UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT

INVESTMENT

COMPANIES

Investment

Company Act File Number 811-22299

RENN

Fund, Inc.

(Exact

name of Registrant as specified in charter)

470

Park Avenue South,

New

York, NY 10016

(Address

of principal executive offices)

(646)

291-2300

(Registrant’s

telephone number, including area code)

Jay

Kesslen

Horizon

Kinetics, LLC

470

Park Avenue South

New

York, NY 10016

(Name

and address of agent for service of process)

(646)

291-2300

(Agent’s

telephone number, including area code)

Date

of fiscal year end: December 31

June

30, 2024

(Date

of reporting period)

Item

1. Reports to Stockholders.

RENN Fund, Inc.

Semi-Annual Report

June 30, 2024

RENN Fund, Inc.

TABLE OF CONTENTS

June 30, 2024

| |

|

Consolidated Financial Statements: |

|

Consolidated Schedule of Investments |

1 |

Consolidated Statement of Assets and Liabilities |

3 |

Consolidated Statement of Operations |

4 |

Consolidated Statements of Changes in Net Assets |

5 |

Consolidated Financial Highlights |

6 |

Consolidated Notes to Financial Statements |

7 |

Other Information |

17 |

Service Providers |

18 |

RENN Fund, Inc.

Consolidated Schedule of Investments

As of June 30, 2024 (Unaudited)

| |

Shares or

Principal

Amount |

|

Company |

|

Cost |

|

|

Value |

|

| |

|

|

|

MONEY MARKET FUNDS – 31.22% |

| |

|

92,663 |

|

Fidelity Government Cash Reserves Portfolio - Institutional Class, 4.71% |

|

$ |

92,283 |

|

|

$ |

92,283 |

|

| |

|

4,814,766 |

|

Fidelity Investment Money Market Funds Government Portfolio - Institutional Class, 5.05% |

|

|

4,814,766 |

|

|

|

4,814,766 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Money Market Funds |

|

|

4,907,049 |

|

|

|

4,907,049 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

CONVERTIBLE BONDS – 0.00% |

| |

|

|

|

Oil and Gas – 0.00% |

|

|

|

|

|

|

|

|

| |

|

1,000,000 |

|

PetroHunter Energy Corporation 8.50% Maturity 12/31/2014(1)(2)(5) |

|

|

540,225 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Convertible Bonds |

|

|

540,225 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

COMMON EQUITIES – 69.95% |

| |

|

|

|

Accomodations – 0.32% |

|

|

|

|

|

|

|

|

| |

|

2,000 |

|

Civeo Corp. |

|

|

54,150 |

|

|

|

49,840 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Asset Management – 0.21% |

|

|

|

|

|

|

|

|

| |

|

973 |

|

Associated Capital Group, Inc. - Class A |

|

|

40,594 |

|

|

|

33,101 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Hospitality – 0.92% |

|

|

|

|

|

|

|

|

| |

|

7,300 |

|

Carnival Corp.(2) |

|

|

104,635 |

|

|

|

136,656 |

|

| |

|

50 |

|

Royal Caribbean Ltd.(2) |

|

|

2,940 |

|

|

|

7,972 |

|

| |

|

|

|

|

|

|

107,575 |

|

|

|

144,628 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Metal Mining – 3.04% |

|

|

|

|

|

|

|

|

| |

|

580 |

|

Franco-Nevada Corp. |

|

|

83,192 |

|

|

|

68,742 |

|

| |

|

18,738 |

|

Mesabi Trust |

|

|

514,855 |

|

|

|

322,856 |

|

| |

|

1,640 |

|

Wheaton Precious Metals Corp. |

|

|

68,954 |

|

|

|

85,969 |

|

| |

|

|

|

|

|

|

667,001 |

|

|

|

477,567 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Medicinal Chemicals and Botanical Products – 16.36% |

| |

|

77,228 |

|

FitLife Brands, Inc.(2) |

|

|

9,131,687 |

|

|

|

2,571,692 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Oil and Gas – 33.44% |

|

|

|

|

|

|

|

|

| |

|

1,400 |

|

Liberty Energy, Inc. |

|

|

27,247 |

|

|

|

29,246 |

|

| |

|

21,177 |

|

Landbridge Company LLC(2) |

|

|

360,009 |

|

|

|

490,248 |

|

| |

|

19,315 |

|

Permian Basin Royalty Trust |

|

|

299,138 |

|

|

|

217,487 |

|

| |

|

808,445 |

|

PetroHunter Energy Corporation(1)(2)(5) |

|

|

101,056 |

|

|

|

— |

|

| |

|

16,302 |

|

PrairieSky Royalty Ltd.(4) |

|

|

207,008 |

|

|

|

309,811 |

|

| |

|

|

|

COMMON EQUITIES – 69.95% (Continued) |

| |

|

100 |

|

Sabine Royalty Trust |

|

$ |

8,002 |

|

|

$ |

6,469 |

|

| |

|

5,724 |

|

Texas Pacific Land Corp. |

|

|

1,079,739 |

|

|

|

4,202,961 |

|

| |

|

|

|

|

|

|

2,082,199 |

|

|

|

5,256,222 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Other Financial Investment Activities – 2.05% |

| |

|

72,600 |

|

Urbana Corp.(4) |

|

|

258,349 |

|

|

|

299,294 |

|

| |

|

6,700 |

|

Urbana Corp. Class A |

|

|

22,434 |

|

|

|

23,164 |

|

| |

|

|

|

|

|

|

280,783 |

|

|

|

322,458 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Securities and Commodity Exchanges – 1.23% |

| |

|

720 |

|

Bakkt Holdings, Inc.(2) |

|

|

16,978 |

|

|

|

13,622 |

|

| |

|

3,000 |

|

CNSX Markets, Inc.(2)(3) |

|

|

13,502 |

|

|

|

13,376 |

|

| |

|

240 |

|

Intercontinental Exchange, Inc. |

|

|

30,806 |

|

|

|

32,854 |

|

| |

|

14,000 |

|

Miami International Holdings, Inc.(1)(2)(3) |

|

|

105,000 |

|

|

|

133,280 |

|

| |

|

|

|

|

|

|

166,286 |

|

|

|

193,132 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Securities, Commodity Contracts, and Other Financial Investments and Related Activities – 2.49% |

| |

|

4 |

|

Grayscale Ethereum Classic Trust(2) |

|

|

46 |

|

|

|

50 |

|

| |

|

7,282 |

|

Grayscale Bitcoin Trust(2) |

|

|

280,127 |

|

|

|

387,694 |

|

| |

|

108 |

|

iShares Bitcoin Trust(2) |

|

|

3,807 |

|

|

|

3,687 |

|

| |

|

4 |

|

iShares Silver Trust ETF(2) |

|

|

111 |

|

|

|

106 |

|

| |

|

|

|

|

|

|

284,091 |

|

|

|

391,537 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Live Sports (Spectator Sports) – 1.78% |

| |

|

5,091 |

|

Big League Advance, LLC.(1)(2)(3) |

|

|

280,000 |

|

|

|

280,005 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Surgical & Medical Instruments & Apparatus – 5.24% |

| |

|

615,000 |

|

Apyx Medical Corp.(2) |

|

|

1,470,958 |

|

|

|

824,100 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Technology Services – 2.87% |

|

|

|

|

|

|

|

|

| |

|

1,048 |

|

CACI International, Inc. – Class A. (2) |

|

|

296,486 |

|

|

|

450,776 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Common Equities |

|

|

14,861,810 |

|

|

|

10,995,058 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

OPEN ENDED MUTUAL FUNDS – 0.13% |

| |

|

824 |

|

Kinetics Spin-Off and Corporate Restructuring Fund(6) |

|

|

13,167 |

|

|

|

19,743 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Open Ended Mutual Funds |

|

|

13,167 |

|

|

|

19,743 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying Notes to Consolidated Financial Statements.

1

RENN Fund, Inc.

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

As of June 30, 2024 (Unaudited)

| |

Shares or

Principal

Amount |

|

Company |

|

Cost |

|

|

Value |

|

| |

|

|

|

PREFERRED STOCKS – 1.18% |

| |

|

30,966 |

|

Diamond Standard, Inc.(1)(2)(3) |

|

$ |

185,798 |

|

|

$ |

185,798 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Preferred Stocks |

|

|

185,798 |

|

|

|

185,798 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

WARRANTS – 0.04% |

| |

|

|

|

Diamond Standard, Inc., Exercise Price: $9.00, |

|

|

|

|

|

|

|

|

| |

|

837 |

|

Expiration Date: January 15, 2026(1)(2)(3) |

|

|

— |

|

|

|

1 |

|

| |

|

|

|

Miami International Holdings, Inc., Exercise Price: $7.50, |

|

|

|

|

|

|

|

|

| |

|

2,132 |

|

Expiration Date: March 31, 2026(1)(2)(3) |

|

|

— |

|

|

|

5,543 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Warrants |

|

|

— |

|

|

|

5,544 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS – 102.52% |

|

|

20,508,049 |

|

|

|

16,113,192 |

|

LIABILITIES LESS OTHER ASSETS – -2.52% |

|

|

|

|

|

|

(395,137 |

) |

NET ASSETS - 100.00% |

|

|

|

|

|

$ |

15,718,055 |

|

| |

Shares or

Principal

Amount |

|

Company |

|

Proceeds |

|

|

Value |

|

| |

|

|

|

SECURITIES SOLD SHORT – 0.04% |

| |

|

|

|

EXCHANGE TRADED FUNDS – 0.04% |

| |

|

(348 |

) |

Direxion Daily Gold Miners Index Bear 2X Shares ETF |

|

$ |

(3,761 |

) |

|

$ |

(2,652 |

) |

| |

|

(422 |

) |

Direxion Daily Junior Gold Miners Index Bear 2X Shares ETF(2) |

|

|

(2,427 |

) |

|

|

(1,624 |

) |

| |

|

(185 |

) |

Direxion Daily S&P Biotech Bear 3X Shares ETF |

|

|

(1,524 |

) |

|

|

(1,356 |

) |

| |

|

(1 |

) |

ProShares Ultra VIX Short-Term Futures ETF(2) |

|

|

(504 |

) |

|

|

(24 |

) |

| |

|

(2 |

) |

ProShares Ultra Silver Class ETF(2) |

|

|

(83 |

) |

|

|

(74 |

) |

| |

|

(11 |

) |

ProShares UltraShort ETF(2) |

|

|

(113 |

) |

|

|

(125 |

) |

| |

|

(6 |

) |

ProShares UltraShort Bloomberg Natural Gas ETF(2) |

|

|

(240 |

) |

|

|

(295 |

) |

| |

|

(7 |

) |

ProShares VIX Short-Term Futures ETF(2) |

|

|

(304 |

) |

|

|

(76 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Exchange Traded Funds |

|

|

(8,956 |

) |

|

|

(6,226 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

EXCHANGE TRADED NOTES – 0.00% |

| |

|

(13 |

) |

iPath Series B S&P VIX Short-Term Futures ETN(2) |

|

|

(554 |

) |

|

|

(142 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Exchange Traded Notes |

|

|

(554 |

) |

|

|

(142 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

TOTAL SECURITIES SOLD SHORT – 0.04% |

|

$ |

(9,510 |

) |

|

$ |

(6,368 |

) |

|

(1)

|

See Annual Report Note 5 - Fair Value Measurements.

|

|

(2)

|

Non-Income Producing.

|

|

(3)

|

Big League Advance, LLC., CNSX Markets, Inc., Diamond Standard, Inc. and Miami International Holdings, Inc. are each currently a private company. These securities are illiquid and valued at fair value.

|

|

(4)

|

Foreign security denominated in U.S. Dollars.

|

|

(5)

|

The PetroHunter Energy Corporation (“PetroHunter”) securities are in bankruptcy. The securities are valued at fair value.

|

|

(6)

|

Affiliated security, given that the security is managed by the same Investment Advisor as the Fund.

|

See accompanying Notes to Consolidated Financial Statements.

2

RENN Fund, Inc.

Consolidated Statement of Assets and Liabilities

June 30, 2024 (Unaudited)

ASSETS |

|

|

|

|

Investments in securities, at value: |

|

|

|

|

Unaffiliated investments (cost $20,494,882) |

|

$ |

16,093,449 |

|

Affiliated investments (cost $13,167) |

|

|

19,743 |

|

Cash |

|

|

13,619 |

|

Cash held at broker |

|

|

12,551 |

|

Receivables: |

|

|

|

|

Dividends and interest receivable |

|

|

24,603 |

|

Prepaid expenses and other assets |

|

|

26,836 |

|

Total assets |

|

|

16,190,801 |

|

| |

|

|

|

|

LIABILITIES |

|

|

|

|

Securities sold short, at value (proceeds $9,510) |

|

|

6,368 |

|

Payables: |

|

|

|

|

Investment securities purchased |

|

|

360,410 |

|

Auditing fees |

|

|

49,410 |

|

Printing and postage |

|

|

22,971 |

|

Fund administration and accounting fees |

|

|

11,491 |

|

Transfer agent fees and expenses |

|

|

8,297 |

|

Legal expense |

|

|

6,592 |

|

Custody fees |

|

|

3,935 |

|

Directors’ fees |

|

|

1,760 |

|

Dividends on securities sold short |

|

|

72 |

|

Accrued other expenses |

|

|

1,440 |

|

Total liabilities |

|

|

472,746 |

|

| |

|

|

|

|

NET ASSETS |

|

$ |

15,718,055 |

|

| |

|

|

|

|

Paid-in-capital |

|

|

33,238,137 |

|

Total accumulated deficit |

|

|

(17,520,082 |

) |

NET ASSETS |

|

$ |

15,718,055 |

|

| |

|

|

|

|

Shares outstanding no par value (unlimited shares authorized) |

|

|

7,015,786 |

|

| |

|

|

|

|

Net asset value, offering and redemption price per share |

|

$ |

2.24 |

|

| |

|

|

|

|

Market Price Per Common Share |

|

$ |

1.70 |

|

| |

|

|

|

|

Market Price (Discount) to Net Asset Value Per Common Share |

|

|

(24.11 |

)% |

See accompanying Notes to Consolidated Financial Statements.

3

RENN Fund, Inc.

Consolidated Statement of Operations

For the Six Months Ended June 30, 2024 (Unaudited)

INVESTMENT INCOME |

|

|

|

|

Income |

|

|

|

|

Dividends from unaffiliated investments (net of withholding tax of $6,533) |

|

$ |

36,846 |

|

Dividends from affiliated investments (net of withholding tax of $-) |

|

|

81 |

|

Interest |

|

|

124,642 |

|

Total investment income |

|

|

161,569 |

|

| |

|

|

|

|

Expenses |

|

|

|

|

Fund accounting and administration fees |

|

|

44,276 |

|

Professional fees |

|

|

16,410 |

|

Transfer agent fees and expenses |

|

|

12,310 |

|

Custody fees |

|

|

11,438 |

|

Shareholder reporting fees |

|

|

10,702 |

|

Stock exchange listing fees |

|

|

8,702 |

|

Insurance fees |

|

|

8,568 |

|

Directors’ fees |

|

|

7,200 |

|

Miscellaneous expenses |

|

|

6,010 |

|

Dividends on securities sold short |

|

|

134 |

|

Total expenses |

|

|

125,750 |

|

Net investment income |

|

|

35,819 |

|

| |

|

|

|

|

Net Realized and Unrealized Gain (Loss): |

|

|

|

|

Net realized loss on: |

|

|

|

|

Unaffiliated Investments |

|

|

(21,256 |

) |

Foreign currency transactions |

|

|

(97 |

) |

Net realized gain |

|

|

(21,353 |

) |

Net change in unrealized appreciation/depreciation on: |

|

|

|

|

Unaffiliated Investments |

|

|

1,860,844 |

|

Affiliated Investments |

|

|

4,450 |

|

Securities sold short |

|

|

937 |

|

Foreign currency translations |

|

|

6 |

|

Net change in unrealized appreciation/depreciation |

|

|

1,866,237 |

|

Net realized and unrealized gain |

|

|

1,844,884 |

|

| |

|

|

|

|

Net Increase in Net Assets from Operations |

|

$ |

1,880,703 |

|

See accompanying Notes to Consolidated Financial Statements.

4

RENN Fund, Inc.

Consolidated Statements of Changes in Net Assets

| |

|

For the

Six Months Ended

June 30, 2024

(Unaudited) |

|

|

For the

Year Ended

December 31, 2023 |

|

INCREASE (DECREASE) IN NET ASSETS FROM |

|

|

|

|

|

|

|

|

Operations |

|

|

|

|

|

|

|

|

Net investment income |

|

$ |

35,819 |

|

|

$ |

9,983 |

|

Net realized loss on investments, securities sold short, distributions received from affiliated investment companies, and foreign currency transactions |

|

|

(21,353 |

) |

|

|

(40,545 |

) |

Net change in unrealized appreciation/depreciation on investments, securities sold short and foreign currency translations |

|

|

1,866,237 |

|

|

|

(854,030 |

) |

Net increase (decrease) resulting from operations |

|

|

1,880,703 |

|

|

|

(884,592 |

) |

| |

|

|

|

|

|

|

|

|

Distributions to Shareholders |

|

|

|

|

|

|

|

|

From net investment income |

|

|

— |

|

|

|

(106,408 |

) |

Net decrease resulting from distributions |

|

|

— |

|

|

|

(106,408 |

) |

| |

|

|

|

|

|

|

|

|

Total increase (decrease) in net assets |

|

|

1,880,703 |

|

|

|

(991,000 |

) |

| |

|

|

|

|

|

|

|

|

Net Assets |

|

|

|

|

|

|

|

|

Beginning of period |

|

|

13,837,352 |

|

|

|

14,828,352 |

|

End of period |

|

$ |

15,718,055 |

|

|

$ |

13,837,352 |

|

See accompanying Notes to Consolidated Financial Statements.

5

RENN Fund, Inc.

Consolidated Financial Highlights

For a capital share outstanding throughout each period |

| |

|

For the

Six Months

Ended

June 30, 2024 |

|

|

For the Year Ended December 31, |

|

| |

|

(Unaudited) |

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

Net asset value, beginning of period |

|

$ |

1.97 |

|

|

$ |

2.11 |

|

|

$ |

2.85 |

|

|

$ |

1.99 |

|

|

$ |

2.08 |

|

|

$ |

1.90 |

|

Income from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income (loss)(1) |

|

|

0.02 |

(2) |

|

|

0.00 |

(2) |

|

|

(0.00 |

)(2) |

|

|

(0.03 |

) |

|

|

(0.03 |

) |

|

|

(0.02 |

) |

Net realized and unrealized gain (loss) on investments |

|

|

0.24 |

|

|

|

(0.12 |

) |

|

|

(0.65 |

) |

|

|

0.91 |

|

|

|

(0.06 |

) |

|

|

0.40 |

|

Total from investment operations |

|

|

0.26 |

|

|

|

(0.12 |

) |

|

|

(0.65 |

) |

|

|

0.88 |

|

|

|

(0.09 |

) |

|

|

0.38 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From net investment income |

|

|

— |

|

|

|

(0.02 |

) |

|

|

0.00 |

(2) |

|

|

(0.02 |

) |

|

|

— |

|

|

|

— |

|

Total distributions |

|

|

— |

|

|

|

(0.02 |

) |

|

|

0.00 |

|

|

|

(0.02 |

) |

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Share Transactions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilutive effect of rights offering |

|

|

— |

|

|

|

— |

|

|

|

(0.09 |

)(7) |

|

|

— |

|

|

|

— |

|

|

|

(0.20 |

)(3) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of period |

|

$ |

2.23 |

|

|

$ |

1.97 |

|

|

$ |

2.11 |

|

|

$ |

2.85 |

|

|

$ |

1.99 |

|

|

$ |

2.08 |

|

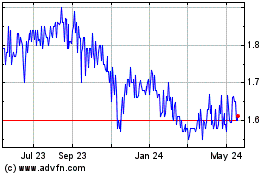

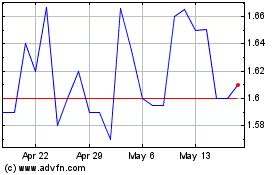

Per-share market value, end of period |

|

$ |

1.70 |

|

|

$ |

1.71 |

|

|

$ |

1.81 |

|

|

$ |

2.65 |

|

|

$ |

1.71 |

|

|

$ |

1.64 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net asset value return(4) |

|

|

13.71 |

%(5) |

|

|

(5.82 |

%) |

|

|

(25.82 |

%) |

|

|

44.40 |

% |

|

|

(4.33 |

%) |

|

|

9.47 |

% |

Total market value return(4) |

|

|

(0.58 |

%)(5) |

|

|

(4.70 |

%) |

|

|

(31.62 |

%) |

|

|

56.40 |

% |

|

|

4.25 |

% |

|

|

10.07 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios and Supplemental Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of period (in thousands) |

|

$ |

15,718 |

|

|

$ |

13,837 |

|

|

$ |

14,828 |

|

|

$ |

16,979 |

|

|

$ |

11,858 |

|

|

$ |

12,356 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of expenses to average net assets(8) |

|

|

1.77 |

%(6) |

|

|

1.87 |

% |

|

|

1.55 |

% |

|

|

1.45 |

% |

|

|

2.35 |

% |

|

|

2.03 |

% |

Ratio of net investment income (loss) to average net assets(8) |

|

|

0.50 |

%(6) |

|

|

0.07 |

% |

|

|

(0.12 |

%) |

|

|

(1.01 |

%) |

|

|

(1.64 |

%) |

|

|

(0.98 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Portfolio turnover rate |

|

|

5 |

%(5) |

|

|

3 |

% |

|

|

2 |

% |

|

|

14 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

(1)

|

Based on average shares outstanding for the period.

|

|

(2)

|

Rounds to less than 0.005.

|

|

(3)

|

Represents the impact of the Fund’s rights offering of 1,487,989 common shares in February 2019 at a subscription price based on a formula. See Note 11 for more information.

|

|

(4)

|

Total net asset value return measures the change in net asset value per share over the period indicated. Total market value return is computed based upon the Fund’s unrounded New York Stock Exchange market price per share and excludes the effects of brokerage commissions. Dividends and distributions are assumed, for purposes of these calculations, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan.

|

|

(7)

|

Represents the impact of the Fund’s rights offering of 1,063,830 common shares in January 2022 at a subscription price based on a formula. See Note 11 for more information.

|

|

(8)

|

The expense and net investment income (loss) ratios do not include income or expenses of the exchanged traded funds or open end mutual fund in which the Fund invests.

|

See accompanying Notes to Consolidated Financial Statements.

6

RENN Fund, Inc.

Consolidated Notes to Financial Statements

As of June 30, 2024 (Unaudited)

Note 1 – Organization

RENN Fund, Inc. (the “Fund”), is a registered, non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund, a Texas corporation, was organized and commenced operations in 1994 and is registered under and pursuant to the provisions of Section 8(a) of the 1940 Act.

The investment objective of the Fund is to provide shareholders with above-market rates of return through capital appreciation and income by a long-term, value oriented investment process that invests in a wide variety of financial instruments, including but not limited to, common stocks, fixed income securities including convertible and non-convertible debt securities or loans, distressed debt, warrants and preferred stock, exchange traded funds and exchange traded notes, and other instruments. In addition, the Fund may sell short stocks, exchange traded funds and exchange traded notes.

Horizon Kinetics Asset Management LLC (“Horizon” or the “Investment Advisor”), a registered investment adviser and wholly owned subsidiary of Horizon Kinetics Holding Corporation (“Horizon Kinetics”), serves as the Fund’s investment manager and is responsible for the Fund’s investment portfolio, subject to the supervision of the Board of Directors. Horizon has served as the Fund’s investment advisor since July 1, 2017.

Note 2 – Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services-Investment Companies”.

(a) Consolidation of Subsidiary

On December 5, 2017, The Renn Fund, Inc. (Cayman) (the “Subsidiary”) was organized as a limited liability company, and is a wholly owned subsidiary of the Fund. The consolidated Schedule of Investments, Statement of Assets and Liabilities, Statement of Operations, Statements of Changes in Net Assets, Statement of Cash Flows and Financial Highlights of the Fund include the accounts of the Subsidiary. All inter-company accounts and transactions have been eliminated in the consolidation for the Fund. The Subsidiary is advised by Horizon and acts as an investment vehicle in order to effect certain investments consistent with the Fund’s investment objectives and policies specified in the Fund’s prospectus and statement of additional information. As of June 30, 2024 total assets of the Fund were $16,190,801, of which $860,847, or approximately 5.32%, represented the Fund’s ownership of the Subsidiary.

The Fund can invest up to 25% of its total assets in its Subsidiary. The Subsidiary acts as an investment vehicle in order to invest in commodity-linked, bitcoin, and other cryptocurrency linked instruments consistent with the Fund’s investment objectives and policies. By investing in its Subsidiary, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The investments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. The Subsidiary is not registered under the 1940 Act and is not subject to all the investor protections of the 1940 Act. However the Fund wholly owns and controls its Subsidiary, making it unlikely that the Subsidiary will take action contrary to the interests of the Fund. The Subsidiary will be subject to the same investment restrictions and limitations, and follow the same compliance policies and procedures, as the Fund.

The Subsidiary is an exempted Cayman investment company and as such is not subject to Cayman Islands taxes at the present time. For U.S. income tax purposes, the Subsidiary is a Controlled Foreign Corporation (“CFC”) not subject to U.S. income taxes. As a wholly-owned CFC, however, the Subsidiary’s net income and net capital gains will be included each year in the Fund’s investment company taxable income.

(b) Valuation of Investments

All investments are stated at their estimated fair value, as described in Note 5.

7

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS (Continued)

As of June 30, 2024 (Unaudited)

(c) Investment Transactions, Investment Income and Expenses

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded net of applicable withholding taxes on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends, if applicable, are paid (a portion of which may be reclaimable) or provided for in accordance with the applicable country’s tax rules and rates and are disclosed in the consolidated Statement of Operations. Withholding tax reclaims are filed in certain countries to recover a portion of the amounts previously withheld. The Fund records a reclaim receivable based on a number of factors, including a jurisdiction’s legal obligation to pay reclaims as well as payment history and market convention. Discounts or premiums on debt securities are accreted or amortized to interest income over the lives of the respective securities using the effective interest method.

(d) Federal Income Taxes

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized gains to its shareholders. Therefore, no provision is made for federal income or excise taxes. Due to the timing of dividend distributions and the differences in accounting for income and realized gains and losses for financial statement and federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains and losses are recorded by the Fund.

The Fund follows the provisions of Accounting Standards Codification ASC 740, Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”), which requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing a Fund’s tax returns to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Consolidated Statement of Operations.

The Income Tax Statement requires management of the Fund to analyze tax positions taken in the prior three open tax years, if any, any tax positions expected to be taken in the Fund’s current tax year, as defined by the IRS statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of and during the open tax years ended December 31, 2020 through 2023, and as of and during the six months ended June 30, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund has no examinations in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

(e) Distributions to Shareholders

The Fund will make distributions of net investment income and capital gains, if any, at least annually. Distributions to shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain (loss) items for financial statement and tax purposes.

(f) Short Sales

Short sales are transactions under which the Fund sells a security it does not own in anticipation of a decline in the value of that security. To complete such a transaction, the Fund must borrow the security to make delivery to the buyer. The Fund then is obligated to replace the security borrowed by purchasing the security at market price at the time of replacement. The price at such time may be more or less than the price at which the security was sold by the Fund. When a security is sold short a decrease in the value of the security will be recognized as a gain and an increase in the value of the security will be recognized as a loss, which is potentially limitless. Until the security is replaced, the Fund is required to pay the lender amounts equal to dividend or interest that accrue during the period of the loan which is recorded as an expense. To borrow the security, the Fund also may be required to pay a premium or an interest fee, which are recorded as interest expense. Cash or securities may be segregated for the broker to meet the necessary margin requirements. The Fund is subject to the risk that it may not always be able to close out a short position at a particular time or at an acceptable price.

8

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS (Continued)

As of June 30, 2024 (Unaudited)

(g) Short-Term Investments

The Fund invested a significant amount (30.63% of its net assets as of June 30, 2024) in the Fidelity Investment Money Market Government Portfolio Fund (“FIGXX”). FIGXX normally invests at least 99.5% of assets in U.S. government securities and repurchase agreements for those securities. FIGXX invests in compliance with industry-standard regulatory requirements for money market funds for the quality, maturity, and diversification of investments. An investment in FIGXX is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although FIGXX seeks to preserve the value of investment at $1.00 per share, it is possible to lose money by investing in FIGXX.

FIGXX files complete Semi-Annual and Annual Reports with the U.S. Securities and Exchange Commission for semi-annual and annual periods of each fiscal year on Form N-CSR. The Forms N-CSR are available on the website of the U.S. Securities and Exchange Commission at www.sec.gov, and may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The net expense ratio per the March 31, 2024 annual report of Fidelity Investment Money Market Government Portfolio Fund was 0.18%.

Note 3 – Principal Investment Risks

Investing in common stocks and other equity or equity-related securities has inherent risks that could cause you to lose money. Some of the principal risks of investing in the Fund are listed below and could adversely affect the net asset value (“NAV”), total return and value of the Fund and your investment. These are not the only risks associated with an investment in the Fund. Rather, the risks discussed below are certain of the significant risks associated with the investment strategy employed by the Fund. The below does not discuss numerous other risks associated with an investment in the Fund, including risks associated with investments in non-diversified, closed-end registered investment funds generally, other business, operating and tax risks associated with an investment in the Fund, and economic and other risks affecting investment markets generally, all of which are beyond the scope of this discussion.

Liquidity Risks: The Investment Advisor may not be able to sell portfolio securities at an optimal time or price. For example, if the Fund is required or the advisor deems it advisable to liquidate all or a portion of a portfolio security quickly, it may realize significantly less than the value at which the investment was previously recorded.

Private Issuer Risks: In addition to the risks associated with small public companies, limited or no public information may exist about private companies, and the Fund will rely on the ability of our Investment Advisor to obtain adequate information to evaluate the potential returns from investing in these companies. If the Investment Advisor is unable to uncover all material information about these companies, the Fund may not make a fully informed investment decision and may lose money on the investment.

Interest Rate Risk: When interest rates increase, any fixed-income securities held by the Fund may decline in value. Long-term fixed-income securities will normally have more price volatility because of this risk than short-term fixed-income securities. The negative impact on fixed-income securities from the resulting rate increases for that and other reasons could be swift and significant.

Leveraging Risks: Investments in derivative instruments may give rise to a form of leverage. The Investment Advisor may engage in speculative transactions which involve substantial risk and leverage. The use of leverage by the Investment Advisor may increase the volatility of the Fund. These leveraged instruments may result in losses to the Fund or may adversely affect the Fund’s NAV or total return, because instruments that contain leverage are more sensitive to changes in interest rates. The Fund may also have to sell assets at inopportune times to satisfy its obligations in connection with such transactions.

Distressed Debt Risks: An investment in distressed debt involves considerable risks, including a higher risk of nonpayment by the debtor. The Fund may incur significant expenses seeking recovery upon default or attempting to negotiate new terms. Furthermore, if one of our portfolio companies were to file for bankruptcy protection, a bankruptcy court might re-characterize the debt held by the Fund and subordinate all or a portion of the Fund’s claim to claims of other creditors, even, in some cases, if the investment is structured as senior secured debt. The bankruptcy process has a number of significant inherent risks, including substantial delays and the risk of loss of all or a substantial portion of the Fund’s investment in the bankrupt entity.

Bitcoin Risk: The value of the Fund’s investment in the Grayscale Bitcoin Trust is subject directly to fluctuations in the value of bitcoins. The value of bitcoins is determined by the supply of and demand for bitcoins in the global market for the trading of bitcoins, which consists of transactions on electronic bitcoin exchanges (“Bitcoin Exchanges”). Pricing on Bitcoin Exchanges and other venues can be volatile and can adversely affect the value of the Grayscale Bitcoin Trust. Currently, there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to the relatively large use of bitcoins by speculators, thus contributing to price volatility

9

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS (Continued)

As of June 30, 2024 (Unaudited)

that could adversely affect the Fund’s direct investment in the Grayscale Bitcoin Trust. Bitcoin transactions are irrevocable, and stolen or incorrectly transferred bitcoins may be irretrievable. As a result, any incorrectly executed bitcoin transactions could adversely affect the value of the Fund’s direct or indirect investment in the Grayscale Bitcoin Trust. Shares of the Grayscale Bitcoin Trust may trade at a premium or discount to the net asset value of the Grayscale Bitcoin Trust.

Short-Selling Risk: The Fund can sell securities short to the maximum extent permitted under the Investment Company Act of 1940 (the “1940 Act”). A short sale by the Fund involves borrowing a security from a lender which is then sold in the open market. At a future date, the security is repurchased by the Fund and returned to the lender. While the security is borrowed, the proceeds from the sale are deposited with the lender and the Fund may be required to pay interest and/or the equivalent of any dividend payments paid by the security to the lender. If the value of the security declines between the time the Fund borrows the security and the time it repurchases and returns the security to the lender, the Fund makes a profit on the difference (less any expenses the Fund is required to pay the lender). There is no assurance that a security will decline in value during the period of the short sale and make a profit for the Fund. If the value of the security sold short increases between the time that the Fund borrows the security and the time it repurchases and returns the security to the lender, the Fund will realize a loss on the difference (plus any expenses the Fund is required to pay to the lender). This loss is theoretically unlimited as there is no limit as to how high the security sold short can appreciate in value, thus increasing the cost of buying that security to cover a short position. The Fund may incur interest or other expenses in selling securities short and such expenses are investment expenses of the Fund.

Investments in Leveraged/Inverse ETFs and ETNs: The Fund may invest long or short in leveraged/inverse ETFs and ETNs. Leveraged/inverse ETFs and ETNs are designed for investors who seek leveraged long or leveraged inverse exposure, as applicable, to the daily performance of an index. These instruments do not guarantee any return of principal and do not pay any interest during their term. In general, investors will be entitled to receive a cash payment, upon early redemption or upon acceleration, as applicable, that will be linked to the performance of an underlying index, plus a daily accrual and less a daily investor fee. Investors should be willing to forgo interest payments and, if the index on which the ETF or ETN is based declines or increases, as applicable, be willing to lose up to 100% of their investment. In many instances a leveraged or inverse ETF or ETN will seek to provide an investor with a corresponding multiple of the index it tracks (e.g., a three times leveraged long ETF that tracks the S&P 500 Index seeks to provide investors with three times the positive rate of return of the S&P 500 Index on a daily basis). Such ETFs and ETNs are very sensitive to changes in the level of their corresponding index, and returns may be negatively impacted in complex ways by the volatility of the corresponding index on a daily or intraday basis.

Note 4 – Investment Advisory Agreement

The Fund entered in to an Investment Advisor Agreement (the “Agreement”) with Horizon. Under the Agreement, Horizon is not paid an advisory fee on net assets less than $25 million and thereafter will charge a management fee of 1.0% on net assets above $25 million. Horizon performs certain services, including certain management, investment advisory and administrative services necessary for the operation of the Fund.

Note 5 – Fair Value Measurements

Investments are carried at fair value, as determined in good faith by Horizon, the Fund’s Board of Directors’ valuation designee. The fair values reported are subject to various risk including changes in the equity markets, general economic conditions, and the financial performance of the companies. Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the fair value of investment securities, it is possible that the amounts reported in the accompanying financial statements could change materially in the near term.

The Fund generally invests in common securities, preferred securities, convertible and nonconvertible debt securities, and warrants. These securities may be unregistered and thinly-to-moderately traded. Generally, the Fund negotiates registration rights at the time of purchase and the portfolio companies are required to register the shares within a designated period, and the cost of registration is borne by the portfolio company.

10

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS (Continued)

As of June 30, 2024 (Unaudited)

On a daily basis, as is necessary, Horizon prepares a valuation to determine fair value of the investments of the Fund. The valuation principles are described below.

Unrestricted common stock of companies listed on an exchange, such as the NYSE or NASDAQ, or in the over-the-counter market is valued at the closing price on the date of valuation. Thinly traded unrestricted common stock of companies listed on an exchange, such as the NYSE or NASDAQ, or in the over-the-counter market is valued at the closing price on the date of valuation, less a marketability discount as determined appropriate by the Fund Managers and approved by the Board of Directors.

Restricted common stock of companies listed on an exchange, such as the NYSE or NASDAQ, or in the over-the-counter market is valued based on the quoted price for an otherwise identical unrestricted security of the same issuer that trades in a public market, adjusted to reflect the effect of any significant restrictions.

The unlisted preferred stock of companies with common stock listed on an exchange, such as the NYSE or NASDAQ, or in the over-the-counter market is valued at the closing price of the common stock into which the preferred stock is convertible on the date of valuation.

Debt securities are valued at fair value. The Fund considers, among other things, whether a debt issuer is in default or bankruptcy. It also considers the underlying collateral. Fair value is generally determined to be the greater of the face value of the debt or the market value of the underlying common stock into which the instrument may be converted.

The unlisted in-the-money options or warrants of companies with the underlying common stock listed on an exchange, such as the NYSE or NASDAQ, or in the over-the-counter market are valued at fair value (the positive difference between the closing price of the underlying common stock and the strike price of the warrant or option). An out-of-the money warrant or option has no value; thus the Fund assigns no value to it.

Investments in privately held entities are valued at fair value. If there is no independent and objective pricing authority (i.e., a public market) for such investments, fair value is based on the latest sale of equity securities to independent third parties. If a private entity does not have an independent value established over an extended period of time, then the Investment Advisor will determine fair value on the basis of appraisal procedures established in good faith and approved by the Board of Directors.

The Fund follows the provisions of Accounting Standards Codification ASC 820, Fair Value Measurements, under which the Fund has established a fair value hierarchy that prioritizes the sources (“inputs”) used to measure fair value into three broad levels: inputs based on quoted market prices in active markets (Level 1 inputs); observable inputs based on corroboration with available market data (Level 2 inputs); and unobservable inputs based on uncorroborated market data or a reporting entity’s own assumptions (Level 3 inputs).

The following table shows a summary of investments measured at fair value on a recurring basis classified under the appropriate level of fair value hierarchy as of June 30, 2024:

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible Bonds |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Common Equities |

|

|

10,568,397 |

|

|

|

— |

|

|

|

426,661 |

|

|

|

10,995,058 |

|

Exchange Traded Funds |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Money Market Funds |

|

|

4,907,049 |

|

|

|

— |

|

|

|

— |

|

|

|

4,907,049 |

|

Open Ended Mutual Funds |

|

|

19,743 |

|

|

|

— |

|

|

|

— |

|

|

|

19,743 |

|

Preferred Stocks |

|

|

— |

|

|

|

— |

|

|

|

185,798 |

|

|

|

185,798 |

|

Warrants |

|

|

— |

|

|

|

— |

|

|

|

5,544 |

|

|

|

5,544 |

|

Total Investments |

|

$ |

15,495,189 |

|

|

$ |

— |

|

|

$ |

618,003 |

|

|

$ |

16,113,192 |

|

11

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS (Continued)

As of June 30, 2024 (Unaudited)

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities Sold Short |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange Traded Funds |

|

$ |

6,226 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

6,226 |

|

Exchange Traded Notes |

|

|

142 |

|

|

|

— |

|

|

|

— |

|

|

|

142 |

|

Total Liabilities |

|

$ |

6,368 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

6,368 |

|

Following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining value:

|

|

Convertible

Bonds |

|

|

Common

Equities |

|

|

Preferred

Stocks |

|

|

Warrants |

|

|

Total |

|

Beginning balance December 31, 2023 |

|

$ |

— |

|

|

$ |

424,205 |

|

|

$ |

185,798 |

|

|

$ |

7,104 |

|

|

$ |

617,107 |

|

Transfers into Level 3 during the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Change in unrealized appreciation/(depreciation) |

|

|

— |

|

|

|

(11,046 |

) |

|

|

— |

|

|

|

(1,560 |

) |

|

|

(12,606 |

) |

Total realized gain/(loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Purchases |

|

|

— |

|

|

|

13,502 |

|

|

|

— |

|

|

|

— |

|

|

|

13,502 |

|

Sales |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Return of capital distributions |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Transfers out of Level 3 during the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Ending balance June 30, 2024 |

|

$ |

— |

|

|

$ |

426,661 |

|

|

$ |

185,798 |

|

|

$ |

5,544 |

|

|

$ |

618,003 |

|

Investments in portfolio companies are being classified as Level 3. At June 30, 2024, Petrohunter Energy Corporation was valued at $0 due to bankruptcy proceedings and thus qualifies as a Level 3 security. Also at June 30, 2024, Big League Advance, LLC., CNSX Markets, Inc., Diamond Standard, Inc., and Miami International Holdings, Inc. were private companies and shares and/or warrants are illiquid, thus qualifying as Level 3 securities. There were no changes to the valuation approaches or techniques during the period. The following table summarizes the valuation techniques and significant unobservable inputs used in determining fair value measurements for these investments classified as Level 3 as of June 30, 2024:

Quantitative Information about Level 3 Fair Value Measurements |

Portfolio Investment

Company |

Valuation

Technique |

Unobservable

Input* |

|

Input Range |

|

|

Valuation

Weighted

Average of

Input |

|

|

Value at

6/30/24 |

|

|

Impact to

Valuation

from an

Increase in

Input** |

|

Petrohunter Energy Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible Bond |

Asset Approach |

Bankruptcy Recovery |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0 |

|

|

|

Increase |

|

Common Stock |

Asset Approach |

Bankruptcy Recovery |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0 |

|

|

|

Increase |

|

Big League Advance, LLC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

Asset Approach |

Precedent Transaction |

|

$ |

55.00 |

|

|

$ |

55.00 |

|

|

$ |

280,005 |

|

|

|

Increase |

|

12

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS (Continued)

As of June 30, 2024 (Unaudited)

Quantitative Information about Level 3 Fair Value Measurements |

Portfolio Investment

Company |

Valuation

Technique |

Unobservable

Input* |

|

Input Range |

|

|

Valuation

Weighted

Average of

Input |

|

|

Value at

6/30/24 |

|

|

Impact to

Valuation

from an

Increase in

Input** |

|

Diamond Standard, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

Cost Approach |

Precedent Transaction |

|

$ |

6.00 |

|

|

$ |

6.00 |

|

|

$ |

185,798 |

|

|

|

Increase |

|

Warrant |

Black Scholes Method |

Volatility |

|

|

10 |

% |

|

|

10 |

% |

|

$ |

1 |

|

|

|

Increase |

|

Miami International Holdings, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

Discounted Cash Flow |

Volatility |

|

|

18.8 |

% |

|

|

N/A |

|

|

$ |

133,280 |

|

|

|

Increase |

|

| |

Option Pricing Model |

Discount for Lack of Marketability |

|

|

12.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Weighted Average Cost of Capital |

|

|

14.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years to Maturity |

|

|

6.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Risk-Free Rate |

|

|

4.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Warrant |

Discounted Cash Flow |

Volatility |

|

|

18.8 |

% |

|

|

N/A |

|

|

$ |

5,543 |

|

|

|

Increase |

|

| |

Option Pricing Model |

Discount for Lack of Marketability |

|

|

12.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Weighted Average Cost of Capital |

|

|

14.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years to Maturity |

|

|

6.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Risk-Free Rate |

|

|

4.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

CNSX Markets, Inc. |

Discounted Cash Flow |

Public Company Method |

|

$ |

6.10 - 6.54 |

|

|

$ |

6.32 |

|

|

$ |

13,376 |

|

|

|

Increase |

|

|

*

|

The Investment Advisor considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. The Fund’s use of fair value pricing may cause the net asset value of Fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

|

|

**

|

This column represents the directional change in the fair value of the Level 3 investments that would result from an increase to the corresponding unobservable input. A decrease to the unobservable input would have the opposite effect.

|

13

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS (Continued)

As of June 30, 2024 (Unaudited)

The Fund has adopted a policy of recording any transfers of investment securities between the different levels in the fair value hierarchy as of the end of the year unless circumstances dictate otherwise.

Note 6 – Investments in Affiliated Issuers

An affiliated issuer is an entity in which the Fund has ownership of at least 5% of the voting securities, or any investment which is advised or sponsored by the advisor. In this instance, affiliation is based on the fact that the Kinetics Spin-off and Corporate Restructuring Fund is advised by Horizon, the same Investment Advisor to the Fund. Issuers that are affiliates of the Fund at period-end are noted in the Fund’s Schedule of Investments. Additional security purchases and the reduction of certain securities shares outstanding of existing portfolio holdings that were not considered affiliated in prior years may result in the Fund owning in excess of 5% of the outstanding shares at period-end. The table below reflects transactions during the period with entities that are affiliates as of June 30, 2024 and may include acquisitions of new investments, prior year holdings that became affiliated during the period and prior period affiliated holdings that are no longer affiliated as of period-end.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends and

Distributions |

|

Name of Issuer

and Title of

Issue |

|

Value

Beginning

of Period |

|

|

Purchases |

|

|

Sales

Proceeds |

|

|

Net Realized

Gain (Loss) |

|

|

Change in

Unrealized

Appreciation

(Depreciation) |

|

|

Value

End of

Period |

|

|

Capital

Gains |

|

|

Income |

|

Kinetics

Spin-off and Corporate Restructuring Fund |

|

$ |

15,293 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

4,450 |

|

|

$ |

19,743 |

|

|

$ |

— |

|

|

$ |

— |

|

Total |

|

$ |

15,293 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

4,450 |

|

|

$ |

19,743 |

|

|

$ |

— |

|

|

$ |

— |

|

Name of Issuer and Title of Issue |

|

Shares

Beginning

of Period |

|

|

Purchases |

|

|

Sales Proceeds |

|

|

Stock Split |

|

|

Shares

End of

Period |

|

Kinetics

Spin-off and Corporate Restructuring Fund |

|

|

824 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

824 |

|

Total |

|

|

824 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

824 |

|

Note 7 – Federal Income Tax Information

At June 30, 2024, the cost of securities and the proceeds from securities sold short, on a tax basis and gross unrealized appreciation and depreciation of investments and securities sold short for federal income tax purposes were as follows:

Cost of investments |

|

$ |

20,498,575 |

|

Gross unrealized appreciation |

|

$ |

3,766,838 |

|

Gross unrealized depreciation |

|

|

(8,158,589 |

) |

Net unrealized depreciation |

|

$ |

(4,391,751 |

) |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to investments in grantor trusts and passive foreign investment companies (PFICs).

14

RENN Fund, Inc.

CONSOLIDATED NOTES TO FINANCIAL STATEMENTS (Continued)

As of June 30, 2024 (Unaudited)

As of December 31, 2023, the components of accumulated earnings/(deficit) on a tax basis were as follows:

Undistributed ordinary income |

|

$ |

— |

|

Undistributed long-term capital gains |

|

|

— |

|

Tax accumulated earnings |

|

|

— |

|

Accumulated capital and other losses |

|

|

(13,260,914 |

) |

Net unrealized depreciation on investments |

|

|

(6,139,864 |

) |

Net unrealized appreciation on foreign currency translations |

|

|

(7 |

) |

Total accumulated deficit |

|

$ |

(19,400,785 |

) |

As of December 31, 2023, the Fund had accumulated capital loss carryforwards as follows:

Not subject to expiration: |

|

|

|

|

Short-term |

|

$ |

136,084 |

|

Long-term |

|

|

13,124,830 |

|

| |

|

$ |

13,260,914 |

|

To the extent that a fund may realize future net capital gains, those gains will be offset by any of its unused capital loss carryforward. Future capital loss carryforward utilization in any given year may be subject to Internal Revenue Code limitations.

The tax character of distributions paid during the tax years ended December 31, 2023 and 2022 were as follows:

Distributions paid from: |

|

2023 |

|

|

2022 |

|

Ordinary income |

|

$ |

106,408 |

|

|

$ |

24,864 |

|