Dow Jones received a payment from EQS/DGAP to publish this press

release.

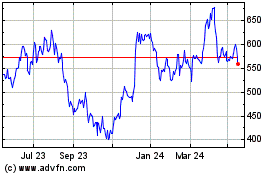

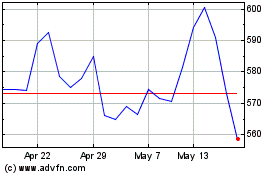

TUI AG (TUI)

TUI AG: Half year financial report 2018

09-May-2018 / 07:00 CET/CEST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

H1 2018

TUI Group - financial highlights

EUR million Q2 Q2 2017 Var. H1 H1 2017 Var. Var. %

2018 restated % 2018 restated % at

constant

currency

Turnover 3,264 3,071.8 + 6.3 6,813. 6,353.8 + 7.2 + 8.5

.1 5

Underlying

EBITA1

Hotels & 84.8 73.6 + 179.2 122.8 + + 48.2

Resorts 15.2 45.9

Cruises 54.9 46.9 + 92.4 75.0 + + 24.0

17.1 23.2

Destination - 9.1 - 2.5 - - 9.3 0.3 n. a. -

Experiences 264.0

Holiday 130.6 118.0 + 262.3 198.1 + + 35.0

Experiences 10.7 32.4

Northern - - 108.7 + - - 138.0 + + 11.8

Region 89.4 17.8 120.5 12.7

Central - - 91.3 + 2.1 - - 143.7 - 1.5 - 1.6

Region 89.4 145.8

Western - - 54.5 - 9.5 - - 102.2 - 3.3 - 3.3

Region 59.7 105.6

Sales & - - 254.5 + 6.3 - - 383.9 + 3.1 + 2.8

Marketing 238.5 371.9

All other - - 17.5 - - 49.0 - 28.5 - - 56.6

segments 25.8 47.4 71.9

TUI Group - - 154.0 + - - 214.3 + + 29.8

133.7 13.2 158.6 26.0

Discontinued - - 3.1 n. a. - - 15.3 n. a. -

operations

Total - - 157.1 + - - 229.6 + + 34.5

133.7 14.9 158.6 30.9

- - 182.4 + - - 251.9 +

EBITA 2, 3 147.2 19.3 192.3 23.7

- - 59.9 + 37.8 - 27.3 n. a.

Underlying 31.5 47.4

EBITDA 3

- - 82.1 + 15.3 - 52.3 n. a.

EBITDA 3 40.2 51.0

- - 163.9 + - - 245.5 +

Net loss for 141.5 13.7 200.2 18.5

the period

Earnings per - - 0.32 + 9.4 - 0.46 - 0.51 + 9.8

share 3 EUR 0.29

Net capex 66.5 365.8 - 207.3 695.1 -

and 81.8 70.2

investments

Equity ratio 21.3 20.0 + 1.3

(31 March) 4

%

Net debt 576.0 1,404.1 -

position (31 59.0

March) 3

Employees 55,773 58,698 - 5.0

(31 March)

Differences may occur due to rounding.

This Half Year Financial Report of the TUI Group was

prepared for the reporting period H1 2018 from 1 October

2017 to 31 March 2018. The terms for previous periods

were renamed accordingly.

1 In order to explain and evaluate the operating

performance by the segments, EBITA adjusted for one-off

effects (underlying EBITA) is presented. Underlying EBITA

has been adjusted for gains on disposal of financial

investments, restructuring measures according to IAS 37,

all effects of purchase price allocations, ancillary

acquisition costs and conditional purchase price payments

and other expenses for and income from one-off items.

Please also refer to page 14 for further details.

2 We define EBITA as earnings before interest, income

taxes and goodwill impairment. EBITA includes

amortisation of other intangible assets. EBITA does not

include measurement effects from interest hedges and in

the prior year also earnings effects from container

shipping.

3 Continuing operations.

4 Equity divided by balance sheet total in %, variance is

given in percentage points.

INTERIM MANAGEMENT REPORT

On track to deliver our growth targets

· We have delivered a good H1 performance, with a further improvement in

the seasonal result. Turnover increased by 7.2 % to EUR 6,813.5 m and

underlying EBITA improved by 26.0 % to EUR - 158.6 m. Growth in earnings

was delivered as a result of continued strong demand for our Holiday

Experiences - including additional hotel and cruise ship capacity as we

continue to deploy the proceeds of disposals into higher returning assets -

and a good portfolio performance by Sales & Marketing.

· The key drivers of the year on year improvement in underlying EBITA are

shown in the table below.

H1 results at a glance

EUR million H1 2018

Underlying EBITA H1 FY2017 - 214

Holiday Experiences + 28

Sales & Marketing + 11

All other segments - 16

Riu hotel disposals (Q1) + 38

Impact Niki bankruptcy (Q1) - 20

Easter timing impact + 22

Foreign exchange translation - 8

Underlying EBITA H1 FY2018 - 159

Please see pages 7 to 11 for further commentary on segmental performance.

During H1 we announced the following strategic developments:

· We will become the world's leading provider of destination experiences,

with the acquisition of Destination Management from Hotelbeds Group. The

acquisition is expected to complete in H2 FY2018, funded from the remaining

proceeds of business disposals.

· Due to the continued strong demand for TUI Cruises, Mein Schiff Herz

(previously Mein Schiff 2) will remain within the TUI Cruises fleet.

Marella Cruises will instead acquire SkySea Golden Era from Royal

Caribbean. The ship will be renamed Marella Explorer 2, launching Summer

2019.

· In addition, approval has been given for a third new build expedition

cruise ship for Hapag-Lloyd Cruises. Planning and negotiation will shortly

launch for a scheduled delivery of the further Hanseatic class ship in

2021.

Current trading

Holiday Experiences

Our portfolio of over 380 hotels continue to perform very well, thanks to the

strength of our portfolio of destinations, new hotel openings and integrated

model. Following a very strong performance in the past few years in Spain and

more subdued demand for Turkey and North Africa, we are seeing a continued

rebalancing towards the latter destinations, as well as strong demand for

Greece (where we have over 40 Group and own concept hotels). Other

destinations such as the Caribbean and Cape Verde also continue to see good

demand. Our hotel and club brands will continue to expand their offering with

five openings in Summer 2018 plus further openings in FY2019. We also

continue to streamline the existing portfolio, having disposed of three Riu

hotels in Q1 and with repositionings under the TUI Blue and TUI Magic Life

brands in FY2018. The renovation of the Robinson Jandia Playa in

Fuerteventura is also underway, with the closure of this popular club for

most of FY2018.

In Cruises new launches are scheduled for TUI Cruises, Marella Cruises and

Hapag-Lloyd Cruises in 2018, 2019, 2021 and 2023. Demand for our cruises

remains strong, with higher yields year on year for the periods currently on

sale in all three brands. In Marella, Majesty exited the fleet in November

2017 and Spirit will exit in November 2018, and from Summer 2019 the entire

fleet will be fully all-inclusive.

Volumes in Destination Experiences (formerly Destination Services) are

expected to develop in line with our Sales & Marketing business. The

acquisition of the Destination Management business of Hotelbeds Group is

expected to complete in H2 FY2018, adding a further 25 countries to our

global destination presence.

Sales & Marketing

As expected, Winter 2017 / 18 closed out well, with revenues up 5 % on prior

year and bookings up 3 %. Growth was driven by North Africa, Cape Verde,

Thailand and Turkey, with stable demand for Spain.

Summer 2018 is also progressing well, with 59 % of the programme sold, in

line with prior year. Following a couple of very strong years, Spain remains

the number one destination by customer volume for Sales & Marketing, but with

year on year growth driven by destinations such as Turkey, North Africa and

Greece. We also see good growth in bookings for other smaller destinations

such as Bulgaria, Cyprus and Croatia.

Sales & Marketing - Current trading Summer 2018?*

YoY variation Total Total Total ASP Programme sold

% revenue customers (%)

Northern +4 +2 +2 60

Region

Central Region +11 +8 +3 60

Western Region +4 +3 +1 58

Total +7 +5 +2 59

* These statistics are up to 29 April 2018, shown on a constant currency

basis and relate to all customers whether risk or non-risk

In Northern Region, Nordics continue to deliver a strong, earlier booking

performance (+ 8 % currently, although the prior year comparatives will

strengthen in the coming months). Margins are ahead of prior year, reflecting

an increase in demand for Turkey and Greece, the introduction of our

proprietary Cyrus yield management system and actions taken by management to

improve the efficiency of the business. UK demand is resilient, with bookings

up 1 % on prior year, and margin performance continues to normalise in line

with our expectations, reflecting the impact on the cost base of the weaker

Pound Sterling. As expected, the UK is seeing a growth in demand for non-Euro

destinations such as Turkey, North Africa, Bulgaria and Croatia, as well as a

shortening of the average duration of holidays.

Within Central Region, bookings from Germany are up 4 %. This reflects a

significant increase in bookings to Turkey, North Africa and Greece, as well

as the continued popularity of Spain. Strong mainstream holiday bookings are

partly offset by lower bookings at this stage for some of our specialist

brands, however, we expect this to improve as we trade through the Summer.

Despite an increase in capacity (following the bankruptcy of Air Berlin /

Niki and subsequent changes to the TUI airline fleet), load factor is ahead

of prior year, helping to limit exposure to the lates market. The Central

Region bookings and revenue performance also reflects our strategy to grow

market share significantly in Poland.

In Western Region, bookings in Belgium and Netherlands are ahead of prior

year (+ 6 % overall), with growth destinations in general similar to the

other source markets. This is partly offset by trading in France, where

bookings are currently down on prior year, mainly due to lower sales of

tours. These were previously traded under the Transat brand and have now

switched to TUI, with some disruption to sales by third party distributors.

We remain focussed on the continued integration of the Transat business and

delivering an improved result in France this year.

Outlook

· We reiterate our guidance of our Annual Report 2017.

· We are continuing to deliver our growth strategy as set out in December

2017, based on market demand, digitalisation and investments, including the

announcements in H1 of further actions to enhance our destination

experiences business and accelerate growth in cruise.

· Based on a good H1 performance and strong current trading we are on track

to deliver at least 10 % underlying EBITA growth in FY2018.

· We are delivering our ambition - strong strategic positioning, strong

earnings growth and strong cash generation, with underlying EBITA doubling

between FY2014 and FY2020.

Expected development of Group turnover, underlying EBITA and

adjustments1

Expected development vs. PY

EUR million 2017 2018

Turnover 2 18,535 around 3 % growth

Underlying EBITA 1,102 at least 10 % growth

Adjustments 76 approx. EUR 80 m cost

1 Variance year-on-year assuming constant foreign-exchange

rates are applied to the result in the current and prior

period and based on the current group structure; guidance

relates to continuing operations and excludes the acquisition

of the Destination Management business from Hotelbeds Group.

2 Excluding cost inflation relating to currency movements.

Structure and strategy of TUI Group

Reporting structure

The present Half Year Financial Report 2018 is essentially based on TUI

Group's reporting structure set out in the Annual Report for 2017.

From Q1 FY2018 on, our segment reporting to reflect the growing strategic

importance of the services delivered in our destinations. Since the beginning

of financial year 2018, Destination Experiences (formerly Destination

Services), a crucial element of our customers' holiday experience, has been

reported as a separate segment alongside Hotels & Resorts and Cruises within

Holiday Experiences. The key figures of the new segment were carried under

Other Tourism in the completed financial year 2017. The other companies

previously reported as part of the Other Tourism segment are now carried

under All other segments; the Group totals have remained unchanged. The prior

year comparatives have been restated.

See Annual Report 2017 from page 24

Group targets and strategy

TUI Group's strategy set out in the Annual Report 2017 remains unchanged.

Details see Annual Report 2017 from page 20

Consolidated earnings

Turnover

EUR million Q2 2018 Q2 2017 Var. % H1 2017 Var. %

restated H1 2018 restated

Hotels & 143.1 158.8 - 9.9 287.9 300.0 - 4.0

Resorts

Cruises 203.3 194.0 + 4.8 395.6 345.9 + 14.4

Destination 21.4 23.4 - 8.5 59.8 54.6 + 9.5

Experiences

Holiday 367.8 376.2 - 2.2 743.3 700.5 + 6.1

Experiences

Northern 1,145.2 1,096.3 + 4.5 2,324.1 2,204.3 + 5.4

Region

Central 1,040.0 887.1 + 17.2 2,305.9 2,028.0 + 13.7

Region

Western 548.6 564.6 - 2.8 1,132.3 1,114.0 + 1.6

Region

Sales & 2,733.8 2,548.0 + 7.3 5,762.3 5,346.3 + 7.8

Marketing

All other 162.5 147.6 + 10.1 307.9 307.0 + 0.3

segments

TUI Group 3,264.1 3,071.8 + 6.3 6,813.5 6,353.8 + 7.2

TUI Group at 3,312.6 3,071.8 + 7.8 6,894.0 6,353.8 + 8.5

constant

currency

Discontinued - 293.9 n. a. - 546.3 n. a.

operations

Total 3,264.1 3,365.7 - 3.0 6,813.5 6,900.1 - 1.3

Underlying EBITA

EUR million Q2 2018 Q2 2017 Var. % H1 2017 Var. %

restated H1 2018 restated

Hotels & 84.8 73.6 + 15.2 179.2 122.8 + 45.9

Resorts

Cruises 54.9 46.9 + 17.1 92.4 75.0 + 23.2

Destination - 9.1 - 2.5 - 264.0 - 9.3 0.3 n. a.

Experiences

Holiday 130.6 118.0 + 10.7 262.3 198.1 + 32.4

Experiences

Northern - 89.4 - 108.7 + 17.8 - 120.5 - 138.0 + 12.7

Region

Central - 89.4 - 91.3 + 2.1 - 145.8 - 143.7 - 1.5

Region

Western - 59.7 - 54.5 - 9.5 - 105.6 - 102.2 - 3.3

Region

Sales & - 238.5 - 254.5 + 6.3 - 371.9 - 383.9 + 3.1

Marketing

All other - 25.8 - 17.5 - 47.4 - 49.0 - 28.5 - 71.9

segments

TUI Group - 133.7 - 154.0 + 13.2 - 158.6 - 214.3 + 26.0

TUI Group at - 125.1 - 154.0 + 18.8 - 150.5 - 214.3 + 29.8

constant

currency

Discontinued - - 3.1 n. a. - - 15.3 n. a.

operations

Total - 133.7 - 157.1 + 14.9 - 158.6 - 229.6 + 30.9

EBITA

EUR million Q2 2018 Q2 2017 Var. % H1 2017 Var. %

restated H1 2018 restated

Hotels & 84.7 72.4 + 17.0 179.1 120.0 + 49.3

Resorts

Cruises 54.9 46.9 + 17.1 92.4 75.0 + 23.2

Destination - 9.3 - 3.1 - 200.0 - 9.9 - 0.8 n. a.

Experiences

Holiday 130.3 116.2 + 12.1 261.6 194.2 + 34.7

Experiences

Northern - 93.8 - 114.5 + 18.1 - 129.2 - 148.1 + 12.8

Region

Central - 91.8 - 86.4 - 6.2 - 151.5 - 140.2 - 8.1

Region

Western - 62.9 - 80.1 + 21.5 - 118.7 - 128.8 + 7.8

Region

Sales & - 248.5 - 281.0 + 11.6 - 399.4 - 417.1 + 4.2

Marketing

All other - 29.0 - 17.6 - 64.8 - 54.5 - 29.0 - 87.9

segments

TUI Group - 147.2 - 182.4 + 19.3 - 192.3 - 251.9 + 23.7

Discontinued - - 6.6 n. a. - - 22.2 n. a.

operations

Total - 147.2 - 189.0 + 22.1 - 192.3 - 274.1 + 29.8

Segmental performance

Holiday Experiences

Hotels & Resorts

Q2 2018 Q2 2017 Var. % H1 2018 H1 2017 Var. %

Total 267.9 281.4 - 4.8 563.3 564.6 - 0.2

turnover

in EUR

million

Turnover 143.1 158.8 - 9.9 287.9 300.0 - 4.0

in EUR

million

Underlying 84.8 73.6 + 15.2 179.2 122.8 + 45.9

EBITA

in EUR

million

Underlying 91.7 73.6 + 24.6 182.0 122.8 + 48.2

EBITA at

constant

currency

rates

in EUR

million

Capacity 7,322.1 7,173.5 + 2.1 16,192.0 15,542.1 + 4.2

hotels

total 1, 4

in '000

Riu 4,038.1 4,180.8 - 3.4 8,433.1 8,382.9 + 0.6

Robinson 555.8 512.8 + 8.4 1,246.9 1,167.0 + 6.9

Blue 957.8 677.0 + 41.4 1,767.4 1,254.4 + 40.9

Diamond

79.6 78.4 + 1.1 77.1 75.3 + 1.8

Occupancy

rate

hotels

total 2

in %,

variance

in %

points

Riu 88.5 90.5 - 2.0 86.5 88.2 - 1.7

Robinson 62.2 60.1 + 2.1 63.0 62.4 + 0.6

Blue 80.0 80.2 - 0.3 78.8 81.1 - 2.3

Diamond

Average 79 78 + 2.1 71 70 + 2.3

revenue

per bed

hotels

total3

in EUR

Riu 72 75 - 3.5 68 69 - 1.6

Robinson 105 101 + 3.7 97 93 + 4.1

Blue 154 144 + 6.7 138 125 + 9.8

Diamond

Turnover measures include fully consolidated companies,

all other KPIs incl. companies measured at equity.

1 Group owned or leased hotel beds multiplied by opening

days per quarter

2 Occupied beds divided by capacity

3 Arrangement revenue divided by occupied beds

4 Previous year's total capacity now includes Blue Diamond

· Hotels & Resorts delivered a strong result in H1, with higher overall

occupancy and average rate. Further hotels were opened in H1, bringing the

total number of openings since merger to 38.

· We also continued to streamline our existing portfolio. As previously

announced, three hotels were sold by Riu in Q1, realising a gain of EUR 38

m. In addition, hotels have been repositioned to TUI Blue and TUI Magic

Life.

· Riu continues to deliver a strong operational performance, with high

occupancy rates reflecting its year-round destination portfolio. Average

revenue per bed performance reflects the impact of foreign exchange

translation, in particular on our Mexican hotels - excluding this, revenue

per bed was up 7 % year on year. The strong operational performance and

year on year benefit of hotel openings were partly offset by the impact of

hurricanes in the Caribbean (resulting in the closure of a hotel in St.

Martin) and loss of earnings from the three hotels which were sold in Q1.

· Robinson's H1 performance was in line with prior year, with new clubs in

the Maldives and Thailand in ramp up phase, and the closure of a club in

Fuerteventura for renovation.

· Blue Diamond delivered further growth in earnings, despite hurricane

disruption, reflecting growth in the hotel portfolio.

· The result also reflects an improved performance in our hotels in Turkey,

as demand continues to strengthen.

· The Hotels & Resorts result includes EUR 3 m impact from the earlier

timing of Easter.

Cruises

Q2 2018 Q2 2017 Var. % H1 2018 H1 2017 Var. %

Turnover 1 203.3 194.0 + 4.8 395.6 345.9 + 14.4

in EUR

million

Underlying 54.9 46.9 + 17.1 92.4 75.0 + 23.2

EBITA

in EUR

million

Underlying 55.2 46.9 + 17.7 93.0 75.0 + 24.0

EBITA at

constant

currency

rates

in EUR

million

Occupancy

in %,

variance in

% points

TUI Cruises 99.6 100.0 - 0.4 98.9 99.7 - 0.8

Marella 98.4 98.1 + 0.3 99.6 99.6 0.0

Cruises 2

Hapag-Lloyd 77.2 76.0 + 1.2 76.4 73.8 + 2.6

Cruises

Passenger

days

in '000

TUI Cruises 1,247.6 1,024.2 + 21.8 2,514.0 2,031.7 + 23.7

Marella 558.8 562.3 - 0.6 1,250.6 1,090.0 + 14.7

Cruises 2

Hapag-Lloyd 92.9 89.3 + 4.0 167.8 163.7 + 2.5

Cruises

Average

daily rates

3

in EUR

TUI Cruises 147 150 - 2.0 148 147 + 0.7

Marella 143 131 + 9.2 136 127 + 7.1

Cruises 2,

4

in GBP

Hapag-Lloyd 653 633 + 3.2 600 595 + 0.8

Cruises

1 No turnover is carried for TUI Cruises as the joint

venture is consolidated at equity

2 Rebranded from Thomson Cruises in October 2017

3 Per day and passenger

4 Inclusive of transfers, flights and hotels due to the

integrated nature of Marella Cruises

· Cruises result increased in H1, with additional capacity in TUI Cruises

and Marella Cruises, and a strong yield performance across all three

brands.

· TUI Cruises earnings increased due to the addition of Mein Schiff 6 in

May 2017, with a continued strong performance across the rest of the fleet.

· Marella Cruises earnings increased primarily due to the addition of

Marella Discovery in May 2017. Majesty exited the fleet in November 2017.

· Hapag-Lloyd Cruises earnings were in line with prior year, with a good

underlying performance offsetting year on year dry dock effects.

Destination Experiences

EUR Q2 2018 Q2 2017 Var. % H1 2017 Var. %

million restated H1 2018 restated

Total 56.2 53.5 + 5.0 138.6 127.0 + 9.1

turnover

Turnover 21.4 23.4 - 8.5 59.8 54.6 + 9.5

Underlying - 9.1 - 2.5 - 264.0 - 9.3 0.3 n. a.

EBITA

Underlying - 8.7 - 2.5 - 248.0 - 7.6 0.3 n. a.

EBITA at

constant

currency

rates

· Destination Experiences' H1 underlying EBITA result reflects a change

made since prior year to the way in which Sales & Marketing are recharged.

This results in a phasing of earnings into H2.

· Excluding the impact of this change, Destination Experiences delivered a

good operational performance. H1 arrival guests grew by 5 %, with increased

earnings in Spain, Portugal and Greece as well as improved trading in

Turkey and Tunisia.

Sales & Marketing

Sales & Marketing

Q2 2018 Q2 2017 Var. % H1 2017 Var. %

restated H1 2018 restated

Turnover 2,733.8 2,548.0 + 7.3 5,762.3 5,346.3 + 7.8

in EUR

million

Underlying - 238.5 - 254.5 + 6.3 - 371.9 - 383.9 + 3.1

EBITA

in EUR

million

Underlying - 240.3 - 254.5 + 5.6 - 373.3 - 383.9 + 2.8

EBITA at

constant

currency

rates

in EUR

million

Direct 75 75 - 74 73 + 1.0

distributi

on mix 1

in %,

variance

in %

points

Online mix 50 49 + 1.0 49 47 + 2.0

2

in %,

variance

in %

points

Customers 3,077 2,883 + 6.7 6,692 6,344 + 5.5

in '000

1 Share of sales via own channels (retail and online)

2 Share of online sales

· Sales & Marketing delivered a good portfolio performance in H1. Turnover

grew by 8 %, reflecting 5 % increase in customer volumes and higher selling

prices in the UK (primarily as a result of currency cost inflation) as well

as the earlier timing of Easter.

· Direct and online distribution mix also continued to increase, to 74 %

and 49 % respectively.

· The H1 underlying EBITA result includes EUR 19 m benefit from the earlier

timing of Easter.

Northern Region

Q2 2018 Q2 2017 Var. % H1 2017 Var. %

restated H1 2018 restated

Turnover 1,145.2 1,096.3 + 4.5 2,324.1 2,204.3 + 5.4

in EUR

million

Underlying - 89.4 - 108.7 + 17.8 - 120.5 - 138.0 + 12.7

EBITA

in EUR

million

Underlying - 90.8 - 108.7 + 16.5 - 121.7 - 138.0 + 11.8

EBITA at

constant

currency

rates

in EUR

million

Direct 91 90 + 1.0 92 90 + 2.0

distributi

on mix1

in %,

variance

in %

points

Online 66 63 + 3.0 65 63 + 2.0

mix2

in %,

variance

in %

points

Customers 1,114 1,117 - 0.3 2,363 2,363 0.0

in '000

1 Share of sales via own channels (retail and online)

2 Share of online sales

· Nordics delivered significant growth in earnings in H1, with a very

strong trading performance. We are particularly pleased with the

improvement in margin, reflecting the benefit of the TUI rebrand,

implementation of Cyrus yield management and One CRM, and realisation of

operational efficiencies.

· In the UK, demand remains resilient, with customer volumes in line with

prior year. Trading margins have continued to normalise as expected, as a

result of the weaker Pound Sterling. The TUI rebrand was completed

successfully with an additional cost of EUR 20 m in H1.

· Our Canadian joint venture delivered a good performance in H1, with

further growth in earnings.

· The Northern Region result includes EUR 15 m benefit from the earlier

timing of Easter.

Central Region

Q2 2018 Q2 2017 Var. % H1 2018 H1 2017 Var. %

Turnover 1,040.0 887.1 + 17.2 2,305.9 2,028.0 + 13.7

in EUR

million

Underlying - 89.4 - 91.3 + 2.1 - 145.8 - 143.7 - 1.5

EBITA

in EUR

million

Underlying - 89.7 - 91.3 + 1.8 - 146.0 - 143.7 - 1.6

EBITA at

constant

currency

rates

in EUR

million

Direct 50 49 + 1.0 49 47 + 2.0

distributi

on mix1

in %,

variance

in %

points

Online 23 19 + 4.0 21 17 + 4.0

mix2

in %,

variance

in %

points

Customers 1,054 885 + 19.0 2,418 2,146 + 12.7

in '000

1 Share of sales via own channels (retail and online)

2 Share of online sales

· Germany continues to see strong demand for holidays, with volumes up 10 %

in H1. Direct and online distribution mix improved further, to 48 % and 21

% respectively.

· The Central Region result reflects the non-repeat (EUR 24 m) of last

year's sickness event in TUI fly.

· This was offset by the write off of EUR 20 m wet lease receivable as a

result of the Niki insolvency. Following the insolvencies of Air Berlin and

Niki, TUI fly has taken back some aircraft and crew, with the remainder

being wet leased out under a new agreement. As outlined at Q1, there has

been some impact on the airline cost base which was not fully recovered

through trading and efficiency, however, we expect this to improve over

time.

· The Central Region result includes EUR 2 m benefit from the earlier

timing of Easter.

Western Region

Q2 2018 Q2 2017 Var. % H1 2018 H1 2017 Var. %

Turnover 548.6 564.6 - 2.8 1,132.3 1,114.0 + 1.6

in EUR

million

Underlying - 59.7 - 54.5 - 9.5 - 105.6 - 102.2 - 3.3

EBITA

in EUR

million

Underlying - 59.8 - 54.5 - 9.7 - 105.6 - 102.2 - 3.3

EBITA at

constant

currency

rates

in EUR

million

Direct 75 73 + 2.0 75 72 + 3.0

distributi

on mix1

in %,

variance

in %

points

Online mix 58 57 + 1.0 58 56 + 2.0

2

in %,

variance

in %

points

Customers 910 881 + 3.3 1,911 1,835 + 4.1

in '000

1 Share of sales via own channels (retail and online)

2 Share of online sales

· Benelux performed well in H1, benefitting from good trading, as well as

the non-repeat of rebrand costs in Belgium and Schiphol night flying

restrictions last year.

· France remains challenging. Whilst the integration of the Transat

business is going well, volumes have been impacted by the transition from

the Transat to TUI brand, therefore the result includes additional

marketing costs to support the rebrand. In addition, the result reflects

the inclusion of Transat's trading losses at the start of the year (the

business was acquired end of October 2016). We remain focussed on improving

the French result in the full year.

· The Western Region result includes EUR 2 m benefit from the earlier

timing of Easter.

All other segments

EUR Q2 2018 Q2 2017 Var. % H1 2017 Var. %

million restated H1 2018 restated

Turnover 162.5 147.6 + 10.1 307.9 307.0 + 0.3

Underlying - 25.8 - 17.5 - 47.4 - 49.0 - 28.5 - 71.9

EBITA

Underlying - 23.0 - 17.5 - 31.4 - 44.6 - 28.5 - 56.6

EBITA at

constant

currency

rates

· As previously stated, the H1 result includes the impact of a significant

planned aircraft maintenance event (D check) in Corsair.

· In addition the variance to prior year reflects the revaluation of share

based payments (in relation to senior management long term incentive

schemes), based on the increase in TUI share price.

Financial position and net assets

Cash Flow / Net capex and investments / Net debt

The cash outflow from operating activities increased by EUR 165.0 m to EUR

443.5 m. This was due in particular to higher advance payments to hotels,

payments for the integration of Transat in France and the deconsolidation of

the Travelopia Group.

From this interim report, we have adjusted the definition of our net debt.

While net debt has so far been calculated as the balance between current and

non-current financial debt and cash and cash equivalents, we will also

consider future short-term interest-bearing investments as a deduction item.

The majority of these investments becomes due between three and six months.

In accordance with IFRS regulations, these investments are not shown as cash

and cash equivalents in the consolidated balance sheet but within current

trade receivables and other assets. This adjustment had no effect on the

previous year.

Net debt

EUR million H1 2018 H1 2017 Var. %

Financial debt 1,977.8 2,027.4 - 2.4

Cash and cash equivalents 1,338.1 623.3 + 114.7

Short-term interest-bearing 63.7 - n. a.

investments

Net debt 576.0 1,404.1 - 59.0

The net debt position of the continuing operations improved by EUR 828.1 m to

EUR 576.0 m. The year-on-year improvement was attributable mainly to the

receipt of disposal proceeds not yet fully reinvested.

Net capex and investments

EUR million Q2 2018 Q2 2017 Var. % H1 2017 Var. %

restated H1 2018 restated

Cash gross

capex

Hotels & 53.0 71.8 - 26.2 115.1 130.6 - 11.9

Resorts

Cruises 2.7 223.8 - 98.8 38.1 247.2 - 84.6

Destination 1.3 0.4 + 225.0 2.1 2.6 - 19.2

Experiences

Holiday 57.0 296.0 - 80.7 155.3 380.4 - 59.2

Experiences

Northern 15.9 13.5 + 17.8 24.2 25.9 - 6.6

Region

Central 3.3 4.1 - 19.5 10.2 7.3 + 39.7

Region

Western 6.9 6.4 + 7.8 13.0 13.7 - 5.1

Region

Sales & 26.1 24.0 + 8.8 47.4 46.9 + 1.1

Marketing

All other 37.6 23.4 + 60.7 92.9 48.3 + 92.3

segments

TUI Group 120.7 343.4 - 64.9 295.6 475.5 - 37.8

Discontinued - 4.5 n. a. - 10.6 n. a.

operations

Total 120.7 347.9 - 65.3 295.6 486.1 - 39.2

Net pre - 60.7 33.7 n. a. - 20.2 117.5 n. a.

delivery

payments on

aircraft

Financial 13.6 1.0 n. a. 24.2 103.1 - 76.5

investments

Divestments - 7.1 - 16.8 + 57.7 - 92.3 - 11.6 - 695.7

Net capex 66.5 365.8 - 81.8 207.3 695.1 - 70.2

and

investments

The decline in net capex and investments was mainly driven by the

acquisition of a cruise ship for Marella Cruises and of Transat last year as

well as the sale of three Riu hotels in Q1 2018.

Assets and liabilities

Assets and liabilities

EUR million 31 Mar 2018 30 Sep 2017 Var. %

Non-current assets 10,088.8 9,867.6 + 2.2

Current assets 3,944.3 4,317.9 - 8.7

Assets 14,033.1 14,185.5 - 1.1

Equity 2,993.2 3,533.7 - 15.3

Provisions 2,098.4 2,278.7 - 7.9

Financial liabilities 1,977.8 1,933.1 + 2.3

Other liabilities 6,963.7 6,440.0 + 8.1

Liabilities 14,033.1 14,185.5 - 1.1

As at 31 March 2018, TUI Group's balance sheet total amounted to EUR 14.0 bn,

a decrease of 1.1 % compared to financial year end 30 September 2017. The

equity ratio stood at 21.3 %, falling below its level of 24.9 % as at 30

September 2017.

Details see Notes from page 30

Fuel / Foreign exchange

Our strategy of hedging the majority of our jet fuel and currency

requirements for future seasons, as detailed below, remains unchanged. This

gives us certainty of costs when planning capacity and pricing. The following

table shows the percentage of our forecast requirement that is currently

hedged for Euros, US Dollars and jet fuel for our Sales & Marketing, which

account for over 90 % of our Group currency and fuel exposure.

Foreign Exchange / Fuel

% Summer 2018 Winter 2018 / 19

Euro 93 67

US Dollar 96 77

Jet Fuel 91 79

As at 3 May 2018

Comments on the consolidated income statement

The consolidated income statement reflects the seasonality of the tourism

business, with negative results generated in the period from October to March

due to the seasonal nature of the business.

In the first half of 2018, turnover totalled EUR 6.8 bn, up 7.2 %

year-on-year. At constant currency rates, turnover grew by 8.5 % year-on-year

in H1 2018. Apart from the 5.5 % increase in customer volumes in Sales &

Marketing, the year-on-year turnover growth was driven by additional capacity

in the Cruises segment, higher average selling prices in the Hotels & Resorts

segment and higher pricing in the UK.

The year-on-year improvement in the result from continuing operations was

attributable to the operating performance as well as the proceeds of

disposals of two hotel companies, a hotel and an aircraft.

Income statement of the TUI Group for the period from 1

Oct 2017 to 31 Mar 2018

EUR million Q2 2018 Q2 2017 Var. % H1 2018 H1 2017 Var. %

Turnover 3,264.1 3,071.8 + 6.3 6,813.5 6,353.8 + 7.2

Cost of sales 3,177.0 3,029.2 + 4.9 6,558.7 6,127.9 + 7.0

Gross profit 87.1 42.6 + 104.5 254.8 225.9 + 12.8

Administrative 313.6 313.8 - 0.1 621.4 601.1 + 3.4

expenses

Other income 2.9 2.9 0.0 48.6 5.1 + 852.9

Other expenses - 0.9 n. a. 0.3 2.2 - 86.4

Financial 3.5 30.8 - 88.6 17.7 37.0 - 52.2

income

Financial 31.0 39.4 - 21.3 68.1 81.1 - 16.0

expenses

Share of 76.4 70.3 + 8.7 121.5 105.6 + 15.1

result of

joint ventures

and associates

Earnings - 174.7 - 207.5 + 15.8 - 247.2 - 310.8 + 20.5

before income

taxes from

continuing

operations

Income taxes - 33.2 - 43.6 + 23.9 - 47.0 - 65.3 + 28.0

Result from - 141.5 - 163.9 + 13.7 - 200.2 - 245.5 + 18.5

continuing

operations

Result from - - 54.6 n. a. - - 63.1 n. a.

discontinued

operations

Group loss - 141.5 - 218.5 + 35.2 - 200.2 - 308.6 + 35.1

Group loss - 170.9 - 245.4 + 30.4 - 270.5 - 362.9 + 25.5

attributable

to

shareholders

of TUI AG

Group loss 29.4 26.9 + 9.3 70.3 54.3 + 29.5

attributable

to

non-controllin

g interest

Alternative performance measures

Key indicators used to manage the TUI Group are EBITA and underlying EBITA.

We define EBITA as earnings before interest, income taxes and goodwill

impairment. EBITA includes amortisation of other intangible assets. EBITA

does not include measurement effects from interest hedges and in the prior

year also earnings effects from container shipping.

We consider underlying EBITA to be the most suitable performance indicator

for explaining the development of the TUI Group's operating performance.

Underlying EBITA has been adjusted for gains on disposal of financial

investments, expenses in connection with restructuring measures according to

IAS 37, all effects of purchase price allocations, ancillary acquisition cost

and conditional purchase price payments and other expenses for and income

from one-off items.

The table below shows a reconciliation of earnings before taxes from

continuing operations to underlying earnings. In H1 FY2018, adjustments

(including one-off items and purchase price allocations for continuing

operations) amounted to EUR 33.7 m, a decline of EUR 3.9 m year-on-year.

Reconciliation to underlying earnings

EUR million Q2 2018 Q2 2017 Var. % H1 2018 H1 2017 Var. %

Earnings - 174.7 - 207.5 + 15.8 - 247.2 - 310.8 + 20.5

before

income taxes

Income from - - 2.3 n. a. - - 2.3 n. a.

the sale of

the shares

in

Container

Shipping

Net interest 27.5 27.4 + 0.4 54.9 61.2 - 10.3

expense and

expense from

the

measurement

of interest

hedges

EBITA - 147.2 - 182.4 + 19.3 - 192.3 - 251.9 + 23.7

Adjustments:

plus: Losses - - - 0.7

on disposals

plus: 4.3 16.9 13.4 17.1

Restructurin

g expense

plus: 7.4 7.5 15.0 15.2

Expense from

purchase

price

allocation

plus: 1.8 4.0 5.3 4.6

Expense /

less: Income

from other

one-off

items

Underlying - 133.7 - 154.0 + 13.2 - 158.6 - 214.3 + 26.0

EBITA

The improvement in the interest result in H1 FY2018 was mainly driven by the

improvement in net debt position and lower interest rates.

Adjustments include one-off income and expense items impacting or distorting

the assessment of the operating profitability of the segments and the Group

due to their level and frequency. These items primarily include major

restructuring and integration expenses not meeting the criteria of IAS 37,

material expenses for litigation, gains and losses from the sale of aircraft

and other material business transactions of a one-off nature.

In H1 FY2018 TUI Group's operating loss adjusted for one-off effects improved

by EUR 55.7 m to EUR 158.6 m.

In H1 FY2018, adjustments included expenses for purchase price allocations of

EUR 15.0 m and in particular for the integration of Transat in France and the

restructuring of our German flight sector.

Key figures of income statement (continuing operations)

EUR million Q2 2018 Q2 2017 Var. % H1 2018 H1 2017 Var. %

Earnings 119.8 102.8 + 16.5 346.0 315.0 + 9.8

before

interest,

income

taxes,

depreciation

, impairment

and rent

(EBITDAR)

Operating 160.0 184.9 - 13.5 330.7 367.3 - 10.0

rental

expenses

Earnings - 40.2 - 82.1 + 51.0 15.3 - 52.3 n. a.

before

interest,

income

taxes,

depreciation

and

impairment

(EBITDA)

Depreciation 107.0 100.3 + 6.7 207.6 199.6 + 4.0

/

amortisation

less

reversals

of

depreciation

/

amortisation

*

Earnings - 147.2 - 182.4 + 19.3 - 192.3 - 251.9 + 23.7

before

interest,

income taxes

and

impairment

of goodwill

(EBITA)

Earnings - 147.2 - 182.4 + 19.3 - 192.3 - 251.9 + 23.7

before

interest and

income taxes

(EBIT)

Net interest 27.5 27.4 - 0.4 54.9 61.2 + 10.3

expense and

expense from

the

measurement

of interest

hedges

Income from - 2.3 n. a. - 2.3 n. a.

the sale of

the shares

in

Container

Shipping

Earnings - 174.7 - 207.5 + 15.8 - 247.2 - 310.8 + 20.5

before

income taxes

(EBT)

* On property, plant and equipment, intangible asssets,

financial and other assets

Other segment indicators

Underlying EBITDA

EUR million Q2 2018 Q2 2017 Var. % H1 2017 Var. %

restated H1 2018 restated

Hotels & 111.5 97.6 + 14.2 228.4 167.9 + 36.0

Resorts

Cruises 68.4 60.1 + 13.8 125.8 101.6 + 23.8

Destination - 6.9 - 0.6 n. a. - 5.0 4.2 n. a.

Experiences

Holiday 173.0 157.1 + 10.1 349.2 273.7 + 27.6

Experiences

Northern - 74.6 - 94.6 + 21.1 - 97.4 - 110.8 + 12.1

Region

Central - 84.4 - 86.6 + 2.5 - 136.0 - 134.0 - 1.5

Region

Western - 55.7 - 50.0 - 11.4 - 97.5 - 93.7 - 4.1

Region

Sales & - 214.7 - 231.2 + 7.1 - 330.9 - 338.5 + 2.2

Marketing

All other 10.2 14.2 - 28.2 19.5 37.5 - 48.0

segments

TUI Group - 31.5 - 59.9 + 47.4 37.8 - 27.3 n. a.

Discontinued - - 3.1 n. a. - - 15.3 n. a.

operations

Total - 31.5 - 63.0 + 50.0 37.8 - 42.6 n. a.

EBITDA

EUR million Q2 2018 Q2 2017 Var. % H1 2017 Var. %

restated H1 2018 restated

Hotels & 111.4 97.5 + 14.3 228.4 167.3 + 36.5

Resorts

Cruises 68.4 60.1 + 13.8 125.8 101.6 + 23.8

Destination - 7.2 - 1.2 - 500.0 - 5.7 3.1 n. a.

Experiences

Holiday 172.6 156.4 + 10.4 348.5 272.0 + 28.1

Experiences

Northern - 76.0 - 97.4 + 22.0 - 100.1 - 114.8 + 12.8

Region

Central - 86.9 - 81.2 - 7.0 - 140.6 - 129.6

Region

Western - 57.7 - 74.9 + 23.0 - 108.3 - 118.7 + 8.8

Region

Sales & - 220.6 - 253.5 + 13.0 - 349.0 - 363.1 + 3.9

Marketing

All other 7.8 15.0 - 48.0 15.8 38.8 - 59.3

segments

TUI Group - 40.2 - 82.1 + 51.0 15.3 - 52.3 n. a.

Discontinued - - 6.6 n. a. - - 22.2 n. a.

operations

Total - 40.2 - 88.7 + 54.7 15.3 - 74.5 n. a.

Employees

31 March 2017 Var. %

31 March 2018 restated

Hotels & Resorts 19,068 18,447 + 3.4

Cruises 313 313 0.0

Destination 3,333 2,648 + 25.9

Experiences

Holiday Experiences 22,714 21,408 + 6.1

Northern Region 13,268 14,016 - 5.3

Central Region 10,235 10,123 + 1.1

Western Region 6,058 6,037 + 0.3

Sales & Marketing 29,561 30,176 - 2.0

All other segments 3,498 3,558 - 1.7

TUI Group 55,773 55,142 + 1.1

Discontinued - 3,556 n. a.

operations

Total 55,773 58,698 - 5.0

Corporate Governance

Composition of the Boards

In H1 2018 the composition of the Executive Board and the Supervisory Board

of TUI AG changed as follows:

The Annual General Meeting on 13 February 2018 elected Dr. Dieter Zetsche,

CEO of Daimler AG, as a member of the Supervisory Board. At the same time,

Deputy Chairman of the Supervisory Board Sir Michael Hodgkinson, stepped down

at the close of the Annual General Meeting. Mr. Peter Long succeeded him in

this role.

Mr. Horst Baier, Chief Financial Officer, has decided not to extend his

contract as Member of the Board that expires in November 2018. The TUI AG

Group Supervisory Board has appointed Ms. Birgit Conix as member of the

Executive Board as of 15 July 2018. On Horst Baier's departure in Autumn

2018, Birgit Conix will take over responsibilities as Chief Financial

Officer.

The current, complete composition of the Executive Board and Supervisory

Board is listed on our website, where it has been made permanently available

to the public.

www.tuigroup.com/en-en/investors/corporate-governance

Risk and Opportunity Report

Successful management of existing and emerging risks and opportunities is

critical to the long-term success of our business and to the achievement of

our strategic objectives. Full details of our risk governance framework and

principal risks and opportunities can be found in the Annual Report 2017.

With the brand change programme successfully being implemented in all source

markets, the related risk is no longer considered principal to the Group. All

other principal risks and uncertainties outlined in that report continue to

face the Group and are set out below:

Inherent risks to the sector

Destination disruption; macroeconomic risks; competition & consumer

preferences; input cost volatility; seasonal cashflow profile; legal &

regulatory compliance; health & safety; supply chain risk; joint venture

partnerships

Actively managed principal risks

IT development & strategy; growth strategy; integration & restructuring

opportunities; sustainable development; information security; Brexit

Our main concern related to Brexit continues to be whether or not all of our

airlines will continue to have access to EU airspace as now. We will continue

to address the importance of there being a special deal for aviation to

protect consumer choice with the relevant UK and EU ministers and officials,

and are assessing options to ensure the Group is not adversely affected to

any material extent in this area. Our Brexit Steering Committee continues to

monitor external developments and coordinates our mitigation strategy.

With the EU GDPR regulation being enforced imminently, whereby any breaches

may result in a significant financial penalty, the gross impact to the

Information Security principal risk has increased. Our mitigation strategy

including making information security part of everyone's job continues to

focus on managing the likelihood of this risk materialising.

Details see Risk Report in our Annual Report 2017, from page 30

INTERIM FINANCIAL STATEMENTS

Income statement of the TUI Group for the period

from 1 Oct 2017 to 31 Mar 2018

EUR million Notes H1 2018 H1 2017

Turnover (1) 6,813.5 6,353.8

Cost of sales (2) 6,558.7 6,127.9

Gross profit 254.8 225.9

Administrative expenses (2) 621.4 601.1

Other income (3) 48.6 5.1

Other expenses 0.3 2.2

Financial income 17.7 37.0

Financial expenses 68.1 81.1

Share of result of joint (4) 121.5 105.6

ventures and associates

Earnings before income - 247.2 - 310.8

taxes from continuing

operations

Income taxes (5) - 47.0 - 65.3

Result from continuing - 200.2 - 245.5

operations

Result from discontinued - - 63.1

operations

Group loss - 200.2 - 308.6

Group loss attributable - 270.5 - 362.9

to shareholders of TUI AG

Group loss attributable (6) 70.3 54.3

to non-controlling

interest

Earnings per share

EUR H1 2018 H1 2017

Basic and diluted earnings per share - 0.46 - 0.62

from continuing operations - 0.46 - 0.51

from discontinued operations - - 0.11

Condensed statement of comprehensive income of the TUI Group

for the period from 1 Oct 2017 to 31 Mar 2018

EUR million H1 2018 H1 2017

Group loss - 200.2 - 308.6

Remeasurements of pension 79.1 223.2

obligations and related fund assets

Income tax related to items that - 13.4 - 53.4

will not be reclassified

Items that will not be reclassified 65.7 169.8

to profit or loss

Foreign exchange differences - 67.7 28.8

Financial instruments available for - 131.9

sale

Cash flow hedges 21.3 - 50.3

Changes in the measurement of 25.7 15.6

companies measured at equity

Income tax related to items that may - 4.5 - 0.2

be reclassified

Items that may be reclassified to - 25.2 125.8

profit or loss

Other comprehensive income 40.5 295.6

Total comprehensive income - 159.7 - 13.0

attributable to shareholders of TUI - 225.3 - 84.8

AG

attributable to non-controlling 65.6 71.8

interest

Allocation of share of shareholders

of TUI AG of total comprehensive

income

Continuing operations - 225.3 - 22.3

Discontinued operations - - 62.5

Financial position of the TUI Group as at 31 Mar 2018

EUR million Notes 31 Mar 2018 30 Sep 2017

Assets

Goodwill 2,877.5 2,889.5

Other intangible 555.5 548.1

assets

Property, plant and (7) 4,401.1 4,253.7

equipment

Investments in 1,379.2 1,306.2

joint ventures and

associates

Financial assets (12) 53.2 69.5

available for sale

Trade receivables (12) 222.2 211.8

and other assets

Touristic payments 170.4 185.2

on account

Derivative (12) 77.7 79.9

financial

instruments

Deferred tax assets 352.0 323.7

Non-current assets 10,088.8 9,867.6

Inventories 118.9 110.2

Financial assets (12) 5.0 -

available for sale

Trade receivables (12) 949.3 794.5

and other assets

Touristic payments 1,036.8 573.4

on account

Derivative (12) 326.2 215.4

financial

instruments

Income tax assets 142.3 98.7

Cash and cash (12), (15) 1,338.1 2,516.1

equivalents

Assets held for (8) 27.7 9.6

sale

Current assets 3,944.3 4,317.9

Total assets 14,033.1 14,185.5

Financial position of the TUI Group as at 31 Mar 2018

EUR million Notes 31 Mar 2018 30 Sep 2017

Equity and liabilities

Subscribed capital 1,501.6 1,501.6

Capital reserves 4,195.0 4,195.0

Revenue reserves - 3,363.0 - 2,756.9

Equity before 2,333.6 2,939.7

non-controlling

interest

Non-controlling 659.6 594.0

interest

Equity (11) 2,993.2 3,533.7

Pension provisions and (9) 987.7 1,094.7

similar obligations

Other provisions 766.1 801.4

Non-current provisions 1,753.8 1,896.1

Financial liabilities (10), (12) 1,801.5 1,761.2

Derivative financial (12) 58.0 50.4

instruments

Income tax liabilities 147.9 150.2

Deferred tax 58.7 109.0

liabilities

Other liabilities (12) 140.2 150.2

Non-current 2,206.3 2,221.0

liabilities

Non-current provisions 3,960.1 4,117.1

and liabilities

Pension provisions and (9) 34.2 32.7

similar obligations

Other provisions 310.4 349.9

Current provisions 344.6 382.6

Financial liabilities (10), (12) 176.3 171.9

Trade payables (12) 1,839.0 2,653.3

Touristic advance 3,803.8 2,446.4

payments received

Derivative financial (12) 300.7 217.2

instruments

Income tax liabilities 61.9 65.3

Other liabilities (12) 552.4 598.0

Current liabilities 6,734.1 6,152.1

Liabilities related to 1.1 -

assets held for sale

Current provisions and 7,079.8 6,534.7

liabilities

Total provisions and 14,033.1 14,185.5

liabilities

Condensed statement of changes in Group equity

for the period from 1 Oct 2017 to 31 Mar 2018

Subscribed Capital Revenue Equity Non-controlling Total

capital reserve reserves before interest

s non-co

EUR million ntroll

ing

intere

st

Balance as at 1,501.6 4,195.0 - 2,939. 594.0 3,533

1 Oct 2017 2,756.9 7 .7

Dividends - - - 381.8 - - -

381.8 381.8

Share-based - - 1.0 1.0 - 1.0

payment

schemes

Group loss - - - 270.5 - 70.3 -

270.5 200.2

Foreign - - - 63.0 - 63.0 - 4.7 -

exchange 67.7

differences

Cash Flow - - 21.3 21.3 - 21.3

Hedges

Remeasurements - - 79.1 79.1 - 79.1

of pension

obligations

and related

fund assets

Changes in the - - 25.7 25.7 - 25.7

measurement of

companies

measured

at equity

Taxes - - - 17.9 - 17.9 - -

attributable 17.9

to other

comprehensive

income

Other - - 45.2 45.2 - 4.7 40.5

comprehensive

income

Total - - - 225.3 - 65.6 -

comprehensive 225.3 159.7

income

Balance as at 1,501.6 4,195.0 - 2,333. 659.6 2,993

31 Mar 2018 3,363.0 6 .2

Condensed statement of changes in Group equity

for the period from 1 Oct 2016 to 31 Mar 2017

Subscribed Capital Revenue Equity Non-controlling Total

capital reserve reserves before interest

s non-co

EUR million ntroll

ing

intere

st

Balance as at 1,500.7 4,192.2 - 2,675. 573.1 3,248

1 Oct 2016 3,017.8 1 .2

Dividends - - - 368.6 - - 0.3 -

368.6 368.9

Share-based - - 0.5 0.5 - 0.5

payment

schemes

Acquisition of - - - 21.8 - 21.8 - -

own shares 21.8

Group loss - - - 362.9 - 54.3 -

362.9 308.6

Foreign - - 11.4 11.4 17.4 28.8

exchange

differences

Financial - - 131.9 131.9 - 131.9

instruments

available for

sale

Cash Flow - - - 50.4 - 50.4 0.1 -

Hedges 50.3

Remeasurements - - 223.2 223.2 - 223.2

of pension

obligations

and related

fund assets

Changes in the - - 15.6 15.6 - 15.6

measurement of

companies

measured at

equity

Taxes - - - 53.6 - 53.6 - -

attributable 53.6

to other

comprehensive

income

Other - - 278.1 278.1 17.5 295.6

comprehensive

income

Total - - - 84.8 - 84.8 71.8 -

comprehensive 13.0

income

Balance as at 1,500.7 4,192.2 - 2,200. 644.6 2,845

31 Mar 2017 3,492.5 4 .0

Condensed cash flow statement of the TUI Group

EUR million Notes H1 2018 H1 2017

Cash outflow from (15) - 443.5 - 278.5

operating activities

Cash outflow from (15) - 261.2 - 695.1

investing activities

Cash outflow from (15) - 470.6 - 478.3

financing activities

Net change in cash and - 1,175.3 - 1,451.9

cash equivalents

Change in cash and - 2.4 - 14.3

cash equivalents due

to exchange rate

fluctuation

Cash and cash 2,516.1 2,403.6

equivalents at

beginning of period

Cash and cash 1,338.4 937.4

equivalents at end of

period

of which included in 0.3 314.1

the balance sheet as

assets held for sale

NOTES

General

The TUI Group, with its major subsidiaries and other shareholdings, operates

in the tourism business. TUI AG based in Hanover and Berlin, Germany, is TUI

Group's parent company and a listed corporation under German law. The shares

in the Company are traded on the London Stock Exchange and the Hanover and

Frankfurt Stock Exchanges.

The condensed interim consolidated financial statements of TUI AG and its

subsidiaries cover the period from 1

October 2017 to 31 March 2018. The interim consolidated financial statements

are prepared in euros. Unless stated otherwise, all amounts are stated in

million euros (EURm).

The interim consolidated financial statements were released for publication

by the Executive Board of TUI AG on 7 May 2018.

Accounting principles

Declaration of compliance

The interim consolidated financial statements for the period ended 31 March

2018 comprise condensed interim consolidated financial statements and an

interim Group management report in accordance with § 115 of the German

Securities Trading Act (WpHG).

The interim consolidated financial statements were prepared in conformity

with the International Financial Reporting Standards (IFRS) and the relevant

Interpretations of the International Accounting Standards Board (IASB) for

interim financial reporting applicable in the European Union.

In accordance with IAS 34, the Group's interim financial statements are

published in a condensed form compared with the consolidated annual financial

statements and should therefore be read in combination with TUI AG's

consolidated financial statements for financial year 2017. The interim

financial statements were reviewed by the Group's auditors.

Going concern report according to the UK Corporate Governance Code

TUI Group meets its day-to-day working capital requirements through cash in

hand, bank balances and loans from financial institutions. As at 31 March

2018, TUI Group's net debt position (financial liabilities less short-term

interest-bearing bank balances) totals EUR 576.0 m (as at 30 September 2017

net financial assets of EUR 583.0 m). The increase in net debt versus

year-end is driven by typical seasonal cash outflows, mainly within the tour

operator.

The Group's main financial liabilities and credit lines as at 31 March 2018

are:

· An external revolving credit facility worth EUR 1,535.0 m maturing in

July 2022 to manage the seasonality of the Group's cash flows and

liquidity,

· a bond 2016 / 21 with a nominal value of EUR 300.0 m issued by TUI AG,

maturing in October 2021,

· finance lease obligations worth EUR 1,294.5 m, and

· liabilities to banks of EUR 358.8 m, primarily due to loan obligations

from the acquisition of property, plant and equipment.

The granting of the credit line requires compliance with certain financial

covenants, which were fully complied with at the balance sheet date.

Due to the current economic factors and the political situation in some

destinations, there is some uncertainty over customer demand. TUI's Executive

Board assumes that TUI's business model is sufficiently flexible to offset

the challenges currently identifiable. The forecasts have shown that TUI

Group will continue to have sufficient funds available from borrowings and

operating cash flows in order to meet its payment obligations for the

foreseeable future and guarantee its ability to continue as a going concern.

In conformity with Rule C1.3 of the UK Corporate Governance Code, the

Executive Board confirms that it is appropriate to adopt the going concern

basis of accounting in preparing the consolidated financial statements.

Accounting and measurement methods

The preparation of the interim financial statements requires management to

make estimates and judgements that affect the reported amounts of assets,

liabilities and contingent liabilities as at the balance sheet date and the

reported amounts of turnover and expenses during the reporting period. Actual

results may deviate from the estimates.

The accounting and measurement methods adopted in the preparation of the

interim financial statements as at

31 March 2018 are materially consistent with those followed in preparing the

previous consolidated financial statements for the financial year ended 30

September 2017. The income taxes were recorded based on the best estimate of

the weighted average tax rate that is expected for the whole financial year.

Newly applied standards

Since the beginning of the financial year 2018 the following standards

amended or newly issued by the IASB have been applied by TUI for the first

time either mandatorily or voluntarily early:

New applied standards in financial year 2018

Applicable Amendments Impact on

Standard from financial

statements

IAS 7 1 Jan 2017 The No impact

Angabeninitiative amendments on interim

will enable reporting,

users of at year-end

financial additional

statements to disclosures

better

evaluate

changes in

liabilities

arising from

financing

activities.

An entity is

required to

disclose

additional

information

about

cashflows and

non-cash

changes in

liabilities,

for which

cashflows are

classified as

financing

activities in

the statement

of cashflows.

IAS 12 1 Jan 2017 The amendment No material

Recognition of clarifies the impact

Deferred Tax Assets accounting

for Unrealised Losses for deferred

tax assets

for

unrealised

losses from

available for

sale

financial

assets.

Various 1 Jan 2017/ The various No impact

Annual Improvements to 1 Jan 2018 amendments

IFRS (early from the

(2014 - 2016) adoption) annual

improvement

project

2014 - 2016

affect minor

changes to

IFRS 12, IAS

28 and IFRS

1.

Regarding the

amendments to

IAS 28 and

IFRS 1, TUI

has elected

to early

adopt the

changes

voluntarily.

Group of consolidated companies

The consolidated financial statements include all material subsidiaries over

which TUI AG has control. Control requires TUI AG to have decision-making

power over the relevant activities, be exposed to variable returns and have

entitlements regarding the returns, or have the ability to affect the level

of those variable returns through its decision-making power.

The interim financial statements as at 31 March 2018 comprised a total of 254

subsidiaries of TUI AG.

Development of the group of consolidated companies *

and the Group companies measured at equity

Consolidated Associates Joint

subsidiaries ventures

Balance at 30 Sep 259 13 28

2017

Additions 5 - 1

Incorporation 2 - -

Acquisition 3 - 1

Disposals 10 - -

Liquidation 8 - -

Sale 2 - -

Balance at 31 Mar 254 13 29

2018

* excl. TUI AG

Acquisitions - Divestments

Acquisitions

In H1 2018, three travel agencies were acquired in the form of asset deals.

Moreover, 100 % of the shares in Cruisetour AG, Zurich, Switzerland, as well

as Croisimonde AG, Zug, Switzerland, were acquired on 21 December 2017. The

aim of the acquisition is to increase market presence in the Cruises segment

in the Swiss market. The considerations transferred for all acquisitions by

TUI Group exclusively consist of purchase price payments, totalling EUR 6.9

m.

The difference arising between the considerations and the remeasured acquired

net assets as at the acquisition date of EUR 5.6 m was carried as provisional

goodwill. This goodwill essentially constitutes part of the future earnings

potential.

Statement of financial position of Cruisetour AG and

Croisimonde AG

as at the date of first-time consolidation

Fair value at date of first-time

consolidation

EUR million

Other intangible assets 0.1

Trade and other receivables 2.9

Cash and cash equivalents 2.5

Other provisions 0.1

Trade and other liabilities 4.7

Equity 0.7

Based on the information available, it was not possible to finalise

measurement of several components of the acquired assets and liabilities of

the acquisitions, in particular in connection with the acquisition of

Cruisetour AG and Croisimonde AG. Use was made of the 12-month period

permitted under IFRS 3 for the completion of the purchase price allocation,

which allows for a provisional purchase price allocation to the individual

assets and liabilities until the end of that period.

In the period from January 2018 to March 2018, Cruisetour AG and Croisimonde

AG generated a turnover of in total EUR 4.0 m and an immaterial profit

contribution. If the acquisition had occurred on 1 October 2017, consolidated

pro-forma revenue of the TUI Group would have been EUR 6.0 m higher and

profit after tax would have been EUR 0.3 m higher.

No material acquisitions were made after the balance sheet date.

In the reporting period, the purchase price allocations of Transat France

S.A. acquired in financial year 2017 were finalised within the 12-month

period stipulated by IFRS 3. Apart from an adjustment that decreased goodwill

by EUR 13.7 m, the figures in the consolidated statement of financial

position as at 31 March 2017 were retroactively adjusted as follows:

Impact of changes in purchase price allocations and

adjustments

on the consolidated statement of financial position

EUR million Fair value at Adjustment Fair values at

date of date of

acquisition first-time

(31 Mar 2017) consolidation

Other intangible 1.2 18.0 19.2

assets

Property, plant and 5.7 2.3 8.0

equipment

Investments - - -

Fixed assets 6.9 20.3 27.2

Trade receivables 6.1 12.6 18.7

Other assets 16.0 - 1.8 14.2

Cash and cash 11.2 6.5 17.7

equivalents

Deferred tax - 6.7 6.7

provisions

Other provisions 6.0 - 0.2 5.8

Other liabilities 56.8 16.7 73.5

Equity - 22.6 14.4 - 8.2

The adjustments made do not have an impact on the prior year's income

statement.

In addition, shares in German Tur Turizm Ticaret A.S. were acquired for a

purchase price of EUR 8.0 m.

Divestments

In the first half of 2018, two Riu Group hotel companies were divested. The

sale of Dominicanotel S.A., Puerto Plata, Dominican Republic, and Puerto

Plata Caribe Beach S.A., Puerto Plata, Dominican Republic, generated a profit

on disposal of EUR 24.3 m. This profit includes a partial disposal of Riu

Group's goodwill of EUR 5.2 m.

Notes to the consolidated income statement

TUI Group's results reflect the significant seasonal swing in tourism between

the winter and summer travel months. The Group seeks to counteract the

seasonal swing through a broad range of holiday offerings in the summer and

winter season and its presence in different travel markets worldwide with

varying annual cycles. The consolidated income statement reflects the

seasonality of the tourism business, with the consequence that the result

generated in the period from October to March is negative. Due to the

seasonality of the business, a comparison of the first half year's results

with the full-year results is not meaningful.

(1) Turnover

Turnover grew by 7.2 % year-on-year. Alongside an increase in customer

volumes in Sales & Marketing, the turnover growth versus H1 2017 was driven

by the additional capacity in the Cruises segment, higher average selling

prices in Hotels & Resorts and higher prices in the UK.

(2) Cost of sales and administrative expenses

Cost of sales represent the expenses incurred to deliver tourism services. In

addition to the expenses for staff costs, depreciation, amortisation, rent

and leasing, they include all costs incurred by the Group in connection with

the procurement and delivery of airline services, hotel accommodation and

cruises as well as distribution costs.

Administrative expenses comprise all expenses incurred in connection with the

performance of administrative functions and break down as follows:

Administrative expenes

EUR million H1 2018 H1 2017

Staff cost 362.0 355.1

Rental and leasing expenses 27.0 30.9

Depreciation, amortisation and impairment 37.9 35.1

Others 194.5 180.0

Total 621.4 601.1

The cost of sales and administrative expenses include the following expenses

for staff, depreciation / amortisation, rent and leasing:

Staff cost

EUR million H1 2018 H1 2017

Wages and salaries 941.1 900.1

Social security contributions, pension costs 217.5 214.2

and benefits

Total 1,158.6 1,114.3

Depreciation / amortisation / impairment

EUR million H1 2018 H1 2017

Depreciation and amortisation of 203.2 198.2

other intangible assets and

property, plant and equipment

Impairment of other intangible 4.8 -

assets and property, plant and

equipment

Total 208.0 198.2

Rental and leasing expenses

EUR million H1 2018 H1 2017

Rental and leasing expenses 349.5 383.3

Aircraft leasing expenses declined year-on-year, primarily due to foreign

exchange effects. Leasing expenses for cruise ships also declined versus the

prior year, in particular due to the expiry of a lease agreement at Marella

Cruises.

(3) Other income

In H1 2018, other income mainly resulted from the sale of two hotel companies

and one hotel. Additional income was generated from the sale of an aircraft.

(4) Share of result of joint ventures and associates

Share of result of joint ventures and associates

H1 2018 H1 2017

EUR million restated

Hotels & Resorts 44.5 42.8

Cruises 53.3 38.3

Destination Experiences 4.2 6.8

Holiday experiences 102.0 87.9

Northern Region 18.5 16.4

Central Region 0.7 1.2

Western Region 0.2 0.1

Sales and Marketing 19.4 17.7

All other segments 0.1 -

Total 121.5 105.6

The increase in income from joint ventures and associates in the Cruises

segment mainly results from the launch of Mein Schiff 6.

(5) Income taxes

The tax income arising in the reporting period is mainly driven by the

seasonality of the tourism business.

(6) Group loss attributable to non-controlling interest

The Group result attributable to non-controlling interest represents a

profit, which primarily relates to the RIUSA II Group with an amount of EUR

70.7 m (previous year EUR 54.3 m).

Notes to the financial position of the TUI Group

(7) Property, plant and equipment

Property, plant and equipment rose by EUR 147.4 m year-on-year to EUR 4,401.1

m. The increase is primarily attributable to the acquisition of aircraft

assets worth EUR 286.8 m, thereof two finance leased aircraft worth EUR 149.1

m, and investments in hotels of EUR 117.6 m, with an opposite effect

resulting from depreciation / amortisation for the first half of the year as

well as foreign currency translation.

(8) Assets held for sale

As at 31 March 2018, a hotel company was classified as a disposal group.

Moreover, an administrative building is held for sale.

(9) Pension provisions and similar obligations

Pension provisions declined by EUR 105.5 m to EUR 1,021.9 m versus the end of

the completed financial year. The decline is primarily driven by a decreasing

shortfall in coverage of the funded pension plans in the UK. Assets of these

funds rose as a result of contributions paid by the employer as well as a

good performance of the plan assets.

Pension plans with an excess of plan assets over funded obligations, carried

under trade receivables and other assets, are almost flat versus 30 September

2017 at EUR 56.0 m.

(10) Financial liabilities

Non-current financial liabilities rose by EUR 40.3 m to EUR 1,801.5 m as

against 30 September 2017. This was mainly driven by the increase in

liabilities from finance leases by EUR 64.6 m. An opposite trend was caused

by a reduction in liabilities to banks by EUR 24.9 m.

(11) Changes in equity

Equity decreased by EUR 540.5 m to EUR 2,993.2 overall versus 30 September

2017.

In H1 2018, TUI AG paid a dividend of EUR 0.65 per no-par value share, EUR

381.8 m in total (previous year EUR 368.6 m), to its shareholders.

The Group loss in the first half of the year is attributable to the

seasonality of the tourism business.

Gains and losses from effective cash flow hedges worth EUR 21.3 m (pre-tax)

are carried under other comprehensive income in equity outside profit and

loss (previous year EUR - 50.3 m).

The revaluation of pension obligations is also carried under other

comprehensive income in equity outside profit and loss.

(12) Financial instruments

Carrying amounts and fair values according to classes

and measurement categories as at 31 Mar 2018

Category under IAS

39

Carrying At At Fair Fair Values Carrying Fair value

amount amort cost value valu according amount of of

ised with e to IAS 17 financial financial

EUR million cost no thro (leases) instruments instruments

effec ugh

t on prof

profi it

t and and

loss loss

Assets

Financial 58.2 - 32.1 26.1 - - 58.2 58.2

assets

Available

for sale

Trade 1,171.5 867.6 - - - - 867.6 867.6

receivables

and other

assets

Derivative

financial

instruments

Hedging 355.8 - - 355.8 - - 355.8 355.8

transaction

s

Other 48.1 - - - 48.1 - 48.1 48.1

derivative

financial

instrument

s

Cash and 1,338.1 1,338 - - - - 1,338.1 1,338.1

cash .1

equivalents

Liabilities

Financial 1,977.8 683.3 - - - 1,294.5 683.3 696.3

liabilities

Trade 1,839.0 1,837 - - - - 1,837.4 1,837.4

payables .4

Derivative

financial

instruments

Hedging 304.4 - - 304.4 - - 304.4 304.4

transaction

s

Other 54.3 - - - 54.3 - 54.3 54.3

derivative

financial

instrument

s

Other 692.6 72.2 - - - - 72.2 72.2

liabilities

Carrying amounts and fair values according to classes

and measurement categories as at 30 Sep 2017

Category under IAS

39

Carrying At At Fair Fair Values Carrying Fair value

amount amort cost value valu according amount of of

ised with e to IAS 17 financial financial

EUR million cost no thro (leases) instruments instruments

effec ugh

t on prof

profi it

t and and

loss loss

Assets

Financial 69.5 - 43.5 26.0 - - 69.5 69.5

assets

Available

for sale

Trade 1,006.3 745.1 - - - - 745.1 745.1

receivables

and other

assets

Derivative

financial

instruments

Hedging 259.8 - - 259.8 - - 259.8 259.8

transaction

s

Other 35.5 - - - 35.5 - 35.5 35.5

derivative

financial

instrument

s

Cash and 2,516.1 2,516 - - - - 2,516.1 2,516.1

cash .1

equivalents

Liabilities

Financial 1,933.1 706.6 - - - 1,226.5 706.6 714.0

liabilities

Trade 2,653.3 2,652 - - - - 2,652.4 2,652.4

payables .4

Derivative

financial

instruments

Hedging 229.2 - - 229.2 - - 229.2 229.2

transaction

s

Other 38.4 - - - 38.4 - 38.4 38.4

derivative

financial

instrument

s

Other 748.2 95.2 - - - - 95.2 95.2

liabilities

Due to the short remaining terms of cash and cash equivalents, current trade

receivables and other assets, current trade payables and other liabilities,

the carrying amounts are taken as realistic estimates of the fair values.

The fair values of non-current trade receivables and other assets correspond

to the present values of the cash flows associated with the assets, using

current interest parameters which reflect market- and counterparty-related

changes in terms and expectations. There are no financial investments held to

maturity.

Financial instruments classified as financial assets available for sale

include an amount of EUR 32.1 m (previous year EUR 43.5 m) for interests in

partnerships and corporations for which no active market exists. The fair

values of these non-listed interests cannot be calculated by means of a

measurement model since their future cash flows cannot be reliably

determined. The investments are carried at cost. In the reporting period, and

also as at 30 September 2017, there were no material disposals of interests

in partnerships or corporations measured at cost. TUI does not intend to sell

or derecognise any significant interest in these partnerships or corporations

in the near future.

Aggregation according to measurement categories under IAS

39 as at 31 Mar 2018

At At cost Fair value Carrying Fair

amortise amount of value

d cost financial

instrume

nts

EUR with no through Total

million effect profit

on and loss

profit

and loss

Loans and 2,205.7 - - - 2,205.7 2,205.7

receivabl

es

Financial

assets

available - 32.1 26.1 - 58.2 58.2

for sale

held for - - - 48.1 48.1 48.1

trading

Financial

liabiliti

es

at 2,592.9 - - - 2,592.9 2,605.9

amortised

cost

held for - - - 54.3 54.3 54.3

trading

Aggregation according to measurement categories under IAS

39 as at 30 Sep 2017

At At cost Fair value Carrying Fair

amortise amount of value

d cost financial

instrume

nts

EUR with no through Total

million effect profit

on and loss

profit

and loss

Loans and 3,261.2 - - - 3,261.2 3,261.2

receivabl

es

Financial

assets

available - 43.5 26.0 - 69.5 69.5

for sale

held for - - - 35.5 35.5 35.5

trading

Financial

liabiliti

es

at 3,454.2 - - - 3,454.2 3,461.6

amortised

cost

held for - - - 38.4 38.4 38.4

trading

Fair value measurement

The following table presents the fair values of the recurring, non-recurring

and other financial instruments recognised at fair value in accordance with

the underlying measurement levels. The individual levels have been defined as

follows in line with the input factors:

· Level 1: quoted (unadjusted) prices in active markets for identical

assets or liabilities.

· Level 2: input factors for the measurement are quoted market price other

than those mentioned in Level 1, directly (as market price quotation) or

indirectly (derivable from market price quotation) observable in the market

for the asset or liability.

· Level 3: input factors for the measurement of the asset or liability are

based on non-observable market data.

Hierarchy of financial instruments measured at fair value as

at 31 Mar 2018