TIDMLMS

RNS Number : 2665S

LMS Capital PLC

12 November 2021

12 November 2021

LMS Capital PLC

COMPLETION OF LMS PREVIOUSLY ANNOUNCED INVESTMENT IN A PORTFOLIO

OF OIL AND GAS PRODUCING ASSETS IN ROMANIA

LMS Capital PLC ("LMS") is pleased to announce that all

necessary regulatory approvals in Romania have now been received by

Dacian Petroleum ("Dacian"), the Romanian oil and gas production

company in which LMS has committed to invest, and the company

should now be able to complete its purchase of an onshore oil and

gas production business in Romania.

A further announcement will be made when completion has

occurred.

Commenting on the transaction, Robert Rayne, chairman of LMS

said:

"We are delighted that the transaction is now able to close. It

has taken longer than anticipated to obtain the necessary

regulatory approvals and get to this point - however our view has

been that this represents an exciting cornerstone investment for

LMS and that the wait was worthwhile. The management of "sunset"

oil and gas assets is an important part of the world's energy

transition.

The terms of the transaction allow for upside from investment

and development of the business. Since the transaction was first

announced in 2020, energy prices have recovered, especially natural

gas, and this will help Dacian's operating cash flows - albeit we

are mindful of the risk of future volatility in prices."

SUMMARY

-- LMS Capital PLC ("LMS") announced in Q3 2020, its commitment

to invest in Dacian Petroleum ("Dacian"), subject to Dacian

receiving required approvals in Romania to proceed with the

acquisition of a business operating onshore oil and gas fields in

Romania

-- Whilst it has taken longer than originally expected, Dacian

has now received all required approvals from the Romanian

Government, and the acquisition is expected to close during

November and Dacian will commence operating the business.

-- The business that has been acquired operates 40 onshore oil

and gas fields with some 90 active wells currently producing

approximately 1,050 barrels of oil equivalent per day ("boepd") -

approximately 60% gas and 40% oil - with significant production

upside and substantial unrecovered reserves

-- LMS led an investment group to acquire a 50% interest in

Dacian, with management holding the remaining 50%.

-- LMS has itself invested US$9.1 million in senior loan and

equity capital to acquire a 32% holding in Dacian. Co-investors

(including LMS Directors) hold 18%

-- The investment by LMS and the Co-investors is structured

almost entirely as senior debt, carrying a 14% annual coupon, which

must be wholly repaid before any returns accrue to equity

-- Dacian is a significant cornerstone investment that

demonstrates LMS' ability to access deal flow in sectors where it

has deep and long-standing relationships, knowledge experience, to

introduce co- investors and to execute transactions.

Rationale for the acquisition

The acquisition offers:

-- the opportunity to acquire a business with a robust operating

plan that is operationally cash flow positive from day one,

expected to meet or exceed target returns and can withstand

volatility in energy prices;

-- a single focus on production and production enhancing

technology that can allow the material extension of the productive

life of mature properties, and in doing so, secure returns likely

to be commensurately high versus the operating risk;

-- a founder team with extensive industry experience and a local

operational team in Romania with prior knowledge of the assets that

are being acquired; and

-- a portfolio of sunset life assets where the extension of life

of aging assets allows for very low carbon footprint per barrel and

molecule produced because the existing industrial infrastructure is

put to further use. These assets are expected to continue oil and

gas production for more than ten years.

Returns

Operating returns

The transaction is expected to be operationally cash flow

positive from completion and is expected to produce returns to

investors through both regular interest and dividend payments. The

investment is expected to meet or exceed LMS' long term return

criteria of 12% to 15% per annum.

The investment is structured as unsecured senior loans which

carry a coupon of 14% per annum and a subscription for share

capital for a nominal sum. The senior loans are expected to be

repaid with interest over approximately 4 years. LMS holds $9.1

million of the 14% senior loans and 32% of the outstanding ordinary

shares. Interest accrues with effect from 20 September 2020 when

funds for the transaction were conditionally transferred. The

accrued net interest to date is approximately $1 million.

Entry price

LMS believes that in relation to the oil and gas reserves

believed to be in place, the acquisition price represents an

attractive entry point into an existing business operating mature

oil and gas producing assets.

Team with relevant experience and local knowledge of the

assets

The Dacian team is highly experienced in the oil and gas

industry and has detailed prior knowledge of the assets included in

the Business which, given their advanced stage of exploitation,

have not been a strategic focus for investment by the previous

owner.

The four founders together have over 100 years of experience in

the oil and gas industry with their roles ranging from direct

operation of oil and gas fields in locations specifically including

Romania, senior leadership of multi-national oilfield service

companies and regional management of oilfield service operations in

Eastern Europe.

In addition to the founders, the senior management team includes

individuals who have worked extensively in the oil industry in

Romania.

Robust operating model - opportunity to add value

The Business being acquired is at an advanced stage of

exploitation and has not been a strategic focus for the seller.

This creates an opportunity to increase oil and gas production

levels through field rejuvenation projects including optimization,

workover and drilling activities that will extend the life of the

well and fields.

These projects can be completed typically in less than one

month, can be funded from operating cash flows, and the payback can

be quickly assessed. Individual projects can be timed and scoped in

response to market conditions including oil and gas prices.

We are confident the investment can meet or exceed our long-term

criteria for returns of 12% to 15% per annum.

Background to the sale of the business

OMV Petrom SA, the vendor, is a Romanian integrated oil company

majority controlled by Austria's OMV. It is one of the largest

corporations in Romania and is the largest oil and gas producer in

South Eastern Europe.

In 2017 OMV Petrom announced the sale of the Business as part of

its operating strategy to divest of smaller, onshore Romanian

fields to allow it to focus on larger international opportunities

including offshore drilling and production in the Black Sea.

Information on Dacian Petroleum

Dacian Petroleum was formed in October 2018 and was formally

qualified as an operator by the Romanian oil and gas authority

(NAMR) in March 2019.

Dacian Petroleum's mission is to build a long-life oil and gas

production company for the purpose of rehabilitating mature oil and

gas producing properties to recover remaining oil and gas reserves

and to do so at a low carbon footprint. The main features of the

Business being acquired are:

-- 40 oil and gas fields, approximately 90 active wells, the

land rights, equipment and assets used in production, and a

workforce of 190 individuals currently employed in the

Business;

-- Current oil and gas production of approximately 1,050 boepd (60% gas; 40% oil); and

-- Local independent petroleum engineering assessment has

concluded that there are substantial remaining hydrocarbons in

place for these fields.

Financing the acquisition

In order to finance the acquisition of the Business, fund

transaction costs and provide cash for working capital and general

corporate purposes, Dacian has raised $20 million, of which $14.0

million is from the Investor Group and the remainder through other

borrowings. Dacian's obligations with respect to the other

borrowings are supported by a personal guarantee (the "Personal

Guarantee") from one of Dacian's founders.

In addition, Dacian is required by the seller to cash

collateralise a performance guarantee ("Performance Guarantee") in

relation to certain obligations in respect of the Business. This

guarantee is for $5.0 million and is required to be set aside out

of operating cash flows over the first three years.

The capital raised by Dacian of $14.0 million from the Investor

Group comprises:

-- the issue to the Investor Group at the time of funding in

September 2020 of $14.0 million Unsecured Senior Loans ("Loans")

maturing after 7 years and bearing interest at 14% from the date of

issue in September 2020; and

-- the issue to the Investor Group of 50% of the ordinary shares in the company.

So long as Dacian is current on its obligations with other

borrowings and the Performance Guarantee and has adequate reserves

for its liabilities, interest on the Loans can be paid at the end

of each year.

The principal amount of Loans cannot be repaid until all

obligations from other borrowings and the Performance Guarantee

have been satisfied.

No dividends can be paid on the ordinary shares until all

obligations on the other borrowings have been fully satisfied, the

Loans and interest thereon have been repaid in full and the

outstanding amounts, if any, under the Personal Guarantee have been

repaid.

LMS Capital has invested $9.05 million in Loans and subscribed

for ordinary shares, resulting in a holding of 32% in the ordinary

shares of Dacian. Other members of the Investor Group will hold 18%

and the founder group will hold 50%.

Investor Group

LMS' investment represents approximately 15% of its NAV at the

time the commitment was made in August 2020 and is the maximum it

can invest in any one transaction under its current investment

policy.

LMS Directors, Robert Rayne, James Wilson and Nick Friedlos have

invested $1.125 million, $1.075 million and $0.1 million

respectively which in total is equal to less than 25% of the amount

being invested by LMS.

Other private investors have funded the balance of $2.7 million

required by Dacian to acquire the Business and to operate it.

All investors - LMS, the LMS Directors and the other private

investors are investing on identical terms, including the same

proportions between the senior loans and ordinary shares in

Dacian.

ENQUIRIES:

LMS Capital PLC - 0207 935 3555

Robbie Rayne, Chairman

Nick Friedlos, Managing Director

Vico Partners - 0203 957 5045

Sofia Newitt - Snewitt@vicopartners.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUUUOURARUAAAA

(END) Dow Jones Newswires

November 12, 2021 07:34 ET (12:34 GMT)

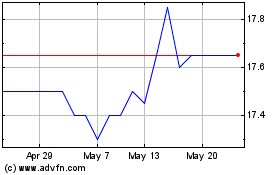

LMS Capital (AQSE:LMS.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

LMS Capital (AQSE:LMS.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025