Form 8-K - Current report

13 July 2024 - 4:38AM

Edgar (US Regulatory)

false

0001460602

0001460602

2024-07-10

2024-07-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 10, 2024

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada

|

|

001-38416

|

|

98-0583166

|

| (State

or other jurisdiction |

|

(Commission

|

|

(IRS

Employer |

| of

incorporation |

|

File

Number) |

|

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS

|

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

July 10, 2024, Orgenesis Inc. (the “Company”) entered into an Asset Purchase Agreement (the “Purchase Agreement”)

with Broaden Bioscience and Technology Corp. (“Broaden”) for the purchase by the Company of the following assets (the “Assets”):

The

process and algorithms developed by Broaden for processing CAR-T, RACE CAR-T and all related products that will enable the Company to

develop and sell treatments to third parties, which include Broaden’s rights, title and interests in and to all intellectual property,

including, but not limited to, patents, patent applications, know-how, materials, licenses, permits and approvals related thereto.

Pursuant

to the Purchase Agreement, in consideration for the purchase of the Assets, the Company will pay Broaden an amount equal to the value

of the Assets established by a third party valuation firm selected by the Company (the “Valuation”), not to exceed $11,000,000

(the “Consideration”), less a debt adjustment relating to the $10,767,298 owed to the Company by Broaden for work performed

and invoiced between August 2022 and May 2023 (the “Debt”), as detailed in the Purchase Agreement. The Consideration that

exceeds the Debt will be payable at the election of the Company in shares of the Company’s common stock at a price of $3.00 per

share or 10% above the market price at such time it is paid, whichever is higher, or a note with amortization in 24 months from the date

of the Purchase Agreement, including prepayment provisions.

Pursuant

to the Purchase Agreement, Broaden will concurrently contract with Orgenesis Maryland LLC, a wholly owned subsidiary of the Company,

to exclusively purchase for Broaden and/or its affiliates all of Broaden’s and/or its affiliates’ requirements for cell therapy

processing services related to the acquired Assets in perpetuity.

The

Purchase Agreement contains representations, warranties, and covenants of the parties that are customary for a transaction of this type.

The foregoing summary of the Purchase Agreement does not purport to be complete and is subject to and qualified in its entirety by the

Purchase Agreement attached as Exhibit 1.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item

2.01 Completion of Acquisition or Disposition of Assets

As

described in Item 1.01 of this Current Report on Form 8-K, on July 10 2024, the Company acquired the Assets pursuant to the Purchase

Agreement. The information set forth under Item 1.01 is incorporated into this Item 2.01 by reference.

Item

9.01. Financial Statements and Exhibits.

The

exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

*

Annexes, schedules and/or exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally

a copy of any omitted attachment to the SEC upon request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ORGENESIS

INC. |

| |

|

| Date:

July 11, 2024 |

By:

|

/s/

Victor Miller |

| |

|

Victor

Miller |

| |

|

Chief

Financial Officer, Treasurer and |

| |

|

Secretary

|

Exhibit

10.1

ASSET

PURCHASE AGREEMENT

(“Agreement”)

by

and between

Broaden

Bioscience and Technology Corp

and

Orgenesis, Inc.

effective

as of July 10, 2024

(“Effective

Date”)

Broaden

and Orgenesis intending to be legally bound, hereby agree as follows:

| Purchaser |

|

Orgenesis,

Inc. and / or any of its subsidiaries (“Orgenesis”)

|

| |

|

|

| Seller |

|

Broaden

Bioscience and Technology Corp (“Broaden”)

|

| |

|

|

| Asset

being sold or transferred |

|

Broaden

hereby sells and assigns to Orgenesis and Orgenesis hereby purchases from Broaden the Product referred to in Exhibit “A”

of this agreement (“Product” or “Assets”): |

| |

|

|

| Rights Under JVA |

|

In addition, Broaden hereby transfers and assigns to Orgenesis, free of charge,

all rights under that certain joint venture agreement entered between Orgenesis and Broaden, dated December 25, 2022 (“JVA”),

including without limitation, all rights for shares in the JV Entity (as defined in the JVA). |

| |

|

|

| Assignment |

|

Each

of Broaden, its affiliates and Mr. Bo Chen shall sign all documents and assignment and take all other actions reasonably requested by

Orgenesis to effectuate the transfer and assignment of all rights, title and interest in and to the Assets to Orgenesis. Without limiting

the generality of the foregoing, Broaden and Mr. Bo Chen executed and delivered to Orgenesis the Patent Assignment Agreement attached

hereto as Exhibit D. |

| |

|

|

| Consideration |

|

The

Assets will be valued by a 3rd party valuation firm selected by Orgenesis (“Valuation”) attached hereto

as EXHIBIT E. Orgenesis will pay Broaden for the value of the asset limited to a maximum of Eleven Million US Dollars $11,000,000

(“Consideration”) less any amount due to Orgenesis and/or any of its subsidiaries in respect of the amount of Ten Million

Seven Hundred and Sixty Seven Thousand Two Hundred and Ninety Eight US Dollars ($10,767,298.00 )(“Debt”) owed

to Orgenesis by Broaden related to work performed by Orgenesis and/or its subsidiaries on behalf of Broaden (and/or its affiliates)

and invoiced between August 2022 and May 2023, as detailed in Exhibit B attached hereto. For the amount of the Consideration

that exceeds the Debt, the remaining consideration will be paid by Orgenesis, at its election, either of Orgenesis stock at a price

of $3.00 per share or 10% above the market price at such time which paid, whichever is higher, or in a note payable with a bullet

amortization in 24 months from the date of the Effective Date of this Agreement and an Orgenesis right to prepayment of some or all

of the principal amount in one or multiple tranches without penalty. |

| Due

Diligence |

|

Broaden

will cooperate with the valuers conducting the Valuation such that the valuer can calculate a fair market value for the Asset. |

| |

|

|

| Exclusivity |

|

Broaden

will concurrently contract with Orgenesis’ subsidiary, Orgenesis Maryland LLC to purchase for Broaden and/or its affiliates

all of Broaden and/or its affiliates requirements for cell therapy processing services related to the acquired Assets, exclusively

from Orgenesis Maryland LLC, in perpetuity. |

| |

|

|

| Waiver

and Release |

|

Subject

to the consummation of the sale, assignment and transfer of the Assets by Broaden to Orgenesis and all other undertakings as set

forth herein, each of Orgenesis and Broaden on behalf of itself, its officers, subsidiaries, affiliated companies, successors and

assigns hereby remises, releases and forever discharges and covenants not to sue the other party, its successors, assigns, affiliated

companies and all employees, directors, officers and agents thereof, from any liability of any kind, whether direct or indirect,

foreseen or unforeseen, contingent or actual, present or future, and any claim, cause of action or demand made or to be made by the

other party or by any other person on behalf of the other Party, in respect of or arising out of the Assets, MSAs/SOWs, JVA and/or

any other agreement signed between the parties, and any representations or misrepresentations, deeds or misdeeds, conduct or misconduct

which may have been made or carried-out during any meetings, discussions, correspondence and any other form of exchange of information

and positions between the parties prior to the execution of this Agreement. |

| |

|

|

| Confidentiality;

Publicity |

|

Each

party hereto acknowledges and confirms that this Agreement and all terms hereof are confidential and, subject to applicable law,

that neither its existence nor the terms hereof will be disclosed to any other person other than parties’ officers, directors,

employees and advisors or potential investors under NDA, unless and to the extent required for fulfillment of any compliance, public

company disclosure requirements, legal and/or regulatory obligations. Confidentiality notwithstanding, either party may issue a press

release after sharing a draft with the other and acting in good faith to incorporate reasonable comments. |

| |

|

|

| Governing

Law |

|

This

Agreement shall be governed by the laws of the State of New York, without regard to its conflict of law provisions. |

| |

|

|

Binding

Agreement; Further Assurances;

|

|

Each

party represents and warrants to the other party that this Agreement is a legal and valid obligation binding upon such party and

is enforceable in accordance with its terms. This Agreement supersedes any prior agreements between the parties with respect to the

subject matter hereof, including, without limitation the Binding Term Sheet signed between the parties on March 25, 2024. The execution,

delivery and performance of this Agreement by such party does not conflict with any agreement, instrument or understanding, oral

or written, to which such Party is a party or by which such party may be bound, nor violate any law or regulation of any court, governmental

body or administrative or other agency having authority over such party. From time to time, at Orgenesis’ request and without

further consideration, Broaden shall execute and deliver such additional documents and take all such further action as may be reasonably

necessary or reasonably requested to effect the actions and consummate the transactions contemplated by this Agreement. |

| Broaden

Bioscience and Technology Corp |

|

Orgenesis

Inc |

| |

|

|

|

|

| by: |

|

|

by: |

|

| name: |

|

|

name: |

|

| title: |

|

|

title: |

|

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

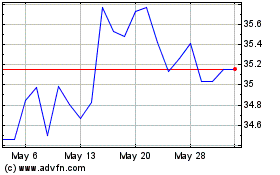

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Jul 2023 to Jul 2024