TIDMORCP

RNS Number : 9483O

Oracle Power PLC

06 February 2023

This announcement contains inside information for the purposes

of Article 7 of EU Regulation No. 596/2014, which forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

6 February 2023

Oracle Power PLC

("Oracle", the "Company" or the "Group")

GBP500,000 placing to support the Green Hydrogen project

development

Oracle Power PLC (AIM: ORCP), a leading developer of Green

Hydrogen, is pleased to announce that it has successfully raised

gross proceeds of GBP500,000 by way of an oversubscribed placing of

294,117,647 new ordinary shares of 0.1p each in the Company

("Ordinary Shares") (the "Placing Shares") at a price of 0.17p per

Ordinary Share (the "Placing Price") (the "Placing").

The net proceeds of the Placing will be utilised primarily to

support the advancement of the Company's Green Hydrogen project

(the "Project") through the joint venture with His Highness Sheikh

Ahmed Dalmook Al Maktoum.

Oracle announced on 28 November 2022 the acquisition by Oracle

Energy of State land by way of a long lease located in the Thatta

district, Sindh, south-east Pakistan, where its flagship Green

Hydrogen project will be located. The Company's partner, His

Highness Sheikh Ahmed Dalmook Al Maktoum, who owns 70% of Oracle

Energy, is an active investor and developer of a number of power

generation projects across the Middle East, Asia and Africa.

The Project would be Pakistan's first commercial Green Hydrogen

production facility, with an initial capacity to produce 55,000

tonnes annually, which would be one of the largest hydrogen

projects in the region.

Green Hydrogen is differentiated from other types of hydrogen as

it is powered exclusively by renewable energy sources and is

produced through water electrolysis. Hydrogen and its by-product

ammonia are key constituents for critical sectors including

manufacturing, transportation, power generation and

agriculture.

The Project site in Sindh is within a highly attractive,

strategic region in southern Pakistan, located within the G

haro-Jhimpir wind corridor, where over 1 GW of renewable power has

been constructed and commissioned.

Beyond access to Pakistan's national grid, the Project has

immediate proximity to existing infrastructure, including access to

water in the form of Karachi's largest fresh-water reservoir, and

established rail and road infrastructure, which connect to

Pakistan's two largest ports - Karachi Port and Port Qasim. Oracle

Energy intends to supply its production to local industries

supporting manufacturing, fertiliser production, gas utilities,

transport and power generation, and also to export to the Middle

East, Europe, China and Asia.

The Project is targeting annual production of 55,000 tonnes of

Green Hydrogen (equivalent to the production of 150,000 kg of

hydrogen per day). Oracle Energy intends to supply its production

to local industries supporting manufacturing, fertiliser

production, gas utilities, transport and power generation, and also

to export to European and Asian markets.

The Project plans the development of solar and wind power

facilities with a combined output of 1.2 GW hybrid power from

proposed capacity 700MW solar and 500MW wind and battery storage to

ensure the continuous production of hydrogen throughout the

year.

Oracle Energy has made rapid progress in the development of the

Project to date. In October 2022, it appointed thyssenkrupp Uhdeto

("thyssenkrupp") to lead the technical and commercial feasibility

study for the Project, due to be released in H1 2023. The Company

is in advanced discussion with multiple partners across the value

chain and has signed MOUs and non-exclusive cooperation agreements

including with the Green Hydrogen certifier, TÜV SÜD. It is also in

advanced discussions with potential offtake customers and

financiers.

The Placing has been carried out through Global Investment

Strategy UK Limited ("GIS") and the Company has entered into a

placing agreement dated 5 February 2023 (the "Placing Agreement")

with GIS pursuant to which it, as agent for the Company, has

procured placees for the Placing Shares at the Placing Price. As

part of the Placing, GIS will receive 11,764,706 warrants over new

Ordinary Shares, exercisable at the Placing Price for a period of 2

years from the date of the Placing.

Naheed Memon, CEO of Oracle, commented:

"We continue to make great strides in advancing our Green

Hydrogen strategy in Pakistan and today's fundraise will enable us

to continue on this upward trajectory. The majority of the funds

raised will be used to support the Green Hydrogen initiative

through Oracle Energy, whilst also providing us with sufficient

working capital to progress the strategies of the other projects in

Oracle's portfolio.

We are now looking toward the next stage in the Project's

development as we move forward with detailed technical and

financial feasibilities. With this financial support, combined with

that from His Highness Shaikh Ahmed Dalmook Al Maktoum, I am

confident we will be able to expedite the development of this

ground-breaking and globally significant project. "

Admission to Trading and Total Voting Rights

Application will be made for the Placing Shares, which will rank

pari passu with the existing ordinary shares, to be admitted to

trading on AIM, with Admission expected to become effective at 8:00

a.m. on or around 10 February 2023.

Following Admission, the total issued share capital of the

Company will be 3,372,415,387 Ordinary Shares, with no shares in

Treasury. Therefore, the total current voting rights in the Company

following Admission will be 3,372,415,387 and this figure may be

used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

*ENDS*

For further information:

Oracle Power PLC

Naheed Memon - CEO +44 (0) 203 580 4314

Strand Hanson Limited (Nominated Adviser

and Broker)

Rory Murphy, Matthew Chandler, Rob Patrick +44 (0) 20 7409 3494

B uchanan (Financial PR)

Oonagh Reidy/ Abigail Gilchrist +44 (0) 203 7466 5000

About Oracle Power PLC:

Oracle Power PLC is an international natural resource and power

project developer quoted on London's AIM market. The Company

currently has two areas of focus: Western Australia and Pakistan.

The Company is active in the energy industry in Pakistan and is

working to establish a Green Hydrogen production facility through

Oracle Energy Limited, a joint venture with His Highness Shaikh

Ahmed Dalmook Al Maktoum.

Oracle Energy has been set up as the project development company

and is funded on a 70:30 basis by Kaheel Energy (100% owned by His

Highness Shaikh Ahmed Dalmook Al Maktoum) and Oracle Power

respectively. The project development company provides a vehicle to

support the accelerated development of the Green Hydrogen project

to meet the growing international and domestic demand of Green

Hydrogen and clean energy.

The Company also continues to advance towards the development of

its Thar Block VI Project in south-east Pakistan into a mine, a

power plant and a proposed coal gasification project.

In Australia, its primary focus is the Northern Zone Gold

Project, located 25km east of the major gold mining centre of

Kalgoorlie, the home of the 'Super Pit' mine, the second largest

gold mine in Australia. Northern Zone has a current Exploration

Target of 200-250Mt at 0.4-0.6g/t Au for between 2.5 - 4.8Moz gold,

with drilling being planned to define a maiden inferred JORC

resource.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEDBGDDRUGDGXU

(END) Dow Jones Newswires

February 06, 2023 02:00 ET (07:00 GMT)

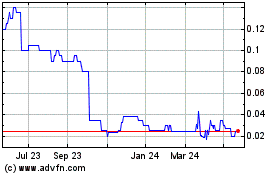

Oracle Power (AQSE:ORCP.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

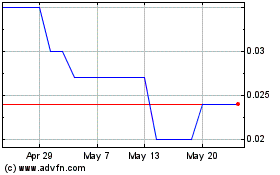

Oracle Power (AQSE:ORCP.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025