Filed pursuant to Rule 424(b)(5)

Registration No. 333-252513

The information in this preliminary prospectus

supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying

prospectus are not an offer to sell these securities, and they are not soliciting an offer to buy these securities in any jurisdiction

where the offer or sale thereof is not permitted.

SUBJECT TO COMPLETION, DATED JULY 25, 2023

PROSPECTUS SUPPLEMENT

(To prospectus dated January 28, 2021)

Shares

Common Stock

B. Riley Financial, Inc.

is offering shares of our common stock, pursuant to this prospectus supplement

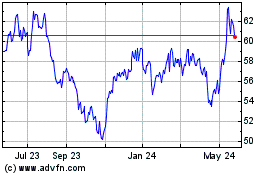

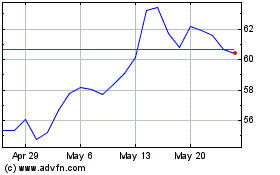

and the accompanying prospectus. Our common stock is traded on the NASDAQ Global Market under the symbol “RILY.” On July 24,

2023, the last reported sale price of our common stock on the NASDAQ Global Market was $58.54 per share.

Co-Chief Executive Officers Bryant

R. Riley and Tom Kelleher have indicated an interest to purchase, in the aggregate, up to $4.5 million of shares of common stock in this

offering at the public offering price. Certain of our officers, directors and employees may also elect to participate in this offering.

The underwriter could determine to sell fewer shares to them than they indicated an interest in purchasing or sell no shares to them,

and they could determine to purchase fewer shares than they indicated an interest in purchasing or purchase no shares in this offering.

The underwriter will receive the same underwriting discount on any shares purchased by them as they will on any other shares sold to the

public in this offering.

Investing in our common

stock involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” beginning on

page S-11 of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement and the accompanying

prospectus.

Neither the U.S. Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | | | |

$ | | |

| Underwriting discount(1) | |

$ | | | |

$ | | |

| Proceeds, before expenses, to us(2) | |

$ | | | |

$ | | |

| (1) | See “Underwriting (Conflicts of Interest)” for

a description of all underwriting compensation payable in connection with this offering. |

| (2) | Assumes no exercise of the underwriter’s option described

below. |

We have granted the underwriter

an option to purchase up to an additional shares of our common stock within

30 days from the date of this prospectus supplement.

The underwriter expects to

deliver the shares to purchasers on or about July , 2023.

B.

Riley Securities

The date of this prospectus supplement is

, 2023.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”)

utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, including

the documents incorporated by reference, which describes the specific terms of this offering. The second part, the accompanying prospectus,

including the documents incorporated by reference, provides more general information. Generally, when we refer to this prospectus, we

are referring to both parts of this document combined. We urge you to carefully read this prospectus supplement and the accompanying prospectus,

and the documents incorporated by reference herein and therein, before buying any of the securities being offered under this prospectus

supplement. This prospectus supplement may add or update information contained in the accompanying prospectus and the documents incorporated

by reference therein. To the extent that any statement we make in this prospectus supplement is inconsistent with statements made in the

accompanying prospectus or any documents incorporated by reference therein that were filed before the date of this prospectus supplement,

the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and

such documents incorporated by reference therein.

You should rely only on the

information contained in this prospectus supplement and the accompanying prospectus, or incorporated by reference herein or therein. Neither

we nor the underwriter have authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized

to give any information or to represent anything not contained in this prospectus supplement and the accompanying prospectus. You should

not rely on any unauthorized information or representation. This prospectus supplement is an offer to sell only the securities offered

hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this

prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of the applicable document and that

any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless

of the date of delivery of this prospectus supplement or the accompanying prospectus, or any sale of a security.

As used in this prospectus,

unless the context indicates or otherwise requires, “the Company,” “B. Riley,” “we,” “us”

or “our” refer to the combined business of B. Riley Financial, Inc. and its consolidated subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement,

the accompanying prospectus and the documents incorporated by reference herein and therein contain forward-looking statements within the

meaning of Section 27A of the Securities Act, as amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). These statements involve known and unknown risks, uncertainties

and other important factors that may cause our actual results, performance or achievements to be materially different from any future

results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include,

but are not limited to, statements relating to our future financial performance, the growth of the market for our services, expansion

plans and opportunities and statements regarding our intended uses of the proceeds of the securities offered hereby. In some cases, you

can identify forward-looking statements by terminology such as “anticipates,” “believes,” “can,” “continue,”

“could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “should,” “will,” “would,” the negative of such terms or other comparable

terminology. The statements we make regarding the following subject matters are forward-looking by their nature: plans, objectives, expectations

and intentions and other factors discussed in “Risk Factors” contained in this prospectus.

The forward-looking statements

contained in this prospectus supplement reflect our current views about future events, are based on assumptions, and are subject to known

and unknown risks and uncertainties. Many important factors could cause actual results or achievements to differ materially from any future

results or achievements expressed in or implied by our forward-looking statements, including the factors listed below. Many of the factors

that will determine future events or achievements are beyond our ability to control or predict. Certain of these are important factors

that could cause actual results or achievements to differ materially from the results or achievements reflected in our forward-looking

statements, including, but not limited to:

| ● | volatility in our revenues and results of operations; |

| ● | changing financial markets and general economic conditions,

including increasing inflation and a rising interest rate environment; |

| ● | our exposure to legal liability and potential for substantial

damages; |

| ● | increasing scrutiny on financial services firms which increases

the risk of financial liability and reputational harm resulting from adverse regulatory actions; |

| ● | the restatement of

our previously issued financial statements, the error that resulted in such restatement, the material weaknesses that were identified

in our internal control over financial reporting and the determination that our internal control over financial reporting and disclosure

controls and procedures were not effective, could result in loss of investor confidence, shareholder litigation or governmental proceedings

or investigations, any of which could cause the market value of our securities to decline or impact our ability to access the capital

markets; |

| ● | our failure to maintain

effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act which could have a material

adverse effect on our financial condition, results of operations and business and the price of our common stock and other securities; |

| ● | additional risks and uncertainties for our business as a

result of entering into new lines of business, making strategic investments or acquisitions or entering into joint ventures; |

| ● | the short term and singular nature of our engagements; |

| ● | our investments in relatively high-risk, illiquid assets

that often have significantly leveraged capital structures may result in a failure to realize any profit or little profit for a considerable

period of time or cause us to lose some or all of the principal amount we invest in these activities; |

| ● | our exposure to credit risk from a variety of activities,

including loans, lines of credit, guarantees and backstop commitments and the potential to not fully realize the value of the collateral

securing certain of our loans; |

| ● | our cash-flow dependence on payments from our investments

in receivables; |

| ● | the accuracy of our estimates and valuations, as well as

potential losses from, inventory or assets in “guarantee” based engagements; |

| ● | the potential loss of financial institution clients; |

| ● | poor investment performance that may decrease assets under

management and reduce revenues from and the profitability of our asset management business; |

| ● | failure to innovate and develop new products in our consumer

business in a timely and cost-efficient manner for its new and existing product categories; |

| ● | potential losses if supply were delayed or constrained or

if there were shortages of required components for our consumer business; |

| ● | failure of our licensees to sell products that generate royalties

to us, to pay us royalties pursuant to their license agreement with us, or to renew these agreements; |

| ● | competition in highly competitive industries; |

| ● | our information may be compromised, and we may be exposed

to liability as a result of security breaches and other disruptions; |

| ● | failure to protect our proprietary rights or need to defend

ourselves against claims of infringement; |

| ● | anti-takeover provisions under our charter documents and

Delaware law that could delay or prevent a change of control or limit the market price of our stock; |

| ● | our existing stockholders exerting control over us and our

significant corporate decisions; |

| ● | the volatility of our common stock; |

| ● | our inability to pay dividends regularly or at all in the

future; |

| ● | the level of indebtedness, and restrictions under such indebtedness

that could adversely impact our operations and liquidity; |

| ● | an increase in market interest rates that could decrease

the value of our senior notes and increase our future borrowing costs; |

| ● | our ability to realize the benefits of our completed acquisitions,

including our ability to achieve anticipated opportunities and operating cost savings, and accretion to reported earnings estimated to

result from completed and proposed acquisitions in the time frame expected by management or at all; |

| ● | the diversion of management time on acquisition-related issues;

and |

| ● | the effect of geopolitical instability, including wars, conflicts

and terrorist attacks, including the impacts of Russia’s invasion of Ukraine. |

The forward-looking statements

contained in this prospectus supplement reflect our views and assumptions only as of the date of this prospectus supplement. You should

not place undue reliance on forward-looking statements. Except as required by law, we assume no responsibility for updating any forward-looking

statements nor do we intend to do so. Our actual results, performance or achievements could differ materially from the results expressed

in, or implied by, these forward-looking statements. The risks included in this section are not exhaustive. Additional factors that could

cause actual results to differ materially from those described in the forward-looking statements are set forth in the section entitled

“Risk Factors” beginning on page S-11.

PROSPECTUS SUPPLEMENT SUMMARY

This summary is not complete

and does not contain all of the information that you should consider before investing in the securities offered by this prospectus supplement

and accompanying prospectus. You should read this summary together with the entire prospectus supplement and the accompanying prospectus,

including our financial statements, the notes to those financial statements and the other documents that are incorporated by reference

in this prospectus supplement and the accompanying prospectus, before making an investment decision. See “Risk Factors” beginning

on page S-11 of this prospectus supplement for a discussion of the risks involved in investing in our securities.

Our Business

B. Riley Financial, Inc. (NASDAQ:

RILY) is a diversified financial services platform that delivers tailored solutions to meet the strategic, operational, and capital needs

of its clients and partners. We operate through several consolidated subsidiaries that provide investment banking, brokerage, wealth management,

asset management, direct lending, business advisory, valuation, and asset disposition services to a broad client base spanning public

and private companies, financial sponsors, investors, financial institutions, legal and professional services firms, and individuals.

The

Company opportunistically invests in and acquires companies or assets with attractive risk-adjusted return profiles to benefit our shareholders.

We own and operate several uncorrelated consumer businesses and invest in brands on a principal basis. Our approach is focused on high

quality companies and assets in industries in which we have extensive knowledge and can benefit from our experience to make operational

improvements and maximize free cash flow. Our principal investments often leverage the financial, restructuring, and operational expertise

of our professionals who work collaboratively across disciplines.

We refer to B. Riley as a “platform”

because of the unique composition of our business. Our platform has grown considerably and become more diversified over the past several

years. We have increased our market share and expanded the depth and breadth of our businesses both organically and through opportunistic

acquisitions. Our increasingly diversified platform enables us to invest opportunistically and to deliver strong long-term investment

performance throughout a range of economic cycles.

Our platform is comprised of

more than 2,615 affiliated professionals, including employees and independent contractors. We are headquartered in Los Angeles, California

and maintain offices throughout the U.S. including in New York, Chicago, Metro District of Columbia, Atlanta, Boston, Dallas, Metro Detroit,

Houston, Memphis, Miami, San Francisco, Boca Raton, and West Palm Beach.

Our major operating subsidiaries

include B. Riley Securities, Inc., a full-service middle market investment bank and institutional broker-dealer; B. Riley Wealth Management,

Inc., a national boutique wealth management firm and retail broker-dealer; B. Riley Advisory Services, Inc., a specialty business advisory

and valuation services firm; and B. Riley Retail Solutions, Inc., a retail liquidation and asset disposition firm.

B. Riley was founded in 1997

by our Co-Chief Executive Officers Bryant Riley and Tom Kelleher, incorporated in Delaware in 2009, and became publicly listed through

its strategic combination with Great American Group, LLC in 2014.

Our Business Segments

We

report our activities in six reportable business segments: Capital Markets, Wealth Management, Financial Consulting, Auction and Liquidation,

Communications, and Consumer segment. The descriptions below illustrate the businesses that comprise our segments.

Capital Markets Segment.

We provide investment banking and institutional brokerage services to publicly traded and privately held companies, institutional investors,

and financial sponsors; fund and asset management services to institutional and high-net-worth individual investors; and direct lending

services to middle market companies.

In addition, we trade equity

securities as a principal for our account, including investments in funds managed by our subsidiaries. We maintain an investment portfolio

comprised of public and private equities and debt securities. We also opportunistically provide loans to our clients. Our investment approach

is value-oriented and represents a core competency of our capital markets strategy. We act as an advisor to our clients, which at times

involves complex transactions consistent with our value-oriented investment philosophy. We often provide consulting, capital raising,

or investment banking services for companies in which B. Riley may have significant influence through equity ownership, representation

on the board of directors (or similar governing body), or both.

Investment Banking.

We provide a full suite of capital markets and financial advisory services for small- and mid-cap companies and issuers and middle market

financial sponsors, as well as larger companies in industries where we have particular expertise.

Our equity capital markets

team provides an array of financing and sector-specific corporate finance solutions focused on the execution of public and private equity

offerings. We source, structure, price and allocate underwritten public offerings and private placements spanning initial public offerings,

secondary and follow-on offerings, at-the-market offerings, Rule 144A offerings (pre-public private placements), block trades, and corporate

equity repurchase programs.

Our debt capital markets

capabilities include the structuring and sourcing of debt financing solutions in public and private capital markets including acting as

an underwriter of preferred stock and unsecured notes offerings, convertible and mezzanine debt offerings, and leveraged loans. In addition,

we raise capital for private credit and private equity funds focused on the middle market.

Our investment banking advisory

professionals blend deep industry and transaction expertise to execute financial transactions for healthy companies pursuing growth, and

for stakeholders of financially distressed companies, both in bankruptcy proceedings and out-of-court transactions. We provide financial

advisory and execution services in support of mergers & acquisitions, restructuring, and recapitalization.

Equity Research. We

are widely recognized for our proprietary and thematic approach to equity research. Our research primarily focuses on small- and mid-cap

equities that are under-followed by Wall Street. We maintain research coverage for a variety of companies and industry sectors, focused

on in-depth analyses of earnings, cash flow, balance sheet strength, and industry outlook involving extensive discussions with key management,

competitors, channel partners, and customers.

Institutional Sales and

Trading. Our institutional equity sales and trading team distributes our proprietary equity research products and communicates our

investment recommendations to our client base of institutional investors, executes equity trades on behalf of clients, sells the securities

of companies for which we act as an underwriter, and makes a market in over 1,000 securities. We maintain active trading relationships

with over 1,000 institutional money managers.

Securities Lending.

We engage in securities-based lending which involves the borrowing and lending of equity and fixed income securities.

Proprietary Trading.

We also engage in proprietary trading for strategic investment purposes and to facilitate the execution of client transactions by utilizing

the firm’s capital.

Fund Management and Asset

Management. We manage private funds and funds of funds. Our managed funds invest in both public and private equities and debt securities,

often leveraging the insight, expertise, and resources of our affiliates. Assets under management (“AUM”) for this

business totaled over $330.0 million as of December 31, 2022.

Direct Lending. Certain

of our affiliates originate and underwrite senior secured loans, second lien secured loan facilities, and unsecured loans to asset-rich

middle market public and private U.S. companies. We periodically participate in loans and financing arrangements for entities in which

the Company has an equity ownership and representation on the board of directors (or similar governing body). B. Riley may also provide

consulting services or investment banking services to raise capital for these companies.

Investing. Part of

our overall strategy includes identifying attractive investment opportunities where we may seek to control or influence the operations

of the companies in which we invest in order to deliver financial and operational improvements designed to maximize free cash flow and,

therefore, returns to our shareholders. Our team concentrates on opportunities presented by distressed companies or divisions that exhibit

challenging market dynamics. Representative transactions include acquisitions of receivable portfolios, recapitalizations, direct equity

investments, debt investments, active minority investments, and buyouts.

Venture Capital. We

invest in late-stage private growth companies with a path towards public markets. We participate in rounds by allocating between $1.0-10.0

million as part of a larger round (Series B, C, or D), with an investment horizon targeting 2-3x returns over two to three years. We are

not a venture fund; investments are made off-balance sheet and syndicated across B. Riley’s investment banking, institutional, and

high-net-worth individual client base.

Wealth Management Segment.

We provide retail brokerage, investment management, and insurance, and tax preparation services to individuals and families, small businesses,

non-profits, trusts, foundations, endowments, and qualified retirement plans through a boutique private wealth and investment management

firm to meet the individual financial needs and goals of our customers.

Our experienced financial

advisors provide investment management, retirement planning, education planning, wealth transfer and trust coordination, and lending and

liquidity solutions. Our investment strategists provide strategies and real-time market views and commentary to help our clients make

important and informed financial and investment decisions. AUM in our wealth management segment totaled approximately $23.9 billion as

of December 31, 2022.

Financial Consulting

Segment. We provide a variety of specialized advisory services spanning bankruptcy, restructuring, turnaround management,

forensic accounting, crisis and litigation support, appraisal and valuation, real estate, and operations management.

Our financial consulting

clients include companies, financial institutions, lenders, financial sponsors, boards of directors, shareholders, creditors, government

agencies, municipalities, regulatory agencies, and legal and professional services firms.

Bankruptcy Restructuring

and Turnaround Management. Professionals in our bankruptcy restructuring and turnaround management group provide restructuring advisory

services spanning strategic and operational advisory, turnaround management, Chief Restructuring Officer and interim management, and fiduciary

and receivership services. We are often engaged to represent debtors, creditors, committees and lenders in out-of-court restructuring

and formal bankruptcy court proceedings. We also act as court-appointed fiduciaries and trustees in chapter 11 and chapter 7 bankruptcy

proceedings.

Forensic Accounting and

Litigation Support. Our services support highly complex, sensitive matters spanning antitrust, competition and class action lawsuits,

commercial litigation and construction disputes, valuation disputes, fraud, and internal investigations. We are often called on to assist

government agencies such as the Securities and Exchange Commission, Department of Justice, and various state and municipalities

to investigate allegations and provide expert analyses related to lost profits and financial damages, data analytics, and to provide expert

witness testimony in court proceedings.

Valuation and

Appraisal. We are primarily engaged by major lending institutions, private equity firms, and other providers of capital for

valuation services in support of mergers and acquisitions, lending, and other transaction financing activities. Our appraisal

professionals offer deep specialization across industries and asset classes, including consumer retail, wholesale and industrial

inventory, machinery and equipment, real estate, tax valuation, intellectual property, fixed assets, business and securities, and

intangible assets. We conduct over 1,500 independent appraisals annually, many of which include recurring company assignments to

support asset-based lending facilities. Our appraisal division’s broad client base represents a vast network of companies for

which other B. Riley affiliates may also provide services.

Real Estate. We provide

services to owners, companies, financial institutions, investors, family offices and individuals to support real estate acquisitions and

sales, bankruptcy auctions and liquidations, loan sales, transaction financing, restructurings, lease renegotiation, and refinancing.

As distressed specialists, the core focus of our business is the restructuring of lease obligations on behalf of healthy and distressed

corporate tenants, both in and out-of-court.

Auction and Liquidation

Segment. We provide retail liquidation services that utilize significant industry experience and a scalable network of independent

contractors and advisors to help clients quickly and efficiently dispose of under-performing assets and generate cash from excess inventory

by conducting or assisting in retail store closings, going out of business sales, bankruptcy sales, and fixture sales. Financial institutions

and other capital providers rely on us to maximize recovery rates in distressed asset sales and in retail bankruptcy situations. Additionally,

we work with healthy, mature retailers that utilize our proven inventory management and strategic disposition solutions to close unproductive

stores and dispose of surplus inventory and fixtures as existing stores are updated. We often conduct large retail liquidations that

entail significant capital requirements through collaborative arrangements with other liquidators and provide services to clients on a

fee, guarantee or outright purchase basis. Our scale and pool of resources allow us to offer our services across North America as well

as parts of Europe, Asia, and Australia. We provide equipment management and capital recovery solutions to lenders in various wholesale

and industrial industries. Our services include auctions, private treaty, liquidation, valuations, and a host of asset planning and recovery

strategies to maximize return.

Communications

Segment. Our communications portfolio of companies consists of related businesses that we

have acquired for attractive risk-adjusted investment return characteristics. We may pursue future acquisitions to expand this

portfolio of businesses which currently includes: Lingo Management, LLC, a global cloud/unified communications and managed service

provider; BullsEye Telecom, a single source communications and cloud technology provider; Marconi Wireless Holdings, LLC, a mobile

virtual network operator that provides mobile phone voice, text, and data services and devices; magicJack VocalTec Ltd., a VoIP

cloud-based technology and communications provider that offers related devices and subscription services; and United Online, Inc.,

an Internet access provider that offers dial-up, mobile broadband and digital subscriber line services under the NetZero and Juno

brands.

Consumer

Segment. Our Consumer segment consists of Targus (“Targus”) and our Brands (“Brands”) investment

portfolio. Targus is a multinational company that designs, manufactures, and sells consumer and enterprise productivity products with

a large business-to-business (B2B) customer client base and global distribution in over 100 countries. The Targus product line includes

laptop and tablet cases, backpacks, universal docking stations, and computer accessories. The Company acquired Targus on October 18, 2022. Our

brands portfolio is focused on generating revenue through the licensing of trademarks and our brand investments. We hold majority ownership

interest in BR Brands, which owns the assets and intellectual property related to licenses of six brands: Catherine Malandrino, English

Laundry, Joan Vass, Kensie Girl, Limited Too and Nanette Lepore. Additionally, we maintain significant equity ownership in the Hurley

and Justice brands with Bluestar Alliance, LLC.

Recent Developments

Preliminary Estimates of Results for the Three and Six Months Ended

June 30, 2023

The following is a capsule

summary of our estimated preliminary unaudited consolidated financial condition and results of operations for the three and six months

ended June 30, 2023. These estimated preliminary results are subject to completion of our customary quarter-end closing, review and audit

procedures and are not a comprehensive statement of our financial results for the three months ended June 30, 2023. We caution that our

final results for the three months ended June 30, 2023 that we will file with the SEC could vary significantly from these preliminary

estimates as a result of the completion of our customary quarter-end closing, review and audit procedures and other developments arising

between now and the time that our financial results for the three months and six months ended June 30, 2023 are finalized. These preliminary

estimates should not be viewed as a substitute for complete financial statements prepared in accordance with GAAP and they are not necessarily

indicative of the results to be achieved in any future period. Accordingly, you should not place undue reliance on these preliminary estimates.

The preliminary estimates of results included below have been prepared by, and is the responsibility of, the Company’s management.

Marcum LLP (“Marcum”), the Company’s independent registered public accounting firm, has not audited, reviewed,

compiled or performed any procedures with respect to the accompanying preliminary financial data. Accordingly, Marcum does not express

an opinion or any other form of assurance with respect thereto.

Revenue for the three months

and six months ended June 30, 2023 is estimated to be within the range of $405 million and $407 million and $837.1 million and $839.1

million, respectively.

For the three months ended

June 30, 2023, we estimate that the net income attributable to the Company will be within the range of $44.6 million and $46.6 million

compared to a net loss of $140.2 million for the three months ended June 30, 2022. Diluted income per common share is expected to be within

the range of $1.48 to $1.55 per diluted share. This compares to a net loss of $5.07 per diluted share for the three months ended June

30, 2022. For the six months ended June 30, 2023, we estimate that the net income attributable to the Company shall be within the range

of $61.8 million and $63.8 million compared to a net loss of $150.2 million for the six months ended June 30, 2022. Diluted income per

common share is expected to be within the range of $1.98 to $2.05 per diluted share. This compares to a net loss of $5.52 per diluted

share for the six months ended June 30, 2022.

For the three months

ended June 30, 2023, we estimate that our adjusted EBITDA will be within the range of $138 million and $140 million compared to a

total adjusted EBITDA loss of $135.8 million for the three months ended June 30, 2022. For the six months ended June 30, 2023, we

estimate that our adjusted EBITDA will be within the range of $232.8 million and $234.8 million compared to a total adjusted EBITDA

loss of $95.1 million for the six months ended June 30, 2022. Operating adjusted EBITDA for the three months ended June 30, 2023 is

estimated to be within the range of $78.5 million and $80.5 million compared to $74.2 million for the three months ended June 30,

2022. Operating adjusted EBITDA for the six months ended June 30, 2023 is estimated to be within the range of $158.6 million and

$160.6 million compared to $158.4 million for the six months ended June 30, 2022. As of June 30, 2023, the Company estimates their

cash and investments balance to be approximately $1.9 billion and their total debt outstanding to be $2.3 billion. As of June 30,

2023, the Company estimates their total debt, net of cash and investments, to be approximately $406 million. The Company expects its

operating adjusted EBITDA for the three month period ending September 30, 2023 will be at least $105 million.

Certain of the

information set forth herein, including operating revenues, adjusted EBITDA, operating adjusted EBITDA and total debt, net of cash

and investments may be considered non-GAAP financial measures. We believe this information is useful to investors because it

provides a basis for measuring our available capital resources, the operating performance of our business and our revenues and our

cash flow, (i) excluding in the case of operating revenues, trading income (losses) and fair value adjustments on loans, (ii)

excluding in the case of adjusted EBITDA, net interest expense, provisions for or benefit from income taxes, depreciation,

amortization, restructuring charge, gain on extinguishment of loans, impairment of trade names, stock-based compensation and

transaction related and other expenses, (iii) excluding in the case of operating adjusted EBITDA, the aforementioned adjustments for

adjusted EBITDA as well as trading income (losses) and fair value adjustments on loans, realized and unrealized gains (losses) on

investments and fair value adjustments and other investment related expenses and (iv) including in the case of total cash and

investments, cash and cash equivalents, restricted cash, due from clearing brokers net of due to clearing brokers, securities and

other investments owned, at fair value net of (a) securities sold not yet purchased and (b) noncontrolling interest related to

investments, advances against customer contracts, loans receivable, at fair value net of loan participations sold, and other

investments reported in prepaid and other assets, that would normally be included in the most directly comparable measures

calculated and presented in accordance with Generally Accepted Accounting Principles (“GAAP”). In addition,

our management uses these non-GAAP financial measures along with the most directly comparable GAAP financial measures in evaluating

the Company's operating performance, management compensation, capital resources, and cash flow. Non-GAAP financial measures should

not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and

non-financial measures as reported by the Company may not be comparable to similarly titled amounts reported by other companies. The

following is a reconciliation of Net Income estimates to Adjusted EBITDA and Operating Adjusted EBITDA to the corresponding GAAP

measure (in thousands), as well as a reconciliation of diluted income per common share.

The Company has not provided guidance for a comparable GAAP measure

or a quantitative reconciliation of its forecast for Operating Adjusted EBITDA in the third quarter of 2023 to the most directly comparable

GAAP measure because it is unable to determine with reasonable certainty the ultimate outcome of certain significant items necessary to

calculate such measure without unreasonable effort. These items include, but are not limited to, final calculation of investment gains

(losses), defined as trading income (losses) and fair value adjustments on loans. Notwithstanding this limitation, as noted above, the

Company estimates Operating Adjusted EBITDA of at least $105 million in the third quarter of 2023. These items are uncertain, depend on

various factors, and could have a material impact on the GAAP reported results for the period.

Reconciliation of Net

Income Preliminary Estimate to Adjusted EBITDA Preliminary Estimate

(Unaudited)

(Dollars in thousands)

| | |

Preliminary Estimate | | |

Prior Period | |

| | |

Three Months

Ended

June 30,

2023 | | |

Three Months

Ended

June 30,

2022 | |

| | |

Low | | |

High | | |

Actual | |

| Net income (loss) attributable to B. Riley Financial, Inc. | |

$ | 44,600 | | |

$ | 46,600 | | |

$ | (140,159 | ) |

| Adjustments: | |

| | | |

| | | |

| | |

| Provision for (benefit from) income taxes | |

| 21,500 | | |

| 21,500 | | |

| (52,513 | ) |

| Interest expense | |

| 47,300 | | |

| 47,300 | | |

| 31,764 | |

| Interest income | |

| (700 | ) | |

| (700 | ) | |

| (500 | ) |

| Share based payments | |

| 10,500 | | |

| 10,500 | | |

| 14,202 | |

| Depreciation and amortization | |

| 12,500 | | |

| 12,500 | | |

| 7,961 | |

| Restructuring charge | |

| 600 | | |

| 600 | | |

| — | |

| Impairment of tradenames | |

| 1,700 | | |

| 1,700 | | |

| — | |

| Transactions related costs and other | |

| — | | |

| — | | |

| 3,468 | |

| | |

| | | |

| | | |

| | |

| Total EBITDA adjustments | |

| 93,400 | | |

| 93,400 | | |

| 4,382 | |

| | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 138,000 | | |

$ | 140,000 | | |

$ | (135,777 | ) |

| | |

| | | |

| | | |

| | |

| Operating EBITDA Adjustments: | |

| | | |

| | | |

| | |

| Trading (income) losses and fair value adjustments on loans | |

| (42,000 | ) | |

| (42,000 | ) | |

| 117,763 | |

| Realized and unrealized (gains) losses on investments and fair value

adjustments | |

| (19,000 | ) | |

| (19,000 | ) | |

| 106,164 | |

| Other investment related expenses | |

| 1,500 | | |

| 1,500 | | |

| (13,930 | ) |

| | |

| | | |

| | | |

| | |

| Total Operating EBITDA Adjustments | |

| (59,500 | ) | |

| (59,500 | ) | |

| 209,997 | |

| | |

| | | |

| | | |

| | |

| Operating Adjusted EBITDA | |

$ | 78,500 | | |

$ | 80,500 | | |

$ | 74,220 | |

Diluted Income per Common Share — Preliminary

Estimate

(Unaudited)

(Dollars in thousands, except share data)

| | |

Preliminary Estimate | | |

Prior Period | |

| | |

Three Months

Ended

June 30,

2023 | | |

Three Months

Ended

June 30,

2022 | |

| | |

Low | | |

High | | |

Actual | |

| Net income (loss) attributable to B. Riley Financial, Inc. | |

$ | 44,600 | | |

$ | 46,600 | | |

$ | (140,159 | ) |

| Preferred stock dividends | |

| 2,000 | | |

| 2,000 | | |

| 2,002 | |

| Net income (loss) available to common shareholders | |

$ | 42,600 | | |

$ | 44,600 | | |

$ | (142,161 | ) |

| | |

| | | |

| | | |

| | |

| Diluted income (loss) per common share | |

$ | 1.48 | | |

$ | 1.55 | | |

$ | (5.07 | ) |

| Weighted average diluted common shares outstanding | |

| 28,700,000 | | |

| 28,700,000 | | |

| 28,051,570 | |

Reconciliation of Net Income Preliminary Estimate

to Adjusted EBITDA Preliminary Estimate

(Unaudited)

(Dollars in thousands)

| | |

Preliminary Estimate | | |

Prior Period | |

| | |

Six Months

Ended

June 30,

2023 | | |

Six Months

Ended

June 30,

2022 | |

| | |

Low | | |

High | | |

Actual | |

| Net income (loss) attributable to B. Riley Financial, Inc. | |

$ | 61,755 | | |

$ | 63,755 | | |

$ | (150,221 | ) |

| Adjustments: | |

| | | |

| | | |

| | |

| Provision for (benefit from) income taxes | |

| 29,419 | | |

| 29,419 | | |

| (56,208 | ) |

| Interest expense | |

| 94,861 | | |

| 94,861 | | |

| 62,200 | |

| Interest income | |

| (3,274 | ) | |

| (3,274 | ) | |

| (567 | ) |

| Share based payments | |

| 24,246 | | |

| 24,246 | | |

| 31,215 | |

| Depreciation and amortization | |

| 25,577 | | |

| 25,577 | | |

| 15,809 | |

| Restructuring charge | |

| 693 | | |

| 693 | | |

| — | |

| Gain on extinguishment of loans | |

| — | | |

| — | | |

| (1,102 | ) |

| Impairment of tradenames | |

| 1,700 | | |

| 1,700 | | |

| — | |

| Transactions related costs and other | |

| (2,146 | ) | |

| (2,146 | ) | |

| 3,759 | |

| | |

| | | |

| | | |

| | |

| Total EBITDA adjustments | |

| 171,076 | | |

| 171,076 | | |

| 55,106 | |

| | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 232,831 | | |

$ | 234,831 | | |

$ | (95,115 | ) |

| | |

| | | |

| | | |

| | |

| Operating EBITDA Adjustments: | |

| | | |

| | | |

| | |

| Trading (income) losses and fair value adjustments on loans | |

| (93,568 | ) | |

| (93,568 | ) | |

| 137,041 | |

| Realized and unrealized (gains) losses on investments and fair value

adjustments | |

| 9,442 | | |

| 9,442 | | |

| 155,276 | |

| Other investment related expenses | |

| 9,921 | | |

| 9,921 | | |

| (38,795 | ) |

| | |

| | | |

| | | |

| | |

| Total Operating EBITDA Adjustments | |

| (74,205 | ) | |

| (74,205 | ) | |

| 253,522 | |

| | |

| | | |

| | | |

| | |

| Operating Adjusted EBITDA | |

$ | 158,626 | | |

$ | 160,626 | | |

$ | 158,407 | |

Diluted Income per Common Share — Preliminary

Estimate

(Unaudited)

(Dollars in thousands, except share data)

| | |

Preliminary Estimate | | |

Prior Period | |

| | |

Six Months

Ended

June 30,

2023 | | |

Six Months

Ended

June 30,

2022 | |

| | |

Low | | |

High | | |

Actual | |

| Net income (loss) attributable to B. Riley Financial, Inc. | |

$ | 61,755 | | |

$ | 63,755 | | |

$ | (150,221 | ) |

| Preferred stock dividends | |

| 4,012 | | |

| 4,012 | | |

| 4,004 | |

| Net income (loss) available to common shareholders | |

$ | 57,743 | | |

$ | 59,743 | | |

$ | (154,225 | ) |

| | |

| | | |

| | | |

| | |

| Diluted income (loss) per common share | |

$ | 1.98 | | |

$ | 2.05 | | |

$ | (5.52 | ) |

| Weighted average diluted common shares outstanding | |

| 29,100,000 | | |

| 29,100,000 | | |

| 27,953,845 | |

Declaration of Regular Common Stock Dividend

On July 25, 2023, the Company

declared a regular quarterly cash dividend of $1.00 per share of common stock payable on or about August 21, 2023 to common stockholders

of record as of August 11, 2023.

Proposed FRG Transaction

On May 10, 2023, Franchise

Group, Inc. (“FRG”) announced that it had entered into a definitive merger agreement pursuant to which members of the

senior management team of FRG and related entities would acquire the approximately 64% of FRG’s common stock not owned by them.

At the same time, the Company entered into an equity commitment letter with the acquisition vehicle formed by FRG senior management pursuant

to which, among other things, the Company agreed to provide certain equity funding and other support in connection with the transaction.

Specifically, the equity commitment letter provides, subject to its terms and conditions, that the Company will contribute an amount equal

to up to $560 million in equity financing for the transaction (the Company currently expects to invest approximately $250 million pursuant

to the equity commitment, with the remainder to be funded by co-investments). FRG has scheduled a special meeting of stockholders for

August 17, 2023 to vote on the transaction and related matters. The proposed transaction is anticipated to close in the second half of

2023, subject to satisfaction or waiver of the closing conditions contained in the definitive documentation.

Credit Facility

The Company is in discussions

with certain of its lenders in respect of a new secured credit facility that, if fully drawn, would increase the Company’s aggregate

consolidated indebtedness by up to an additional $300 million, a portion of the proceeds of which would be used to finance the Company’s

equity investment in FRG. If entered into, the new secured credit facility is expected to be secured by a first priority lien on, among

others, all assets secured by the Company’s existing secured credit facility. As with the Company’s existing secured credit

facility, the new secured credit facility is also expected to contain certain affirmative and negative covenants customary for financings

of this type including, among other things, covenants that restrict the Company’s and certain of its subsidiaries’ ability

to incur additional indebtedness or liens, to dispose of assets, to enter into restrictive agreements, to make certain investments, loans,

advances, guarantees and acquisitions, to prepay certain indebtedness and to pay dividends or to make other distributions or redemptions/repurchases

in respect of their respective equity interests. There can be no assurances that the Company will enter into the new credit facility and,

if so, regarding the terms of that new facility.

Our Corporate Information

We are a Delaware corporation.

Our executive offices are located at 11100 Santa Monica Blvd., Suite 800, Los Angeles, California, 90025, and the telephone number at

our principal executive office is (310) 966-1444. Our website address is http://www.brileyfin.com. We have not incorporated by

reference into this prospectus supplement and accompanying prospectus the information on our website, and you should not consider it to

be a part of this document.

THE OFFERING

For a more complete description

of our common stock, please see the information under the caption “Description of our Common Stock” beginning on page 4 of

the accompanying prospectus.

| Issuer |

|

B. Riley Financial, Inc. |

| Common stock offered by us |

|

shares of common stock (or shares of common stock if the underwriter exercises its option to purchase additional shares in full). |

| Common stock outstanding after this offering |

|

shares

of common stock (or shares of common stock if the underwriter

exercises its option to purchase additional shares in full). |

| Use of proceeds |

|

We anticipate using the net proceeds from this offering for general corporate purposes, which may include funding future acquisitions and investments, repaying and/or refinancing indebtedness, making loans and/or providing guaranty or backstop commitments to our clients in the ordinary course of our business, making capital expenditures and funding working capital. Pending such use, we may invest the net proceeds in short-term interest-bearing accounts, securities or similar investments. See “Use of Proceeds.” |

| NASDAQ Global Market |

|

“RILY” |

| Transfer Agent |

|

Continental Stock Transfer & Trust Company. |

| Risk Factors |

|

An investment in our common stock involves significant risks. Please refer to “Risk Factors” beginning on page S-11 and other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

| Insider Participation |

|

Co-Chief Executive Officers Bryant R. Riley and Tom

Kelleher have indicated an interest to purchase, in the aggregate, up to $4.5 million of shares of common stock in this

offering at the public offering price. Certain of our officers, directors and employees may also elect to participate in this

offering. The underwriter could determine to sell fewer shares to them than they indicated an interest in purchasing or sell no

shares to them, and they could determine to purchase fewer shares than they indicated an interest in purchasing or purchase no

shares in this offering. The underwriter will receive the same underwriting discount on any shares purchased by them as they will on

any other shares sold to the public in this offering. |

| Conflicts of Interest |

|

B. Riley Securities is an affiliate of B. Riley Financial, Inc. and, as such, may be deemed to have a “conflict of interest” in this offering of common stock within the meaning of Financial Industry Regulatory Authority, Inc. (“FINRA”) Rule 5121. Consequently, this offering of common stock will be conducted in compliance with the provisions of FINRA Rule 5121. B. Riley Securities may not make sales of common stock in this offering to any of its discretionary accounts without the prior written approval of the account holder. |

The number of shares of our

common stock to be outstanding immediately after the closing of this offering is based on 28,135,636 shares of common stock outstanding

as of March 31, 2023 and excludes, as of that date:

| ● | 1,392,844 shares of common stock available for future grant

under our equity incentive plans; |

| ● | 2,791,340 shares of common stock issuable upon the vesting

and settlement of restricted stock units; and |

| ● | 200,000 shares of common stock issuable upon exercise of

warrants outstanding prior to this offering. |

RISK FACTORS

An investment in our common

stock involves significant risks, including the risks described below and discussed under the section captioned “Risk Factors”

contained in our annual report on Form 10-K for the year ended December 31, 2022 and our quarterly report on Form 10-Q for the

quarter ended March 31, 2023, and as updated by our subsequent filings under the Exchange Act, which are incorporated by reference in

this prospectus supplement and the accompanying prospectus in their entirety. Before purchasing our common stock, you should carefully

consider each of the following risk factors as well as the other information contained in this prospectus supplement and the accompanying

prospectus and the documents incorporated by reference, including our consolidated financial statements and the related notes. Each of

these risk factors, either alone or taken together, could adversely affect our business, operating results and financial condition, as

well as adversely affect the value of an investment in our common stock. The risks described below are not the only ones we face. Additional

risks of which we are not presently aware or that we currently believe are immaterial which may also impair our business operations and

financial position. If any of the events described below were to occur, our financial condition, our results of operations and/or our

future growth prospects could be materially and adversely affected. As a result, you could lose some or all of any investment you may

have made or may make in our Company.

Risks Related to this Offering

We may allocate the net proceeds from this

offering in ways that you and other stockholders may not approve.

We intend to use the net proceeds

from this offering for general corporate purposes, which may include funding future acquisitions and investments, repaying and/or refinancing

indebtedness, making loans and/or providing guaranty or backstop commitments to our clients in the ordinary course of our business, making

capital expenditures and funding working capital. In general, our management will have broad discretion in the application of the net

proceeds from this offering and could spend the net proceeds in ways that do not necessarily improve our operating results or enhance

the value of our common stock.

Our stock price may be volatile, and your

investment in our stock could suffer a decline in value.

Factors which could have a

significant impact on the market price of our common stock include, but are not limited to the following:

| ● | general economic and financial market conditions; |

| ● | government action or regulation; |

| ● | the financial condition, performance and prospects of us

and our competitors; |

| ● | changes in financial estimates or recommendations by securities

analysts with respect to us, our competitors or our industry; |

| ● | our issuance of additional common stock, preferred equity

or debt securities; and |

| ● | actual or anticipated variations in quarterly operating results

of us and our competitors. |

These and other external factors

may cause the market price and demand for our common stock to fluctuate substantially, which may limit or prevent investors from readily

selling their shares of common stock and may otherwise negatively affect the liquidity of our common stock. Volatility in the market price

of our common stock could also subject us to securities class action litigation.

Future sales of our common stock could cause

the market price for our common stock to decline.

We cannot predict the effect,

if any, that market sales of shares of our common stock or the availability of shares of our common stock for sale will have on the market

price of our common stock prevailing from time to time. Sales of substantial amounts of shares of our common stock in the public market,

or the perception that those sales will occur, could cause the market price of our common stock to decline or be depressed.

The shares of our common stock

issued in connection with this offering will be freely tradable without restriction or further registration under the Securities Act.

This includes the shares of our common stock that may be acquired by insiders.

Anti-takeover

provisions under our charter documents and Delaware law could delay or prevent a change of control and could also limit the market price

of our stock.

Our amended and restated

certificate of incorporation and our bylaws, as amended, contain provisions that could delay or prevent a change of control of our company

or changes in our board of directors that our stockholders might consider favorable. Our amended and restated certificate of incorporation

provides that our board of directors will be authorized to issue from time to time, without further stockholder approval, up to 1,000,000

shares of preferred stock in one or more series and to fix or alter the designations, preferences, rights and any qualifications, limitations

or restrictions of the shares of each series, including the dividend rights, dividend rates, conversion rights, voting rights, rights

of redemption, including sinking fund provisions, redemption price or prices, liquidation preferences and the number of shares constituting

any series or designations of any series. Such shares of preferred stock could have preferences over our common stock with respect to

dividends and liquidation rights. We may issue additional preferred stock in ways which may delay, defer or prevent a change of control

of our company without further action by our stockholders. Such shares of preferred stock may be issued with voting rights that may adversely

affect the voting power of the holders of our common stock by increasing the number of outstanding shares having voting rights, and by

the creation of class or series voting rights.

We are also governed by the

provisions of Section 203 of the Delaware General Corporate Law, which may prohibit certain business combinations with stockholders owning

15% or more of our outstanding voting stock. The foregoing and other provisions in our amended and restated certificate of incorporation,

our bylaws, as amended, and Delaware law could make it more difficult for stockholders or potential acquirers to obtain control of our

board of directors or initiate actions that are opposed by the then-current board of directors, including delaying or impeding a merger,

tender offer, or proxy contest or other change of control transaction involving our company. Any delay or prevention of a change of control

transaction or changes in our board of directors could prevent the consummation of a transaction in which our stockholders could receive

a substantial premium over the then current market price for their shares.

Because of their significant stock ownership,

some of our existing stockholders will be able to exert control over us and our significant corporate decisions.

Our executive officers, directors

and their affiliates own or control, in the aggregate, approximately 30.2% of our outstanding common stock as of December 31, 2022.

In particular, our Chairman and Co-Chief Executive Officer, Bryant R. Riley, owns or controls, in the aggregate, 6,516,410 shares of our

common stock or 23.0% of our outstanding common stock as of December 31, 2022. These stockholders are able to exercise influence

over matters requiring stockholder approval, such as the election of directors and the approval of significant corporate transactions,

including transactions involving an actual or potential change of control of the company or other transactions that non-controlling stockholders

may not deem to be in their best interests. This concentration of ownership may harm the market price of our common stock by, among other

things: delaying, deferring, or preventing a change in control of our company; impeding a merger, consolidation, takeover, or other business

combination involving our company; causing us to enter into transactions or agreements that are not in the best interests of all stockholders;

or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of our company.

USE OF PROCEEDS

The net proceeds from the sale

of shares of common stock offered herby, after deducting the underwriting discount and other estimated expenses of this offering payable

by us, are estimated to be approximately $ million (approximately $

million if the underwriter’s option to purchase up to additional shares

is exercised in full).

We will use the net proceeds

from the sale of shares of our common stock for general corporate purposes, which may include funding future acquisitions and investments,

repaying and/or refinancing indebtedness, making loans and/or providing guaranty or backstop commitments to our clients in the ordinary

course of our business, making capital expenditures and funding working capital. Pending such use, we may invest the net proceeds in short-term

interest-bearing accounts, securities or similar investments.

CAPITALIZATION

The following table shows our

cash and cash equivalents and capitalization as of March 31, 2023:

| ● | on an as adjusted basis, after giving effect to the sale

of shares of common stock in this offering (assuming no exercise of the underwriter’s option to purchase additional shares of common

stock). |

| | |

As of March 31, 2023 | |

| | |

Actual | | |

As Adjusted | |

| | |

(dollars in thousands) | |

| Cash and cash equivalents | |

$ | 209,971 | | |

$ | | |

| Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 59,969 | | |

$ | 59,969 | |

| Accrued expenses and other liabilities | |

| 263,335 | | |

| 263,335 | |

| Deferred revenue | |

| 84,019 | | |

| 84,019 | |

| Deferred income taxes | |

| 34,274 | | |

| 34,274 | |

| Due to related parties and partners | |

| 431 | | |

| 431 | |

| Due to clearing brokers | |

| 6,033 | | |

| 6,033 | |

| Securities sold not yet purchased | |

| 7,806 | | |

| 7,806 | |

| Securities loaned | |

| 2,937,982 | | |

| 2,937,982 | |

| Operating lease liabilities | |

| 100,075 | | |

| 100,075 | |

| Notes payable | |

| 19,882 | | |

| 19,882 | |

| Revolving credit facility | |

| 139,463 | | |

| 139,463 | |

| Term loans, net | |

| 626,613 | | |

| 626,613 | |

| Senior notes payable, net | |

| 1,722,977 | | |

| 1,722,977 | |

| Total Liabilities | |

| 6,002,859 | | |

| 6,002,859 | |

| Redeemable noncontrolling interests in equity of subsidiaries | |

| 174,967 | | |

| 174,967 | |

| B. Riley Financial, Inc. stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 1,000,000 shares authorized, 4,563 issued and 4,545 outstanding as of March 31, 2023 and December 31, 2022, respectively; and liquidation preference of $114,082 and $113,615 as of March 31, 2023 and December 31, 2022, respectively | |

| — | | |

| — | |

| Common stock, $0.0001 par value, 100,000,000 shares authorized, 28,135,636 and 28,523,764 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | |

| 3 | | |

| — | |

| Additional paid-in capital | |

| 445,352 | | |

| — | |

| Accumulated deficit | |

| (62,566 | ) | |

| (62,566 | ) |

| Accumulated other comprehensive loss | |

| (1,604 | ) | |

| (1,604 | ) |

| Total B. Riley Financial, Inc. stockholders’ equity | |

| 381,185 | | |

| — | |

| Noncontrolling interests | |

| 59,179 | | |

| 59,179 | |

| Total Capitalization | |

$ | 6,618,190 | | |

$ | | |

UNDERWRITING (Conflicts of Interest)

B. Riley Securities is acting as sole book-running manager and underwriter

for this offering. Subject to the terms and conditions set forth in an underwriting agreement among us and the underwriter (the “Underwriting

Agreement”), we have agreed to sell to the underwriter, and the underwriter has agreed to purchase from us, the shares of common

stock offered hereby.

The underwriting agreement

provides that the obligations of the underwriter to purchase the shares of common stock included in this offering are subject to approval

of legal matters by counsel, including conditions contained in the underwriting agreement. The underwriter is obligated to purchase all

the shares of common stock if any of the shares of common stock are purchased (other than those covered by the option as described below).

We have granted to the underwriter

an option, exercisable for 30 days from the date of delivery of the shares initially purchased, to purchase up to an aggregate of

additional shares of common stock at the public offering price set forth

on the cover page hereof, less underwriting discounts and commissions.

The underwriter proposes to

offer part of the shares of common stock to the public directly at the public offering price set forth on the cover page of this prospectus

supplement and part to dealers at that price less a concession not in excess of $

per share. After the initial offering of shares of common stock, the offering price and other selling terms may from time to time be varied

by the underwriter.

The following table shows the

per share and total public offering price, underwriting discounts and commissions that we will pay to the underwriter in connection with

this offering and proceeds, before expenses, to us. The amounts are shown assuming both no exercise or full exercise by the underwriter

of its option to purchase up to additional shares of our common stock.

| | |

Per Share | | |

No Exercise | | |

Full Exercise | |

| Public offering price | |

| | | |

| | | |

| | |

| Underwriting discount | |

| | | |

| | | |

| | |

| Proceeds, before expenses, to us | |

| | | |

| | | |

| | |

In addition, we

estimate that our share of the total expenses of this offering, excluding underwriting discounts and commissions, will be

approximately $ . We have also agreed to reimburse the underwriter for

its reasonable out-of-pocket expenses, including attorneys’ fees, up to $50,000.

Price Stabilization and Short Positions

Until the distribution of shares

of common stock is complete, SEC rules may limit the ability of the underwriter to bid for and purchase shares of our common stock. As

an exception to these rules, underwriters are permitted to engage in certain transactions which stabilize the price of the shares of common

stock, which may include short sales, covering transactions and stabilizing transactions. Short sales involve sales of shares of common

stock in excess of the number of shares to be purchased by the underwriter in the offering, which creates a short position. “Covered”

short sales are sales made in an amount not greater than the underwriter’s option to purchase additional shares of common stock

from us in the offering. The underwriter may close out any covered short position by either exercising their option to purchase additional

shares of common stock or purchasing shares of common stock in the open market. In determining the source of shares of common stock to

close out the covered short position, the underwriter will consider, among other things, the price of shares of common stock available

for purchase in the open market as compared to the share price at which they may purchase through their option to purchase additional

shares. “Naked” short sales are any sales in excess of such option. The underwriter must close out any naked short position

by purchasing shares of common stock in the open market. A naked short position is more likely to be created if the underwriter is concerned

that there may be downward pressure on the price of the shares of common stock in the open market after pricing that could adversely affect

investors who purchase in the offering. Stabilizing transactions consist of various bids for or purchases of the shares of common stock

made by the underwriter in the open market prior to the completion of the offering.

The underwriter may also impose

a penalty bid. This occurs when a particular underwriter repays to the other underwriter a portion of the underwriting discount received

by it because the representatives have repurchased shares sold by or for the account of such underwriter in stabilizing or short covering

transactions.

Neither we nor the underwriter

make any representation or prediction as to the direction or magnitude of any effect that the transactions described above might have

on our shares of common stock. Any of these activities may have the effect of preventing or retarding a decline in the market price of

our shares of common stock. They may also cause the price of the shares of common stock to be higher than the price that would otherwise

exist in the open market in the absence of these transactions. The underwriter may conduct these transactions on the NASDAQ or in the

over-the-counter market, or otherwise. If the underwriter commences any of these transactions, they may discontinue them at any time without

notice.

We have agreed that, for a

period of 90 days from the date of this prospectus supplement, we will not, and the Company’s directors and officers will not,

without the prior written consent of the underwriter, offer, sell, contract to sell, pledge, or otherwise dispose of any securities issued

or guaranteed by us or shares of any class of our capital stock.

We expect that delivery of

the shares will be made to investors on or about July , 2023 (such settlement being referred to as “T+2

”).

In the ordinary course of their

various business activities, the underwriter and its affiliates may make or hold a broad array of investments and actively trade debt

and equity securities (or related derivative securities) and financial instruments (which may include bank loans and/or credit default

swaps) for their own account and for the accounts of their customers and may at any time hold long and short positions in such securities

and instruments. Such investments and securities activities may involve securities and/or instruments of ours or our affiliates. The underwriter

and its affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities

or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

We have agreed to indemnify

the underwriter against certain liabilities, including liabilities under the Securities Act, or to contribute to payments the underwriter

may be required to make because of any of those liabilities.

A prospectus supplement in

electronic format may be made available on web sites maintained by the underwriter. Other than the prospectus supplement in electronic

format, the information on the underwriter’s web site and any information contained in any other web site maintained by an underwriter

is not part of this prospectus supplement or the accompanying prospectus.

Listing

Our common stock is traded

on the NASDAQ Global Market under the symbol “RILY.”

Conflicts of Interest

The underwriter is our affiliate.

and, as such, may be deemed to have a “conflict of interest” in this offering of common stock within the meaning of FINRA

Rule 5121. Consequently, this offering of common stock will be conducted in compliance with the provisions of FINRA Rule 5121. The underwriter

may not make sales of common stock in this offering to any of its discretionary accounts without the prior written approval of the account

holder.

Additional Relationships

The underwriter and its affiliates

are full service financial institutions engaged in various activities, which may include sales and trading, commercial and investment

banking, advisory, investment management, investment research, principal investment, hedging, market making, brokerage and other financial

and non-financial activities and services. The underwriter and its affiliates may provide from time to time in the future in the ordinary

course of their business certain commercial banking, financial advisory, investment banking and other services to us for which they will

be entitled to receive customary fees and expenses. The underwriter has in the past and may in the future borrow money from or obtain

other financial and non-financial services from us for which we will be entitled to receive customary fees and expenses.

Notice to Prospective Investors

in Canada (Alberta, British Columbia, Manitoba, Ontario and Québec Only)

This document constitutes an

“exempt offering document” as defined in and for the purposes of applicable Canadian securities laws. No prospectus has been

filed with any securities commission or similar regulatory authority in Canada in connection with the offer and sale of shares of our

common stock described herein (the “Securities”). No securities commission or similar regulatory authority in Canada has reviewed

or in any way passed upon this document or on the merits of the Securities and any representation to the contrary is an offence.

Canadian investors are advised

that this document has been prepared in reliance on section 3A.3 of National Instrument 33-105 Underwriting Conflicts (“NI

33-105”). Pursuant to section 3A.3 of NI 33-105, this document is exempt from the requirement that the issuer and the underwriters

in the offering provide Canadian investors with certain conflicts of interest disclosure pertaining to “connected issuer”

and/or “related issuer” relationships as may otherwise be required pursuant to subsection 2.1(1) of NI 33-105.

Resale Restrictions

The offer and sale of the Securities

in Canada are being made on a private placement basis only and are exempt from the prospectus requirement under applicable Canadian securities

laws. Any resale of Securities acquired by a Canadian investor in this offering must be made in accordance with applicable Canadian securities

laws, which may vary depending on the relevant jurisdiction, and which may require resales to be made in accordance with Canadian prospectus

requirements, a statutory exemption from the prospectus requirements, in a transaction exempt from the prospectus requirements or otherwise

under a discretionary exemption from the prospectus requirements granted by the applicable local Canadian securities regulatory authority.

These resale restrictions may under certain circumstances apply to resales of the Securities outside of Canada.

Representations of Purchasers

Each Canadian investor who

purchases the Securities will be deemed to have represented to us, the selling stockholder and each dealer from whom a purchase confirmation

is received, as applicable, that the investor (i) is purchasing as principal, or is deemed to be purchasing as principal in accordance

with applicable Canadian securities laws, for investment only and not with a view to resale or redistribution; (ii) is an “accredited

investor” as such term is defined in section 1.1 of National Instrument 45-106 Prospectus Exemptions or, in Ontario, as such

term is defined in subsection 73.3(1) of the Securities Act (Ontario); and (iii) is a “permitted client” as such term

is defined in section 1.1 of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Taxation and Eligibility

for Investment

Any discussion of taxation

and related matters contained in this document does not purport to be a comprehensive description of all of the tax considerations that