Three Micro Cap ETFs To Play The January Effect - Best Performing ETFs

03 January 2012 - 10:01PM

Zacks

With 2011 turning out to be a mixed year to say the least for

the markets, many investors are eagerly looking forward to the new

year and (hopefully) better returns in the equity world. Luckily

for investors, January is usually a pretty strong month for stocks,

suggesting that many could see large gains to start the year if

historical trends hold true once again. This is largely due to what

is popularly known as the ‘January Effect’.

This idea states that stock prices generally have a rough or

so-so December and then surge higher in January thanks to investors

redeploying their capital. This phenomenon could be due to several

reasons, many of which are based on how investors behave around the

end of the year. Primarily, tax-loss selling in December can often

push down stock prices in the month as investors sell some of their

losers in order to harvest losses come tax time. These investors

then wait until the new year to put the money to work in the

market, boosting prices in turn. This effect can be especially

potent for small cap stocks as this asset class has a history of

starting off the year on a high note (read ETFs vs. Mutual

Funds).

However, thanks to widespread knowledge of the phenomenon, the

impact of this has been muted in recent years while the shift to

long-term retirement plans—which have no need for end of year tax

selling—has also reduced the effect across the market. Fortunately,

the effect still can live on in some corners of the market and

especially so in the smallest of the small, the micro cap ETF world

(read Three Outperforming Active ETFs).

These securities have proven to exceed their large cap brethren

primarily in January and not so much in the rest of the year. In

fact, recent research suggests that bottom decile of stocks by

market cap have outperformed the largest tenth by 700 basis points

in January but have matched the return of the space in the rest of

the year. This suggests that January is truly the time to get in on

micro cap securities, assuming that these historical figures hold

true this year as well. Should this be the case, investors should

take a closer look at some of the micro cap ETFs on the market

which could offer up excellent exposure to this potentially potent

stock market anomaly:

iShares Russell Micro Cap Index Fund (IWC)

This ETF tracks the Russell Microcap Index which is a benchmark

that consists of ultra small companies based in the U.S. The

average market capitalization of the fund is just under a quarter

billion while just 4% of assets are classified as small caps as

opposed to micro cap securities. The fund currently consists of

close to 1,400 securities and it puts just 3.3% of assets to the

top ten holdings. Financials take the top spot from a sector

perspective at close to 27.2% while health care (17.4%) and

technology (13.7%) round out the top three. The fund lost 10.4%

last year but has rebounded strongly over the past three months

gaining 14.1% in the period (read Three Low Beta Sector ETFs).

First Trust Dow Jones Select Micro Cap Index Fund (FDM)

This fund from Illinois-based First Trust tracks the Dow Jones

Select Microcap index which follows firms that are in the bottom

two deciles of NYSE stocks. The managers also look to take a more

‘active’ approach in their security selection process, picking

firms based on market capitalization, trading volume, and financial

indicators that include trailing price/earnings ratio, trailing

price/sales ratio, per-share profit change for the previous

quarter, operating profit margin and six-month total return. As a

result, the fund has far fewer securities than its counterparts on

the list with just 239 firms in total (see Avoid Turmoil With The

Community Bank ETF).

Nevertheless, the fund still has a heavy concentration in

financials (24.1%) while industrials (20.5%) and technology (14.7%)

firms round out the top three sectors. However, FDM does have a

heavier concentration in its top ten holdings putting 7.8% of the

total assets in this group and it does have a high turnover level

with the rate coming in at 86% on a yearly basis. Thanks in part to

this, the fund has lost less than IWC in 2011, falling by 8.9% over

the course of the year. Yet, the product also has surged higher in

the past three months as well, gaining 17.7% over that smaller time

period.

Wilshire Micro Cap ETF (WMCR)

The last entrant on the list comes from Guggenheim and its WMCR

which tracks the Wilshire Micro Cap Index. With this benchmark, the

fund tracks close to 830 securities and has the lowest expense

ratio of the group coming in at 50 basis points a year. The fund

puts 7.2% of its assets in the top ten holdings and has just 1.6%

of the assets outside of the micro cap space. This fund also has a

heavy concentration in financials (23.7%), although health care and

tech combine to make up another 35% of the portfolio as well. In

terms of performance, the fund has underperformed despite its lower

cost; losing 20.4% on the year and gaining just 4.7% in the past

three month period (see Three Worst Performing ETFs of 2011).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

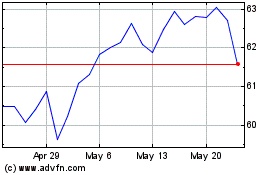

First Trust Dow Jones Se... (AMEX:FDM)

Historical Stock Chart

From Dec 2024 to Jan 2025

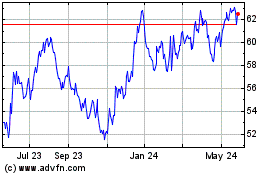

First Trust Dow Jones Se... (AMEX:FDM)

Historical Stock Chart

From Jan 2024 to Jan 2025