TIDMBUR

RNS Number : 3209M

Burford Capital Limited

13 September 2023

September 13, 2023

BURFORD CAPITAL REPORTS FIRST HALF AND SECOND QUARTER 2023

FINANCIAL RESULTS;

STRONGEST SET OF SIX-MONTH FINANCIAL RESULTS IN BURFORD'S

HISTORY

Burford Capital Limited ("Burford"), the leading global finance

and asset management firm focused on law, today announces its

unaudited financial results at and for the three and six months

ended June 30, 2023 .(1) Burford's report on Form 6-K at and for

the three and six months ended June 30, 2023, including unaudited

condensed consolidated financial statements (the "2Q23 Quarterly

Report"), is available at

http://www.rns-pdf.londonstockexchange.com/rns/3209M_1-2023-9-13.pdf

and on the Burford Capital website at

http://investors.burfordcapital.com .

Christopher Bogart, Chief Executive Officer of Burford Capital,

commented:

"We have produced the strongest set of six-month financial

results in Burford's history, with net income attributable to

shareholders of nearly $240 million and tangible book value per

share growth of 12% over the past six months. Our core portfolio

generated a lot of cash with realized gains tripling on our core

portfolio realizations, and new business was very strong. Our new

valuation methodology is sensitive to interest rate changes and

thus higher rates during the first six months of 2023 were a

headwind for the fair value of our core portfolio, especially

during the second quarter, but these valuation movements are

non-cash and unrealized and are expected to continue to fluctuate

over time. Operating expenses reflect strong portfolio performance

and certain idiosyncratic events."

(1) In this announcement, references to (1) "2Q23" and "2Q22"

are to Burford's unaudited financial results for the three months

ended June 30, 2023 and 2022, respectively, and (2) "1H23"and

"1H22" are to Burford's unaudited financial results for the six

months ended June 30, 2023 and 2022, respectively.

All figures in this announcement are unaudited and presented on

a consolidated basis in accordance with the generally accepted

accounting principles in the United States ("US GAAP"), unless

otherwise stated. Definitions, reconciliations and information

additional to those set forth in this announcement are available on

the Burford Capital website and in the 2Q23 Quarterly Report (as

defined above). In addition, Burford applied its revised valuation

methodology for capital provision assets to its unaudited condensed

consolidated financial statements at June 30, 2023 and for the

three and six months ended June 30, 2023 and 2022 included in this

announcement. Thus, for comparative purposes, this announcement

contains Burford's restated unaudited condensed consolidated

financial statements for the six months ended June 30, 2022.

However, because Burford has not previously issued quarterly

financial statements, the unaudited condensed consolidated

financial statements for the three months ended June 30, 2022

contained in this announcement have not historically been presented

and therefore are not a restatement of previously issued unaudited

condensed consolidated financial statements.

Highlights

Key activity(2)

======================================================================================

-- 2Q23 realized gains tripled to $59 million, up 254% from $17

million in 2Q22

o 1H23 realized gains of $94 million, up 255% from $27 million

in 1H22

-- 2Q23 realizations of $133 million, up 167% from $50 million

in 2Q22

o 1H23 realizations of $195 million, up 178% from $70 million

in 1H22, reflecting increased portfolio velocity, as the

case backlog in the courts continues to clear

-- 2Q23 cash receipts(3) of $150 million, up 266% from $41 million

in 2Q22

o 1H23 cash receipts(3) of $247 million, up 148% from $99

million in 1H22, primarily driven by realizations including

three matters that generated aggregate proceeds of $147

million

-- 2Q23 deployments of $181 million, up 159% from $70 million

in 2Q22

o 1H23 deployments of $248 million, up 103% from $122 million

in 1H22, reflecting in part the balance sheet's greater

participation in new capital provision-direct assets

(2) Represents Burford-only capital provision-direct assets

(3) Represents Burford-only proceeds from capital provision-direct,

capital provision-indirect and asset management

Financial results(4)

======================================================================================

-- Total revenues in 1H23 of $382 million, up 214% from $122

million in 1H22, driven by higher capital provision income

due to positive momentum in the progression of our portfolio

o In 2Q23, while realized gains were up sharply, total revenues

were $43 million (2Q22: $15 million), reflecting the impact

of increased discount rates on our revised valuation methodology

-- Operating income in 1H23 of $284 million, up 332% from $66

million in 1H22; operating income in 2Q23 was essentially

at breakeven, primarily reflecting increased operating expenses

o Increase in operating expenses in 2Q23 driven primarily

by an increase in compensation expenses and general, administrative

and other expenses compared to 2Q22

o All but $1.2 million of the increase in compensation and

benefits in 2Q23 compared to 2Q22 was non-cash, driven

principally by accruals as a result of increases in Burford's

share price and asset values

o Increase in general, administrative and other expenses

in 2Q23 compared to 2Q22 includes $3.3 million in audit,

professional and corporate legal fees due to the development

of the revised fair value methodology and build-out of

quarterly reporting

-- Net income attributable to Burford Capital Limited shareholders

of $238 million in 1H23 (1H22: $7 million), with net income

per ordinary and diluted share of $1.09 and $1.07, respectively

(1H22: $0.03 each)

o Net loss attributable to Burford Capital Limited shareholders

of $22 million in 2Q23 (2Q22: net loss of $49 million),

with net loss per ordinary and diluted share of $0.10 each

(2Q22: net loss per ordinary and diluted share of $0.23

each)

-- Tangible book value attributable to Burford Capital Limited

per ordinary share of $8.26 at June 30, 2023, up 12% from

$7.36 at December 31, 2022

(4) Represents Burford-only

Portfolio

======================================================================================

-- Group-wide portfolio grew to $7.0 billion at June 30, 2023

(December 31, 2022: $6.1 billion), due to significant fair

value gains and growth in deployments and undrawn commitments

o Group-wide new commitments of $557 million in 2Q23 (2Q22:

$363 million) and $722 million in 1H23 (1H22: $445 million)

-- Consolidated fair value of capital provision assets increased

18% to $4.4 billion at June 30, 2023 from $3.7 billion at

December 31, 2022

o O f the $672 million increase in capital provision asset

value in 1H23, $280 million attributable to the YPF-related

assets

-- Fair value of Burford-only capital provision assets increased

16% to $3.1 billion at June 30, 2023 from $2.6 billion at

December 31, 2022

o Of the $423 million increase in capital provision asset

value in 1H23, $185 million attributable to the YPF-related

assets

-- On September 8, 2023, the court rendered a decision in the

YPF-related assets holding that the appropriate date for the

tender offer was April 16, 2012 and that pre-judgment interest

should run from May 3, 2012 at a simple interest rate of 8%

-- Cumulative ROIC since inception from Burford-only capital

provision-direct assets steady at 88% (December 31, 2022:

88%) and IRR of 29% (December 31, 2022: 29%)

Liquidity and capital

======================================================================================

-- Burford-only cash and cash equivalents and marketable securities

of $441 million at June 30, 2023 (December 31, 2022: $210

million)

o Strong liquidity position at June 30, 2023 primarily reflects

issuance of $400 million in senior notes in June 2023

and increasing Burford-only realizations, partially offset

by strong Burford-only deployments

o On July 12, 2023, Burford redeemed in full the aggregate

outstanding principal amount of the 6.125% bonds due 2024

at a redemption price of par

-- Burford-only due from settlement of capital provision assets

decreased 19% to $93 million at June 30, 2023, of which $69

million (74%) was collected in cash at September 7, 2023

-- Total shareholders' equity attributable to Burford Capital

Limited was $1,942 million at June 30, 2023 (December 31,

2022: $1,743 million)

o Total shareholders' equity attributable to Burford Capital

Limited per ordinary share of $8.87 at June 30, 2023 (December

31, 2022: $7.97 per ordinary share)

Dividend

======================================================================================

-- On September 8, 2023, Burford's board of directors declared

an interim dividend of 6.25c per ordinary share payable on

December 7, 2023 to shareholders of record on November 10,

2023, with an ex-dividend date of November 9, 2023

Investor and Analyst Conference Call

Burford will hold a conference call for investors and analysts

at 10.00am EDT / 3.00pm BST on Wednesday, September 13, 2023. The

dial-in number for the conference call is +1 646 787-9445 (USA) /

+44 (0)20 4587 0498 (UK) / +44 (0)20 3936 2999 (all other

locations) and the access code is 329784. To minimize the risk of

delayed access, participants are urged to dial into the conference

call by 9.40am EDT / 2.40pm BST .

A live webcast of the call will also be available at

https://www.investis-live.com/burfordcapital/6499460f383e9013000dafed/rosepu

, and pre-registration at that link is encouraged.

An accompanying 2Q23 and 1H23 results presentation for investors

and analysts will also be made available on the Burford Capital

website prior to the conference call at

http://investors.burfordcapital.com .

Following the conference call, a replay facility for this event

will be available until Wednesday, September 27, 2023 by dialing +1

845 709-8569 (USA) / +44 (0)20 3936 3001 (UK) / +44 (0)20 3936 3001

(all other locations) and using the replay access code 178093. A

replay facility will also be accessible through the webcast at

https://www.investis-live.com/burfordcapital/6499460f383e9013000dafed/rosepu

.

For further information, please contact:

Burford Capital Limited

For investor and analyst inquiries:

Robert Bailhache, Head of Investor Relations, +44 (0)20 3530

EMEA and Asia - email 2023

Jim Ballan, Head of Investor Relations, Americas

- email +1 (646) 793 9176

For press inquiries:

David Helfenbein, Vice President, Public Relations

- email +1 (212) 235 6824

Numis Securities Limited - NOMAD and Joint +44 (0)20 7260

Broker 1000

Giles Rolls

Charlie Farquhar

+44 (0)20 7029

Jefferies International Limited - Joint Broker 8000

Graham Davidson

Tony White

+44 (0)20 3207

Berenberg - Joint Broker 7800

Toby Flaux

James Thompson

About Burford Capital

Burford Capital is the leading global finance and asset

management firm focused on law. Its businesses include litigation

finance and risk management , asset recovery and a wide range of

legal finance and advisory activities. Burford is publicly traded

on the New York Stock Exchange (NYSE: BUR) and the London Stock

Exchange (LSE: BUR), and it works with companies and law firms

around the world from its offices in New York, London, Chicago,

Washington, DC, Singapore, Dubai, Sydney and Hong Kong.

For more information, please visit www.burfordcapital.com.

Summary Financial Statements and Reconciliations

The tables below set forth summaries of the condensed

consolidated and Burford-only statements of operations for the

three and six months ended June 30, 2023 and 2022, the condensed

consolidated and Burford-only statements of financial position at

June 30, 2023 and December 31, 2022 and corresponding

reconciliations from consolidated to Burford-only financial results

. Furthermore, the tables below set forth certain additional

reconciliations for financial information contained in this

announcement.

Summary condensed consolidated statements of operations

Three months ended Six months ended

June 30, June 30,

--------------------- --------------------

($ in thousands) 2023 2022 2023 2022

================================ ========== ========= ========= =========

Revenues

Capital provision income 35,667 35,006 511,600 175,745

Plus/(Less): Third-party

interests in capital

provision assets 4,813 16,857 (95,532) 218

Asset management income 1,894 2,394 3,891 5,508

Services and other income 2,177 (6,767) 5,497 (10,879)

Total revenues 44,551 47,490 425,456 170,592

Total operating expenses 43,632 26,540 97,931 56,827

Operating income 919 20,950 327,525 113,765

Finance costs and loss

on debt extinguishment 21,124 21,636 41,677 37,477

Foreign currency transactions

(gains)/losses (8,898) 2,544 (11,338) 3,058

(Loss)/income before income

taxes (11,307) (3,230) 297,186 73,230

(Provision) for income

taxes (8,969) (14,942) (16,081) (18,366)

Net income (20,276) (18,172) 281,105 54,864

========== ========= ========= =========

Net income attributable

to Burford Capital

Limited shareholders (21,540) (49,352) 237,885 6,928

========== ========= ========= =========

Net income attributable

to Burford Capital

Limited shareholders per

ordinary share

Basic $ (0.10) $ (0.23) $ 1.09 $ 0.03

Diluted $ (0.10) $ (0.23) $ 1.07 $ 0.03

Summary Burford-only statement of operations

Three months ended Six months ended

June 30, June 30,

--------------------- -------------------

($ in thousands) 2023 2022 2023 2022

============================ ========== ========= ======== =========

Revenues

Capital provision income 35,392 (4,810) 351,407 95,777

Asset management income 5,684 25,829 25,041 36,763

Services and other income 2,161 (5,641) 5,466 (10,885)

Total revenues 43,237 15,378 381,914 121,655

Operating income (330) (10,660) 284,338 65,826

Net income (21,540) (49,352) 237,885 65,826

Net income per share:

Basic $ (0.10) $ (0.23) $ 1.09 $ 0.03

Diluted $ (0.10) $ (0.23) $ 1.07 $ 0.03

Reconciliation of summary condensed consolidated statement of

operations to summary Burford-only statement of operations

Three months ended June 30, 2023

-------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

----------------------------------------------------------------------------

Elimination of third-party interests

--------------------------------------------------------

Strategic

Value Advantage

($ in thousands) Consolidated Fund BOF-C Colorado Fund Other Burford-only

------------------ ------------- ---------- --------- --------- ---------- ---------- ------------------

Capital provision

income 35,667 (100) 72 4,728 (4,983) 8 35,392

Plus/(Less):

Third-party

interests in

capital

provision assets 4,813 - - (4,753) - (60) -

Asset management

income 1,894 46 3,744 - - - 5,684

Services and

other

income 2,177 - (1) - - (15) 2,161

Total revenues 44,551 (54) 3,815 (25) (4,983) (67) 43,237

Operating income 919 87 3,628 - (4,903) (61) (330)

Net income/(loss) (20,276) 87 3,628 - (4,903) (76) (21,540)

Three months ended June 30, 2022

-------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

----------------------------------------------------------------------------

Elimination of third-party interests

--------------------------------------------------------

Strategic

Value Advantage

($ in thousands) Consolidated Fund BOF-C Colorado Fund Other Burford-only

------------------ ------------- ---------- --------- --------- ---------- ---------- -------------

Capital provision

income 35,006 (1,769) (55,580) 16,423 48 1,062 (4,810)

Plus/(Less):

Third-party

interests in

capital

provision assets 16,857 - - (16,435) - (422) -

Asset management

income 2,394 57 23,378 - - - 25,829

Services and

other

income (6,767) 1,132 - - - (6) (5,641)

Total revenues 47,490 (580) (32,202) (12) 48 634 15,378

Operating income 20,950 (245) (32,240) - 138 737 (10,660)

Net income/(loss) (18,172) (245) (32,240) - 138 1,167 (49,352)

Six months ended June 30, 2023

------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

---------------------------------------------------------------------

Elimination of third-party interests

------------------------------------------------------

Strategic

Value Advantage

($ in thousands) Consolidated Fund BOF-C Colorado Fund Other Burford-only

-------------------------- ------------- ---------- --------- --------- ---------- -------- -------------

Capital provision

income 511,600 (207) (48,236) (95,041) (12,005) (4,704) 351,407

Plus/(Less): Third-party

interests in capital

provision assets (95,532) - - 95,011 - 521 -

Asset management

income 3,891 92 21,058 - - - 25,041

Services and other

income 5,497 - (2) - - (29) 5,466

Total revenues 425,456 (115) (27,180) (30) (12,005) (4,212) 381,914

Operating income 327,525 181 (27,397) - (11,802) (4,169) 284,338

Net income/(loss) 281,105 181 (27,397) - (11,802) (4,202) 237,885

Six months ended June 30, 2022

------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

---------------------------------------------------------------------

Elimination of third-party interests

------------------------------------------------------

Strategic

Value Advantage

($ in thousands) Consolidated Fund BOF-C Colorado Fund Other Burford-only

-------------------------- ------------- ---------- --------- --------- ---------- -------- -------------

Capital provision

income 175,745 (2,277) (74,175) 498 (318) (3,696) 95,777

Plus/(Less): Third-party

interests in capital

provision assets 218 - - (510) - 292 -

Asset management

income 5,508 218 31,037 - - - 36,763

Services and other

income (10,879) - - - - (6) (10,885)

Total revenues 170,592 (2,059) (43,138) (12) (318) (3,410) 121,655

Operating income 113,765 (1,357) (43,200) - (77) (3,305) 65,826

Net income/(loss) 54,864 (1,357) (43,200) - (77) (3,302) 6,928

Reconciliation of capital provision income excluding YPF-related

assets

For the six months ended June 30,

($ in thousands) 2023 2022

-------------------------------------------------------- ------------------- --------------

Capital provision income 511,600 175,745

Less: Capital provision income from YPF-related assets (277,318) (1,440)

-------------------------------------------------------- ------------------- --------------

Capital provision income excluding YPF-related assets 234,282 174,305

======================================================== =================== ==============

Summary condensed consolidated statement of financial

position

At

($ in thousands) June 30, 2023 December 31, 2022

============================================================================= ============== ==================

Total assets 5,177,712 4,288,359

Total liabilities 2,441,646 1,901,289

Total Burford Capital Limited equity 1,942,025 1,742,584

Non-controlling interests 794,041 644,486

Total shareholders' equity 2,736,066 2,387,070

Basic ordinary shares outstanding 218,957,218 218,581,877

Total shareholders' equity attributable to Burford Capital Limited per basic

ordinary share 8.87 7.97

Total shareholders' equity per basic ordinary share 12.50 10.92

Reconciliation of summary condensed consolidated statement of

financial position to summary Burford-only statement of financial

position

At June 30, 2023

--------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-----------------------------------------------------------------------------------

Elimination of third-party interests

--------------------------------------------------------------------

Strategic Value

($ in thousands) Consolidated Fund BOF-C Colorado Advantage Fund Other Burford-only

------------------ ------------- ---------------- ---------- ---------- --------------- --------- -------------

Total assets 5,177,712 (2,518) (556,238) (504,275) (178,766) (73,413) 3,862,502

Total liabilities 2,441,646 (141) (4,234) (504,275) (75) (12,444) 1,920,477

Total

shareholders'

equity 2,736,066 (2,377) (552,004) - (178,691) (60,969) 1,942,025

At December 31, 2022

--------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-----------------------------------------------------------------------------------

Elimination of third-party interests

--------------------------------------------------------------------

Strategic Value

($ in thousands) Consolidated Fund BOF-C Colorado Advantage Fund Other Burford-only

------------------ ------------- ---------------- ---------- ---------- --------------- --------- -------------

Total assets 4,288,359 (2,779) (477,590) (409,249) (103,523) (76,792) 3,218,426

Total liabilities 1,901,289 (228) (4,234) (409,249) (120) (11,616) 1,475,842

Total

shareholders'

equity 2,387,070 (2,551) (473,356) - (103,403) (65,176) 1,742,584

Reconciliation of components of realizations from a consolidated

basis to a Group-wide basis

Three months ended June 30, 2023

-------------------------------------------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------- ---------------------------------------------------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

-------------------- -------------------- -------------------------- ------------------------ ---------------- --------------------- ----------------

Capital

provision-direct 130,520 2,677 133,197 22,986 17,328 173,511

Capital

provision-indirect 27,064 (22,605) 4,459 22,290 - 26,749

Post-settlement - - - 79,576 - 79,576

Total realizations 157,584 (19,928) 137,656 124,852 17,328 279,836

==================== ========================== ======================== ================ ===================== ================

Three months ended June 30, 2022

---------------------------------------------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------- -----------------------------------------------------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

-------------------- -------------------- -------------------------- ------------------------ ----------------- --------------------- -----------------

Capital

provision-direct 54,769 (4,919) 49,850 14,043 9,069 72,962

Capital

provision-indirect 7,114 (1,792) 5,322 13,326 - 18,648

Post-settlement - - - 8,840 - 8,840

Total realizations 61,883 (6,711) 55,172 36,209 9,069 100,450

==================== ========================== ======================== ================= ===================== =================

Six months ended June 30, 2023

-------------------------------------------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------- ---------------------------------------------------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

-------------------- -------------------- -------------------------- ------------------------ ---------------- --------------------- ----------------

Capital

provision-direct 246,252 (51,309) 194,943 73,376 52,751 321,070

Capital

provision-indirect 39,644 (33,089) 6,555 32,774 - 39,329

Post-settlement - - - 98,256 - 98,256

Total realizations 285,896 (84,398) 201,498 204,406 52,751 458,655

==================== ========================== ======================== ================ ===================== ================

Six months ended June 30, 2022

-------------------------------------------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------- ---------------------------------------------------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

-------------------- -------------------- -------------------------- ------------------------ ---------------- --------------------- ----------------

Capital

provision-direct 75,980 (5,778) 70,202 24,381 12,319 106,902

Capital

provision-indirect 12,466 (6,367) 6,099 17,901 - 24,000

Post-settlement - - - 38,303 - 38,303

Total realizations 88,446 (12,145) 76,301 80,585 12,319 169,205

==================== ========================== ======================== ================ ===================== ================

Reconciliation of components of deployments from a consolidated

basis to a Group-wide basis

Three months ended June 30, 2023

--------------------------------------------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------- ----------------------------------------------------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

-------------------- -------------------- -------------------------- ------------------------ ----------------- --------------------- ----------------

Capital

provision-direct 246,840 (65,387) 181,453 6,070 58,504 246,027

Capital

provision-indirect 78,794 (65,662) 13,132 65,662 - 78,794

Post-settlement - - - 31,939 - 31,939

Total deployments 325,634 (131,049) 194,585 103,671 58,504 356,760

==================== ========================== ======================== ================= ===================== ================

Three months ended June 30, 2022

---------------------------------------------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------- -----------------------------------------------------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

-------------------- -------------------- -------------------------- ------------------------ ----------------- --------------------- -----------------

Capital

provision-direct 92,445 (22,273) 70,172 8,926 21,291 100,389

Capital

provision-indirect 5,429 (3,518) 1,911 3,518 - 5,429

Post-settlement - - - 26,116 - 26,116

Total deployments 97,874 (25,791) 72,083 38,560 21,291 131,934

==================== ========================== ======================== ================= ===================== =================

Six months ended June 30, 2023

-------------------------------------------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------- ---------------------------------------------------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

-------------------- -------------------- -------------------------- ------------------------ ---------------- --------------------- ----------------

Capital

provision-direct 331,525 (83,079) 248,446 12,983 75,956 337,385

Capital

provision-indirect 112,794 (93,995) 18,799 93,995 - 112,794

Post-settlement - - - 35,806 - 35,806

Total deployments 444,319 (177,074) 267,245 142,784 75,956 485,985

==================== ========================== ======================== ================ ===================== ================

Six months ended June 30, 2022

-------------------------------------------------------------------------------------------------------------------------------------

(GAAP) (Non-GAAP)

-------------------- ---------------------------------------------------------------------------------------------------------------

Eliminations Other

($ in thousands) Consolidated and adjustments Burford-only funds BOF-C Group-wide

-------------------- -------------------- -------------------------- ------------------------ ---------------- --------------------- ----------------

Capital

provision-direct 183,566 (61,436) 122,130 14,667 60,304 197,101

Capital

provision-indirect 20,176 (16,776) 3,400 16,776 - 20,176

Post-settlement - - - 43,152 - 43,152

Total deployments 203,742 (78,212) 125,530 74,595 60,304 260,429

==================== ========================== ======================== ================ ===================== ================

Reconciliation of consolidated proceeds from capital provision

assets to Burford-only cash receipts

Six months Three months Three months

ended June ended March ended June

($ in thousands) 30, 2023 31, 2023 30, 2023

---------------------------------------------- ------------ ------------- -------------

Consolidated proceeds from capital

provision assets 308,007 144,485 163,522

Less: Elimination of third-party interests (87,513) (60,563) (26,950)

Burford-only total proceeds from capital

provision assets 220,494 83,922 136,572

---------------------------------------------- ------------ ------------- -------------

Burford-only proceeds from capital

provision-direct assets 213,321 77,742 135,579

Burford-only proceeds from capital

provision-indirect assets 7,173 6,180 993

Burford-only total proceeds from capital

provision assets 220,494 83,922 136,572

---------------------------------------------- ------------ ------------- -------------

Consolidated asset management income 3,891 1,997 1,894

Plus: Eliminated income from funds 21,150 17,360 3,790

Burford-only asset management income 25,041 19,357 5,684

Less: Non-cash adjustments(1) (1,728) (7,086) 5,358

Burford-only proceeds from asset management

income 23,313 12,271 11,042

Burford-only proceeds from marketable

security interest and dividends 1,563 881 682

Burford-only proceeds from asset recovery

fee for services 38 83 (45)

Burford-only proceeds from insurance

receipts 1,530 - 1,530

Burford-only proceeds from asset management

and other services 26,444 13,235 13,209

---------------------------------------------- ------------ ------------- -------------

Cash receipts 246,938 97,157 149,781

============================================== ============ ============= =============

(1) Adjustments for the change in asset management receivables

accrued during the applicable period but not yet received at the

end of such period.

Six months Three months Three months

ended June ended March ended June

($ in thousands) 30, 2022 31, 2022 30, 2022

---------------------------------------------- ------------ ------------- -------------

Consolidated proceeds from capital

provision assets 108,541 69,369 39,172

Less: Elimination of third-party interests (21,451) (14,109) (7,342)

Burford-only total proceeds from capital

provision assets 87,090 55,260 31,830

---------------------------------------------- ------------ ------------- -------------

Burford-only proceeds from capital

provision-direct assets 81,511 55,163 26,348

Burford-only proceeds from capital

provision-indirect assets 5,579 97 5,482

Burford-only total proceeds from capital

provision assets 87,090 55,260 31,830

---------------------------------------------- ------------ ------------- -------------

Consolidated asset management income 5,508 3,114 2,394

Plus: Eliminated income from funds 31,255 7,820 23,435

Burford-only asset management income 36,763 10,934 25,829

Less: Non-cash adjustments(1) (26,547) (8,725) (17,822)

Burford-only proceeds from asset management

income 10,216 2,209 8,007

Burford-only proceeds from marketable

security interest and dividends 967 614 353

Burford-only proceeds from asset recovery

fee for services 577 418 159

Burford-only proceeds from insurance

receipts 413 - 413

Burford-only proceeds from other corporate 191 - 191

Burford-only proceeds from asset management

and other services 12,364 3,241 9,123

---------------------------------------------- ------------ ------------- -------------

Cash receipts 99,454 58,501 40,953

============================================== ============ ============= =============

(1) Adjustments for the change in asset management receivables

accrued during the applicable period but not yet received at the

end of such period.

Reconciliation of consolidated aggregate cash receipts from

three matters of note to Burford only cash receipts

Six months ended June 30,

2023

-----------------------------------------------

Elimination

($ in thousands) Consolidated and adjustments Burford-only

----------------------------------------- ------------- ----------------- -------------

Aggregate cash receipts - three matters

of note 181,514 (34,050) 147,464

Reconciliation of consolidated portfolio to Group-wide

portfolio

($ in thousands) At June 30, 2023 At December 31, 2022

============================================== ======================== ==============================

Consolidated carrying value 4,407,888 3,735,556

Consolidated undrawn commitments 1,983,154 1,720,727

---------------------------------------------- ------------------------ ------------------------------

Eliminations of third-party interests:

Less: Attributable to carrying value (1,348,424) (1,100,137)

Less: Attributable to undrawn commitments (471,789) (413,446)

Burford-only Carrying value 3,059,464 2,635,419

Burford-only undrawn commitments 1,511,365 1,307,281

---------------------------------------------- ------------------------ ------------------------------

Burford-only portfolio 4,570,829 3,942,700

---------------------------------------------- ------------------------ ------------------------------

Other funds carrying value 1,115,482 1,076,320

Other funds undrawn commitments 265,502 239,145

---------------------------------------------- ------------------------ ------------------------------

Other funds portfolio 1,380,984 1,315,465

---------------------------------------------- ------------------------ ------------------------------

BOF-C carrying value 597,340 516,982

BOF-C undrawn commitments 434,930 371,724

---------------------------------------------- ------------------------ ------------------------------

BOF-C portfolio 1,032,270 888,706

---------------------------------------------- ------------------------ ------------------------------

Total group-wide portfolio 6,984,083 6,146,871

============================================== ======================== ==============================

Reconciliation of consolidated to Burford-only cash and cash

equivalents and marketable securities

At June 30, 2023 At December 31, 2022

----------------------------------------------- -----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

-------------------------------- --------------------------------

Elimination of Elimination of

third-party third-party

($ in thousands) Consolidated interests Burford-only Consolidated interests Burford-only

------------------ ------------- ----------------- ------------- ------------- ----------------- -------------

Cash and cash

equivalents 365,336 (31,779) 333,557 107,658 (33,979) 73,679

Marketable

securities 107,180 - 107,180 136,358 - 136,358

Total cash and

cash equivalents

and marketable

securities 472,516 (31,779) 440,737 244,016 (33,979) 210,037

Reconciliation of consolidated to Burford-only capital provision

assets

At June 30, 2023 At December 31, 2022

---------------------------------------------- ----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

------------------------------- -------------------------------

Elimination Elimination

of third-party of third-party

($ in thousands) Consolidated interests Burford-only Consolidated interests Burford-only

------------------- ------------- ---------------- ------------- ------------- ---------------- -------------

YPF-related

assets 1,512,062 (504,397) 1,007,665 1,232,549 (409,514) 823,035

Other assets 2,895,826 (844,027) 2,051,799 2,503,007 (689,602) 1,813,405

Capital provision

assets 4,407,888 (1,348,424) 3,059,464 3,735,556 (1,099,116) 2,636,440

Reconciliation of consolidated to Burford-only due from

settlement of capital provision assets

At June 30, 2023 At December 31, 2022

----------------------------------------------- -----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

-------------------------------- --------------------------------

Elimination of Elimination of

third-party third-party

($ in thousands) Consolidated interests Burford-only Consolidated interests Burford-only

------------------ ------------- ----------------- ------------- ------------- ----------------- -------------

Due from

settlement of

capital

provision assets 94,391 (1,754) 92,637 116,582 (1,932) 114,650

Reconciliation of consolidated to Burford-only realized gains on

capital provision-direct assets

Three months ended June 30, 2023 Three months ended June 30, 2022

----------------------------------------------- -----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

-------------------------------- --------------------------------

Eliminations and Eliminations and

($ in thousands) Consolidated adjustments Burford-only Consolidated adjustments Burford-only

------------------ ------------- ----------------- ------------- ------------- ----------------- -------------

Realized gains

relative to cost 59,335 (554) 58,781 21,497 (4,908) 16,589

Six months ended June Six months ended June

30, 2023 30, 2022

----------------------------------------------- -----------------------------------------------

(GAAP) (Non-GAAP) (GAAP) (Non-GAAP)

-------------------------------- --------------------------------

Eliminations Eliminations

($ in thousands) Consolidated and adjustments Burford-only Consolidated and adjustments Burford-only

------------------ ------------- ----------------- ------------- ------------- ----------------- -------------

Realized gains

relative to

cost 127,405 (33,011) 94,394 32,085 (5,484) 26,601

Reconciliation of tangible book value attributable to Burford

Capital Limited per ordinary share

($ in thousands, except share data) At June 30, 2023 At December 31, 2022

========================================================================= ================ ====================

Total Burford Capital Limited equity 1,942,025 1,742,584

Less: Goodwill (133,962) (133,912)

-------------------------------------------------------------------------- ---------------- --------------------

Tangible book value attributable to Burford Capital Limited 1,808,063 1,608,672

-------------------------------------------------------------------------- ---------------- --------------------

Basic ordinary shares outstanding 218,957,218 218,581,877

-------------------------------------------------------------------------- ---------------- --------------------

Tangible book value attributable to Burford Capital Limited per ordinary

share 8.26 7.36

-------------------------------------------------------------------------- ---------------- --------------------

Reconciliation of shareholders' equity attributable to Burford

Capital Limited per ordinary share

($ in thousands, except share data) At June 30, 2023 At December 31, 2022

========================================================================= ================ ====================

Total shareholders' equity 2,653,361 2,387,070

Less: Non-controlling interests (661,083) (644,486)

-------------------------------------------------------------------------- ---------------- --------------------

Total Burford Capital Limited equity 1,942,025 1,742,584

-------------------------------------------------------------------------- ---------------- --------------------

Basic ordinary shares outstanding 218,957,218 218,581,877

-------------------------------------------------------------------------- ---------------- --------------------

Shareholders' equity attributable to Burford Capital Limited per ordinary

share 8.87 7.97

-------------------------------------------------------------------------- ---------------- --------------------

Definitions and Use of Non-GAAP Financial Measures and

Alternative Performance Measures

Burford reports its financial results in accordance with US

GAAP. US GAAP requires us to present financial statements that

consolidate some of the limited partner interests in private funds

we manage as well as assets held on our balance sheet where we have

a partner or minority investor. We therefore refer to various

presentations of our financial results as follows:

-- Consolidated refers to assets, liabilities and activities

that include those third-party interests, partially owned

subsidiaries and special purpose vehicles that we are required

to consolidate under US GAAP. At the date of this announcement,

the major entities where there is also a third-party partner

in, or owner of, those entities include BCIM Strategic Value

Master Fund, LP, Burford Opportunity Fund C LP, Burford

Advantage Master Fund LP, Colorado Investments Limited ("Colorado")

and several other entities in which Burford holds investments

where there is also a third-party partner in, or owner of,

those entities.

-- Burford-only refers to assets, liabilities and activities

that pertain only to Burford on a proprietary basis, excluding

any third-party interests and the portions of jointly owned

entities owned by others.

-- Group-wide refers to the totality of assets managed by

Burford, including those portions of the private funds owned

by third parties and including private funds that are not

consolidated within Burford's consolidated financial statements.

Group-wide is therefore the sum of Burford-only and non-controlling

interests in consolidated and non-consolidated private funds.

Group-wide does not include third-party interests in capital

provision assets, the economics of which have been sold

to those third parties, that do not meet the criteria to

be recognized as a sale under US GAAP. This includes the

third-party interests in Colorado and other capital provision

asset subparticipations.

We subdivide our capital provision assets into two

categories:

-- Direct , which includes all of our capital provision assets

that we have originated directly (i.e., not through participation

in a private fund) from our balance sheet. We also include

direct (i.e., not through participation in a private fund)

complex strategies assets in this category.

-- Indirect , which includes our balance sheet's participations

in two of our private funds (i.e., BCIM Strategic Value

Master Fund, LP and Burford Advantage Master Fund LP) .

We also use certain unaudited alternative performance measures,

including:

-- Internal rate of return ("IRR") is a discount rate that

makes the net present value of a series of cash flows equal

to zero and is expressed as a percentage figure. We compute

IRR on concluded (including partially concluded) legal finance

assets by treating that entire portfolio (or, when noted,

a subset thereof) as one undifferentiated pool of capital

and measuring actual and, if necessary, estimated inflows

and outflows from that pool, allocating costs appropriately.

IRRs do not include unrealized gains or losses.

-- Return on invested capital ("ROIC") from a concluded asset

is the absolute amount of realizations from such asset in

excess of the amount of expenditure incurred in funding

such asset divided by the amount of expenditure incurred,

expressed as a percentage figure. ROIC is a measure of our

ability to generate absolute returns on our assets. Some

industry participants express returns on a multiple of invested

capital ("MOIC") instead of a ROIC basis. MOIC includes

the return of capital and, therefore, is 1x higher than

ROIC. In other words, 70% ROIC is the same as 1.70x MOIC.

Other unaudited alternative performance measures and terms we

use include:

-- Commitment is the amount of financing we agree to provide

for a legal finance asset. Commitments can be definitive

(requiring us to provide funding on a schedule or, more

often, when certain expenses are incurred) or discretionary

(allowing us to provide funding after reviewing and approving

a future matter). Unless otherwise indicated, commitments

include deployed cost and undrawn commitments.

-- Deployment refers to the funding provided for an asset,

which adds to our deployed cost in such asset.

-- Deployed cost is the amount of funding we have provided

for an asset at the applicable point in time.

-- Fair value adjustment is the amount of unrealized gain

or loss recognized in our consolidated statements of operations

in the relevant period and added to or subtracted from,

as applicable, the asset or liability value in our consolidated

statements of financial position.

-- Portfolio includes deployed cost, net unrealized gains

or losses and undrawn commitments.

-- Realization: A legal finance asset is realized when the

asset is concluded (i.e., when litigation risk has been

resolved). A realization will result in us receiving cash

or, occasionally, non-cash assets or recognizing a due from

settlement receivable, reflecting what we are owed on the

asset.

-- Realized gain / loss reflects the total amount of gain

or loss generated by a legal finance asset when it is realized,

calculated as realized proceeds less deployed cost, without

regard for any previously recognized fair value adjustment.

-- Unrealized gain / loss represents the fair value of our

legal finance assets over or under their funded cost, as

determined in accordance with the requirements of the applicable

US GAAP standards, for the relevant financial reporting

period (consolidated statement of operations) or cumulatively

(consolidated statement of financial position).

-- YPF-related assets refers to our Petersen and Eton Park

legal finance assets, which are two claims relating to Republic

of Argentina's nationalization of YPF S.A., the Argentine

energy company.

We also use certain non-GAAP financial measures, including:

-- Cash receipts provide a measure of the cash that our capital

provision and other assets generate during a given period

as well as cash from certain other fees and income. In particular,

cash receipts represent the cash generated from capital

provision and other assets, including cash proceeds from

realized or concluded assets and any related hedging assets,

and cash received from asset management income, services

and/or other income, before any deployments into funding

existing or new assets. Cash receipts are a non-GAAP financial

measure and should not be considered in isolation from,

as a substitute for, or superior to, financial measures

calculated in accordance with US GAAP. The most directly

comparable measure calculated in accordance with US GAAP

is proceeds from capital provision assets as set forth in

our consolidated statements of cash flows. We believe that

cash receipts are an important measure of our operating

and financial performance and are useful to management and

investors when assessing the performance of our Burford-only

capital provision assets.

-- Tangible book value attributable to Burford Capital Limited

is calculated by subtracting intangible assets (such as

goodwill) from total Burford Capital Limited equity . T

angible book value attributable to Burford Capital Limited

per ordinary share is calculated by dividing tangible book

value attributable to Burford Capital Limited by the total

number of outstanding ordinary shares . Each of tangible

book value attributable to Burford Capital Limited and tangible

book value attributable to Burford Capital Limited per ordinary

share is a non-GAAP financial measure and should not be

considered in isolation from, as a substitute for, or superior

to, financial measures calculated in accordance with US

GAAP. The most directly comparable measure calculated in

accordance with US GAAP is total Burford Capital Limited

equity as set forth in our consolidated statements of financial

position. We believe that tangible book value attributable

to Burford Capital Limited per ordinary share is an important

measure of our financial condition and is useful to management

and investors when assessing capital adequacy and our ability

to generate earnings on tangible equity invested by our

shareholders.

For additional information, including reconciliations of our

non-GAAP financial measures to the most directly comparable US GAAP

measures and reconciliations of our alternative performance

measures additional to those set forth in this announcement, see

the 2Q23 Quarterly Report furnished to the US Securities and

Exchange Commission on September 13, 2023 and made available on our

website at http://investors.burfordcapital.com . Non-GAAP financial

measures should not be considered in isolation from, as substitutes

for, or superior to, financial measures calculated in accordance

with US GAAP.

This announcement does not constitute an offer to sell or the

solicitation of an offer to buy any ordinary shares or other

securities of Burford.

This announcement does not constitute an offer of any Burford

private fund. Burford Capital Investment Management LLC, which acts

as the fund manager of all Burford private funds, is registered as

an investment adviser with the US Securities and Exchange

Commission. The information provided in this announcement is for

informational purposes only. Past performance is not indicative of

future results. The information contained in this announcement is

not, and should not be construed as, an offer to sell or the

solicitation of an offer to buy any securities (including, without

limitation, interests or shares in any of Burford private funds).

Any such offer or solicitation may be made only by means of a final

confidential private placement memorandum and other offering

documents.

Forward-looking statements

This announcement contains "forward-looking statements" within

the meaning of Section 21E of the US Securities Exchange Act of

1934, as amended, regarding assumptions, expectations, projections,

intentions and beliefs about future events. These statements are

intended as "forward-looking statements". In some cases,

predictive, future-tense or forward-looking words such as "aim",

"anticipate", "believe", "continue", "could", "estimate", "expect",

"forecast", "guidance", "intend", "may", "plan", "potential",

"predict", "projected", "should" or "will" or the negative of such

terms or other comparable terminology are intended to identify

forward-looking statements, but are not the exclusive means of

identifying such statements. In addition, Burford and its

representatives may from time to time make other oral or written

statements which are forward-looking statements, including in its

periodic reports that Burford files with, or furnishes to, the US

Securities and Exchange Commission, other information made

available to Burford's security holders and other written

materials. By their nature, forward-looking statements involve

known and unknown risks, uncertainties and other factors because

they relate to events and depend on circumstances that may or may

not occur in the future. Burford cautions you that forward-looking

statements are not guarantees of future performance and are based

on numerous assumptions, expectations, projections, intentions and

beliefs and that Burford's actual results of operations, including

its financial position and liquidity, and the development of the

industry in which it operates, may differ materially from (and be

more negative than) those made in, or suggested by, the

forward-looking statements contained in this announcement.

Significant factors that may cause actual results to differ from

those Burford expects include, among others, those discussed under

"Risk Factors" in Burford's annual report on Form 20-F for the year

ended December 31, 2022 filed with the US Securities and Exchange

Commission on May 16, 2023 and other reports or documents that

Burford files with, or furnishes to, the US Securities and Exchange

Commission from time to time. In addition, even if Burford's

results of operations, including its financial position and

liquidity, and the development of the industry in which it operates

are consistent with the forward-looking statements contained in

this announcement, those results of operations or developments may

not be indicative of results of operations or developments in

subsequent periods.

Except as required by law, Burford undertakes no obligation to

update or revise the forward-looking statements contained in this

announcement, whether as a result of new information, future events

or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LJMLTMTTBMIJ

(END) Dow Jones Newswires

September 13, 2023 07:00 ET (11:00 GMT)

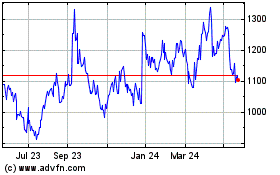

Burford Capital (AQSE:BUR.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

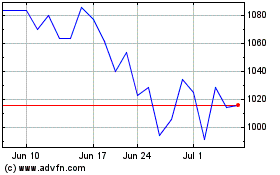

Burford Capital (AQSE:BUR.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024