TIDMMTC

RNS Number : 4285H

Mothercare PLC

24 November 2022

Mothercare plc

Interim results announcement

Driving the Mothercare brand globally

Mothercare plc ("Mothercare" "the Company" or "the Group"), the

leading specialist global brand for parents and young children,

today announces unaudited half year results for the 26-week period

to 24 September 2022 ("H1 FY23"). The comparative period was a

26-week period to 25 September 2021 ("H1 FY22").

Key Highlights

-- International retail sales by franchise partners of GBP162.1

million (2021: GBP184.3 million, excluding Russia GBP140.8

million), an increase of 15% over last year, excluding sales from

Russia.

-- Adjusted EBITDA of GBP3.2 million (H1 FY22: GBP5.6 million)

reflecting the loss of contribution from Russia for the whole of

the current period, which was around GBP2.9 million for the

equivalent period last year.

-- Group adjusted profit before taxation from operations of

GBP2.9 million (H1 FY22: GBP5.2 million).

-- Total Group profit before taxation of GBP0.8 million (H1 FY22: GBP4.0 million).

-- Successfully completed the refinancing of the business, without further equity dilution.

-- New Chief Executive Officer appointed and joining in January.

-- Net debt reduced to GBP11.6 million (GBP13.3 million at 25 September 2021).

-- Pension scheme deficit materially reduced to GBP42 million at

30 September 2022 (GBP124.6 million deficit at 31 March 2020).

Our Group

26 weeks 28 weeks

26 weeks to to to

24 Sep 2022 25 Sep 2021 10 Oct 2020

Turnover GBPm 38.5 41.7 44.4

Adjusted EBITDA (2) GBPm 3.2 5.6 (0.1)

Adjusted profit from operations (2) GBPm 2.9 5.2 (1.3)

Adjusted profit before taxation (2) GBPm 1.7 3.6 (4.4)

Profit for the period GBPm 0.4 3.6 (13.2)

Adjusted basic earnings per share (2) 0.2p 0.9p (1.2)p

Basic earnings per share 0.1p 1.0p (3.5)p

------------------------------------------------ ------------ ------------ -----------

Our Franchise partners

26 weeks 28 weeks

26 weeks to to to

24 Sep 2022 25 Sep 2021 10 Oct 2020

Worldwide retail sales (1) GBPm 162.1 184.3 189.2

Online retail sales GBPm 13.1 17.6 27.1

Total number of stores 562 740 793

Space (k) sq. ft. 1,345 1,967 2,180

--------------------------------- ------------ ------------ -----------

Clive Whiley, Chairman of Mothercare plc, commented:

"Our results demonstrate the strong foundations and resilience

we have created in the business over recent years. Furthermore, we

have generated both profit and cash despite the impact of Covid-19

and the war in Ukraine.

Our immediate priority now remains to support our franchise

partners as we together navigate out of this suppressed demand

period, recover from supply chain disruptions and rebuild their

store footfall whilst growing their digital sales. This inevitably

means that a return to pre pandemic levels of trading is taking

time, however this will ultimately benefit both our own business

and our franchise partners' businesses in the longer term.

Today I am delighted to announce the impending arrival of Dan Le

Vesconte as our new Chief Executive Officer, with extensive

experience in the retail direct-to-consumer, wholesale and

licensing sector he will be a great asset to the executive team.

Whilst we remain mindful of the current global economic uncertainty

we are now wholly focused upon restoring critical mass and driving

the Mothercare brand globally over the next five years."

Investor and analyst enquiries

to:

Mothercare plc Email : investorrelations@mothercare.com

Clive Whiley, Chairman

Andrew Cook, Chief Financial

Officer

Numis Securities Limited Tel : 020 7260 1000

(Nominated Advisor & Joint

Corporate Broker)

Luke Bordewich

Henry Slater

finnCap (Joint Corporate Tel : 020 7220 0500

Broker)

Christopher Raggett

Media enquiries to:

MHP Email : mothercare@mhpc.com

Simon Hockridge Tel : 07709 496 125

Tim Rowntree

Notes

1 - Worldwide retail sales are total International and UK retail

franchise partner sales to end customers (which are estimated and

unaudited) .

2 - Adjusted figures are stated before the impact of the

adjusting items set out in note 4.

3 - Net debt is defined as total borrowings, cash at bank and

IFRS 16 lease liabilities.

4 - This announcement contains certain forward-looking

statements concerning the Group. Although the Board believes its

expectations are based on reasonable assumptions, the matters to

which such statements refer may be influenced by factors that could

cause actual outcomes and results to be materially different. The

forward-looking statements speak only as at the date of this

document and the Group does not undertake any obligation to

announce any revisions to such statements, except as required by

law or by any appropriate regulatory authority.

5 - The information contained within this announcement is deemed

by the Company to constitute inside information for the purposes of

the Market Abuse Regulation (EU) No 596/2014. Upon the publication

of this announcement via a Regulatory Information Service, this

inside information is now considered to be in the public

domain.

6 - The person responsible for the release of this announcement

is Lynne Medini, Group Company Secretary at Mothercare plc,

Westside 1, London Road, Hemel Hempstead, HP3 9TD.

7 - M othercare plc's Legal Entity Identifier (" LEI") number is

213800ZL6RPV9Z9GFO74.

Chairman's statement

Overview

The transformation of the business in recent years to focus upon

our core international franchise and brand management competencies

as an asset light global franchising business, has proved

invaluable. We were once again forced to contend with unavoidable

adverse events this half, in particular with the termination of our

operations in Russia. It is therefore testimony to the resilience

of the business that, notwithstanding the ongoing challenges from

the pandemic and the current global economic uncertainty on our

franchise partners, we still succeeded in generating free cash flow

from operations and an adjusted EBITDA of GBP3.2 million for the

six months to 24 September 2022. We continue to make the necessary

adjustments to our supply chain, operations and administrative

costs demanded to address the consequent diseconomies of reduced

scale. At the half-year end we successfully refinanced the

business, without further equity dilution, which further enhances

our financial flexibility.

Trading Update

Although at the half-year end our franchise partners' global

stores were all open following the pandemic, retail sales of GBP162

million for the period were heavily impacted by the pausing of

operations we announced on 9 March 2022 and the subsequent

termination of the right to operate Mothercare branded stores in

Russia on 27 June 2022. Excluding the impact of the lost Russian

retail sales, worldwide retail sales grew at 15% in the 26 weeks to

24 September 2022. Online retail sales for the period reduced to 8%

of total retail sales (H1 FY22: 9.5%) in part reflecting the loss

of the higher Russian online activity but still well ahead of the

pre pandemic level of 4.9%.

Against this back-drop our franchisees in Asian markets

performed particularly well, with India and Malaysia ahead of pre

pandemic levels of sales, recovering strongly from Covid-19

impacted periods. The UK franchise with Boots increased sales

performance by 10% year on year over the same period. However,

performance in our Middle Eastern region, specifically the Kingdom

of Saudi Arabia and the United Arab Emirates remained much more

challenging. Saudi Arabia has undergone significant changes over

the last few years including sales tax, Saudisation of the

workforce and the introduction of many new leisure activities which

didn't previously exist all competing for consumers' money. This

continues to change the shape of our retail offering in the country

although we remain confident of the longer term market

opportunity.

Overall we have seen strong contributions from our innovation

pipeline and core new-born and baby essentials categories where we

have made improvements to design, quality and fit. We are currently

evolving these same improvements into further ranges across our

product age spectrum. In addition, we have recently launched our

new toy range MPlay, now worth 5% of our order book, which is

designed to develop early stage hand and eye co-ordination and

mobility skills and is the first of several developments in our

Home and Travel product category.

Given the pressures on families around the world as a result of

inflation and as a direct response to the input cost challenges we

face, we continue to evolve our product to ensure we can offer

value for money. To this end we have increased our offer on packs

and outfit sets both providing better value.

Growth Opportunities

As we strive to be the leading global brand for parents and

young children the Mothercare brand is in an almost unparalleled

position. It is a highly trusted British heritage brand, which is

globally recognised and connects with new-born babies and children

across multiple product categories. The Board is conscious that, at

present, the Company's singular route to market is via our

franchisees and thus we have barely scratched the surface in

exploring the multiple possibilities available to us to grow the

future global presence of the brand:

-- We are driving initiatives to maintain momentum in improving

profitability. Underwritten by the establishment of a cost base

that is appropriate for our business with the necessary skills and

experience to deliver further growth as we return to more normal

pre-pandemic levels of business.

-- Mothercare is still not represented in eight of the top ten

markets in the world, when ranked by wealth and birth rate. We are

exploring options to enter new territories through several channels

or a combination thereof via e-commerce (either DTC or

marketplaces) or with partners that would hold the online rights

for a territory and provide the website and full supply chain

capability in these markets. We have opportunities to wholesale the

Mothercare product into third party retailers, both large retailers

or independents and we can licence the brand either by specific

product in a country (e.g. baby bottles and teats) or the whole

offer if it is more economical to manufacture our Mothercare

designs locally.

We will fully leverage this intrinsic value through connections

with other businesses and the development of the product range and

licensing beyond our historic limits. There is a window of

opportunity for us, via step-change growth, to bring synergies and

enhanced profitability into our business, as the core strengths of

the Group across supply, franchisee partnerships and international

reach continue to demonstrate momentum.

Update on Initiatives

Supply chain model

Our efforts to develop our supply chain to reduce cost,

complexity and deliver goods to our franchise partners in the

quickest way led to a marked improvement in on-time availability,

with over 85% of our product being delivered direct from our

country of manufacturing to our retail partners' markets.

Enterprise Resource Planning ('ERP') System

Our new ERP system includes a leading product lifecycle

management system integrated with a supply chain and finance system

with portal-based access for both our franchise partners and

manufacturing partners to both input and access information. This

is due to go live early in the next financial year, with the full

benefit of the cost savings in the financial year ending March

2024. We are confident that the final system will deliver at least

the expected benefits and cost savings.

Brand Review

We have substantially completed our in-depth review of our brand

positioning and customer perceptions across all of our major

markets. We understand evolving customer needs in each territory

even better as we seek both to elevate our product and to reinforce

categories where we have natural defensive strengths. This improved

insight will inform the future brand and product strategy to be

driven by the new Chief Executive Officer.

Cost Reductions

The continual review and challenge to costs held administrative

expenses flat at prior year levels, inflationary pressures

notwithstanding, whilst still ensuring we operate to the standards

of a world class business.

Pension Schemes

The last full actuarial valuation of the schemes was at 31 March

2020 and showed a deficit of GBP124.6 million, resulting from total

assets of GBP383.7 and total liabilities of GBP508.3 million. Based

on a desktop review of this valuation provided to the pension

scheme trustees, at 30 September 2022 the deficit had reduced by

67% to GBP42 million.

The revised recovery plan agreed with the Trustees in September

includes total contributions (Deficit Repair Contributions plus

costs) in the financial years to: March 2023 GBP1 million; March

2024 GBP4 million; March 2025 GBP7 million; March 2026 GBP8

million; March 2027 & beyond GBP9 million aggregating to fully

fund a GBP78 million deficit by March 2033.

However, the recent turmoil in financial markets following the

mini budget alongside the complexity of Liability Driven Investment

hedging strategies means that this calculation is far from

straightforward. We look forward to improved clarity at the next

full actuarial valuation, at March 2023. At which time, if the

recent reduction in the deficit remains, the subsequent annual

payments could be further reduced.

Management & Board changes

Our successful transition to be an international brand owner and

operator, has led to a need to reinforce the product, brand,

E-commerce and distribution skills within the executive team.

Accordingly I am delighted that we have appointed Daniel Le

Vesconte as the Group's new Chief Executive Officer today. Dan

brings a wealth of international brand experience in direct to

consumer, franchise, wholesale and licensing, having held senior

leadership roles for several globally recognised brands including

Abercrombie and Fitch, Hollister and Gilly Hicks (A&F Corp), Dr

Martens (Dr Martens PLC), the Wolverine Worldwide group of brands

and Vans and Reef (VF Corp).

Dan joins us in January and will work closely with our global

stakeholders to spearhead the growth of the iconic Mothercare brand

into the next generation, complementing our existing executive team

to accelerate step-change growth.

Outlook

The strong platform for growth we have created would not have

been possible with out the ongoing commitment and support of all

stakeholders, including our Mothercare colleagues, our franchise

partners, our manufacturing partners, our pension scheme trustees

and our shareholders.

Whilst trading conditions will likely remain challenging across

our markets, including consumer sentiment and inflation, the

far-reaching and ongoing improvements to our product offer,

increased focus on value and the demographics of births and

children around the world will provide a degree of insulation in

these uncertain times. O ur medium-term guidance for the steady

state operation, in more normal circumstances, of our continuing

franchise operations remains that they are capable of exceeding

GBP10 million operating profit.

We have once again demonstrated our fortitude to deal with major

challenges effectively and remain profitable and cash generative.

The results from our recent focus on product design have encouraged

us to concentrate our efforts upon accelerating our exposure to new

products and markets , restoring critical mass and optimising the

Mothercare brand globally over the next five years.

Clive Whiley

Chairman

Condensed consolidated income statement

For the 26 weeks ended 24 September 2022

26 weeks ended 24 26 weeks ended 25 52 weeks

September 2022 September 2021 ended

(Unaudited ) (Unaudited) 26 March

2022

Restated * (Audited)

Before Adjusted Total Before Adjusted Total Total

adjusted items(1) adjusted items

Note items items (1)

GBP GBP GBP GBP GBP million GBP

million million million million GBP million

million

---------------- ------ --------- --------- ---------------- --------- --------- ----------------- -----------

Revenue 38.5 - 38.5 41.7 - 41.7 82.5

Cost of sales (27.5) - (27.5) (28.2) - (28.2) (54.9)

---------------- ------ --------- --------- ---------------- --------- --------- ----------------- -----------

Gross profit 11.0 - 11.0 13.5 - 13.5 27.6

Administrative

expenses (8.1) - (8.1) (8.3) 0.4 (7.9) (14.1)

Impairment

losses

on receivables - - - - - - (0.5)

---------------- ------

Profit from

operations 2.9 - 2.9 5.2 0.4 5.6 13.0

Net finance

costs 5 (1.2) (0.9) (2.1) (1.6) - (1.6) (1.9)

---------------- ------ --------- --------- ---------------- --------- --------- ----------------- -----------

Profit before

taxation 1.7 (0.9) 0.8 3.6 0.4 4.0 11.1

Taxation 6 (0.4) - (0.4) (0.4) - (0.4) 1.0

---------------- ------ --------- --------- ---------------- --------- --------- ----------------- -----------

Profit for the

period 1.3 (0.9) 0.4 3.2 0.4 3.6 12.1

---------------- ------ --------- --------- ---------------- --------- --------- ----------------- -----------

Profit for the period

attributable to equity

holders of the parent 1.3 (0.9) 0.4 3.2 0.4 3.6 12.1

------------------------ --------- --------- ---------------- --------- --------- ----------------- -----------

Earnings per

share

0.2 0.5

Basic 7 p 0.1 p 0.6 p p 1.6p

0.2 0.6

Diluted 7 p 0.1 p 0.6 p p 1.6p

---------------- ------ --------- --------- -------------------- --------- --------- ----------------- ---------------

(1) Adjusted items included: restructuring costs included in

finance costs, and property related income and other restructuring

costs included in administrative expenses. Adjusted items are

one-off or significant in nature and or /value. Excluding these

items from the profit metrics provides readers with helpful

additional information on the performance of the business across

the periods because it is consistent with how business performance

is reviewed by the Board and Operating Board.

* The comparative results for the period to 25 September 2021

have been restated to incorporate the impact of a

misclassification. An amount of GBP2.3 million in operating

expenses has been reclassified to cost of sales, the change has

resulted in a decrease in gross profit of GBP2.3 to GBP13.5 million

compared to the amount previously reported of GBP15.8 million.

Condensed consolidated statement of comprehensive income

For the 26 weeks ended 24 September 2022

26 weeks 26 weeks 52 weeks

ended ended ended

24 September 25 September 26 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

----------------------------------------------- --- --------------- -------------- ------------

Profit for the period 0.4 3.6 12.1

Items that will not be reclassified

subsequently to the income statement:

Actuarial (loss)/gain on defined

benefit pension schemes (1.1) 1.9 35.0

Income tax relating to items not

reclassified 0.2 - (3.1)

(0.9) 1.9 31.9

----------------------------------------------- --- --------------- -------------- ------------

Items that may be reclassified subsequently

to the income statement:

Exchange differences on translation 0.1 - -

of foreign operations

0.1 - -

----------------------------------------------- --- --------------- -------------- ------------

Other comprehensive (expense)/income

for the period (0.8) 1.9 31.9

----------------------------------------------- --- --------------- -------------- ------------

Total comprehensive (expense)/income

for the period wholly attributable

to equity holders of the parent (0.4) 5.5 44.0

---------------------------------------------- ---- --------------- -------------- ------------

Condensed consolidated balance sheet

As at 24 September 2022

24 September 25 September 26 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

Note GBP million GBP million GBP million

--------------------------------------- ----- ------------------- ------------- ------------

Non-current assets

Intangible assets 8 4.5 1.2 3.6

Property, plant and equipment 8 0.2 0.4 0.3

Right-of-use assets 0.7 1.1 0.9

Retirement benefit obligations 11.8 - 12.4

17.2 2.7 17.2

--------------------------------------- -----

Current assets

Inventories 0.6 4.5 2.1

Trade and other receivables 6.9 11.5 8.1

Derivative financial instruments 11 0.2 - 0.2

Current tax asset 0.3 - -

Cash and cash equivalents 8.7 6.9 9.2

16.7 25.5 19.6

--------------------------------------- ----- ------------------- ------------- ------------

Total assets 33.9 28.2 36.8

--------------------------------------- ----- ------------------- ------------- ------------

Current liabilities

Trade and other payables (10.7) (18.2) (12.1)

Lease liabilities (0.5) (0.3) (0.3)

Derivative financial instruments 11 - (1.5) -

Provisions (0.9) (2.3) (1.7)

(12.1) (22.3) (14.1)

--------------------------------------- -----

Non-current liabilities

Borrowings 9 (19.3) (19.0) (19.1)

Lease liabilities (0.5) (0.9) (0.8)

Retirement benefit obligations 10 - (22.0) -

Provisions (0.6) (1.2) (0.9)

Deferred tax liability (0.2) - (0.4)

(20.6) (43.1) (21.2)

--------------------------------------- ----- ------------------- ------------- ------------

Total liabilities (32.7) (65.4) (35.3)

--------------------------------------- ----- ------------------- ------------- ------------

Net assets/(liabilities) 1.2 (37.2) 1.5

--------------------------------------- ----- ------------------- ------------- ------------

Equity attributable to equity holders

of the parent

Share capital 89.3 89.3 89.3

Share premium account 108.8 108.8 108.8

Own shares (1.0) (1.0) (1.0)

Translation reserve (3.6) (3.5) (3.7)

Retained deficit (192.3) (230.8) (191.9)

--------------------------------------- ----- ------------

Total equity 1.2 (37.2) 1.5

--------------------------------------- ----- ------------------- ------------- ------------

Condensed consolidated statement of changes in equity

For the 26 weeks ended 24 September 2022 (unaudited)

Share Share Own Translation Retained Total

capital premium shares reserve deficit equity

account

GBP million GBP GBP GBP GBP million GBP

million million million million

--------------------------------- ------------ --------- --------- ------------ ------------ -----------

Balance as at 26 March

2022 as previously reported 89.3 108.8 (1.0) (3.7) (191.9) 1.5

Profit for the period - - - - 0.4 0.4

Other comprehensive income

for the period - - - 0.1 (0.9) (0.8)

--------------------------------- ------------ --------- --------- ------------ ------------ -----------

Total comprehensive income

for the period - - - 0.1 (0.5) (0.4)

Adjustments to equity

for equity-settled share-based

payments - - - - 0.1 0.1

Balance at 24 September

2022 89.3 108.8 (1.0) (3.6) (192.3) 1.2

--------------------------------- ------------ --------- --------- ------------ ------------ -----------

For the 26 weeks ended 25 September 2021 (unaudited)

Share Share Own Translation Retained Total

capital premium shares reserve deficit equity

account

GBP million GBP GBP GBP million GBP million GBP

million million million

--------------------------------- ------------ --------- --------- ------------ ------------ ---------

Balance as at 26 March

2022 as previously reported 89.3 108.8 (1.0) (3.7) (236.4) (43.0)

Profit for the period - - - - 3.6 3.6

Other comprehensive income

for the period - - - - 1.9 1.9

Total comprehensive income

for the period - - - - 5.5 5.5

Adjustments to equity

for equity-settled share-based

payments - - - - 0.3 0.3

Balance at 25 September

2021 89.3 108.8 (1.0) (3.7) (230.6) (37.2)

--------------------------------- ------------ --------- --------- ------------ ------------ ---------

For the 52 weeks ended 26 March 2022 (audited)

Share Share Own Translation Retained Total

capital premium shares reserve deficit equity

account

GBP million GBP GBP GBP million GBP million GBP

million million million

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Balance at 27 March 2021 89.3 108.8 (1.0) (3.7) (236.4) (43.0)

Items that will not be

reclassified subsequently

to the

income statement - - - - 31.9 31.9

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Other comprehensive income - - - - 31.9 31.9

Profit for the period - - - - 12.1 12.1

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Total comprehensive income - - - - 44.0 44.0

Adjustment to equity for

equity-settled share-based

payments - - - - 0.5 0.5

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Balance at 26 March 2022 89.3 108.8 (1.0) (3.7) (191.9) 1.5

----------------------------- ------------ --------- --------- ------------ ------------ ---------

Condensed consolidated cash flow statement

For the 26 weeks ended 24 September 2022

26 weeks 26 weeks 52 weeks

ended ended ended

Note 24 September 25 September 26 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

------------------------------------------- ------ --------------- -------------- ------------

Net cash flow from operating activities 13 2.1 2.1 8.1

Cash flows from investing activities

Purchase of property, plant and

equipment 0.0 (0.1) (0.1)

Purchase of intangibles - software (0.7) (0.5) (2.8)

Cash used in investing activities (0.7) (0.6) (2.9)

------------------------------------------- ------ --------------- -------------- ------------

Cash flows from financing activities

Interest paid (1.9) (1.3) (2.5)

Repayments of obligations under

leases (0.1) (0.2) (0.5)

Net cash outflow from financing

activities (2.0) (1.5) (3.0)

--------------- -------------- ------------

Net (decrease)/increase in cash

and cash equivalents (0.6) - 2.2

------------------------------------------- ------ --------------- -------------- ------------

Cash and cash equivalents at beginning

of period 9.2 6.9 6.9

Effect of foreign exchange rate

changes 0.1 - 0.1

------------------------------------------- ------

Cash and cash equivalents at end

of period 8.7 6.9 9.2

------------------------------------------- ------ --------------- -------------- ------------

Notes to the condensed consolidated financial statements

1 General information

The review of the Group's business activities, together with

factors likely to affect its future development, performance and

position are set out in the Financial Highlights and Chairman's

Statement.

The results for the 26 weeks ended 24 September 2022 are

unaudited.

These unaudited condensed consolidated interim financial

statements for the current period and prior financial periods do

not constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for the 2022

financial year has been filed with the Registrar of Companies. The

2022 financial statements are available on the Group's website (

www.mothercareplc.com ). The auditor has reported on these: their

report was unqualified.

2 Accounting Policies and Standards

Basis of preparation

These unaudited condensed consolidated interim financial

statements have been prepared in accordance with the Disclosure and

Transparency Rules of the UK Financial Conduct Authority, and with

IAS 34 'Interim Financial Reporting'. Unless otherwise stated, the

accounting policies applied, and the judgements, estimates and

assumptions made in applying these policies, are consistent with

those described in the Annual Report and Financial Statements 2022.

The financial period represents the 26 weeks ended 24 September

2022. The comparative periods are the 26 weeks ended 25 September

2021 and the 52 weeks ended 26 March 2022.

Going concern

When considering the going concern assumption, the Directors of

the Group have reviewed a number of factors, including the Group's

trading results and its continued access to sufficient borrowing

facilities against the Group's latest forecasts and projections,

comprising:

-- A Base Case forecast which excludes any income from Russia; and

-- A Sensitised forecast, which applies sensitivities against

the Base Case for reasonably possible adverse variations in

performance, reflecting the ongoing volatility in our key

markets.

In making the assessment on going concern the Directors have

assumed that it is able to mitigate the material uncertainty in

relation to levels of recovery in retail sales post COVID-19

coupled with the heightened global economic uncertainty. The impact

of these issues on the future prospects of the Company is not fully

quantifiable at the reporting date, as the complexity and scale of

these issues at a global level is outside of what any business

could accurately reflect in a financial forecast.

However, we have attempted to capture the impact on both our

supply chain and key franchise partners based on what is currently

known. We have modelled a substantial reduction in global retail

sales as a result of subdued, consumer confidence or disposable

income, throughout the remainder of FY23 with recovery in FY24.

The Sensitised scenario assumes the following additional key

assumption:

-- A delayed recovery that assumes that retail sales remain

subdued throughout the majority of the forecast period as a result

of consumer confidence returning more slowly post COVID-19, coupled

with the potential impact on customers disposable income due to the

current heightened global economic uncertainty.

Notes to the condensed consolidated financial statements

2 Accounting Policies and Standards (continued)

Going concern (continued)

The Board's confidence in the Group's Base Case forecast, which

indicates the Group will operate within the terms of its revised

borrowing facilities which now includes more appropriate covenants

following the cessation of the Russian operation and the Group's

proven cash management capability, supports our preparation of the

financial statements on a going concern basis.

However, if trading conditions were to deteriorate beyond the

level of risks applied in the Sensitised forecast, or the Group was

unable to mitigate the material uncertainties assumed in the Base

Case Forecast and the Group was not able to execute further cost or

cash management programmes, the Group would at certain points of

the working capital cycle have insufficient cash. If this scenario

were to crystallise the Group would need to renegotiate with its

lender in order to secure waivers to potential covenant breaches

and consequential cash remedies or secure additional funding.

Therefore, we have concluded that, in this situation, there is a

material uncertainty that casts significant doubt that the Group

will be able to operate as a going concern without such waivers or

new financing facilities.

Adoption of new IFRSs

The same accounting policies, presentation and methods of

computation are followed in this half yearly report as applied in

the Group's last audited financial statements for the 52 weeks

ended 26 March 2022.

Standard issued but not yet effective

There are no standards issued but not yet effective that have

been identified as expected to have a material impact on the

disclosures or the amounts reported in these financial

statements.

Foreign currency adjustments

Foreign currency monetary assets and liabilities are revalued to

the closing balance sheet rate under IAS21 "The Effects of Changes

in Foreign Exchange Rates".

Taxation

The taxation charge for the 26 week period is calculated by

applying the best estimate of the average annual effective tax rate

expected for the full year to the profit/loss for the period after

adjusting for any significant one-off items, and a tax credit is

recognised only to the extent that the resulting tax asset is more

than likely not to reverse.

Notes to the condensed consolidated financial statements

2 Accounting Policies and Standards (continued)

Retirement benefits

Payments to defined contribution retirement benefit schemes are

charged as an expense as they fall due.

For defined benefit schemes, the cost of providing benefits is

determined using the Projected Unit Credit Method, with actuarial

valuations being carried out at each balance sheet date. Actuarial

gains and losses are recognised in full in the period in which they

occur. They are recognised outside of the income statement and

presented in other comprehensive income.

Past service cost is recognised immediately to the extent that

the benefits are already vested.

The retirement benefit obligation recognised in the balance

sheet represents the present value of the defined benefit

obligation less the fair value of scheme assets. Any asset

resulting from this calculation is limited to past service cost,

plus the present value of available refunds.

The Group has an unconditional right to a refund of surplus

under the rules.

In consultation with the independent actuaries to the schemes,

the valuation of the pension obligation has been updated to

reflect: current market discount rates; current market values of

investments and actual investment returns; and also for any other

events that would significantly affect the pension liabilities. The

impact of these changes in assumptions and events has been

estimated in arriving at the valuation of the pension

obligation.

Alternative performance measures (APMs)

In the reporting of financial information, the Directors have

adopted various APMs of historical or future financial performance,

position or cash flows other than those defined or specified under

International Financial Reporting Standards (IFRS).

These measures are not defined by IFRS and therefore may not be

directly comparable with other companies' APMs, including those in

the Group's industry.

APMs should be considered in addition to, and are not intended

to be a substitute for, or superior to, IFRS measures.

Purpose

The Directors believe that these APMs assist in providing

additional useful information on the performance and position of

the Group because they are consistent with how business performance

is reported to the Board and Operating Board.

APMs are also used to enhance the comparability of information

between reporting periods and geographical units (such as

like-for-like sales), by adjusting for non-recurring or

uncontrollable factors which affect IFRS measures, to aid the user

in understanding the Group's performance.

Consequently, APMs are used by the Directors and management for

performance analysis, planning, reporting and incentive setting

purposes and have remained consistent with prior year.

Notes to the condensed consolidated financial statements

2 Accounting Policies and Standards (continued)

The key APMs that the Group has focused on during the period are

as follows:

Group worldwide retail sales

Group worldwide sales are total International and UK retail

sales from our franchise partners. Total Group revenue is a

statutory number and is made up of total receipts from our

franchise partners, which includes royalty payments and the cost of

goods dispatched to franchise partners.

Profit/(loss) before adjusted items

The Group's policy is to exclude items that are considered to be

significant in both nature and/or quantum and where treatment as an

adjusted item provides stakeholders with additional useful

information to assess the year-on-year trading performance of

the Group.

3 Segmental information

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reported to the Group's executive decision makers

(comprising the executive directors and operating board) in order

to allocate resources to the segments and assess their performance.

Under IFRS 8, the Group has not identified that its continuing

operations represent more than one operating segment.

The results of franchise partners are not reported separately,

nor are resources allocated on a franchise partner by franchise

partner basis, and therefore have not been identified to constitute

separate operating segments.

Notes to the condensed consolidated financial statements

4 Adjusted items

Due to their significance or one-off nature, certain items have

been classified as adjusted items as follows:

26 weeks 26 weeks ended 52 weeks

ended ended

24 September 25 September 26 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

---------------------------------------------

GBP million GBP million GBP million

--------------------------------------------- --------------- --------------- ------------

Adjusted costs/(income):

Restructuring costs included in finance

costs 0.9 - 1.2

Property related (income)/costs included

in administrative expenses - (0.5) 0.5

Other restructuring costs included in

administrative expenses - 0.1 1.4

Adjusted items before tax 0.9 (0.4) 3.1

--------------------------------------------- --------------- --------------- ------------

Restructuring costs included in finance costs - GBP0.9 million

(H1 FY22: GBP nil)

The current year costs relate to legal and professional fees

incurred in renegotiating the loan in the current year of GBP0.5

million and a GBP0.4 million loss arising from the modification of

the existing loan.

Property related (income)/costs included in administrative

expenses - GBPNil (H1 FY22: GBP0.5 million income)

In the comparative period, there was a GBP0.5 million release of

provisions in relation to onerous lease costs prior to the

administration of Mothercare UK Limited. The release of provision

represented amounts settled by the Group during the period.

Other restructuring costs included in administrative expenses -

GBPNil (H1 FY22: GBP0.1 million costs)

In the comparative period GBP0.1 million of severance pay

related costs were incurred as a result of Group restructuring of

operations.

5 Net finance costs

26 weeks 26 weeks 52 weeks

ended ended ended

24 September 25 September 26 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

------------------------------------------- --- --------------- -------------- ------------

Interest (income)/expense on pension

liabilities (0.2) 0.2 0.5

Interest expense on lease liabilities 0.1 0.1 0.1

Fair value movement on embedded derivatives

and warrants - - (1.2)

Other net interest 1.3 1.3 2.5

------------------------------------------------ --------------- -------------- ------------

Net finance costs 1.2 1.6 1.9

------------------------------------------------ --------------- -------------- ------------

Notes to the condensed consolidated financial statements

6 Taxation

26 weeks 26 weeks 52 weeks

ended ended ended

24 September 25 September 26 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

------------------------------------------ --- --------------- -------------- ------------

Current tax - Overseas tax and UK

corporation tax 0.4 0.4 1.7

Deferred tax - UK tax charge for temporary

differences - - (2.7)

----------------------------------------------- --------------- -------------- ------------

Total tax charge 0.4 0.4 (1.0)

----------------------------------------------- --------------- -------------- ------------

No deferred tax asset has been recognised in the financial

statements at the balance sheet date (H1 FY22: GBPnil million).

7 Earnings per share

26 weeks 26 weeks 52 weeks

ended ended ended

24 September 25 September 26 March

2022 2021 2022 (Audited)

(Unaudited) (Unaudited)

million million million

-------------------------------------------- --- --------------- -------------- -----------------

Weighted average number of shares in

issue for the purpose of basic earnings

per share 563.8 562.9 563.8

Dilutive potential ordinary shares 1.8 28.7 10.1

-------------------------------------------------

Weighted average number of shares in

issue for the purpose of diluted earnings

per share 565.6 591.6 573.9

-------------------------------------------------

GBP million GBP million GBP million

-------------------------------------------- --- --------------- -------------- -----------------

Profit for basic and diluted earnings

per share 0.4 3.6 12.1

Adjusted items 0.9 (0.4) (3.1)

Tax effect of adjusted items - - -

Adjusted earnings 1.3 3.2 (9.0)

------------------------------------------------- --------------- -------------- -----------------

GBP million GBP million GBP million

-------------------------------------------- --- --------------- -------------- -----------------

Pence Pence Pence

-------------------------------------------- ---

Basic earnings per share 0.1 0.6 1.6

Basic adjusted earnings per share 0.2 0.6 2.1

Diluted earnings per share 0.1 0.6 1.6

Diluted adjusted earnings per share 0.2 0.5 2.1

------------------------------------------------- --------------- -------------- -----------------

The total dividend for the period is nil pence per share (H1

FY22: nil pence per share).

Notes to the condensed consolidated financial statements

8 Tangible fixed assets and Software assets

There were no additions to Right-of-use assets in the

period.

Capital additions of GBP1.0 million were made during the period

(H1 FY22: GBP0.3 million). These comprised tangible fixed assets of

GBP0.0 million (H1 FY22: GBPnil million) and software assets of

GBP1.0 million (H1 FY22: GBP0.3 million).

9 Borrowings

The Group had outstanding borrowings at 24 September 2022 of

GBP19.3 million (26 March 2022: GBP19.1 million) .

The credit facility of GBP19.3 million (26 March 2022: GBP19 .1

million) is secured on the shares of specified obligor subsidiaries

and the assets of the group not already pledged. The Group also

holds a financial asset of GBP0.2 million (26 March 2022: GBP0. 2

million) reflecting the expected proceeds from the wind-down of the

UK operations by the administrators of Mothercare UK Ltd and

Mothercare Business Services Limited.

10 Retirement benefit schemes

The Group has calculated the value of its pension liability

under IAS 19 as at 24 September 2022. The FY22 year end assumptions

have been rolled forward and updated for changes in market rates

over the current interim period.

For the two schemes, based on the actuarial assumptions from the

last full actuarial valuations carried out as of March 2020 and

using the rolled forward assumptions referred to above, a net asset

of GBP11.8 million (H1 FY22: GBP22.0 million liability) has been

recognised. The swing to a surplus position was mainly due to the

assumptions used to place a value on the scheme liabilities. The

discount rate and long term inflation expectations increased over

the period.

11 Financial instruments: fair value disclosures

The Group held the following financial instruments at fair value

at 24 September 2022.

Fair value Fair value Fair value

measurements measurements measurements

at 24 September at 25 September at 26

2022 2021 March

(Unaudited) (Unaudited)) 2022

(Audited)

GBP million GBP million GBP million

----------------------------------------- ----------------- ----------------- ----------------

Non-current financial liabilities:

Derivative financial instruments:

Embedded derivative arising on warrants - (1.2) -

Financial guarantees - (0.3) -

Current financial assets:

Derivative financial instruments:

Financial asset 0.2 2.6 0.2

0.2 1.1 0.2

----------------------------------------- ----------------- ----------------- ----------------

In prior year, the Group had warrants which provides the

opportunity to purchase shares at an exercise price of 12 pence per

share and a financial guarantee over a leasehold premises

previously traded as Mothercare UK Ltd (in administration). The

option to purchase at the exercise price was fair valued and

treated as an embedded derivative. The fair value of embedded

derivatives arising on the warrant was measured using the

Black-Scholes model, based on quoted prices and fell under level 2

of IFRS 7's fair value hierarchy.

Notes to the condensed consolidated financial statements

11 Financial instruments: fair value disclosures (continued)

The Group's financial asset (Level 3 within the IFRS 7

hierarchy) represents a right, arising under the sales purchase

agreement with the administrators of MUK, to receive the proceeds

of the wind-up of the UK retail store estate and website operations

as repayment for the Group's secured borrowings. It has been

estimated by the administrators that the Group will receive GBP0.2

million (H1 FY22: GBP2.6 million). Many of the outflows which would

impact the valuation of this financial asset are finalised, with

the final repayment being dependent on the amounts to be received

back by the merchant acquirer and final settlement of VAT.

The Directors consider that the carrying value amounts of

financial assets and financial liabilities recorded at amortised

cost in the financial statements are approximately equal to their

fair values.

12 Share-based payments

A charge is recognised for share-based payments based on the

fair value of the awards at the date of grant, the estimated number

of shares that will vest and the vesting period of each award. The

total net charge for share-based payments under IFRS 2 is GBP0.1

million (H1 FY22: GBP0.3 million).

13 Notes to the cash flow statement

26 weeks 26 weeks 52 weeks

ended ended ended

24 September 25 September 26 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP million GBP million GBP million

-------------------------------------------------- --------------- -------------- ------------

Profit from operations 2.9 5.6 13.0

Adjustments for:

Depreciation of property, plant and

equipment and right of use assets 0.3 0.3 0.6

Amortisation of intangible assets 0.1 0.1 0.3

Loss/(gain) on non-cash foreign currency

adjustments 1.4 0.1 (0.1)

Share-based payments 0.1 0.3 0.5

Movement in provisions (1.1) (2.6) (3.4)

Net gain on financial derivative instruments - - (0.6)

Payments to retirement benefit schemes (1.3) (2.9) (5.2)

Charge in respect of retirement benefit

schemes 1.0 1.1 1.7

-------------------------------------------------- --------------- --------------

Operating cash flow before movement

in working capital 3.4 2.0 6.8

Decrease in inventories 1.1 1.4 3.8

Decrease in receivables 0.2 6.0 11.7

Decrease in payables (1.9) (6.8) (12.9)

Cash generated from operations 2.8 2.6 9.4

-------------------------------------------------- --------------- -------------- ------------

Income taxes paid (0.7) (0.5) (1.3)

-------------------------------------------------- --------------- -------------- ------------

Net cash flow from operating activities 2.1 2.1 8.1

Analysis of net debt

26 March Non-cash 24 September

2022 Cash Foreign movements 2022

flow exchange

GBP million GBP million GBP million GBP million GBP million

--------------------------- ------------ ------------ ------------ ------------ ---------------

Cash and cash equivalents 9.2 (0.6) 0.1 - 8.7

IFRS 16 lease liabilities (1.1) 0.1 - - (1.0)

Term loan (19.1) - - (0.2) (19.3)

Net debt (11.0) (0.5) 0.1 (0.2) (11.6)

--------------------------- ------------ ------------ ------------ ------------ ---------------

Notes to the condensed consolidated financial statements

14 Related party transactions

Transactions between the Group and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note. Transactions between the Group and its

joint ventures and associates are disclosed below.

Trading transactions:

There was no revenue earned from related parties in the current

or prior period.

A provision of GBP1.8 million (H1 FY22: GBP1.8 million) exists

for doubtful debts in respect of the amounts owed by the related

party.

Additional Disclosures

Embedded enterprise risk management framework

We have implemented an embedded enterprise risk management (ERM)

framework which applies to every part of our business operations.

The primary focus of ERM is to manage the principal and emerging

risks to the business and to support management in risk-based

decision making. The Board monitors ERM by assessing the

effectiveness of internal controls and effectiveness of risk

management. Clear risk tolerance levels across strategic,

operational and reputational risks are set by the Board enabling

consistent and risk aware decision making.

Principal risks and uncertainties

Our Principal Risks are those that can materially impact our

performance, opportunities or reputation. Our Executive, Audit and

Risk Committee, and Operating Board, undertake an assessment of our

Principal risks at least annually in relation to achieving our

strategy and our future performance. Mothercare has a policy of

continuously identifying and reviewing Principal Risks. Workshops

are held with department leaders to identify, assess and evaluate

Principal Risks, and with the Operating Board to discuss, evaluate,

mitigate and own Principal and operational risks. The following

risks have been agreed:

-- Liquidity

-- Dependence on a small number of partners

-- Covid-19

-- Challenging global economic and political conditions

-- ERP system

-- Regulatory and legal

-- Brand, reputation and relationships

-- Personnel and talent

Directors' Responsibility statement

The Directors are responsible for preparing the Interim Results

for the 26-week period ended 24 September 2022 in accordance with

applicable law, regulations and accounting standards. The Directors

confirm that to the best of their knowledge the condensed

consolidated interim financial statements have been prepared in

accordance with IAS 34: 'Interim Financial Reporting', and that the

interim management report includes a fair review of the information

required by DTR 4.2.7R and DTR 4.2.8R, namely:

-- an indication of the important events that have occurred

during the first 26 weeks of the financial year and their impact on

the condensed consolidated interim financial statements, and a

description of the principal risks and uncertainties for the

remaining 26 weeks of the financial year; and

-- material related party transactions in the first 26 weeks of

the year and any material changes in the related party transactions

described in the last annual report.

The Directors of Mothercare plc are listed on page 38 of the

Mothercare plc Annual Report and Financial Statements 2022. A list

of directors is maintained on the Mothercare plc website at:

www.mothercareplc.com. With the exception of today's announcement,

there have been no changes since the publication of the Annual

Report.

By order of the Board

Clive Whiley Andrew Cook

Chairman Chief Financial Officer

24 November 2022

Shareholder information

Financial calendar

2023

------------------------------------------------------------- ----------

Preliminary announcement of results for the 52 weeks ending July

25 March 2023

Issue of report and accounts July

Annual General Meeting September

Announcement of interim results for the 26 weeks ending 23 November

September 2023

Registered office and head office

Westside 1, London Road, Hemel Hempstead, Hertfordshire HP3

9TD

www.mothercareplc.com

Registered number 1950509

Group Company Secretary

Lynne Medini

Registrars

Administrative enquiries concerning shareholders in Mothercare

plc for such matters as the loss of a share certificate, dividend

payments or a change of address should be directed, in the first

instance, to the registrars:

Equiniti Limited

Aspect House, Spencer Road, Lancing, West Sussex BN99 6DA

Telephone 0371 384 2013

Overseas +44 (0)121 415 7042

www.shareview.co.uk

Postal share dealing service

A postal share dealing service is available through the

Company's registrars for the purchase and sale of Mothercare plc

shares from the www.shareview.co.uk website or on the shareholder

helpline Telephone 0371 384 2013, Overseas +44(0)121 415 7042.

Further details can be obtained from Equiniti on 0371 384 2013

(calls to this number are charged at the standard landline rate per

minute plus network extras. Lines are open 8.30 am to 5.30pm,

Monday to Friday).

The Company's stockbrokers are:

Numis Securities Limited

45 Gresham Street

London EC2V 7BF

Telephone 020 7260 1000

finnCap Limited

One Bartholomew Close

London EC1A 7BL

Telephone 020 7220 0500

ShareGift

Shareholders with a small number of shares, the value of which

makes it uneconomic to sell them, may wish to consider donating

them to charity through ShareGift, a registered charity

administered by The Orr Mackintosh Foundation. The share transfer

form needed to make a donation may be obtained from the Mothercare

plc registrars, Equiniti Limited.

Further information about ShareGift is available from

www.sharegift.org or by telephone on 020 7930 3737.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKQBDKBDKPDB

(END) Dow Jones Newswires

November 24, 2022 02:00 ET (07:00 GMT)

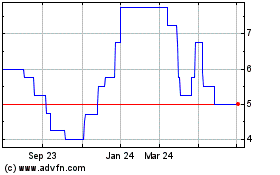

Mothercare (AQSE:MTC.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

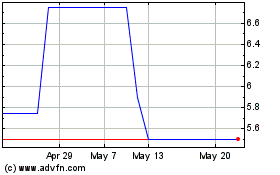

Mothercare (AQSE:MTC.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025