Fox Gets Boost From Sky Sale -- WSJ

07 February 2019 - 7:02PM

Dow Jones News

By Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 7, 2019).

21st Century Fox Inc.'s quarterly profit rose on gains for the

company's cable networks and movie business and the sale of shares

in Sky PLC.

The New York-based media company is in the midst of a major

overhaul, including the sale of its Hollywood studio and other

entertainment assets to Walt Disney Co. for $71 billion and its

stake in European content and distribution giant Sky.

21st Century Fox said on Wednesday that it has made significant

progress with the Disney transaction and its spinoff into a newly

named Fox Corp.

The company earned $10.82 billion, or $5.80 a share, in its

fiscal second quarter, up from $1.83 billion, or 99 cents a share,

a year earlier. The sale of the company's stake in Sky to Comcast

Corp. contributed $5.62 a share for the period ended Dec. 31.

It reported adjusted per-share earnings of 37 cents, down from

42 cents a year earlier but ahead of the estimate of 32 cents from

analysts polled by FactSet.

The company's cable business, which includes Fox News and Fox

Sports 1, booked $4.45 billion in revenue, up about 7% from a year

earlier and roughly in line with analysts' expectations. There had

been some concern that advertiser boycotts triggered by

controversial statements by Fox News personalities would hurt

revenue. The division's operating income rose 6.5%.

Sales for its filmed-entertainment unit, which produces for both

TV and movie screens, fell roughly 4%, but operating income for the

segment was up 47%, in part due to lower theatrical-release

costs.

In the U.S., advertising revenue for broadcast television rose

15%, largely on the back of sports on the Fox network, while the

unit's overall sales rose 19%. However, it reported an operating

loss stemming from increased spending on rights to air Thursday

Night Football games.

Overall revenue for the quarter increased about 6% to $8.49

billion.

When Disney completes its acquisition of the Fox entertainment

assets, the new Fox company will revolve around live programming,

especially news, on channels such as Fox News, and sports on the

FS1 Network.

21st Century Fox shares common ownership with News Corp, parent

company of The Wall Street Journal.

Corrections & Amplifications Analysts polled by FactSet

expected 21st Century Fox to earn 33 cents a share in the fourth

quarter. A previous version of this article incorrectly said

analysts expected 99 cents per share. (Feb. 6)

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

February 07, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

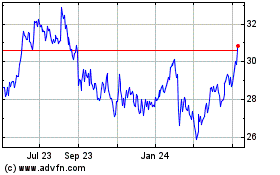

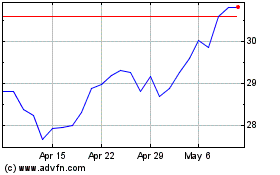

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024