (3%).

While we continue to extend duration in our portfolio to better

match our expected liability cashflows, our interest rate duration

was 2.5 years at 30 June 2022 (compared to duration on our

liabilities of 6 years) primarily as a result of significant cash

balances at 30 June 2022 and 17% of the portfolio invested in

floating rate securities. With the rise in interest rates, we

expect to redeploy assets at attractive market yields; our

portfolio market yield, excluding cash, is currently 4%.

During H1 2022, financial markets witnessed a significant

increase in interest rates resulting in mark-to-market unrealised

losses on fixed income assets across the wider insurance industry.

Our investment portfolio incurred unrealised net investment losses

on fixed income investments of $88 million, which are included in

our IFRS results, and represent 5.2% of the total portfolio, lower

than that experienced by publicly-traded peers in the insurance

industry. Given these assets are held in high quality, investment

grade securities with a shorter duration than our stable,

casualty-oriented liabilities, we do not expect to realise these

accounting-based losses. While IFRS does not allow for the

discounting of reserves, our group regulatory financials do and

hence the increase in interest rates benefitted our solvency

capital position with the discount rate impact on reserves more

than offsetting the mark to market unrealised losses in our

investment portfolio. Our realised net investment losses were c.

$12 million primarily as a result of the liquidation of securities

in exchange for cash in a Reinsurance-to-Close transaction as

required by Lloyd's. Nonetheless, the increase in interest rates

provides attractive reinvestment opportunities for the Group as our

significant cash position is being reinvested.

Capital and liquidity

Our estimated Group Solvency ratio pro forma for the Conditional

Issuance and Open Offer of $96 million that closed in July was well

above our target level of 150%. Our pro forma adjusted debt to

capital ratio, which provides for partial equity credit on our

subordinated debt, is 33%, slightly above our target of 30%. We

received pre-emptive waivers of certain financial covenants from

our bank lenders, which were contingent on our Fundraise which

completed in July 2022.

Change in accounting policy beginning in 2023

The Group will be voluntarily changing its basis of accounting

from IFRS to the Generally Accepted Accounting Principles in the

United States of America ("US GAAP") and will present its

consolidated financial statements in US GAAP effective 1 January

2023. The reason for this change is due to the meaningful ongoing

costs to conform with IFRS 17, which would place R&Q at a

significant competitive disadvantage in the Legacy Insurance

market, where most of the market participants report under US GAAP.

The data requirements of IFRS 17 for run-off insurance policies and

reinsurance contracts drive implementation costs for both existing

and future transactions that are more than double that required

under US GAAP. While there are differences between IFRS and US

GAAP, the change in accounting framework will not alter the

economic-based KPIs that we use to manage the business.

Condensed Consolidated Income Statement

Six months Six months Year

ended ended ended 31

30 June 30 June December

2022 2021 2021

(unaudited) (unaudited) (audited)

Note $m $m $m

Gross written premium 837.3 527.0 1,539.7

Reinsurers' share of gross

written

premium (764.4) (429.1) (1,463.5)

--------------------- ---------------------- ----------------------------

Net written premium 72.9 97.9 76.2

--------------------- ---------------------- ----------------------------

Change in gross provision for

unearned

premiums (256.0) (131.3) (279.2)

Change in provision for unearned

premiums,

reinsurers' share 222.7 131.0 267.0

--------------------- ---------------------- ----------------------------

Net change in provision for

unearned

premiums (33.3) (0.3) (12.2)

--------------------- ---------------------- ----------------------------

Net earned premium 39.6 97.6 64.0

--------------------- ---------------------- ----------------------------

Earned fee income 32.2 13.9 31.8

Investment income 5 (89.8) 5.4 6.4

Other income 1.2 5.9 6.6

--------------------- ---------------------- ----------------------------

(56.4) 25.2 44.8

Total income 3 (16.8) 122.8 108.8

Gross claims paid (311.3) (228.9) (485.9)

Reinsurers' share of gross

claims

paid 201.8 106.3 154.2

--------------------- ---------------------- ----------------------------

Net claims paid (109.5) (122.6) (331.7)

--------------------- ---------------------- ----------------------------

Movement in gross technical

provisions (123.6) (12.5) (468.6)

Movement in reinsurers' share of

technical

provisions 194.1 40.5 674.4

--------------------- ---------------------- ----------------------------

Net change in provision for

claims 70.5 28.0 205.8

--------------------- ---------------------- ----------------------------

Net insurance claims incurred (39.0) (94.6) (125.9)

--------------------- ---------------------- ----------------------------

Operating expenses (66.7) (81.6) (166.0)

Result of operating

activities

before goodwill on bargain

purchase

and impairment of intangible

assets (122.5) (53.4) (183.1)

Goodwill on bargain purchase 0.2 22.7 49.7

Amortisation and impairment

of

intangible assets (5.1) (6.9) (13.3)

Share of profit of associates 5.2 5.8 11.2

--------------------- ---------------------- ----------------------------

Result of operating

activities (122.2) (31.8) (135.5)

Finance costs (14.5) (13.6) (26.5)

--------------------- ---------------------- ----------------------------

Loss from operations before

income

taxes 3 (136.7) (45.4) (162.0)

Income tax credit 6 14.3 8.6 34.6

--------------------- ---------------------- ----------------------------

Loss for the period (122.4) (36.8) (127.4)

===================== ====================== ============================

Attributable to equity

holders

of the parent:-

Attributable to ordinary

shareholders (122.4) (36.8) (127.4)

Non-controlling interests - - -

--------------------- ---------------------- ----------------------------

(122.4) (36.8) (127.4)

===================== ====================== ============================

Earnings per ordinary share

from

operations: -

Basic 8 (44.3)c (13.7)c (46.9)c

Diluted 8 (44.3)c (13.7)c (46.9)c

===================== ====================== ============================

The accompanying notes form an integral part of these Condensed

Consolidated Financial Statements.

Condensed Consolidated Statement of Comprehensive Income

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

(unaudited) (unaudited) (audited)

$m $m $m

Other comprehensive income: -

Items that will not be reclassified

to profit or loss:

Pension scheme actuarial (losses)/gains (1.0) 0.9 3.1

Deferred tax on pension scheme actuarial

losses/(gains) 0.2 0.3 (0.2)

-------------------- ------------------- ------------------------

(0.8) 1.2 2.9

Items that may be subsequently

reclassified

to profit or loss: -

Exchange (losses)/gains on consolidation (33.8) 2.0 (3.3)

-------------------- ------------------- ------------------------

Other comprehensive income (34.6) 3.2 (0.4)

Loss for the period (122.4) (36.8) (127.4)

Total comprehensive income for

the period (157.0) (33.6) (127.8)

==================== =================== ========================

Attributable to: -

Equity holders of the parent (157.0) (33.6) (127.8)

Non-controlling interests - - -

-------------------- ------------------- ------------------------

Total comprehensive income for

the period (157.0) (33.6) (127.8)

==================== =================== ========================

The accompanying notes form an integral part of these Condensed

Consolidated Financial Statements.

Condensed Consolidated Statement of Changes in Equity for the

six months ended 30 June 2022

Attributable to equity holders

of the Parent

------------------ --------------------

Share Share Foreign Retained Total Non-controlling Total

capital premium currency earnings interests

translation

reserve

$m $m $m $m $m $m $m

At beginning of

period 7.5 288.3 (15.7) 116.4 396.5 - 396.5

Loss for the

year - - - (122.4) (122.4) - (122.4)

Other

comprehensive

income

Exchange losses

on

consolidation - - (33.8) - (33.8) - (33.8)

Pension scheme

actuarial

losses - - - (1.0) (1.0) - (1.0)

Deferred tax on

pension scheme

actuarial

gains - - - 0.2 0.2 - 0.2

------------------ -------------------- ------------------------- -------------------------- --------------------- ------------------------- ---------------------

Total other

comprehensive

income for the

period - - (33.8) (0.8) (34.6) - (34.6)

------------------ -------------------- ------------------------- -------------------------- --------------------- ------------------------- ---------------------

Total

comprehensive

income for the

period - - (33.8) (123.2) (157.0) - (157.0)

Transactions

with

owners

Issue of shares 0.6 34.5 - - 35.1 - 35.1

At end of

period 8.1 322.8 (49.5) (6.8) 274.6 - 274.6

================== ==================== ========================= ========================== ===================== ========================= =====================

Condensed Consolidated Statement of Changes in Equity for the

six months ended 30 June 2021

Attributable to equity holders of the Parent

------------------ ----------------------------

Share Share Convertible Treasury Foreign Retained Total Non-controlling Total

capital premium debt share currency earnings interests

reserve translation

reserve

$m $m $m $m $m $m $m $m $m

At beginning of

period 6.2 200.9 80.0 (0.2) (24.7) 267.5 529.7 (0.5) 529.2

Functional currency

revaluation (0.1) 7.2 7.2 - 12.3 (26.6) - - -

Loss for the period - - - - - (36.8) (36.8) - (36.8)

Other

comprehensive

income

Exchange gains

on consolidation - - - - 2.0 - 2.0 - 2.0

Pension scheme

actuarial losses - - - - - 0.9 0.9 - 0.9

Deferred tax on

pension scheme

actuarial losses - - - - - 0.3 0.3 - 0.3

------------------ -------------------- --------------------------- ------------------------- ------------------------- ------------------------- -------------------- ------------------------- --------------------

Total other

comprehensive

income for the

period - - - - 2.0 1.2 3.2 - 3.2

------------------ -------------------- --------------------------- ------------------------- ------------------------- ------------------------- -------------------- ------------------------- --------------------

Total comprehensive

income for the

period - - - - 2.0 (35.6) (33.6) - (33.6)

Transactions with

owners

Share based payments - 0.3 - 0.2 - - 0.5 - 0.5

Conversion of

convertible

debt to ordinary

shares 1.4 85.9 (87.2) - - - 0.1 - 0.1

Dividend - (0.8) - - - - (0.8) - (0.8)

Non-controlling

interest in

subsidiary

disposed - - - - - - - 0.5 0.5

------------------ -------------------- --------------------------- ------------------------- ------------------------- ------------------------- -------------------- ------------------------- --------------------

At end of period 7.5 293.5 - - (10.4) 205.3 495.9 - 495.9

================== ==================== =========================== ========================= ========================= ========================= ==================== ========================= ====================

Condensed Consolidated Statement of Changes in Equity for the

year ended 31 December 2021

Attributable to equity holders of the Parent

------------------ --------------------

Share Share Convertible Treasury Foreign Retained Total Non-controlling Total

capital premium debt share currency earnings interests

reserve translation

reserve

$m $m $m $m $m $m $m $m $m

At beginning of

period 6.2 200.9 80.0 (0.2) (24.7) 267.5 529.7 (0.5) 529.2

Functional

currency

revaluation (0.2) 7.2 7.2 - 12.3 (26.6) (0.1) - (0.1)

Loss for the

period - - - - - (127.4) (127.4) - (127.4)

Other

comprehensive

income

Exchange losses

on consolidation - - - - (3.3) - (3.3) - (3.3)

Pension scheme

actuarial losses - - - - - 3.1 3.1 - 3.1

Deferred tax on

pension scheme

actuarial losses - - - - - (0.2) (0.2) - (0.2)

------------------ -------------------- ------------------------- ------------------------- ------------------------- ------------------------- -------------------- ------------------------- --------------------

Total other

comprehensive

income for the

period - - - - (3.3) 2.9 (0.4) - (0.4)

------------------ -------------------- ------------------------- ------------------------- ------------------------- ------------------------- -------------------- ------------------------- --------------------

Total

comprehensive

income for the

period - - - - (3.3) (124.5) (127.8) - (127.8)

Transactions

with

owners

Share based

payments 0.1 2.6 - 0.2 - - 2.9 - 2.9

Issue of

convertible

debt 1.4 85.9 (87.2) - - - 0.1 - 0.1

Purchase of own - - - - - - - - -

shares

Dividend - (8.3) - - - - (8.3) - (8.3)

Non-controlling

interest in

subsidiary

disposed of - - - - - - - 0.5 0.5

------------------ -------------------- ------------------------- ------------------------- ------------------------- ------------------------- -------------------- ------------------------- --------------------

At end of period 7.5 288.3 - - (15.7) 116.4 396.5 - 396.5

================== ==================== ========================= ========================= ========================= ========================= ==================== ========================= ====================

The accompanying notes form an integral part of these Condensed

Consolidated Financial Statements.

Condensed Consolidated Statement of Financial Position as at 30

June 2022

30 June 30 June 31 December

Note 2022 2021 2021

(unaudited) (unaudited) (audited)

$m $m $m

Assets

Intangible assets 77.9 82.8 86.2

Investments in associates 21.5 47.7 46.2

Property, plant and equipment 2.0 1.8 2.1

Right of use assets 5.0 5.7 6.1

Investment properties 1.7 1.9 1.8

Financial instruments 1,486.1 1,490.6 1,533.1

Reinsurers' share of insurance

liabilities 7 2,387.8 1,376.6 2,105.6

Current tax assets 4.3 - 3.6

Deferred tax assets 32.9 7.9 20.4

Insurance and other receivables 879.7 794.0 1,096.3

Cash and cash equivalents 375.8 224.8 266.3

------------------- -------------------- ----------------------

Total assets 5,274.7 4,033.8 5,167.7

=================== ==================== ======================

Liabilities

Insurance contract provisions 7 3,437.0 2,616.7 3,207.5

Financial liabilities 391.0 372.1 406.5

Deferred tax liabilities 7.5 13.3 9.0

Insurance and other payables 9 1,155.1 523.8 1,140.1

Current tax liabilities 3.5 3.2 2.4

Pension scheme obligations 6.0 8.8 5.7

------------------- -------------------- ----------------------

Total liabilities 5,000.1 3,537.9 4,771.2

------------------- -------------------- ----------------------

Equity

Share capital 11 8.1 7.4 7.5

Share premium 322.8 293.6 288.3

Foreign currency translation reserve (49.5) (10.4) (15.7)

Retained earnings (6.8) 205.3 116.4

------------------- -------------------- ----------------------

Attributable to equity holders

of the parent 274.6 495.9 396.5

Non-controlling interests in - - -

subsidiary

undertakings

------------------- -------------------- ----------------------

Total equity 274.6 495.9 396.5

------------------- -------------------- ----------------------

Total liabilities and equity 5,274.7 4,033.8 5,167.7

=================== ==================== ======================

The Condensed Consolidated Financial Statements were approved by

the Board of Directors on 4 September 2022 and were signed on its

behalf by:

W L Spiegel T S Solomon

The accompanying notes form an integral part of these Condensed

Consolidated Financial Statements.

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2021

Condensed Consolidated Cash Flow Statement 2022 2021

(unaudited) (unaudited) (audited)

$m $m $m

Cash flows from operating activities

Loss for the period (136.7) (36.8) (127.4)

Tax included in consolidated income

statement - (8.6) (34.6)

Finance costs 14.5 13.6 26.5

Depreciation and impairments 1.2 0.3 2.9

Share based payments - 0.5 2.8

Share of profits of associates (5.2) (5.7) (11.2)

Profit on divestment - (2.6) (2.6)

Goodwill on bargain purchase (0.2) (22.7) (49.7)

Amortisation and impairment of intangible

assets 5.1 6.9 13.3

Fair value loss on financial assets 100.0 6.3 17.7

Contributions to pension scheme (0.5) (0.5) (1.1)

Profit on net assets of pension schemes 0.3 - 0.1

Decrease/(increase) in receivables 219.6 (109.0) (409.5)

Decrease in deposits with ceding undertakings 3.4 160.0 158.7

Increase in payables 16.6 98.0 705.7

Decrease in net insurance technical

provisions (37.2) (27.7) (193.5)

------------------- ------------------- --------------------

Net cash from operating activities 180.9 72.0 98.1

------------------- ------------------- --------------------

Cash flows to investing activities

Purchase of property, plant and equipment (0.2) (0.1) (0.7)

Sale of financial assets 134.9 61.2 100.8

Purchase of financial assets (245.5) (340.2) (397.6)

Acquisition of subsidiary undertaking

(offset by cash acquired) 0.6 41.4 46.7

Distributions from associates 29.9 3.3 10.3

Divestment (offset by cash disposed

of) - 3.5 3.5

------------------- ------------------- --------------------

Net cash used in investing activities (80.3) (230.9) (237.0)

------------------- ------------------- --------------------

Net cash from financing activities

Repayment of borrowings (9.7) (27.7) (42.0)

New borrowing arrangements 9.1 58.3 121.7

Dividend - - (8.3)

Interest and other finance costs paid (14.5) (13.6) (26.5)

Cancellation of shares - (0.8) -

Receipts from issue of shares 35.1 - -

Net cash from financing activities 20.0 16.2 44.9

------------------- ------------------- --------------------

Net (decrease)/increase in cash and

cash equivalents 120.6 (142.7) (94.0)

Cash and cash equivalents at beginning

of period 266.3 363.5 363.5

Foreign exchange movement on cash and

cash equivalents (11.1) 4.0 (3.2)

------------------- ------------------- --------------------

Cash and cash equivalents at end of

period 375.8 224.8 266.3

=================== =================== ====================

Share of Syndicates' cash restricted

funds 37.0 57.8 50.7

Other funds 338.8 167.0 215.6

------------------- ------------------- --------------------

Cash and cash equivalents at end of

period 375.8 224.8 266.3

=================== =================== ====================

The accompanying notes form an integral part of these Condensed

Consolidated Financial Statements.

1. Basis of preparation

The Condensed Consolidated Financial Statements have been

prepared using accounting policies consistent with International

Financial Reporting Standards (IFRSs) and in accordance with

International Accounting Standard (IAS) 34 Interim Financial

Reporting.

The Condensed Consolidated Financial Statements for the 2022 and

2021 half years are unaudited but have been subject to review by

the Group's auditors.

2 . Significant accounting policies

The accounting policies adopted in the preparation of the

Condensed Consolidated Financial Statements are consistent with

those followed in the preparation of the Group's Consolidated

Financial Statements for the year ended 31 December 2021. There

have been no amendments to accounting policies or new International

Financial Reporting Standards adopted by the Group.

The Group will be voluntarily changing its basis of accounting

from IFRS to the Generally Accepted Accounting Principles in the

United States of America ("US GAAP") and will present its

consolidated financial statements in US GAAP effective 1 January

2023. The reason for this change is due to the meaningful ongoing

costs to conform with IFRS 17, which would place R&Q at a

significant competitive disadvantage in the Legacy Insurance

market, where most of the market participants report under US GAAP.

The data requirements of IFRS 17 for run-off insurance policies and

reinsurance contracts drive implementation costs for both existing

and future transactions that are more than double that required

under US GAAP.

3 . Segmental information

The Group's segments represent the level at which financial

information is reported to the Board, being the chief operating

decision maker as defined in IFRS 8. The reportable segments have

been identified as follows: -

-- Program Management - delegates underwriting authority to

Managing General Agents (MGAs) to provide program capacity through

its licensed platforms in the US and Europe

-- Legacy Insurance - acquires legacy portfolios and manages the

run-off of claims reserves

-- Corporate/Other - primarily includes the holding company and interest expense on debt

The Group uses alternative performance measures which are

described below.

Segmental results for the six months ended 30 June 2022

Program Legacy Corporate

Note Management Insurance / Other Total

$m $m $m $m

Underwriting

income (i) (2.1) (3.4) - (5.5)

Fee income (ii) 44.3 8.8 - 53.1

Investment

income (iii) 1.0 6.7 - 7.7

----------------------- ----------------------- ----------------------- --------------------

Gross

operating

income (iv) 43.2 12.1 - 55.3

----------------------- ----------------------- ----------------------- --------------------

Fixed

operating

expenses (v) (19.9) (38.8) (6.7) (65.4)

Interest expense - - (14.2) (14.2)

----------------------- ----------------------- ----------------------- --------------------

Pre-tax

operating

profit/(loss) (vi) 23.3 (26.7) (20.9) (24.3)

----------------------- ----------------------- ----------------------- --------------------

Deduction for

unearned

program fee

revenue (vii) (14.9)

Movement on

net

intangibles (viii) (4.9)

Net unrealised

and realised

losses (ix) (100.0)

Non-core and

exceptional

items (x) (13.0)

Foreign

exchange (xi) 20.4

--------------------

Loss before tax (136.7)

====================

Segment assets as at 30

June 2022 1,694.2 3,398.1 182.4 5,274.7

======================= ======================= ======================= ====================

Segment liabilities as

at 30 June 2022 1,618.1 3,102.7 279.3 5,000.1

======================= ======================= ======================= ====================

Segmental results for the six months ended 30 June 2021

Program Legacy Corporate

Note Management Insurance / Other Total

$m $m $m $m

Underwriting

income (i) (1.2) 20.3 - 19.1

Fee income (ii) 25.1 - - 25.1

Investment

income (iii) 0.9 9.2 1.5 11.6

----------------------- ----------------------- ----------------------- -------------------

Gross

operating

income (iv) 24.8 29.5 1.5 55.8

----------------------- ----------------------- ----------------------- -------------------

Fixed

operating

expenses (v) (14.9) (44.3) (8.3) (67.5)

Interest expense - - (11.8) (11.8)

----------------------- ----------------------- ----------------------- -------------------

Pre-tax

operating

profit/(loss) (vi) 9.9 (14.8) (18.6) (23.5)

----------------------- ----------------------- ----------------------- -------------------

Deduction for

unearned

program fee

revenue (vii) (5.5)

Movement on

net

intangibles (viii) (3.3)

Net unrealised

and realised

losses (ix) (6.5)

Non-core and

exceptional

items (x) (6.6)

-------------------

Loss before tax (45.4)

===================

Segment assets as at 30

June 2021 1,170.4 2,683.9 179.5 4,033.8

======================= ======================= ======================= ===================

Segment liabilities as

at 30 June 2021 1,105.0 2,121.9 311.0 3,537.9

======================= ======================= ======================= ===================

Segmental results for the year ended 31 December 2021

Program Legacy Corporate

Note Management Insurance / Other Total

$m $m $m $m

Underwriting

income (i) (1.1) 58.5 - 57.4

Fee income (ii) 56.1 - - 56.1

Investment

income (iii) 2.7 19.3 2.8 24.8

----------------------- ----------------------- ----------------------- --------------------

Gross operating

income (iv) 57.7 77.8 2.8 138.3

----------------------- ----------------------- ----------------------- --------------------

Fixed operating

expenses (v) (37.1) (83.5) (16.0) (136.6)

Interest expense - - (22.7) (22.7)

----------------------- ----------------------- ----------------------- --------------------

Pre-tax

operating

profit/(loss) (vi) 20.6 (5.7) (35.9) (21.0)

----------------------- ----------------------- ----------------------- --------------------

Deduction for

unearned

program fee

revenue (vii) (13.2)

Movement on net

intangibles (viii) 2.3

Net unrealised

and realised

gains/(losses) (ix) (18.4)

Non-core and

exceptional

items (x) (111.7)

--------------------

Loss before tax (162.0)

====================

Segment assets as at 31

December 2021 1,039.6 4,113.3 14.8 5,167.7

======================= ======================= ======================= ====================

Segment liabilities as

at 31 December 2021 864.1 3,292.2 614.9 4,771.2

======================= ======================= ======================= ====================

Notes:

(i) Underwriting income represents Legacy Insurance tangible day

one gains and reserve development / savings, net of claims costs

and brokerage commissions. Underwriting income also includes

Program Management retained earned premiums, net of claims costs,

acquisition costs, claims handling expenses and premium taxes /

levies.

(ii) Fee income comprises program fee income which represents

the fee income from insurance policies already bound (written),

regardless of the amount of premium earned in the financial period,

earnings from minority stakes in MGAs, and legacy insurance fee

income earned on business ceded to Gibson Re.

(iii) Investment income represents income arising on the

investment portfolio excluding net realised and unrealised

investment gains or losses on fixed income assets.

(iv) Gross operating income represents pre-tax operating profit

before fixed operating expenses (v) and interest expense.

(v) Fixed operating expenses include employment, legal,

accommodation, information technology, Lloyd's Syndicate and other

fixed expenses of ongoing operations, excluding non-core and

exceptional items.

(vi) Pre-tax operating profit or loss is a measure of how the

Group's core businesses performed adjusted for unearned program fee

income, intangibles created in Legacy acquisitions, net realised

and unrealised investment gains on fixed income assets and

exceptional exchange net gains upon consolidation and non-core,

non-recurring costs.

(vii) Unearned program fee income represents the portion of

program fee income (ii) which has not yet been earned on an IFRS

basis.

(viii) Movement on net intangibles comprises the aggregate of

intangible assets arising on acquisitions in the period less

amortisation on existing intangible assets charged in the

period.

(ix) Realised and unrealised net gains arise on fixed income

assets, which are primarily driven by interest rate movements.

(x) Non-core and exceptional items comprise the result of

entities which are considered non-core or exceptional P&L

items.

(xi) Foreign exchange represents translation of net liabilities

denominated in non-US$ currency, which in H1 2022 was material due

to the significant strengthening of the US$ (in H1 2021 this was

not material and was included in operating expenses).

Geographical analysis

As at 30 June 2022

UK North America Europe Total

$m $m $m $m

Gross assets 1,501.1 2,740.6 1,367.0 5,608.7

Intercompany eliminations (123.3) (155.5) (55.3) (334.1)

----------------- ----------------- ------------------ -----------------

Segment assets 1,377.8 2,585.1 1,311.7 5,274.6

================= ================= ================== =================

Gross liabilities 1,387.5 2,704.7 1,242.0 5,334.2

Intercompany eliminations (231.1) (67.8) (35.2) (334.1)

----------------- ----------------- ------------------ -----------------

Segment liabilities 1,156.4 2,636.9 1,206.8 5,000.1

================= ================= ================== =================

External revenue for the

six months ended 30 June

2022 (21.4) (36.3) 40.9 (16.8)

================= ================= ================== =================

Revenue from external customers represents the Group's total

consolidated income, after elimination of internal revenue.

As at 30 June 2021

UK North America Europe Total

$m $m $m $m

Gross assets 1,319.5 1,893.1 1,179.7 4,392.3

Intercompany eliminations (195.0) (98.7) (64.8) (358.5)

------------------ ------------------ ------------------ -----------------

Segment assets 1,124.5 1,794.4 1,114.9 4,033.8

================== ================== ================== =================

Gross liabilities 1,133.7 1,718.9 1,043.7 3,896.3

Intercompany eliminations (253.5) (50.2) (54.8) (358.5)

------------------ ------------------ ------------------ -----------------

Segment liabilities 880.2 1,668.7 988.9 3,537.8

================== ================== ================== =================

External revenue for the

six months ended 30 June

2021 21.4 87.8 13.6 122.8

================== ================== ================== =================

Revenue from external customers represents the Group's total

consolidated income, after elimination of internal revenue.

As at 31 December 2021

UK North America Europe Total

$m $m $m $m

Gross assets 1,716.7 2,418.6 1,331.9 5,467.2

Intercompany eliminations (137.4) (103.5) (58.6) (299.5)

------------------- ------------------ ------------------ -----------------

Segment assets 1,579.3 2,315.1 1,273.3 5,167.7

=================== ================== ================== =================

Gross liabilities 1,307.3 2,566.5 1,196.9 5,070.7

Intercompany eliminations (238.3) (12.2) (49.0) (299.5)

------------------- ------------------ ------------------ -----------------

Segment liabilities 1,069.0 2,554.3 1,147.9 4,771.2

=================== ================== ================== =================

External revenue for the

year ended 31 December

2021 7.9 59.6 41.3 108.8

=================== ================== ================== =================

Revenue from external customers represents the Group's total

consolidated income, after elimination of internal revenue.

4 . Fair Value

The following table shows the fair values of financial assets

using a valuation hierarchy; the fair value hierarchy has the

following levels: -

Level 1 - Valuations based on quoted prices in active markets

for identical instruments. An active market is a market in which

transactions for the instrument occur with sufficient frequency and

volume on an ongoing basis such that quoted prices reflect prices

at which an orderly transaction would take place between market

participants at the measurement date.

Level 2 - Valuations based on quoted prices in markets that are

not active or based on pricing models for which significant inputs

can be corroborated by observable market data.

Level 3 - Valuations based on inputs that are unobservable or

for which there is limited activity against which to measure fair

value.

Level Level Level Total

As at 30 June 2022 1 2 3

$m $m $m $m

Government and government

agencies 372.8 - - 372.8

Corporate bonds 1,010.0 22.2 - 1,032.2

Equities 19.8 4.4 - 24.2

Investment funds 17.8 20.6 - 38.4

Purchased reinsurance

receivables - - 6.5 6.5

----------------- -------------- --------------- -----------------

Total financial assets measured

at fair value 1,420.4 47.2 6.5 1,474.1

================= ============== =============== =================

Level Level Level Total

As at 30 June 2021 1 2 3

$m $m $m $m

Government and government

agencies 316.4 - - 316.4

Corporate bonds 987.2 50.0 - 1,037.2

Equities 12.9 0.3 - 13.2

Investment funds 20.4 84.0 - 104.4

Purchased reinsurance

receivables - - 6.4 6.4

----------------- -------------- --------------- -----------------

Total financial assets measured

at fair value 1,336.9 134.3 6.4 1,477.6

================= ============== =============== =================

Level Level Level Total

As at 31 December 2021 1 2 3

$m $m $m $m

Government and government

agencies 330.9 - - 330.9

Corporate bonds 999.0 56.9 - 1,055.9

Equities 11.6 0.3 - 11.9

Investment funds - 112.6 - 112.6

Purchased reinsurance

receivables - - 6.6 6.6

----------------- -------------- --------------- -----------------

Total financial assets measured

at fair value 1,341.5 169.8 6.6 1,517.9

================= ============== =============== =================

The following table shows the movement on Level 3 assets

measured at fair value for the six months ended 30 June 2022 and

2021, and the year ended 31 December 2021: -

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

$m $m $m

Opening balance 6.6 6.4 6.4

Total net gains recognised in the Consolidated

Income Statement (0.1) - 0.2

Closing balance 6.5 6.4 6.6

=================== ================ ===================

Level 3 investments (purchased reinsurance receivables) have

been valued using detailed models outlining the anticipated timing

and amounts of future receipts.

5. Investment income

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

$m $m $m

Interest income 10.2 11.6 24.1

Realised gains/(losses) on

investments (12.0) 2.8 3.8

Unrealised (losses)/gains

on investments (88.0) (9.0) (21.5)

------------------------ ------------------------- ---------------------

(89.8) 5.4 6.4

======================== ========================= =====================

6. Income tax

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

$m $m $m

Tax credit 14.3 8.6 34.6

====================== ======================== ======================

The tax credit in the Condensed Consolidated Income Statement is

calculated on an effective tax rate method.

7. Insurance contract provisions and reinsurance balances

Six months

Six months ended Year ended

ended 30 30 June 31 December

June 2022 2021 2021

Gross $m $m $m

Insurance contract provisions at beginning

of period 3,207.5 2,402.8 2,402.8

Claims paid (311.3) (228.9) (485.9)

Increase in provisions arising from

acquisition and disposal of subsidiary

undertakings and syndicate participations 0.5 38.2 91.1

Increase in provisions arising from

acquisition of reinsurance portfolios - 74.3 430.4

Increase in claims provisions 434.9 167.1 524.0

Increase in unearned premium reserve 256.0 131.3 279.3

Net exchange differences (150.6) 31.9 (34.2)

-------------------- ------------------ -------------------

Insurance contract provisions at end

of period 3,437.0 2,616.7 3,207.5

-------------------- ------------------ -------------------

Six months

Six months ended Year ended

ended 30 30 June 31 December

June 2022 2021 2021

Reinsurance $m $m $m

Reinsurers' share of insurance contract

provisions at beginning of period 2,105.6 1,180.6 1,180.6

Proceeds from commutations and reinsurers'

share of gross claims paid (201.8) (106.3) (154.2)

Increase in provisions arising from

acquisition and disposal of subsidiary

undertakings and syndicate participations - - 164.2

Increase in provisions arising from

acquisition of reinsurance portfolios - - 247.5

Increase in claims provisions 395.9 146.8 416.9

Increase in unearned premium reserve 222.7 131.1 267.0

Net exchange differences (134.6) 24.4 (16.4)

--------------------- ----------------- -------------------

Reinsurers' share of insurance contract

provisions at end of period 2,387.8 1,376.6 2,105.6

--------------------- ----------------- -------------------

Six months

Six months ended Year ended

ended 30 30 June 31 December

June 2022 2021 2021

Net $m $m $m

Net claims outstanding at beginning

of period 1,101.9 1,222.2 1,222.2

Net claims paid and proceeds from commutations (109.5) (122.6) (331.7)

Increase/(decrease) in provisions arising

from acquisition of subsidiary undertakings

and syndicate participations 0.5 38.2 (73.1)

Increase in provisions arising from

acquisition of reinsurance portfolios - 74.3 182.9

Increase in claims provisions 39.0 20.3 107.1

Increase in unearned premium reserve 33.3 0.2 12.3

Net exchange differences (16.0) 7.5 (17.8)

--------------------- ----------------- -------------------

Net claims outstanding at end of period 1,049.2 1,240.1 1,101.9

--------------------- ----------------- -------------------

The assumptions used in the estimation of claims provisions

relating to insurance contracts are intended to result in

provisions which are sufficient to settle the net liabilities from

insurance contracts.

Provision is made at the reporting date for the estimated

ultimate cost of settling all claims incurred in respect of events

and developments up to that date, whether reported or not. The

source of data used as inputs for the assumptions is primarily

internal.

Significant uncertainty exists as to the likely outcome of any

claim and the ultimate costs of completing the run off of the

Group's owned insurance operations.

The Group owns several insurance companies and Syndicate

participations in run-off. Significant uncertainty arises in the

quantification of technical provisions for all insurance entities

and Lloyd's Syndicates under the Group's control due to the long

tail nature of the business underwritten by those entities. The

business written by the insurance company subsidiaries consists in

part of long tail liabilities, including asbestos, pollution,

health hazard and other US liability insurance. The claims for this

type of business are typically not settled until several years

after policies have been written. Furthermore, much of the business

written by these companies is reinsurance and retrocession of other

insurance companies, which lengthens the settlement period.

The provisions carried by the Group's owned insurance companies

and Syndicate participations are calculated using a variety of

actuarial techniques. The provisions are calculated and reviewed by

the Group's internal actuarial team. In addition, the Group

regularly commissions independent external actuarial reviews. The

use of external advisers provides management with additional

comfort that the Group's internally produced statistics and trends

are consistent with observable market information and other

published data.

When preparing these Condensed Consolidated Financial

Statements, full provision is made in the aggregate for all costs

of running off the business of the insurance entities to the extent

that the provision exceeds the estimated future investment return

expected to be earned by those entities deemed to be in run-off.

When assessing the amount of any provision to be made, the future

investment income and claims handling expenses and all other costs

of all the insurance company subsidiaries' and syndicates'

businesses in run-off are considered in aggregate. The quantum of

the costs of running off the business and the future investment

income has been determined through the preparation of cash flow

forecasts over the anticipated period of the run offs. The gross

costs of running off the business are estimated to be fully covered

by future investment income.

Provisions for outstanding claims and Incurred but Not Reported

(IBNR) claims are initially estimated at a gross level and a

separate calculation is carried out to estimate the size of

reinsurance recoveries. Insurance companies and Syndicate

participations within the Group are covered by a variety of treaty,

excess of loss and stop loss reinsurance programs.

8. Earnings per share

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

No. 000's No. 000's No. 000's

Weighted average number of Ordinary

shares 276,263.0 267,915.0 271,611.0

Effect of dilutive share options - - -

------------------- ------------------ ---------------------

Weighted average number of Ordinary

shares for the purposes

of diluted earnings per share 276,263.0 267,915.0 271,611.0

=================== ================== =====================

$m $m $m

Earnings per share for profit from

operations

Loss for the period attributable to

Ordinary shareholders (122.4) (36.8) (127.4)

=================== ================== =====================

Basic earnings per share (44.3)c (13.7)c (46.9)c

Diluted earnings per share (44.3)c (13.7)c (46.9)c

=================== ================== =====================

9. Insurance and other payables

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

$m $m $m

Structured liabilities 506.2 516.4 506.2

Structured settlements (506.2) (516.4) (506.2)

------------------- ------------------- -------------------

- - -

Other creditors 1,155.1 523.8 1,140.1

1,155.1 523.8 1,140.1

=================== =================== ===================

Structured Settlements

No new structured settlement arrangements have been entered into

during the period. Some Group subsidiaries have paid for annuities

from third party life insurance companies for the benefit of

certain claimants. The subsidiary company retains the credit risk

in the unlikely event that the life insurance company defaults on

its obligations to pay the annuity amounts. In the event that any

of these life insurance companies were unable to meet their

obligations to these annuitants, any remaining liability may fall

upon the respective insurance company subsidiaries. The Directors

believe that, having regard to the quality of the security of the

life insurance companies together with the reinsurance available to

the relevant Group insurance companies, the possibility of a

material liability arising in this way is very unlikely. The life

companies will settle the liability directly with the claimants and

no cash will flow through the Group. These annuities have been

shown as reducing the insurance companies' liabilities to reflect

the substance of the transactions and to ensure that the disclosure

of the balances does not detract from the users' ability to

understand the Group's future cash flows.

10. Borrowings

The total amounts owed to credit institutions at 30 June 2022

was $382.0m (30 June 2021: $362.7m, 31 December 2021: $395.9m).

The Group has issued the following debt:

Issuer Principal Rate Maturity

R&Q Insurance Holdings Ltd $70,000k 6.35% above USD 2028

LIBOR

R&Q Insurance Holdings Ltd $125,000k 6.75% above USD 2033

LIBOR

Accredited Insurance (Europe) EUR20,000k 6.7% above EURIBOR 2025

Limited

Accredited Insurance (Europe) EUR5,000k 6.7% above EURIBOR 2027

Limited

R&Q Re (Bermuda) Limited $20,000k 7.75% above USD 2023

LIBOR

The Group's subsidiary, Accredited America Insurance Holding

Corporation provides a full and unconditional guarantee for the

payment of principal, interest and any other amounts due in respect

of the $70,000k Notes issued by R&Q Insurance Holdings Ltd.

11. Issued share capital

Issued share capital as at 30 June 2022 amounted to $8.1m (30

June 2021: $7.4m, 31 December 2021: $7.5m).

During the period the Group issued 27,425,612 ordinary shares at

GBP1.05 per share.

12. Guarantees and indemnities in the ordinary course of business

The Group gives various guarantees in the ordinary course of

business.

13. Goodwill

When testing for impairment of goodwill, the recoverable amount

of each relevant cash generating unit is determined based on cash

flow projections. These cash flow projections are based on the

financial forecasts approved by management. Management also

consider the current net asset value and earnings of each cash

generating unit.

No changes to the underlying assumptions have been made in the

interim review.

14. Business combinations

During the first six months of 2022, the Group made one business

combination of run-off portfolios. The Group's business combination

involved a Legacy Insurance transaction and has been accounted for

using the acquisition method of accounting.

Legacy entities and businesses

The following table shows the fair value of assets and

liabilities included in the Condensed Consolidated Financial

Statements at the date of acquisition of the legacy business:

Net Goodwill

Intangible Other Cash & Other Technical assets on bargain

assets receivables investments payables provisions Tax acquired Consideration purchase

$m $m $m $m $m $m $m $m $m

La

Vittoria 0.1 - 0.6 - (0.5) - 0.2 - 0.2

0.1 - 0.6 - (0.5) - 0.2 - 0.2

---------------- ----------------- --------------------- ------------- ---------------- ------------- -------------- ---------------------- ----------------

Goodwill on bargain purchase arises when the consideration is

less than the fair value of the net assets acquired. It is

calculated after the alignment of accounting policies and other

adjustments to the valuation of assets and liabilities to reflect

their fair value at acquisition.

M&A transactions can arise as legacy business can give rise

to onerous capital and reporting obligations for insurers, even

though they no longer actively participate in such business.

In order to disclose the impact on the Group as if the legacy

entity had been owned for the whole period, assumptions would have

to be made about the Group's ability to manage efficiently the

run-off of the legacy liabilities prior to the acquisition. As a

result, and in accordance with IAS 8, the Directors believe it is

not practicable to disclose revenue and profit before tax as if the

entity had been owned for the whole period.

Where significant uncertainties arise in the quantification of

the liabilities, the Directors have estimated the fair value based

on the currently available information and on assumptions which

they believe to be reasonable.

The Group completed the following business combination during

2022:

La Vittoria

On 4 May 2022, Accredited Insurance (Europe) Limited completed

the novation from SCOR SE Rappresentanza Generale Per I'Italia (as

legal successor to La Vittoria Riassicurazioni) ("La Vittoria"), a

French domiciled insurance company, of La Vittoria's participations

in the Excess and Casualty Reinsurance Association ("ECRA") pool.

The policies covered property and casualty risks underwritten from

1973 to 1980.

15. Related party transactions

The following Officers and connected parties were entitled to

the following distributions during the period as follows:

Six months ended Six months ended Year ended 31

30 June 2022 30 June 2021 December 2021

$m $m $m

A K

Quilter

and

family - - 0.1

W L

Spiegel - - 0.2

T S - - -

Solomon

16. Foreign exchange rates

The Group used the following exchange rates to translate foreign

currency assets, liabilities, income and expenses into United

States Dollars, being the Group's presentational currency:

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2022 20201 2021

Average

UK Sterling 0.77 0.72 0.73

Euro 0.92 0.83 0.84

---------------- ---------------- ----------------

Spot

UK Sterling 0.82 0.72 0.75

Euro 0.95 0.84 0.88

---------------- ---------------- ----------------

17. Contingent liability

Attention is drawn to Note 7 which sets out the uncertainties

inherent in assessing outstanding claims reserves in the ordinary

course. The Group's insurance contract provisions include a

provision for costs only in respect of a potential accumulation of

claims from a single policyholder in the Group's Legacy business.

The claims involve multiple uncertainties including questions

relating to liability, coverage, incidence, quantum and other legal

and technical issues. Management has concluded that it is not

possible to measure the appropriate reserve for these claims with

sufficient reliability. Based on the documentation made available

to date, and expert opinion and legal advice, management believes

that it is not probable that any significant amount, other than

costs, will be payable to settle the claim; however, the ultimate

cost of the claims could be materially higher. In the

circumstances, and in accordance with IAS 37, management has

concluded that it is not currently appropriate to recognize any

estimate of the possible outcome but to disclose the position as a

contingent liability.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SSLFALEESEFU

(END) Dow Jones Newswires

September 05, 2022 02:00 ET (06:00 GMT)

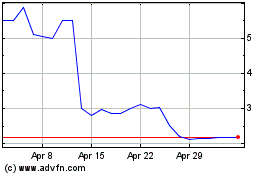

R&q Insurance (LSE:RQIH)

Historical Stock Chart

From Mar 2024 to Apr 2024

R&q Insurance (LSE:RQIH)

Historical Stock Chart

From Apr 2023 to Apr 2024