TIDMHUM

RNS Number : 9360O

Hummingbird Resources PLC

06 February 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

6 February 2023

Hummingbird Resources plc

("Hummingbird" or the "Company")

Q4 2022 and 2023 Outlook

Closing out the 2022 year with strong production of +28koz,

meeting revised full year guidance and on track at Kouroussa,

Guinea for first gold pour at the end of Q2 2023

Hummingbird Resources plc (AIM: HUM) provides an operational

update for the fourth quarter of 2022 ("Q4 2022") and its outlook

for FY2023.

Operational update

Yanfolila, Mali

-- Production: Strong Q4 2022 gold production of 28,264 ounces

("oz"), +67% from Q3 2022

o Full year 2022 production of 80,635 oz, meeting revised

guidance

-- All-in Sustaining Cost ("AISC"): Materially improved

quarterly AISC of US$1,248 per oz for Q4 2022 (Q3 2022 US$2,161 per

oz)

o Full year 2022 AISC of US$1,782 pe--r oz, meeting revised

guidance

-- Gold sold: 27,860 oz of gold sold in Q4 2022 at an average

realised price of US$1,726 per oz (Q3 2022: 16,917 oz of gold sold

at an average realised price of US$1,713 per oz). The Company held

2,057 oz of gold inventory on 31 December 2022, valued at c.US$3.7

million

Kouroussa, Guinea

-- Kouroussa remains on track for first gold pour at the end of

Q2 2023

-- Critical path construction and operational readiness items

are nearing completion

-- 2 million lost time injury ("LTI") free hours achieved, a key

safety achievement for the Kouroussa construction team, with this

positive safety trend continuing

Dugbe, Liberia

-- As reported in the Q3 2022 operational update, the Company is

currently conducting a strategic review of its options to best

realise the maximum value of the Dugbe project for all

stakeholders. This process is ongoing with our joint venture

partner, Pasofino Gold Limited ("Pasofino")

Corporate

-- Improved Group EBITDA of c.US$11 million for Q4 2022

-- ESG : The Company achieved full World Gold Council ("WGC")

Responsible Gold Mining Principles ("RGMP") compliance during the

quarter as detailed in 15 November 2022 RNS

2023 Outlook

-- The Company provides a 2023 guidance update for Yanfolila,

Mali and, once Kouroussa, Guinea is in production and ramping up,

the Company will provide a more detailed Group wide guidance update

for the full year

o Expectations are that once Kouroussa is fully operational, the

mine will add a material uplift to the Group's production profile

for FY2023 and beyond

-- FY2023 production guidance for Yanfolila, Mali of 80,000 -

90,000 oz, with full year AISC of under US$1,500 per oz

Dan Betts, CEO of Hummingbird, commented:

"Following the initiation of restructuring the Company's

contract mining operations as detailed last quarter, Hummingbird

finished the year in a substantially stronger position, with

Yanfolila producing its best quarterly production for several

years, of over 28koz, an improved AISC profile generating positive

cashflows, with similar trends continuing for this current

quarter.

Kouroussa's construction continued to make material advances and

remains on target for first gold pour at the end of Q2 2023,

despite a challenging macro environment. Kouroussa is a high-grade

mine, with LOM upside through further drilling which we are

reviewing for 2H 2023, that will provide strong cash flow

generation, taking the Company to be a +200,000 oz gold producer,

which we will give more detailed guidance on once in production and

ramping up.

Further, during the quarter we achieved full WGC RGMP

compliance, a key milestone in terms of the Company's

implementation of leading industry standard ESG policies and

procedures.

For 2023 we will achieve our strategic goal of being a

multi-asset, multi-jurisdiction gold producer. With Yanfolila

operational performance improving, and Kouroussa set to come online

the end of Q2 2023, the Company is at a pivotal juncture for

exponential growth, with expectations for improved cash flow

generation and a stronger balance sheet this year."

Operational Update

Further operational and post period updates on:

Yanfolila, Mali

-- Q4 2022 production of 28,264 oz was a +67% improvement from

the 16,827 oz in Q3 2022, and 80,653 oz for FY 2022, meeting

revised guidance

o As noted in our Q3 2022 release, to stabilise production, the

Company intervened with our contract miner in securing additional

key equipment to site, including grade control and production rigs,

coupled with onsite leadership changes

o These measures have been broadly successful, with the Company

being able to better achieve its mine plan schedule, move into the

higher-grade Komana East ("KE") deposit, resulting in a strong

production quarter, with a similar quarter-on quarter production

profile expected for this quarter, Q1 2023

-- Mill feed grade for Q4 2022 averaged 2.45 grammes per tonne

("g/t"), a material improvement from the previous quarters, with a

FY 2022 average mill feed grade of 2.00 g/t

o With operational and production improvements as highlighted

above, better access to the higher-grade ore deposit at KE was

achieved, leading to the improved grade profile

-- Ore processed totalled 382,683 tonnes ("t"), a +30%

improvement from Q3 2022 levels, as the key target deposit for the

quarter, being KE, was mined, leading to higher-grade and more

tonnage ore feed processed at the mill

-- Mined bank cubic meters ("BCM") totalled 1,303,770 in Q4 2022

and 7,734,175 for FY 2022

o The BCM movement in Q4 2022 was lower than Q3 2022, as the key

target mine area for the quarter, being KE, required less overall

BCM movement and more drill rig exposure to access the higher-grade

ore feed to the mill. This resulted in an improvement in ore

processed at the mill as noted above compared to Q3 2022 levels

-- Processing plant recovery rates for Q4 2022 were 94.28%,

returning to the average 1H 2022 rates

-- As noted in our Q3 2022 update, the Komana East underground

("KEUG") deposit is in our 2023 Yanfolila mine plan with first

underground gold production expected by the end of Q4 2023, for a

full year of production scheduled for FY 2024. With a + 278,000 oz

Reserve, at 3.94 g/t , and increased mine life potential with

further drilling, the KEUG will be a key deposit to underpin

Yanfolila's future production profile

-- The Company has initiated a detailed cost control and

reduction programme at Yanfolila, Mali with a focus to reduce AISC

for FY2023 and beyond versus FY2022 levels

-- Per the highlights above, FY2023 production guidance for

Yanfolila, Mali of 80,000 - 90,000 oz, with a full year AISC of

under US$1,500 per oz

Kouroussa, Guinea:

Kouroussa is a high-grade, low-cost mine, which has a current

Reserve of 647,000 oz at 4.15 g/t with upside potential to extend

life of mine ("LOM") with further drilling, which is being reviewed

for 2H 2023. As previously announced, the mine is estimated to

produce an average of between 120,000 oz and 140,000 oz for the

first three years of production and average 100,000 oz over the

initial LOM.

As noted in the highlights above, Kouroussa remains on track for

first gold pour at end of Q2 2023, with a more detailed Group wide

production guidance update to be released once the mine is in

production and ramping up.

Key operational and construction updates that occurred for the

quarter include:

-- All process plant earthworks completed

-- Civil works for the Oxide ore crushing ROM wall, SAG mill,

and Reclaim Tunnel have been completed, Carbon Plant civil works

near completion and Gold Room civil works have commenced

-- All Pre-Leach, CIL and Detoxification tanks constructed,

reagents make-up building erected

-- Plant store and Workshop infrastructure buildings completed

and mine administration building roofing installation in

progress

-- All mine camp accommodation units near completion, camp

messing and entertainment building under construction

-- TSF construction progress aligned with the planned process

plant commissioning date

Installation and delivery of key items

-- Mechanical installation commenced for Mineral Sizer and SAG

mill, all SAG mill base plates are installed and signed off. SAG

mill fixed and floating bearing installation commenced

-- CIL and Detox Agitator shafts and blades, delivered to site

and installed

-- Air services building, compressors and air receivers

installed

-- All crushing circuit mechanicals delivered to site - Apron

Feeder, Vibrating Grizzly Feeder, Jaw Crusher and Mineral Sizer.

Conveyor mechanical equipment delivered to site

-- SAG mill base plates, fasteners, bearings, trommel screen,

feed chute, shell cans and liners delivered to site

-- Carbon safety screen installed

Operational Readiness update

-- A General Manager with significant operational experience

joined during Q4 2022 and is implementing detailed operational

readiness programs towards first gold pour

-- Long lead items for the project have been ordered, with the

last remaining key equipment delivery items due early this quarter,

Q1 2023

-- Operation readiness programmes are being finalised and

implemented in preparation for first gold pour end of Q2 2023

including: mine plan; grade control drilling; overall mining and

power infrastructure implementation; and active recruitment for

final key operational positions

-- Mobilisation of mining personnel and equipment took place

during the quarter, with mining ramping up in 1H 2023

-- Power plant scheduled to be operational in Q1 2023, with the

addition of a +7-megawatt hour ("Mwh") solar farm to be constructed

and operational by year end. Once installed it is anticipated that

in excess of 30% of the power will be generated through solar, with

discussions ongoing to increase this to 40% in 2024, being a key

part of the Company's greenhouse gas ("GHG") emission reduction

strategy

-- As noted on our Q3 2022 release, community engagement remains

a key feature of all workstreams, with the community projects and

livelihood initiatives underway, which the Company expects to

expand upon in 2023 including: water supply infrastructure; local

community hospital infrastructure improvements and medical

supplies; market gardens; and commercial product manufacturing

training such as Shea butter and honey cultivation

Dugbe, Liberia:

As noted above, the Company is currently conducting a strategic

review of its options to best realise the maximum value of the

Dugbe project for all stakeholders with our joint venture partner,

Pasofino. The Company will provide more details once more material

progress is made.

Financial Summary:

-- Q4 2022 AISC improved materially from Q3 2022 levels at

US$1,248 per oz, versus US$2,161 per oz, primarily due to the

improved quarterly production

o FY 2022 AISC of US$1,782 oz, meeting revised guidance

-- Improved Group EBITDA of c.US$11 million for Q4 2022

-- Net debt position c.US$114 million end of Q4 2022 (c.US$110

million including gold inventory value). As detailed in the Q3 2022

release, an additional c.US$35 million debt facility was agreed

with Coris Bank International ("Coris Bank"), to secure funding

requirements and ensure Kouroussa moves into production, with

c.US$15 million of the US$35 million remaining available and

expected to be drawn 1H 2023

-- Of the budgeted c.US$115 million capex for the construction

of Kouroussa, c.US$65 million has been paid as at the end of Q4

2022, with the balance to be paid over the coming quarters from

Yanfolila cash flows (which have improved) and existing debt

facilities, including c.US$20 million contractor deferrals,

retention incentives and working capital not expected to be paid

until Kouroussa is into full production

ESG Q4 2022 updates include:

-- The Company achieved full WGC RGMP compliance during the

quarter as detailed on 15 November 2022. Adopting the WGC RGMPs is

a key part of the Company's strategy for building a long term,

sustainable mining Company and a key ESG result and highlight for

2022

-- The Company continued to have strong community engagement

both at Yanfolila and Kouroussa, including the development and

enhancement of community projects at both sites including: water

supply infrastructure; malaria prevention spraying; market gardens;

training initiatives; and community healthcare support. FY 2023 ESG

budgets have been finalised and the Company expects to enhance our

community project works, especially at Kouroussa

-- As noted above, at Kouroussa, planning and budgeting was

finalised during Q4 2024 to have installed a +7Mwh solar farm to

provide energy efficiencies and reduce the Company's GHG emissions

at the mine. Once installed it is anticipated that in excess of 30%

of the power will be generated through solar, with discussions

ongoing to increase this to 40% in 2024

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold production, development and exploration

Company, member of the World Gold Council and founding member of

Single Mine Origin ( www.singlemineorigin.com ). The Company

currently has two core gold projects, the operational Yanfolila

Gold Mine in Mali, and the Kouroussa Gold Mine in Guinea, which

will more than double current gold production when in full

production, scheduled for first gold pour the end of Q2 2023.

Further, the Company has a controlling interest in the Dugbe Gold

Project in Liberia that is being developed by Pasofino Gold Limited

through an earn-in agreement. The final feasibility results on

Dugbe showcase 2.76Moz in Reserves and strong economics such as a

3.5-year capex payback period once in production, 14-year life of

mine at a low AISC profile. Our vision is to continue to grow our

asset base, producing profitable ounces, while central to all we do

being our Environmental, Social & Governance ("ESG") policies

and practices.

F or further information, please visit

hummingbirdresources.co.uk or subscribe to our investor releases

via investor email alerts

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Edward Montgomery,

CSO & ESG

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Thomas Diehl Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Oonagh Reidy Financial PR/IR 5000

George Cleary Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDTJMPTMTBMBRJ

(END) Dow Jones Newswires

February 06, 2023 02:00 ET (07:00 GMT)

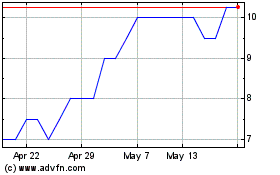

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024