ETF Options Strategy: Bull Call Spread - ETF News And Commentary

08 March 2013 - 10:01PM

Zacks

Despite all global headwinds the U.S. equity markets have shown

great resilience. In fact the uptrend in equities has proved that

considering the present circumstances, equities are still the best

place to park money.

Nevertheless, with the Dow surpassing its all time high and the

S&P 500 hovering around its high water mark, the question in

everyone’s mind is ‘how much more can this continue without a

pullback?’ (read Three Most Popular ETFs of February).

Some are starting to believe that a correction is imminent, or

at least overdue. But the markets have proved many pundits wrong

predicting a pullback in the recent past.

This makes a perfect case to be ‘conservatively

bullish’ on the market, especially in the near term.

Given this outlook, a Bull Call Spread options

strategy on the SPDR S&P 500 ETF (SPY) might

be worthwhile, especially given the recent pattern it has

exhibited.

As we can see from the chart above the ETF has resumed its

upward trajectory as indicated by the green parallel lines after

exhibiting some degree of distortion in the latter part of February

(red encircled portion). Furthermore it has a strong momentum of

103.62, which has been relatively flat for quite some time (read

Can the Dollar ETF (UUP) Finally Break Out?).

These factors could play an important role in the ETF sustaining

these levels with a slight bullish bias past the March expiry

series.

Strategy

One possible way to play to play these trends are with options.

A potential lower risk technique could using a bull call spread on

SPY options.

An example of this technique is as follows:

Buy: At-the-Money SPY Call option with a strike price of 155,

March 2013 expiry currently trading at $0.71.

Sell: Out-of the-money SPY Call option with a strike price of

157, March 2013 expiry currently trading at $0.13.

SPY is currently trading at $154.82 (i.e. Spot Price).

Payoff

|

Action

|

Type of Option

|

Strike Price

|

Premium

|

Expiry

|

|

Buy

|

Call

|

155.00

|

$0.71

|

March 2013

|

|

Sell

|

Call

|

157.00

|

$0.13

|

March 2013

|

|

|

|

|

|

|

|

Maximum Loss (Risk)

|

|

|

|

$0.57

|

|

Break Even Point

|

|

|

|

$155.59

|

|

Reward

|

|

|

|

$1.41

|

|

Potential ROI

|

|

|

|

238%

|

|

Reward: Risk Ratio

|

|

|

|

2.38

|

Payoff Explained

This is a conservative strategy in which both profit and loss is

capped. The strategy starts with a first up initial investment of

$0.57 per lot which is the difference between the option premium

paid on buying, and the option premium received on selling the

option.

This also represents the maximum possible loss that an investor

can suffer, but only if both the options expire worthless. A loss

is realized if the underlying closes below the breakeven point of

$155.59 below expiry (read Bet on the Euro with These 3 ETFs).

However, the reward for the underlying strategy could be a

handsome $1.41 which can be achieved if the underlying (i.e. SPY)

increases to $155.59 (i.e. the break even point) or more from

current levels.

Therefore we are looking at less than a one percent increase in

the underlying for a 238% return on our investment. This translates

into a Reward: Risk ratio of 2.38 times (read Two Amazing ETFs For

S&P 500 Exposure).

However, investors should note that the maximum possible gain is

limited to $1.42 per lot. Therefore even if the underlying

increased substantially more than the break even point, the profit

potential for this strategy remains the same.

Additionally, it is worth pointing out that the time until

expiration is pretty short and these contracts will need to move

favorably very soon. Thus, there is a definite possibility that

investors could see a loss with this technique.

But if you believe that the market can continue to surge higher,

and if you are seeking a lower risk short-term strategy, a closer

look at options could be the way to go for some investors.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

The ideas expressed in this article are for illustrative

purposes only.

ISHARS-SP500 (IVV): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

VANGD-SP5 ETF (VOO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

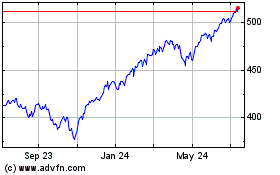

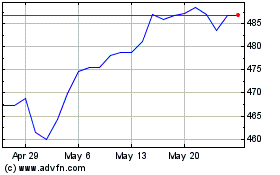

Vanguard S&P 500 (AMEX:VOO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vanguard S&P 500 (AMEX:VOO)

Historical Stock Chart

From Feb 2024 to Feb 2025