Announcement re Refinancing

18 October 2024 - 2:00AM

UK Regulatory

Announcement re Refinancing

Refinancing

Mothercare plc (“Mothercare” or the “Company”),

the specialist global brand for parents and young children, is

pleased to announce a refinancing with GB Europe Management

Services Ltd (“Gordon Brothers”) of the Company’s existing debt

facilities.

The Board of Mothercare believes that these new secured debt

facilities of £8 million, taken together with the gross

consideration of £16 million from Reliance Brands Holding UK

Limited (“Reliance) announced earlier today, delivers a

de-leveraged Mothercare that can once more move forward with

confidence and invest appropriately in the Company’s future

development.

Clive Whiley, Chairman of Mothercare, commented:

“Today’s agreements with Reliance and Gordon Brothers strengthen

our operations in South Asia and support a material reduction in

our bank facilities and leverage.

We have worked closely with Gordon Brothers for over five years

now and value its ongoing support for Mothercare. The

revised facility agreement and related arrangements reflect the

strength of that ongoing relationship and trust alongside

recognising the accretive nature of the joint-venture to our equity

valuation. For Mothercare, the reduction in the required

facility size, funded by the formation of the joint venture, and

the resulting significantly reduced cash interest cost, greatly

improves our flexibility for FY25 and beyond.

Taking today’s developments together with the inherent

strength of the business’s brand, we believe Mothercare can

approach 2025 and beyond with a renewed and growing sense

of confidence at the opportunities ahead, notwithstanding our

ongoing cautious shorter term outlook, given the continuing

challenges facing our Middle East operations.”

New Financing Arrangements with Gordon

Brothers

Mothercare has applied the proceeds received from Reliance

towards a refinancing of the Company’s existing debt facilities

with Gordon Brothers. Under the terms of these new financing

arrangements, the previous £19.5m term loan (which attracted

interest at a rate of 13% per annum, plus SONIA, plus PIK interest

of 1% per annum) has been replaced with:

- an £8m 2 year term loan facility,

which attracts interest at a rate of 4.8% per annum, plus SONIA

(with a floor of 5.2%), plus PIK interest of 1% per annum, rising

to 2% per annum through the term of the loan; and

- the granting to Gordon Brothers of

new warrants to subscribe up to 43.4m new ordinary shares of

Mothercare at a subscription price of 8.5p per share (the

“Warrants”). These Warrants, which are exercisable for 5 years from

the date of issue, contain certain anti-dilution rights which will

operate so as to secure for Gordon Brothers the right to subscribe

for an aggregate equity interest representing approximately 7% of

the Company’s issued share capital (following exercise in full of

the Warrants).

Overall Financial Impact of the Joint Venture

Arrangements and Refinancing

For the financial year ended 30 March 2024, the intellectual

property assets that were transferred to JVCO 2024, which had no

associated balance sheet carrying value, generated Mothercare

retail sales under the previous franchise arrangements of

approximately £24 million (approximately 9% of the total retail

sales), and contributed approximately £0.9 million to adjusted

EBITDA.

The result of the restructuring of its operations in South Asia

and the associated sale of the 51% stake in JVCO 2024, Mothercare

estimates will result in a taxable gain of £29 million and – after

the use of certain preexisting tax losses – a cash tax cost of

approximately £3 million. Taking into account this and other

pre-completion adjustments, refinancing expenses, transactional

costs and associated additional pension deficit payments,

Mothercare expects to apply approximately £11.5 million of net cash

proceeds to refinance the existing Gordon Brothers facilities as

outlined above.

Following the completion of these transactions, we expect to

announce the preliminary results for the year ended 30 March 2024

tomorrow.

Investor and analyst enquiries to:

Mothercare

plc Email:

investorrelations@mothercare.com

Clive Whiley, Chairman

Andrew Cook, Chief Financial Officer

Deutsche Numis | Deutsche Bank AG

Tel: 020 7260

1000

(NOMAD & Joint Corporate Broker)

Luke Bordewich

Henry Slater

Cavendish Capital

Markets Tel:

020 7220 0500

(Joint Corporate

Broker)

Carl Holmes

Media enquiries to:

MHP

Tim

Rowntree Email: mothercare@mhpgroup.com

Rachel Farrington Phone: 07801

894577

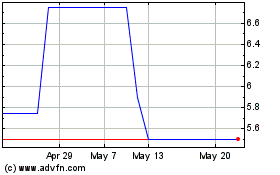

Mothercare (AQSE:MTC.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

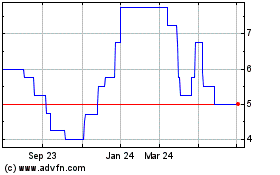

Mothercare (AQSE:MTC.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025