Segro Buys Remaining of Properties at Heathrow Airport; Raises Money

10 March 2017 - 6:47PM

Dow Jones News

By Olga Cotaga

LONDON--Segro PLC (SGRO.LN) said Friday it is buying the

remaining 50% of the Airport Property Partnership joint venture

from Aviva group entities for 365 million pounds ($439.8 million)

in cash and assets.

The joint venture owns 21 direct property assets, valued at

GBP1.1 billion. The majority of these properties are located at

London's Heathrow airport.

The property investment and development company will pay for the

acquisition GBP216 million in cash raised through a share rights

issue and the rest it will cover in assets which it will sell to

Aviva.

Via a rights issue of 166 million shares, priced at 345 pence

each, Segro will raise GBP573 million, it said. The price is at a

30% discount to Thursday's closing price of 490.60 pence.

The company said that GBP165 million from the share issue it

will invest in further development and GBP175 million it will

invest in land.

-Write to Olga Cotaga at olga.cotaga@wsj.com, Twitter

@OlgaCotaga

(END) Dow Jones Newswires

March 10, 2017 02:32 ET (07:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

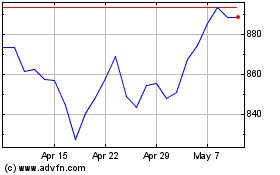

Segro (LSE:SGRO)

Historical Stock Chart

From Apr 2024 to May 2024

Segro (LSE:SGRO)

Historical Stock Chart

From May 2023 to May 2024