Pound Retreats After BoE Decision

18 March 2021 - 9:03PM

RTTF2

The pound pulled back against its key counterparts in the

European session on Thursday, after the Bank of England kept its

benchmark rate and quantitative easing program unchanged.

The nine-member Monetary Policy Committee, headed by Governor

Andrew Bailey, voted to hold the interest rate at 0.10 percent and

the quantitative easing at GBP 895 billion in the latest policy

meeting.

All members of the MPC judged that the existing stance of

monetary policy remained appropriate.

The committee said it did not intend to tighten monetary policy

at least until there was clear evidence that significant progress

was being made in eliminating spare capacity and achieving the 2

percent inflation target sustainably.

If the outlook for inflation weakened, the committee stood ready

to take whatever additional action was necessary to achieve its

remit, the bank said.

The currency showed mixed trading against its major counterparts

in the Asian session. While it rose against the greenback and the

franc, it held steady against the euro. Versus the yen, it

fell.

The pound declined to 1.3914 against the greenback, after rising

to a 6-day high of 1.4001 at 3:00 am ET. The pair had finished

Wednesday's deals at 1.3959. The pound is poised to find support

around the 1.35 mark.

The pound eased off to 151.90 against the yen, from near a

3-year high of 152.55 seen at 4:00 am ET. On the downside, 149.00

is likely seen as the next support for the pound.

Reversing from more than a 1-year high of 0.8533 hit at 7:00 am

ET, the pound dropped back to 0.8572 against the euro. Next key

support for the pound is seen around the 0.88 level.

Data from Eurostat showed that the euro area trade surplus

decreased in January from the previous month on weak exports.

The trade surplus fell to a seasonally adjusted EUR 24.2 billion

from EUR 27.5 billion in December.

In contrast, the pound held steady against the franc, after

touching a 3-day peak of 1.2959 at 7:50 am ET. At Wednesday's

close, the pair was worth 1.2869.

Data from the Federal Customs Administration showed that

Switzerland's exports declined in February after rising in the

previous month.

Exports fell by a real 1.4 percent month-on-month in February,

after a 6.0 percent growth in January. In December, exports

decreased 6.1 percent.

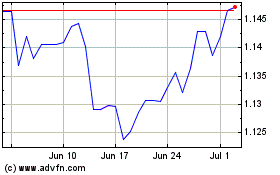

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024