Shipping ETF in Focus: Choppy Seas Ahead? - ETF News And Commentary

20 September 2013 - 10:07PM

Zacks

September started off on a solid note for the shipping industry,

which was under stress over the last few years on macroeconomic

headwinds and declining rates. The industry is bouncing back

strongly with rising freight rates on the back growing shipments

and a slowdown in new ship construction.

This is especially true given the rally in the Baltic Dry Shipping

Index, which is a measure of the costs to ship raw materials by

sea. The index jumped to a four year high, climbing over 45% over

the past one month.

Improving Fundamentals

China, the world's largest shipmaker by tonnage, has seen nearly

156% year-over-year increase in new ship orders in the first seven

months of this year.

This is because rising steel production and prices are attracting

iron ore (a major component of steel) purchases by Chinese steel

mills, leading to growing demand for shipping vessels. Iron ore

imports in China grew 11% in August, followed by 17% in July (read:

Time to Bet on the Steel ETF).

The price of steel is likely to rise given the lack of Fed

tapering, as commodities could see a boost in this environment.

Further, commodities such as corn and soybeans recently saw

increase in prices. As a result, exports for these commodities

through ship vessels would climb to record levels by the end of the

year, according to the projection by the US Department of

Agriculture (read: 2 Commodity ETFs Offering Investors Sweet

Returns).

Overall, the increase in shipments of iron ore, coal, grains,

minerals, soybean and corn would raise freight rates across the

globe, greatly benefiting the shipping industry as a whole.

ETF Angle

In such a backdrop, the main ETF tracking the industry has

performed extremely well this year. The

Guggenheim Shipping

ETF (SEA) gained nearly

6.5% in the past one month and delivered outsized returns of over

24% in the year-to-date time frame. This return clearly outpaced

the broad market fund, SPY, and other products in the industrial

space by a wide margin (see: all the Industrial ETFs here).

We think the SEA could be poised for a further surge in the coming

months, based on both technical and fundamental factors described

below:

Technical Look

The fund currently made its new high of $19.90 and its short-term

moving averages have managed to stay above long-term levels. The

9-Day SMA is now comfortably above the longer-term 200-Day SMA,

suggesting continued bullishness for this ETF.

Meanwhile, the ETF has seen an increase in trading volume of late

further confirming the uptrend in the fund. This is further

confirmed by an upswing in the Parabolic SAR, although this figure

should definitely be monitored closely (see more in the Zacks ETF

Center).

Fundamentals

Fundamentals

The product tracks the Dow Jones Global Shipping Index, which

measures the stock performance of high dividend-paying companies in

the global shipping industry. Holding 26 securities in its basket,

the fund is guilty of concentration, as company-specific risk runs

high.

The top firm – AP Moller – holds about 19.90% of the assets while

Nippon Yusen and Sembcorp Marine take the next two spots at 9.56%

and 5.54%, respectively. In terms of country exposure, the United

States takes the top position with 22.05% share, closely followed

by Denmark (20.64%) and Hong Kong (14.30%).

Currently, the ETF is under-appreciated and unloved by many

investors as indicated by its AUM of only $42.7 million and average

daily trading volume of just under 31,000 shares. The product

charges 65 bps in fees and expenses (read: Smooth Sailing Ahead for

the Shipping ETF?).

Bottom Line

The shipping ETF could be poised to surge throughout the rest of

the year given its impressive performance and improving global

conditions. The space has bounced from its lows and continues to

trend higher on better demand/supply fundamentals.

As such, we recommend investors focus on this ETF as it is a

barometer for global demand and overall economic health, and it

could be well positioned to add to gains in the months ahead,

thanks to strong technical and fundamental factors at play in this

often overlooked corner of the market.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

GUGG-SHIPPING (SEA): ETF Research Reports

TEEKAY LNG PTNR (TGP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

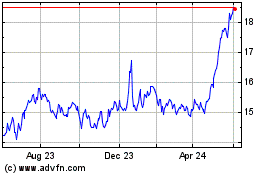

US Global Sea to Sky Car... (AMEX:SEA)

Historical Stock Chart

From Dec 2024 to Jan 2025

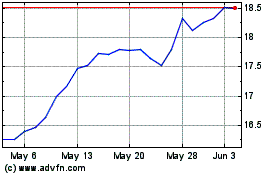

US Global Sea to Sky Car... (AMEX:SEA)

Historical Stock Chart

From Jan 2024 to Jan 2025