TIDMBOD

RNS Number : 6594G

Botswana Diamonds PLC

31 March 2022

31(st) March 2022

Botswana Diamonds PLC ("Botswana Diamonds" or the "the

Company")

Unaudited Interim Statement and Financial Results for the Six

Months Ended 31 December 2021

Botswana Diamonds (AIM: BOD) is pleased to announce its

unaudited interim results for the six months ended 31 December 2021

during which time the Company has made significant progress on its

diamond development projects at Thorny River in South Africa and in

the Kalahari of Botswana.

Highlights

-- The Thorny River project is progressing. A mine development

model will be completed within a month. New gravity surveys have

identified four new targets, three close to existing

discoveries.

-- An agreement has been reached for the existing shareholders

in Maibwe to acquire 100% of the company.

-- An extension to the long stop date of 31(st) March to 10(th)

May 2022 to acquire the Ghaghoo Mine has been agreed to finalise

discussions with interested financiers.

Market

The diamond market has seen a rapid and dramatic recovery in

recent months with prices rising by upwards of 40%. Pent up demand

and reductions in supply have led to this rise. If sanctions impact

on the supply from Alrosa, the world's biggest producer then prices

will rise further. The increased demand has come from across the

world and in most if not all categories of diamonds.

South Africa

Substantial and significant progress has been made on the Thorny

River project. Additional detailed ground geophysical surveys have

identified four new targets adjacent to the existing discoveries.

Three of these are within two hundred metres of the River and River

Extension blows. These four targets will be drilled in the dry

season from June through August. Any discoveries will add to the

current resource. A mine plan for the complex will be completed

within a month.

The acquisition by BOD of the minority shareholding in Vutomi,

the holders of the Thorny River assets, is expected to be completed

during Q2 2022 with only regulatory approval for the transaction

outstanding.

Botswana

Agreement has finally been reached with the liquidators of BCL

to acquire the remaining 51% of Maibwe. Following completion of the

acquisition Maibwe will be owned by Future Mineral (50%), Siseko

(29%) and BOD (21%). BOD owns 51% of Siseko so the net interest of

BOD will be 36%.

A new work programme will be prepared including modelling of the

current diamond results to optimise a fresh drilling programme.

It has been agreed between Gem Diamonds and BOD to extend the

long stop date of 31(st) March 2022 for the acquisition of the

Ghaghoo Mine to 10(th) May 2022 to enable BOD to finalise

discussions with interested financiers.

Work continues on the Diamexstrat JV. One area in particular has

been identified which using the most modern evaluation techniques

shows compelling evidence for the presence of undiscovered

kimberlites. The analysis is almost complete after which an

exploration programme will be launched.

Corporate

A Company-arranged placing was successfully completed in October

2021 with existing and new investors to raise GBP550,000 via the

issue of 55,000,000 new ordinary shares at a placing price of 1p

per Placing Share. Each Placing Share has one warrant attached with

the right to subscribe for one new ordinary share at 2p per new

ordinary share for a period of three years from 25 October

2021.

John Teeling

Chairman

30(th) March 2022

_______________

This release has been approved by James Campbell, Managing

Director of Botswana Diamonds plc, a qualified geologist

(Pr.Sci.Nat), a Fellow of the Southern African Institute of Mining

and Metallurgy, the Institute of Materials, Metals and Mining (UK)

and the Geological Society of South Africa and who has over

35-years' experience in the diamond sector.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014. The person who arranged

for the release of this announcement on behalf of the Company was

James Campbell, Director

A copy of this announcement is available on the Company's

website, at www.botswanadiamonds.co.uk

S

Enquiries:

Beaumont Cornish - Nominated Adviser

Michael Cornish

Roland Cornish +44 (0) 020 7628 3396

Beaumont Cornish Limited - Broker

Roland Cornish

Felicity Geidt +44 (0) 207 628 3396

First Equity Limited - Joint Broker

Jason Robertson +44 (0) 207 374 2212

BlytheRay - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Rachael Brooks +44 (0) 207 138 3206

Said Izagaren +44 (0) 207 138 3206

Naomi Holmes +44 (0) 207 138 3206

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Ciara Wylie +353 (0) 1 661 4055

www.botswanadiamonds.co.uk

Botswana Diamonds plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six Months Six Months Year

Ended Ended Ended

31 Dec 21 31 Dec 20 30 Jun 21

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Administrative expenses ( 228 ) ( 195 ) ( 402 )

Impairment of exploration and evaluation assets - - ( 70 )

-------------------- -------------------- -------------------------------------

OPERATING LOSS ( 228 ) ( 195 ) ( 472 )

LOSS BEFORE TAXATION ( 228 ) ( 195 ) ( 472 )

Income tax expense - - -

-------------------- -------------------- -------------------------------------

LOSS AFTER TAXATION ( 228 ) ( 195 ) ( 472 )

Exchange difference on translation of foreign operations ( 159 ) 48 ( 85 )

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD ( 387 ) ( 147 ) ( 557 )

==================== ==================== =====================================

LOSS PER SHARE - basic and diluted (0.03p) (0.03p) (0.06p)

==================== ==================== =====================================

CONDENSED CONSOLIDATED BALANCE SHEET 31 Dec 21 31 Dec 20 30 Jun 21

unaudited unaudited audited

ASSETS: GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Intangible assets 8,126 8,287 8,194

Plant and equipment 207 - 207

-------------------- -------------------- -------------------------------------

8,333 8,287 8,401

-------------------- -------------------- -------------------------------------

CURRENT ASSETS

Other receivables 16 5 41

Cash and cash equivalents 318 39 165

-------------------- -------------------- -------------------------------------

334 44 206

-------------------- -------------------- -------------------------------------

TOTAL ASSETS 8,667 8,331 8,607

-------------------- -------------------- -------------------------------------

LIABILITIES:

CURRENT LIABILITIES

Trade and other payables ( 650 ) ( 486 ) ( 744 )

-------------------- -------------------- -------------------------------------

TOTAL LIABILITIES ( 650 ) ( 486 ) ( 744 )

NET ASSETS 8,017 7,845 7,863

==================== ==================== =====================================

EQUITY

Share capital - deferred shares 1,796 1,796 1,796

Share capital - ordinary shares 2,124 1,803 1,982

Share premium 11,383 10,734 10,984

Share based payments reserve 111 111 111

Retained Deficit ( 5,933 ) ( 5,427 ) ( 5,705 )

Translation Reserve ( 481 ) ( 189 ) ( 322 )

Other reserves ( 983 ) ( 983 ) ( 983 )

-------------------- -------------------- -------------------------------------

TOTAL EQUITY 8,017 7,845 7,863

==================== ==================== =====================================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share based payment Total

Share Capital Share Premium Reserves Retained Deficit Translation Reserve Other Reserve Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 June

2020 3,474 10,564 111 ( 5,232 ) ( 237 ) ( 983 ) 7,697

Issue of

shares 125 175 - - - - 300

Share issue

expenses - ( 5 ) - - - - ( 5 )

Total

comprehensive

loss ( 195 ) 48 - ( 147 )

------------------ --------------- -------------------- -------------------- -------------------- -------------------- ---------------

At 31 December

2020 3,599 10,734 111 ( 5,427 ) ( 189 ) ( 983 ) 7,845

Issue of

shares 179 250 - - - - 429

Total

comprehensive

loss - ( 278 ) ( 133 ) - ( 411 )

------------------ --------------- -------------------- -------------------- -------------------- -------------------- ---------------

At 30 June

2021 3,778 10,984 111 ( 5,705 ) ( 322 ) ( 983 ) 7,863

Issue of

shares 142 418 - - - - 560

Share issue

expenses - ( 19 ) - - - - ( 19 )

Total

comprehensive

loss - - ( 228 ) ( 159 ) - ( 387 )

--------------------

At 31 December

2021 3,920 11,383 111 ( 5,933 ) ( 481 ) ( 983 ) 8,017

================== =============== ==================== ==================== ==================== ==================== ===============

CONDENSED CONSOLIDATED CASH FLOW Six Months Six Months Year

Ended Ended Ended

31 Dec 21 31 Dec 20 30 Jun 21

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the period ( 228 ) ( 195 ) ( 472 )

Impairment of exploration and evaluation assets - - 70

Foreign exchange losses 2 1 ( 4 )

---------------- ----------------- ----------

( 226 ) ( 194 ) ( 406 )

Movements in Working Capital ( 69 ) 73 95

---------------- ----------------- ----------

NET CASH USED IN OPERATING ACTIVITIES ( 295 ) ( 121 ) ( 311 )

---------------- ----------------- ----------

CASH FLOWS FROM INVESTING ACTIVITIES

Additions to exploration and evaluation assets ( 91 ) ( 152 ) ( 263 )

---------------- ----------------- ----------

NET CASH USED IN INVESTING ACTIVITIES ( 91 ) ( 152 ) ( 263 )

---------------- ----------------- ----------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from share issue 560 300 729

Share issue costs ( 19 ) ( 5 ) ( 5 )

---------------- ----------------- ----------

NET CASH GENERATED FROM FINANCING ACTIVITIES 541 295 724

---------------- ----------------- ----------

NET INCREASE IN CASH AND CASH EQUIVALENTS 155 22 150

Cash and cash equivalents at beginning of the period 165 18 18

Effect of foreign exchange rate changes ( 2 ) ( 1 ) ( 3 )

CASH AND CASH EQUIVALENT AT THE OF THE PERIOD 318 39 165

================ ================= ==========

Notes:

1. INFORMATION

The financial information for the six months ended 31 December

2021 and the comparative amounts for the six months ended 31

December 2020 are unaudited. The financial information above does

not constitute full statutory accounts within the meaning of

section 434 of the Companies Act 2006.

The Interim Financial Report has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the European

Union.

The accounting policies and methods of computation used in the

preparation of the Interim Financial Report are consistent with

those used in the Group 2021 Annual Report, which is available at

www.botswanadiamonds.co.uk

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. DIVID

No dividend is proposed in respect of the period.

3. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the period available to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the period.

Diluted loss per share is computed by dividing the loss after

taxation for the period by the weighted average number of ordinary

shares in issue, adjusted for the effect of all dilutive potential

ordinary shares that were outstanding during the period.

The following table sets forth the computation for basic and

diluted earnings per share (EPS):

Six Months Six Months

Ended Ended Year Ended

31 Dec 31 Dec 30 Jun

21 20 21

GBP'000 GBP'000 GBP'000

Numerator

For basic and diluted EPS retained

loss (228) (195) (472)

============== ============== ==============

No. No. No.

Denominator

Weighted average number of ordinary

shares 813,171,948 702,728,751 739,571,217

============== ============== ==============

Loss per share - Basic and Diluted (0.03p) (0.03p) (0.06p)

============== ============== ==============

The following potential ordinary shares are anti-dilutive and

are therefore excluded from the weighted average number of shares

for the purposes of the diluted earnings per share:

No. No. No.

Share options 11,410,000 11,410,000 11,410,000

============== ============== ==============

4. INTANGIBLE ASSETS

31 Dec 31 Dec 30 June

21 20 21

Exploration and evaluation assets: GBP'000 GBP'000 GBP'000

Cost:

Opening balance 9,563 9,385 9,385

Additions 91 153 263

Exchange variance (159) 48 (85)

9,495 9,586 9,563

======== ======== ========

Impairment:

Opening balance 1,369 1,299 1,299

Provision for impairment - - 70

-------- -------- --------

1,369 1,299 1,369

======== ======== ========

Carrying Value:

Opening balance 8,194 8,087 8,087

======== ======== ========

Closing balance 8,126 8,287 8,194

======== ======== ========

Regional Analysis 31 Dec 31 Dec 30 Jun

21 20 21

GBP'000 GBP'000 GBP'000

Botswana 6,925 7,130 7,043

South Africa 1,201 1,109 1,151

Zimbabwe - 48 -

8,126 8,287 8,194

========= ========= =========

Exploration and evaluation assets relate to expenditure incurred

in exploration for diamonds in Botswana and South Africa. The

directors are aware that by its nature there is an inherent

uncertainty in exploration and evaluation assets and therefore

inherent uncertainty in relation to the carrying value of

capitalized exploration and evaluation assets.

During the prior year, the Group incurred expenditure of

GBP58,815 on exploring for new licences in Zimbabwe and GBP11,203

miscellaneous costs. As at year end no licences had been granted.

Therefore, the directors decided to impair the costs. Accordingly,

an impairment of GBP70,018 had been recorded by the Group in the

prior.

On 6 February 2017 the Group entered into an Option and Earn-In

Agreement with Vutomi Mining Pty Ltd and Razorbill Properties 12

Pty Ltd (collectively known as 'Vutomi'), a private diamond

exploration and development firm in South Africa. Pursuant to the

terms of the Agreement, Botswana Diamonds earned a 40% equity

interest in the project. More recently a separate agreement for

funding of exploration resulted in the Company's interest in Vutomi

increasing from 40% to 45.94%.

On 29 September 2021 the Company exercised its pre-emptive right

to acquire the outstanding third-party interests in Vutomi Mining

(Proprietary) Limited and Razorbill Properties 12 (Proprietary)

Limited. Vutomi holds the mineral rights to the Thorny River

Diamond Project as well as other exploration assets.

The consideration for Vutomi comprises 56,989,330 new ordinary

shares in Botswana Diamonds plc which, at the closing mid-market

price on 28 September 2021 of 1.10p per share, is valued at

GBP626,883. There are no lock-in arrangements, but the

consideration shares will be issued in two equal tranches (three

months apart) following Completion. Completion is subject to a

number of conditions (with a long stop date of 22 September 2022

unless otherwise agreed between the parties).

The Company expects the conditions to be fulfilled and the

transaction to complete during Q2 2022.

The Company has further agreed that, immediately on completion

of the acquisition, the Company will sell 26% of Vutomi for a

deferred consideration of US$316,333 to the Company's local South

African Empowerment partner, Baroville, in order to comply with

South African requirements on empowerment ownership, which will be

funded by a loan from Botswana Diamonds.

On completion, the Company will own 74% of Vutomi.

The realisation of these intangible assets is dependent on the

successful discovery and development of economic diamond resources

and the ability of the Group to raise sufficient finance to develop

the projects. It is subject to a number of significant potential

risks, as set out below:

-- licence obligations;

-- exchange rate risks;

-- uncertainties over development and operational costs;

-- political and legal risks, including arrangements with

governments for licenses, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- title to assets;

-- financial risk management;

-- going concern; and

-- operational and environmental risks.

Included in additions for the period are GBP6,500 (June 2021:

GBP14,225) of wages and salaries and GBP35,831 (June 2021:

GBP65,553) of directors remuneration which has been capitalized.

This is for time spent directly on the operations rather than on

corporate activities.

5. PLANT AND EQUIPMENT

31 Dec 31 Dec 30 Jun

21 20 21

GBP'000 GBP'000 GBP'000

At 1 July 207 - -

Additions - - 207

At 30 June 207 - 207

========= ========= =========

On 18 July 2020 the Group entered into an agreement to acquire

the KX36 Diamond discovery in Botswana, along with two adjacent

Prospecting Licences and a diamond processing plant. These

interests are part of a package held by Sekaka Diamond Exploration

(Pty) Ltd. The acquisition was completed on 20 November 2020. The

diamond processing plant is a recently constructed, fit-for-purpose

bulk sampling plant on site. The sampling plant includes crushing,

scrubbing, dense media separation circuits and x-ray recovery

modules within a secured area.

6. SHARE CAPITAL

Deferred Shares - nominal value of 0.75p per share Number Share Capital Share Premium

GBP'000 GBP'000

At 1 July 2020 and 1 July 2021 239,487,648 1,796,157 -

At 30 June 2021 and 31 December 2021 239,487,648 1,796,157 -

============ ============== ==============

Ordinary Shares - nominal value of 0.25p per share Number Share Capital Share Premium

GBP'000 GBP'000

At 1 July 2020 671,221,902 1,678 10,564

Issued during the period 50,000,000 125 175

Share issue expenses - - (5)

At 31 December 2019 721,221,902 1,803 10,734

------------ -------------- --------------

Issued during the period 71,500,000 179 250

Share issue expenses - - -

At 30 June 2021 792,721,902 1,982 10,984

------------ -------------- --------------

Issued during the period 56,683,333 142 418

Share issue expenses - - (19)

At 31 December 2021 849,405,235 2,124 11,383

============ ============== ==============

Movements in share capital

On 7 September 2020, the Company raised GBP300,000 through the

issue of 50,000,000 new ordinary shares of 0.25p each at a price of

0.60p per share to provide additional working capital and fund

development costs. Each placing share has one warrant attached with

the right to subscribe for one new ordinary share at 0.6p per share

for a period of two years from 7 September 2020.

On 22 January 2021, the Company raised GBP363,000 through the

issue of 60,500,000 new ordinary shares of 0.25p each at a price of

0.60p per share to provide additional working capital and fund

development costs. Each placing share has one warrant attached with

the right to subscribe for one new ordinary share at 0.6p per share

for a period of two years from 23 January 2021.

On 13 May 2021, a total of 11,000,000 warrants were exercised at

a price of 0.60p per warrant for GBP66,000.

On 25 October 2021, the Company raised GBP550,000 through the

issue of 55,000,000 new ordinary shares of 0.25p each at a price of

1p per share to provide additional working capital and fund

development costs. Each placing share has one warrant attached with

the right to subscribe for one new ordinary share at 2p per share

for a period of three years from 5 November 2021.

On 3 December 2021, a total of 1,683,333 warrants were exercised

at a price of 0.60p per warrant for GBP10,100.

7. SHARE BASED PAYMENTS

WARRANTS

Dec 2021 Jun 2021 Dec 2020

Number of Warrants Weighted average Number of Warrants Weighted average Number of Warrants Weighted average

exercise price in exercise price in exercise price in

pence pence pence

Outstanding

at

beginning

of the

period 139,166,667 0.60 155,939,394 0.60 105,939,394 0.60

Issued 55,000,000 2 60,500,000 0.60 50,000,000 0.60

Exercised (1,683,333) 0.60 (11,000,000) 0.60 - -

Expired - - (66,272,727) 0.60 - -

Outstanding

at end of

the period 192,483,334 1 139,166,667 0.60 155,939,394 0.60

Further information of the warrants are detailed in Note 6

above.

8. POST BALANCE SHEET EVENTS

On 20 January 2022 the Company announced pursuant to the receipt

of conversion notices from holders of 29,666,667 warrants

exercisable at 0.60 pence each, it had issued 29,666,667 ordinary

shares of GBP0.0025 each at the exercise price of 0.60 pence per

new share. The proceeds of the exercise of GBP178,000 will be used

for additional working capital.

On 1 February 2022 the Company released a statement regarding a

joint venture with Vast Resources plc ("VAST") that was previously

announced in August 2021. The company had announced in August 2021

that Okwa Diamonds Pty Ltd ("Okwa"), a joint venture with VAST in

which the Company has an initial 10% carried interest, had

conditionally agreed to acquire Gem Diamonds Botswana Pty Ltd

("GDB"), a wholly owned subsidiary of Gem Diamonds Ltd ("Gem

Diamonds"), for a cash consideration of US$4 million.

Under the terms of the joint venture agreement, VAST was

responsible for funding Okwa with the first US$15 million of

funding required for the purposes of carrying out due diligence,

acquiring GDB and placing the mine back into production. Completion

was subject to a number of conditions (with a long stop date of 31

January 2022) including relevant regulatory and competition

authority approvals within Botswana which have now been fulfilled

and written approvals have been obtained from the Competition

Authority and, most recently in December 2021, the Ministry of

Mineral Resources, Green Energy and Technology of the Government of

the Republic of Botswana.

On 1 February 2022 VAST informed the Boards of Botswana Diamonds

and Gem Diamonds that they did not intend to proceed with the

transaction.

The Board of BOD has identified alternative potential partners

to replace VAST as its joint venture partner in Okwa and confirmed

to Gem Diamonds its commitment to conclude the transaction as

originally envisaged as soon as possible. BOD, VAST and Gem

Diamonds have been working together towards a mutually beneficial

outcome and agreed initially to extend the long stop date under the

sale agreement from 31 January 2022 to 31 March 2022, and which has

now been extended further to [DATE] 2022, to allow BOD to secure an

alternative joint venture partner. The new partner replacing VAST

in the Okwa joint venture may require further approval from the

relevant Government of Botswana authorities.

9. APPROVAL

The Interim Report for the period to 31(st) December 2021 was

approved by the Directors on 30(th) March 2022.

10. AVAILABILITY OF REPORT

The Interim Statement will be available on the website at

www.botswanadiamonds.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZGFFVGFGZZM

(END) Dow Jones Newswires

March 31, 2022 02:00 ET (06:00 GMT)

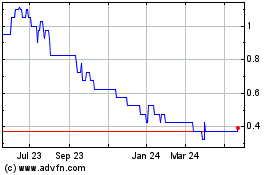

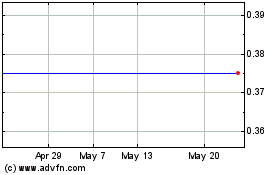

Botswana Diamond (AQSE:BOD.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Botswana Diamond (AQSE:BOD.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024