Warehouse REIT PLC Dividend details and Interim Accounts (3790F)

20 February 2018 - 9:03PM

UK Regulatory

TIDMWHR

RNS Number : 3790F

Warehouse REIT PLC

20 February 2018

20 February 2018

Warehouse REIT plc

(the 'Company' or 'Warehouse REIT')

Dividend details and Interim Accounts

Warehouse REIT plc on 30 January 2018 declared an interim

dividend of 1.0 pence per ordinary share in respect of the period

since the Company's Admission to trading on the London Stock

Exchange on 20 September 2017 to 31 December 2017. The 1.0 pence

per share dividend payment will be made on 9 March 2018 to

shareholders who were on the register as at 9 February 2018.

0.78 pence of this dividend will be paid as a Property Income

Distribution ("PID") and 0.22 pence will be paid as non-PID.

In addition and in accordance with section 838 of the Companies

Act 2006, Interim Accounts of the Company covering the period 1

August 2017 to 31 December 2017 have been prepared to support the

payment of an interim dividend to the Ordinary shareholders of the

Company on 9 March 2018.

The Interim Accounts of the Company have been filed with

Companies House and are also available upon request from the

Company Secretary.

Enquiries:

Warehouse REIT plc via FTI Consulting

Tilstone Partners Limited +44 (0) 1244

Andrew Bird, Peter Greenslade 470 090

G10 Capital Limited (part of the

Lawson Conner Group), acting as

AIFM +44 (0) 20

Agnese Soldane, Gerhard Grueter 3696 1302

Peel Hunt (Financial Adviser,

Nominated Adviser and Broker) +44 (0)20 7418

Capel Irwin, Edward Fox 8900

FTI Consulting (Financial PR &

IR Adviser to the Company)

Dido Laurimore, Ellie Sweeney, +44 (0) 20

Richard Gotla 3727 1000

Further information on Warehouse REIT is available on its

website:

http://www.warehousereitplc.co.uk

Notes to editors:

Warehouse REIT announced the results of its IPO on 15 September,

having raised gross proceeds of GBP150 million (GBP146.8 million

net) to invest in a diversified portfolio of UK warehouse assets

located in urban areas.

Occupier demand for urban warehouse space is increasing as the

structural growth in e-commerce has driven the rise in internet

shopping and investment by retailers in the "last mile" delivery

sector. The urban warehouse sector offers one of, if not the

highest, initial yield of all UK property sectors.

The Company is an alternative investment fund ("AIF") for the

purposes of the AIFM Directive and as such is required to have an

investment manager who is duly authorised to undertake the role of

an alternative investment fund manager. The Investment Manager is

currently G10 Capital Limited, whose role will pass to Tilstone

Partners Limited ("TPL"), on receipt of FCA approval.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DIVBBLFLVLFBBBF

(END) Dow Jones Newswires

February 20, 2018 05:03 ET (10:03 GMT)

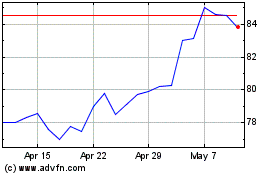

Warehouse Reit (LSE:WHR)

Historical Stock Chart

From Apr 2024 to May 2024

Warehouse Reit (LSE:WHR)

Historical Stock Chart

From May 2023 to May 2024