Caledonia Mining Corporation Plc (“Caledonia” or the

“Company”) (NYSE AMERICAN, AIM and VFEX: CMCL) today announces

that it has entered into an "At the Market" or "ATM" sales

agreement with Cantor Fitzgerald & Co (“Cantor”) (the “ATM

Sales Agreement”), pursuant to which the Company may, at its

discretion from time to time, sell up to US$50,000,000 worth of

shares (the “ATM Offering”). Any sales of shares would occur by

means of ordinary brokers’ transactions or block trades, with sales

only being made on the NYSE American at market prices. Caledonia

expects to use the amount of any net proceeds from the sales for

investment in the development of the Bilboes sulphide project.

In connection with the ATM Offering, yesterday

Caledonia filed a technical report summary titled “Bilboes Gold

Project Technical Report Summary”, prepared for Caledonia by DRA

Projects (Pty) Ltd (“DRA”), in accordance with Subpart 1300 and

Item 601(b)(96) of Regulation S-K (“S-K 1300”), as adopted by the

United States Securities and Exchange Commission.

DRA previously issued an S-K 1300

pre-feasibility study for the project entitled “Bilboes Gold

Project Technical Report Study”, with an issue date of May 15, 2024

and an effective date of December 31, 2023. On June 3, 2024,

Caledonia published a new technical report for Bilboes, which

superseded prior technical reports and technical report summaries

for Bilboes. The new Bilboes technical report was a preliminary

economic assessment prepared in accordance with Canada’s National

Instrument 43-101 and did not comply with S-K 1300.

The purpose of the technical report summary

filed yesterday is to report mineral resources for the project in

accordance with S-K 1300, to present the results of an initial

assessment for the implementation of open pit mining to recover the

gold mineralization and to propose additional work required for

feasibility level studies. The effective date of the technical

report summary, being May 30, 2024, and the amounts of mineral

resources reported are identical to those reported in the

preliminary economic assessment.

The Company intends to publish a new feasibility

study for the project in the first quarter of 2025.

Cantor, acting as

sales agent, may conduct sales for the benefit of the Company

should the Company elect to initiate a transaction or transactions,

dependent on market conditions and such other terms as the Company

may specify. The ATM Sales Agreement is not a formal placing and

any potential sales of new shares are not underwritten by the sales

agent.

Accordingly, an

application has been made to AIM for a block admission in respect

of 4,000,000 new depositary interests representing the same number

of shares in the share capital of the Company which will rank pari

passu with the existing shares in issue. It is expected that the

block admission will become effective on or about December 18,

2024. These new shares will be issued and allotted from

time to time to settle any sales conducted under the ATM Sales

Agreement.

Following admission,

the Company's issued share capital remains unchanged at 19,214,554.

The Company will make six-monthly announcements of the utilisation

of the block admission, in line with its obligations under AIM Rule

29.

A prospectus

supplement, (the “Prospectus Supplement”) to the Company’s base

shelf prospectus (the “Base Shelf Prospectus”), will be filed with

the United States Securities and Exchange Commission (the “SEC”) as

part of the Company’s registration statement on Form F-3 (the

“Registration Statement”). The Prospectus Supplement, the Base

Shelf Prospectus and the Registration Statement contain important

detailed information about the Company and the ATM Offering.

Prospective investors should read the Prospectus Supplement, the

Base Shelf Prospectus and the Registration Statement and the other

documents the Company has filed for more complete information about

the Company and the ATM Offering before making an investment

decision. Investors may obtain copies of the Prospectus Supplement

by visiting the SEC’s website at www.sec.gov.

Enquiries:

|

Caledonia Mining Corporation PlcMark

LearmonthCamilla Horsfall |

Tel: +44 1534 679 800Tel:

+44 7817 841 793 |

|

|

|

| Cavendish Capital Markets

Limited (Nomad and Joint Broker)Adrian Hadden Pearl

Kellie |

Tel: +44 20 7397 1965Tel:

+44 131 220 9775 |

| |

|

| Panmure Liberum Limited

(Joint Broker)Scott MathiesonMatt Hogg |

Tel: +44 20 3100 2000 |

| |

|

| Camarco, Financial PR

(UK)Gordon PooleJulia TilleyElfie Kent |

Tel: +44 20 3757 4980 |

| |

|

| 3PPB (Financial PR, North

America)Patrick ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1

203 940 2538 |

| |

|

| Curate Public Relations

(Zimbabwe)Debra Tatenda |

Tel: +263 77802131 |

| |

|

| IH Securities (Private)

Limited (VFEX Sponsor - Zimbabwe)Lloyd Mlotshwa |

Tel: +263 (242) 745

119/33/39 |

Note: This announcement contains inside

information which is disclosed in accordance with the Market Abuse

Regulation (EU) No. 596/2014

(“MAR”)

as it forms part of UK domestic law by virtue of the

European Union (Withdrawal) Act 2018 and is disclosed in accordance

with the Company's obligations under Article 17 of

MAR.

Cautionary Note Concerning

Forward-Looking InformationInformation and statements

contained in this news release that are not historical facts are

“forward-looking information” within the meaning of applicable

securities legislation that involve risks and uncertainties

relating, but not limited, to Caledonia’s current expectations,

intentions, plans, and beliefs. Forward-looking information can

often be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “target”, “intend”,

“estimate”, “could”, “should”, “may” and “will” or the negative of

these terms or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions

or statements about future events or performance. Examples of

forward-looking information in this news release include: filing of

a prospectus supplement, potential sales of shares, development of

the Bilboes sulphide project and the application of the proceeds to

that project. This forward-looking information is based, in part,

on assumptions and factors that may change or prove to be

incorrect, thus causing actual results, performance or achievements

to be materially different from those expressed or implied by

forward-looking information. Such factors and assumptions include,

but are not limited to: failure to sell any shares or raise other

finance, establish estimated resources and reserves, the grade and

recovery of ore which is mined varying from estimates, success of

future exploration and drilling programs, reliability of drilling,

sampling and assay data, assumptions regarding the

representativeness of mineralization being inaccurate, success of

planned metallurgical test-work, capital and operating costs

varying significantly from estimates, delays in obtaining or

failures to obtain required governmental, environmental or other

project approvals, inflation, changes in exchange rates,

fluctuations in commodity prices, delays in the development of

projects and other factors.

Security holders, potential security holders and

other prospective investors should be aware that these statements

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those suggested by the forward-looking statements. Such factors

include, but are not limited to: risks relating to estimates of

mineral reserves and mineral resources proving to be inaccurate,

failure to sell shares or raise other finance to develop the

Bilboes sulphide project, fluctuations in gold price, risks and

hazards associated with the business of mineral exploration,

development and mining, risks relating to the credit worthiness or

financial condition of suppliers, refiners and other parties with

whom the Company does business; inadequate insurance, or inability

to obtain insurance, to cover these risks and hazards, employee

relations; relationships with and claims by local communities and

indigenous populations; political risk; risks related to natural

disasters, terrorism, civil unrest, public health concerns

(including health epidemics or outbreaks of communicable diseases

such as the coronavirus (COVID-19)); availability and increasing

costs associated with mining inputs and labour; the speculative

nature of mineral exploration and development, including the risks

of obtaining or maintaining necessary licenses and permits,

diminishing quantities or grades of mineral reserves as mining

occurs; global financial condition, the actual results of current

exploration activities, changes to conclusions of economic

evaluations, and changes in project parameters to deal with

unanticipated economic or other factors, risks of increased capital

and operating costs, environmental, safety or regulatory risks,

expropriation, the Company’s title to properties including

ownership thereof, increased competition in the mining industry for

properties, equipment, qualified personnel and their costs, risks

relating to the uncertainty of timing of events including targeted

production rate increase and currency fluctuations. Security

holders, potential security holders and other prospective investors

are cautioned not to place undue reliance on forward-looking

information. By its nature, forward-looking information involves

numerous assumptions, inherent risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and various future events will

not occur. Caledonia undertakes no obligation to update publicly or

otherwise revise any forward-looking information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law.

This news release is not an offer of the shares

of Caledonia for sale in the United States or elsewhere. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the shares of

Caledonia, in any province, state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such province, state

or jurisdiction.

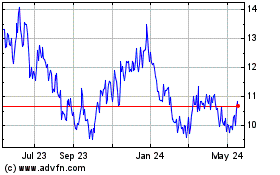

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Nov 2024 to Dec 2024

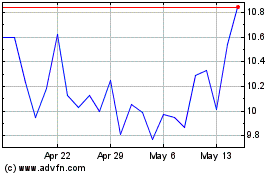

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Dec 2023 to Dec 2024