TIDMCTO

RNS Number : 3830S

TClarke PLC

14 July 2022

TClarke plc

Half year results for the six months ended 30 June 2022

TClarke posts record half year results as it closes in on

GBP500m revenue target

TClarke plc ("the Group" or "TClarke"), the Building Services

Group, announces its half year results for the period ended 30 June

2022.

Business Highlights:

-- First half year revenues exceed GBP200m for the first time

-- 2.9% operating margin achieved

-- Interim dividend increased by 67%

-- Full year 2022 revenues now expected to be circa GBP450m, ahead of market expectations

-- Record forward order book of GBP586m as at 30 June 2022

-- Bonding capacity increased to support GBP500m per annum revenues

-- Bank facilities extended to August 2026

Financial Highlights:

6 months to 30 June H1 2022 H1 2021

Revenue GBP206.2m GBP138.2m

Operating profit (EBIT) GBP6.0m GBP2.4m

Operating margin 2.9% 1.7%

Profit before tax GBP5.5m GBP1.9m

Earnings per share

(Basic) 10.24p 3.58p

Interim Dividend 1.25p 0.75p

Net Cash GBP7.2m GBP2.0m

Forward order book GBP586m GBP503m

---------- ----------

Earnings per share is calculated by dividing profit after tax by

the weighted average number of shares in issue

Trading

Trading has continued to be strong for the first six months of

2022 with revenue up 49% compared with the corresponding period

last year. Revenue growth has been experienced by all regions but

has been particularly strong in London where revenues at GBP125.1m

are 72% higher than in 2021. This growth is expected to continue

throughout the rest of 2022 with revenues for the full year now

expected to be circa GBP450m.

The growth in revenues has been supported by maintaining our

operating margin close to target levels at 2.9%; again driven by

the London business. London's operating margin for the first six

months of the current year is 4.6% (2021 1.4%), UK South operating

margin is 2.8% (2021 3.7%) and UK North operating margin is 2.7%

(2021 3.7%). After deducting group costs of GBP2.0m the overall

Group operating margin during the period is 2.9% (2021 1.7%).

Cash and Facilities

Good financial discipline is at the centre of our operations.

Net cash is GBP7.2m as at 30 June 2022; an increase of GBP5.2m

compared with 30 June 2021. Average month end net cash during H1

2022 is GBP3m.The principal cash movements are detailed in the

banking facilities section of this report.

In support of our growth strategy we have now put in place

banking facilities with NatWest comprising a GBP25m revolving

credit facility (RCF) which extends to August 2026 and a GBP5m

overdraft facility.

Many of our clients demand performance bonds to be in place as

part of the contract requirements. Due to the strength of the

business TClarke has at its disposal one of the largest bonding

capacities when compared to our recognised peer group. This too has

recently been increased to provide for a total bonding capacity of

GBP65.1m.

Dividend

The Board proposes an interim dividend of 1.25p per share (2021:

0.75p per share) to be paid on 30 September 2022 to shareholders on

the register at 2 September 2022. TClarke has a progressive

dividend policy and is also rebalancing the split between the

interim and final dividend. As a result the interim dividend now

proposed has been increased by the full amount of the expected

increase in total dividend for 2022.

Net Assets

Group net assets have increased by GBP8.6m in the six months to

30 June 2022 and now stand at GBP35.1m. This is principally due to

the increase in retained earnings and the post-tax reduction in

pension deficit.

Order Book

Our future confidence is underpinned with the success of the

Group's forward order book which has been replenished and expanded

and now stands at a new record of GBP586m. This is an GBP83m

increase compared to the position at 30 June 2021. In addition,

TClarke has many target projects and opportunities with our

pipeline of current bids exceeding GBP1bn.The split of the order

book is as follows:

30 June 30 June

Market Sector 2022 2021 Increase

GBPm GBPm %

-------- -------- ----------

Infrastructure 141 93 52%

-------- -------- ----------

Technology 184 132 39%

-------- -------- ----------

Residential &

Hotels 96 113 -15%

-------- -------- ----------

Engineering Services 151 153 -1%

-------- -------- ----------

Facilities Management 14 12 17%

-------- -------- ----------

Total 586 503 17%

-------- -------- ----------

Outlook

TClarke is moving rapidly towards achieving its 2023 GBP500m

annual revenue target whilst maintaining its operating margin. The

Board expects based upon the performance to date, revenues to

exceed current expectations for 2022 at circa GBP450m for the full

year.

Mark Lawrence, Chief Executive, commented

"With the current economic conditions, the business is rightly

cautious, however the strategy we follow is of a disciplined

tendering approach with early engagement with our supply chain

partners and our clients which is ensuring we are not exposed to

unnecessary risks.

The record half year revenues and forward order book along with

the current visibility of future workloads in our target revenue

streams mean TClarke now expects to deliver GBP450m revenue in 2022

and achieve its GBP500m target in 2023."

-ends-

Date: 14 July 2022

For further information contact:

TClarke plc

Mark Lawrence

Chief Executive Officer

Trevor Mitchell

Finance Director

Tel: 020 7997 7400

www.tclarke.co.uk

Cenkos Securities plc (Corporate

Broker)

Ben Jeynes (Corporate Finance)

Alex Pollen (Sales)

Tel: 020 7397 8900

www.cenkos.com

RMS Partners

Simon Courtenay

Tel: 020 3735 6551

Operational Review

The Group is managed in three operational areas, London, UK

South and UK North, providing nationwide coverage from twenty

locations across the UK.

We focus on repeat customers and framework contracts in the

following key markets:

-- Infrastructure

-- Residential & Hotels

-- Facilities Management

-- Engineering Services

-- Technologies

TClarke - London

30 06 2022 30 06 2021

GBPm GBPm

Revenue 125.1 72.8

----------- -----------

Operating profit 5.8 1.0

----------- -----------

Operating profit margin 4.6% 1.4%

----------- -----------

Order book 3 81 346

----------- -----------

London is the most significant of our three operating divisions

and includes our combined engineering services London business, our

London technology business and our off-site prefabrication facility

at Stansted.

The growth in revenue has been primarily driven by our success

of our data centre offering. Having successfully delivered a major

data centre in the first half of the year, we expect to continue to

deliver on the remaining (and larger) live data centre projects in

the second half of the year.

Our core Engineering Services have also continued to perform

strongly, delivering a number of high profile shell and core

commercial and hotel developments, which is reflected in the 3.2%

increase in operating margin from the same period of 2021.

TClarke - UK South

30 06 2022 30 06 2021

GBPm GBPm

Revenue 43.6 35.4

----------- -----------

Operating profit 1.2 1.3

----------- -----------

Operating profit margin 2.8% 3.7%

----------- -----------

Order book 86 57

----------- -----------

UK South operates from our offices at Birmingham, Derby, Oxford,

Kimbolton, Newport, Peterborough, Portishead, Plymouth and St

Austell, and is able to target a vast range of construction and

facilities management opportunities across the region.

The first half of the year has seen good revenue growth compared

to 2021, with strong performances in both our Security and Climate

divisions. Our new Oxford office is now fully operational having

started to trade in the first half of the year and is expected to

deliver a profit in its first full year. Our expectation is for

margins to recover during the second half of 2022, back to the UK

South's normal operating margin of circa 3.7%.

TClarke - UK North

30 06 2022 30 06 2021

GBPm GBPm

Revenue 37.5 30.0

----------- -----------

Operating profit 1.0 1.1

----------- -----------

Operating profit margin 2.7% 3.7%

----------- -----------

Order book 1 19 100

----------- -----------

The UK North division operates from five principal locations;

Liverpool, Manchester, Leeds, Newcastle and Eurocentral

Scotland.

The North West has made the most significant contribution to the

GBP1.0m operating profit including the successful delivery of a

major engineering services project in Manchester. The operating

margin has decreased by 1% compared to 2021 due to the business mix

in the first half of the year. Our expectation is for the UK North

to maintain an operating margin of circa 2.7% in the second half of

2022.

Pension Obligations

In accordance with IAS 19 'Employee Benefits', an actuarial gain

of GBP5.5m, net of tax, has been recognised in reserves during the

period, with the pension scheme deficit decreasing to GBP15.9m

(30th June 2021: GBP24.5m). The decrease in the deficit is largely

the result of the discount rate increasing to 3.82% (30(th) June

2021: 2.0%), partially offset by the hedging strategy employed by

the scheme. In accordance with the Group's agreed deficit reduction

plan, described in detail in the most recent annual report, the

annual deficit reduction contribution is set at GBP1.5m for the

current year, and will remain at this amount until the review of

the output of the triennial actuarial valuation of the scheme which

is currently in progress.

The scheme is closed to new members and the Group continues to

meet its ongoing obligations to the scheme.

Banking Facilities and Cash Flow

The Group has recently renewed its banking facilities, which now

comprise a GBP5m overdraft facility (previously GBP10m), repayable

on demand, and a GBP25m revolving credit facility ("RCF")

(previously GBP15m) expiring 31st August 2026. At 30 June 2022 the

Group had drawn down GBP5m (2021: GBP15m) of the RCF and the

overdraft facility was unutilised. The gross cash balance was

GBP11.9m, resulting in net cash of GBP7.2m. The Group therefore has

up to GBP37.2m available to support the Group's working capital

flows and funding demands during the course of the year. The Group

has GBP65.1m bonding facilities in place of which GBP26.3m were

utilised at 30 June 2022.

The net cash figure of GBP7.2m is GBP5.2m higher than at the

same time in 2021 reflecting profit for the period and other

non-operating cashflows, as set out below:

GBPm

--------------------------- ------

Balance 1 July 2021 2.0

--------------------------- ------

Profit after tax 9.2

Dividends (2.1)

Pension deficit reduction (1.5)

Employee Share Trust

Share Purchase (0.5)

Other 0.1

Balance at 30 June

2022 7.2

--------------------------- ------

Net Assets and Capital Structure

The Group is funded by equity capital, retained reserves and

bank facilities, and there are no plans to change this.

Shareholders' equity is GBP35.1m; an increase of GBP16.1m compared

to 30 June 2021.

Condensed consolidated income statement

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

to to to

30 06 2022 30 06 2021 31 12 2021

GBPm GBPm GBPm

Revenue 206.2 138.2 327.1

Cost of sales (181.5) (123.0) (286.6)

----------- ----------- -----------

Gross profit 24.7 15.2 40.5

Administrative expenses (18.7) (12.8) (31.7)

----------- ----------- -----------

Operating profit 6.0 2.4 8.8

Finance costs (0.5) (0.5) (1.0)

----------- ----------- -----------

Profit before taxation 5.5 1.9 7.8

Taxation (1.1) (0.4) (1.5)

----------- ----------- -----------

Profit for the period 4.4 1.5 6.3

Earnings per share

Attributable to owners of TClarke

plc

Basic 10.24p 3.58p 14.99p

Diluted 10.17p 3.38p 13.91p

Condensed consolidated statement of comprehensive income

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

to to to

30 06 2022 30 06 2021 31 12 2021

GBPm GBPm GBPm

Profit for the period 4.4 1.5 6.3

Other comprehensive income

Items that will not be reclassified

to profit or loss

Actuarial gain on defined benefit

pension scheme, net of tax 5.5 4.4 6.0

Other comprehensive income for the

period, net of tax 5.5 4.4 6.0

Total comprehensive income for

the period 9.9 5.9 12.3

----------- ----------- -----------

Condensed consolidated statement of financial position

Unaudited Unaudited Audited

30 06 2022 30 06 2021 31 12 2021

GBPm GBPm GBPm

Non-current assets

Intangible assets 25.3 25.3 25.3

Property, plant and equipment 12.5 7.6 7.5

Deferred taxation 4.4 5.2 6.4

Trade and other receivables 4.9 3.2 4.9

Total non-current assets 47.1 41.3 44.1

----------- ----------- -----------

Current assets

Inventories 0.4 0.4 0.4

Amounts due from customers under construction

contracts 69.8 56.4 51.7

Trade and other receivables 39.9 37.3 52.5

Current tax receivables 0.2 0.6 0.2

Cash and cash equivalents 12.2 17.0 20.3

----------- ----------- -----------

Total current assets 122.5 111.7 125.1

----------- ----------- -----------

Total assets 169.6 153.0 169.2

----------- ----------- -----------

Current liabilities

Borrowings (5.0) (15.0) (15.0)

Amounts due to customers under construction

contracts (2.5) (1.8) (2.9)

Trade and other payables (101.9) (85.8) (96.3)

Obligations under leases (1.8) (1.2) (1.6)

----------- ----------- -----------

Total current liabilities (111.2) (103.8) (115.8)

----------- ----------- -----------

Net current assets 11.3 7.9 9.3

----------- ----------- -----------

Non-current liabilities

Obligations under leases (5.7) (2.0) (1.3)

Deferred tax liabilities - (0.2) -

Trade and other payables (1.7) (3.5) (1.7)

Retirement benefit obligation (15.9) (24.5) (23.9)

Total non-current liabilities (23.3) (30.2) (26.9)

----------- ----------- -----------

Total liabilities (134.5) (134.0) (142.7)

Net assets 35.1 19.0 26.5

----------- ----------- -----------

Equity attributable to owners of the

parent

Share capital 4.4 4.3 4.4

Share premium 4.4 3.8 4.2

Revaluation reserve 0.7 0.9 0.7

Retained earnings 25.6 10.1 17.2

----------- ----------- -----------

Total equity 35.1 19.0 26.5

----------- ----------- -----------

Condensed consolidated statement of cash flows

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

to to to

30 06 2022 30 06 2021 31 12 2021

GBPm GBPm GBPm

Net cash generated by / (used in) operating

activities (see note 5A) 5.3 (5.3) (0.6)

----------- ------------- -----------

Investing activities

Purchase of property, plant and equipment (0.6) (0.1) (0.4)

Net cash used in investing activities (0.6) (0.1) (0.4)

Financing activities

New shares issued 0.2 0.5

Facility fee - - (0.1)

Repayment of bank borrowing (10.0) - -

Equity dividends paid (1.8) (1.5) (1.9)

Acquisition of shares by ESOT (0.5) (0.5) (0.9)

Repayment of lease obligations (0.7) (0.8) (1.5)

Net cash used in financing activities (12.8) (2.8) (3.9)

----------- ------------- -----------

Net decrease in cash and cash equivalents (8.1) (8.2) (4.9)

Cash and cash equivalents at beginning

of period 20.3 25.2 25.2

----------- ------------- -----------

Cash and cash equivalents at end of period

(see note 5) 12.2 17.0 20.3

----------- ------------- -----------

Condensed consolidated statement of changes

in equity

For the six months ended 30th June 2022

Share Share Revaluation Retained

capital premium reserve earnings Total

GBPm GBPm GBPm GBPm GBPm

At 1st January 2022 4.4 4.2 0.7 17.2 26.5

---------- ---------- ---- ------------ ----------- ---------

Comprehensive income

Profit for the period - - - 4.4 4.4

Other comprehensive income

Actuarial gain on retirement

benefit obligation - - - 7.5 7.5

Deferred income tax on

actuarial gain on retirement

benefit obligation - - - (2.0) (2.0)

Total other comprehensive

income - - - 5.5 5.5

---------- ---------- ---- ------------ ----------- ---------

Total comprehensive income - - - 9.9 9.9

---------- ---------- ---- ------------ ----------- ---------

Transactions with owners

Share based payment debit - - - 0.8 0.8

Shares acquired by ESOT - - - (0.5) (0.5)

Allotted in respect of share

option schemes - 0.2 - - 0.2

Dividends paid - - - (1.8) (1.8)

---- ------------

Total transactions with owners - - - (1.5) (1.3)

---------- ---------- ---- ------------ ----------- ---------

At 30th June 2022 4.4 4.4 0.7 25.6 35.1

---------- ---------- ---- ------------ ----------- ---------

Condensed consolidated statement of changes in equity

For the six months ended 30th June 2021

Share Share Revaluation Retained

capital premium reserve earnings Total

GBPm GBPm GBPm GBPm GBPm

At 1st January 2021 4.3 3.8 0.9 6.8 15.7

--------- --------- ------------ ---------- -------

Comprehensive income

Profit for the period - - - 1.5 1.5

Other comprehensive income

Actuarial gain on

retirement

benefit obligation - - - 5.5 5.5

Deferred income tax on

actuarial gain on

retirement

benefit obligation - - - (1.1) (1.1)

Total other comprehensive

income - - - 4.4 4.4

--------- --------- ------------ ---------- -------

Total comprehensive income - - - 5.9 5.9

--------- --------- ------------ ---------- -------

Total transactions with

owners - - - (2.6) (2.6)

--------- --------- ------------ ---------- -------

At 30th June 2021 4.3 3.8 0.8 10.1 19.0

--------- --------- ------------ ---------- -------

Condensed consolidated statement of changes in equity

For the year ended 31st December 2021

Share Share Revaluation Retained

capital premium reserve earnings Total

GBPm GBPm GBPm GBPm GBPm

At 1st January 2021 4.3 3.8 0.9 6.8 15.7

--------- --------- ------------ ----------- -------

Comprehensive income

Profit for the year - - - 6.3 6.3

Other comprehensive income

Actuarial gain on retirement

benefit obligation - - - 5.6 5.6

Deferred income tax on

actuarial gain on retirement

benefit obligation - - - 0.4 0.4

Total other comprehensive

income - - - 6.0 6.0

--------- --------- ------------ ----------- -------

Total comprehensive income - - - 12.3 12.3

--------- --------- ------------ ----------- -------

Transactions with owners

Transfer on depreciation of

freehold properties - - (0.1) 0.1 -

Share based payment credit - - - 0.8 0.8

Shares acquired by ESOT - - - (0.9) (0.9)

Allotted in respect of share

option schemes 0.1 0.4 - 0.5

Dividends paid - - - (1.9) (1.9)

Total transactions with owners 0.1 0.4 (0.1) (1.9) (1.5)

--------- --------- ------------ ----------- -------

At 31st December 2021 4.4 4.2 0.7 17.2 26.5

--------- --------- ------------ ----------- -------

Notes to the condensed consolidated financial statements for the

six months to 30 June 2022

Note 1 - Basis of preparation

TClarke plc (the 'Company') is a company incorporated and

domiciled in the United Kingdom. The nature of the Group's

operations and its principal activities are set out in Note 2 below

and in the interim management report. The consolidated interim

financial statements comprise the condensed financial statements of

the Company and its subsidiaries (together the 'Group').

These condensed interim financial statements do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The statutory accounts for the year ended 31

December 2021 were approved by the Board of Directors on 08 March

2022 and have been delivered to the Registrar of Companies and a

copy has been made available on the Company's website at

www.tclarke.co.uk . The auditors' report on those accounts was

unqualified and did not contain any statement under section 498 of

the Companies Act 2006.

These condensed interim financial statements for the half year

ended 30 June 2022 have been prepared in accordance with the

UK-adopted International Accounting Standard 34, 'Interim Financial

Reporting' and the Disclosure Guidance and Transparency Rules

sourcebook of the United Kingdom's Financial Conduct Authority.

They do not include all the information required for the full

annual financial statements and should be read in conjunction with

the financial statements of the Group as at and for the year ended

31 December 2021.

The interim financial statements have not been audited or

reviewed by the Company's auditors.

Accounting policies

Except as described below, the financial statements have been

prepared using the accounting policies and presentation that were

applied in the audited financial statements for the year ended 31

December 2021.

Taxes on income in the interim periods are accrued using the

estimated effective tax rate that would be applicable to expected

total annual earnings.

Estimates and financial risk management

The preparation of interim financial statements requires the

Directors to make judgements, estimates and assumptions about the

carrying amounts of assets and liabilities at the reporting date

and the amounts of revenue and expense incurred during the period

that may not be readily apparent from other sources. The estimates

and associated assumptions are based on historical experience and

other factors that are considered to be relevant. Actual results

may differ from these estimates.

In preparing these interim financial statements, the significant

judgements made by the Directors in applying the Group's accounting

policies and the key sources of uncertainty together with the

Group's financial risk management objectives and policies were the

same as those that applied to the financial statements as at and

for the year ended 31st December 2021. The principal risks and

uncertainties continue to be those which are set out on pages 26-29

of the Group's annual report and accounts for the year ended 31st

December 2021.

Going concern

The Group has recently renewed its banking facilities, which now

comprise a GBP5m overdraft facility repayable on demand, and a

GBP25m revolving credit facility ("RCF") expiring 31st August 2026.

At 30 June 2022 the Group had drawn down GBP5m (2021: GBP15m) of

the RCF and the overdraft facility was. The gross cash balance was

GBP12.2m, resulting in net cash of GBP7.2m. The Group therefore has

up to GBP37.2m available to support the Group's working capital

flows and funding demands during the course of the year.

After making appropriate enquiries, the Directors are satisfied

that the Company and Group have adequate resources to continue

their operations for the foreseeable future. Accordingly, the

Directors continue to adopt the going concern basis in preparing

the financial statements.

Note 2 - Segmental information

The Group provides electrical and mechanical contracting and

related services to the construction industry and end users.

For management and internal reporting purposes the Group is

organised geographically into three regional divisions; London, UK

South & UK North, reporting to the Chief Executive, who is the

chief operating decision maker.

30 June 2022 London UK South UK North Group costs Total

and Unallocated

GBPm GBPm GBPm GBPm GBPm

Revenue from contracts with

customers 125.1 43.6 37.5 - 206.2

------- --------- --------- ----------------- ------

Operating profit 5.8 1.2 1.0 (2.0) 6.0

Finance costs - - - (0.5) (0.5)

------- --------- --------- ----------------- ------

Profit/(loss) before tax 5.8 1.2 1.0 (2.5) 5.5

Taxation expense - - - (1.1) (1.1)

------- --------- --------- ----------------- ------

Profit/(loss) for the period 5.8 1.2 1.0 (3.6) 4.4

------- --------- --------- ----------------- ------

London UK South UK North Total

GBPm GBPm GBPm GBPm

Business sector

--------- ----------- ----------- --------

Engineering 38.2 10.5 9.3 58.0

Facilities Management 1.5 9.7 5.8 17.0

Infrastructure 9.8 21.0 8.6 39.4

Residential 16.9 1.0 11.7 29.6

Technologies 58.7 1.4 2.1 62.2

Total revenue 125.1 43.6 37.5 206.2

--------- ----------- ----------- --------

30 June 2021 London UK South UK North Group costs Total

and Unallocated

GBPm GBPm GBPm GBPm GBPm

Revenue from contracts with

customers 72.8 35.4 30.0 - 138.2

----------- ----------- --------- ----------------- ------------

Operating profit 1.0 1.3 1.1 (1.0) 2.4

Finance costs - - - (0.5) (0.5)

----------- ----------- --------- ----------------- ------------

Profit/(loss) before tax 1.0 1.3 1.1 (1.5) 1.9

Taxation expense - - - (0.4) (0.4)

----------- ----------- --------- ----------------- ------------

Profit/(loss) for the period 1.0 1.3 1.1 (1.9) 1.5

----------- ----------- --------- ----------------- ------------

London UK South UK North Total

GBPm GBPm GBPm GBPm

Business sector

------------- ---------------- ----------------- --------

Facilities Management 1.0 1.1 4.4 6.5

Infrastructure 9.3 22.8 12.2 44.3

Engineering Services 37.2 6.0 1.8 45.0

Residential & Hotels 12.6 5.3 11.0 28.9

Technologies 12.7 0.2 0.6 13.5

Total revenue 72.8 35.4 30.0 138.2

------------- ---------------- ----------------- --------

31 December 2021 London UK South UK North Group costs Total

and Unallocated

GBPm GBPm GBPm GBPm GBPm

Revenue from contracts with

customers 189.4 67.1 70.6 - 327.1

------- ----------- --------- ----------------- --------

Operating profit/(loss) 6.2 2.6 3.0 (3.0) 8.8

Finance costs - - - (1.0) (1.0)

------- ----------- --------- ----------------- --------

Profit/(loss) before tax 6.2 2.6 3.0 (4.0) 7.8

Taxation expense - - - (1.5) (1.5)

------- ----------- --------- ----------------- --------

Profit/(loss) for the year 6.2 2.6 3.0 (5.5) 6.3

------- ----------- --------- ----------------- --------

London UK South UK North Total

GBPm GBPm GBPm GBPm

Business sector

---------------- ------------- ----------------- ----------

Facilities Management 2.7 13.6 9.7 26.0

Infrastructure 15.1 34.4 29.3 78.8

Engineering Services 91.7 14.3 10.9 116.9

Residential & Hotels 31.5 4.8 19.6 55.9

Technologies 48.4 - 1.1 31.5

Total revenue 189.4 67.1 70.6 327.1

---------------- ------------- ----------------- ----------

Note 3 - Taxation expense

The effective corporation tax rate applied for the period is

19.0% (30 June 2021: 19.0%).

Note 4 - Earnings per share

A. Basic earnings per share

The earnings per share represent the profit for the period

divided by the weighted average number of ordinary shares in

issue.

Unaudited Unaudited Audited

30 06 2022 30 06 2021 31 12 2021

GBPm GBPm GBPm

Earnings

Profit attributable to owners of the

Company 4.4 1.5 6.3

Weighted average number of ordinary

shares (000s) 42,988 41,898 42,284

------------ ------------ -------------

Basic earnings per share 10.24p 3.58p 14.99p

------------ ------------ -------------

B. Diluted earnings per share

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The Company

has two categories of dilutive potential ordinary shares: share

options granted under the Company's SAYE schemes, and conditional

share awards granted under the Long-Term Incentive Plan. Further

details of these schemes are given in note 18 of the 2021 annual

report and financial statements .

Unaudited Unaudited Audited

30 06 2022 30 06 2021 31 12 2021

GBPm GBPm GBPm

Earnings

Profit attributable to owners of the

Company 4.4 1.5 6.3

4.4 1.5 6.3

------------ ------------ -------------

Weighted average number of ordinary

shares in issue (000s) 42,988 41,898 42,284

Adjustments

SAYE Share Options (000s) 278 451 471

Long-Term Incentive Plan Conditional

share awards (000s) - 1,982 2,790

Weighted average number of ordinary

shares for diluted earnings per share

(000s) 43,266 44,331 45,545

------------ ------------ -------------

Diluted earnings per share 10.17p 3.38p 13.91p

------------ ------------ -------------

Note 5 - Notes to the consolidated statement of cash flows

Unaudited Unaudited Audited

A. - Reconciliation of operating profit 30 06 2022 30 06 2021 31 12 2021

to net cash from operating activities GBPm GBPm GBPm

Operating profit 6.0 2.4 8.8

Depreciation charges 1.1 1.0 2.0

Equity settled share based payments 0.8 (0.6) 0.8

Additional pension contributions (0.8) (0.8) (1.5)

Defined benefit pension scheme movement 0.2 0.2 0.4

Operating cash flows before movements

in working capital 7.3 2.2 10.5

Increase in contract balances (18.1) (14.0) (8.2)

Decrease / (Increase) in operating trade

and other receivables 11.3 (2.4) (18.8)

Increase in operating trade and other

payables 5.0 9.2 16.4

------------ ------------ ------------

Cash generated by / (used in) operating

activities 5.5 (5.0) (0.1)

Interest paid (0.2) (0.3) (0.5)

------------ ------------ ------------

Net cash generated by / (used in) operating

activities 5.3 (5.3) (0.6)

------------ ------------ ------------

B. Cash and cash equivalents

Cash and cash equivalents comprise cash at bank less bank

overdrafts.

Note 6 - Related party transactions

Transactions between the Company and its subsidiary

undertakings, which are related parties, have been eliminated on

consolidation and are not disclosed in this note. Full disclosure

of the Group's other related party transactions is given in Note 21

to the Group's financial statements for the year ended 31 December

2021. There have been no material changes in these relationships in

the six months ended 30 June 2022 that have materially affected the

financial position or performance of the Group during that

period.

Note 7 - Pension commitments

The present value of the defined benefit retirement benefit

scheme and the related past and current service costs were measured

using the projected unit credit method. The amount included in the

statement of financial position arising from the Group's

obligations in respect of its defined benefit retirement benefit

scheme is as follows:

Unaudited Unaudited Audited

30 06 2022 30 06 2021 31 12 2021

GBPm GBPm GBPm

Present value of defined benefit

obligations 51.2 69.9 73.4

Fair value of scheme assets (35.3) (45.4) (49.5)

------------- ------------- -------------

Deficit in scheme recognised

in the statement of financial

position 15.9 24.5 23.9

Key assumptions used

Rate of increase in salaries 2.49% 2.90% 3.39%

Rate of increase of pensions

in payment 3.11% 3.10% 3.15%

Discount rate 3.82% 2.00% 1.89%

Inflation assumption (RPI) 3.19% 3.20% 3.25%

Inflation assumption (CPI) 1.99% 2.40% 2.05%

Unaudited Audited

Mortality assumptions (years) 30 06 2022 Unaudited 31 12 2021

30 06 2021

Life expectancy at age 65 for

current pensioners:

Men 21.2 21.8 21.5

Women 23.2 24.1 23.4

Life expectancy at age 65 for

future pensioners

(current age 45)

Men 22.1 22.8 22.5

Women 24.3 25.3 24.6

Statement of Directors' responsibilities

The Directors confirm that the condensed interim financial

statements have been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting' and that the

interim management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

On behalf of the Board

Iain McCusker - Chairman

Mark Lawrence - Chief Executive

Trevor Mitchell - Finance Director

14 July 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGMNFFDGZZM

(END) Dow Jones Newswires

July 14, 2022 02:00 ET (06:00 GMT)

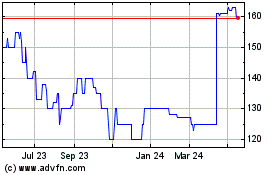

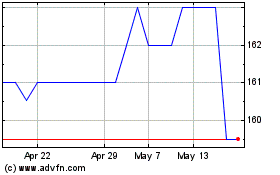

TClarke (AQSE:CTO.GB)

Historical Stock Chart

From May 2024 to Jun 2024

TClarke (AQSE:CTO.GB)

Historical Stock Chart

From Jun 2023 to Jun 2024