TIDMORM

RNS Number : 1091E

Ormonde Mining PLC

27 June 2023

This announcement contains inside information

27 June 2023

Ormonde Mining plc

("Ormonde", the "Company" or the "Group")

Final Results for the Year Ended 31 December 2022

Ormonde announces its final results for the year ended 31

December 2022.

Key points:

-- Sale of legacy La Zarza assets for EUR2.3 million, further

strengthening the Group's balance sheet

-- Investment in Peak Nickel Limited provides shareholders with

exposure to fast-growing battery metals sector

-- Extensive review of further natural resources projects has

resulted in a shortlist of attractive possible further

investments

-- Applications have been made for the renewal of gold investigation permits in Spain

Brian Timmons, Chairman, commented:

"During 2022 and the first part of 2023, the Board has delivered

on extracting value from legacy assets to boost the Group's balance

sheet and commenced its proposed strategy of leveraging this strong

balance sheet to generate new value enhancing deals for

shareholders.

The sale of the La Zarza assets and subsequent investment into

Peak Nickel Limited represent the first steps in shareholder value

creation and provide the platform for further exciting investments

in prospective mining jurisdictions. The Board continues to advance

discussions with interested parties to move onto the next stages of

this strategy.

On behalf of the Board, I would like to thank our shareholders

for their continued support and especially for their patience

displayed during the past 18 months. I look forward to updating you

all on Ormonde's progress from here."

Enquiries:

Ormonde Mining plc

Brian Timmons, Chairman

Tel: +353 (0)1 801 4184

Vigo Consulting (Investor Relations)

Ben Simons / Charlie Neish

Tel: 44 (0)20 7390 0230

Davy (Nomad, Euronext Growth Listing Sponsor and Broker)

Anthony Farrell

Tel: +353 (0)1 679 6363

About Ormonde Mining plc

Ormonde is focussed on the evaluation and execution of new

opportunities through which the Company can leverage its listing

and balance sheet to generate shareholder value whilst placing a

strong emphasis on cash preservation.

Currently, Ormonde holds a 20% interest in Peak Nickel Limited,

a private UK company which is advancing exploration on a

potentially significant battery metals project.

Ormonde's shares are listed on the London Stock Exchange (AIM)

and the Euronext Growth market in Dublin.

For more information, visit the Company's website at

www.ormondemining.com .

Chairman's Review

Introduction

I am pleased to present my second annual review to shareholders

since I took over as Ormonde's Chairman in October 2021.

During the year, the Board, with the assistance of our technical

advisory team, began delivering upon its commitment to leverage the

Group's balance sheet to generate value for shareholders. This has

involved an extensive review of a range of potential opportunities

leading to a shortlist of attractive possible investments.

We are of course cognisant that shareholders have been waiting

some time for news of further investments; however, this is a

process that requires both time and diligence to ensure the

transactions we pursue deliver the maximum opportunity for value

creation. I would like to assure shareholders that discussions

continue to progress, as does our partnership with our first

investee company, Peak Nickel Limited.

The investment in Peak Nickel Limited announced in February 2023

provides Ormonde's shareholders with exposure to the fast growing

and active battery metals sector. The Board expects further

investments to follow.

This investment activity was undertaken whilst the Board worked

to monetise the legacy La Zarza asset in Spain. Ormonde continues

to seek value adding options for the Group's remaining Spanish gold

assets.

Investment - Peak Nickel Limited

Subsequent to the year end, the Group acquired a 20% interest in

Peak Nickel Limited ("PNL") for total payments of GBP512,500. PNL

is a UK company which is advancing exploration on a very promising

battery metals project. The Group's investment was designed to

enable a fast-track initial drilling programme aimed at identifying

a modern, code-compliant resource in those minerals.

At the time of investment, Ormonde was granted an exclusive

option by PNL to either invest up to a further GBP4 million in cash

in PNL for further exploration work, bringing Ormonde's interest to

49.9%; or acquire the remaining 80% of PNL by way of issuance of

ordinary shares in Ormonde to PNL.

La Zarza Disposal

While new opportunities with significant value upside potential

were being shortlisted, the Board continued to advance negotiations

with interested parties towards monetising the value within the

legacy La Zarza Copper-Gold Project in Spain ("La Zarza").

On 28 September 2022, shareholders approved at an EGM a proposal

from the Board for the sale of the Group's landholding, drill core

and data assets associated with La Zarza for a cash consideration

of EUR2.3 million to La Zarza Mineria Metalica S.L.U., a subsidiary

of the Spanish company Tharsis Mining S.L., which controls the

mining rights to La Zarza.

Under the terms of this sale agreement, the Group received the

first tranche payment of EUR800,000 on closing, with the balance to

be paid in three equal payments of EUR500,000 on the first, second

and third anniversaries of completion. The next payment is due to

be received on or around 30 September 2023, further boosting the

Group's balance sheet. Ormonde holds security in respect of the

deferred cash payments.

Spanish Assets

The Group's interest in a number of gold investigation permits

(IPs) situated in Spain, held for over a decade, expired during the

Covid period, and the Group has applied for renewal of these

exploration licenses. In the event that these IPs are renewed,

Ormonde intends to undertake exploration activity on the licences.

There is no certainty of renewal of the IPs, and, accordingly,

these assets have been subject to an impairment of EUR167,000 as at

31 December 2022.

Financials

Ormonde recorded a total comprehensive loss for the period of

EUR1.1 million for 2022, compared with a loss of EUR1.6 million in

2021. As of 31 December 2022, the Group had net assets of EUR4.9

million, including a cash balance of EUR3.56 million, providing the

Group with a platform from which to invest further.

Suspension of Shares

The Board is mindful of the continued suspended status of the

Group's shares under market rules pending an announcement and

publication of an admission document. As announced on 7 February

2023, following the PNL investment, Ormonde is required to execute

a further transaction with PNL or another party, which would be

categorised as a reverse takeover under AIM Rule 14. This

transaction would require both shareholder approval and the

publication of an AIM admission document. Ormonde continues to

review its investment options in relation to this requirement and

the Board looks forward to sharing its strategy with shareholders

in due course.

Conclusions and Outlook

During 2022 and the first part of 2023, the Board has delivered

on extracting value from legacy assets to boost the Group's balance

sheet and commenced its proposed strategy of leveraging this strong

balance sheet to generate new value enhancing deals for

shareholders.

The sale of the La Zarza assets and subsequent investment into

PNL represent the first steps in shareholder value creation and

provide the platform for further exciting investments in

prospective mining jurisdictions . The Board continues to advance

discussions with interested parties to move onto the next stages of

this strategy.

On behalf of the Board, I would like to thank our shareholders

for their continued support and especially for their patience

displayed during the past 18 months. I look forward to updating you

all on Ormonde's progress in due course.

Brian Timmons

Chairman

27 June 2023

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2022

Year ended Year ended

31-Dec-22 31-Dec-21

Notes EUR000s EUR000s

Revenue 0 0

Administration expenses (881) (1,194)

Impairment of intangibles 10 (167) (400)

______ ______

Loss on ordinary activities (1,048) (1,594)

Finance costs (17) (24)

______ ______

Loss for the year (1,065) (1,618)

Taxation 0 0

______ ______

Loss for the Period after tax (1,065) (1,618)

______ ______

Total comprehensive (loss)/income

for the period (1,065) (1,618)

Earnings per share

Basic & diluted (loss) per share

(in cent) 8 (0.23) (0.34)

Total earnings per share

Basic & diluted earnings/ (loss)

per share (in cent) 8 (0.23) (0.34)

All activities are derived from continuing activities. All

(losses)/profits and total comprehensive loss for the year (and

preceding year) are attributable to the equity holders of the

Company. The Group has not recognised gains or losses other than

those dealt within the Statement of Comprehensive Income.

Consolidated Statement of Financial Position

as at 31 December 2022

31-Dec-22 31-Dec-21

Notes EUR000s EUR000s

Assets

Non-current assets

Intangible assets 10 157 309

Trade and other receivables 14 700 0

_______ _______

Total Non-Current Assets 857 309

Current assets

Trade and other receivables 14 613 93

Asset classified as held for sale 13 0 2,000

Cash & cash equivalents 15 3,564 3,746

_______ _______

Total Current Assets 4,177 5,839

_______ _______

Total Assets 5,034 6,148

_______ _______

Equity & liabilities

Capital and Reserves

Issued capital 17 4,725 4,725

Share premium account 17 29,932 29,932

Share based payment reserve 18 281 281

Capital conversion reserve fund 18 29 29

Capital redemption reserve fund 18 7 7

Retained losses 19 (30,078) (29,013)

_______ _______

Equity attributable to the Owners

of the Company 4,896 5,961

Current Liabilities

Trade & other payables 16 138 187

_______ _______

Total Liabilities 138 187

_______ _______

Total Equity & Liabilities 5,034 6,148

_______ _______

Company Statement of Financial Position

as at 31 December 2022

As regrouped

31-Dec-22 31-Dec-21

Notes EUR000s EUR000s

Assets

Investment in subsidiaries 12 130 443

Trade and other receivables 14 1,388 2,079

_______ _______

Total Non-Current Assets 1,518 2,522

Current assets

Trade and other receivables 14 95 76

Cash & cash equivalents 15 3,554 3,740

_______ _______

Total Current Assets 3,649 3,816

_______ _______

Total Assets 5,167 6,338

_______ _______

Equity & Liabilities

Capital and Reserves

Issued capital 17 4,725 4,725

Share premium account 17 29,932 29,932

Share based payment reserve 18 281 281

Capital conversion reserve fund 18 29 29

Capital redemption reserve fund 18 7 7

Retained losses 19 (30,051) (28,935)

_______ _______

Equity attributable to the Owners

of the Company 4,923 6,039

Current Liabilities

Trade & other payables 16 244 299

_______ _______

Total Liabilities 244 299

_______ _______

Total Equity & Liabilities 5,167 6,338

_______ _______

Consolidated Statement of Cashflows

for the year ended 31 December 2022

Year ended Year ended

Notes 31-Dec-22 31-Dec-21

EUR000s EUR000s

Cashflows from operating activities

Loss for the year before taxation (1,065) (1,618)

________ ________

(1,065) (1,618)

Adjustments for:

Impairment of intangible assets 167 0

Impairment of Asset classified as

held for resale 0 400

Non-cash items: Share Option cost 0 72

________ ________

(898) (1,146)

Movement in Working Capital

Movement in receivables (20) (35)

Movement in liabilities (49) (24)

________ ________

Net Cash used in operations (967) (1,205)

Investing activities

Expenditure on intangible assets (15) (14)

Proceeds from disposal of assets

held for resale 800 0

________ ________

Net cash used in investing activities 785 (14)

Net (decrease) in cash and cash

equivalents (182) (1,219)

Cash and cash equivalents at the

beginning of the year 15 3,746 4,965

______ ______

Cash and cash equivalents at the

end of the year 15 3,564 3,746

______ ______

The accompanying notes in the Annual Report and Group Financial

Statements mailed to shareholders and available on the Group's

website form an integral part of these financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UBVNRORUNUAR

(END) Dow Jones Newswires

June 27, 2023 13:20 ET (17:20 GMT)

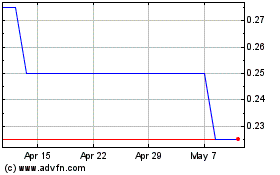

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Apr 2024 to May 2024

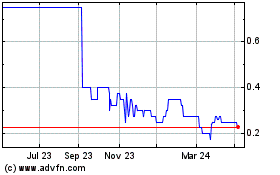

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From May 2023 to May 2024